Cancer Biopsy Market Size and Trends 2026 to 2035

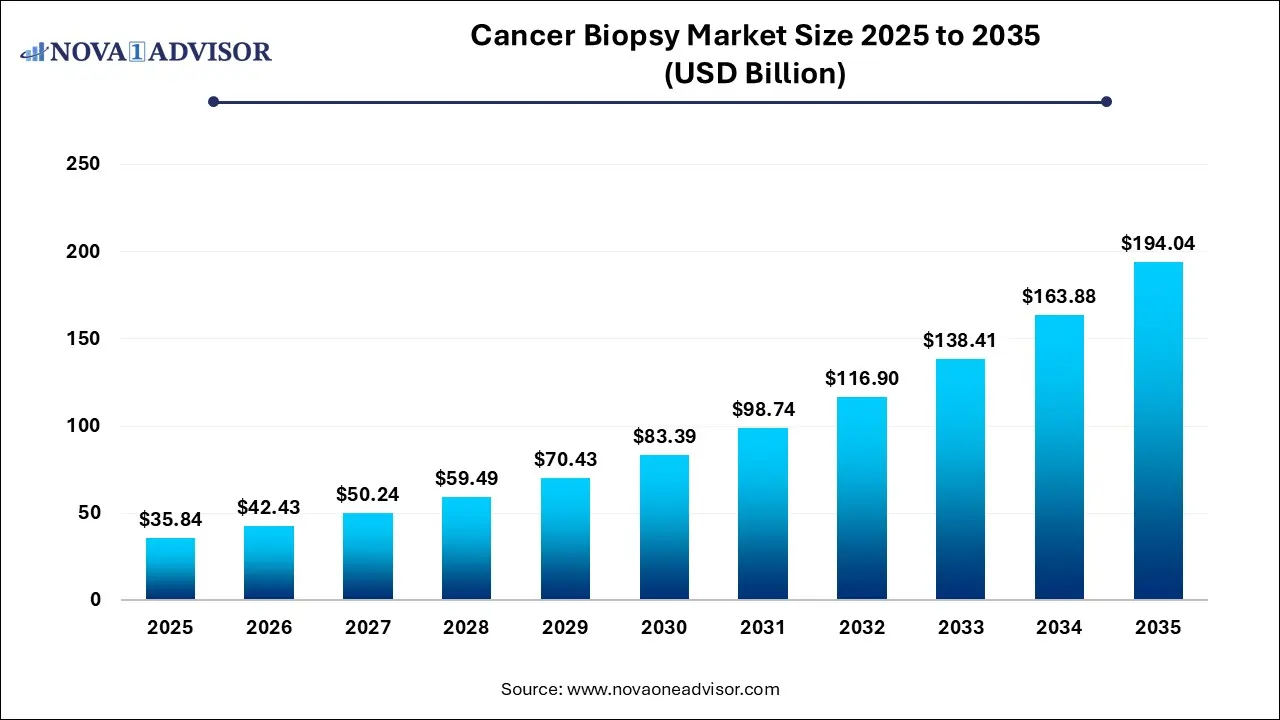

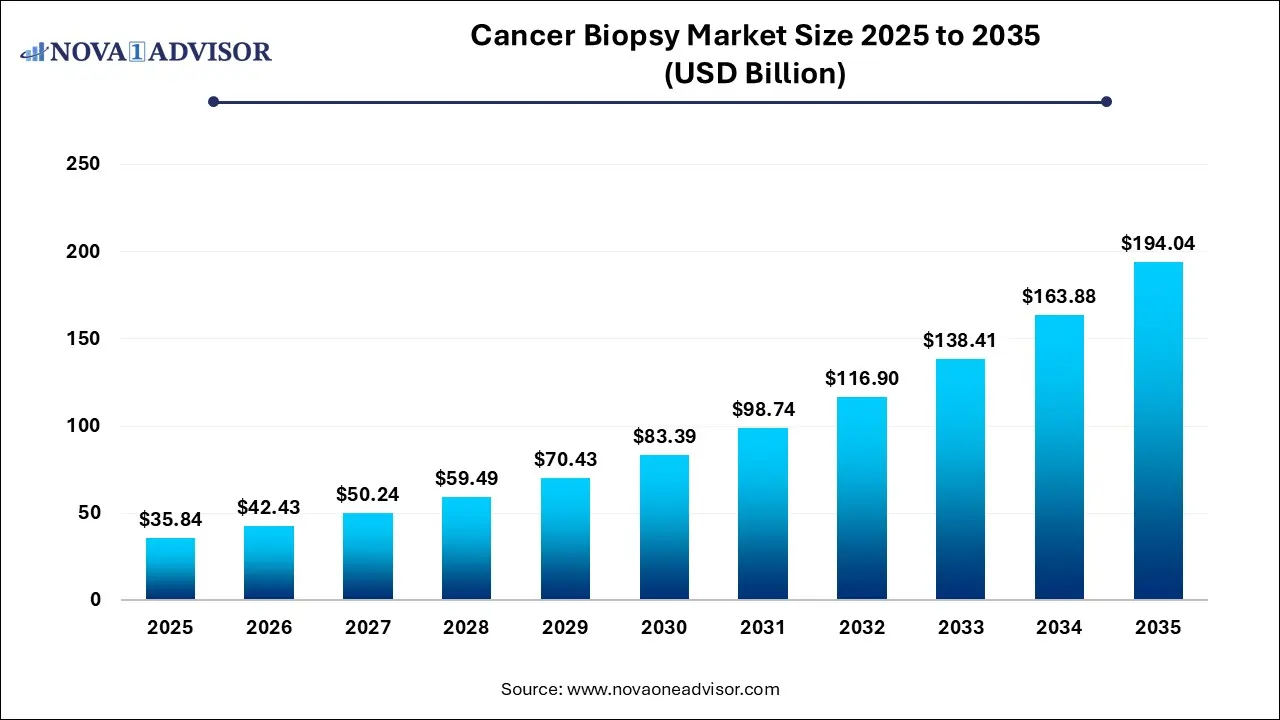

The global cancer biopsy market size was estimated at USD 35.84 billion in 2025 and is expected to be worth around USD 194.04 billion by 2035, poised to grow at a compound annual growth rate (CAGR) of 18.4% during the forecast period 2026 to 2035.

Cancer Biopsy Market Key Takeaways

- Tissue biopsy generated the highest revenue and accounted for 63.42% of the total revenue in 2025.

- Liquid biopsies are anticipated to expand at the fastest CAGR over the forecast period.

- Breast biopsy emerged as the dominant segment with a market share of 16.31% in 2025, and the same is anticipated to grow at the fastest CAGR over the forecast period.

- Kits and consumables accounted for a revenue share of 62.0% in 2025.

- Instruments are anticipated to grow at the fastest CAGR over the forecast period.

- North America market generated the highest revenue in 2025 and accounted for 41.85% of the total revenue generated.

Cancer Biopsy Market Overview

The global cancer biopsy market has evolved into a critical segment within the oncology diagnostics landscape, enabling clinicians to detect, analyze, and monitor cancerous cells at various stages of the disease. Biopsy procedures, which involve the extraction of tissue or fluid samples for laboratory examination, remain the cornerstone of cancer diagnosis and are pivotal in establishing effective treatment protocols.

Driven by the global rise in cancer incidence, increasing demand for early diagnosis, and the adoption of personalized medicine, the cancer biopsy market is witnessing significant growth. According to the World Health Organization (WHO), cancer is one of the leading causes of death globally, with approximately 10 million deaths in 2020. These staggering statistics reinforce the urgent need for accurate diagnostic tools among which biopsy techniques are most definitive.

The market has undergone substantial technological advancements, including the emergence of liquid biopsies, which offer a less invasive alternative to traditional tissue biopsies. This technique analyzes biomarkers in blood or other fluids and is being increasingly adopted for monitoring disease progression, relapse, and therapeutic resistance. Additionally, innovations in imaging guidance (such as ultrasound, CT, and MRI) and molecular profiling have enhanced the precision, safety, and clinical utility of biopsy procedures.

As health systems worldwide transition toward value-based care and precision oncology, the biopsy market is poised for robust expansion. Investments in cancer screening programs, government funding for diagnostic R&D, and the integration of artificial intelligence into biopsy analysis are expected to further propel market development.

Major Trends in the Market

-

Rapid Adoption of Liquid Biopsy Techniques: Non-invasive sampling is gaining traction due to reduced patient discomfort, real-time monitoring capabilities, and suitability for hard-to-reach tumors.

-

Rise in Companion Diagnostics: Biopsies are increasingly being used to guide targeted therapy selections, especially in cancers like non-small cell lung cancer (NSCLC) and breast cancer.

-

Integration of Artificial Intelligence in Histopathology: AI-powered image analysis is improving accuracy, reducing human error, and shortening diagnostic turnaround times.

-

Miniaturization and Innovation in Biopsy Devices: Companies are developing fine-gauge, high-yield needles and smart tissue collection devices for improved procedural outcomes.

-

Expansion of Home-Based Testing: Startups and laboratories are offering blood-based biopsy kits for home collection, especially for post-treatment monitoring.

-

Emerging Focus on Biomarker Discovery: Biopsies are playing a pivotal role in discovering new genetic markers, enhancing cancer subtyping and treatment personalization.

-

Increase in Outpatient Biopsy Procedures: Cost-effectiveness and convenience are prompting healthcare systems to shift certain procedures from inpatient to outpatient settings.

-

Cross-Border Collaborations for Clinical Trials: Biopsy-centric oncology trials are expanding internationally, supporting biomarker validation and global regulatory submissions.

Cancer Biopsy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 42.43 Billion |

| Market Size by 2035 |

USD 194.04 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 18.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

QIAGEN; Illumina Inc.; ANGLE plc.; BD; Myriad Genetics; Hologic, Inc.; BIOCEPT, INC.; Thermo Fisher Scientific, Inc.; Danaher Corporation; F. Hoffmann-La Roche Ltd.; Epigenomics AG; HelioHealth (Laboratory for Advanced Medicine); 20/20 Genesystems, Inc. (Genesys Biolabs); Personal Genome Diagnostics, Inc.; Natera, Inc.; Chronix Biomedical, Inc.; Personalis, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Grail, INC.; Guardant Health; Exact Sciences Corporation; Biodesix (Integrated Diagnostics); Oncimmune. |

Market Driver: Rising Global Cancer Burden and Need for Early Detection

A key driver fueling the cancer biopsy market is the increasing global burden of cancer and the concurrent demand for early and accurate diagnosis. According to the International Agency for Research on Cancer (IARC), the number of new cancer cases is expected to rise by over 60% globally by 2040. Early detection is strongly correlated with improved treatment outcomes and survival rates, particularly in aggressive cancers such as pancreatic, lung, and liver cancers.

Biopsy remains the gold standard for confirming cancer diagnosis and characterizing tumor biology. As public awareness grows and healthcare infrastructure strengthens—particularly in emerging economies—more patients are being screened and tested at earlier stages of disease progression. Governments, insurance providers, and NGOs are emphasizing cancer screening through national programs, further increasing the demand for diagnostic biopsy tools and services.

Moreover, in the age of personalized medicine, biopsy results are no longer used solely for diagnosis but also for guiding treatment. Oncologists rely on genetic and molecular data from biopsy samples to prescribe targeted therapies, making biopsies indispensable in modern oncology.

Market Restraint: Risk of Complications and High Procedural Costs

Despite its critical clinical role, biopsy procedures can be associated with significant challenges—chief among them being procedural complications and high costs. Tissue biopsies, particularly those involving surgical interventions, carry risks such as infection, bleeding, and pain, which can deter patient compliance or delay subsequent treatment.

Invasive biopsy procedures often require imaging guidance, sedation, or even operating room resources, especially for inaccessible or internal tumors (e.g., lung, liver, brain). These requirements increase the cost of diagnosis and place a burden on already stretched healthcare systems. The situation is even more pronounced in low- and middle-income countries, where access to specialized biopsy services may be limited.

Moreover, there’s a concern of false negatives in some biopsy techniques, particularly when tumor heterogeneity is involved or when the sample is inadequate. Repeat procedures may be required, further increasing costs and patient anxiety. These limitations make innovation and accessibility in biopsy technologies a critical area for improvement.

Market Opportunity: Expansion of Liquid Biopsy in Oncology

One of the most promising opportunities in the cancer biopsy market lies in the expansion and refinement of liquid biopsy technologies. Unlike traditional tissue biopsies that require surgical intervention, liquid biopsies involve analyzing tumor-derived materials such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), or extracellular vesicles from blood, saliva, urine, or other bodily fluids.

The ability to detect cancer-specific mutations or epigenetic alterations from a simple blood draw offers immense clinical value. Liquid biopsies are particularly useful for early detection, monitoring of minimal residual disease (MRD), tracking tumor evolution, and identifying resistance mutations during therapy. For example, liquid biopsy tests like Guardant360 and FoundationOne Liquid CDx are now used to profile multiple cancer genes from a single blood sample.

As regulatory approvals increase and payers begin to reimburse for such tests, liquid biopsy adoption is expected to surge—especially in outpatient and home-based care models. This evolution will unlock new markets and help decentralize cancer care delivery while enabling longitudinal patient monitoring in a minimally invasive manner.

By Type Insights

Tissue biopsies remain the dominant biopsy type, owing to their entrenched role in clinical guidelines and their superior tissue architecture visualization. Whether through needle aspiration, core needle sampling, or surgical excision, tissue biopsies offer comprehensive histopathological analysis that guides not only diagnosis but staging and grading of tumors. Techniques like ultrasound-guided liver biopsy or CT-guided lung biopsy remain essential tools in the oncologist’s arsenal.

Liquid biopsies are the fastest-growing type, driven by their non-invasive nature and technological advancements in biomarker detection. These tests are gaining favor in situations where tissue is inaccessible, the patient's health prohibits surgery, or continuous monitoring is required. Liquid biopsies are especially prominent in lung and breast cancers for monitoring EGFR and HER2 mutations. Their growing adoption in clinical trials and FDA’s support for companion diagnostics further fuels this segment’s acceleration.

By Application Insights

Breast cancer held the largest market share by application, supported by the global emphasis on routine breast cancer screening and high prevalence rates, especially among women in the U.S., Europe, and parts of Asia. Core needle biopsy is widely used to confirm diagnosis after mammographic or ultrasound findings, and immunohistochemistry (IHC) from biopsy samples plays a key role in determining hormone receptor status (ER/PR/HER2). Companies have also developed specific breast biopsy devices that improve accuracy while reducing patient discomfort.

Lung cancer is the fastest-growing application segment, fueled by the rising incidence and the emergence of targeted therapies that require molecular profiling. Non-small cell lung cancer (NSCLC) patients are now commonly screened using both tissue and liquid biopsies for mutations such as EGFR, ALK, ROS1, and KRAS. Liquid biopsies, in particular, are playing a major role in early-stage detection and in monitoring therapy resistance. The increased push for low-dose CT screening and biomarker-driven therapies makes lung cancer a critical growth area.

By Product Insights

Kits and Consumables dominated the product segment, as they are required for each biopsy procedure, regardless of the technology or cancer type. These include collection tubes, reagents, staining solutions, slide kits, and disposable biopsy needles. With the rising volume of cancer screening and diagnosis, the demand for consumables continues to scale. Their recurrent usage, combined with shorter replacement cycles, makes this segment a consistent revenue generator for both hospital labs and commercial diagnostic firms.

Services are the fastest-growing product segment, reflecting the surge in outsourced biopsy analysis, liquid biopsy profiling, and companion diagnostics. Biopsy services now go beyond basic histopathology to include advanced genomic and proteomic analysis, often conducted in centralized labs like Foundation Medicine or NeoGenomics. With the rise of home collection kits and DTC (Direct-to-Consumer) models, biopsy services are also becoming more decentralized and patient-focused, expanding their reach and utility across various patient populations.

By Regional Insights

North America dominates the cancer biopsy market, accounting for the largest market share due to its advanced healthcare infrastructure, high cancer prevalence, and early adoption of innovative technologies. The U.S., in particular, leads the region with its widespread reimbursement policies, presence of key market players, and government-backed initiatives for cancer detection and genomic medicine. Institutions like the National Cancer Institute (NCI) continue to fund research into biopsy techniques and biomarker discovery, supporting both academic and commercial advancement. The rapid uptake of liquid biopsy services by companies like Guardant Health and Exact Sciences reflects the region’s strong technological ecosystem.

Asia-Pacific is the fastest-growing regional market, driven by increasing awareness, expanding healthcare investments, and rising cancer burdens across China, India, Japan, and Southeast Asia. Government initiatives promoting early diagnosis and screening—such as India’s Ayushman Bharat or China’s Healthy China 2030 plan—are boosting biopsy demand. Furthermore, local companies are entering the market with cost-effective biopsy kits and devices tailored to regional needs. As diagnostics infrastructure improves and international collaborations grow, Asia-Pacific is expected to become a critical hub for biopsy development and adoption.

Cancer Biopsy Market Top Key Companies:

- Qiagen N.V.

- Illumina, Inc.

- ANGLE Plc

- BD (Becton, Dickinson and Company)

- Myriad Genetics

- Hologic, Inc.

- Biocept, Inc.

- Thermo Fisher Scientific, Inc.

- Danaher

- F. Hoffmann-La Roche Ltd.

- Lucence Diagnostics Pte. Ltd.

- GRAIL, Inc.

- Guardant Health

- Exact Sciences Corporation

- Freenome Holdings, Inc.

- Biodesix (Integrated Diagnostics)

- Oncimmune

- Epigenomics AG

- HelioHealth (Laboratory for Advanced Medicine)

- Genesystems, Inc. (Genesys Biolabs)

- Chronix Biomedical, Inc.

- Personal Genome Diagnostics Inc.

- Natera, Inc.

- Personalis Inc.

Recent Developments

-

April 2025 – Guardant Health announced FDA approval for its updated Guardant360 CDx liquid biopsy test, enabling comprehensive genomic profiling across all solid tumors using a single blood sample.

-

March 2025 – Exact Sciences acquired a minority stake in a Korean liquid biopsy firm to co-develop blood-based tests for colorectal and pancreatic cancers tailored to the Asia-Pacific market.

-

January 2025 – Qiagen launched a new sample preparation kit for ctDNA extraction compatible with its QIAseq liquid biopsy workflows, improving yield from plasma samples.

-

November 2024 – Biocept Inc. reported the expansion of its cerebrospinal fluid (CSF) liquid biopsy testing service for central nervous system tumors, catering to a niche but growing diagnostic area.

-

September 2024 – Illumina Inc. partnered with Roche to integrate its NGS-based biopsy analysis tools into Roche’s oncology companion diagnostic workflows, expanding multi-cancer genomic testing.

Cancer Biopsy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Cancer Biopsy market.

By Product

- Instruments

- Kits And Consumables

- Services

By Type

- Tissue Biopsies

- Needle Biopsies

- Fine Needle Aspiration (FNA)

- Core Needle Biopsy (CNB)

- Surgical Biopsies

- Liquid Biopsies

- Others

By Application

- Breast Cancer

- Colorectal Cancer

- Cervical Cancers

- Lung Cancers

- Prostate Cancers

- Skin Cancers

- Blood Cancers

- Kidney Cancers

- Liver Cancers

- Pancreatic Cancers

- Ovarian Cancers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)