Cancer Biomarkers Market Size and Growth Report By 2033

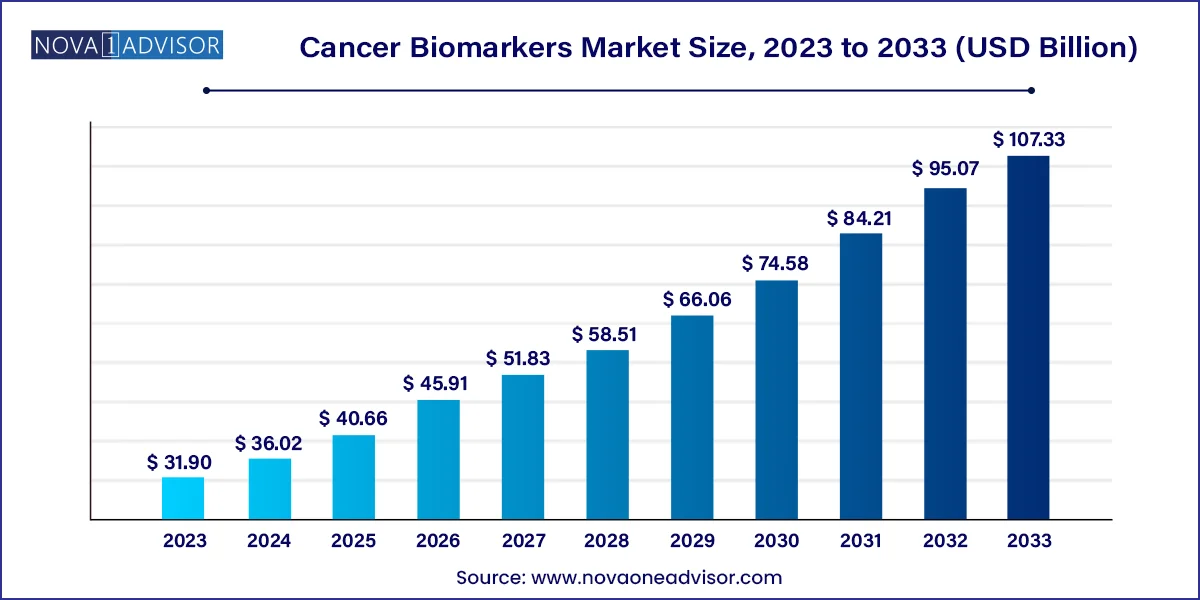

The global cancer biomarkers market size was USD 31.90 billion in 2023, calculated at USD 36.02 billion in 2024 and is expected to reach around USD 107.33 billion by 2033, expanding at a CAGR of 12.9% from 2024 to 2033.

Cancer Biomarkers Market Key Takeaways

- The breast cancer segment held a significant market share in terms of revenue in 2023 and it is also expected to be the witness the fastest CAGR over the forecast period.

- The genetic biomarkers segment dominated the market in terms of revenue share in 2023.

- The epigenetics segment is expected to be the fastest growing segment over the forecast period.

- The diagnostics segment dominated the market in terms of revenue share in 2023.

- The personalized medicine segment is the fastest growing segment during the forecast period.

- The imaging technologies segment dominated the market share in 2023

- The OMICS segment is expected to grow at the fastest CAGR over the forecast period.

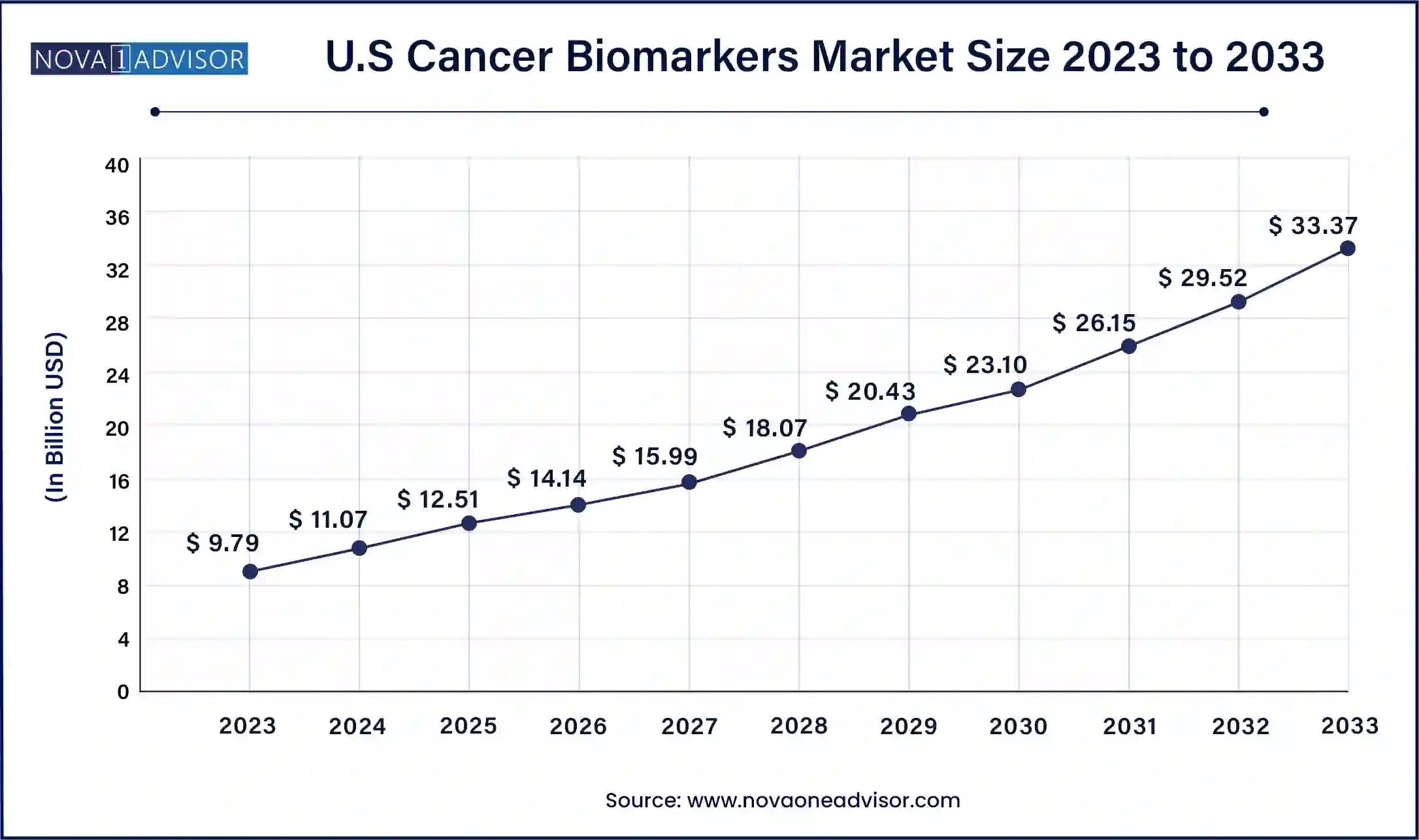

U.S. Cancer Biomarkers Market Size, Industry Report, 2033

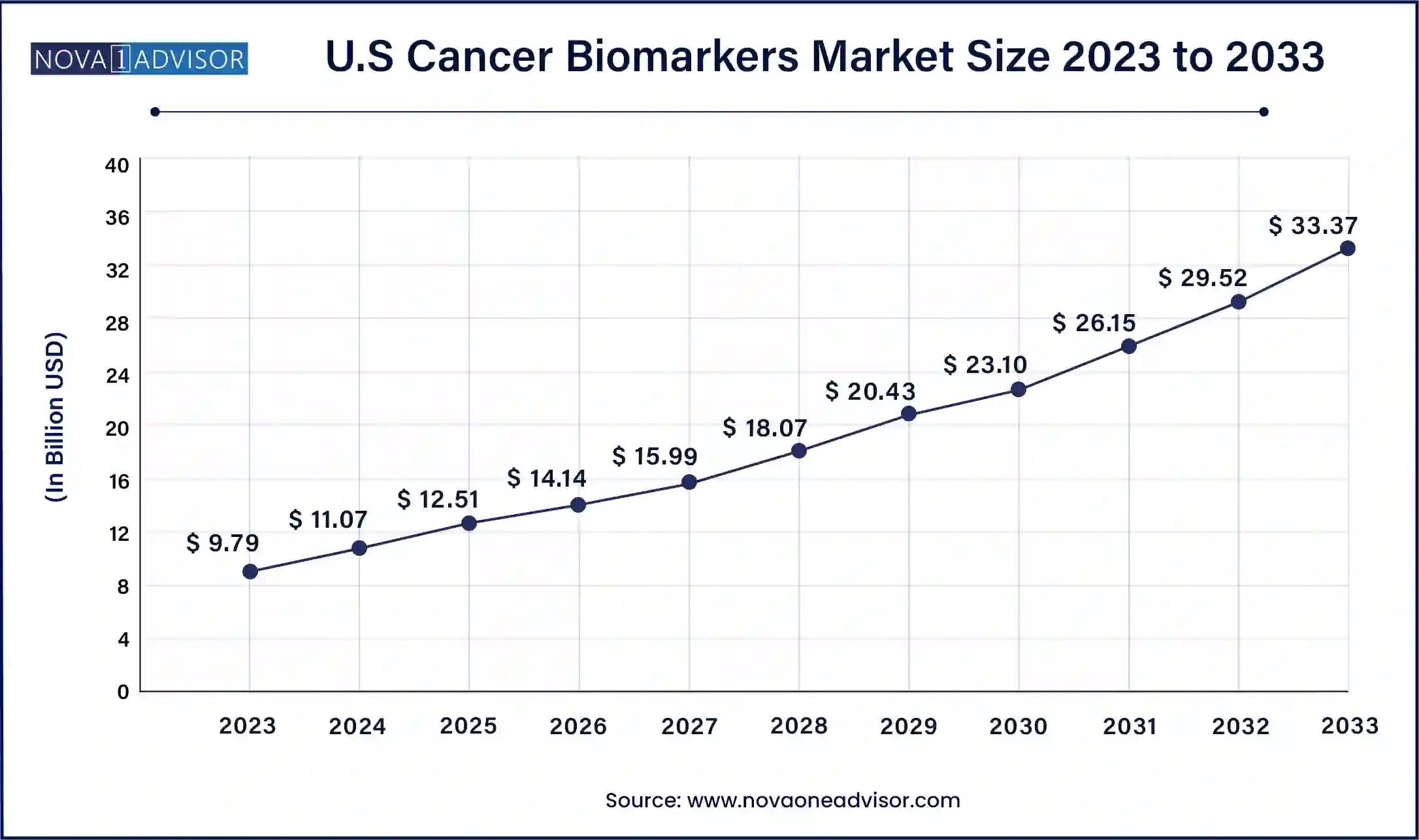

The U.S. cancer biomarkers market size was exhibited at USD 9.79 billion in 2023 and is projected to be worth around USD 33.37 billion by 2033, poised to grow at a CAGR of 13.05% from 2024 to 2033.

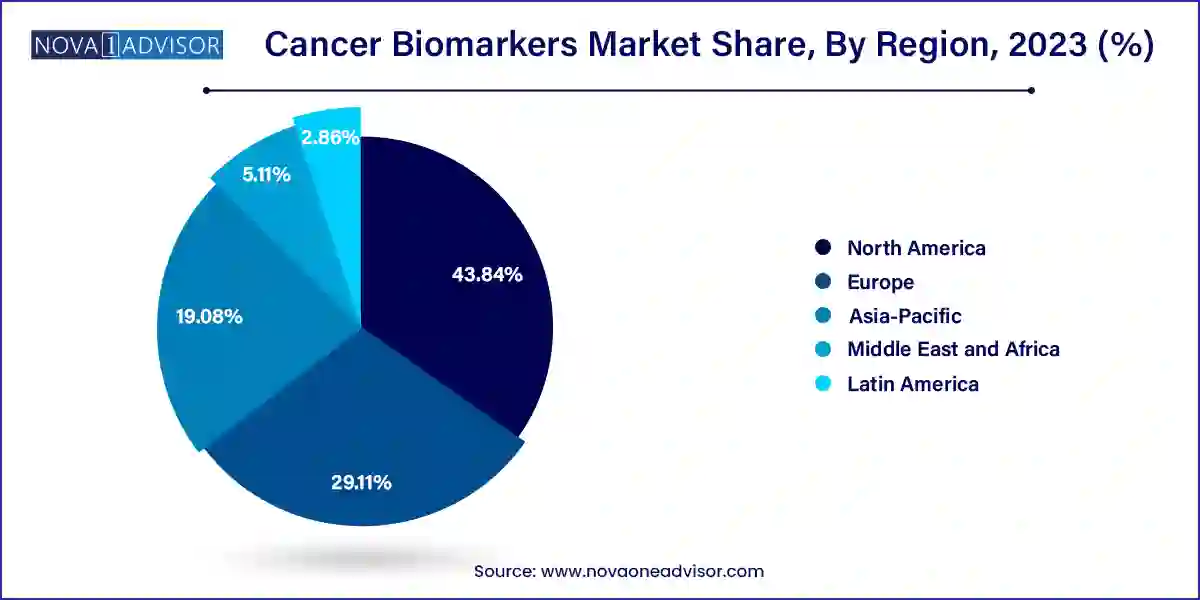

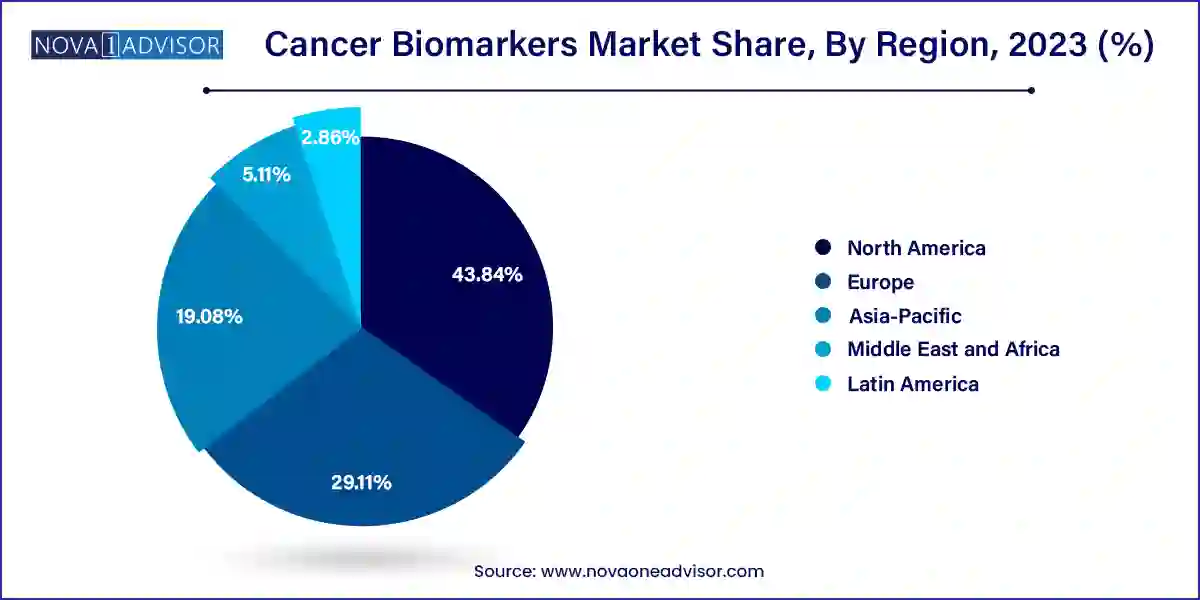

North America holds the largest share of the cancer biomarkers market, with the United States at the forefront of innovation and adoption. The region benefits from a well-established healthcare infrastructure, significant funding for cancer research, and early regulatory approvals for biomarker-based diagnostics and therapeutics. Institutions like the National Cancer Institute (NCI) and partnerships between biotech companies and academic centers drive the discovery and clinical translation of novel biomarkers. Additionally, favorable reimbursement policies and widespread awareness campaigns have led to high adoption rates of cancer screening tests involving biomarkers.

Asia-Pacific is the fastest-growing region in the cancer biomarkers market, driven by increasing cancer burden, growing healthcare expenditures, and expanding access to genomic testing. Countries like China, India, Japan, and South Korea are investing heavily in cancer genomics and personalized healthcare. For instance, Japan’s national screening programs integrate biomarker testing for early cancer detection. Meanwhile, China’s Precision Medicine Initiative aims to integrate genomic data with clinical practice. The rising prevalence of lung, liver, and gastric cancers in the region underscores the need for robust biomarker-based diagnostics and therapeutics.

Market Overview

The cancer biomarkers market has witnessed a paradigm shift in the past decade, evolving from a niche research field into a cornerstone of modern oncology and personalized medicine. Cancer biomarkers refer to specific molecules genes, proteins, or metabolic byproducts that are produced by cancer cells or the body in response to cancer. These biomarkers play a pivotal role in cancer detection, diagnosis, prognosis, and therapeutic monitoring. With the surge in global cancer incidence, the medical community has increasingly turned toward biomarker-based diagnostics and treatments to improve patient outcomes and optimize healthcare costs.

The World Health Organization (WHO) reported nearly 10 million cancer deaths in 2020, a figure that is expected to rise significantly in the coming years. The demand for early detection tools, targeted therapies, and effective monitoring mechanisms is intensifying. In this landscape, cancer biomarkers serve as valuable assets that provide precise insights into tumor biology, guide drug development, and support clinicians in tailoring treatment strategies based on molecular characteristics of the tumor. The emergence of high-throughput technologies like next-generation sequencing (NGS), proteomics, and metabolomics has further propelled the identification and utilization of novel biomarkers.

Moreover, the cancer biomarker ecosystem is supported by growing investments from biopharmaceutical companies, collaborations between industry and academia, and government initiatives aimed at promoting early diagnosis and personalized treatment approaches. With a clear emphasis on precision oncology and patient-centric care, the market is poised for sustained growth, underpinned by both clinical and technological advancements.

Major Trends in the Market

-

Expansion of Multi-omics Platforms: Integration of genomics, proteomics, metabolomics, and transcriptomics to provide comprehensive biomarker profiles for precise cancer characterization.

-

Growing Role in Immunotherapy: Biomarkers such as PD-L1 and MSI are increasingly used to predict immunotherapy response, leading to more selective and effective treatments.

-

Liquid Biopsy Integration: Non-invasive approaches to detect circulating tumor DNA (ctDNA) and other biomarkers in blood are reshaping diagnostics and monitoring strategies.

-

AI and Machine Learning in Biomarker Discovery: Computational tools are accelerating the identification of novel biomarkers and enhancing data interpretation in oncology research.

-

Regulatory Push for Companion Diagnostics: Increasing FDA approvals for companion diagnostics are promoting biomarker-driven therapies for various cancers.

-

Rise of Biomarker-based Clinical Trials: Drug developers are designing clinical trials based on molecular profiling, improving trial efficiency and success rates.

-

Focus on Early Detection and Screening Programs: National cancer screening initiatives in countries like Japan, the U.S., and the UK are increasingly leveraging biomarkers for early cancer identification.

Cancer Biomarkers Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 40.66 Billion |

| Market Size by 2033 |

USD 107.33 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, biomolecule, application, technology, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott; QIAGEN; Thermo Fisher Scientific Inc; Affymetrix Inc; Illumina, Inc.; Agilent Technologies; F. Hoffmann-La Roche AG; Merck & Co. Inc; Hologic, Inc., and Sino Biological Inc. |

Market Driver: Rising Demand for Personalized Medicine

The most significant driver propelling the cancer biomarkers market is the surging demand for personalized medicine. Unlike traditional “one-size-fits-all” treatment approaches, personalized medicine considers an individual’s unique genetic and molecular profile. Cancer biomarkers lie at the heart of this shift. For instance, HER2 is a well-known biomarker used in breast cancer patients to determine eligibility for trastuzumab (Herceptin) therapy. Similarly, KRAS mutation status is a key determinant in colorectal cancer treatment selection. As more cancers are understood at the molecular level, biomarkers enable targeted therapy selection, reduce adverse effects, and increase treatment efficacy.

Governments and healthcare providers globally are recognizing the cost-benefit advantage of personalized medicine. It reduces unnecessary interventions and enhances survival rates, especially in complex cases like non-small cell lung cancer (NSCLC), where EGFR mutations or ALK rearrangements dictate therapy. The expansion of genetic testing panels and NGS platforms has made it feasible to analyze multiple biomarkers simultaneously, accelerating the mainstream adoption of personalized oncology across hospital settings.

Market Restraint: High Costs and Accessibility Barriers

Despite the promise of biomarker-based cancer management, the high cost of biomarker testing remains a critical restraint, particularly in low- and middle-income countries. Many advanced biomarker tests require sophisticated laboratory infrastructure, expensive reagents, and skilled personnel. Moreover, reimbursement frameworks for biomarker-based diagnostics vary widely across regions, creating financial uncertainties for patients and providers.

For instance, while the U.S. offers relatively supportive insurance coverage through Medicare and private insurers for some FDA-approved companion diagnostics, countries in Latin America or Sub-Saharan Africa struggle with limited availability and affordability. Additionally, lack of awareness, low penetration of genomic technologies, and regulatory hurdles delay the clinical translation of emerging biomarkers. Addressing cost-related challenges through technological innovation, streamlined workflows, and global partnerships is crucial for equitable biomarker adoption.

Market Opportunity: Accelerated Drug Development and Companion Diagnostics

The expanding role of cancer biomarkers in drug discovery and development presents a significant growth opportunity for market players. Biomarkers not only enable patient stratification in clinical trials but also serve as endpoints to measure drug efficacy. This facilitates faster regulatory approvals and better-targeted therapies. The emergence of biomarker-driven clinical trial designs, such as umbrella and basket trials, exemplifies how molecular markers are transforming oncology research.

Companion diagnostics (CDx) are another area poised for rapid expansion. CDx tests identify the right patient population for specific drugs, such as PD-L1 testing for immunotherapy drugs like pembrolizumab (Keytruda). Regulatory bodies are increasingly approving drugs in conjunction with their respective biomarker assays, thereby creating a symbiotic relationship between diagnostics and therapeutics. This convergence opens new avenues for collaboration between diagnostic firms and pharmaceutical companies, accelerating innovation and expanding market potential.

Cancer Biomarkers Market By Type Insights

The lung cancer segment has emerged as the dominant segment within the cancer biomarkers market, owing to the high global prevalence and mortality associated with this cancer type. Biomarkers such as EGFR mutations, ALK rearrangements, and PD-L1 expression have revolutionized the treatment landscape of non-small cell lung cancer (NSCLC). These molecular markers guide the use of targeted therapies and immunotherapy, significantly improving survival outcomes. Given the aggressive nature of lung cancer and its poor prognosis when diagnosed late, the availability of biomarkers for early detection and monitoring is highly valuable.

While lung cancer maintains its dominance, the breast cancer segment is witnessing robust growth, driven by widespread awareness and established screening protocols involving HER2, ER, and PR biomarkers. The use of multigene assays like Oncotype DX and MammaPrint for prognosis and treatment planning has further enhanced the role of biomarkers in breast cancer care. These tools help avoid overtreatment in early-stage cases and enable personalized therapy decisions, thereby supporting the broader adoption of biomarker testing across oncology clinics.

Cancer Biomarkers Market By Biomolecule Insights

Genetic biomarkers lead the market due to their established role in predicting cancer risk, treatment response, and recurrence. Mutations in BRCA1/BRCA2 (breast/ovarian cancer), KRAS (colorectal and lung cancer), and BRAF (melanoma) are routinely tested to guide therapeutic decisions. Advances in sequencing technologies have enabled the rapid and cost-effective analysis of genetic alterations, making them the most clinically actionable biomarker category.

On the other hand, proteomic biomarkers are rapidly emerging as a powerful complement to genetic data. Proteins reflect dynamic changes in the tumor environment and provide insights into disease progression and treatment response. Biomarkers such as CA-125 for ovarian cancer and PSA for prostate cancer are widely used. Proteomics-based approaches, combined with AI-driven data analysis, are expanding the biomarker repertoire, especially in areas like immuno-oncology and resistance mechanisms.

Cancer Biomarkers Market By Application Insights

Diagnostics accounted for the largest share of the cancer biomarkers market. The increasing reliance on biomarkers for cancer screening, early detection, and differential diagnosis underpins this dominance. Biomarkers provide specificity and sensitivity that conventional diagnostic tools often lack. Blood-based biomarker tests, for instance, are less invasive and offer high clinical utility in routine cancer assessments.

Meanwhile, personalized medicine is the fastest-growing application segment. As oncology shifts toward individualized treatment, the demand for predictive and prognostic biomarkers is accelerating. Molecular profiling to match patients with the most effective therapies is no longer limited to academic settings it is being widely integrated into standard clinical protocols. This trend is supported by real-world evidence and regulatory endorsement of biomarker-guided therapies across major cancers.

Cancer Biomarkers Market By Technology Insights

OMICS technologies, encompassing genomics, proteomics, metabolomics, and transcriptomics, dominate the cancer biomarker landscape. These platforms enable the discovery of multiple biomarkers across various biological pathways, offering a comprehensive understanding of tumor biology. High-throughput sequencing and microarray technologies have accelerated biomarker discovery and facilitated personalized cancer care.

Imaging technologies, while slightly behind in market share, remain critical in monitoring tumor response and guiding biopsy procedures. Innovations like PET-CT with radiolabeled biomarkers and functional MRI have enhanced the precision of cancer diagnostics. However, the integration of imaging with molecular data (radiogenomics) represents an exciting frontier where the convergence of OMICS and imaging could unlock new clinical insights.

Cancer Biomarkers Market Top Key Companies:

- Abbott

- QIAGEN

- Thermo Fisher Scientific Inc

- Affymetrix Inc

- Illumina, Inc.

- Agilent Technologies

- F. Hoffmann-La Roche AG

- Merck & Co. Inc

- Hologic, Inc

- Sino Biological Inc

Cancer Biomarkers Market Recent Developments

-

March 2025: Roche announced the launch of the AVENIO Tumor Tissue Comprehensive Genomic Profiling kit, expanding its cancer biomarker assay portfolio for clinical and research use.

-

January 2025: Illumina entered a strategic partnership with AstraZeneca to develop next-generation companion diagnostics for targeted oncology therapies.

-

December 2024: Bio-Rad Laboratories introduced new multiplexed ELISA kits designed for protein biomarker detection in early-stage cancers.

-

October 2024: Thermo Fisher Scientific received FDA clearance for its Oncomine Dx Target Test, a multi-biomarker assay for non-small cell lung cancer.

-

September 2024: GRAIL announced data from a large-scale study showing the effectiveness of its Galleri multi-cancer early detection test, which detects over 50 types of cancers using cfDNA biomarkers.

Cancer Biomarkers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Cancer Biomarkers market.

By Type

- Breast cancer

- Prostate cancer

- Colorectal cancer

- Cervical cancer

- Liver cancer

- Lung cancer

- Others

By Biomolecule

- Genetic Biomarkers

- Epigenetic Biomarkers

- Metabolic Biomarkers

- Proteomic Biomarkers

- Others

By Application

- Drug discovery and Development

- Diagnostics

- Personalized medicine

- Others

By Technology

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)