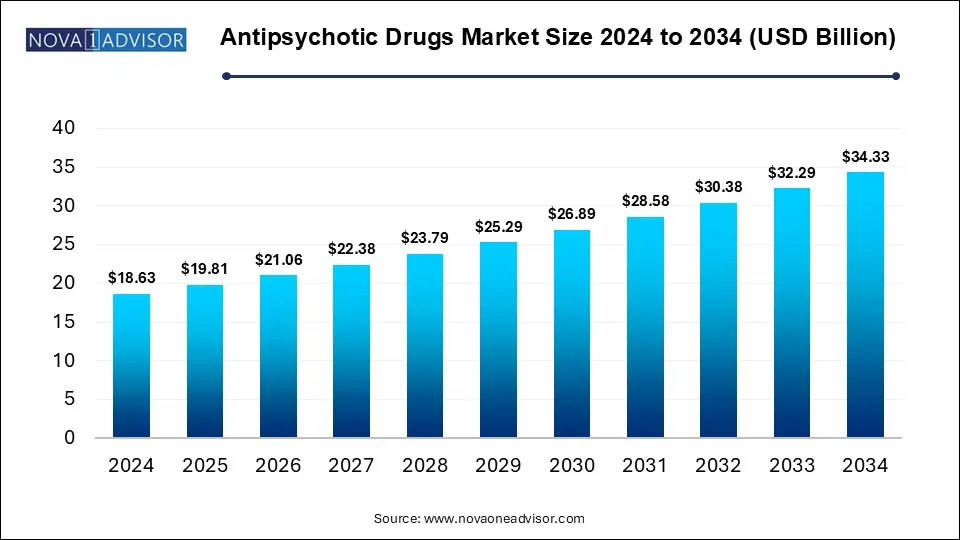

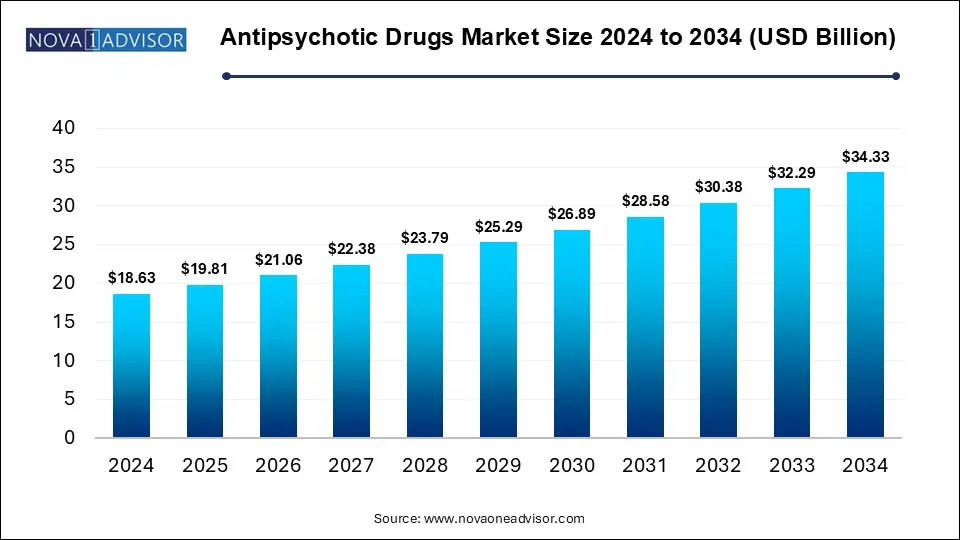

Antipsychotic Drugs Market Size and Forecast 2025 to 2034

The global antipsychotic drugs market size was valued at USD 18.63 billion in 2024 and is anticipated to reach around USD 34.33 billion by 2034, growing at a CAGR of 6.3% from 2025 to 2034. The market is growing due to the rising prevalence of mental health disorders. Increasing awareness, improved diagnosis, and advancement in drug development are further, fueling market demand.

Antipsychotic Drugs Market Key Takeaways

- North America dominated the antipsychotic drugs market in 2024.

- Asia-Pacific is expected to grow at the highest CAGR in the market during the forecast period.

- By therapeutic class, the second-generation segment dominated the market.

- By therapeutic class, the first-generation segment is expected to grow at the fastest CAGR in the market during the studied years.

- By application, the schizophrenia segment held the largest market share.

- By application, the bipolar disorders segment is expected to grow at the fastest CAGR in the market during the studied years.

- By distribution, the hospital pharmacies segment led the market in 2024.

- By distribution, the online pharmacies segment is expected to grow at the fastest CAGR in the market during the studied years.

Market Overview

The antipsychotic drugs market represents a crucial segment of the global pharmaceutical industry, targeting the management and treatment of mental illnesses marked by distorted thinking, hallucinations, delusions, and emotional disassociation. Primarily used to treat schizophrenia, bipolar disorder, unipolar depression, and dementia-related psychosis, antipsychotics play a vital role in psychiatric therapy by restoring neurochemical balance and improving quality of life for millions worldwide.

Antipsychotic medications function by modifying dopamine and serotonin pathways in the brain, thereby regulating symptoms like paranoia, mania, aggression, and disorganized behavior. The market includes a wide range of drugs—from classic first-generation agents like haloperidol to newer, more refined second and third-generation drugs such as aripiprazole and brexpiprazole. These medications differ significantly in their pharmacodynamics, side-effect profiles, and effectiveness against negative symptoms.

Over the past decade, the global burden of mental disorders has risen sharply. The World Health Organization (WHO) estimates that approximately one in eight people worldwide lives with a mental disorder. Among them, conditions like schizophrenia and bipolar disorder, though less prevalent than anxiety or depression, contribute disproportionately to disability-adjusted life years (DALYs). The rising awareness of psychiatric health, improvements in diagnostic capabilities, and policy-level efforts to de-stigmatize mental illness have fueled higher treatment rates and demand for advanced medications.

Pharmaceutical companies are actively developing next-generation antipsychotics with improved efficacy and fewer metabolic or neurological side effects. Long-acting injectables (LAIs), depot formulations, and novel mechanisms of action are reshaping the therapeutic landscape. Additionally, digital health platforms and telepsychiatry are expanding access to psychiatric care, boosting prescription volumes. As innovation continues to reshape treatment protocols and patient adherence tools, the antipsychotic drugs market is poised for robust and sustained growth.

How is the Antipsychotic Drugs Market Evolving?

Antipsychotic drugs are medications used to manage and treat symptoms of psychotic disorders, such as schizophrenia and bipolar disorders, such as schizophrenia and bipolar disorders, by altering the effects of neurotransmitters in the brain, particularly dopamine. They help reduce symptoms like hallucination, delusion, and disorganized thinking. The Antipsychotic drugs market evolving due to the growing prevalence of mental health conditions such as schizophrenia and bipolar disorder, along with increasing awareness and acceptance of psychiatric treatment. Advances in drug formulation including long-acting injectables and drugs with fewer side effects, are enhancing patient compliance and outcomes. Additionally, the expansion of healthcare infrastructure and access to mental health services, especially in developing regions, is further supporting market growth. Pharmaceutical companies are also investing in innovative therapies and personalized treatment approaches.

- For Instance, In January 2024, the FDA approved Pimavanserin Capsules (34 mg) and Tablets (10 mg), known under the brand name Nuplazid, for treating hallucinations and delusions linked to psychosis in Parkinson’s disease patients.

What are the Key Trends in the Antipsychotic Drugs Market in 2025?

- In April 2024, Alkermes shared findings from a Phase 3 extension study at the Schizophrenia International Research Society (SIRS) Congress, focusing on the long-term safety, tolerability, effectiveness, and sustained benefits of their antipsychotic medication, LYBALVI.

- In January 2024, Teva Pharmaceutical Industries Ltd. finalized the enrollment of 640 participants for its ongoing Phase 3 trial of mdc-TJK (TEV-44749) across the U.S. and EU. This investigational drug is a once-monthly subcutaneous long-acting form of the atypical antipsychotic olanzapine, being developed for the treatment of schizophrenia.

How Can AI Affect the Antipsychotic Drugs Market?

AI can significantly impact the antipsychotic drug market by accelerating drug discovery, improving clinical trial design, and enhancing patient monitoring. It helps identify potential drug candidates faster through predictive modeling and data analysis. AI also supports personalized treatment by analyzing patient data to tailor therapies based on individual needs. Additionally, it can improve early diagnosis of psychiatric conditions, enabling timely intervention and more effective use of antipsychotic medications, ultimately driving innovation and efficiency in the market.

Antipsychotic Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 19.81 Billion |

| Market Size by 2034 |

USD 34.33 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.3% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Disease, drug, therapeutic class, distribution channel, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

H. Lundbeck A/S; Otsuka Pharmaceutical Co., Ltd. ; Janssen Global Services, LLC; Eli Lilly and Company ; AbbVie, Inc.; Teva Pharmaceutical Industries Ltd. ; Dr. Reddy’s Laboratories Ltd.; Sumitomo Pharma ; Alkermes ; Bristol-Myers Squibb Company |

Market Dynamics

Driver

Increasing Prevalence of Mental Health Disorders

A growing number of individuals are being diagnosed with psychiatric conditions like schizophrenia and bipolar disorder, leading to a surge in demand for effective treatment options. As awareness and acceptance of mental care continue to rise, more people are turning to medical support, including antipsychotic drugs. This shift is encouraging pharmaceutical companies to invest in research and development, ultimately contributing to the steady growth of the antipsychotic drugs market worldwide.

- For Instance,In November 2024, Medscape highlighted a significant global increase in antipsychotic polypharmacy, with about 25% of antipsychotic users now taking multiple medications a clear sign of rising demand, prevalence, and complexity in treatment.

Restraint

Side Effects Related to Antipsychotic Drugs Market

Many patients experience issues like weight gain, sedation, diabetes risk, and movement disorders, which can lead to poor treatment adherence and reduced quality of life. These adverse effects often discourage long-term use and prompt patients to discontinue therapy. As a result, despite the growing need for treatment, safety concerns continue to limit the widespread acceptance and effectiveness of antipsychotic medications.

Opportunity

Advancement Drug Formulations

Improved drug formulations are shaping the future of the antipsychotic market by offering more convenient and tolerable treatment options. Newer delivery methods, such as monthly injections and advanced oral forms, help maintain steady medication levels and reduce the burden of daily dosing. These innovations address common challenges like non-compliance and side effects, making treatment more manageable for patients. As a result, they pave the way for better outcomes and increased acceptance of antipsychotic therapies worldwide.

- For Instance, In March 2024, the European Commission approved Abilify Maintena® 960 mg, a long-acting injectable given once every two months for schizophrenia. This new formulation offers greater convenience and helps improve patient adherence by reducing the need for frequent dosing.

Global Antipsychotic Drugs Market Report Segmentation Insights

By Disease Insights

Schizophrenia accounts for the biggest shares in the market because it requires continuous medical management and often involves complex symptoms that need long-term pharmacological support. Unlike some other mental health conditions, schizophrenia frequently demands consistent treatment to prevent relapse and hospitalization. The condition's severity and impact on daily functioning make antipsychotic medication essential, leading to high prescription rates. This sustained need for effective drug therapy contributed to the strong market presence of schizophrenia.

- For Instance, In April 2023, the FDA approved UZEDY, an extended-release injectable form of risperidone developed by MedinCell and Teva Pharmaceuticals, for the treatment of schizophrenia in adults. This long-acting formulation offers a new option for managing the condition with improved dosing convenience.

The bipolar disorder segment is expected to grow rapidly due to increased awareness, earlier diagnosis, and broader use of antipsychotics beyond schizophrenia. These drugs are now commonly prescribed to manage mood swings and prevent relapse in bipolar patients. With more people seeking mental health support and physicians adopting antipsychotics as part of long-term bipolar care, the demand for effective and fast-acting treatment options is rising market.

By Drug Insights

Risperidone continues to dominate the drug-level segmentation due to its wide usage in both schizophrenia and bipolar disorder, as well as its relatively favorable safety profile. It is also approved for use in pediatric patients with autism-related irritability. The availability of generic formulations has increased its accessibility globally, making it a first-line antipsychotic in many public health systems. Its extended-release and injectable forms have further cemented its widespread use.

However, brexpiprazole is the fastest-growing drug segment, reflecting a shift toward third-generation antipsychotics. Approved for schizophrenia and as an adjunctive therapy for major depressive disorder, brexpiprazole offers reduced risk of akathisia and metabolic complications compared to its predecessors. With ongoing studies exploring its efficacy in borderline personality disorder, PTSD, and agitation in Alzheimer’s disease, brexpiprazole’s potential label expansions are expected to drive future growth significantly.

By Therapeutic Class Insights

How does the second-generation Segment Dominate the Antipsychotic Drugs Market in 2024?

Second-generation antipsychotics have become the leading choice in treatment due to their balanced approach to managing symptoms with fewer side effects. Unlike older drugs, they are effective in addressing both emotional withdrawal and hallucinations, making them suitable for long-term use. Their broader therapeutic benefits, along with better patient tolerance, have led healthcare providers to favor them in treatment plans, driving their dominance in the antipsychotic drugs market across various mental health conditions.

The first-generation antipsychotic segment is projected to grow faster as healthcare providers in resource-limited settings continue to rely on these established treatments. Despite newer alternatives, these drugs remain widely used due to their proven effectiveness in managing severe symptoms and their broad availability in generic forms. As mental health services expand globally, especially in public healthcare systems, the demand for affordability and reliable medications like first-generation antipsychotics is expected to rise steadily.

- For Instance, As reported by the National Library of Medicine in February 2024, research into molecules functioning as partial agonists at dopamine receptors has supported the creation of more advanced and targeted drugs for treating psychosis. This progress is contributing to the development of innovative therapies with potentially improved safety and effectiveness.

By Distribution Channel Insights

Why Did the Hospital Segment Dominate the Antipsychotic Drugs Market in 2024?

In 2024, the hospital pharmacies segment held the biggest market shares as they played a crucial role in delivering medications during both emergency intervention and inpatient psychiatric care. These facilities ensure accurate dispensing, close monitoring, and immediate treatment for patients with severe mental health conditions. Hospital settings are also key locations for initiating and managing long-acting injectable therapies, making them preferred distribution channels for timely and controlled access to antipsychotic medication.

The online pharmacies segment grows at the fastest rate in the antipsychotic drugs market due to increasing digital adoption and the growing preference for discreet, hassle-free medication access. With mental health stigma still present in some regions, many patients find online platforms more comfortable for ordering antipsychotic medications. The ease of automated refills, secure prescription upload, and expanding telehealth services further enhance the appeal of online pharmacies, making them an increasingly popular choice for ongoing psychiatric treatment.

By Regional Insights

How is North America Contributing to the Expansion of the Antipsychotic Drugs Market?

North America led the market in 2024 due to its high burden of mental health disorders, especially schizophrenia and bipolar disorder. The region's strong healthcare infrastructure, early adoption of advanced therapies, and presence of major pharmaceutical companies contribute significantly to market growth. Additionally, widespread insurance coverage and government support improve patient access to treatment. Continuous investment in research and innovation further strengthens North America's position as the dominant player in the global antipsychotic drug market.

- For Instance, In April 2025, Luye Pharma Group launched ERZOFRI, an extended-release injectable, for commercial use in the U.S. It is approved for treating adults with schizophrenia and can also be used alone or alongside other treatments for managing schizoaffective disorder.

How is the Asia Pacific Accelerating the Antipsychotic Drugs Market?

Asia Pacific is forecasted to register the fastest growth in the market due to a combination of rising mental health awareness, expanding healthcare infrastructure, and growing government support for integrating psychiatric care into primary healthcare. Countries like China and India, with large and increasingly urbanized populations, are seeing rapid increases in diagnosed cases. The expansion of insurance coverage, along with cultural shifts reducing stigma, is fueling broader access to antipsychotic treatments across the region.

- For Instance, In December 2024, Newron Pharmaceuticals S.p.A., a company specializing in treatments for central and peripheral nervous system disorders, entered into a licensing agreement with EA Pharma Co., Ltd., a subsidiary of Eisai Co., Ltd. Under this agreement, EA Pharma will develop, produce, and market Newron’s novel glutamate release modulator, evenamide, across Japan and selected Asian regions.

Antipsychotic Drugs Market Top Key Companies:

- H. Lundbeck A/S

- Otsuka Pharmaceutical Co., Ltd.

- Janssen Global Services, LLC

- Eli Lilly and Company

- AbbVie, Inc.

- Teva Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Sumitomo Pharma

- Alkermes

- Bristol-Myers Squibb Company

Antipsychotic Drugs Market Recent Developments

- In April 2025, Johnson & Johnson finalized the acquisition of Intra-Cellular Therapies, Inc. Following the deal, Intra-Cellular Therapies became part of Johnson & Johnson and now functions as a business unit under Johnson & Johnson Innovative Medicine.

- In May 2024, Otsuka Pharmaceutical Co., Ltd. announced that its U.S. arm, OPDC, along with Lundbeck, shared findings from Phase II (Trial 061) and Phase III (Trials 071 and 072) studies evaluating the safety and efficacy of brexpiprazole combined with sertraline for treating PTSD in adults. The data was presented at the annual ASCP meeting held in Miami.

Antipsychotic Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Antipsychotic Drugs market.

By Disease

- Schizophrenia

- Bipolar Disorder

- Unipolar Depression

- Dementia

- Others

By Drug

- Risperidone

- Quetiapine

- Olanzapine

- Aripiprazole

- Brexpiprazole

- Paliperidone Palmitate

- Others

By Therapeutic Class

- First Generation

- Second Generation

- Third Generation

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)