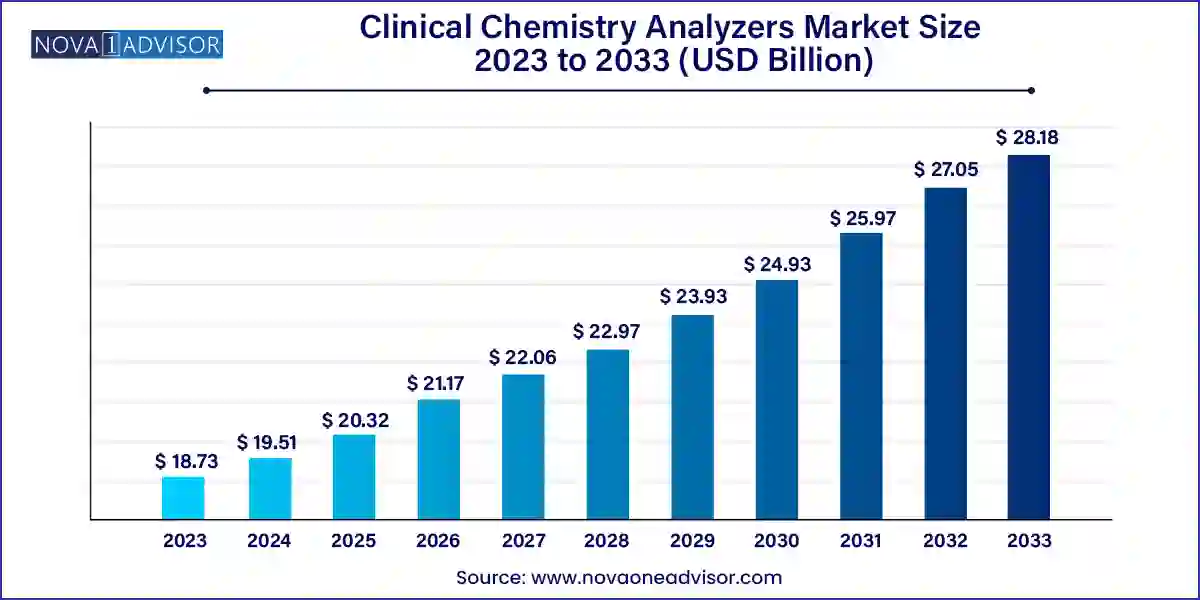

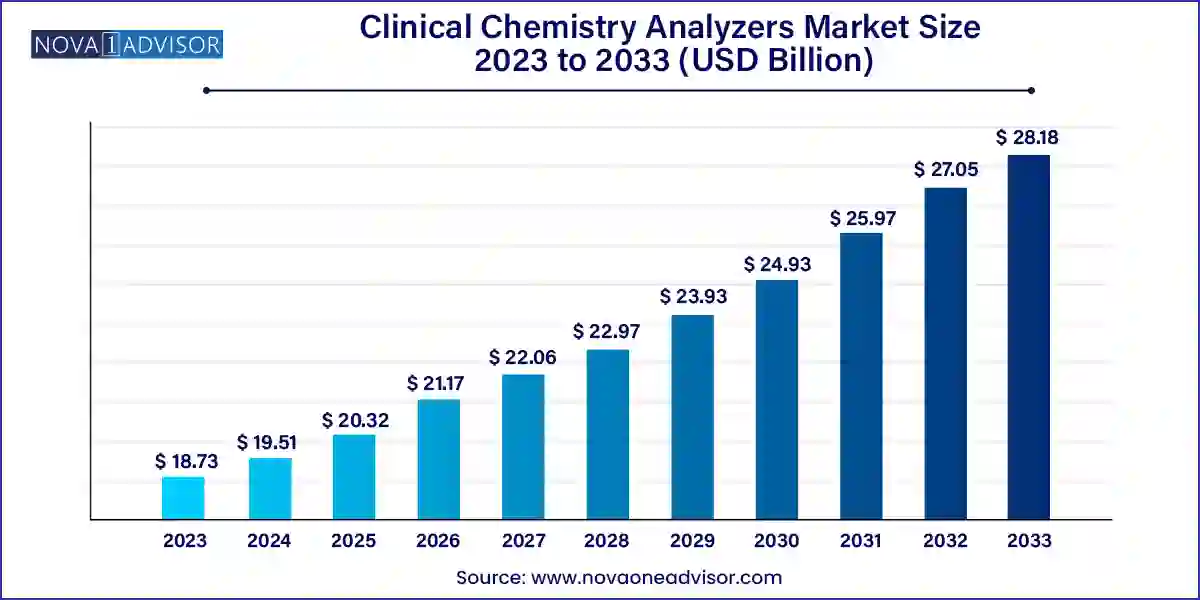

The global clinical chemistry analyzers market size was exhibited at USD 18.73 billion in 2023 and is projected to hit around USD 28.18 billion by 2033, growing at a CAGR of 4.17% during the forecast period 2024 to 2033.

Key Takeaways:

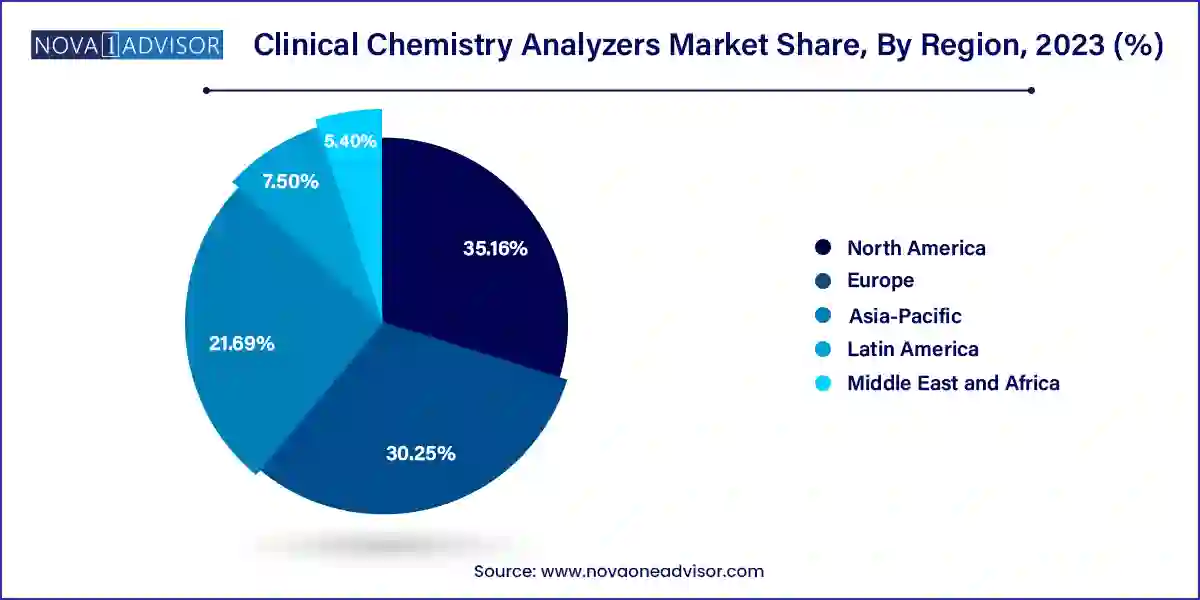

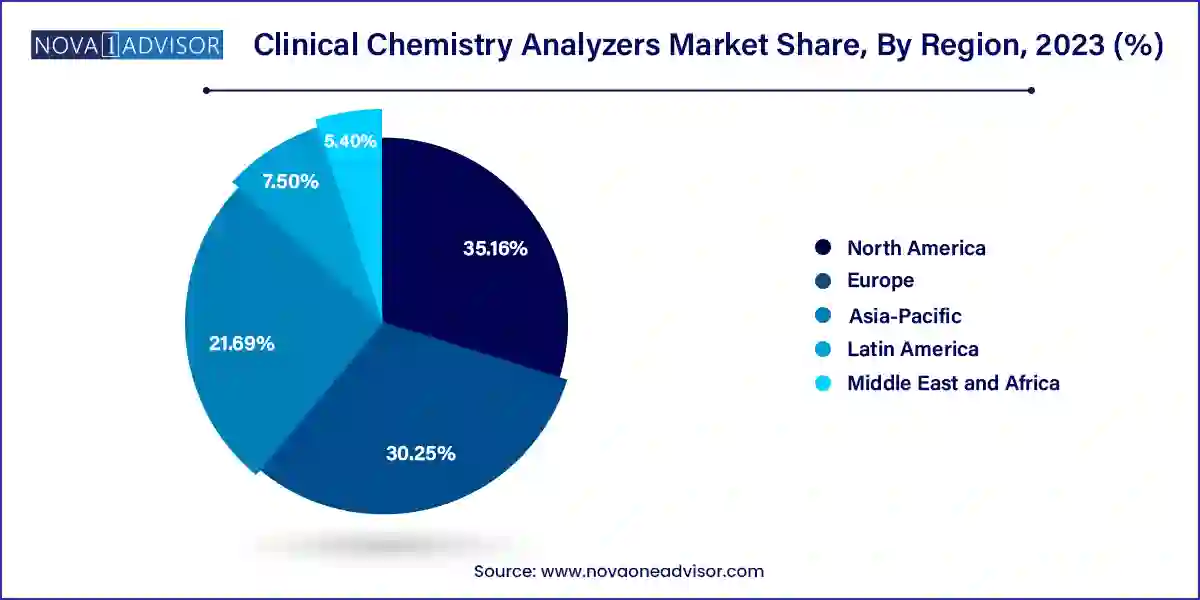

- North America dominated the market with the revenue share of 35.16% in 2023.

- Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period.

- Based on product, the reagents segment led the market with the largest revenue share of 57.4% in 2023.

- The analyzers segment is expected to grow the fastest CAGR over the forecast period.

- Based on the test type, the basic metabolic panel (BMP) segment held a market with the largest revenue share of 29.56% in 2023.

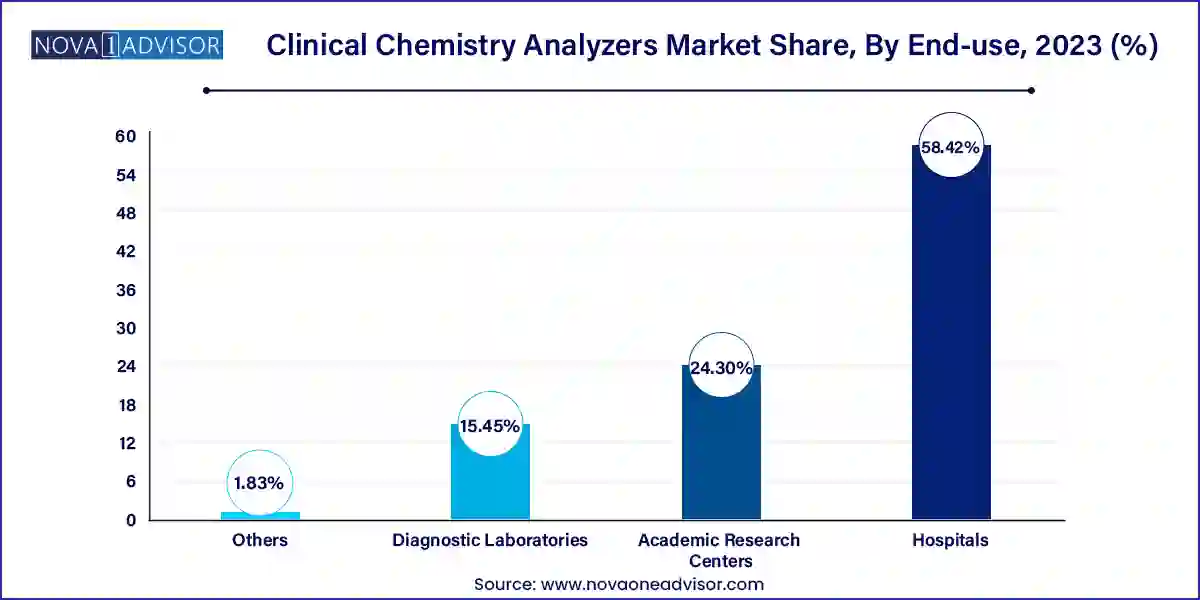

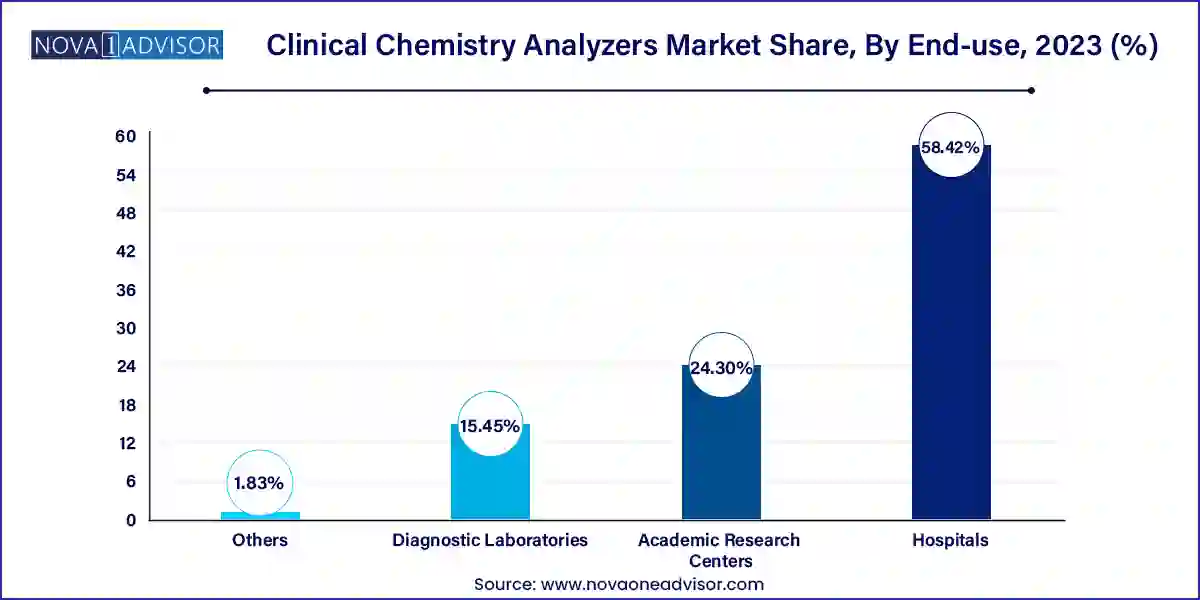

- Based on end-use, the hospitals segment led the market in 2023 with the largest revenue share of 58.42%.

- The diagnostic laboratories segment is expected to grow at fastest CAGR over the forecast period.

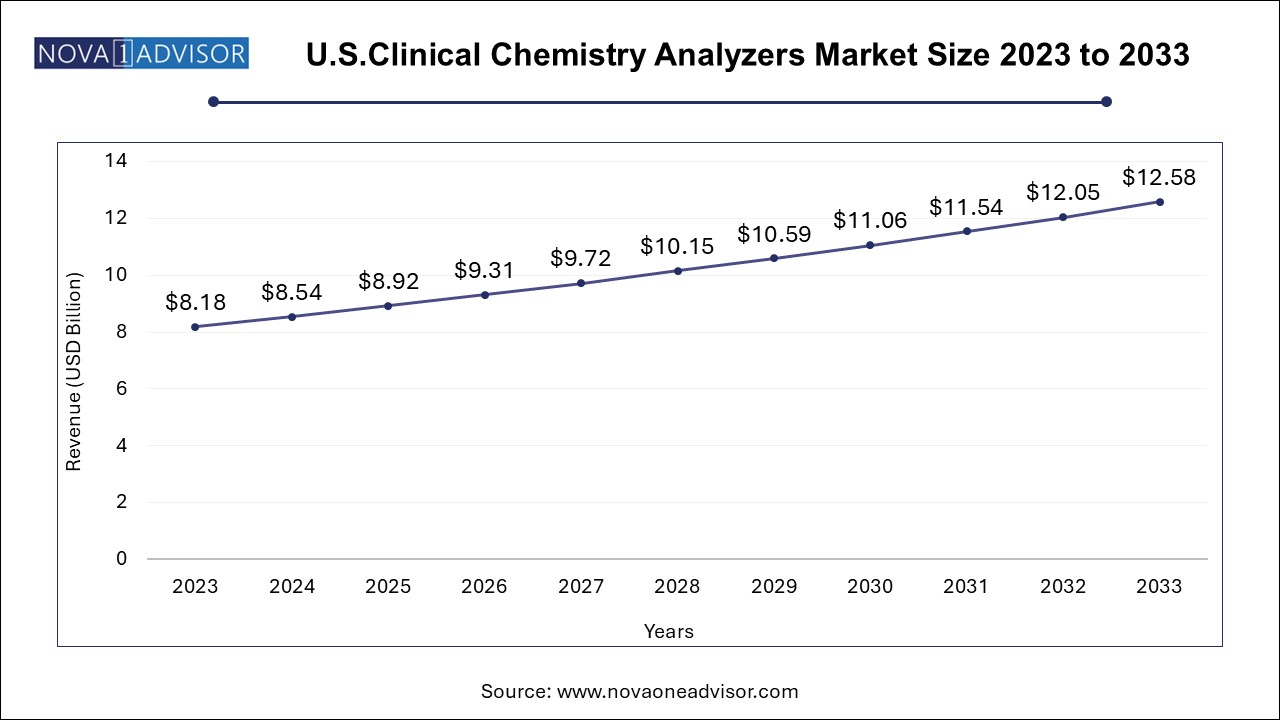

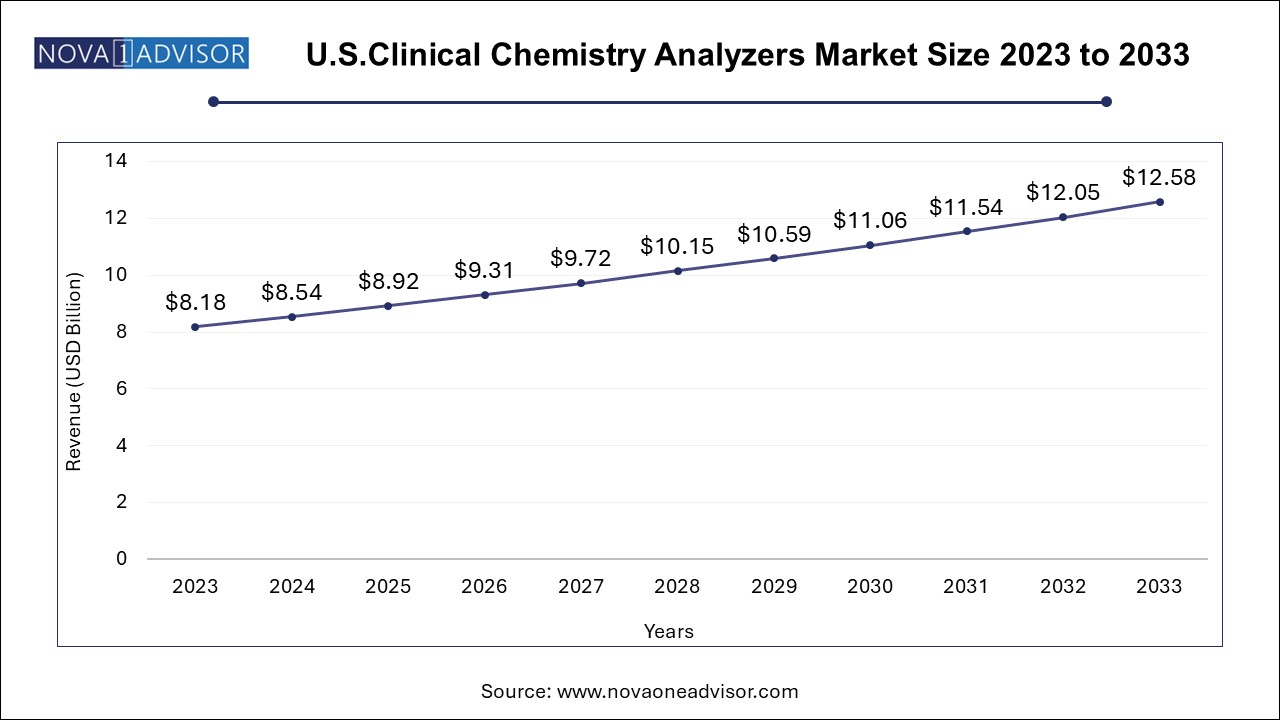

U.S. Clinical Chemistry Analyzers Market Size, Share and Trends 2024 to 2034

The U.S. clinical chemistry analyzers market size was valued at USD 8.18 Billion in 2023 and is expected to grow from USD 8.54 Billion in 2024 to reach USD 12.58 billion by 2033, at a CAGR of 4.4% during the forecast period (2024-2033)

North America dominated the market with the revenue share of 35.16% in 2023, due to rising healthcare spending in country, such as the U.S. The healthcare infrastructure in the U.S. is well established, which has led to a huge adoption rate for clinical chemistry and reagents in laboratories and hospitals. Moreover, favorable healthcare reimbursement scenarios in such regions have also motivated greater penetration of automated chemistry analyzers.

The U.S. dominated the North America market in 2023 due to including the growing adoption of analyzers in healthcare settings, continuous technological advancements, and the presence of key market players. Some of the key market players include Beckman Coulter, Elitech Group, Horiba Ltd., Johnson & Johnson, Mindray Medical International Ltd., Ortho-Clinical Diagnostics, and Siemens AG. In July 2023 , Siemens Healthineers Atellica CI Analyzer received FDA clearance and is now available in major markets worldwide, marking its official launch, which is expected to boost the regional market growth. Additionally, the growing geriatric population in the U.S. is contributing to the market's growth, as the elderly population is more likely to require diagnostic tests and services.

Market Overview

The clinical chemistry analyzers market forms a critical backbone of the modern diagnostic landscape, enabling rapid and precise biochemical analyses of blood and other bodily fluids. These instruments are indispensable in hospitals, diagnostic laboratories, and academic research centers for measuring metabolites, electrolytes, proteins, and enzymes parameters essential for disease detection, treatment monitoring, and health screening.

As global healthcare systems evolve toward more data-driven and preventive models, the role of clinical chemistry analyzers has expanded from mere diagnostic tools to central elements of comprehensive healthcare delivery. Rising incidences of chronic diseases like diabetes, cardiovascular disorders, renal dysfunctions, and liver diseases are directly fueling the demand for advanced chemical testing. Additionally, increasing health awareness among populations, aging demographics, and routine health checkups contribute to the growing volume of chemistry-based tests conducted globally.

Clinical chemistry analyzers are broadly classified by their capacity ranging from small benchtop systems for point-of-care settings to very large, fully automated platforms capable of handling hundreds of samples per hour. Equally important are the reagents calibrators, controls, and specialized biochemical solutions without which these systems cannot function. The market is not only witnessing steady growth in demand but also continuous innovation in areas such as reagent standardization, automation, integration with laboratory information systems (LIS), and miniaturization for decentralized use.

As laboratory automation becomes more prevalent and test volumes continue to rise, manufacturers of clinical chemistry analyzers are focusing on throughput, reliability, cost-efficiency, and flexibility to address the evolving needs of healthcare providers.

Major Trends in the Market

-

Growing Preference for Integrated and Modular Analyzers

Laboratories are increasingly adopting modular chemistry analyzers that combine immunoassay and chemistry functions to reduce operational footprint and increase testing efficiency.

-

Reagent Rental Business Models on the Rise

Equipment-leasing models where analyzers are provided for free or at low cost in exchange for reagent purchase commitments are gaining traction, especially in developing markets.

-

Adoption of Automation and AI-Driven Analytics

Automation in sample handling, result interpretation, and anomaly detection is reducing error rates and enhancing laboratory productivity.

-

Increased Demand for Specialized Tests

There is rising demand for specialty chemical assays, including cardiac markers, therapeutic drug monitoring (TDM), and fertility tests.

-

Emergence of Portable Chemistry Analyzers for POC Testing

Handheld and portable chemistry analyzers are being deployed in outpatient clinics, emergency rooms, and rural health centers for rapid diagnostics.

Report Scope of The Clinical Chemistry Analyzers Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 19.51 Billion |

| Market Size by 2033 |

USD 28.18 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.17% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Test, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Thermo Fisher Scientific, Inc.; Danaher Corporation (Beckman Coulter); Abbott, Siemens Healthineers AG; F. Hoffmann-La Roche Ltd; Horiba, Ltd.; ELITech Group; QuidelOrtho Corporation; Randox Laboratories Ltd. |

Market Driver: Rising Global Burden of Chronic and Lifestyle Diseases

One of the foremost drivers of the clinical chemistry analyzers market is the escalating prevalence of chronic and lifestyle-related diseases. Conditions such as diabetes, kidney disease, cardiovascular disease, and liver dysfunction are growing at an alarming rate, particularly in low- and middle-income countries where urbanization and lifestyle changes have led to poor dietary habits and sedentary behavior.

These chronic diseases often require continuous monitoring of parameters such as glucose, cholesterol, liver enzymes, and creatinine. Clinical chemistry analyzers allow rapid, high-throughput testing of these biomarkers, enabling healthcare providers to manage diseases more effectively. For instance, patients undergoing chemotherapy often require weekly or even daily liver and kidney function tests, making chemistry analyzers indispensable in oncology departments. Similarly, annual lipid panels and thyroid tests are routine parts of preventative healthcare in many regions, underscoring the utility of these devices in both acute and chronic care.

Market Restraint: High Capital Cost and Maintenance Requirements

Despite the indispensable role of clinical chemistry analyzers, their high upfront cost and ongoing maintenance requirements can be a significant barrier especially for smaller clinics, rural healthcare centers, and public hospitals with limited budgets. Fully automated, large-capacity analyzers can cost hundreds of thousands of dollars, excluding the recurring expense of reagents, calibrators, and technician training.

Moreover, maintaining these devices demands a skilled workforce capable of troubleshooting, quality control, and regular calibration. In regions lacking sufficient biomedical engineering expertise, technical breakdowns can lead to service disruptions and diagnostic delays. Additionally, reagent costs can fluctuate based on supplier contracts, making operational budgeting unpredictable for resource-constrained facilities.

Market Opportunity: Expansion of Diagnostic Infrastructure in Emerging Markets

A major growth opportunity for the clinical chemistry analyzers market lies in the expanding diagnostic infrastructure of emerging economies. Governments in Asia-Pacific, Latin America, and Africa are investing in healthcare modernization programs, aiming to strengthen diagnostic capabilities at both tertiary and primary healthcare levels.

Initiatives such as India's Ayushman Bharat, Brazil’s SUS upgrades, and Kenya’s Universal Health Coverage pilot are creating demand for decentralized, mid-capacity analyzers suitable for community health centers and district hospitals. Manufacturers offering scalable, cost-effective, and user-friendly devices are well-positioned to capture these markets.

Moreover, international health organizations and NGOs are increasingly funding the deployment of clinical laboratory equipment in rural and underserved regions. With localized training and support models, companies can establish long-term presence in these emerging territories while fulfilling a critical public health need.

Segments:

Clinical Chemistry Analyzers Market By Product Insights

Large and very large clinical chemistry analyzers dominate the product segment due to their capacity to handle high-throughput environments such as central hospital laboratories, reference labs, and commercial diagnostic centers. These systems are capable of processing hundreds of tests per hour and are often integrated into total laboratory automation (TLA) setups. Their sophisticated features include automated sample loading, barcode scanning, reagent tracking, and LIS connectivity.

These analyzers are particularly prevalent in regions with well-developed healthcare infrastructure. In North America and Western Europe, tertiary care hospitals rely on these systems for managing increasing test volumes from both inpatient and outpatient settings. Their dominance stems not just from throughput but also from reliability, data traceability, and integration capabilities.

Small and medium analyzers are emerging as the fastest-growing product segment due to rising demand in point-of-care and decentralized diagnostics. Clinics, urgent care centers, and outpatient facilities are investing in compact systems that offer essential chemistry panels without the complexity of larger platforms. These analyzers are particularly useful in rural and peri-urban areas, where patients require quick diagnostics and referrals are limited.

Moreover, manufacturers are designing these systems with pre-packaged reagents, user-friendly interfaces, and minimal calibration requirements, reducing the need for specialized staff. As home healthcare, mobile diagnostics, and decentralized clinical trials become more common, the growth trajectory for smaller analyzers is expected to accelerate.

Clinical Chemistry Analyzers Market By Test Insights

The basic metabolic panel dominates the test segment owing to its routine usage in assessing critical body functions such as kidney health, glucose metabolism, and electrolyte balance. BMP is typically ordered during hospital admissions, emergency room visits, and routine physical exams. This panel includes tests for sodium, potassium, calcium, creatinine, blood urea nitrogen (BUN), and glucose making it a cornerstone of general diagnostics.

Given the growing burden of metabolic disorders and acute conditions like sepsis and dehydration, BMP tests are frequently requisitioned across all healthcare settings. They serve as a gateway to further specialized testing and inform a broad range of clinical decisions, from medication adjustments to dialysis initiation.

Specialty chemical tests are gaining momentum as clinicians increasingly rely on biomarker-based diagnostics for targeted interventions. These include cardiac enzymes (e.g., troponin), inflammatory markers (e.g., CRP), fertility hormones (e.g., estradiol, FSH), and drug levels for therapeutic monitoring. The emergence of precision medicine and companion diagnostics has fueled this trend.

For example, monitoring of liver enzymes in patients taking statins or chemotherapy drugs is a common application. Similarly, fertility clinics use hormone panels extensively for treatment planning. The increasing adoption of evidence-based medicine, personalized protocols, and chronic care management ensures that specialty tests will see exponential growth in both volume and complexity.

Clinical Chemistry Analyzers Market By End-use Insights

Hospitals dominate the end-use segment as they account for the highest number of patient interactions and therefore the largest volume of diagnostic tests. From emergency departments and intensive care units to outpatient clinics and surgical centers, hospitals require a diverse range of biochemical tests to guide clinical decision-making.

Most hospitals deploy large and medium analyzers in centralized labs to cater to high demand. In some cases, satellite labs with compact analyzers are placed in intensive care or surgical recovery units for rapid test turnaround. Additionally, hospitals typically have more comprehensive quality control protocols and experienced technicians, making them ideal settings for high-complexity analyzers.

Independent diagnostic laboratories are among the fastest-growing segments as healthcare systems increasingly shift to outsourced testing to manage cost and capacity. These laboratories often serve multiple hospitals, clinics, and physician practices, offering centralized testing with faster turnaround and lower costs per test.

With the rise of home sample collection and digital test result platforms, diagnostic labs are also capturing the consumer diagnostics market. Investments in multi-analyzer platforms, cloud-based reporting systems, and courier logistics are transforming them into efficient diagnostic hubs with expansive reach.

Recent Developments

-

February 2025 – A German diagnostics company unveiled a new AI-enhanced chemistry analyzer capable of identifying sample anomalies and reducing retest rates by 22%.

-

March 2025 – An Indian IVD manufacturer received CE certification for a new compact clinical chemistry system designed for low-resource settings, targeting Southeast Asian and African markets.

-

January 2025 – A U.S.-based diagnostics giant launched a subscription-based reagent rental program bundled with real-time analytics dashboards for medium-sized hospital labs.

Some of the prominent players in the Clinical chemistry analyzers market include:

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Thermo Fisher Scientific, Inc.

- Danaher Corporation (Beckman Coulter)

- Abbott

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- Horiba, Ltd.

- ELITech Group

- QuidelOrtho Corporation

- Randox Laboratories Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical chemistry analyzers market.

Product

-

- Small

- Medium

- Large

- Very Large

-

- Calibrators

- Controls

- Standards

- Others

Test

- Basic Metabolic Panel (BMP)

- Electrolyte Panel

- Liver Panel

- Lipid Profile

- Renal Profile

- Thyroid Function Panel

- Specialty Chemical Tests

End-use

- Hospitals

- Academic Research Centers

- Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)