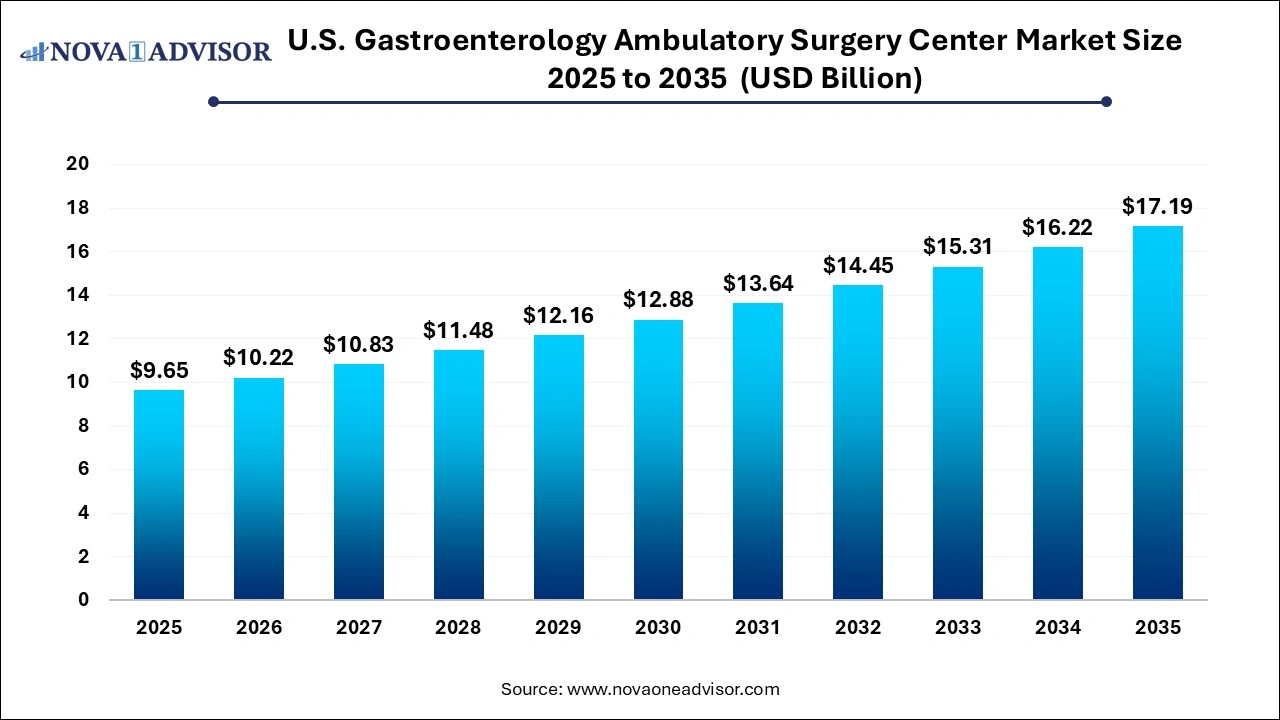

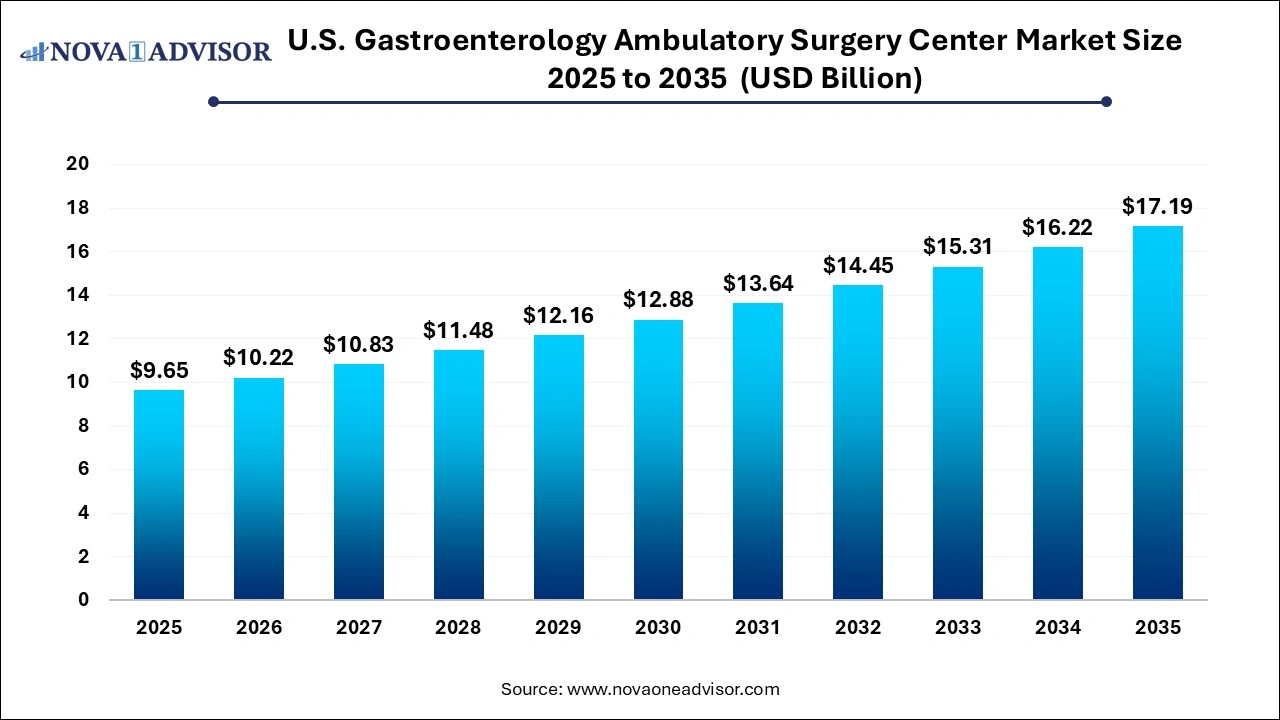

U.S. Gastroenterology Ambulatory Surgery Center Market Size and Growth 2026 to 2035

The U.S. gastroenterology ambulatory surgery center market size was estimated at USD 9.65 billion in 2025 and is expected to hit around USD 17.19 billion by 2035, poised to reach at a notable CAGR of 5.94% during the forecast period 2026 to 2035.

Key Takeaways:

- By Ownership, the U.S. Gastroenterology Ambulatory Surgery Center market was valued at USD 15.9 billion in 2025 and expected to witness growth at a CAGR of 5.9% from 2026 to 2035.

- Accounted for the highest market share in 2025, owing to maximum professional control over the clinical environment and quality of care delivered to patients.

- The rising burden of surgical procedures in the hospital increases the demand for ASC to perform various procedures such as urology, gastrointestinal, and ophthalmic surgery.

- The high adoption rate of advanced surgical procedures such as minimally invasive surgeries and new endoscopy technologies are the key factors driving the ambulatory surgery centers market in U.S. In addition

U.S. Gastroenterology Ambulatory Surgery Center Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 10.22 Billion |

| Market Size by 2035 |

USD 17.19 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.94% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Ownership |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Cardinal Health; Medtronic PLC; Ethicon (Johnson & Johnson); Boston Scientific; Olympus; Becton Dickinson (BD); Hill-Rom Holdings; GE Healthcare; Koninklijke Philips N.V.; Cook Medical |

Growing incidences of gastrointestinal disorders, rising geriatric population, overcrowding of the Hospital Outpatient Department (HOPD), and rising preference for ambulatory services to avoid unnecessary hospitalization charges are the major factors driving the market growth. According to the American Hospital Association's (AHA) 2022 Hospital Statistics report, in 2020, the outpatient revenue increased significantly and was around 95% of the inpatient revenue. This was mainly due to reduced inpatient admissions as compared to outpatient visits. The overall outpatient visits increased by 1.2% year-on-year while the hospital admission increased by less than 1%. This slowdown in hospital admissions shows the rising preference of the patients toward Ambulatory Surgery Centers (ASCs).

Rising healthcare costs are a major concern disrupting the industry and with it comes the fact that not all patients are capable to afford the cost of treatment that they need. This issue has forced healthcare service providers to find out an alternative to provide high-quality treatment at an affordable price. ASCs have proven to be an effective solution in this scenario. In the U.S., visits to ASCs for the treatment of gastrointestinal diseases are steadily increasing. Gastroenterology is one of the most common surgical specialties in multi- and single-specialty ASCs.

Medicare is the largest payer for ambulatory services in the country. From January 2020, Centers for Medicare and Medicaid Services (CMS) increased the reimbursement rate for endomicroscopy in upper GI endoscopy procedures in hospitals and in ambulatory surgical centers. Since ASCs include low admin cost but no hospitalization cost, ASC remains a more profitable business for the physicians when compared to hospitals. According to the Definitive Healthcare data, in 2017, ASCs performed more than 7.7 million Medicare procedures.

Ownership Insights

On the basis of ownership, the U.S. gastroenterology ambulatory surgery center market has been segmented into hospital-affiliated, freestanding/physician-owned, corporation-owned, and others. The other segment includes ventures between physician-hospital, physician-corporation, and physician-corporation-hospital. The freestanding segment (mainly comprising physician-owned ambulatory surgery centers) accounted for the highest market share in 2018, owing to maximum professional control over the clinical environment and quality of care delivered to patients. It allows physicians to focus on a small number of procedures in a single setting. With hands-on control, physicians maintain quality control processes in ASCs within a smaller space and fewer operating rooms as compared to hospitals.

The rising burden of surgical procedures in the hospital increases the demand for ASC to perform various procedures such as urology, gastrointestinal, and ophthalmic surgery. Endoscopic Ambulatory Surgery Centers (EASC) are the freestanding facilities designated to carry out gastrointestinal procedures at a low cost. These facilities are more competent than the hospital and offer an added source of revenue to the healthcare providers. According to Becker’s review of GI and Endoscopy in ASCs, in the U.S., around 25% of all cases in ASCs involve GI/endoscopic procedures. Also, more than 27% of all the single-specialty surgery centers are driven due to gastroenterology procedure

Regional Insights

The high adoption rate of advanced surgical procedures such as minimally invasive surgeries and new endoscopy technologies are the key factors driving the ambulatory surgery centers market in U.S. In addition, the high cost of medical services offered by physicians in the country and unnecessary hospitalization, create the need for cost-effective and efficient treatment options for patients seeking treatment. According to the data published by The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), 60 to 70 million people suffer from gastrointestinal diseases each year in U.S. The most common diseases include Gastroesophageal Reflux Disease (GERD), Irritable Bowel Syndrome (IBS), indigestion, constipation, diarrhea, and abdominal pain.

Some of the prominent players in the U.S. Gastroenterology Ambulatory Surgery Center Market include:

- Envision Healthcare Corporation

- Tenet Healthcare Corporation

- Surgery Partners

- Community Health Systems, Inc. (CHS)

- Universal Health Service (UHS)

- Hospital Corporation of America (HCA)

- Surgery Care Affiliates (SCA)

- SurgCenter Development

- Covenant Surgical Partners

- Regent Surgical Health

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Gastroenterology Ambulatory Surgery Center market.

By Ownership

- Hospital-Affiliated

- Freestanding

- Corporation-Owned

- Others