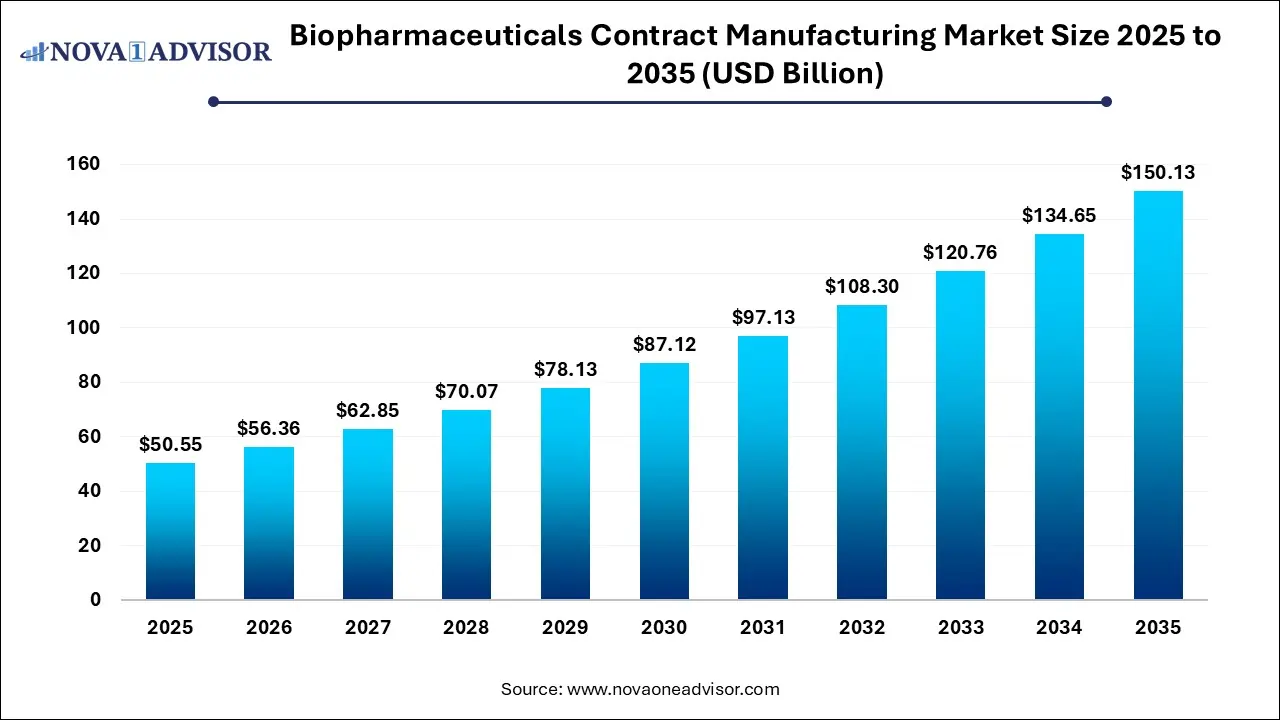

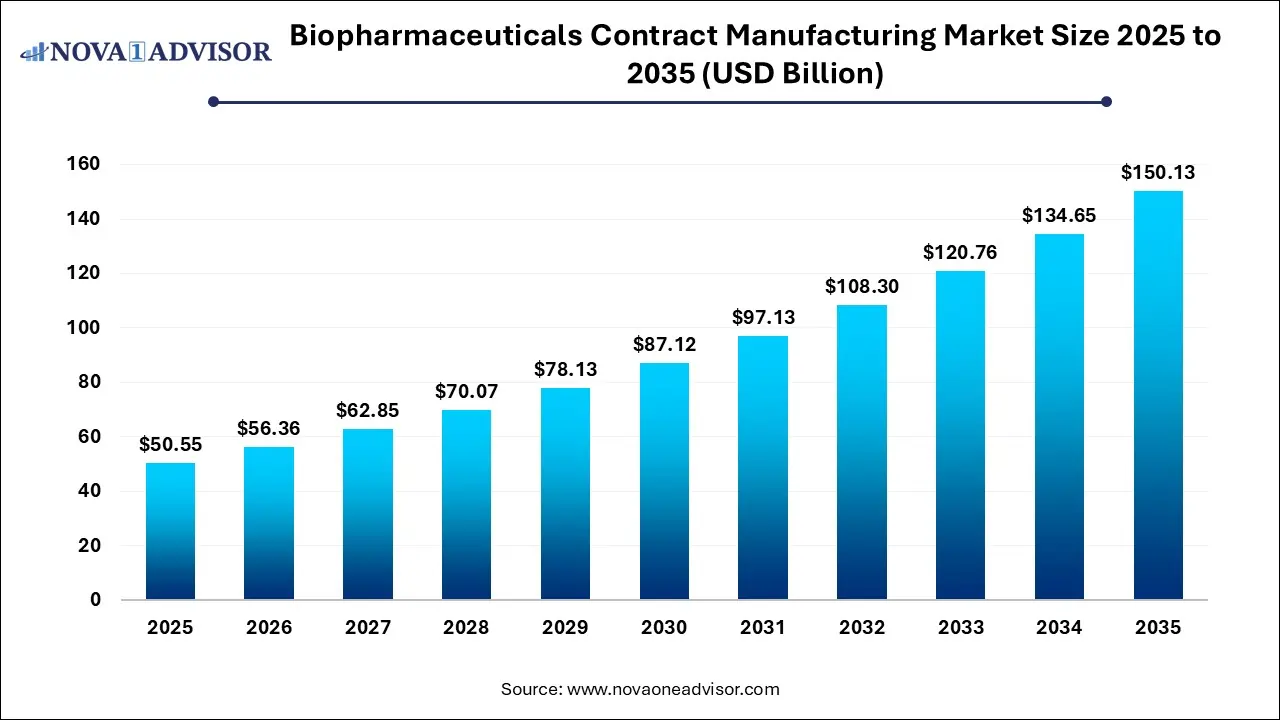

Biopharmaceuticals Contract Manufacturing Market Size and Growth 2026 to 2035

The global biopharmaceuticals contract manufacturing market size was estimated at USD 50.55 billion in 2025 and is projected to hit around USD 150.13 billion by 2035, growing at a CAGR of 11.5% during the forecast period from 2026 to 2035.

Biopharmaceuticals Contract Manufacturing Market Key Takeaways

- By source, the mammalian segment dominated the market in 2025.

- By source, the non-mammalian segment is expected to have the fastest growth rate.

- By service, process development led the market as of this year.

- By service, fill and finish operations are seen to be the fastest growing segment.

- By product, monoclonal antibodies (mAbs) dominated the product segment this year in 2025.

- By product, antisense, RNAi, and molecular therapies are expected fastest growing segment throughout the forecast period.

- By therapeutic area, the oncology segment dominated the market this year.

- By therapeutic area, the neurology segment is seen to have the fastest growth rate.

- By region, North America held the largest market share in 2025.

- By region, Asia-Pacific is expected to grow at the fastest rate throughout the forecast period.

What is Biopharmaceuticals Contract Manufacturing?

The Biopharmaceuticals Contract Manufacturing Market involves the outsourcing of manufacturing activities by biopharmaceutical companies to third-party organizations. This outsourcing encompasses a range of services including process development, scale-up, manufacturing, and packaging of biopharmaceutical products. Biopharmaceutical contract manufacturing services are used across various industries such as pharmaceuticals, biotechnology and healthcare. The process involves manufacturing biopharmaceuticals on behalf of companies that lack the necessary infrastructure or expertise. This allows companies to focus on core competencies such as research and development while also leveraging the specialized capabilities of contract manufacturers.

What are the Key Trends in the Biopharmaceuticals Contract Manufacturing Market?

- Rise for Mammalian Cell Culture Systems: Mammalian systems are gaining popularity in today’s market due to their suitability for complex biologics like antibodies.

- Single-Use Bioreactors: Disposable systems are gaining traction as they reduce contamination risks, shorten turnaround times and lower upfront investment.

- Increase in Biosimilar Manufacturing: Patent expiries of blockbuster biologics are creating a surge in demand for biosimilar CDMO partnerships, thus fostering growth.

- Expansion of CDMO Capabilities: mRNA vaccines and gene-modifying therapies are pushing the boundaries of contract manufacturing scope, giving rise to robust research and development.

- Rise in Investments: CDMOs are actively building quality infrastructures and investing heavily to cater to multi-product as well as multi-process manufacturing.

What is the Impact of AI in the Biopharmaceuticals Contract Manufacturing Market?

The biopharmaceutical contract manufacturing market is undergoing a significant transformation as artificial intelligence and automation makes its way in traditional production processes. As the global demand for biologics and personalized medicine increases, traditional manufacturing methods face challenges in efficiency, scalability and quality control. This is where AI systems and tools come into play as they offer groundbreaking solutions that help streamline production, reduce costs and improve product consistency.

One of the most significant advantages of AI and automation in the market is the optimization of production workflows. Traditional methods often involve labor-intensive processes with high variability, which leads to inefficiencies and increased operational costs. AI-driven predictive analytics and machine learning models help identify bottlenecks, optimize resource allocation and enhance overall process efficiency. Automated image analysis and machine learning algorithms also help in revolutionizing quality assessment. Processes like AI-driven microscopy can rapidly analyze cell cultures to detect contamination or deviations in growth patterns. Similarly, automation in analytical techniques, such as high-throughput sequencing, ensures precise detection of impurities, including residual CHO host cell DNA, which is essential for regulatory compliance and patient safety. Through all these factors, we can see how AI is changing the landscape of the biopharmaceutical domain.

Biopharmaceuticals Contract Manufacturing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 56.36 Billion |

| Market Size by 2035 |

USD 150.13 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.5% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Source, Service, Product, Therapeutic Area, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Boehringer Ingelheim GmbH; Lonza; Inno Biologics Sdn Bhd; Rentschler Biotechnologie GmbH; JRS Pharma; AGC Biologics; ProBioGen; Fujifilm Diosynth Biotechnologies U.S.A., Inc.; Toyobo Co., Ltd.; Samsung BioLogics; Thermo Fisher Scientific, Inc.; Binex Co., Ltd.; WuXi Biologics; AbbVie, Inc; Novartis AG; ADMA Biologics, Inc.; Catalent, Inc; Cambrex Corporation; Pfizer Inc.; Siegfried Holding AG |

Market Dynamics

Driver

Development in the Biopharmaceutical Industry

Rising research and developments as well as investments in biologics, significant growth of the biosimilars market, the expiration of patents for major biologic drugs, are key drivers further accelerating the demand for contract manufacturing services. Additionally, the development of advanced therapies such as cell and gene therapies is creating demand for specialized manufacturing capabilities. Moreover, the global COVID-19 pandemic has also enhanced demand for large-scale manufacturing capabilities for vaccines and treatments, further boosting the market’s potential.

Rapid increase in the number of biopharmaceuticals is also another such driver. The increasing number of pipeline products is boosting demand for outsourcing services as it helps to reduce the time to market of these products. Both small scale and large scale firms are considering outsourcing as a cost-effective approach to improve product pipelines and enhance their share in the biopharmaceutical market.

Restraint

Production Complexities and Regulatory Framework

Despite promising growth, the market does have its fair share of challenges that slows down its growth and development. One such significant restraint in the market is the complexity of biopharmaceutical production and a stringent regulatory ecosystem. Manufacturing biologics involves living cells and is highly sensitive to environmental fluctuations, thus requiring rigorous quality control, consistent process validation and compliance with the cGMP.

This complexity increases the risk of batch failures, contamination and delays especially for CDMOs that handle multiple clients and product types. The need to meet regulatory standards set by the FDA, EMA and PMDA on a global scale creates an extra layer of cost, time and documentation burden. This makes it difficult for firms to keep up, slowing down market entry.

Opportunity

Advancements in Biotechnology and Biomedical Science

Continuous advancements in biotechnology and biomedical science techniques have opened up new areas of opportunities as well as enhanced the process of biopharmaceutical development for the management of several chronic conditions. These advancements help to better understand cell-line production, protein identification and expression engineering. The rising adoption of machine learning and AI tools to collect data in biopharmaceutical manufacturing is also expected to propel the market forward. Furthermore, usage of nanosystems has also increased in the recent years, helping to address delivery challenges as well as the application of mRNA therapeutics in the treatment of various diseases.

The expansion of RNA-based drugs and gene therapies are also transforming the therapeutic landscape. The success of mRNA-based vaccines during the Covid-19 pandemic has accelerated investments in RNA therapeutics, particularly for cancer, infectious diseases and rare genetic disorders. These advanced modalities require highly specialized manufacturing processes, including lipid nanoparticle (LNP) formulation, in vitro transcription (IVT) and vector production. We can see that many biopharma companies are now turning to CDMOs for optimizing their RNA manufacturing capabilities.

Biopharmaceuticals Contract Manufacturing Market By Segmental Analysis

By Source Insights

Which source type dominated the market in 2025?

Mammalian cell-based production dominated the market in 2024. This method is preferred for producing complex biologics such as monoclonal antibodies, fusion proteins and hormones due to its ability to generate human-like glycosylation patterns. Chinese hamster ovary (CHO) cells are the most widely used mammalian systems, offering high productivity and scalability. Most FDA-approved biologics today are manufactured using mammalian systems, and demand continues to grow as pipeline complexity increases.

Non-mammalian systems, including microbial and yeast expression systems are the fastest-growing segment as of this year, particularly in the production of biosimilars, vaccines and non-glycosylated proteins. These systems offer advantages like shorter production times, cost efficiency, and robustness, thus making them popular.

Biopharmaceuticals Contract Manufacturing Market By Source, 2025-2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Mammalian |

38.39 |

42.62 |

47.33 |

52.55 |

58.35 |

64.79 |

71.93 |

79.87 |

88.68 |

98.46 |

109.33 |

| Non-mammalian |

6.78 |

7.65 |

8.62 |

9.72 |

10.96 |

12.35 |

13.91 |

15.68 |

17.66 |

19.89 |

22.40 |

By Service Insights

Which service segment led the market as of this year?

Process development services led the market as of this year. Biopharma companies rely heavily on CDMOs to optimize upstream and downstream parameters before committing to full-scale manufacturing. These services include cell line development, media optimization, purification protocols and scale-up validation, thus forming the very foundation of commercial manufacturing success.

Fill and finish operations are seen to be the fastest growing segment, driven by rising demand for sterile packaging of biologics in prefilled syringes, vials and cartridges. With the rise of self-injection biologics and parenteral administration routes, final formulation, aseptic filling and packaging are increasingly outsourced to CDMOs.

By Product Insights

Which product dominated the market this year?

Monoclonal antibodies (mAbs) dominated the product segment this year in 2025. This is because they continue to be the most commercially successful class of biologics. CDMOs are being heavily invested in developing infrastructure, bioreactors and regulatory frameworks specifically for mAb production. Moreover, rising applications in oncology, autoimmune diseases, and infectious diseases ensure continued growth and high-volume production.

Antisense, RNAi, and molecular therapies are expected fastest growing segment throughout the forecast period. The approval of RNA-based therapies and growing clinical pipelines in rare diseases and oncology have created a surge in demand for niche CDMO expertise. These therapies require unique synthesis, encapsulation, and quality testing capabilities, pushing CDMOs to invest in specialized facilities.

Biopharmaceuticals Contract Manufacturing Market By Product, 2025-2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Biologics |

9.93 |

10.95 |

12.08 |

13.32 |

14.69 |

16.19 |

17.85 |

19.68 |

21.69 |

23.90 |

26.34 |

| Monoclonal antibodies (MABs) |

11.29 |

12.61 |

14.09 |

15.75 |

17.60 |

19.66 |

21.97 |

24.55 |

27.43 |

30.65 |

34.24 |

| Recombinant Proteins |

5.42 |

6.08 |

6.82 |

7.66 |

8.59 |

9.64 |

10.81 |

12.13 |

13.61 |

15.27 |

17.12 |

| Vaccines |

6.32 |

7.09 |

7.94 |

8.90 |

9.98 |

11.18 |

12.53 |

14.04 |

15.74 |

17.63 |

19.76 |

| Antisense, RNAi, & Molecular Therapy |

3.16 |

3.57 |

4.03 |

4.54 |

5.13 |

5.78 |

6.52 |

7.36 |

8.29 |

9.35 |

10.54 |

| Others |

2.71 |

3.07 |

3.47 |

3.92 |

4.43 |

5.01 |

5.66 |

6.40 |

7.23 |

8.17 |

9.22 |

| Biosimilars |

6.32 |

6.88 |

7.49 |

8.15 |

8.87 |

9.64 |

10.47 |

11.37 |

12.33 |

13.37 |

14.49 |

By Therapeutic Area

Which therapeutic area segment held the largest market share in 2025?

The Oncology segment held the largest market share in 2025. This is due to the biopharma industry’s focus on immuno-oncology, mAbs and targeted therapies. This segment is advantageous because it is flexible and offers scalable manufacturing platforms. Many oncology biologics are produced using mammalian systems with rapid scale-up needs, making CDMO partnerships an essential component.

The Neurology segment is seen to have the fastest growth rate during the forecast period, due to increasing approvals and late-stage trials for biologics targeting diseases like Alzheimer’s, Parkinson’s and multiple sclerosis. The complexity of neurological disease biology requires advanced biologics such as antibody-drug conjugates, biosimilars, and gene therapies, all of which demand specialized production environments.

By Regional Analysis

Why did North America dominate the market?

North America dominated the global biopharmaceutical contract manufacturing market in 2025. This dominance can be attributed to the fact that the region is home to a mature biopharma ecosystem, has stringent regulatory frameworks and a high concentration of CDMOs and biopharmaceutical companies. The U.S. in particular is a major hub for major players like Thermo Fisher Scientific, Catalent etc. which continues to expand capacity and technology. The region also benefits from robust funding for biotech startups and public-private collaborations for pandemic preparedness and advanced therapeutics.

What are the advancements in Asia-Pacific?

Asia-Pacific is expected to be the fastest-growing region as of this year, driven by rising investment in biopharma manufacturing hubs in countries like China, India and South Korea. Governments are increasingly incentivizing CDMO capacity building through tax benefits and infrastructure support, while domestic biotech companies increasingly turn to outsourcing for cost-effective scale-up.

Biopharmaceuticals Contract Manufacturing Market By Region, 2025-2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| North America |

17.16 |

19.05 |

21.14 |

23.47 |

26.05 |

28.92 |

32.10 |

35.63 |

39.55 |

43.90 |

48.73 |

| Europe |

12.64 |

14.12 |

15.77 |

17.62 |

19.68 |

21.98 |

24.55 |

27.42 |

30.62 |

34.20 |

38.20 |

| Asia-Pacific |

9.03 |

10.10 |

11.30 |

12.64 |

14.13 |

15.81 |

17.68 |

19.77 |

22.11 |

24.73 |

27.66 |

| Latin America |

3.16 |

3.52 |

3.92 |

4.36 |

4.85 |

5.40 |

6.01 |

6.69 |

7.44 |

8.28 |

9.22 |

| Middle East & Africa (MEA) |

3.16 |

3.47 |

3.80 |

4.17 |

4.57 |

5.01 |

5.49 |

6.02 |

6.59 |

7.22 |

7.90 |

Key Companies and Market Share Insights

Recent Developments

- In March 2025, Boehringer Ingelheim enhanced its biopharmaceutical contract manufacturing services in China. The reform was led by the Chinese medicine authority NMPA (National Medical Products Administration), and aims at enhancing control, efficiency, and flexibility in the production process. It is also offering distinct service packages for different segments in biopharmaceutical production and enabling the sustainable global supply of medications to patients.

- In October 2025, SunRock Biopharma, a biotechnology company which is focused on developing next-generation therapeutic antibodies, and Chime Biologics, a global leading contract development and manufacturing organization (CDMO) announced a strategic collaboration for the development of SRB5, a novel anti-CCR9 monoclonal antibody targeting inflammatory bowel disease (IBD), with potential expansion into other immune-mediated inflammatory indications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the biopharmaceuticals contract manufacturing market.

By Source

By Service

- Process Development

- Downstream

- Upstream

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

By Product

- Biologics

- Monoclonal antibodies (MABs)

- Recombinant Proteins

- Vaccines

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilars

By Therapeutic Area

- Oncology

- Autoimmune Diseases

- Metabolic Diseases

- Cardiovascular Diseases

- Neurology

- Infectious Diseases

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)