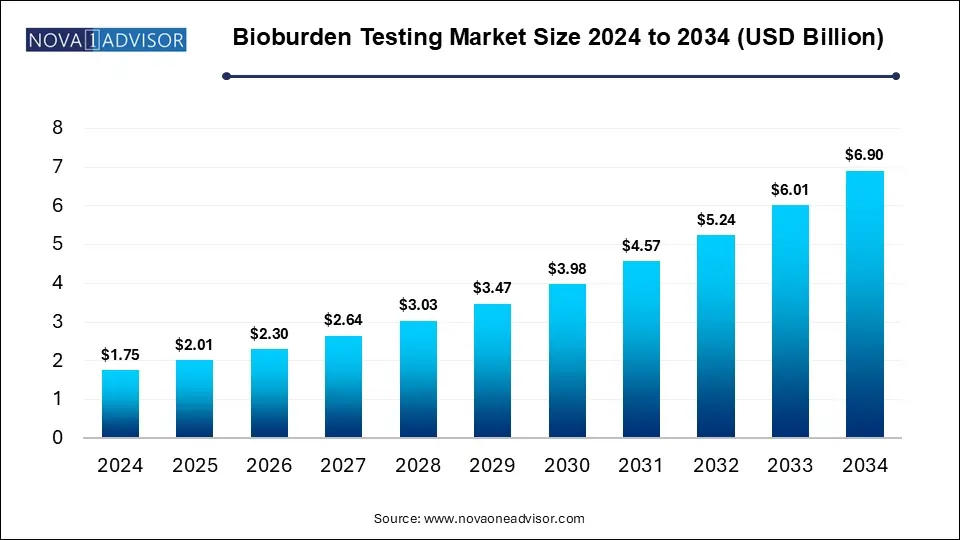

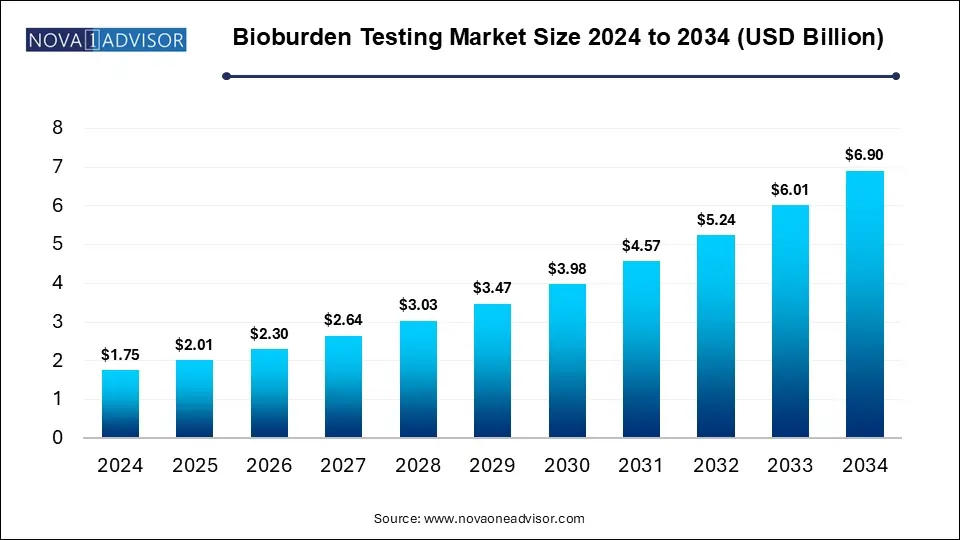

Bioburden Testing Market Size and Growth

The Bioburden Testing Market size was exhibited at USD 1.75 billion in 2024 and is projected to hit around USD 6.9 billion by 2034, growing at a CAGR of 14.7% during the forecast period 2025 to 2034.

Key Takeaways:

- Consumables dominated the bioburden testing market, accounting for the highest revenue share of 67% in 2024.

- Aerobic count testing led the bioburden testing market, accounting for the largest revenue share of 37% in 2024.

- The raw material testing sector dominated the bioburden testing market, with the largest revenue share of 31% in 2024.

- Pharmaceutical and biotechnology companies dominated the bioburden testing market with the largest revenue share in 2024.

- The North America bioburden testing market dominated the global market and accounted for the largest revenue share of 36% in 2024.

Market Overview

The Bioburden Testing Market represents a critical pillar in the quality assurance infrastructure across the pharmaceutical, biotechnology, and medical device manufacturing sectors. Bioburden testing measures the total number of viable microorganisms such as bacteria, fungi, or spores present on a product or within a manufacturing environment prior to sterilization. As regulatory scrutiny and public health awareness intensify, the importance of robust microbial testing procedures has grown exponentially.

This market is being propelled by the heightened demand for sterility in life sciences products, the rise in global pharmaceutical manufacturing, and increasing product recalls due to microbial contamination. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the International Organization for Standardization (ISO) have established stringent bioburden testing standards, compelling manufacturers to invest in comprehensive microbial quality testing solutions.

Bioburden testing is essential in various phases of product development, including raw material qualification, in-process monitoring, sterilization validation, and cleaning validation of equipment. The increased complexity of biologics and combination products has driven greater reliance on advanced and automated bioburden detection technologies. With innovation in rapid microbiological methods (RMM), real-time PCR systems, and automation tools, the market is rapidly evolving to meet growing demand across both industrialized and emerging economies.

The market outlook through 2030 suggests sustained growth, supported by a surge in pharmaceutical outsourcing, advancements in analytical instruments, and a growing emphasis on contamination control. Bioburden testing is no longer a regulatory checkbox but a competitive advantage for companies prioritizing product safety, quality, and market credibility.

Major Trends in the Market

-

Adoption of Rapid Microbial Testing Technologies

Faster turnaround times and more accurate results are being achieved through automated PCR-based platforms and real-time microbial identification.

-

Rising Demand from Biologics Manufacturing

As biologics are more sensitive to contamination, bioburden testing is increasingly crucial in their production pipelines.

-

Integration of Automation and Robotics in Bioburden Labs

Automation helps reduce human error, improve efficiency, and maintain data integrity, especially in high-throughput testing environments.

-

Expansion of Regulatory Oversight in Emerging Markets

Regulatory bodies in Asia Pacific and Latin America are strengthening requirements for microbial testing in manufacturing.

-

Increased Outsourcing to Contract Manufacturing and Testing Organizations

Small and mid-sized manufacturers are outsourcing bioburden testing to reduce capital expenditure on in-house facilities.

-

Development of Multiplex and AI-Driven Analysis Platforms

New AI-powered systems are now capable of identifying multiple microbial strains simultaneously from a single test.

Report Scope of Bioburden Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.01 Billion |

| Market Size by 2034 |

USD 6.9 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 14.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Test Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Charles River Laboratories; Merck KGaA; SGS SA; WuXi AppTec; BD; North American Science Associates Inc.; Nelson Laboratories, LLC; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; Pacific Biolabs |

Market Driver: Regulatory Pressure for Sterile Manufacturing

A significant driver for the bioburden testing market is the increasing regulatory pressure to ensure sterility and microbiological safety in life sciences products. Regulatory frameworks such as the FDA’s 21 CFR Part 211, EU GMP Annex 1, and ISO 11737 mandate routine bioburden assessments throughout the manufacturing lifecycle. These requirements encompass not only end-product testing but also environmental monitoring, equipment validation, and raw material checks.

Failure to comply with bioburden standards has led to high-profile recalls, warning letters, and product bans, pushing companies to prioritize microbial monitoring. For example, in 2023, a global medical device manufacturer issued a large recall due to contamination concerns traced back to inadequate sterilization validation. These incidents underscore the necessity of continuous bioburden surveillance, reinforcing its role as a non-negotiable quality control measure in GMP-compliant operations.

Market Restraint: High Cost of Automated and Advanced Testing Equipment

Despite the market's positive trajectory, a notable restraint is the high cost associated with acquiring and maintaining advanced bioburden testing systems. PCR instruments, automated microbial detection platforms, and robotic handlers require significant capital investment, particularly for small and medium-sized enterprises (SMEs). Moreover, installation, validation, and staff training costs add to the financial burden.

For example, establishing an automated PCR-based bioburden lab may involve a multi-million-dollar budget, making it less feasible for companies with limited resources. Additionally, stringent calibration and maintenance protocols can increase operational expenses. These cost barriers often delay technology upgrades and limit market penetration in resource-limited regions, particularly among food manufacturers and small diagnostic laboratories.

Market Opportunity: Growing Adoption in Food, Beverage, and Agriculture Sectors

A key market opportunity lies in the expanding adoption of bioburden testing in food, beverage, and agricultural manufacturing. With global food safety concerns mounting, bioburden testing is gaining prominence as a preventive control in quality assurance systems. From dairy products to canned foods and packaged meat, microbial contamination remains a leading cause of recalls and health risks.

Manufacturers are increasingly incorporating routine microbial load assessments to comply with food safety standards such as HACCP, ISO 22000, and FDA's FSMA. Additionally, the agricultural industry is applying bioburden testing to evaluate the microbial quality of seeds, irrigation systems, and post-harvest processing. These cross-sectoral applications provide a fertile ground for market expansion beyond the pharmaceutical and medical device realms.

Segmental Analysis

Product Outlook

Consumables dominated the product segment, contributing the largest share to overall market revenues in 2024. These include reagents, culture media, vials, pipette tips, and filtration assemblies required for every bioburden assay. Since they are single-use or limited-use items, consumables offer continuous revenue opportunities. The rise in testing frequency across production stages and expanding lab capacities have further boosted demand. Manufacturers often enter long-term supply contracts for consumables, ensuring predictable revenue streams.

Automated microbial identification systems are projected to be the fastest-growing product category, thanks to increasing emphasis on data reliability, audit readiness, and reduced manual labor. These systems integrate optical readers, image processors, and AI-based colony identification to accelerate microbial count and classification. Instruments like bioMérieux’s VITEK® and Thermo Fisher’s SureTect PCR system are already witnessing growing adoption in high-throughput labs.

Test Type Outlook

Aerobic count testing leads the test type segment, accounting for the majority of routine bioburden evaluations in pharmaceutical and food manufacturing. These tests target aerobic bacteria, which are among the most common contaminants and can easily proliferate in nutrient-rich environments. As part of standard GMP compliance, aerobic testing is conducted on water systems, raw materials, and final products, sustaining its dominance across industries.

Spore count testing is anticipated to be the fastest growing, driven by its importance in sterilization validation and monitoring of hard-to-eliminate contaminants. Spore-forming bacteria such as Bacillus species are highly resistant to environmental stress and sterilization procedures. Identifying and quantifying them is essential in validating autoclaves, dry heat sterilizers, and radiation protocols especially in injectable drugs and surgical instruments.

Application Outlook

Medical device testing dominated the application landscape, owing to the strict regulatory requirements for bioburden limits in implants, catheters, and surgical instruments. According to ISO 11737-1, manufacturers must test each batch of medical devices before sterilization to assess microbiological safety. This ensures product reliability, patient safety, and regulatory compliance. The rise in single-use and minimally invasive devices is further intensifying the need for robust bioburden control.

Sterilization validation testing is projected to grow the fastest, driven by the increasing complexity of biologics, combination devices, and injectable products. With diverse sterilization methods ranging from gamma irradiation to ethylene oxide (EtO) manufacturers need customized testing protocols to confirm the efficacy of their processes. As regulatory bodies demand more rigorous validation documentation, this application segment is gaining strong momentum.

End-use Outlook

Pharmaceutical and biotechnology companies accounted for the largest share, reflecting their high dependence on microbial quality testing in product development and manufacturing. These companies test everything from raw materials and excipients to final packaging environments. The global boom in biologics, cell therapies, and vaccines is translating to increased investments in microbial quality assurance infrastructure, sustaining this segment’s lead.

Microbial testing laboratories are emerging as the fastest-growing end-user segment, as companies increasingly outsource their quality control functions. Third-party labs provide scalable and cost-effective solutions with access to the latest instrumentation and certified personnel. This outsourcing trend is especially prominent among start-ups and mid-tier manufacturers looking to comply with evolving regulations without expanding internal capacity.

Regional Analysis

North America continues to dominate the global bioburden testing market, largely due to its advanced healthcare manufacturing ecosystem, strong regulatory enforcement, and concentration of major industry players. The U.S. market leads in terms of installed base for advanced bioburden testing systems, supported by a proactive FDA, robust investment in pharmaceutical R&D, and frequent audits requiring compliance with stringent quality norms. Additionally, local presence of global giants like Thermo Fisher, Charles River, and bioMérieux reinforces North America’s leadership in both technology development and testing services.

Asia Pacific is the fastest growing region, propelled by a rapid expansion of pharmaceutical and medical device manufacturing, especially in China, India, and South Korea. Governments in these countries are tightening quality control regulations and investing in biotech infrastructure. The growth of local generics and contract manufacturing organizations (CMOs) is creating significant demand for bioburden testing. Moreover, the rise in domestic consumption of packaged food and cosmetics, coupled with increasing public health standards, is driving microbial testing adoption in adjacent sectors.

Some of The Prominent Players in The Bioburden Testing Market Include:

- Charles River Laboratories

- Merck KGaA

- SGS SA

- WuXi AppTec

- BD

- North American Science Associates Inc.

- Nelson Laboratories, LLC

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Pacific Biolabs

Recent Developments

-

March 2025 – Thermo Fisher Scientific unveiled an upgraded SureTect PCR system for high-throughput bioburden detection in injectable drug manufacturing, reducing testing turnaround from 72 hours to less than 24.

-

January 2025 – Charles River Laboratories announced the expansion of its microbial testing facility in Singapore, catering to growing biopharma production in Southeast Asia.

-

November 2024 – bioMérieux launched the VITEK REVEAL™, a next-generation microbial identification platform integrating machine learning algorithms for enhanced bioburden profiling.

-

September 2024 – Merck KGaA (MilliporeSigma) introduced a new rapid bioburden test kit for cell therapy manufacturing, allowing in-process microbial assessment within 8 hours.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Bioburden Testing Market

Product

-

- Culture Media

- Reagents and Kits

-

- Automated Microbial Identification Systems

- PCR Instruments

Test Type

- Aerobic Count Testing

- Anaerobic Count Testing

- Fungi/Mold Count Testing

- Spore Count Testing

Application

- Raw Material Testing

- Medical Device Testing

- In-Process Material Testing

- Sterilization Validation Testing

- Equipment Cleaning Validation

End-use

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Contract Manufacturing Organizations

- Manufacturers of Food & Beverage and Agricultural Products

- Microbial Testing Laboratories

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)