U.S. Freestanding Emergency Department Market Size, Share, Growth, Report 2026 to 2035

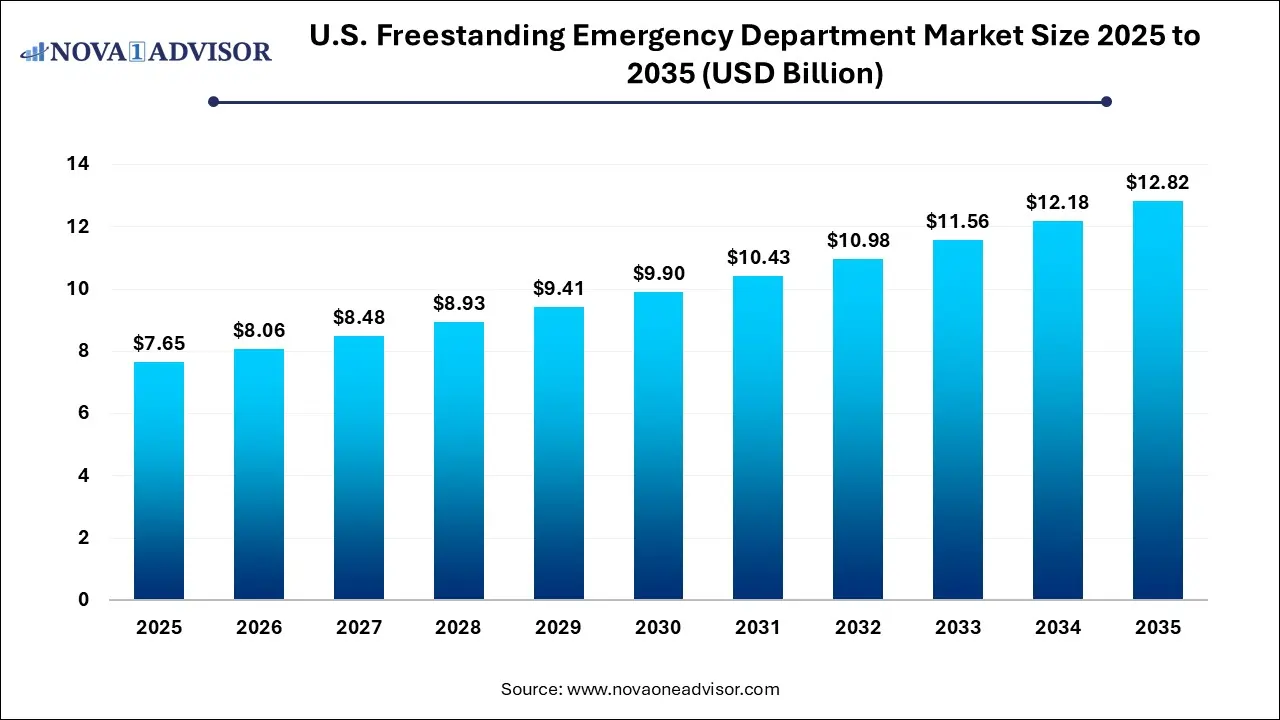

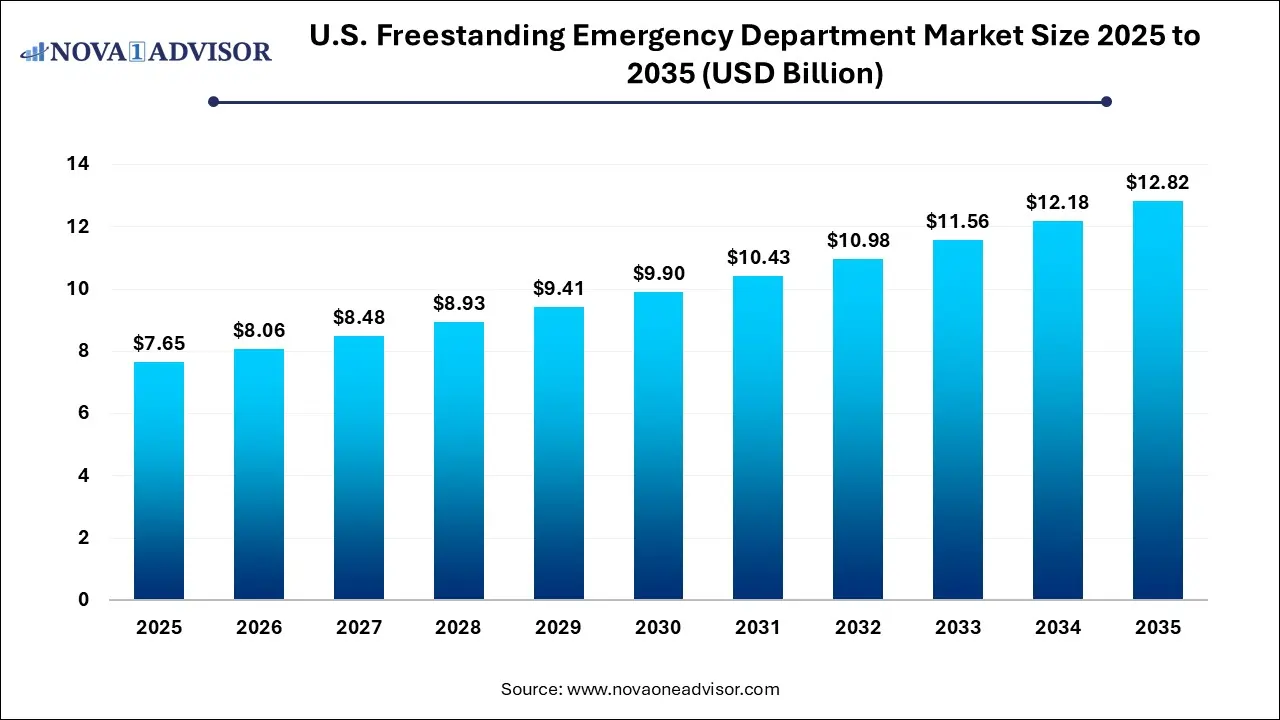

The U.S. freestanding emergency department market size was exhibited at USD 7.65 billion in 2025 and is projected to hit around USD 12.82 billion by 2035, growing at a CAGR of 5.3% during the forecast period 2026 to 2035.

Market Overview

The U.S. Freestanding Emergency Department (FSED) market represents a rapidly evolving frontier in acute healthcare delivery. Unlike traditional emergency rooms housed within hospitals, FSEDs are standalone medical facilities equipped to provide emergency care around the clock. They offer many of the same services as hospital-based emergency departments (EDs), including imaging, laboratory testing, trauma stabilization, and emergency physician consultations. Over the past decade, these facilities have grown in number and acceptance, emerging as viable alternatives for communities lacking quick access to hospital-based EDs.

FSEDs are primarily categorized into two types: Hospital-affiliated Off-Campus Emergency Departments (OCEDs) and Independent Freestanding Emergency Departments (IFSEDs). OCEDs are typically satellite facilities affiliated with hospital systems, whereas IFSEDs are often physician-owned and operate independently. This structural variation enables a flexible approach to emergency healthcare, especially in suburban and underserved urban locales.

The growth in the FSED market is being propelled by several factors including rising emergency care demand, hospital overcrowding, consumer preference for short wait times, and favorable state-level policies in states like Texas, Florida, and Colorado. Furthermore, as healthcare transitions from centralized to decentralized models, FSEDs are seen as pivotal in bridging access gaps without overburdening full-service hospitals.

Despite their promise, these facilities also face regulatory scrutiny, reimbursement hurdles, and challenges related to consumer awareness. Nevertheless, market players are innovating through technology integration, 24/7 service capabilities, strategic partnerships with hospital networks, and service expansions to remain competitive in an increasingly value-driven healthcare landscape.

Major Trends in the Market

-

Expansion in Suburban and Semi-Rural Areas: FSEDs are increasingly being established in suburban locations where hospital EDs are sparse but population density and emergency care demand are rising.

-

Vertical Integration with Hospital Systems: Major healthcare providers are acquiring or affiliating with independent FSEDs to streamline patient flow and diversify care delivery models.

-

Technology-Enabled Care: Use of EHRs, AI-powered triage systems, and tele-emergency platforms is becoming more common to optimize patient intake and diagnostics.

-

Shorter Wait Times as a Competitive Edge: Many FSEDs advertise average wait times under 10 minutes, drawing patients seeking faster alternatives to traditional ERs.

-

Multi-Service Integration: FSEDs are expanding beyond emergency services to include imaging (CT, X-ray, ultrasound) and laboratory testing to offer a more complete patient experience.

-

State Policy Support and Licensing: States like Texas, Arizona, and Colorado have formal licensing frameworks for FSEDs, encouraging market entry and standardization.

-

Consumer Education Campaigns: Operators are investing in educating communities about the availability, scope, and insurance acceptance at FSEDs to dispel misconceptions.

U.S. Freestanding Emergency Department Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 8.06 Billion |

| Market Size by 2035 |

USD 12.82 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.3% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Ownership, Service |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Adeptus Health Inc.; Tenet Healthcare Corporation; Universal Health Services, Inc.; HCA Healthcare, Inc.; Community Health Systems, Inc.; Ascension Health; Legacy Lifepoint Health, Inc.; Ardent Health Services; Emerus |

Market Driver: Rising Emergency Care Demand and Hospital ED Overcrowding

One of the most significant drivers of the U.S. FSED market is the escalating demand for emergency care coupled with overcrowding in hospital emergency departments. According to the CDC, the U.S. recorded over 130 million ED visits annually, a number that continues to climb due to population growth, chronic disease prevalence, and an aging demographic. Traditional hospital EDs are increasingly burdened, often leading to long wait times, patient dissatisfaction, and operational inefficiencies.

FSEDs address this gap by offering quick, accessible, and high-quality emergency care. They are especially beneficial in areas where hospitals are either not present or are unable to keep up with patient volumes. For instance, in states like Texas, FSEDs have become vital in managing patient overflow and reducing non-urgent visits to hospital EDs. Their ability to function with leaner operational models, combined with 24/7 readiness, has made them highly attractive from both patient and payer perspectives. Moreover, they also help hospitals optimize their resources by diverting lower-acuity cases, thereby improving outcomes and resource allocation.

Market Restraint: Insurance Reimbursement and Regulatory Uncertainty

Despite their clinical advantages, FSEDs face a notable restraint in the form of insurance reimbursement disparities and regulatory complexities. One of the key challenges is the lack of consistent Medicare and Medicaid reimbursement, particularly for IFSEDs. Since federal laws currently allow reimbursement mainly for hospital-affiliated OCEDs, independent centers often struggle to secure coverage for services rendered to publicly insured patients.

This results in billing disputes, higher out-of-pocket costs for patients, and hesitancy among insurers to contract with IFSEDs. Furthermore, not all states have a well-defined licensing framework for FSEDs, leading to legal ambiguities that hamper market expansion. For example, while Texas has embraced FSEDs with favorable regulations, several other states still operate under restrictive laws that limit their establishment or functionality.

The absence of uniform policy standards across states and federal entities makes the business landscape challenging for operators. Consequently, many IFSEDs rely heavily on private insurance reimbursements and direct payments, which constrains their scalability and limits accessibility for economically disadvantaged populations.

Market Opportunity: Integration of Tele-Emergency and Diagnostic Services

A significant growth opportunity for FSEDs lies in the integration of tele-emergency and remote diagnostic technologies. As digital health infrastructure matures, FSEDs can leverage these innovations to enhance care quality, extend reach, and optimize workforce deployment. Tele-emergency services allow real-time consultations with specialists such as neurologists or cardiologists, enabling faster and more accurate diagnosis in time-sensitive conditions like stroke or cardiac events.

Furthermore, the use of remote imaging and AI-driven triage tools allows FSEDs to operate efficiently with fewer on-site staff, reducing overhead without compromising care. In rural settings, where specialist access is limited, these technologies can be transformative. For instance, a freestanding ED in rural Arizona partnered with a regional medical center to provide tele-radiology services, reducing turnaround time for image interpretation by 60%.

With increased federal support for telehealth and growing consumer acceptance of virtual care, FSEDs are well-positioned to harness this opportunity to redefine emergency care delivery. Integration of such services can also aid in achieving payer alignment and expanding the patient base through hybrid care models.

Segmental Analysis

By Ownership

Off-Campus Emergency Departments (OCEDs) dominate the ownership segment of the U.S. FSED market. These hospital-affiliated centers benefit from existing hospital infrastructure, seamless patient transfer protocols, and eligibility for public payer reimbursements, which gives them a competitive edge. Their association with established health systems also enhances patient trust and supports broader referral networks. OCEDs are often strategically placed in high-traffic suburban areas to relieve the load on main hospital campuses. For example, Banner Health in Arizona has implemented a network of OCEDs across Phoenix, enabling rapid triage and diversion from overwhelmed hospital facilities. These OCEDs function as satellites that help hospitals expand geographic reach and optimize patient distribution.

Independent Freestanding Emergency Departments (IFSEDs) are the fastest-growing ownership segment. Although constrained by reimbursement challenges, IFSEDs are experiencing growth due to their agility, operational autonomy, and ability to serve niche markets. These centers are often physician-owned and can be set up with lower capital investment than traditional hospital EDs. Many IFSEDs focus on delivering concierge-style emergency services, with minimal wait times and high patient satisfaction scores. For instance, SignatureCare Emergency Centers in Texas has rapidly expanded its IFSED model, offering luxurious interiors, shorter stay durations, and personalized care. These attributes are helping IFSEDs carve a distinct identity, particularly among privately insured and affluent populations.

By Service

Emergency Department (ED) Service dominates the service segment of the FSED market. The core function of all FSEDs is to provide 24/7 emergency care services including triage, trauma stabilization, resuscitation, and medical management of acute conditions. These services form the backbone of FSED operations and contribute the highest revenue share. ED services are typically supported by board-certified emergency physicians, trained nurses, and physician assistants, ensuring the facility can handle a wide spectrum of urgent cases. Many OCEDs are now certified for trauma-level capabilities, enabling them to manage life-threatening emergencies without needing to transfer patients. Their role became particularly crucial during the COVID-19 pandemic, when hospital-based EDs were overwhelmed.

Imaging Service is the fastest-growing service segment within the U.S. FSED market. As patient expectations evolve and diagnostic timelines shrink, FSEDs are increasingly investing in advanced imaging equipment including CT scanners, X-rays, and ultrasounds. These services are vital not only for trauma assessment but also for evaluating chest pain, fractures, abdominal pain, and neurological symptoms. The integration of PACS (Picture Archiving and Communication Systems) and remote radiology platforms allows for swift image sharing and interpretation, minimizing delays. Imaging services have become a key differentiator for FSEDs, with facilities advertising “diagnosis within 30 minutes” as part of their value proposition. The bundling of ED visits with imaging diagnostics also enhances billing and insurance reimbursement.

Country-Level Analysis: United States

Across the United States, the adoption and regulatory support for FSEDs vary widely by state. Texas leads the country in the number of operational FSEDs, with a well-established licensing framework that supports both OCEDs and IFSEDs. Florida, Colorado, and Arizona follow suit, having formalized rules that allow both types of facilities to function under strict quality controls and transparency mandates.

Conversely, several states either restrict the operation of IFSEDs or limit reimbursement for services provided outside of hospital systems. This regulatory fragmentation has led to uneven market penetration, where some states boast robust networks of FSEDs while others remain underserved. The Nurse Licensure Compact and the Emergency Triage, Treat, and Transport (ET3) model introduced by CMS have begun to encourage standardization, allowing better coordination between FSEDs and EMS services.

On the policy front, bipartisan discussions are ongoing about expanding Medicare recognition of IFSEDs, which could significantly boost their financial sustainability and encourage expansion into rural areas. Additionally, population health metrics and emergency care access gaps are being increasingly used to determine Certificate of Need (CON) exemptions, enabling strategic market entry.

Recent Developments

-

April 2025: SignatureCare Emergency Center announced the opening of two new IFSEDs in suburban Houston, each equipped with in-house imaging and pediatric trauma care capabilities.

-

March 2025: HCA Healthcare revealed plans to convert several urgent care centers into OCEDs across Nevada and Georgia to align with shifting patient volumes and extend acute care access.

-

February 2025: Emerus Holdings Inc., a major operator of micro-hospitals and OCEDs, signed a partnership with Baylor Scott & White Health to expand emergency care centers across central Texas.

-

January 2025: NextCare Holdings launched a pilot project in Arizona integrating tele-triage kiosks at FSEDs, allowing patients to self-report symptoms and reduce registration bottlenecks.

-

December 2024: Ascension Health acquired two IFSEDs in Florida, planning to rebrand them under their community care initiative to offer comprehensive emergency and diagnostic services.

Some of the prominent players in the U.S. Freestanding Emergency Department Market include:

- Adeptus Health Inc.

- Tenet Healthcare Corporation

- Universal Health Services, Inc.

- HCA Healthcare, Inc.

- Community Health Systems, Inc.

- Ascension Health

- Legacy Lifepoint Health, Inc.

- Ardent Health Services

- Emerus

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Freestanding Emergency Department market.

By Ownership

- Off-Campus Emergency Department (OCED)

- Independent Freestanding Emergency Department (IFSED)

By Service

- Emergency Department (ED) Service

- Imaging Service

- Laboratory Service