Cell and Gene Therapy Market Size and Forecast 2026 to 2035

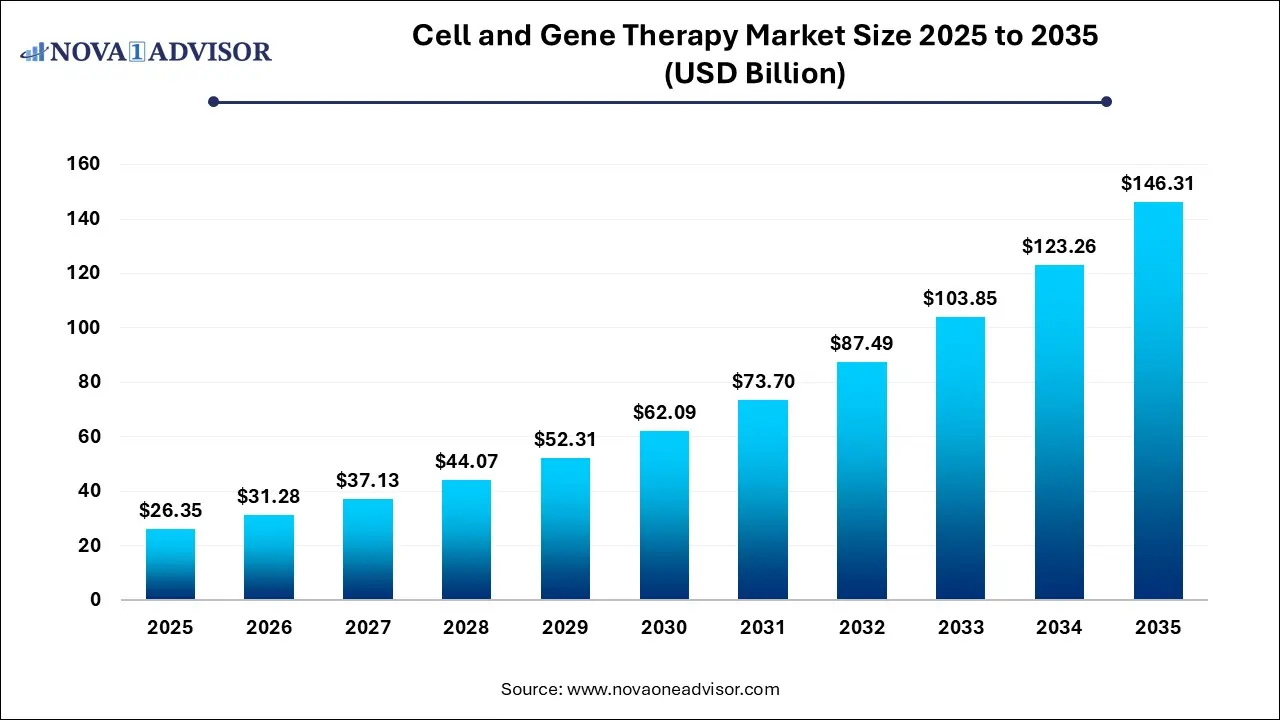

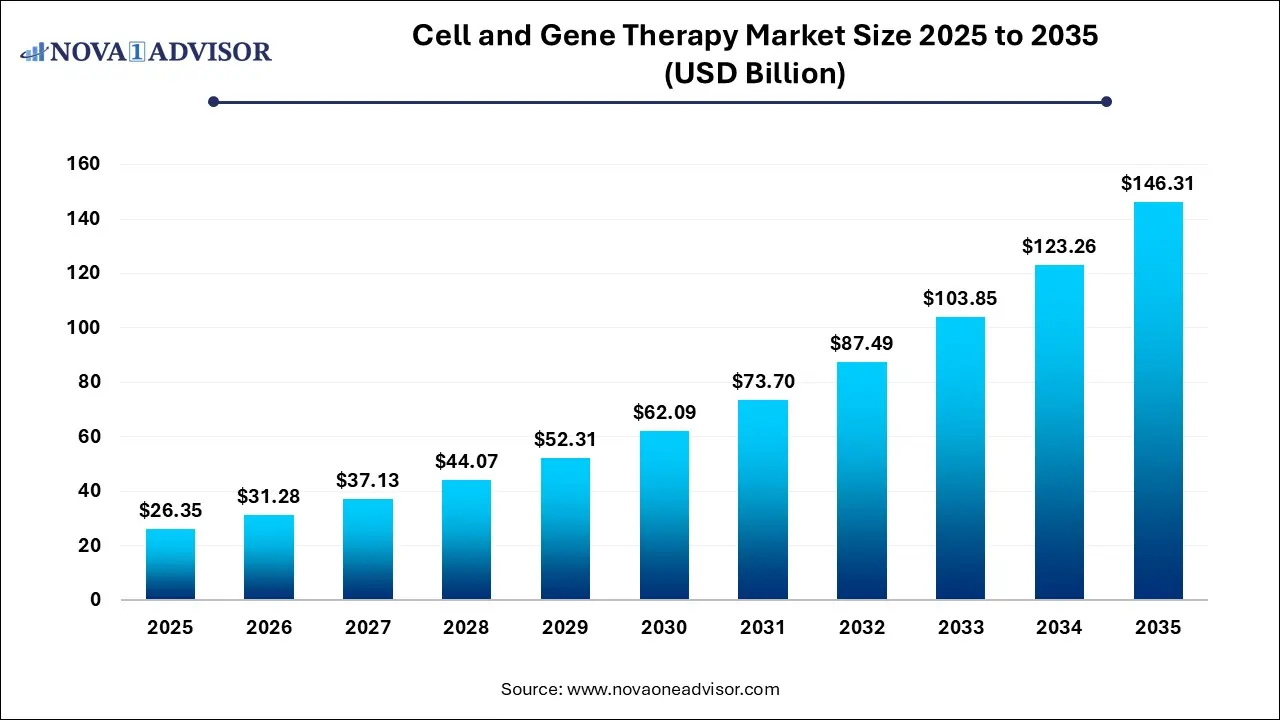

The global cell and gene therapy market size was estimated at USD 26.35 billion in 2025 and is projected to hit around USD 146.31 billion by 2035, growing at a CAGR of 18.7% during the forecast period from 2026 to 2035. The market is driven by the rising prevalence of chronic disease, innovation in technology, such as gene editing technologies, vector delivery systems, and improved manufacturing and delivery technologies.

Key Takeaways:

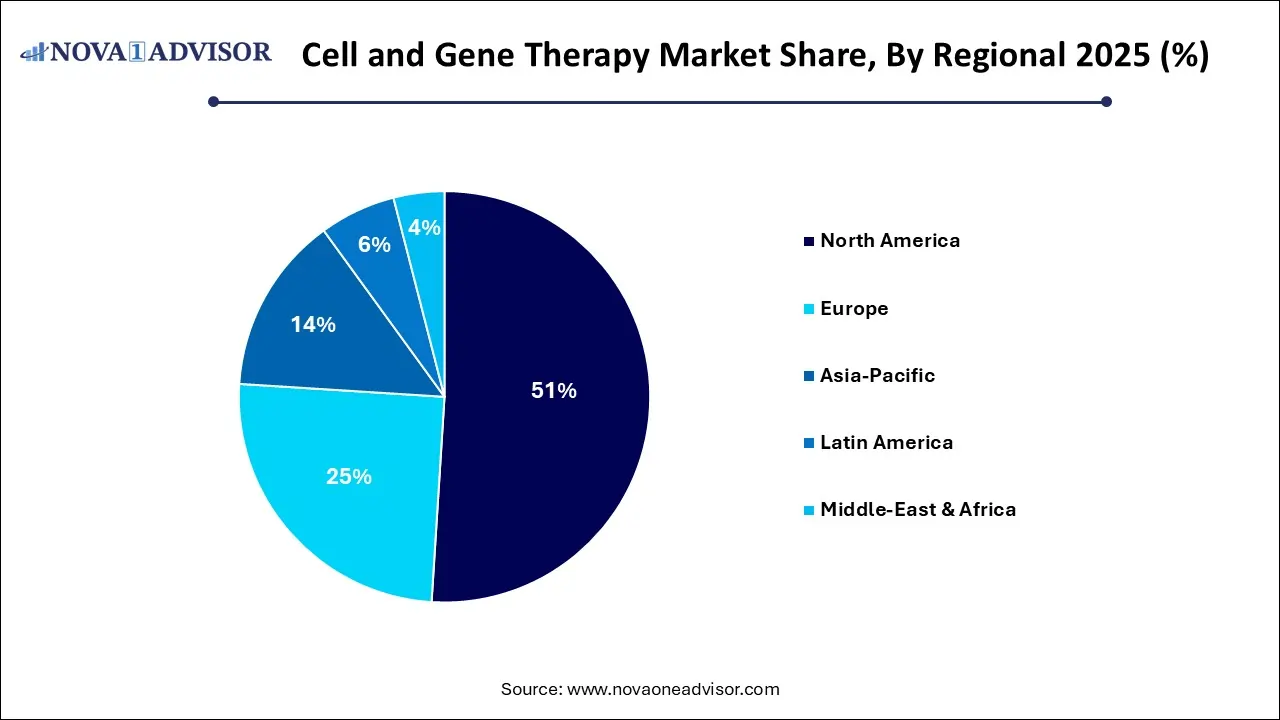

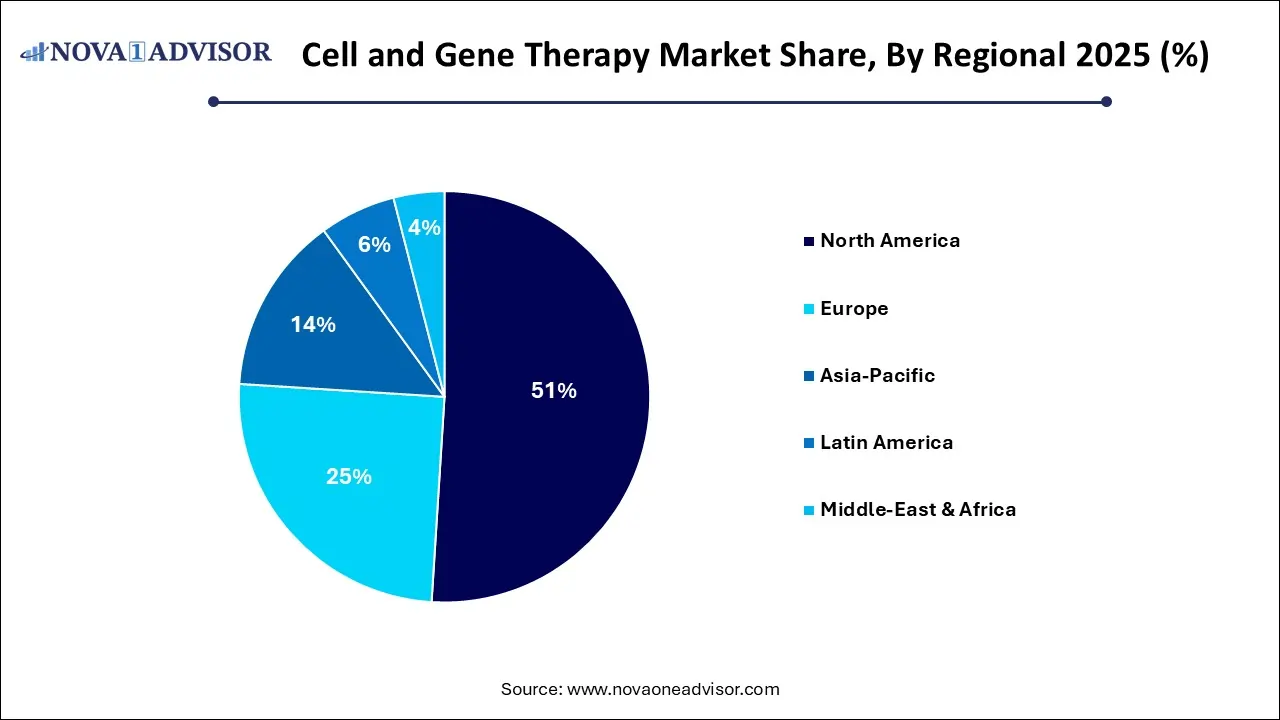

- By region, North America dominated the cell and gene therapy market with a revenue share of approximately 51% in 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

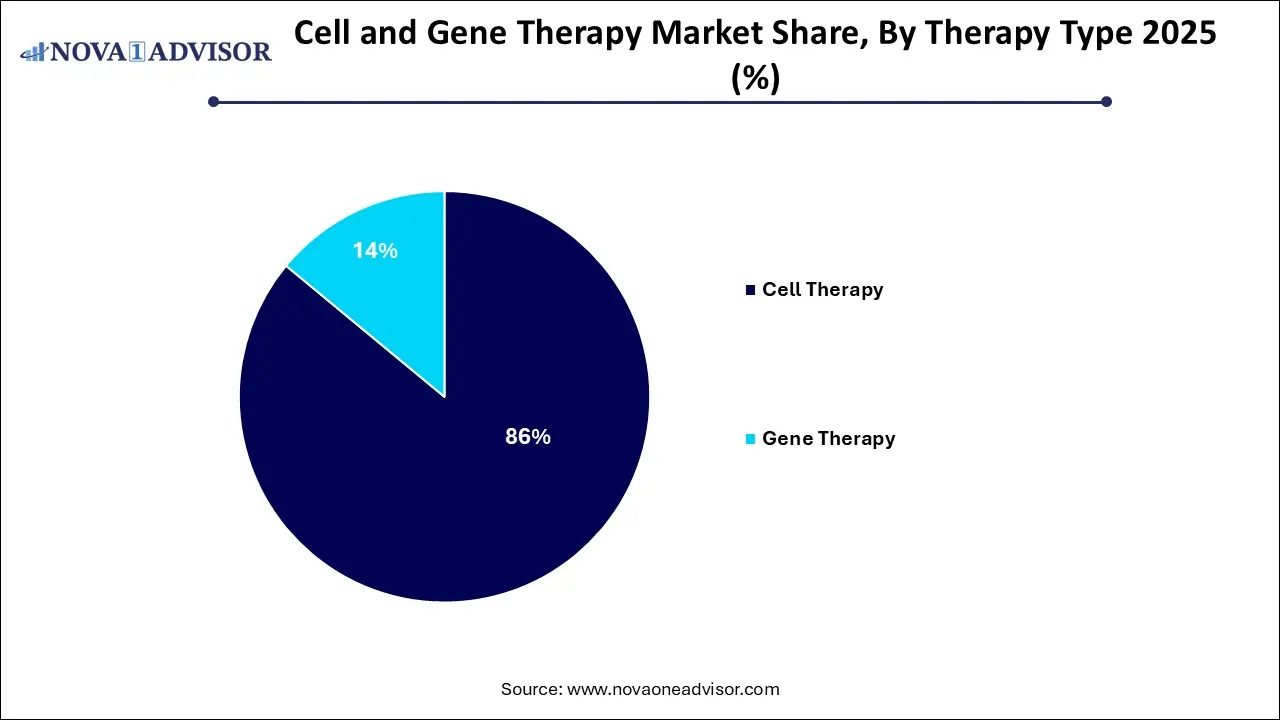

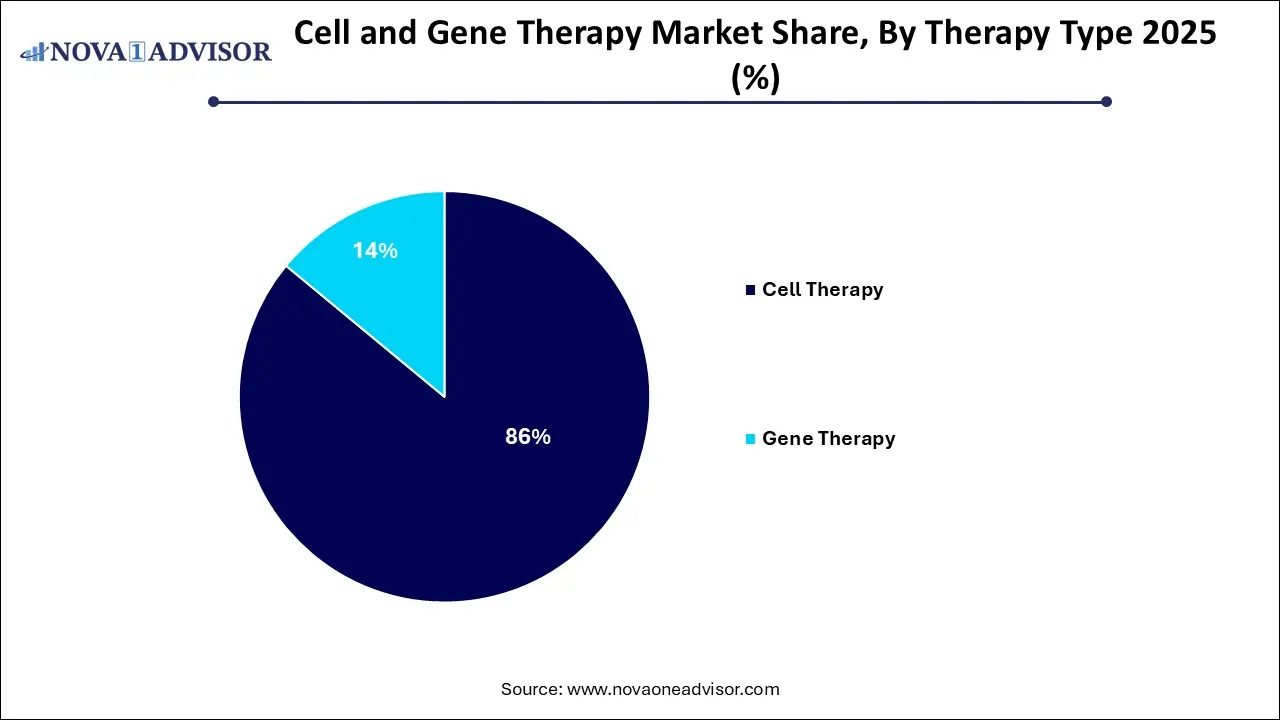

- By therapy type, the cell therapy segment dominated the market with the highest revenue shares of approximately 86%.

- By therapy type, the gene therapy (in vivo) segment is expected to grow at the fastest CAGR in the Cell and Gene Therapy market during the forecast period.

- By vector type, the viral vectors segment held the highest revenue shares of approximately 68% in the market in 2025.

- By vector type, the non-viral vectors (LNPs) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the oncology segment held the highest market share of approximately 47% in 2025.

- By application, the rare & genetic disorders segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the pharmaceutical & biotechnology companies segment led the Cell and Gene Therapy market with the largest revenue share of approximately 41% in 2024.

- By end user, the CROs & CDMOs segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By delivery mode, the ex vivo administration segment held the largest market share with the biggest revenue share of approximately 58% in 2025.

- By delivery mode, the in vivo administration segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By industry vertical, the biotechnology segment held the largest market share with the biggest revenue share of approximately 37% in 2025.

- By industry vertical, the pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period.

Cell and Gene Therapy Market Overview:

The cell and gene therapy market encompasses technologies, products, and services involved in modifying, engineering, and delivering therapeutic cells and genetic material to treat, prevent, or potentially cure diseases. It includes autologous and allogeneic cell therapies, gene transfer and editing platforms, viral and non-viral vectors, manufacturing systems, and clinical applications spanning oncology, rare genetic disorders, cardiovascular, neurological, and infectious diseases. The market growth is driven by the rising prevalence of chronic and rare genetic diseases, along with the aging worldwide population, increasing demand for therapeutic solutions. The advancement in delivery systems, including viral vectors and non-viral methods like lipid nanoparticles, is improving the safety and efficacy of transporting genetic material into target cells. The innovation in automation and AI and strategic investments, and supportive regulations, expansion of the market growth.

Cell and gene therapy market outlook

- Industry Growth Overview: Between 2026 and 2035, this market is expected to rise significantly due to rising incidences of infectious diseases globally coupled with increase in number of private hospitals in developed nations.

- Major Investors: Numerous market players are actively entering this market, drawn by collaborations, R&D and business expansions. Several gene therapy companies such as Helixmith Co. Ltd., JCR Pharmaceuticals Co. Ltd., Dendreon Pharmaceuticals LLC., Kolon TissueGene Inc and some others have started investing rapidly for developing advanced gene-based therapies for treating a wide range of diseases.

- Startup Ecosystem: Various startup brands are engaged in developing gene therapies across the globe. The prominent startup companies dealing in gene and cell therapies comprises of Beam Therapeutics, CRISPR Therapeutics, Editas Medicine and some others.

Technological advancements and innovations

The AI is revolutionizing the development of delivery vectors, such as Adeno-Associated Viruses, by optimizing their capsids to be more efficient, specific, and safer. The advancement in automation, closed-loop systems, and scalable vector production is increasing the efficiency and reducing the cost of manufacturing CGTs. AI can help in enhanced quality control, real-time monitoring and control, and design more effective Chimeric Antigen Receptors by predicting the most promising candidates from extensive libraries and optimizing their function.

- In May 2025, Dyno Therapeutics announced the launch of three new Adeno-associated virus (AAV) capsids, called Dyno-4z2, Dyno-3hv, and Dyno-ahq. These are designed to deliver gene therapies more efficiently and specifically to the eye, muscles, and central nervous system (CNS).

Market Trends

- Diversification beyond oncology – While oncology remained a key focus, trials in other therapeutic areas, like rare diseases, gained momentum.

- In April 2024, Pfizer's Beqvez received Health Canada's approval for hemophilia B, demonstrating progress in non-cancer indications.

- In January 2024, Adaptimmune's afami-cel, an engineered T cell therapy for advanced synovial sarcoma, was granted priority review by the FDA

- Focus on allogeneic therapies – Research into "off-the-shelf" allogeneic therapies continued, offering potential advantages in scalability and cost over autologous therapies.

- In January 2024, AbbVie and Umoja Biopharma partnered to develop in-situ generated CAR-T cell therapy candidates utilizing a proprietary platform.

Cell and Gene Therapy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 31.28 Billion |

| Market Size by 2035 |

USD 146.31 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 18.7% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Therapy Type, By Vector Type, By Application, By End User, By Delivery Mode, By Industry Vertical, By Region

|

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Novartis AG , Gilead Sciences (Kite Pharma) , Bristol Myers Squibb , Bluebird Bio , Orchard Therapeutics , Spark Therapeutics (Roche) , uniQure , CRISPR Therapeutics , Editas Medicine , Intellia Therapeutics , Regenxbio , Sangamo Therapeutics , Fate Therapeutics , Adaptimmune Therapeutics , Poseida Therapeutics , Mustang Bio , Iovance Biotherapeutics , Pfizer Inc. (gene therapy division) , Bayer AG (cell & gene therapy investments) , Takeda Pharmaceutical |

Market Opportunity

Focus on rare and genetic diseases, an opportunity for the cell and gene therapy market

Gene therapy is particularly promising for rare diseases, many of which have no effective treatments. By addressing the root genetic cause of a disease, these therapies offer the potential for long-term correction or even a cure.

- In March 2024, LENMELDY™ (atidarsagene autotemcel) was approved for early-onset metachromatic leukodystrophy (MLD).

Market Challenge

High upfront cost limitations of the Cell and Gene Therapy market

Gene therapy is among the most expensive drugs on the market, with some single-treatment doses costing millions of dollars. This creates a severe financial burden for patients and healthcare systems. For smaller payers, such as self-insured employers, even one lightning strike could be financially destabilizing.

Segmental Insights

Therapy Type Insights

The cell therapy segment dominated the Cell and Gene Therapy market in 2025. The cell therapy segment dominated the market because its efficacy in oncology cell therapies, such as CAR-T treatments, demonstrated strong results in targeting and treating various cancers, especially blood cancers and solid tumors. The growing investment and funding and regulatory support, and approvals. The innovation in cell-based treatment technologies, including gene editing tools, enhances the efficacy and safety of these therapies, expansion of the market growth.

The gene therapy (in vivo) segment is the fastest-growing in the Cell and Gene Therapy market during the forecast period. The technological advancements in targeted delivery systems and pipeline development for rare and chronic diseases. The significant investment and funding are being channelled into gene therapy research, including the development of advanced gene editing technologies and improved delivery methods for in vitro applications. It is a simplified and less invasive procedure that drives market growth.

Cell and Gene Therapy Market By Therapy Type, 2022-2025 (USD Million)

| By Therapy Type |

2022 |

2023 |

2024 |

2025 |

| Cell Therapy |

3,330.1 |

3,766.3 |

4,271.5 |

4,854.2 |

| Autologous Cell Therapy |

1,415.8 |

1,587.6 |

1,785.0 |

2,010.8 |

| Allogeneic Cell Therapy |

648.1 |

745.4 |

859.5 |

992.8 |

| Stem Cell Therapy |

505.7 |

574.7 |

654.9 |

747.7 |

| Hematopoietic Stem Cells (HSC) |

214.6 |

240.8 |

270.9 |

305.3 |

| Mesenchymal Stem Cells (MSC) |

196.1 |

225.5 |

260.0 |

300.3 |

| Induced Pluripotent Stem Cells (iPSC) |

95.0 |

108.4 |

124.0 |

142.2 |

| Immune Cell Therapy |

329.4 |

376.9 |

432.2 |

496.7 |

| CAR-T Cell Therapy |

146.1 |

167.9 |

193.4 |

223.2 |

| TCR (T-cell Receptor) Therapy – targets intracellular antigens |

71.0 |

82.3 |

95.5 |

111.1 |

| TIL (Tumor Infiltrating Lymphocyte) Therapy |

39.1 |

44.2 |

50.2 |

57.0 |

| NK (Natural Killer) Cell Therapy |

52.0 |

59.0 |

67.2 |

76.6 |

| Macrophage Therapies |

21.2 |

23.5 |

26.0 |

28.8 |

| Dendritic Cell Therapy |

123.6 |

139.4 |

157.7 |

178.7 |

| Others |

307.4 |

342.4 |

382.2 |

427.5 |

| Gene Therapy |

1,969.1 |

2,244.0 |

2,564.2 |

2,936.0 |

| In-vivo Gene Therapy |

895.1 |

1,025.5 |

1,178.1 |

1,356.1 |

| Ex-vivo Gene Therapy |

528.8 |

599.4 |

681.2 |

775.7 |

| Gene Editing Therapies |

231.4 |

269.1 |

313.7 |

366.3 |

| RNA-Based Therapies |

195.5 |

217.4 |

242.3 |

270.4 |

| Others |

118.3 |

132.6 |

148.9 |

167.5 |

Vector Type Insights

The viral vectors segment held the largest revenue share in the Cell and Gene Therapy market in 2025. It has high transduction efficiency and stable gene expression, a safer profile, and reduced immunogenicity. The widespread use of approved and late-stage therapies, application across diverse therapeutic areas, and viral vectors to treat a wide range of diseases, including genetic disorders, cancer, and infectious diseases. The increased R&D investment and regulatory support, expansion of contract manufacturing organizations boost the market growth.

The non-viral vectors (LNPs) segment is experiencing the fastest growth in the Cell and Gene Therapy market during the forecast period. The rising demand for safe and scalable gene delivery systems and innovation in LNP technology. The development and deployment of LNP-based mRNA vaccines, such as those for COVID-19, showcased the potential of non-viral carriers for safe and effective nucleic acid delivery.

Cell and Gene Therapy Market, By Vector Type (Gene Delivery Method) 2022-2025 (USD Million)

| By Vector Type (Gene Delivery Method) |

2022 |

2023 |

2024 |

2025 |

| Viral Vectors |

3,891.6 |

4,395.2 |

4,977.5 |

5,648.3 |

| Adeno-Associated Virus (AAV) |

1,692.1 |

1,913.2 |

2,169.1 |

2,464.2 |

| Lentivirus |

1,162.6 |

1,307.9 |

1,475.3 |

1,667.4 |

| Retrovirus |

387.0 |

430.9 |

480.9 |

537.8 |

| Herpes Simplex Virus (HSV) |

158.6 |

183.7 |

213.3 |

248.0 |

| Adenovirus |

294.4 |

344.2 |

403.0 |

472.4 |

| Others |

196.9 |

215.3 |

235.8 |

258.5 |

| Non-Viral Vectors |

1,407.6 |

1,615.1 |

1,858.2 |

2,142.0 |

| Lipid Nanoparticles (LNPs) |

513.4 |

591.9 |

684.2 |

792.4 |

| Naked DNA/RNA Plasmids |

353.5 |

402.6 |

459.7 |

525.8 |

| Electroporation |

205.8 |

235.8 |

270.9 |

311.8 |

| Gene gun / microinjection |

89.6 |

101.7 |

115.8 |

132.1 |

| CRISPR-Cas Delivery Systems (non-viral) |

166.5 |

194.1 |

226.7 |

265.2 |

| Others |

78.7 |

89.1 |

101.0 |

114.7 |

Application Insights

The oncology segment dominated the Cell and Gene Therapy market in 2025. The high global cancer prevalence and the clinical success of CAR-T cell therapies for blood cancers. This dominance was further supported by a robust oncology-focused clinical trial pipeline and significant R&D investments, which are also driving the expansion of these therapies to treat solid tumors. Favorable regulatory pathways accelerated the development and approval of new oncology CGT products, while the personalized nature of these treatments met the rising demand for targeted cancer therapies.

The rare and genetic disorders segment is the fastest-growing in the market during the forecast period. The inherent limitations of traditional treatments for many rare genetic disorders create a powerful demand for the potentially curative capabilities of CGT, which targets the root genetic causes of these conditions. This demand was met with rapid progress in gene editing, exemplified by tools like CRISPR-Cas9, and increasingly efficient delivery systems, which made CGTs safer and more precise for a broader range of disorders.

End Use Insights

The pharmaceutical & biotechnology segment dominated the cell and gene therapy market in 2025. Their immense financial power, extensive R&D capabilities, and advanced manufacturing infrastructure to drive innovation from clinical development to commercialization. Through strategic mergers and acquisitions of promising smaller biotech firms, large players expand their CGT pipelines and gain expertise. This market control is further cemented by their experience in navigating complex regulatory pathways and utilizing global commercial networks to manage supply chains and secure market access for expensive, intricate therapies.

The CROs & CDMOs segment is the fastest-growing in the market during the forecast period. The providing specialized expertise and infrastructure, they enable biopharmaceutical companies to navigate regulatory hurdles, manage costs, and accelerate development timelines. This critical support allows biotech firms to focus on innovation, ultimately driving the development of life-changing therapies to market faster and more efficiently.

Cell and Gene Therapy Market By End Use, 2022-2025 (USD Million)

| By End Use |

2022 |

2023 |

2024 |

2025 |

| Hospitals and Specialty Clinics (administering therapies) |

4,141.0 |

4,676.4 |

5,295.5 |

6,008.5 |

| Government/Public Health Bodies (NIH, EMA programs) |

708.6 |

817.5 |

945.6 |

1,095.7 |

| Others |

449.6 |

516.4 |

594.6 |

686.0 |

Regional Insights

Which Region Dominated the Cell and Gene Therapy Market?

North America dominated the market in 2025, and the region is expected to sustain the position during the forecast period. North America dominated the market in 2025 due to its supportive regulatory environment FDA implemented initiatives, such as regenerative medicine advanced therapy and breakthrough therapy designations, to accelerate the development. The region's high investment in R&D and automation using automated, closed-loop systems to reduce human errors and contamination. The region focuses on targeted therapeutic areas, and the adoption of advanced technologies drives the market growth.

The United States Cell and Gene Therapy Market Trends

The United States market is growing due to the expansion of therapeutic areas beyond oncology, and promising clinical activity is focusing on rare genetic disorders, infectious diseases, and neurological conditions like Parkinson's and Alzheimer's. The advancement in manufacturing and delivery, and integration of artificial intelligence. AI algorithms are being used to analyse large datasets to identify new therapeutic targets and optimize gene-editing tools like CRISPR, speeding up drug discovery.

Why is Asia Pacific Significantly Growing in the Cell and Gene Therapy Market?

Asia Pacific expects significant growth in the market during the forecast period. The Asia Pacific is expected to register the fastest growth in the market due to significant investment in research and development, focus on oncology, oncology trials, especially for CAR-T cell therapies targeting hematological cancers and solid tumors, which represent a large share of the region's CGT research. Maturating biotech ecosystem and investments, increasing government and private sector funding, are attracting new companies and fostering innovation.

China cell and gene therapy market analysis

The growing cases of viral diseases coupled with rapid incidences of musculoskeletal disorders among the people has boosted the market expansion. Additionally, the rising investment by pharma companies for opening up new research and development centers is playing a prominent role in shaping the industry in a positive manner.

Why Europe is a significant contributor of the cell and gene therapy market?

Europe is a significant contributor of the cell and gene therapy industry. The rising cases of cardiovascular diseases in numerous countries such as Germany, France, Italy, UK, and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the biotechnology sector coupled with technological advancements in the healthcare institutes is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Biontech, CureVac N.V., Evotec SE and some others is expected to drive the growth of the cell and gene therapy market in this region.

UK cell and gene therapy market analysis

The surging demand for high-quality cancer therapeutics along with rising prevalence of neurological disorders has boosted the market expansion. Additionally, partnerships among genetic companies and hospitals to develop advanced therapeutics is contributing to the industry in a positive manner.

What is the role of Latin America in the cell and gene therapy market?

Latin America has played a prominent role in the cell and gene therapy market. The increasing prevalence of cancers in numerous countries including Argentina, Brazil, Peru, Venezuela and some others has boosted the market expansion. Also, rapid investment by government for strengthening the healthcare sector along with rise in number of pharmaceutical companies is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous cell and gene therapy companies such as Celluris, Optimal Therapies, James Lind and some others is expected to boost the growth of the cell and gene therapy market in this region.

Argentina cell and gene therapy market trends

The surging cases of ophthalmic disorders along with technological advancements in the genetic engineering sector has propelled the market expansion. Also, rising emphasis of healthcare providers to adopt gene and cell therapies for treating dreaded diseases is playing a significant role in shaping the industrial landscape.

Why Middle East and Africa held a notable share of the cell and gene therapy market?

Middle East and Africa held a notable share of the industry. The growing incidences of neurological diseases in several nations such as UAE, Saudi Arabia, Qatar, South Africa and some others has driven the market growth. Additionally, technological advancements in the genetic engineering sector coupled with rise in number of biotech companies is contributing to the industry in a positive manner. Moreover, the presence of several market players such as NewBridge Pharmaceuticals, AryoGen Pharmed, Protalix BioTherapeutics and some others is expected to accelerate the growth of the cell and gene therapy market in this region.

UAE cell and gene therapy market analysis

The rising investment by genetic therapies companies for opening up new research and development centers along with surging cases of neurodegenerative diseases has boosted the market expansion. Also, increase in number of biotechnology startups is playing a prominent role in shaping the industrial landscape.

Cell and Gene Therapy Market, By Region, 2022-2025 (USD Million)

| By Region |

2022 |

2023 |

2024 |

2025 |

| North America |

2,724.8 |

3,067.2 |

3,461.9 |

3,915.1 |

| Europe |

1,315.8 |

1,493.4 |

1,699.7 |

1,938.5 |

| Asia Pacific |

952.3 |

1,109.7 |

1,295.9 |

1,515.3 |

| South America |

95.9 |

105.5 |

116.3 |

128.3 |

| Middle East & Africa |

210.4 |

234.4 |

261.9 |

293.1 |

Cell and Gene Therapy Market Value Chain Analysis

1.R&D

Cell and Gene Therapy are neutral shells, usually made from gene therapy, cell therapy, pipeline statistics, advances in gene editing technologies, AI, and machine learning integration.

2. Formulation

Cell and Gene Therapy involves designing and optimizing a delivery vehicle (vector) to safely and effectively transport genetic material into target cells. The primary goal is to protect the vector and its genetic cargo from degradation and elicit the desired biological response.

3. Patient Support and Services

Cell and Gene Therapy are critical components that address the unique challenges of these complex, high-cost, and logistically demanding treatments. These services are essential for guiding patients and caregivers through the entire journey, ensuring access, managing logistics, and providing crucial emotional and educational resources.

Cell and Gene Therapy Market Top Companies

Recent Developments

- In November 2025, Bharat Biotech launched Nucelion Therapeutics. This new center is inaugurated to enhance cell and gene therapy manufacturing in India.

- In November 2025, Novartis announced that the FDA approved Itvisma. Itvisma is a gene replacement therapy designed for patients suffering from spinal muscular atrophy (SMA).

- In November 2025, Azalea Therapeutics, Inc announced to invest US$ 82 million. This investment is done for developing a wide range of gene therapies for the consumers of the U.S.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Cell and Gene Therapy market.

By Therapy Type

-

- Autologous Cell Therapy

- Allogeneic Cell Therapy

- Stem Cell Therapy (MSC, HSC, iPSC)

- T-cell Therapy (CAR-T, TCR-T, NK cells)

- Dendritic Cell Therapy

- Others

- Gene Therapy

-

- Gene Addition / Replacement

- Gene Silencing (RNAi, antisense)

- Genome Editing (CRISPR/Cas, TALEN, ZFN)

- Ex Vivo Gene Therapy

- In Vivo Gene Therapy

- Others

By Vector Type

-

- Adeno-associated Virus (AAV)

- Lentivirus

- Retrovirus

- Adenovirus

- Herpes Simplex Virus (HSV)

- Others

- Non-Viral Vectors

-

- Lipid Nanoparticles (LNPs)

- Electroporation

- Naked DNA / RNA

- Physical & Chemical Methods (polymeric nanoparticles, nanocarriers)

- Others

By Application

- Oncology (hematological malignancies, solid tumors)

- Rare & Genetic Disorders (hemophilia, SMA, DMD)

- Cardiovascular Diseases

- Neurological Disorders

- Ophthalmic Disorders

- Infectious Diseases

- Musculoskeletal Disorders

- Others

By End User

- Hospitals & Clinics

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Contract Research & Manufacturing Organizations (CROs/CDMOs)

- Others

By Delivery Mode

- In Vivo Administration

- Ex Vivo Administration

By Industry Vertical

- Pharmaceuticals

- Biotechnology

- Healthcare & Diagnostics

- Research & Academia

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)