U.S. Annual Wellness Visits Market Size and Research 2026 to 2035

The U.S. annual wellness visits market size was exhibited at USD 3.75 billion in 2025 and is projected to hit around USD 11.30 billion by 2035, growing at a CAGR of 11.66% during the forecast period 2026 to 2035.

Key Takeaways:

- Health risk assessment (HRA) dominated the market in 2025.

- Subsequent annual wellness visits captured the highest revenue share in 2025.

- In terms of provider type, the hospitals segment accounted for a major portion of the market.

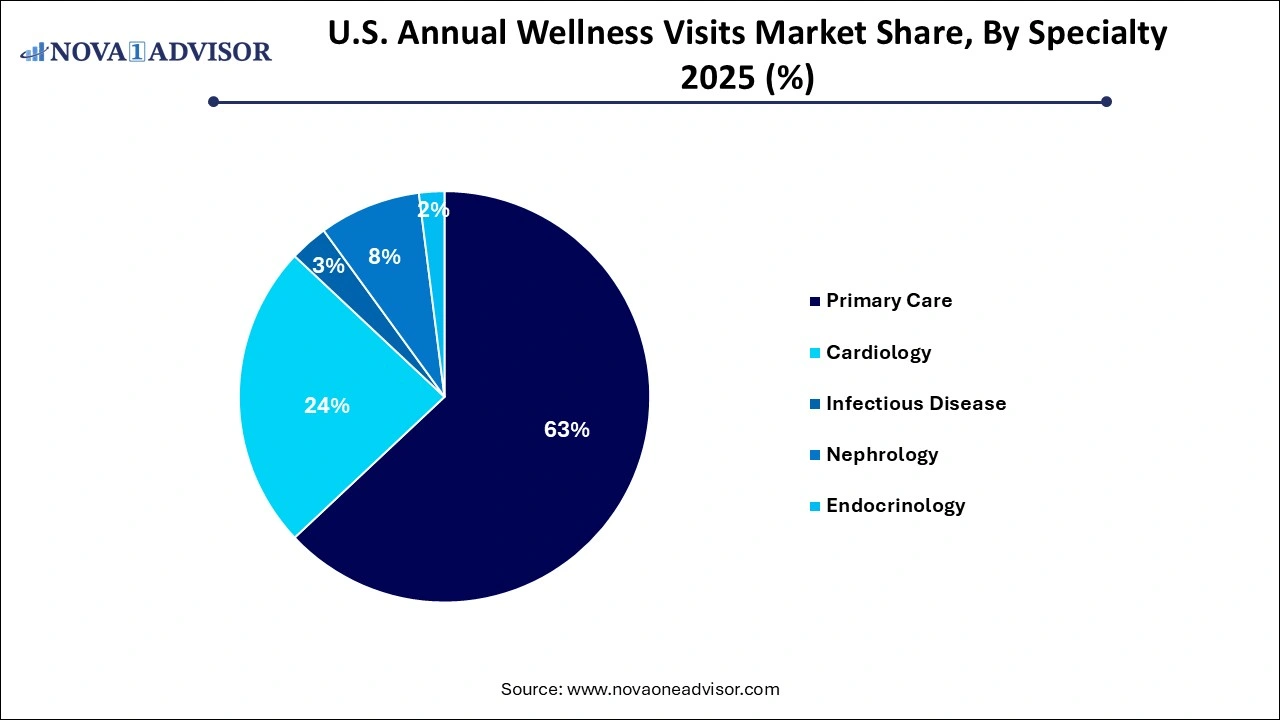

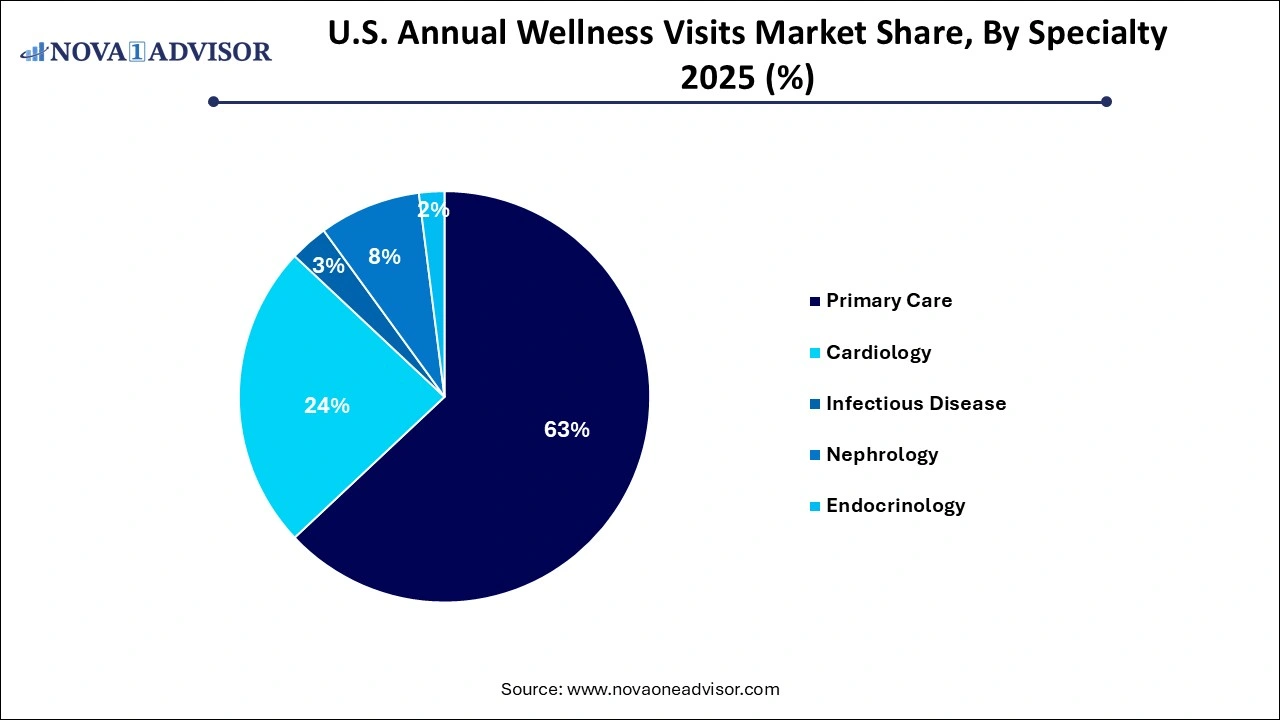

- The primary care segment dominated the market in 2025 with a revenue share of 63%.

- The cardiology segment is projected to witness considerable growth during the forecast period.

Market Overview

The U.S. Annual Wellness Visits (AWV) Market has emerged as a critical pillar in the preventive care landscape, driven by the growing emphasis on early detection, chronic disease management, and value-based care. An Annual Wellness Visit is a preventive service covered under Medicare and many private health plans, designed to create or update a personalized prevention plan. These visits help identify health risks, screen for cognitive or functional impairments, and promote healthy aging and disease prevention.

Since its introduction in 2011 through the Affordable Care Act (ACA), Medicare's Annual Wellness Visit has seen growing adoption among providers and beneficiaries. Unlike a traditional physical exam, AWVs focus on comprehensive health risk assessments, cognitive screenings, immunization reviews, and care planning rather than hands-on examination. The Centers for Medicare & Medicaid Services (CMS) reimburses these visits separately, incentivizing providers to adopt preventive care models while helping patients avoid higher downstream medical costs.

The AWV model has seen adoption across a broad provider base, including primary care physicians, nurse practitioners, physician assistants, and care coordination teams. Retail health clinics, telehealth platforms, and value-based healthcare organizations are also incorporating AWVs into their care delivery models. As U.S. healthcare shifts from volume to value, annual wellness visits serve as a cornerstone for engaging older adults, improving care coordination, and identifying unmet needs such as mental health or social determinants of health (SDOH).

With an aging population, rising healthcare costs, and increasing focus on preventive services under Medicare Advantage and Accountable Care Organizations (ACOs), the U.S. Annual Wellness Visits Market is expected to expand steadily over the next decade.

Major Trends in the Market

-

Expansion of Retail Clinics and Telehealth Platforms: Companies like CVS Health and Walgreens are offering AWVs via in-store clinics and virtual care.

-

Integration with Chronic Disease Management Programs: AWVs are increasingly bundled with care plans for diabetes, hypertension, and obesity.

-

AI-Powered Risk Assessment Tools: Predictive analytics and digital questionnaires are streamlining Health Risk Assessments (HRAs).

-

Behavioral and Mental Health Screenings Embedded in AWVs: Depression, anxiety, and cognitive decline assessments are standard components.

-

Increased Participation by Medicare Advantage Plans: MA insurers incentivize AWVs as part of Star Ratings and quality measures.

-

Adoption of Virtual AWVs: Especially after the COVID-19 pandemic, CMS and commercial payers have broadened coverage of virtual AWV options.

-

Focus on Closing Preventive Care Gaps: AWVs are used to prompt cancer screenings, immunizations, and lab test orders.

-

Regulatory Encouragement for SDOH Screening: Providers are now integrating questions about housing, food access, and transportation into wellness visits.

Report Scope of The U.S. Annual Wellness Visits Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.19 Billion |

| Market Size by 2035 |

USD 11.30 Billion |

| Growth Rate From 2025 to 2035 |

CAGR of 11.66% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Services, Type, Specialty, Provider Type |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Morris Hospital & Healthcare Centers; Sparta Community Hospital District; Medical Center Clinic; St. Luke Community Healthcare; Mason Health; UC San Diego; HealthCare Partners, MSO.; Mercy; RUSH Copley Medical Center; Carson Tahoe Health; Overlake Hospital Medical Center; Northwestern Medicine; The General Hospital Corporation; Hamilton Health Care System; UCLA Health |

Market Driver: Aging U.S. Population and Preventive Care Policy Expansion

A primary driver of the Annual Wellness Visits Market is the rapid growth of the aging population in the United States, paired with policy frameworks that emphasize preventive healthcare. By 2030, all Baby Boomers will be age 65 or older, increasing Medicare enrollment by millions. This population segment faces a higher risk of chronic conditions, functional decline, and polypharmacy, making regular preventive check-ins essential.

The U.S. government, through Medicare and CMS initiatives, actively promotes AWVs to reduce avoidable hospitalizations, identify early signs of cognitive decline or cancer, and enhance overall quality of life. Providers are incentivized to conduct AWVs via separate billing codes (G0438 for initial visits and G0439 for subsequent visits), making them a revenue-generating opportunity in addition to a clinical imperative.

Incorporating AWVs into routine care workflows also aligns with broader value-based care metrics, including HEDIS measures, CMS Star Ratings, and ACO performance benchmarks. This policy and demographic synergy is driving consistent growth in the AWV market, particularly among Medicare Advantage enrollees.

Market Restraint: Low Patient Awareness and Inconsistent Provider Adoption

Despite its advantages, one of the main restraints in the AWV market is limited patient awareness and inconsistent provider execution. Many Medicare beneficiaries do not fully understand what an Annual Wellness Visit entails or confuse it with a traditional physical exam. As a result, utilization remains below its full potential.

From the provider side, AWVs require dedicated time, coordination, and documentation. Practices without robust care coordination infrastructure may struggle to integrate them efficiently into clinical workflows. Smaller physician groups, especially those not part of a Medicare Shared Savings Program (MSSP) or ACO, often deprioritize AWVs in favor of acute care or chronic condition management due to perceived administrative burden.

Additionally, some patients who book AWVs arrive expecting full physicals, lab work, or hands-on diagnostics—which are not covered under AWV guidelines. This mismatch in expectations can lead to dissatisfaction or billing complications, creating further hesitation in adoption.

Market Opportunity: Digital Enablement and Value-Based Care Integration

The most promising opportunity in the U.S. Annual Wellness Visits Market lies in digitally enabling AWV delivery and embedding it into value-based care programs. With virtual care adoption accelerating post-COVID, many providers and payers are now exploring hybrid and fully virtual models for AWVs. CMS-approved tele-AWV programs allow remote collection of health data, mental health screening, care planning, and referrals all from the patient’s home.

Digital health startups are integrating AWVs into broader preventive platforms. Tools like AI-driven Health Risk Assessments (HRAs), natural language processing for documentation, and virtual scribing can improve both efficiency and patient satisfaction. Health systems can also integrate AWVs into population health strategies, leveraging them to trigger follow-up for mammograms, colonoscopies, or diabetes management programs.

Medicare Advantage payers, in particular, are investing in outreach campaigns and mobile AWV clinics to reach enrollees. By increasing AWV completion rates, plans improve Star Ratings, receive bonus payments, and close care gaps. As value-based reimbursement expands across public and private payers, AWVs will be increasingly viewed as a foundational touchpoint for managing risk-adjusted populations.

Segmental Insights

By Services Insights

Health risk assessments (HRAs) dominate the AWV service segment, forming the backbone of the visit structure. HRAs include questions on lifestyle habits, health conditions, family history, safety risks, and functional status. Providers use this information to stratify patient risk and personalize prevention strategies. As HRAs are mandatory for billing the AWV, and essential to the care plan development process, their adoption is virtually universal. With digital tools now automating HRAs, practices can complete assessments efficiently and even collect data before appointments.

Mental health screening is the fastest-growing AWV service, due to increased awareness around cognitive health, depression, and anxiety in aging populations. CMS encourages inclusion of tools like the PHQ-9 for depression and the GPCOG for cognitive impairment within AWVs. Amid the growing mental health crisis among seniors—especially in the wake of COVID-related isolation—providers are prioritizing these screenings. Several health systems now flag patients with loneliness or mood concerns during AWVs for social work or behavioral health referrals, showing a significant expansion of mental health as a core AWV deliverable.

By Type Insights

Subsequent Annual Wellness Visits dominate the U.S. AWV market, reflecting the repeat nature of this service and high retention rates among Medicare beneficiaries once enrolled. After completing an initial AWV (coded G0438), patients are eligible for yearly subsequent visits (coded G0439), which focus on updating health risk assessments, managing chronic issues, and reviewing screening compliance. These visits are often coordinated with medication reviews and care management plans, making them a valuable clinical tool for providers engaged in long-term patient monitoring.

Initial AWVs are the fastest-growing type, fueled by increasing outreach from Medicare Advantage plans, ACOs, and health systems aiming to onboard new beneficiaries. The initial AWV serves as a gateway to long-term care coordination and provides the foundational personal prevention plan that shapes future visits. Initiatives such as "Welcome to Medicare" mailers, digital onboarding for new enrollees, and mobile outreach in underserved communities are driving rapid growth in initial visit completions. As CMS continues to prioritize early preventive engagement, the growth of initial AWVs will likely remain robust through 2030.

By Provider Type Insights

Physician’s offices currently lead the market in AWV delivery, particularly among primary care practices serving Medicare populations. These offices have the infrastructure to manage AWV documentation, care planning, and follow-ups. In integrated systems, AWVs are tied to population health goals, with outreach programs encouraging seniors to complete them annually. Internal medicine and family practices frequently assign nurse practitioners or medical assistants to conduct portions of the AWV, ensuring efficiency and compliance.

Retail clinics and telehealth providers are the fastest growing AWV provider types, driven by consumer preference for convenience and broader payer support. CVS Health, for instance, expanded its MinuteClinic offerings in 2024 to include AWVs across multiple states. Telehealth companies are also building AWV-specific platforms, pairing remote visits with mailed preventive tools such as home lab kits and remote monitoring devices. These models cater to homebound patients, tech-savvy seniors, and those living in rural areas. As retail and virtual care normalize in senior healthcare, their share of AWV delivery is projected to rise sharply.

By Specialty Insights

Primary care continues to dominate the AWV specialty segment, as the visit is designed to be broad, preventive, and typically occurs in a generalist setting. Family medicine and internal medicine providers are most likely to integrate AWVs into routine visits, especially within Medicare Shared Savings Program (MSSP) ACOs or Medicare Advantage panels. These specialists play a central role in initiating preventive care conversations and referring patients to necessary screenings or specialty services.

Endocrinology and cardiology are the fastest-growing specialties participating in AWVs, particularly among patients with diabetes, hypertension, and cardiovascular risk factors. In 2024, CMS encouraged more specialists to incorporate AWVs within their patient panels, especially for chronic care management. Endocrinologists conducting AWVs can integrate diabetic foot exams, A1C tracking, and nutrition counseling, while cardiologists can incorporate heart health screenings, medication adherence evaluations, and lifestyle coaching. As specialists increasingly assume roles in population health and risk management, their participation in AWVs will continue to grow.

Endocrinology and cardiology are the fastest-growing specialties participating in AWVs, particularly among patients with diabetes, hypertension, and cardiovascular risk factors. In 2024, CMS encouraged more specialists to incorporate AWVs within their patient panels, especially for chronic care management. Endocrinologists conducting AWVs can integrate diabetic foot exams, A1C tracking, and nutrition counseling, while cardiologists can incorporate heart health screenings, medication adherence evaluations, and lifestyle coaching. As specialists increasingly assume roles in population health and risk management, their participation in AWVs will continue to grow.

Country-Level Analysis – United States

In the United States, Annual Wellness Visits have become a focal point of Medicare’s preventive care strategy, particularly within the context of chronic disease management and aging demographics. Federal support for AWVs remains strong through CMS regulations and reimbursement policies, with both Original Medicare and Medicare Advantage plans promoting completion through targeted outreach and quality incentive structures.

Health systems, ACOs, and provider groups across the country are integrating AWVs into electronic health records (EHRs), population health tools, and care team workflows. States with large senior populations like Florida, Texas, and California report some of the highest AWV engagement, driven by MA plan competition and senior-focused retail clinics. Even in rural regions, telehealth and mobile clinics are expanding access to AWVs.

Moreover, CMS innovation models like the Accountable Health Communities (AHC) and Primary Care First (PCF) encourage AWV completion as a foundational activity. Payers, too, are developing hybrid models to reach historically underserved populations with in-home or tele-AWV options, helping close health equity gaps. The U.S. market is therefore dynamic, policy-driven, and technology-enabled, making it a leading global model for preventive wellness services.

Some of the prominent players in the U.S. annual wellness visits market include:

- Morris Hospital & Healthcare Centers

- Sparta Community Hospital District

- Medical Center Clinic

- St. Luke Community Healthcare.

- Mason Health.

- UC San Diego

- HealthCare Partners, MSO.

- Mercy

- RUSH Copley Medical Center

- Carson Tahoe Health

- Overlake Hospital Medical Center

- Northwestern Medicine

- The General Hospital Corporation

- Hamilton Health Care System

- UCLA Health

Recent Developments

-

March 2024 – CVS Health expanded AWV services across its MinuteClinic locations and began piloting AWV-specific virtual care modules for seniors in 10 states, focusing on Medicare Advantage populations.

-

February 2024 – Oak Street Health, acquired by CVS, launched a value-based initiative tying AWV completion to patient retention and chronic care outcomes, leveraging community health workers to support scheduling.

-

January 2024 – Kaiser Permanente integrated AI-driven documentation support into its AWV workflows, reducing visit times by 20% and increasing patient satisfaction.

-

December 2023 – VillageMD began offering at-home AWVs through its primary care practices in partnership with home health agencies, targeting patients with mobility challenges.

-

October 2023 – Beaumont Health initiated a program integrating AWVs with behavioral health assessments and fall risk evaluations, supported by EHR-based tracking and Medicare risk adjustment reporting.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. annual wellness visits market

Type

- Initial Annual Wellness Visit

- Subsequent Annual Wellness Visit

Services

- Health Risk Assessment

- Physical Exam

- Laboratory Tests

- Immunizations

- Cancer Screening

- Mental Health Screening

- Health Education And Guidance

Provider Type

- Clinics

- Hospitals

- Physician’s Office

Specialty

- Primary Care

- Cardiology

- Infectious Disease

- Nephrology

- Endocrinology

Endocrinology and cardiology are the fastest-growing specialties participating in AWVs, particularly among patients with diabetes, hypertension, and cardiovascular risk factors. In 2024, CMS encouraged more specialists to incorporate AWVs within their patient panels, especially for chronic care management. Endocrinologists conducting AWVs can integrate diabetic foot exams, A1C tracking, and nutrition counseling, while cardiologists can incorporate heart health screenings, medication adherence evaluations, and lifestyle coaching. As specialists increasingly assume roles in population health and risk management, their participation in AWVs will continue to grow.

Endocrinology and cardiology are the fastest-growing specialties participating in AWVs, particularly among patients with diabetes, hypertension, and cardiovascular risk factors. In 2024, CMS encouraged more specialists to incorporate AWVs within their patient panels, especially for chronic care management. Endocrinologists conducting AWVs can integrate diabetic foot exams, A1C tracking, and nutrition counseling, while cardiologists can incorporate heart health screenings, medication adherence evaluations, and lifestyle coaching. As specialists increasingly assume roles in population health and risk management, their participation in AWVs will continue to grow.