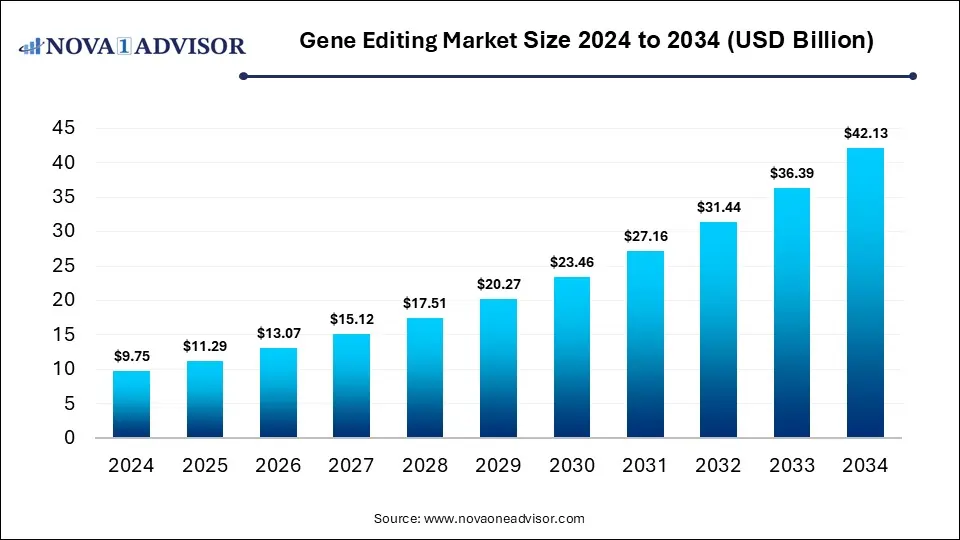

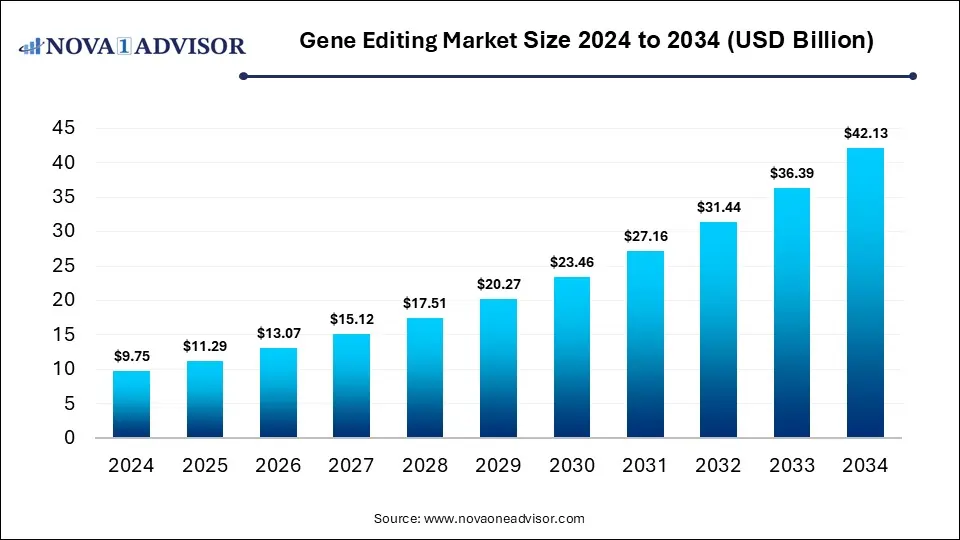

Gene Editing Market Size and Growth 2025 to 2034

The global gene editing market size is calculated at USD 9.75 billion in 2024, grows to USD 11.29 billion in 2025, and is projected to reach around USD 42.13 billion by 2034, expanding at a CAGR of 15.76% from 2025 to 2034. The market is growing due to rising demand for advanced therapies to treat genetic disorders and cancers. Additionally, technological advancements like CRISPR are making genomic editing more precise, efficient, and cost-effective.

Gene Editing Market Key Takeaways

- North America dominated the gene editing market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the CRISPR-Cas9 gene editing segment held the largest market share in 2024.

- By technology, the transcription activator-like effector-based nucleases segment is expected to grow at a significant rate in the market during the forecast period.

- By application, the gene editing segment dominated the market with a major revenue share in 2024.

- By application, the cell line engineering segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the biotechnology and pharmaceutical companies segment led the market in 2024.

- By end user, the academic and government research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Gene Editing Market?

The market refers to the industry focused on developing and commercializing technologies, tools, and services that enable precise modification. Of genetic materials for application in healthcare, agriculture, and research. The market is expanding due to the growing adoption of regenerative medicine, rising focus on crop improvement for food security, and increasing use in veterinary sciences. The surge in rare disease research, demand for efficient cell and gene therapies, and supportive regulatory approvals are also propelling growth. Moreover, the integration of artificial intelligence for target identification reduces sequencing costs, and rising partnerships among academic institutions and industry players are creating new opportunities, driving wider acceptance of gene editing solutions globally.

What are the Key trends in the Gene Editing Market in 2024?

- In May 2024, Merck KGaA (Germany) acquired Mirus Bio, Inc. (US) to combine Mirus Bio’s transfection technology with its own bioprocessing expertise. This move strengthened Merck’s position in viral vector production and boosted its ability to support the development of cell and gene therapies.

- In March 2023, GenScript (US) partnered with PersonGen-Anke Cellular Therapeutics (US) to strengthen cell isolation solutions and improve cell therapy development. Through this collaboration, GenScript’s CytoSinct platform was set to help PersonGen lower costs and enhance research efficiency in advancing cell therapies.

How Can AI Affect the Gene Editing Market?

AI is influencing the market by streamlining genome sequencing interpretation, automating laboratory workflows, and enhancing high-throughput screening for genetic modifications. It aids in discovering novel biomarkers, supports predictive modeling for therapeutic outcomes, and assists in large-scale data integration across multi-omics studies. Additionally, AI facilitates virtual simulations of genetic edits, enabling safer pre-clinical evaluations. By improving scalability, decision-making, and cross-disciplinary research, AI is opening new opportunities for innovation and commercialization within the gene editing industry.

Report Scope of Gene Editing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 11.29 Billion |

| Market Size by 2034 |

USD 42.13 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.76% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Technology, By Application, By end User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Beren Therapeutics, Agilent Technologies, Creative Biogene, Thermo Fisher-Scientific, Synthego, Integrated DNA Technology, Bean Therapeutics, Intellia Therapeutics, Lonza, Horizon Discovery Group plc., Tecan Life-Sciences, Bluebird Bio |

Market Dynamics

Driver

Rising Investment in Research and Development for Advanced Genetic Solutions

Rising R&D investment drives the gene editing market by enabling exploration of novel editing platforms beyond CRISPR, encouraging breakthroughs in delivery systems, and advancing next-generation therapeutic pipelines. Increased funding also supports the development of robust bioinformatics tools, integration of multi-omics research, and the validation of complex genetic targets. Moreover, sustained investment allows scaling of manufacturing capabilities and infrastructure, ensuring broader accessibility of gene editing technologies. These efforts collectively strengthen innovation and expand practical application, positioning R&D as a major growth catalyst.

- For Instance, During the first half of 2024, investment in agricultural gene-editing startups soared, raising $161 million across six deals. This marked a 206% year-on-year increase compared to the same period in 2023, signaling renewed investor confidence in developing resilient, high-yield crops through advanced gene-editing technologies.

Restraint

Ethical Regulatory Challenges

Ethical and regulatory challenges hinder the gene editing market as an inconsistent global standard creates uncertainty for developers and investors. Lack of harmonized guidelines often delays cross-border research and commercialization. Moreover, regulators face difficulty keeping pace with rapidly evolving technologies, leaving gaps that slow approvals. Public skepticism and limited awareness further pressure policymakers to adopt a cautious approach. These factors restrict smooth market expansion, making it harder for companies to scale gene editing innovation effectively and confidently worldwide.

Opportunity

Expansion of Gene Editing Regenerative Medicine

The expansion of gene editing in regenerative medicine presents a future opportunity as it supports the creation of patient-specific, disease-resistant cell lines, minimizing risks of rejection and complications. It also allows scientists to model complex diseases more accurately, accelerating the discovery of novel therapies. Furthermore, combining gene editing with advanced biomaterials and 3D bioprinting opens possibilities for engineered tissues and organs. These innovations can broaden treatment options and unlock new markets, positioning regenerative medicine as a key growth frontier.

- For Instance, In May 2024, Lineage Cell Therapeutics (with Genentech) showcased 24-month clinical data for OpRegen (RG6501), a stem cell–based therapy for Geographic Atrophy (advanced dry age-related macular degeneration). Patients received a single subretinal injection of retinal pigment epithelial cells, showing safety and preliminary benefits in preserving vision. This exemplifies how gene editing and cell therapy combine to regenerate eye tissue.

Segmental Insights

How did CRISPR-Cas9 Gene Editing Segment dominate the Cell Editing in 2024?

The CRISPR-Cas 9 gene editing segment led the market in 2024 as continuous innovation improved its accuracy and minimized off-target effects, boosting confidence in clinical and research use. Strong intellectual property portfolios and widespread licensed agreements expanded its availability across industries. Moreover, increased collaboration between biotech firms, pharmaceutical companies, and academic institutions accelerated large-scale projects using CRISPR-Cas9. Its proven scalability for therapeutic development and agricultural biotechnology positioned it as the most commercially viable and widely adopted gene editing platform during the year.

The transcription activator-like effector-based nucleases segment is expected to witness the fastest growth as advancements in protein engineering are making them easier to design and more adaptable for customised applications. Their compatibility with a wide variety of cell types and organisms expands their research utility. In addition, TALENs are being increasingly explored for developing allogenic cell therapies in are industry biotechnology industry. Growing investment in next-generation platforms that combine TALENs with synthetic biology tools is further accelerating their adoption and market expansion.

Gene Editing Market By Technology, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Zinc Finger Nucleases (ZFNs) |

0.78 |

0.84 |

0.89 |

0.94 |

0.98 |

1.01 |

1.03 |

1.03 |

1.01 |

0.95 |

0.84 |

| CRISPR-Cas9 Gene Editing |

4.68 |

5.55 |

6.59 |

7.8 |

9.25 |

10.95 |

12.95 |

15.32 |

18.11 |

21.4 |

25.28 |

| Restriction Enzymes |

0.98 |

1.06 |

1.15 |

1.24 |

1.33 |

1.42 |

1.5 |

1.58 |

1.63 |

1.67 |

1.69 |

| Others |

1.56 |

1.81 |

2.09 |

2.42 |

2.8 |

3.24 |

3.75 |

4.35 |

5.03 |

5.82 |

6.74 |

| Transcription Activator-Like Effector-based Nucleases (TALENs) |

1.75 |

2.03 |

2.35 |

2.72 |

3.15 |

3.65 |

4.23 |

4.88 |

5.66 |

6.55 |

7.58 |

Why Did the Gene Editing Segment Dominate the Market in 2024?

The gene editing segment captured the largest revenue share as it plays a crucial role in creating genetically engineered cell lines, animal models, and customized research tools that accelerate biomedical discoveries. Its adoption in developing disease-resistant crops and improving livestock traits has also expanded its commercial scope beyond healthcare. Furthermore, rising integration with advanced technologies like synthetic biology and high-throughput screening has amplified its utility, making gene editing central to both scientific innovation and industrial biotechnology growth.

The cell line engineering segment is expected to record the fastest CAGR, and researchers are increasingly leveraging engineered cell lines for studying complex disease mechanisms and high-throughput drug screening. Their role in toxicology testing and precision diagnostics is also expanding, reducing dependency on animal models. Additionally, customized cell lines are being adopted for synthetic biology and industrial bioprocessing applications. Growing collaborations between biotech firms and academic institutions to create innovative engineered models further accelerate the growth of this segment.

How does the Biotechnology and Pharmaceutical Companies Segment Dominate the Gene Editing Market?

The biotechnology and pharmaceutical companies segment dominated the market in 2024 as they increasingly integrated gene editing into precision medicine pipelines and companies' diagnostic development. These firms also utilized gene editing for creating proprietary cell lines and engineered models that improved efficiency in screening and validation of new drugs. Moreover, their ability to scale manufacturing and rapidly gain more advantages solidifies their position as the leading end users in the industry.

The academic and government research institutes segment is set to grow at the fastest CAGR as they are expanding efforts in building open-access databases, bioblanks, and reference genomics that support broader scientific use of gene editing. These institutions are also prioritizing interdisciplinary projects that link genetics with fields like computational biology and regenerative medicine. Furthermore, their focus on developing low-cost, scalable editing tools for public health and agriculture sustainability widens adoption, positioning them as key accelerators of future market growth.

Regional Insights

How is North America contributing to the Expansion of the Gene Editing Market?

North America led the gene editing market in 2024 as the region placed strong emphasis on early adoption of next-generation technologies like base and prime editing. Growing investment in rare disease research and advanced oncology programs created significant demand for gene editing solutions. Furthermore, the presence of specialized training centers and a skilled scientific workforce accelerated innovation. Expanding collaborations with agricultural biotech firms and increasing focus on food security also contributed to North America’s dominant market position.

How is Asia-Pacific Accelerating the Gene Editing Market?

Asia Pacific is expected to register the fastest CAGR as regional players are emphasizing cost-effective innovation, making gene editing tools more accessible for research and clinical use. The rise of start-ups and incubators focused on genetic engineering is fostering a competitive ecosystem. Moreover, collaborations between universities and industries are driving breakthroughs in regenerative medicine and crop improvement. Increasing awareness of advanced therapies among patients and clinicians is also accelerating adoption, positioning the Asia Pacific as a rapidly expanding gene editing hub.

Gene Editing Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

3.7 |

4.25 |

4.86 |

5.56 |

6.37 |

7.3 |

8.35 |

9.56 |

10.94 |

12.52 |

14.32 |

| Europe |

2.73 |

3.13 |

3.58 |

4.1 |

4.69 |

5.37 |

6.15 |

7.03 |

8.05 |

9.21 |

10.53 |

| Asia Pacific |

2.54 |

3.01 |

3.58 |

4.25 |

5.04 |

5.98 |

7.08 |

8.39 |

9.94 |

11.75 |

13.9 |

| Latin America |

0.39 |

0.45 |

0.52 |

0.6 |

0.7 |

0.81 |

0.94 |

1.09 |

1.26 |

1.46 |

1.69 |

| Middle East and Africa (MEA) |

0.39 |

0.45 |

0.53 |

0.61 |

0.71 |

0.81 |

0.94 |

1.09 |

1.25 |

1.45 |

1.69 |

Top Companies in the Gene Editing Market

Recent Developments in the Gene Editing Market

- In July 2024, Agilent Technologies, Inc. (US) acquired Canada-based BIOVECTRA, Inc. to strengthen its biopharma portfolio. With BIOVECTRA’s specialization in biologics and gene editing, the deal expanded Agilent’s drug development and manufacturing capabilities, further enhancing its position in the life sciences market.

- In June 2024, South Korea’s GenKOre partnered with U.S.-based Revvity to co-develop gene therapies for eye disorders. By combining GenKOre’s TaRGET platform with Revvity’s AAV vector technology, the collaboration focused on advancing in vivo treatments for conditions like Leber Congenital Amaurosis 10 and Usher Syndrome Type 2A, while also opening pathways for broader development and commercialization opportunities in ocular gene editing.

Segments Covered in the Report

By Technology

- Zinc Finger Nucleases (ZFNs)

- CRISPR-Cas9 Gene Editing

- Restriction Enzymes

- Others

- Transcription Activator-Like Effector-based Nucleases (TALENs)

By Application

- Drug development

- Others

- Gene editing

- Cell Line Engineering

- Animal Genetic Engineering

- Plant Genetic Engineering

By end User

- Biotechnology and Pharmaceutical Companies

- Academic and Government Research Institutes

- Contract Research Organizations

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)