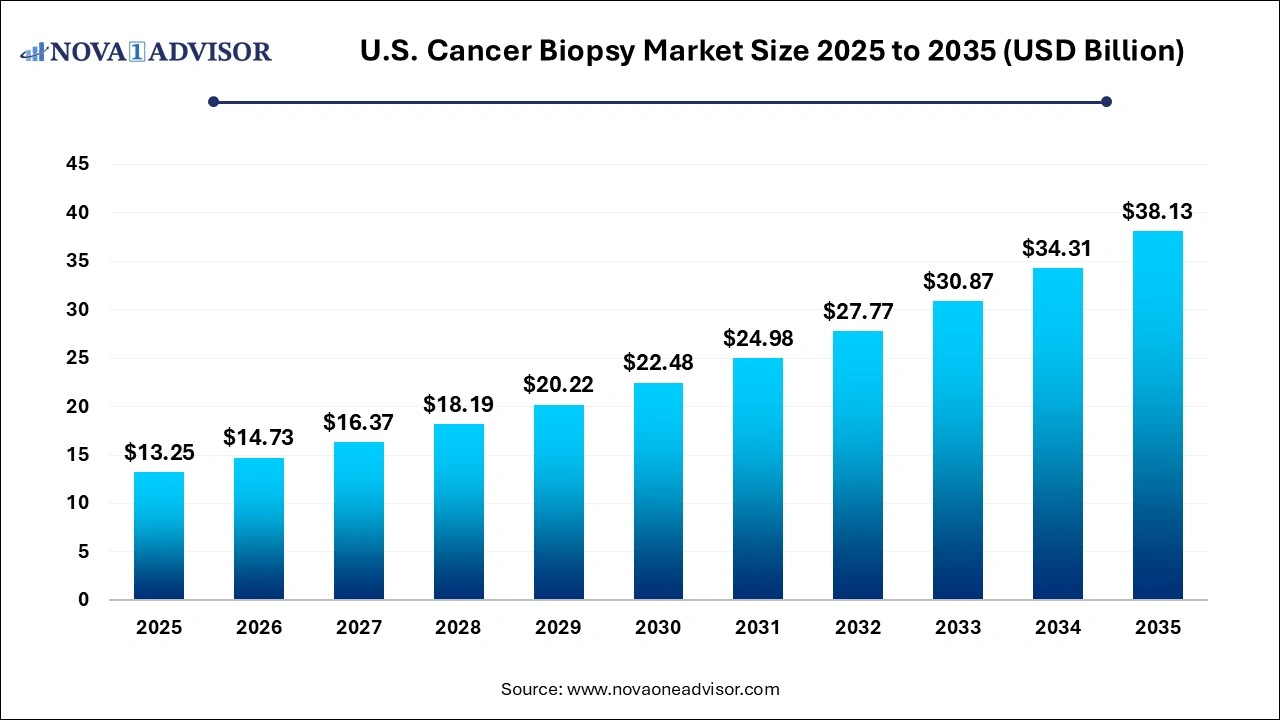

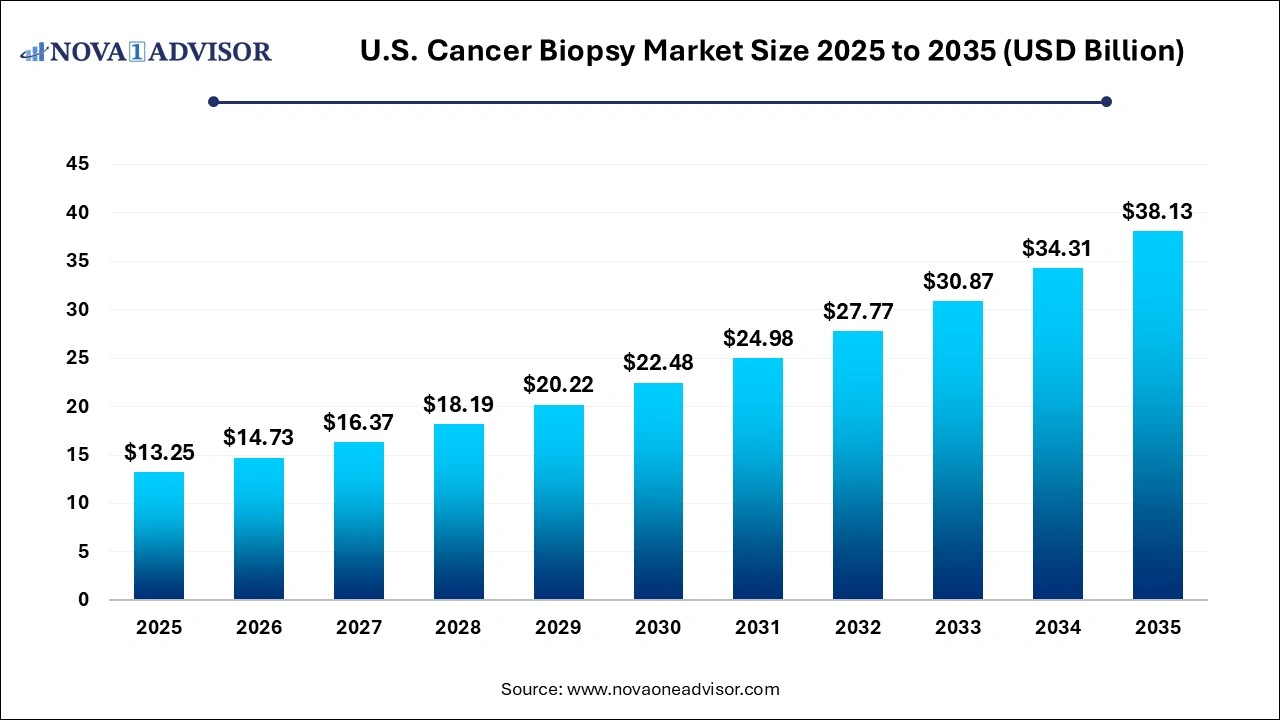

U.S. Cancer Biopsy Market Size and Trends 2026 to 2035

The U.S. cancer biopsy market size was estimated at USD 13.25 billion in 2025 and is expected to be worth around USD 38.13 billion by 2035, poised to grow at a compound annual growth rate (CAGR) of 11.15% during the forecast period 2026 to 2035.

U.S. Cancer Biopsy Market Key Takeaways

- Fine-needle aspiration segment dominated the U.S. cancer biopsy market in 2025 with a revenue share of 34.7%.

- Skin /punch biopsy segment is expected to show lucrative growth during the forecast period.

- Screening & monitoring segment held the largest share of 54.31% in 2025.

- Pharma & Biopharma Discovery & Development segment is expected to show the fastest growth during the forecast period.

- Breast cancer segment accounted for the largest revenue share of 22% in the U.S. cancer biopsy market in 2025.

- Thyroid segment is expected to show the fastest growth during the forecast period.

U.S. Cancer Biopsy Market Overview

The U.S. cancer biopsy market stands at the intersection of clinical diagnostics and oncology innovation, playing a pivotal role in the early detection, diagnosis, monitoring, and research of cancer. Biopsies are essential diagnostic tools that allow clinicians to examine tissue and cell samples to determine the presence, type, and progression of cancerous growths. In the United States, where cancer is the second leading cause of death, the demand for precision diagnostics and personalized medicine is escalating. This has led to a robust growth trajectory for the biopsy market.

Driven by advances in imaging technologies, minimally invasive procedures, and the integration of AI in pathology, the cancer biopsy landscape is evolving rapidly. From conventional fine-needle aspirations to next-generation molecular biopsies, the market is diversifying with an emphasis on accuracy, speed, and patient comfort. Government initiatives promoting early cancer detection and insurance reimbursements for advanced diagnostics are further catalyzing the adoption of biopsy solutions.

The market's future is poised to benefit from ongoing research in liquid biopsies and genomic profiling, as precision oncology gains ground. These innovations not only enhance diagnostic accuracy but also open new avenues for translational and pharmaceutical research, solidifying the biopsy's role in the continuum of cancer care.

Major Trends in the U.S. Cancer Biopsy Market

-

Rise of Minimally Invasive Techniques: There is a strong preference for needle-based and punch biopsies over traditional surgical methods due to faster recovery and reduced complications.

-

Emergence of AI in Biopsy Analysis: AI-powered pathology tools are transforming the interpretation of biopsy samples, enabling higher diagnostic accuracy and faster turnaround times.

-

Growth in Liquid Biopsies: Though not yet mainstream, research and pilot studies in liquid biopsies are gaining traction for their potential to detect cancer biomarkers in blood or other fluids.

-

Integration with Molecular Diagnostics: Combining biopsy with genetic sequencing and biomarker testing is driving precision treatment planning.

-

Increase in Outpatient Biopsy Procedures: Advancements in biopsy tools and techniques are making it feasible to perform procedures in outpatient settings, lowering healthcare costs.

-

Greater Pharma Collaboration: Biopsy services are increasingly integrated into clinical trials and drug development pipelines.

U.S. Cancer Biopsy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 14.73 Billion |

| Market Size by 2035 |

USD 38.13 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.15% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, application, site(organ) |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

BD (Becton, Dickinson and Company); IZI Medical Products; Johnson & Johnson Services, Inc.; Argon Medical; Spectra Medical Devices, Inc.; Medtronic; Boston Scientific Corporation; CONMED Corporation; INRAD, Inc.; Thermo Fisher Scientific, Inc. |

Segmental Insights

By Type Insights

Core Biopsy dominated the type segment in the U.S. cancer biopsy market. Offering a balance between invasiveness and diagnostic clarity, core biopsy procedures provide ample tissue for histological examination and are widely used in breast, prostate, and liver cancer assessments. Clinical applications of core biopsy continue to rise, especially in breast cancer diagnosis, where it serves as a standard pre-treatment evaluation tool. The high diagnostic yield, affordability, and adoption in both public and private care settings support its dominance.

At the same time, fine-needle aspiration is the fastest-growing biopsy method, particularly in outpatient and minimally invasive settings. Its increasing use in thyroid, lung, and lymph node assessments is driven by patient comfort and reduced complications. In pharma-use settings, FNAs are valuable for sampling tumors with minimal disruption, aiding clinical trials and biomarker research. Their integration with image-guidance systems and cytopathology is accelerating adoption.

By Application Insights

Diagnostics led the application segment, reflecting the foundational role of biopsy in confirming cancer presence and guiding clinical decisions. Hospitals and pathology labs across the U.S. routinely perform biopsies as the gold standard for cancer diagnosis. As cancer screenings become more proactive, the diagnostic segment is expected to maintain its dominance. For example, biopsies are standard follow-up procedures to abnormal mammograms, CT scans, or PET imaging.

In contrast, pharma and biopharma discovery & development is rapidly emerging, driven by the integration of biopsies into translational research and clinical trials. Biopsies allow pharmaceutical developers to evaluate drug-tumor interactions, resistance profiles, and biomarker expressions. As personalized therapies expand, the demand for high-quality tumor samples in controlled trials is expected to rise significantly.

By Site (Organ) Insights

Breast cancer remained the dominant site for biopsy procedures due to the widespread use of screening mammography and the high incidence of breast cancer among women in the U.S. Core and fine-needle biopsies are commonly employed in diagnosing suspicious breast lumps. The strong awareness around breast cancer, combined with established screening guidelines and insurance coverage, ensures high biopsy volume for this site.

Lung cancer biopsies are growing the fastest, largely due to improvements in imaging and the increased adoption of low-dose CT screening in high-risk populations. Given the difficulty in accessing deep lung tissues, minimally invasive biopsy techniques guided by bronchoscopy or CT have seen technological advancements. These biopsies are also central to determining PD-L1 expression levels and other genetic markers, which are key in selecting immunotherapy treatments.

By Country Insights

In the U.S., the cancer biopsy landscape is shaped by a strong healthcare infrastructure, cutting-edge technology adoption, and a policy environment supportive of cancer diagnostics. Major urban centers boast advanced biopsy facilities with robotic guidance systems, digital pathology, and AI tools for slide interpretation. The Cancer Moonshot initiative and increased funding to the National Cancer Institute (NCI) continue to boost innovation and awareness in cancer diagnostics.

However, disparities still exist between metropolitan and rural regions in terms of access to biopsy services. To address this, mobile diagnostic units and telepathology services are being explored. Furthermore, with rising insurance reimbursements for diagnostic procedures and a growing geriatric population, biopsy volumes are set to climb steadily. Educational campaigns led by non-profits and governmental agencies are also helping to overcome stigma and fear associated with biopsy procedures.

U.S. Cancer Biopsy Market Top Key Companies:

U.S. Cancer Biopsy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Cancer Biopsy market.

By Type

- Fine-needle Aspiration

- Core Biopsy

- Surgical Biopsy

- Skin Biopsy /Punch Biopsy

- Others

By Application

- Screening & Monitoring

- Diagnostics

- Investigational & Translational Research

- Pharma & Biopharma Discovery & Development

By Site (Organ)

- Liver

- Breast

- Thyroid

- Prostate Gland

- Uterus & Cervix

- Kidney

- Bladder

- Lungs

- Pancreas

- Others