U.S. Healthcare Staffing Market Size and Growth 2026 to 2035

The U.S. healthcare staffing market size was valued at USD 79.45 billion in 2025 and is expected to be worth around USD 138.83 billion by 2035, growing at a CAGR of 5.74% during the forecast period from 2026 to 2035. Technological advancement and rising healthcare expenditure drive the U.S. healthcare staffing market.

U.S. Healthcare Staffing Market Key Takeaways

- By type insight, the travel nurse staffing segment dominated the market.

- By type insight, the locum tenens staff segment is expected to grow fastest during the forecast period.

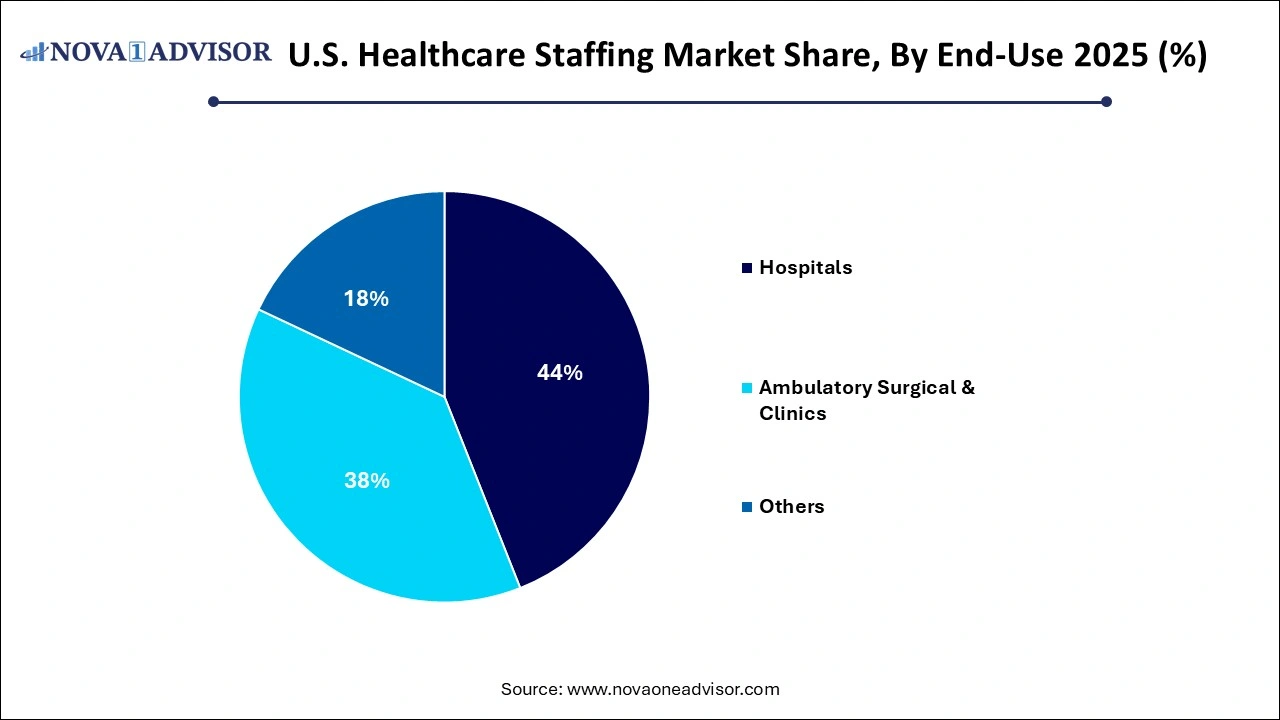

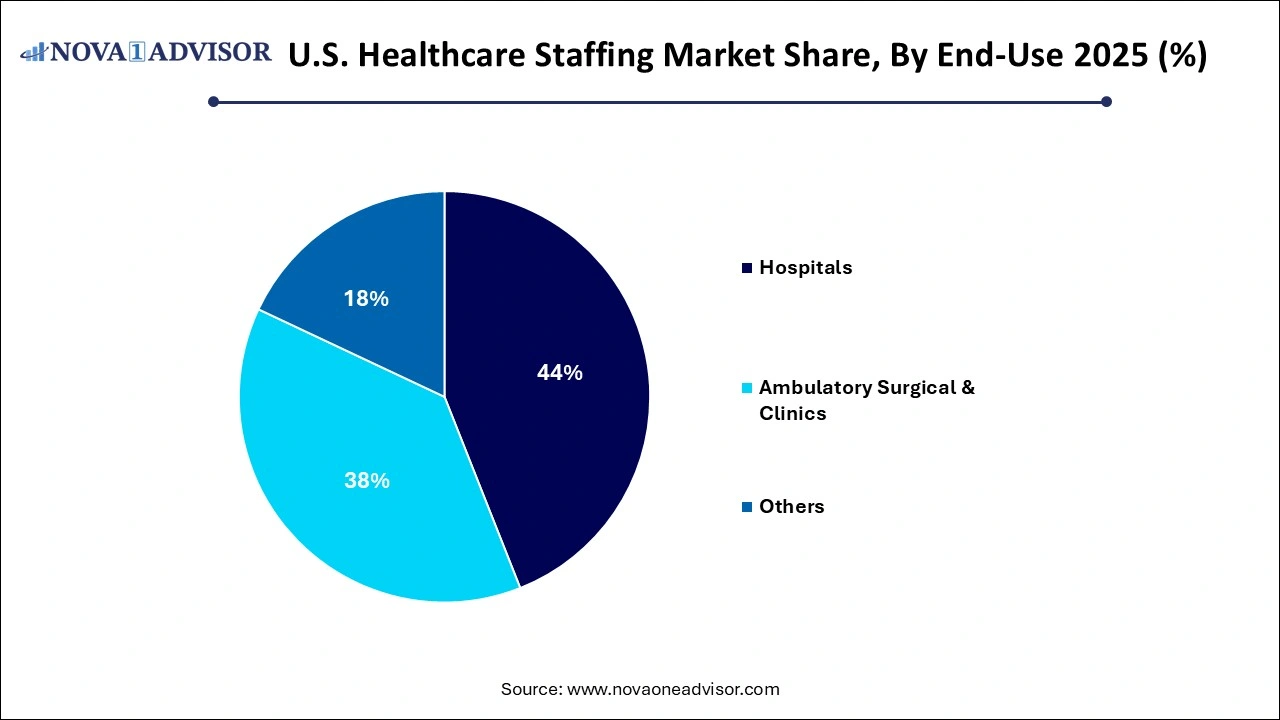

- By end-use insight, the hospitals segment held a dominant market share.

- By end-use insight, the Ambulatory surgical, and clinics segment is expected to grow fastest during the forecast period.

U.S. Healthcare Staffing Market Overview

The rising demand for temporary medical professionals and contract employment has propelled the growth of the U.S. healthcare staffing market. The demand for temporary medical professionals, an aged population, and a shortage of skilled nursing staff have inflated the U.S. healthcare staffing market. Hospitals and facilities are joining with staffing agencies for temporary and permanent placements. Travel and per-diem nurses attract candidates with the flexibility to work when desired, travel internationally, and gain exposure to various medical environments. Professional standards and accreditations of healthcare staffing provide quality services accepted by hospitals, clinics, government agencies, and pharmaceutical companies. The burgeoning dependence on staffing agencies will catalyze further growth of this market.

U.S. Healthcare Staffing Market Growth Factors

- Aging Population & Increased Demand for Healthcare - Their increased demand for healthcare professionals to meet the ever-growing levels of requirements for staffing solutions is co-related with increased elderly populations and increasing chronic disease incidences.

- Workforce Shortage within Healthcare - An increase in the number of hospitals and clinics for temporary staffing solutions with staffing agencies where there are shortages of physicians, nurses, allied health workers, and so on.

- Flexibility and Temporary Staffing Models - Travel nursing, locum tenens, and other per-diem options will allow healthcare practitioners greater flexibility and give facilities the benefit of adjusting their labor force without increased numbers and costs of staff in baseline-program budgets.

- High-tech Developments in Recruitment- AI-enabled recruitment platforms and automation-oriented instruments are boosting efficiency in matching professionals against healthcare institutions.

Report Scope of U.S. Healthcare Staffing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 84.01 Billion |

| Market Size by 2035 |

USD 138.83 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.74% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, End User |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Amn Healthcare, Envision Healthcare Corporation, CHG Management, Inc., Maxim Healthcare Group, Cross Country Healthcare, Inc., Trustaff, Aya Healthcare, Teamhealth, Adecco Group, Locumtenens.Com and Others. |

U.S. Healthcare Staffing Market Dynamics

Driver

Growing Demand for Nurse Staffing driving the U.S. healthcare staffing market

The increasing demand for nurse practitioners and physician assistants is due to the aging populace, widening access to healthcare, and the continuous health delivery team model. These practitioners play an important role in bridging the growing shortage of physicians by performing many of the capabilities formerly unique to doctors. Nurse practitioners and physician assistants provide an affordable quality level of care, highly welcomed both by patients and healthcare institutions. As the need for medical professionals continues to rise, so will their role.

Opportunity

Emerging Technologies: Unlocking New Opportunities

Technologies, changing workforce expectations, and staffing models will be the drivers of change in the future of healthcare staffing. AI and automation will optimize recruitment, credentialing, and scheduling, while telehealth will support the development of remote healthcare positions. Virtual consults, patient monitoring, and digital health platforms will increase accessibility and improve on-the-job satisfaction. Flexible staffing models such as gig-based and per diem work will resonate, while intensive training programs will upskill workers and increase retention. Healthcare organizations must look ahead and establish a proactive stance by investing in technology and building supportive work environments. Caring for employee welfare, career growth, and operational efficiency will be a pathway for establishing a sustainable, resilient workforce.

Restraint

Strict regulatory challenges hamper market growth

Strong endorsement regulatory challenges exist for compliance staffing in healthcare organizations and staffing agencies since they have to comply with many laws: licensure, labor, and patient care standards. It is a tangled web: compliance, thus, creates numerous conditions impacting staffing flexibility and administrative burden. The issues involve fulfilling state-based licensure and certification requirements, measures for data protection under HIPAA, and employment laws such as fair labor standards and anti-discrimination laws. Joint Commission accreditation standards and Centers for Medicare & Medicaid Services standards must also be adhered to by the agencies. In dealing with these, healthcare organizations and staffing companies must invest resources in compliance management systems, continuing education, and legal counsel.

Segment analysis

By Type

Due to its inherent flexibility, attractive pay, and different geographical areas, the travel nurse staffing section is the largest segment in the healthcare market. It actually provides for temporary shortages in the workforce, thus ensuring that patient care is not compromised. An increasing cost of healthcare has forced hospitals to optimally utilize their staffing, cutting down permanent staff and relying on travel nurses to fill in critical needs during times of peak demand. With increased demand for healthcare, this segment gets a further boost. The locum tenens staff segment is expected to grow fastest during the forecast period, dedicated to pharmacy technicians, because of the increasing shortage of general practitioners and specialists. On the other hand, hospitals and clinics rely more on locum tenens staff for temporary coverage and management of the patient load during peak seasons, which is expected to drive the rapid growth of this segment.

By End-Use

By end-use insight, the hospitals segment held a dominant market share. Healthcare staffing is critical for ensuring patient safety, quality of care, and the smooth running of operations in any given hospital. This reduces errors and enhances patient outcomes; it ensures timely care and engenders operational efficiency. Proper staffing can allow for better scheduling and utilization of resources which means less overtime reduced need for agency staff and enhanced patient flow. Generative AI is an experimental tool for improving healthcare staffing, but more importantly, it should be used to ensure patient safety and quality of care.

The ambulatory surgical and clinics segment is expected to grow fastest during the forecast period. Ambulatory care is an important subset of services provided for maintaining patients who are discharged from the hospital, thereby increasing its costs and efficiency. It needs qualified personnel for its working environment, considering timely care and improved health results. Sustainable staffing assures smooth operations, reduces waiting times, and encourages the sustainability of the health system itself.

The ambulatory surgical and clinics segment is expected to grow fastest during the forecast period. Ambulatory care is an important subset of services provided for maintaining patients who are discharged from the hospital, thereby increasing its costs and efficiency. It needs qualified personnel for its working environment, considering timely care and improved health results. Sustainable staffing assures smooth operations, reduces waiting times, and encourages the sustainability of the health system itself.

Some of The Prominent Players in The U.S. Healthcare Staffing Market Include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Healthcare Staffing Market

By Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

-

- Physicians

- Physician Assistants

- Nurse Practitioners

- Others

- Allied Healthcare Staffing

By End-User

- Hospitals

- Ambulatory Surgical & Clinics

- Others

The ambulatory surgical and clinics segment is expected to grow fastest during the forecast period. Ambulatory care is an important subset of services provided for maintaining patients who are discharged from the hospital, thereby increasing its costs and efficiency. It needs qualified personnel for its working environment, considering timely care and improved health results. Sustainable staffing assures smooth operations, reduces waiting times, and encourages the sustainability of the health system itself.

The ambulatory surgical and clinics segment is expected to grow fastest during the forecast period. Ambulatory care is an important subset of services provided for maintaining patients who are discharged from the hospital, thereby increasing its costs and efficiency. It needs qualified personnel for its working environment, considering timely care and improved health results. Sustainable staffing assures smooth operations, reduces waiting times, and encourages the sustainability of the health system itself.