U.S. MicroRNA Market Size & Trends

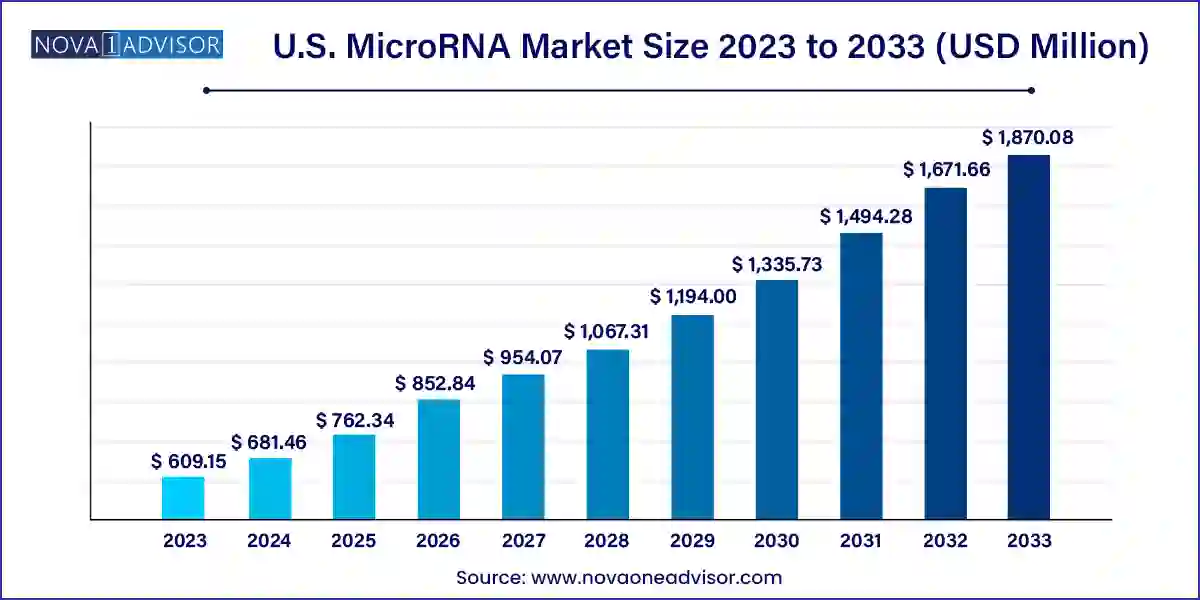

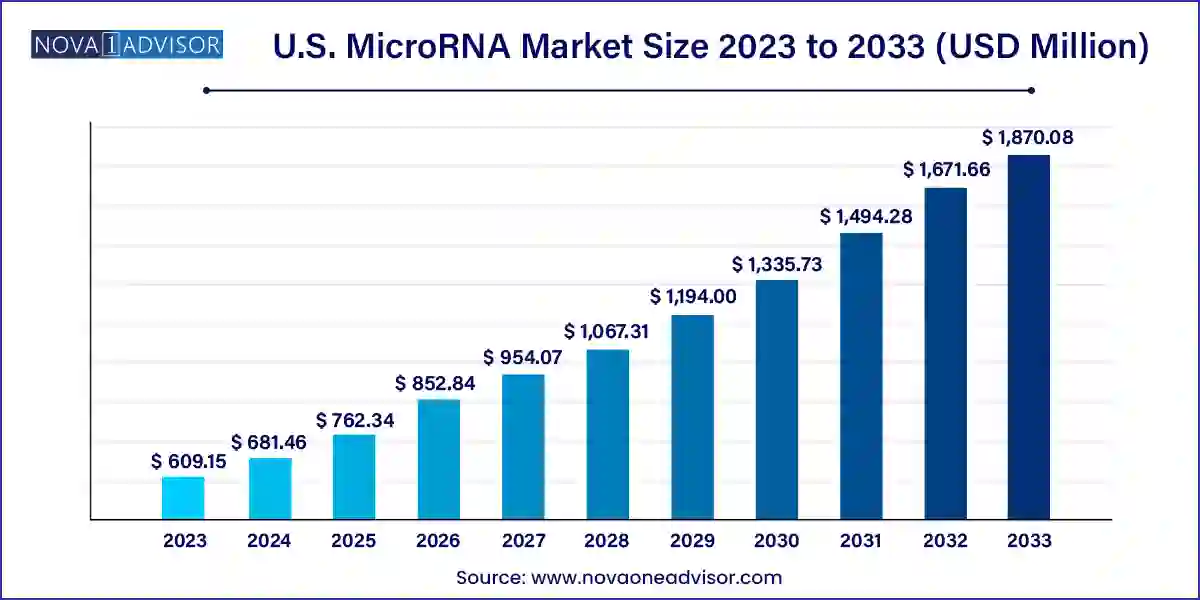

The U.S. microRNA market size was exhibited at USD 609.15 million in 2023 and is projected to hit around USD 1,870.08 million by 2033, growing at a CAGR of 11.87% during the forecast period 2024 to 2033.

Key Takeaways:

- Services segment dominated the market with a share of 58% in 2023.

- The product segment is expected to boost significantly from 2024 to 2033.

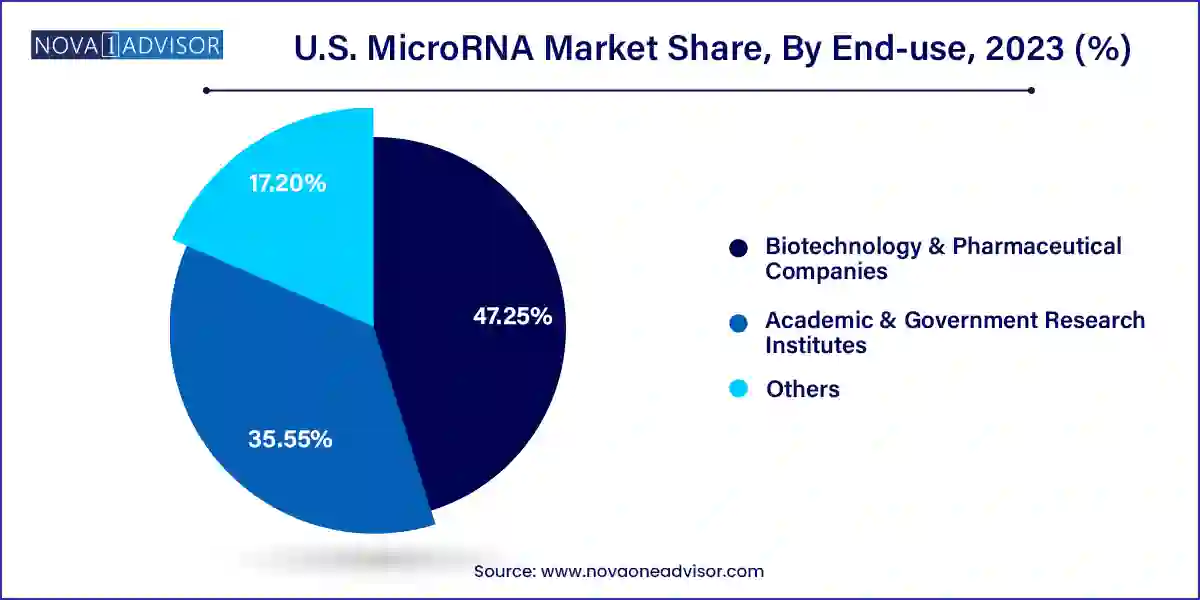

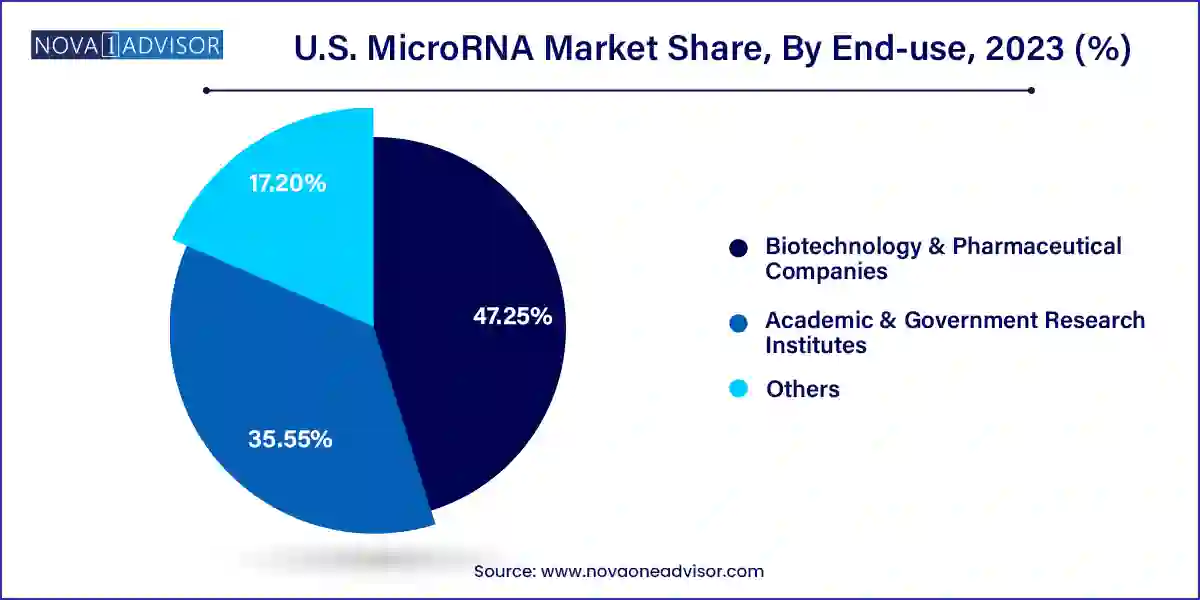

- Biotechnology & Pharmaceutical Companies segment accounted for 47.25% of revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period.

- Other segment is projected to expand at a significant CAGR from 2024 to 2033.

- The cancer segment held the largest share of 37% in 2023.

- The infectious diseases segment is anticipated to witness growth at the fastest CAGR from 2024 to 2033.

Market Overview

The U.S. microRNA (miRNA) market has emerged as a vital segment within the broader molecular diagnostics and biomedical research industries. MicroRNAs, short non-coding RNA molecules involved in gene expression regulation, have shown significant promise in various clinical applications, including cancer diagnostics, infectious disease detection, and therapeutic development. Their ability to act as stable biomarkers in biological fluids such as blood and plasma has placed miRNA at the forefront of precision medicine initiatives in the United States.

With increasing investments in genomics, biotechnology, and personalized medicine, U.S.-based research institutions and biopharmaceutical companies are leveraging miRNA technologies for both basic and translational research. The market encompasses a diverse range of products and services, from miRNA profiling instruments and consumables to advanced services such as isolation, quantification, and functional analysis. This growth is further catalyzed by government and private sector funding directed toward cancer research, infectious disease surveillance, and neurodegenerative disease investigation, where miRNA plays a pivotal role.

Moreover, the growing emphasis on minimally invasive diagnostics and the rise of liquid biopsy applications have propelled miRNA-based tools into clinical labs. As clinical validation for miRNA biomarkers improves, the U.S. healthcare system is expected to integrate these technologies more deeply into routine diagnostics and therapeutic strategies.

Major Trends in the Market

-

Expansion of miRNA as Biomarkers for Cancer Detection and Prognosis

-

Rising Adoption of Liquid Biopsy and Non-invasive Diagnostic Techniques

-

Integration of Artificial Intelligence for miRNA Data Interpretation

-

Increased Government Funding for Genomics and RNA-based Research

-

Development of miRNA-based Therapeutics for Rare and Chronic Diseases

-

Emergence of Point-of-Care (POC) Testing for miRNA Applications

-

Strategic Collaborations Between Pharma Companies and Academic Institutions

-

Technological Advancements in NGS, qPCR, and Microarray Platforms

Report Scope of U.S. MicroRNA Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 681.46 Million |

| Market Size by 2033 |

USD 1,870.08 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 11.87% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product & Services, Applications, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc; NanoString Technologies, Inc; BioGenex; GeneCopoeia, Inc.; New England Biolabs; Precision Nanosystems; Cytiva; PerkinElmer, Inc.; Illumina, Inc.; AptamiR Therapeutics |

Key Market Driver: Increasing Prevalence of Cancer and Demand for Early Diagnosis

One of the most influential drivers in the U.S. microRNA market is the rising incidence of cancer and the corresponding need for early, accurate diagnostics. According to the American Cancer Society, an estimated 2 million new cancer cases will be diagnosed in the U.S. in 2025 alone. Early detection significantly improves treatment outcomes and reduces healthcare costs, prompting researchers and clinicians to seek biomarkers that can identify cancers at initial stages.

MicroRNAs have emerged as ideal candidates for this purpose due to their stability in bodily fluids and specific expression patterns across cancer types. For instance, the expression of miR-21 has been strongly associated with colorectal and breast cancers, while miR-155 is linked with leukemia and lymphomas. Such associations have prompted the integration of miRNA profiling into diagnostic workflows, enhancing the specificity and sensitivity of cancer detection technologies.

Key Market Restraint: Challenges in Clinical Validation and Standardization

Despite its potential, the U.S. microRNA market faces a significant challenge in the clinical validation and standardization of miRNA-based assays. Unlike traditional protein-based biomarkers, miRNAs require sophisticated protocols for extraction, normalization, and quantification. The lack of universally accepted reference standards and methodological consistency across laboratories hampers reproducibility and slows regulatory approval.

This issue becomes especially pressing in clinical settings where diagnostic accuracy and repeatability are paramount. Moreover, miRNA expression levels can be influenced by sample handling, storage conditions, and specimen types, further complicating their clinical utility. As such, advancing the clinical utility of miRNA diagnostics depends on the development of standardized guidelines and validation frameworks supported by regulatory agencies and scientific consortia.

Key Market Opportunity: Therapeutic Development Targeting MicroRNA Pathways

While diagnostic applications dominate current miRNA usage, a major opportunity lies in the development of miRNA-targeted therapeutics. These include miRNA mimics and inhibitors that modulate the expression of genes associated with disease progression. Several biotech firms in the U.S. are exploring miRNA-based treatments for cancers, cardiovascular conditions, and neurodegenerative diseases.

For instance, companies like Regulus Therapeutics have conducted clinical trials targeting miR-21 to treat kidney fibrosis and liver diseases. The potential to design miRNA-based drugs that directly influence disease-related pathways opens new frontiers for precision medicine. As delivery technologies improve—particularly for ensuring stability and cellular uptake—miRNA therapeutics may evolve into a transformative treatment modality.

U.S. MicroRNA Market By Product & Services Insights

Services dominated the market, particularly in advanced applications like miRNA profiling, quantification, and functional analysis. These services are crucial for academic and clinical research where customized approaches are needed to understand gene regulatory mechanisms. Functional analysis services, for instance, help in determining the role of specific miRNAs in cellular pathways, essential in understanding cancer metastasis or drug resistance mechanisms. Profiling and quantification services using technologies like qPCR and NGS are extensively used in biomarker discovery programs.

Furthermore, services that include specimen processing from whole blood, serum, plasma, and tissue samples have become increasingly important. Research institutions often outsource these specialized services to ensure accuracy and save on operational costs. The growing trend of contract research and the rise of CROs offering niche miRNA capabilities have also reinforced the dominance of this segment.

Consumables are the fastest-growing segment in the products category, driven by the surge in miRNA testing and routine research usage. Kits for isolation, purification, and cDNA synthesis are used extensively in both R&D and diagnostic settings. As miRNA studies expand, demand for reagents and assay kits across various workflows has surged. These consumables also ensure consistency in experiments, crucial for reproducibility and regulatory submissions.

In the consumables category, specimen-specific reagents (e.g., for serum or FFPE samples) are gaining attention. Isolation kits compatible with FFPE tissues, for instance, are essential in oncology labs analyzing archival cancer tissues. Furthermore, as multiplexing becomes common in clinical workflows, high-throughput reagents for profiling multiple miRNAs in a single run are driving rapid growth in this category.

U.S. MicroRNA Market By End-use Insights

Biotechnology and pharmaceutical companies dominate end-use segments, accounting for a significant share of miRNA consumption. These entities invest heavily in research aimed at developing novel diagnostics and therapeutics based on miRNA. They also drive clinical trials, intellectual property generation, and commercialization of miRNA platforms.

Large pharma players have entered partnerships with academic labs or acquired startups to access proprietary miRNA technologies. Their use of miRNA tools spans drug discovery, biomarker validation, and therapeutic target identification. For example, miRNA modulators are increasingly being evaluated as companion diagnostics alongside oncology drugs.

Academic and government research institutes are the fastest-growing segment, propelled by increased funding and expanding collaborative networks. Federal agencies like the National Institutes of Health (NIH) and the Department of Defense have issued grants focused on RNA-based research. Academic labs are using miRNA profiling in studies ranging from developmental biology to epigenetics.

As part of translational research mandates, universities are creating spin-offs focused on miRNA diagnostics, fostering innovation and commercialization. The relatively low cost of miRNA analysis (compared to whole-genome sequencing) also makes it attractive for grant-funded research, especially in institutions exploring novel disease mechanisms.

U.S. MicroRNA Market By Application Insights

Cancer applications dominate the U.S. microRNA market due to the extensive research linking various miRNAs to tumorigenesis, progression, and therapeutic resistance. The role of miRNAs as oncogenes or tumor suppressors has made them invaluable in oncology diagnostics. For example, miRNA panels are being developed for lung, breast, prostate, and pancreatic cancers, aiding in risk assessment, early diagnosis, and treatment monitoring.

Recent collaborations between cancer research centers and biotech firms have resulted in biomarker panels that integrate miRNA with other genomic data, creating multi-omics profiles for personalized care. Liquid biopsy-based miRNA diagnostics are especially favored in oncology for their non-invasive nature. With the surge in precision oncology initiatives, the demand for miRNA-based tests is expected to remain high.

Infectious diseases represent the fastest-growing application area, especially after the COVID-19 pandemic highlighted the need for rapid, accurate diagnostics. Studies have shown that miRNAs play a regulatory role in immune response and viral replication. For instance, miR-146a and miR-155 have been investigated for their roles in inflammation during viral infections.

With the increasing threat of emerging pathogens and antimicrobial resistance, miRNA profiling is being explored for differentiating viral from bacterial infections, thereby supporting rational use of antibiotics. Public health institutions and biotech firms are partnering to develop miRNA panels for diseases such as HIV, hepatitis, and even influenza, opening doors for robust infectious disease management.

Country-Level Analysis

The U.S. microRNA market is characterized by a robust research ecosystem, favorable funding landscape, and an active regulatory environment that supports innovation. The country's strong academic institutions, such as MIT, Stanford, and Harvard, are leading contributors to miRNA research, often in collaboration with biotech firms. Moreover, the NIH continues to provide substantial funding for RNA-centric studies under its various cancer, neurological, and cardiovascular research programs.

Commercial adoption is also on the rise, with diagnostics companies launching miRNA-based products for clinical use. The FDA has shown increased interest in developing regulatory frameworks for RNA diagnostics and therapeutics, particularly in the wake of mRNA vaccine successes. Geographically, cities like Boston, San Diego, and San Francisco have emerged as hotspots for miRNA research and commercialization due to their concentration of biotech startups and venture capital investment.

Recent Developments

-

January 2025: Regulus Therapeutics announced the initiation of a Phase 1 clinical trial targeting miR-21 for the treatment of Alport syndrome, a rare kidney disease.

-

March 2025: Thermo Fisher Scientific launched a new miRNA profiling kit compatible with NGS platforms, enhancing sensitivity for low-abundance transcripts.

-

February 2025: NanoString Technologies revealed updates to its nCounter platform, expanding capabilities for multiplex miRNA detection in cancer research.

-

December 2024: Abcam plc entered a collaboration with the University of Pennsylvania to validate novel miRNA biomarkers for immunological disorders.

-

November 2024: QIAGEN introduced a fully automated workflow for miRNA isolation and quantification, aimed at clinical diagnostics labs.

Some of the prominent players in the U.S. microRNA market include:

- Thermo Fisher Scientific, Inc

- NanoString Technologies, Inc

- BioGenex

- GeneCopoeia, Inc.

- New England Biolabs

- Precision Nanosystems

- Cytiva

- PerkinElmer, Inc.

- Illumina, Inc.

- AptamiR Therapeutics

- Synlogic

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. microRNA market

Products & Services

-

-

- Isolation & Purification

- miRNA cDNA Synthesis

- Profiling, Localization, & Quantification

- Functional Analysis

- Others

-

-

- Whole Blood

- Serum

- Plasma

- FFPE

- Fresh Frozen Tissue

- Others

-

-

-

- Real-Time PCR

- Microarray

- NGS

- Others

-

-

-

- Isolation & Purification

- miRNA cDNA Synthesis

- Profiling, Localization, & Quantification

- Functional Analysis & Others

- Others

-

-

- Whole Blood

- Serum

- Plasma

- FFPE

- Fresh Frozen Tissue

- Others

-

-

- Isolation & Purification

- miRNA cDNA Synthesis

- Profiling, Localization, & Quantification

- Functional Analysis

- Others

Application

- Cancer

- Infectious Diseases

- Immunological Disorder

- Cardiovascular Disease

- Neurological Disease

- Others

End-use

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Others