U.S. Compounding Pharmacies Market Size and Forecast 2025 to 2034

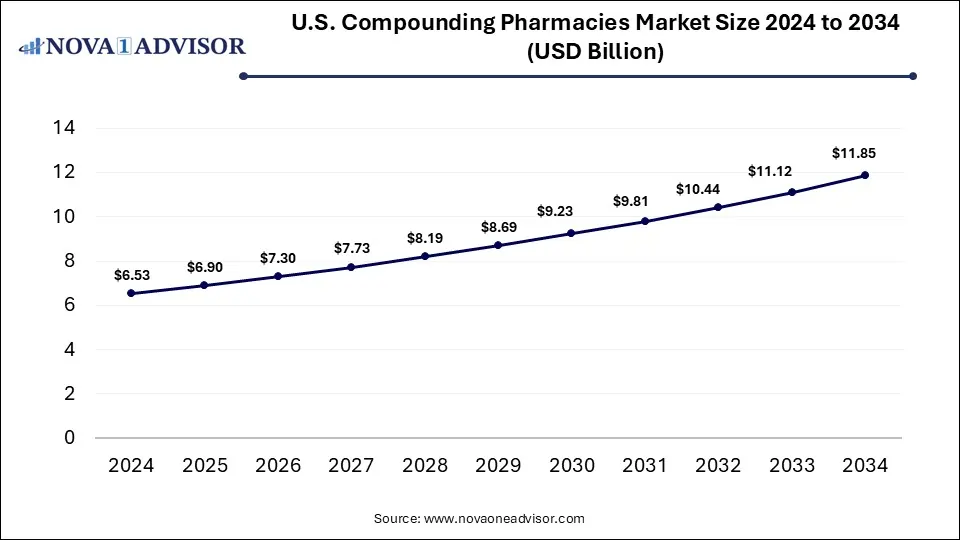

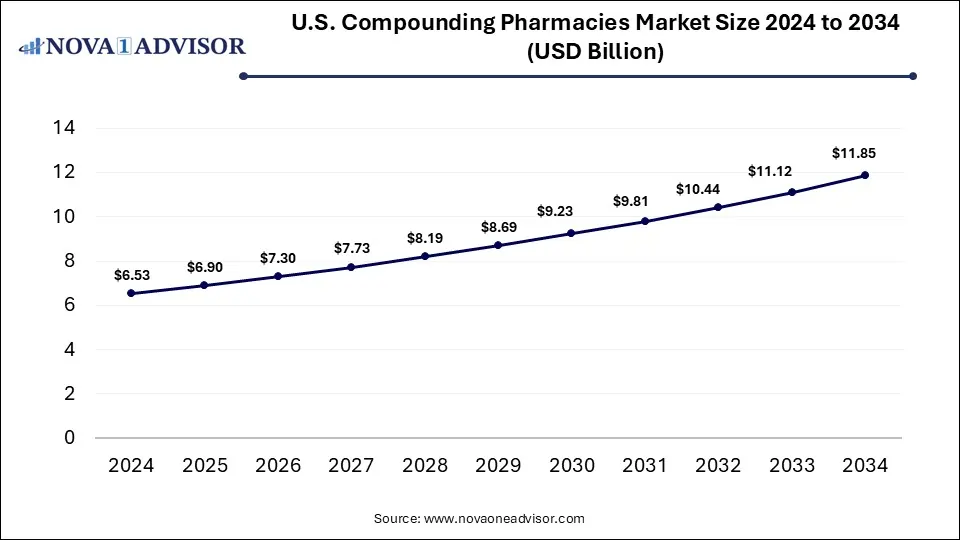

The U.S. compounding pharmacies market size is calculated at USD 6.53 billion in 2024, grows to USD 6.90 billion in 2025, and is projected to reach around USD 11.85 billion by 2034, expanding at a CAGR of 6.2% from 2025 to 2034. The U.S. compounding pharmacies market expansion is driven by the rising demand for tailored medication solutions, focus on patient-centered care, need for addressing drug shortages, and improved service offerings.

U.S. Compounding Pharmacies Market Key Takeaways

- By pharmacy type, the 503A segment captured the highest market revenue share in 2024.

- By pharmacy type, the 503B segment is anticipated to grow at the fastest CAGR over the forecast period.

- By therapeutic area, the hormone replacement therapy segment dominated the market with the largest revenue share in 2024.

- By therapeutic area, the nutritional supplements segment is expected to show the fastest growth over the forecast period.

- By product, the oral segment held the largest market share in 2024.

- By product, the nasal segment is expected to register fastest growth during the forecast period.

- By age, the pediatric segment captured the largest market share in 2024.

- By age, the adult segment is expected to show the fastest growth during the forecast period.

- By compounding type, the pharmaceutical ingredient alteration (PIA) segment generated the highest market revenue in 2024.

- By compounding type, the pharmaceutical dosage alteration (PDA) segment is expected register the fastest CAGR over the forecast period.

- By sterility, the non-sterile segment accounted for the highest market share in 2024.

- By sterility, the sterile segment is expected to grow at the fastest rate during the predicted timeframe.

- By end-user, the hospitals and clinics segment dominated the market accounting for the largest revenue share in 2024.

- By end-user, the specialty clinics segment is expected to expand rapidly over the forecast period.

What Drives the Growth of the U.S. Compounding Pharmacies Market Growth?

Compounding pharmacies refer to specialized pharmacies providing customized medications for patients with specific needs which are not available through commercially manufactured drugs. Compound pharmacists modify or combine specific ingredients for creating medications tailored to an individual’s unique requirements, including allergies, adjustments to dosage, or preferred forms like liquid instead of a tablet.

The rising burden of chronic diseases like arthritis and diabetes, aging demographics, increasing disposable incomes, need for addressing unique unmet medical needs, and increased awareness are the factors driving the growth of the U.S. compounding pharmacies market. Expansion of wholesale services for compounded medications by companies is expanding the market potential.

- For instance, in September 2024, Revelation Pharma introduced Revelation Wholesale, which is its new go-to source for providing comprehensive healthcare solutions and an extension to its nationwide compounding network. The new platform will allow healthcare providers to deliver and exceed the unique needs of their patients, including human and animal both. (Source: https://www.prnewswire.com/)

What Are the Key Trends in the U.S. Compounding Pharmacies Market in 2025?

- In July 2025, eNavvi, the physician-founded cash-pay digital prescribing platform, launched its All Specialty Compound Medication Marketplace which will allow U.S. clinicians to prescribe vetted and FDA-compliant compounded medications in under 60 seconds. Along with the launch, the platform also invited accredited compounding pharmacies to join its network. (Source: https://www.prnewswire.com/)

- In June 2025, Craft Telemedicine officially introduced its new telemedicine platform which is a transformative no-subscription telemedicine model offering patients with complete control over specialized compounded medications and freedom of filling their prescriptions at any pharmacy of their choice. The human-centered platform operates on a pay-per-prescription model. (Source: https://www.prnewswire.com/ )

How is AI Influencing the U.S. Compounding Pharmacies Market?

The integration of artificial intelligence (AI) in the U.S. compounding pharmacies market is driven by factors such as the well-established healthcare infrastructure, increased adoption of digital technologies, expanding applications, growing emphasis on precision medicine, stringent regulations, and focus on improving safety and quality control of compounded medications.

The implementation of AI for analyzing workflows can help in detecting slowdowns and for suggesting improvements, further reducing administrative work for pharmacists and allowing them devote more time towards patient care and other clinical tasks. AI algorithms can be applied for streamlining and automating various processes in compounding pharmacies such as automating documentation process, for simplifying complex dosage calculations, speeding up invoice generation, and in inventory management. Machine learning models are being used for the development of smart formulation platforms to assist compounding pharmacies in optimizing drug formulations and for predicting Beyond Use Dates (BUDs).

U.S. Compounding Pharmacies Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 6.90 Billion |

| Market Size by 2034 |

USD 11.85 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.2% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

By Pharmacy Type, By Product, By Sterility, By Compounding Type, By Therapeutic Area, By Age Cohort and By End-User

|

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Avella Specialty Pharmacy, Central Admixture Pharmacy Services, Inc., Clinigen Limited, Fagron, Fresenius Kabi USA, ImprimisRx (Harrow Health, Inc.), PenCol Pharmacy, Sixth Avenue Medical Pharmacy, Triangle Compounding, Vertisis Custom Pharmacy

|

Market Dynamics

Drivers

Rising Demand for Tailored Treatments

There is a huge demand for personalized medicine across the U.S. for various applications which drives the growth compounding pharmacies providing customized medical solutions. Several patients, particularly children and elder people require medications in specific dosages or forms, which are not available commercially. Compounding pharmacies can efficiently address these specific patient needs by developing custom formulations as well as create combination of multiple medications into a single dose for simplifying complex treatment regimens, further ensuring that patients receive proper treatment based on their individual needs.

Restraints

Lack of Regulatory Oversight and High Compliance Costs

The regulation of medications developed by compounded pharmacies is complicated involving state and federal laws, which lead to lack of standardization and inconsistency in practices and enforcement across various states in the U.S. Also, compounded drugs do not receive FDA approvals and are not tested under strict safety, efficacy and quality control testing parameters as compared to commercially manufactured drugs, further raising concerns regarding the consistency and reliability among patients and healthcare providers.

Furthermore, stringent regulations imposed on compounding pharmacies, especially for sterile compounding, requires heavy investments in advanced equipment, cleanroom facilities, comprehensive testing, staff training, as well as continuous expenses with costs of documentation process and quality control. These factors can restrain the growth of compounding pharmacies, especially for smaller, independent pharmacies.

Opportunities

Advancements in Compounding Processes

The integration of new technologies such as automated dispensing systems, AI-powered software, robotics is mitigating the risk of human errors in complex compounding processes, leading to improved safety, efficacy and compliance of compounded medications. Improvements in sterile compounding such as advanced cleanroom facilities, environmental monitoring, and automated equipment are facilitating bulk production of these medications, while ensuring regulatory compliance. The rising investments in technologies like e-prescription and digital platforms are improving workflows and enhancing patient experience.

Segmental Insights

What Drives the Dominance of the 503A Segment in the Market in 2024?

By pharmacy type, the 503A segment dominated the market with the highest revenue share in 2024. A 503A compounding pharmacy refers to a traditional pharmacy providing compounded medications based on individual patient prescriptions and they operate under state board oversight while ensuring adherence to the United States Pharmacopeia (USP) chapter 797 guidelines. Strict regulations outlined in the Federal Food, Drug, and Cosmetic Act (FD&C Act) for 503A pharmacies ensures the quality and safety of their compounding practices. The segment’s market dominance is driven by the surging rates of chronic illnesses, focus on specialized care, demand for personalized medicine, adeptness at fulfilling prescriptions with patient-specific requirements such as allergy considerations and dosage adjustments, as well as the need for addressing drug shortages and catering to complex medication regimens.

By pharmacy type, the 503B segment is anticipated to witness fastest growth during the forecast period. A 503B compounding pharmacy is an outsourcing facility for compounded medications producing large batches, beyond patient-specific prescriptions, for sale to healthcare facilities. These facilities are strictly regulated by the FDA and must adhere to Current Good Manufacturing Practices (CGMP), which enhances their credibility and reliability for healthcare providers seeking safe and effective compounded medications. The rising awareness regarding benefits of compounded medications, focus on precision medicine, increasing demand for bulk compounded medications, advanced healthcare infrastructure, cost-effectiveness, and the need for sterile compounding and ready-to-administer medications are the factors boosting the market growth.

U.S. Compounding Pharmacies Market, by Pharmacy Type 2022-2024 (USD Billion)

|

By Pharmacy Type

|

2022 |

2023 |

2024 |

| 503A |

4.27 |

4.51 |

4.77 |

| 503B |

1.59 |

1.67 |

1.76 |

How Hormone Replacement Therapy Segment Dominated the Market in 2024?

By therapeutic area, the hormone replacement therapy (HRT) segment accounted for the highest market revenue share in 2024. There is limited availability of doses and delivery methods for commercially available HRT products, which drives the demand for creating custom formulations such as creams, capsules, gels, troches with adjusted hormone dosages and flexible delivery methods suitable to individual patient’s needs that are offered by compounding pharmacies. The rising awareness of hormonal imbalances, aging population, shifting preference towards bioidentical hormones, and access to hormone formulations that are free of inactive ingredients and allergens causing adverse reactions in sensitive patients are the factors driving the market dominance of this segment.

- For instance, in June 2025, Olympia Pharmaceuticals, a nationally leading 503A and 503B compounding pharmacy, launched its new consumer-focused platform, OlympiaYou.com, which is an innovative digital platform developed for empowering patients through wellness and sexual health support. The new platform offers access to virtual pharmacist care and delivery of health assistance support options, particularly for individuals exploring female sexual enhancement, hormone support, erectile dysfunction and weight loss. (Source: https://www.globenewswire.com/ )

By therapeutic area, the nutritional supplements segment is expected to show the fastest CAGR during the forecast period. The rising awareness among a large number of Americans regarding management of health and wellness, prevention of diseases, and addressing nutritional deficiencies is boosting the demand for customized nutritional solutions. Compounding pharmacies offer nutritional supplements with combination of ingredients such as vitamins and minerals, specific dosages, delivery methods tailored to individual patient needs and selection for supporting the management of various condition such as chronic pain, hormonal imbalances, and obesity, as well as for addressing nutritional deficiencies.

U.S. Compounding Pharmacies Market, by Therapeutic Area 2022-2024 (USD Billion)

| By Therapeutic Area |

2022 |

2023 |

2024 |

| Hormone replacement |

1.16 |

1.22 |

1.30 |

| Pain management |

0.95 |

1.01 |

1.07 |

| Dermatology |

0.54 |

0.57 |

0.61 |

| Paediatrics |

0.37 |

0.40 |

0.42 |

| Urology |

0.32 |

0.34 |

0.36 |

| Others |

2.52 |

2.64 |

2.77 |

What Made Oral the Dominant Market Segment in 2024?

By product, the oral segment dominated the market with the largest share in 2024. Oral medications such as tablets, capsules, syrups, and suspensions, are generally the most convenient, ease to use and non-invasive method for administrating drugs to patients, leading to improved compliance and better adherence by patients to treatment plans. A considerable number of population, especially geriatric and pediatric patients face difficulties in swallowing pills. Compounding pharmacies can transform solid medications to a liquid form, making it easier and palatable for these patients to consume their medicine. Additionally, oral medications are a major part of non-sterile compounding which is an expanding area in the compounding pharmacies market and directly contributes to the segment’s market growth.

By product, the nasal segment is anticipated to grow rapidly during the predicted timeframe. Nasal administration refers to a non-invasive delivery method with rapid absorption of drugs in the bloodstream. Compounding pharmacies provide patients with customized nasal medications that are free of preservatives, dyes, or other inactive ingredients for various applications such as allergies, sinus infections, pain management, and other conditions, further offering alternative for patients to commercially available medications.

U.S. Compounding Pharmacies Market, by Product 2022-2024 (USD Billion)

| By Product |

2022 |

2023 |

2024 |

| Oral |

2.11 |

2.23 |

2.36 |

| Liquid Preparations |

1.34 |

1.41 |

1.50 |

| Topical |

1.17 |

1.24 |

1.31 |

| Rectal |

0.18 |

0.19 |

0.20 |

| Ophthalmic |

0.24 |

0.25 |

0.27 |

| Nasal |

0.34 |

0.36 |

0.39 |

| Otic |

0.48 |

0.49 |

0.50 |

Why Did the Pediatric Segment Dominate the Market in 2024?

By age, the pediatric segment held the highest market share in 2024. The market dominance of this segment is driven by the rising demand for customized medications for children, especially young children and infants, requiring highly specific dosages based on their age, body surface area, and weight. Standard medications usually formulated for adults can be potentially dangerous and unsuitable for children which drives the need for compounded medications developed by compounding pharmacists that are precise with weight-based dosages for ensuring safety and efficacy in the younger population.

The increasing prevalence of chronic conditions like pediatric asthma, ADHD, and infectious diseases in children are contributing to the market growth. The rising collaborations of paediatricians with compounding pharmacies for ensuring medication adherence, efficacy and reliability in the pediatric population, further expanding the market potential.

By age, the adult segment is expected to show the fastest growth over the forecast period. The increasing awareness regarding the benefits of compounding pharmacies, rising healthcare expenditure, focus on preventive healthcare, need for addressing chronic and lifestyle-related diseases as well as nutritional deficiencies are the factors driving the market growth of this segment. Supply gaps in commercially available drugs, leading to unavailability of essential medications for adults due to discontinuations or shortages, can be addressed by compounding pharmacies.

What Made Pharmaceutical Ingredient Alteration (PIA) the Dominant Segment in 2024?

By compounding type, the pharmaceutical ingredient alteration (PIA) segment captured the biggest market revenue share in 2024. Pharmaceutical ingredient alteration (PIA) refers to adjusting the active pharmaceutical ingredients (APIs) for eliminating allergens or excipients in medications that can cause adverse reactions, further offering a suitable treatment option for patients with specific sensitivities. The rising demand for tailored medications specific to individual needs, focus on addressing unmet medical needs, effective management of allergies and sensitivity, as well as advancements in compounding equipment and techniques are the factors driving the market dominance of this segment.

By compounding type, the pharmaceutical dosage alteration (PDA) segment is expected to grow at the fastest rate over the projected timeframe. The market growth of this segment is driven by the increasing need for developing customized dosages for specific populations, particularly pediatric and geriatric patients having difficulty in swallowing pills. Compounding pharmacies offer various services to different types of patient populations such as creation of customized dosages, simplifying complex treatment regimens, and providing medications in case of drug shortages or discontinuations.

U.S. Compounding Pharmacies Market, by Compounding Type 2022-2024 (USD Billion)

| By Compounding Type |

2022 |

2023 |

2024 |

| PIA |

3.01 |

3.18 |

3.36 |

| CUPM |

0.93 |

0.98 |

1.04 |

| PDA |

0.30 |

0.32 |

0.34 |

| Others |

1.62 |

1.70 |

1.78 |

How Did the Non-Sterile Segment Dominate the Market in 2024?

By sterility, the non-sterile segment dominated the market with the highest revenue share in 2024. Non-sterile compounded medications such as creams, gels, capsules, ointments, and oral suspensions are in high demand due to increasing focus on personalized medicine, which offers access to tailored medications that are developed based on individual patient requirements, including type of formulation, dosage and administration route. The ongoing advancements in pharmacy practices, increased emphasis on addressing drug shortages, regulatory support, cost-effectiveness of these medications, and expanding applications throughout various therapeutic areas are the factors fuelling the market growth of this segment.

By sterility, the sterile segment is expected to show the fastest growth during the forecast period. The demand for sterile preparations for sensitive treatment areas, rising chronic disease burden, aging populations, surging investments through private organizations and government initiatives for improving infrastructure and expanding production capacities, and rise in number of 503B facilities are the factors contributing to the market growth. Advancements in sterile compounding techniques and innovations such as automated drug dispensing systems are expanding the market potential.

- For instance, in December 2024, Germfree launched Smarthood, which is the world’s first-of-a-kind software-agnostic and fully integrated intravenous (IV) workflow hardware solution. The new solution streamlines sterile compounding workflows for pharmacists and technicians by combining advanced technologies into a single platform which minimizes contamination risks and reduces operational errors. (Source: https://www.prnewswire.com/ )

U.S. Compounding Pharmacies Market, by Sterility 2022-2024 (USD Billion)

| By Sterility |

2022 |

2023 |

2024 |

| Sterile |

1.63 |

1.73 |

1.83 |

| Non-Sterile |

4.23 |

4.45 |

4.70 |

Why Did the Hospitals and Clinics Segment Dominate the Market in 2024?

By end-user, the hospitals and clinics segment dominated the market with the highest revenue share in 2024. Drug shortages of commercially manufactured drugs are the most widely faced ongoing issue by hospitals and clinics, which drives the demand for compounded medications to ensure consistent supply. The expanding network of 503B compounding pharmacies, regulatory support, focus on addressing patient-specific medication requirements, and the rising demand for sterile compounded preparations like chemotherapy drugs, total parenteral nutrition (TPN) and intravenous (IV) solutions are the factors fueling the market growth. Additionally, hospitals are collaborating with compounding pharmacies to enhance their operational efficiency by freeing up their internal pharmacy staff to focus on patient care and other clinical tasks as well as to mitigate the financial and legal risks associated with in-house compounding by outsourcing sterile compounding.

By end-user, the specialty clinics segment is expected to grow at the fastest rate over the forecast period. Specialty clinics provide specialized therapies across various therapeutic areas, such as dermatology, hormone replacement therapy, pain management and veterinary medicine, which require specialized or non-standard drug formulations for treating these conditions. Compounding pharmacies are exceptionally equipped for creating these tailored medications with a focus on addressing patient-specific needs. Furthermore, the emergence of functional and integrative medicine offering holistic and patient-centered care is creating a huge demand for personalized treatments through specialty clinics who are partnering with compounding pharmacies to provide customized nutritional supplements, bioidentical hormones, and other tailored therapies, further enhancing patient care.

U.S. Compounding Pharmacies Market, by End-User 2022-2024 (USD Billion)

| By End-User |

2022 |

2023 |

2024 |

| Hospitals and Clinics |

1.92 |

2.03 |

2.15 |

| Specialty Clinics |

1.70 |

1.80 |

1.90 |

| Others |

2.24 |

2.36 |

2.48 |

Country-Level Analysis

The U.S. is a globally leading contributor to the compounding pharmacies market. The market growth can be attributed to the large presence of major companies, rising trend of outsourcing sterile compounding services from 503B outsourcing facilities, increased emphasis on ensuring regulatory compliance, and demand for medications free of allergens and preservatives. Integration of telehealth platforms, online prescriptions and Electronic Health Records (EHRs) are improving patient access to compounded medications.

The rising collaborations of compounding pharmacies with specialty clinics, telehealth providers, and functional medicine practitioners, as well as the increased focus of compounding pharmacies on targeting underserved areas with limited access to specialized medications are expanding the market potential. Moreover, the U.S. government influence through agencies like the Food and Drug Administration’s (FDA’s) Compounding Incidents Program as well as the implementation of the Drug Quality and Security Act (DQSA) which is a part of the Compounding Quality Act (CQA) are bolstering the market growth.

Key U.S. Compounding Pharmacies Companies:

- Avella Specialty Pharmacy

- Central Admixture Pharmacy Services, Inc.

- Clinigen Limited

- Fagron

- Fresenius Kabi USA

- ImprimisRx (Harrow Health, Inc.)

- PenCol Pharmacy

- Sixth Avenue Medical Pharmacy

- Triangle Compounding

- Vertisis Custom Pharmacy

U.S. Compounding Pharmacies Market Recent Developments

- In January 2025, Revelation Pharma, a nationwide network comprising of 503A and 503B compounding pharmacies, expanded its national compounding network with the acquisition of AleraCare Pharmacy, which is an independent compounding pharmacy and a part of the AleraCare Organization. The acquisition limited to AleraCare's compounding pharmacy operations, will be renamed as OmniScript Compounding. (Source: https://www.prnewswire.com/)

- In October 2024, Strive Compounding Pharmacy acquired an approximately 50,000 sq. ft. facility in St. Louis, Missouri for expanding its telehealth compounding and fulfilment services. (Source: https://www.prnewswire.com/)

U.S. Compounding Pharmacies Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Compounding Pharmacies market.

By Pharmacy Type

By Product

- Oral

- Capsules

- Granules

- Tablets

- Powder

- Others

- Liquid Preparations

- Emulsion

- Syrup

- Solutions

- Suspension

- Others

- Topical

- Gels

- Ointments

- Creams

- Pastes

- Others

- Rectal

- Enema

- Suppositories

- Others

- Ophthalmic

- Nasal

- Otic

By Sterility

By Compounding Type

- Pharmaceutical Ingredient Alteration (PIA)

- Currently Unavailable Pharmaceutical Manufacturing (CUPM)

- Pharmaceutical Dosage Alteration (PDA)

- Others

By Age Cohort

- Pediatric

- Adult

- Geriatric

By Therapeutic Area

- Hormone Replacement

- Pain Management

- Dermatology

- Pediatrics

- Urology

- Others

By End-User

- Hospitals and Clinics

- Specialty Clinics

- Others