CRISPR-based Gene Editing Market Size and Forecast 2026 to 2035

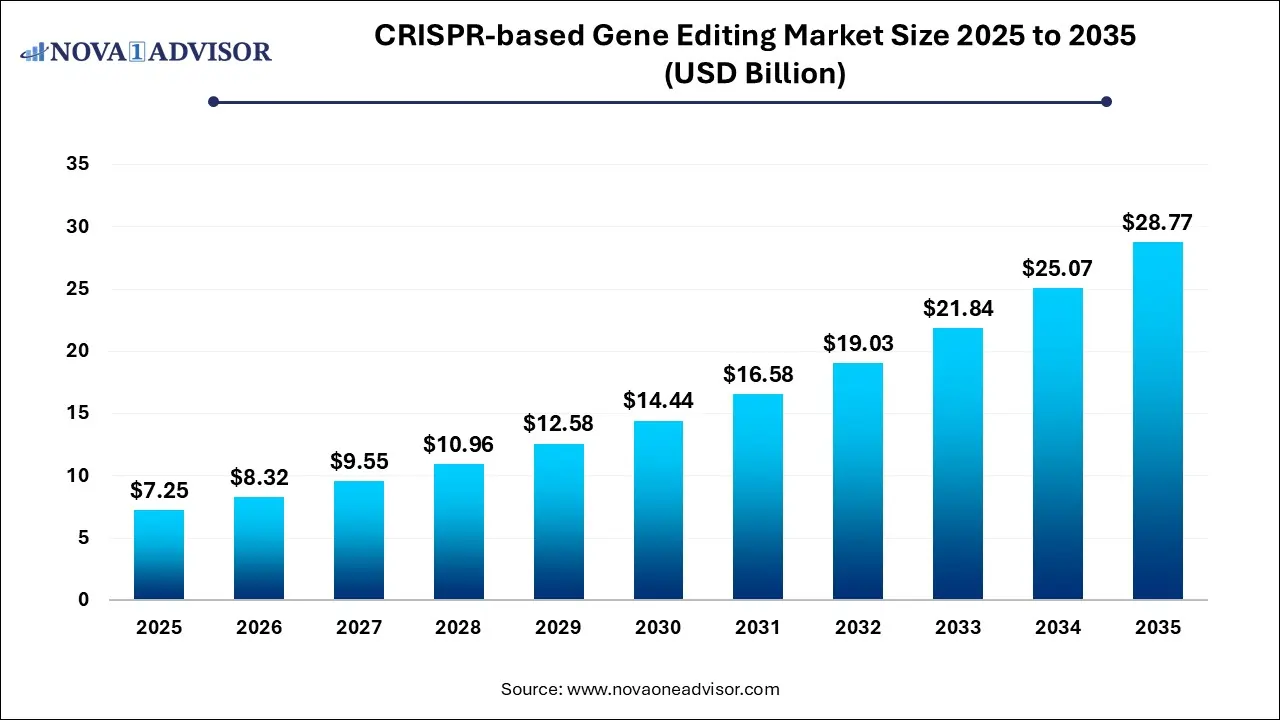

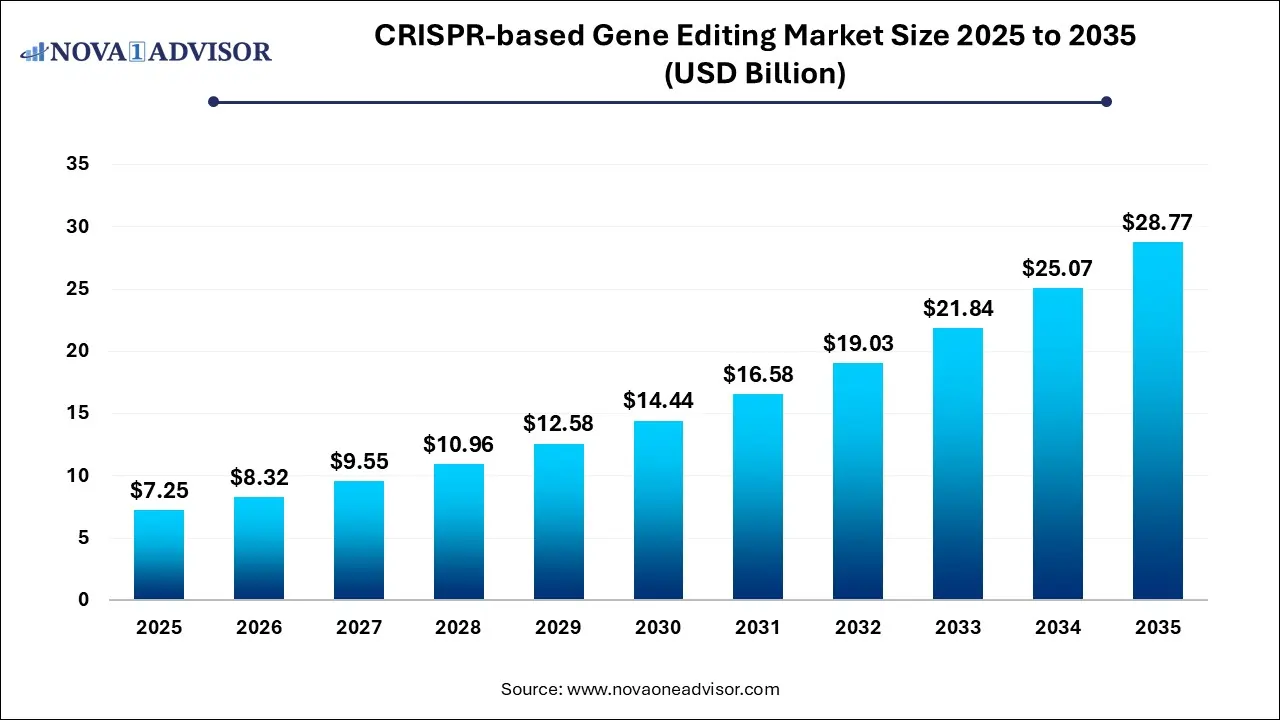

The global CRISPR-based gene editing market size was valued at USD 7.25 billion in 2025 and is anticipated to reach around USD 28.77 billion by 2035, growing at a CAGR of 14.78% from 2026 to 2035. The growth of the CRISPR-based gene editing market is driven by increasing incidences of genetic disorders, continuous advancements in CRISPR technology, focus on personalized medicine and regenerative medicine as well as rising investments in CRISPR research and development.

CRISPR-based Gene Editing Market Key Takeaways

- By product and service, the products segment dominated the market in 2025.

- By Product and Service, the service segment is expected to grow the fastest throughout the forecast period.

- By application, the biomedical segment led the market as of this year.

- By application, the agricultural segment is seen to have the fastest growth rate.

- By end user, pharmaceutical and biotech companies held the largest market share as of 2025.

- By end user, research and academic institutions are expected to grow the fastest as of this year.

- By region, North America dominated the global market in 2025.

- By region, Asia-Pacific is seen to grow the fastest during the forecast period.

Market Overview

The CRISPR-based gene editing market is a groundbreaking transformation in molecular biology, biomedical innovation and biotechnology applications. It is a powerful tool which is used for precise genome modification. This technology enables researchers to edit genes with utmost accuracy and efficiency. The technology behind CRISPR-based gene editing has democratized the procedure, making it accessible to academic institutions, startups and well established pharmaceutical companies. Its versatile nature allows applications ranging from basic research to therapeutic interventions for genetic disorders.

Market Outlook

- Market Growth Overview: The CRISPR-based gene editing market is expected to grow significantly between 2025 and 2034, driven by the rising incidence of monogenic diseases, focus on tailored treatments, and rising funding and government support for biotech innovation.

- Sustainability Trends: Sustainability trends involve sustainable agriculture practices, environmental bioremediation, and resource optimization.

- Major Investors: Major investors in the market include ARK Investment Management, BlackRock, and State Street.

- Startup Economy: The startup economy is focused on strategic partnerships and M&A, significant investment, and regulatory navigations.

Major Trends in the Market

- Growing Use of CRISPR in Diagnostics

Researchers and companies are increasingly using CRISPR’s RNA-guided enzymes to develop next-generation diagnostic tools that deliver faster and more accurate results. These CRISPR-based tests have the potential to transform how diseases are detected and monitored.

- Expanding into New Therapeutic Areas

Advances in gene editing and delivery systems are opening doors for CRISPR to move beyond rare genetic disorders into more complex diseases like neurodegenerative, cardiovascular, and autoimmune conditions. This broadening scope is fueling long-term market growth and innovation.

- Increase in Collaborations and Partnerships

The CRISPR field is seeing a surge in partnerships between biotech firms, pharmaceutical companies, and academic institutions. These collaborations are helping share expertise, secure funding, and accelerate the development of next-generation CRISPR applications.

- Widening Applications Across Industries

Beyond healthcare, CRISPR technology is finding exciting applications in agriculture and industrial biotechnology, from creating disease-resistant crops to engineering microbes for sustainable production, signaling its transformative impact across multiple sectors.

- Innovation in Delivery Technologies

A key area of focus is improving how CRISPR components are delivered to target cells. Researchers are exploring lipid nanoparticles, viral vectors, and other novel carriers to enhance precision, safety, and efficiency in gene editing.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms in the CRISPR-based gene editing market has revolutionized the healthcare domain, driving efficiency in target identification and off-target prediction. AI data analysis techniques help to speed up the discovery of therapeutic targets, predict off-target effects and even optimize therapies throughout multiple CRISPR applications across many domains like drug development, diagnostics and personalized medicine.

The convergence of such technologies helps to enhance CRISPR applications across numerous areas such as drug development, diagnostics and personalized medicine applications. These developments provide new modalities essential for the innovation of personalized therapies and help to ensure efficiency, precision and safety. Through these factors, we can see how AI is propelling the market further, giving rise to new cutting edge processes and medical technologies.

CRISPR-based Gene Editing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 8.32 Billion |

| Market Size by 2035 |

USD 28.77 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 14.78% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product & Service, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Revvity, Inc.; Danaher Corporation; GenScript; Merck KGaA; Thermo Fisher Scientific, Inc.; Tocris Bioscience; OriGene Technologies, Inc.; Bio-Rad Laboratories; Bio-Techne; New England Biolabs, Inc. |

Market Dynamics

Driver

Rise of Genetic Disorders on a Global Level

The growing prevalence of genetic disorders is a key driver propelling the CRISPR-based gene editing market forward. Conditions such as sickle cell disease, beta-thalassemia, cystic fibrosis, Huntington's disease and hemophilia are on the rise, contributing to substantial clinical and economic burdens worldwide. Moreover, advances in genetic screening, increased patient awareness and improved diagnostics have revealed a larger patient pool, creating competition amongst key players. In addition, improved survival rates of infants with complex medical needs mean more individuals live with these disorders into adulthood, expanding the long-term patient base.

Another key factor driving the market is the expanding use of precision medicine with advances in genomic sequencing and editing technologies. The precision, efficiency and versatility of gene editing are being improved day by day with the help of robust research and development.

Restraint

Ethical Implications

Despite its promising potential, the market faces several restraints that can potentially hinder its expansion. One such major concern is the ethical implication surrounding gene editing technologies. As CRISPR enables precise modifications to the genome, ethical dilemmas related to human germline editing and customized babies raise questions about the long-term consequences of such interventions and the morality attached to it. Moreover, the high costs associated with CRISPR research and development can limit access for small scale and medium scale organizations and academic institutions, further slowing down market potentially.

Opportunity

Technological Advancements

Advancements in CRISPR technology and applications are accelerating market growth by enhancing precision, efficiency and versatility in gene editing. This has opened up new avenues of opportunities. Over the years, the CRISPR-Cas technology has evolved beyond basic DNA cutting into a more sophisticated genome engineering platform. The market has also witnessed a rise in innovations such as high-fidelity Cas variants, base editing, prime editing as well as improved delivery mechanisms such as lipid nanoparticles and viral vectors. These advancements have reduced off-target effects, increased editing efficiency as well as broadened the scope of treatable conditions. Furthermore, the integration with artificial intelligence and machine learning has optimized guide RNA design and target site selection processes, enabling faster and more accurate development cycles.

Another opportunistic area lies in the integration of big data analytics into gene editing processes. By leveraging real-time data analysis, researchers are now able to enhance the efficiency of CRISPR applications, leading to more rapid advancements in therapeutic development.

CRISPR-based Gene Editing Market Report Segmentation Insights

By Product & Service Insights

Which product and service segment dominated the market in 2025?

The products segment dominated the market in 2025. The widespread adoption of CRISPR technology in research laboratories has led to a rise in demand for high-quality enzymes and kits that are essential for gene editing applications. Moreover, CRISPR libraries allow researchers to conduct high-throughput screenings and facilitate functional genomics studies. These libraries are vital for drug discovery and developing novel therapies, addressing critical health challenges such as cancer and genetic disorders.

The services segment is expected to witness the fastest growth over the forecast period. As CRISPR technology becomes more mainstream, researchers and organizations require specialized services for effective implementation, including designing, optimizing and validating CRISPR systems. These offerings help to simplify research processes and accelerate project timelines, making them an attractive option.

By Application Insights

Which application segment led the market as of this year?

The biomedical segment led the market in 2025. This growth is fueled by several factors, including the increasing prevalence of genetic disorders and cancers, alongside significant advancements in CRISPR technology. The advantage of this technology lies in its ability to precisely edit genes offers transformative potential for conditions such as sickle cell disease and Duchenne muscular dystrophy, driving heavy research and investment in this area.

The agricultural segment is expected to witness the fastest growth over the forecast period. This growth is driven by CRISPR’s ability to deliver precise, cost-effective genetic modifications that can enhance crop yield, nutritional value and resistance to pests, diseases and other environmental stressors. This technology helps to offer faster development timelines and greater regulatory acceptance in certain markets, making it highly attractive to agri-biotech companies.

By End Use Insights

Which end user held the largest market share?

The pharmaceutical and biotechnology companies segment held the largest market share as of 2025. This is due to their central role in therapeutic product development and clinical translation. These types of organizations invest heavily in CRISPR research to build gene therapy pipelines, secure intellectual property and enter licensing or collaboration agreements. Companies like CRISPR Therapeutics, Intellia Therapeutics, and Beam Therapeutics have raised billions in funding and built advanced CRISPR drug development platforms.

Academic and research institutes are seen to be the fastest growing segment throughout the forecast period, especially in foundational CRISPR research, tool development and proof-of-concept disease models. NIH-funded programs, the Innovative Genomics Institute and various other university spin-offs continue to push the boundaries of CRISPR science.

By Regional Analysis

Why is North America dominating the market?

North America dominated the market in 2025. This dominance can be attributed to the strong presence of major biotechnology and pharmaceutical companies and substantial investments in research and development in the region. North America also benefits from a robust supportive government regulatory framework that helps to facilitate innovation and accelerate the approval process for new therapies. Moreover, the high prevalence of genetic disorders, especially in countries like the U.S highlights the urgent demand for effective treatments, driving growth and development.

What are the advancements in Asia-Pacific?

Asia-Pacific is expected to witness the fastest growth rate throughout the forecast period. This growth is driven by expanding biotechnology and pharmaceutical sectors, rising healthcare expenditure and the increasing adoption of precision medicine. Countries such as China, Japan, South Korea and India are seen investing heavily in genomic research, clinical trials and CRISPR-based product developments, supported by government initiatives and favorable policy reforms. The region also benefits from a large patient population that has unmet medical needs, further accelerating demand for advanced genetic therapies.

China CRISPR-based Gene Editing Market Trends

China is the leading contributor to the CRISPR-based gene editing market in the Asia Pacific region. China is the first country for conducting human clinical trials by using CRISPR-Cas9 for genetic disorders. The rising investments in biotechnology and genetic research as well as genome projects by the various companies, research organizations as well as government bodies are contributing to the market growth. The rising prevalence of chronic and rare diseases in the country’s middle class and aging population are creating the need for novel and effective therapies requiring CRISPRE technology for their development. Government initiatives such as the “Made in China 2025” initiative is encouraging the use of gene editing technologies for developing new therapies. The National Medical Products Administration (NMPA) is streamlining the approval of novel gene therapies and in-vitro diagnostics in China, further driving the market growth.

India CRISPR-based Gene Editing Market Trends

The CRISPR-based gene editing market in India is experiencing significant growth, driven by factors such as increasing burden of chronic diseases like cancer and genetic disorders like sickle cell anemia, improvements in CRISPR technology, rising number of clinical trials, and increased funding in biotechnology research by the government and private sectors. The increased applications of CRISPR technology in agriculture for enhancing crop yield, improving nutritional value, and to develop disease-resistant crops are expanding the market potential.

- For instance, in May 2025, at the Bharat Ratna C. Subramaniam Auditorium, NASC Complex, New Delhi, Union Agriculture and Farmers Welfare Minister Shri Shivraj Singh Chouhan launched India’s first genome-edited rice varieties – DRR Rice 100 (Kamla) and Pusa DST Rice 1. The new varieties developed by the Indian Council of Agricultural Research (ICAR) by using CRISPR-based genome editing technology will offer higher production yield, improved climate adaptability, and water conservation. The launch makes India the first country in the world for developing genome-edited rice varieties. (Source: https://www.pib.gov.in/)

CRISPR-based Gene Editing Market Top Key Companies:

CRISPR-based Gene Editing Market Recent Developments

- In July 2025, the Chan Zuckerberg Initiative (CZI) and the Innovative Genomics Institute (IGI) declared raising funds for the Center for Pediatric CRISPR Cures (Center). CRISPR-based editing technology will be used by the center to advance on-demand gene-editing cures for severe pediatric genetic diseases and will also connect CRISPR cure designing and testing at the University of California, Berkeley (UC Berkeley) with clinical treatment at the University of California, San Francisco (UCSF).

- In May 2025, Aldevron, a globally leading producer of DNA, RNA and protein, in collaboration with Intergrated DNA Technologies (IDT), a globally leading provider of genomic solutions, successfully manufactured the world’s first mRNA-based personalized CRISPR gene editing drug product for treating an infant with urea cycle disorder (UCD).

- In January 2025, Intellia Therapeutics, Inc., a leader in clinical-stage gene editing with focus on CRISPR-based therapies, declared dosing the first patient in the global HAELO Phase 3 study of NTLA-2002, which is a wholly owned investigational in vivo CRISPR-based treatment for hereditary angioedema (HAE).

- In May 2025, Union Agriculture and Farmers Welfare Minister Shri Shivraj Singh Chouhan launched India’s first genome-edited rice varieties, the DRR Rice 100 and Pusa DST Rice 1. The new varieties developed by the Indian Council of Agricultural Research by using CRISPR-based genome editing technology are set to offer higher production yield, improved climate adaptability, and water conservation. The launch makes India the first country in the world for developing genome-edited rice varieties.

CRISPR-based Gene Editing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the CRISPR-based gene editing market.

By Product & Service

- Products

- CRISPR Kits & Reagents

- CRISPR Libraries

- Others

- Services

By Application

- Biomedical

- Therapeutic Development

- By Indication

- Genetic Disorders

- Oncology

- Ophthalmology

- Others

- By Delivery Method

- Disease Diagnostics

- Agricultural applications

- Plant Engineering

- Farm Animals Engineering

- Others

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)