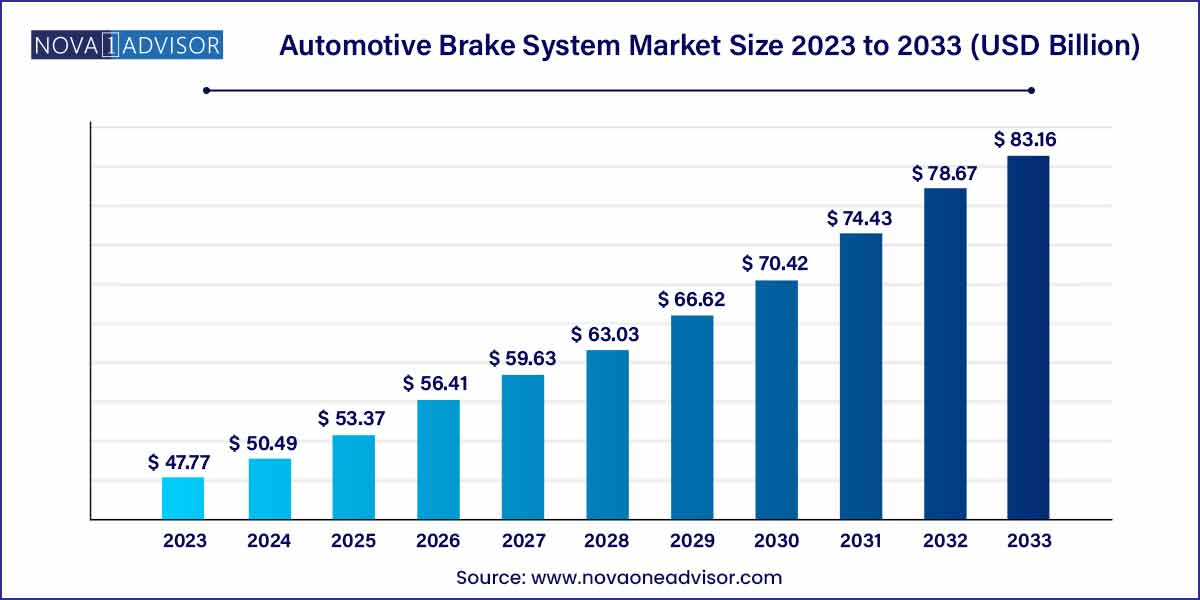

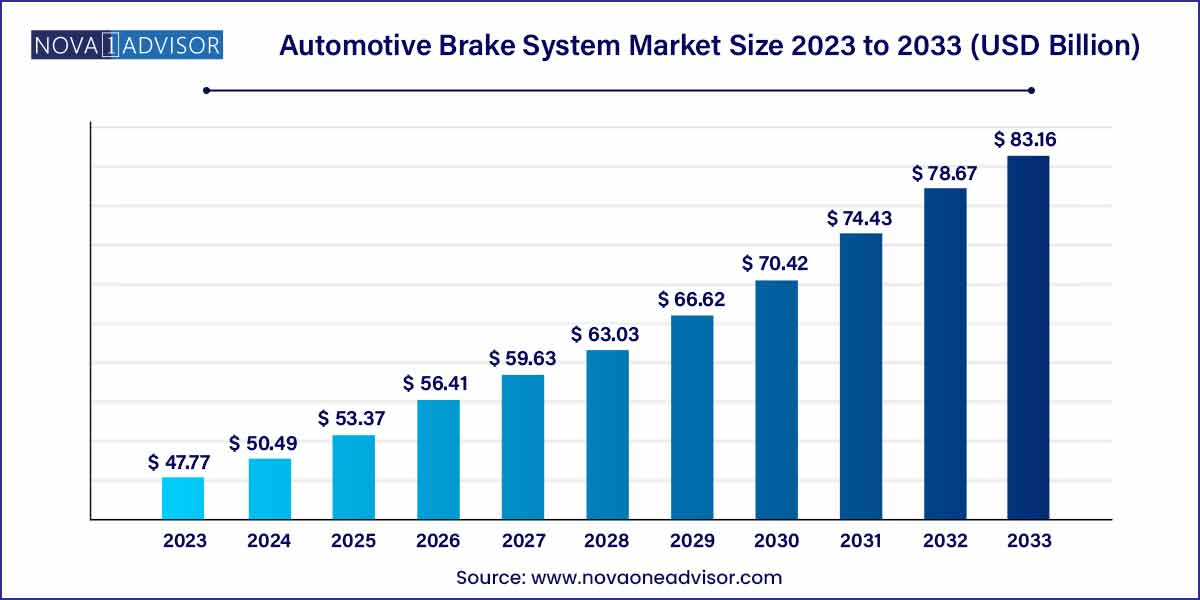

The global automotive brake system market size was exhibited at USD 47.77 billion in 2023 and is projected to hit around USD 83.16 billion by 2033, growing at a CAGR of 5.7% during the forecast period of 2024 to 2033.

Key Takeaways:

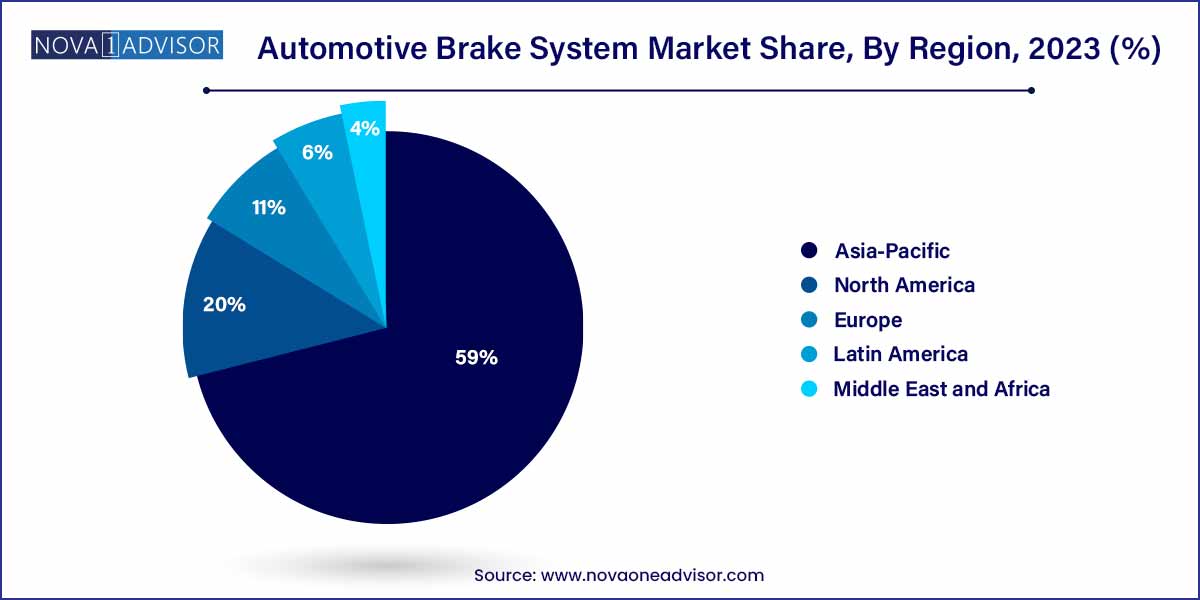

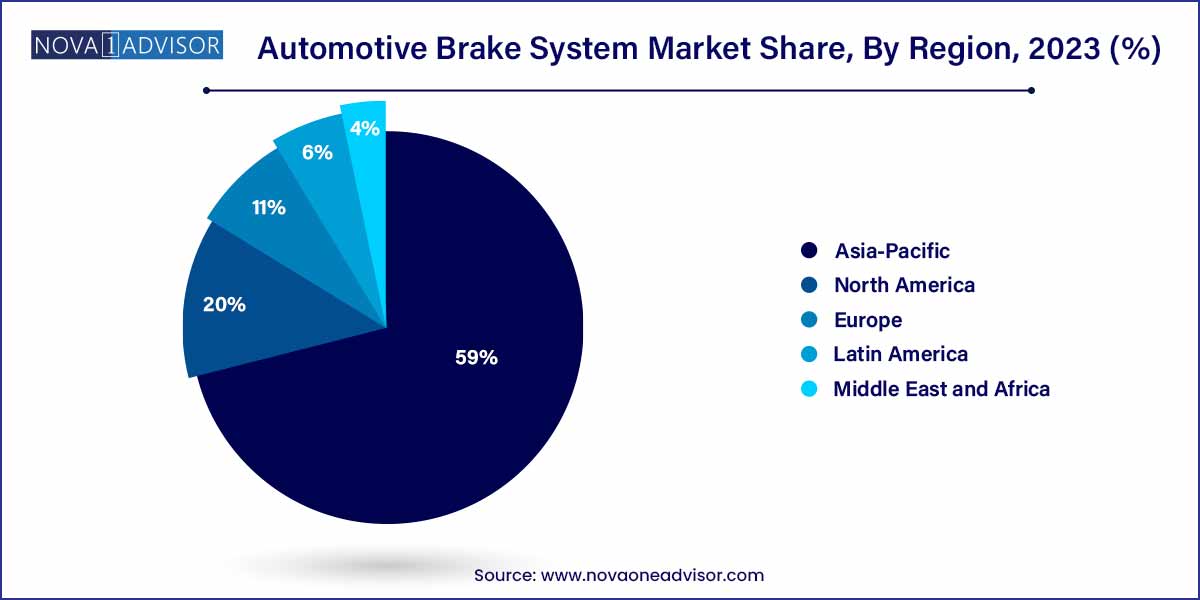

- Asia Pacific dominated the market with the largest revenue share of 59.0% in 2023.

- The disc brake segment held the largest market share of 61.1% in 2023.

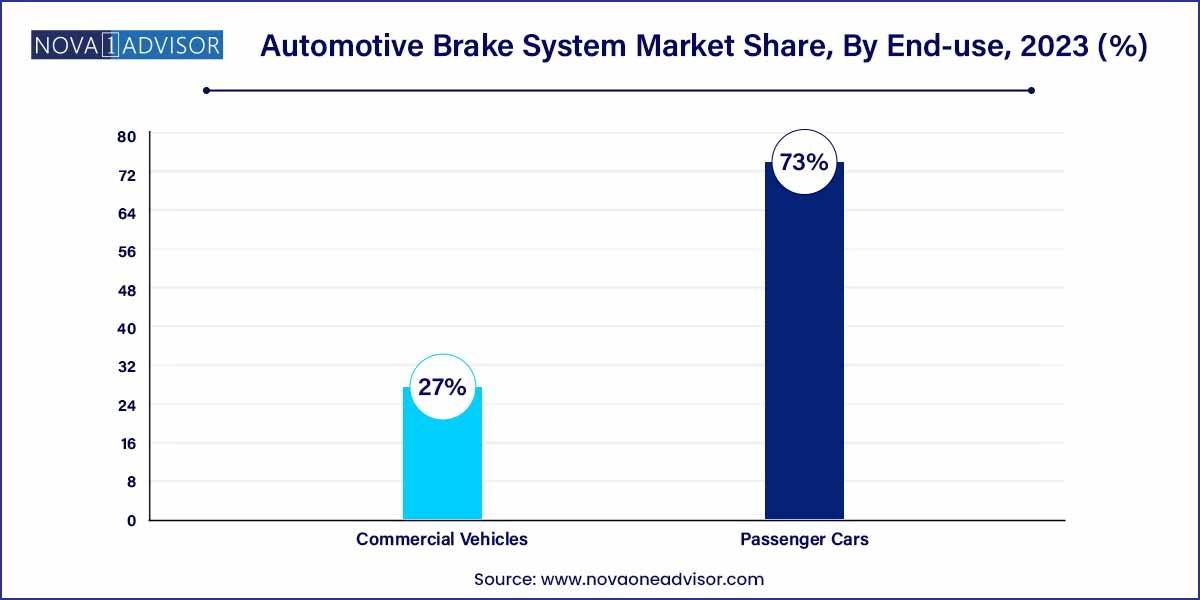

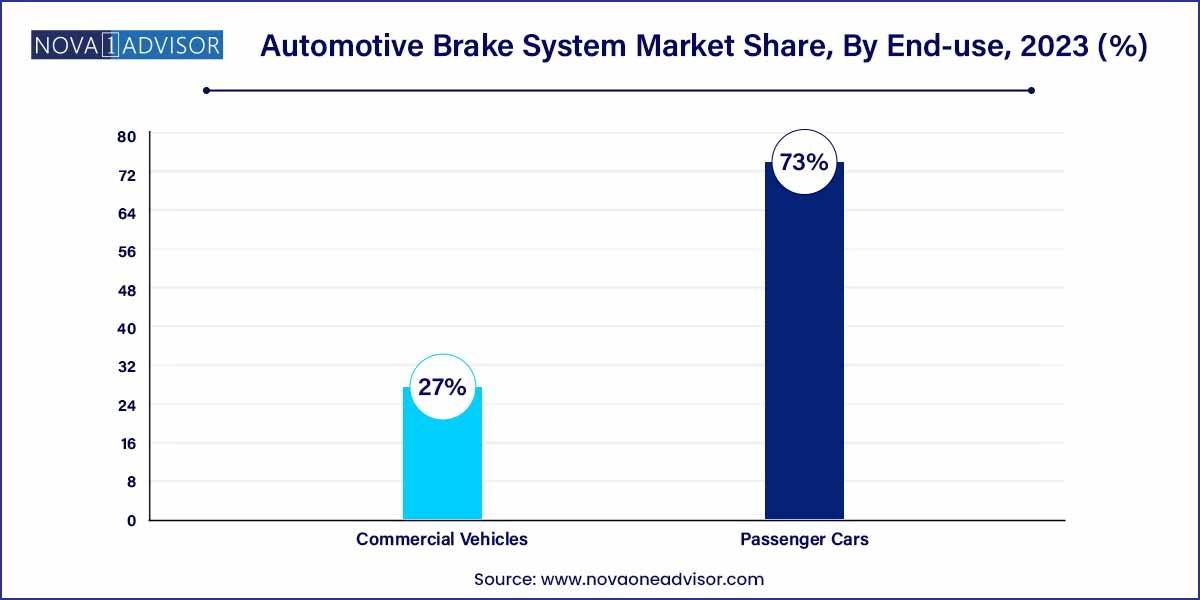

- Passenger cars dominated the market, with the highest revenue share of 73.0% in 2023.

- Electronic Stability Control (ESC) dominated the market with the highest revenue share of 32.6% in 2023.

Automotive Brake System Market by Overview

In the rapidly evolving landscape of the automotive industry, the brake system stands as a pivotal component, ensuring both safety and performance. This comprehensive overview dives into the intricate dynamics of the automotive brake system market, providing insights into its current state and future trajectories.

Automotive Brake System Market Growth

In the ever-evolving landscape of the automotive brake system market, several key growth factors are steering the industry towards new horizons. One paramount driver is the heightened awareness and emphasis on road safety, compelling manufacturers to invest in advanced brake technologies. Technological innovations, another significant growth catalyst, are shaping the landscape with intelligent braking systems and automation, enhancing overall vehicle safety and performance. Stringent government regulations, particularly those mandating elevated vehicle safety standards, act as a catalyst for the adoption of sophisticated brake systems. Despite the challenges posed by cost pressures and complexities in integrating advanced technologies, the market is experiencing sustained growth.

Automotive Brake System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 47.77 Billion |

| Market Size by 2033 |

USD 83.16 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Vehicle Type, Technology, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AKEBONO BRAKE INDUSTRY CO., LTD.; ZF Friedrichshafen AG, ADVICS CO.,LTD., Hitachi Astemo, Ltd., Brembo S.p.A, Robert Bosch GmbH, AISIN CORPORATION, Haldex, The Web Co, NISSIN KOGYO Co., Ltd. |

Automotive Brake System Market Dynamics

- Evolving Safety Standards:

One of the dynamic forces propelling the automotive brake system market is the continual evolution of safety standards. Increasing awareness and a growing emphasis on road safety have prompted regulatory bodies worldwide to enforce stringent requirements for vehicle safety. These standards act as a driving force for automotive manufacturers to continually innovate and implement advanced brake technologies.

- Technological Advancements:

Technological innovation stands as a pivotal dynamic shaping the automotive brake system market. The industry is experiencing a paradigm shift with ongoing advancements in brake system technologies. The integration of smart sensors, anti-lock braking systems (ABS), and electronic stability control (ESC) has become commonplace, enhancing the precision and responsiveness of braking systems.

Automotive Brake System Market Restraint

- Cost pressures on manufacturers:

A significant restraint affecting the automotive brake system market is the persistent cost pressures on manufacturers. As the industry strives to incorporate advanced technologies and meet stringent safety standards, the associated production costs inevitably rise. Manufacturers face the challenge of striking a delicate balance between incorporating cutting-edge brake technologies and maintaining competitive pricing.

- Integration Complexity of Advanced Technologies:

The integration complexity of advanced technologies represents another noteworthy restraint in the automotive brake system market. As vehicles become more technologically sophisticated, incorporating features such as regenerative braking, brake-by-wire systems, and autonomous braking, the engineering and integration challenges intensify.

Automotive Brake System Market Opportunity

- Rising Demand for Electric Vehicles (EVs):

An unparalleled opportunity in the automotive brake system market lies in the escalating demand for electric vehicles (EVs). As the automotive industry undergoes a transformative shift towards sustainable mobility, electric vehicles are gaining widespread acceptance. The unique characteristics of EVs, such as regenerative braking capabilities, open avenues for innovation in brake system technologies.

- Advancements in Material Technologies:

Another key opportunity in the automotive brake system market arises from continuous advancements in material technologies. The exploration of novel materials with enhanced durability, thermal stability, and frictional characteristics opens doors for innovation in brake system components.

Automotive Brake System Market Challenges

- Complex Regulatory Landscape:

A predominant challenge in the automotive brake system market is navigating the complex regulatory landscape. Global markets are subject to varying safety standards and regulations, and compliance can be a demanding task for manufacturers. Adhering to divergent requirements across regions necessitates continuous adjustments to brake system designs and functionalities.

- Market Saturation in Mature Economies:

Market saturation in mature economies represents a formidable challenge for the automotive brake system market. In regions where automotive penetration is high and vehicle ownership is already widespread, the scope for substantial growth diminishes. Manufacturers face the hurdle of intense competition and the need for product differentiation to capture market share.

Segments Insights:

By Type Insights

Disc brakes dominate the automotive brake system market, particularly in passenger vehicles and performance cars. Disc brakes offer superior stopping power, heat dissipation, and consistency under high-stress conditions. They are especially effective in vehicles requiring responsive braking, such as sports cars and luxury sedans. OEMs in North America, Europe, and Japan have transitioned nearly all passenger models to disc brakes on both front and rear axles. Furthermore, electric vehicles, which are typically heavier due to battery packs, benefit from disc brakes’ enhanced heat management and performance.

However, drum brakes still retain relevance in cost-sensitive and utility segments, especially in Asia-Pacific and Latin America. In many subcompact vehicles and budget commercial trucks, drum brakes are used on rear axles to lower costs and simplify maintenance. While their performance under continuous load is inferior to disc brakes, their enclosed design makes them more resistant to dirt and corrosion, which is advantageous in off-road and agricultural applications. Despite the global push for disc brakes, drum brakes are expected to see steady demand in low-margin vehicle segments.

By Vehicle Type Insights

Passenger cars represent the largest share of the automotive brake system market. This dominance is attributed to high global passenger car production and the wide-scale adoption of electronic braking systems in sedans, SUVs, and hatchbacks. Safety regulations targeting mass-market vehicles have led to the widespread standardization of ABS and ESC in this segment. Furthermore, the premium car market often features high-performance braking systems such as ventilated discs, carbon ceramic brakes, and brake-by-wire technology to enhance driving dynamics and brand differentiation.

Meanwhile, commercial vehicles are witnessing the fastest growth, driven by the boom in e-commerce, last-mile delivery services, and fleet safety management. Light commercial vehicles (LCVs) and heavy-duty trucks are increasingly being equipped with ABS and ESC due to tightening safety norms and the operational risks associated with transporting heavy loads. Moreover, commercial operators are investing in fleet safety technologies to reduce insurance premiums, improve uptime, and meet environmental regulations. As disc brakes gain traction in commercial trucks for superior performance under heavy loads, the segment is expected to expand at a high CAGR over the forecast period.

By Technology Insights

Anti-lock Braking Systems (ABS) dominate the technology landscape, as they are now legally mandated in most developed markets for all new passenger and commercial vehicles. ABS prevents wheel lock-up during sudden braking, maintaining steering control and reducing stopping distances. Over the years, ABS has become a foundational safety feature, often bundled with other technologies such as EBD and TCS.

However, Electronic Stability Control (ESC) is the fastest-growing technology, owing to its enhanced capabilities in preventing skidding, rollover, and loss of vehicle control. ESC systems automatically apply brakes to individual wheels during oversteer or understeer situations, significantly improving vehicle stability. With global safety authorities recognizing ESC's life-saving potential, mandates for ESC installation are expanding, particularly in emerging markets. ESC is also a prerequisite for autonomous and semi-autonomous driving features, ensuring its sustained growth in next-generation vehicle platforms.

By Regional Insights

Asia-Pacific is the dominant regional market for automotive brake systems, accounting for the highest volume of vehicle production globally. China, India, Japan, and South Korea are major contributors, supported by robust domestic auto manufacturing and growing consumer demand. The region benefits from a large supplier base, competitive labor costs, and rising adoption of safety technologies due to regulatory upgrades. China’s “New Energy Vehicle” policies and India’s Bharat NCAP crash testing norms are pushing OEMs to upgrade brake systems in mass-market models. Local and international suppliers alike are investing in R&D centers and manufacturing hubs across the region to capitalize on this growth.

North America is the fastest-growing market, driven by high vehicle safety standards, consumer preference for technologically advanced vehicles, and rapid EV adoption. The U.S. and Canada have made advanced brake systems standard in new vehicles, and the growing popularity of SUVs and pickup trucks vehicles that require robust braking performance has further boosted demand. The region’s early transition to brake-by-wire systems, coupled with the proliferation of electric vehicles from Tesla, Rivian, and Ford, is creating strong demand for regenerative and integrated braking solutions. In addition, the growth of commercial fleets for logistics and gig economy platforms is accelerating the adoption of advanced brake systems in light and medium commercial vehicles.

Recent Developments

-

March 2025: ZF Friedrichshafen AG launched a new integrated braking system combining ABS, ESC, and regenerative braking designed specifically for electric SUVs and light trucks.

-

February 2025: Bosch Mobility Solutions announced an expansion of its brake-by-wire production line in Mexico to meet rising demand from North American EV manufacturers.

-

December 2024: Continental AG partnered with a leading EV startup to co-develop an intelligent braking module compatible with L4 autonomous vehicle architectures.

-

October 2024: Brembo unveiled its latest Sensify™ platform at the Paris Motor Show—a fully digital braking ecosystem that adapts brake response based on real-time data.

-

August 2024: Nissin Kogyo Co., Ltd. announced a strategic investment into next-generation regenerative braking systems aimed at two-wheeler and micro-mobility markets.

Some of the prominent players in the automotive brake system market include:

- AKEBONO BRAKE INDUSTRY CO., LTD.

- ZF Friedrichshafen AG

- ADVICS CO.,LTD.

- Hitachi Astemo, Ltd.

- Brembo S.p.A

- Robert Bosch GmbH

- AISIN CORPORATION

- Haldex

- The Web Co

- NISSIN KOGYO Co., Ltd

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global automotive brake system market.

Type

Vehicle Type

- Passenger Cars

- Commercial Vehicles

Technology

- Anti-Lock Brake System (ABS)

- Traction Control System (TCS)

- Electronic Stability Control (ESC)

- Electronic Brake-Force Distribution (EBD)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)