U.S. Biotechnology Market Size and Growth 2026 to 2035

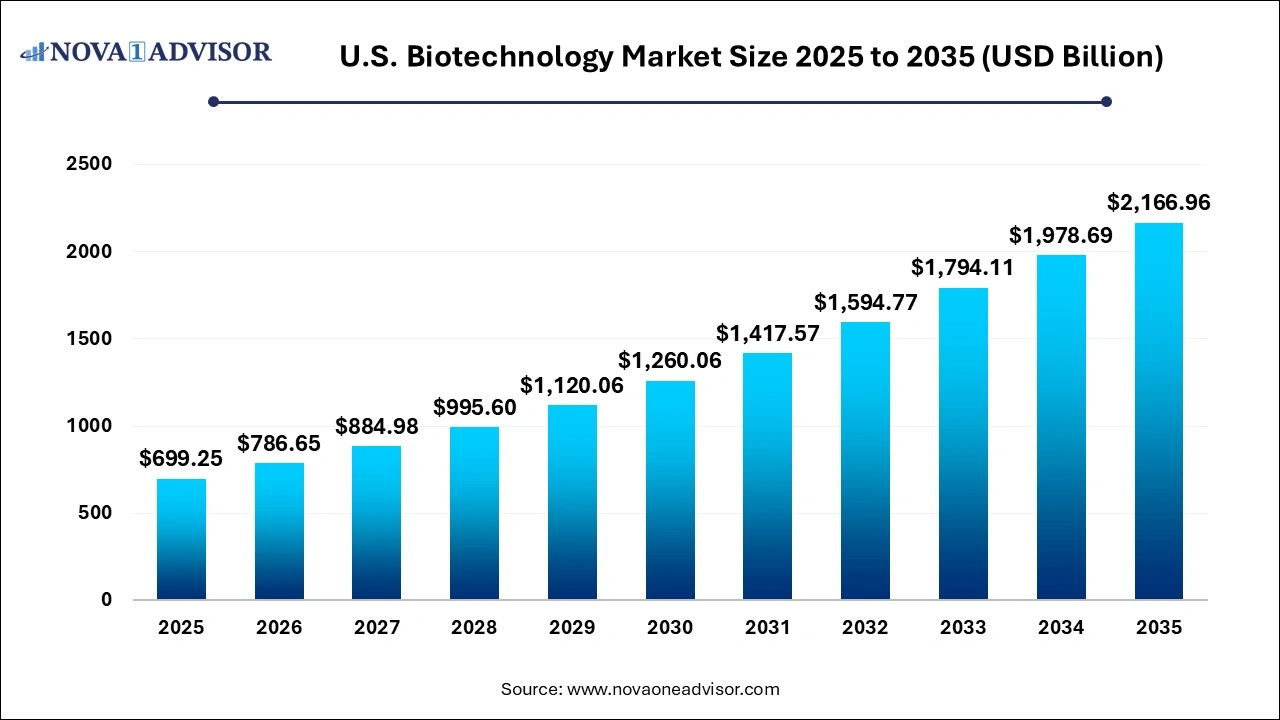

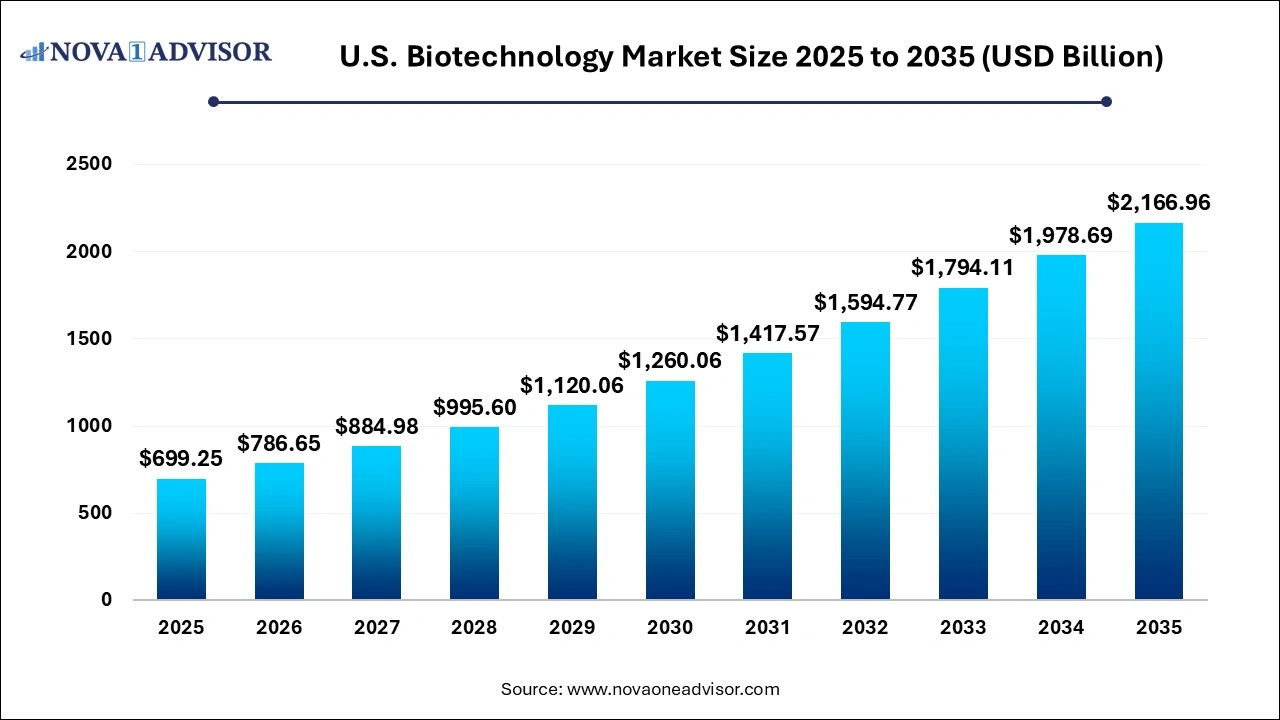

The U.S. biotechnology market size was estimated at USD 699.25 billion in 2025 and is projected to hit around USD 2,166.96 billion by 2035, growing at a CAGR of 11.98% during the forecast period from 2026 to 2035.

Key Takeaways:

- DNA sequencing dominated this market and held the highest revenue market share of 18% in 2025.

- The others’ segment is anticipated to grow at the fastest CAGR of 28.1% during the forecast period.

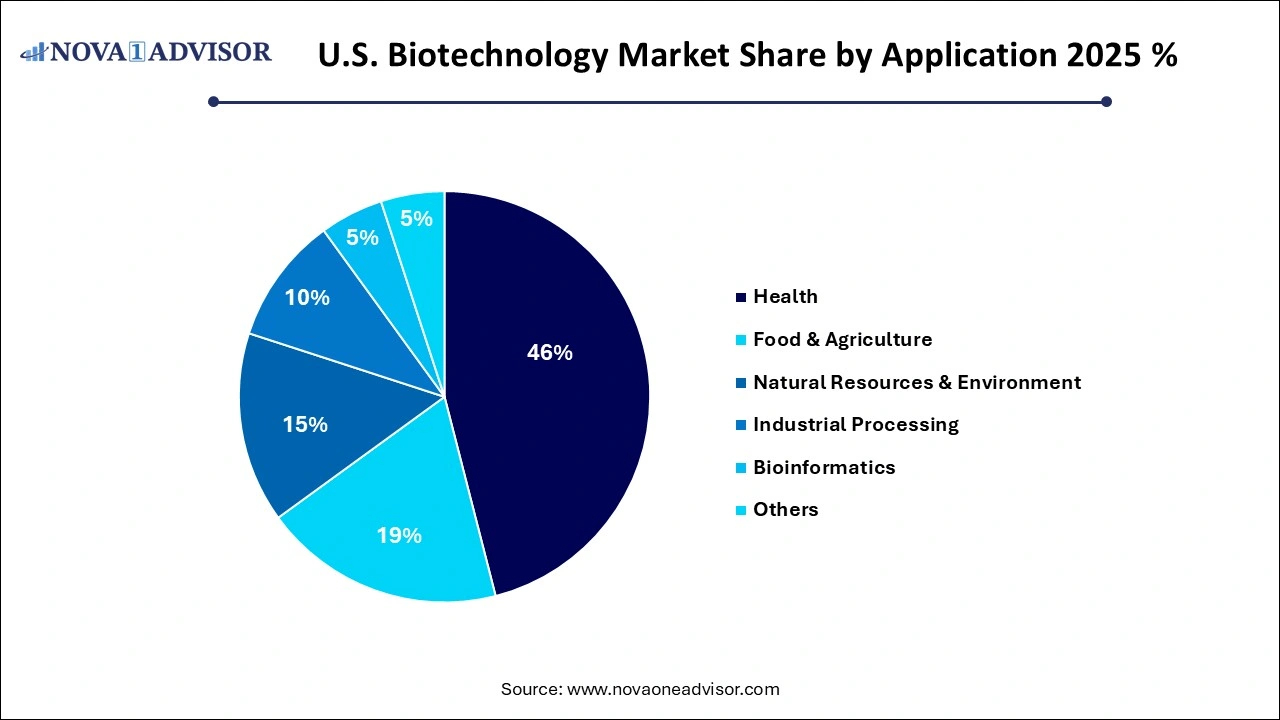

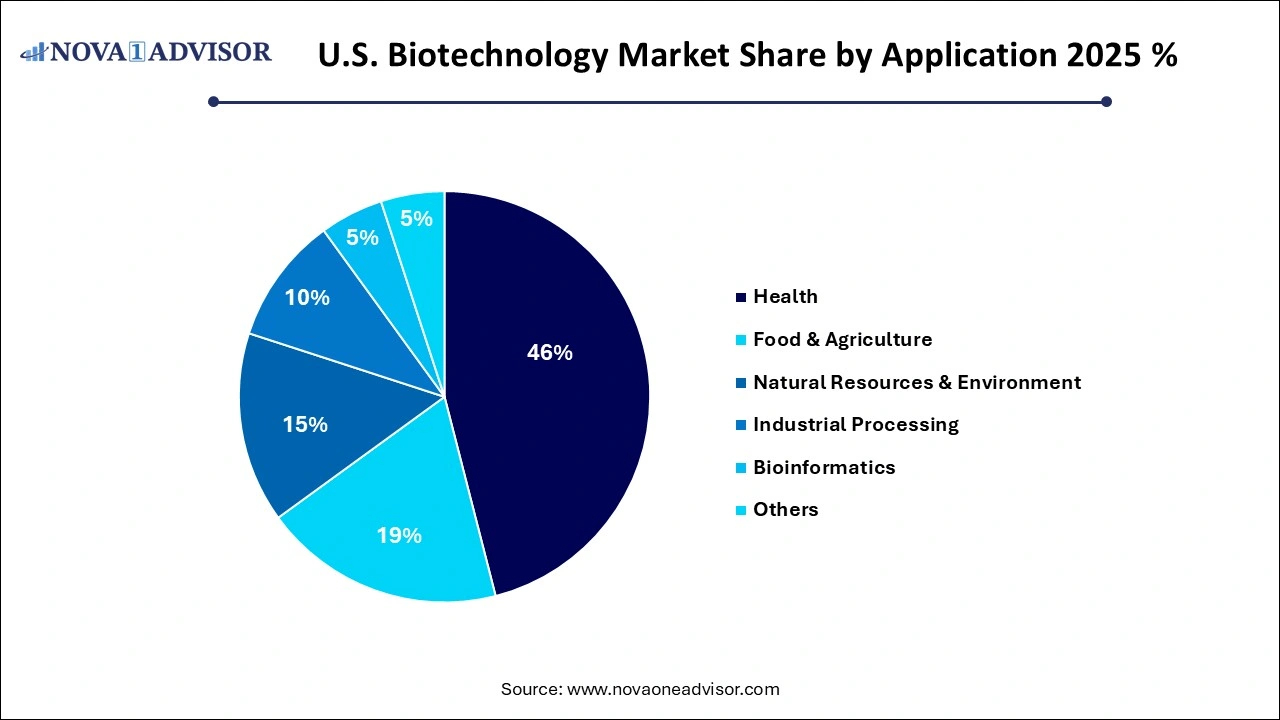

- The health segment dominated the market and accounted for the largest revenue market share of 46% in 2025.

- Bioinformatics is expected to witness the fastest growth, with a CAGR of 17.2% during the forecast period.

U.S. Biotechnology Market Overview

The U.S. biotechnology market stands at the forefront of global innovation, commanding a dominant share of the worldwide biotechnology industry. This sector is characterized by its remarkable diversity and rapid evolution, encompassing cutting-edge research in genomics, bioinformatics, cell biology, and biomanufacturing. The U.S. has been a consistent leader in translating scientific discovery into real-world applications—ranging from life-saving therapeutics and diagnostics to sustainable agriculture and environmental remediation.

Fueled by strong public and private investment, a mature regulatory infrastructure, and a highly skilled research workforce, the U.S. biotechnology industry continues to expand its influence. Breakthroughs in DNA sequencing, CRISPR gene editing, cell-based assays, and regenerative medicine have revolutionized healthcare and industrial processes. Moreover, the convergence of AI and machine learning with biotechnology is driving unprecedented efficiencies in drug discovery, disease prediction, and production optimization.

Biotech startups thrive in hubs like Boston, San Francisco, and San Diego, while collaborations between academia, venture capitalists, and pharmaceutical companies underpin a vibrant innovation pipeline. With the Biden administration’s National Biotechnology and Biomanufacturing Initiative, introduced in 2022, federal support has significantly increased for domestic manufacturing and biotechnological resilience. This initiative aims to reduce reliance on foreign supply chains and accelerate homegrown biotechnological capabilities across multiple sectors.

U.S. Biotechnology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 786.65 Billion |

| Market Size by 2035 |

USD 2,166.96 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.98% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

AstraZeneca; Gilead Sciences, Inc.; Bristol-Myers Squibb; Sanofi; Biogen; Abbott Laboratories; Pfizer, Inc.; Amgen Inc.; Novo Nordisk A/S; Merck KGaA; Johnson & Johnson Services, Inc.; Novartis AG; F. Hoffmann-La Roche Ltd.; Lonza |

Market Driver: Advancements in Genomic Research and Precision Medicine

One of the most powerful drivers in the U.S. biotechnology market is the accelerated progress in genomic research, particularly as it supports precision medicine. The falling costs of high-throughput DNA sequencing and the increasing availability of bioinformatics tools have unlocked a new era in personalized healthcare. Patients can now be stratified by genetic markers, enabling clinicians to predict disease risks, select optimal therapies, and avoid adverse drug reactions.

For example, the partnership between Illumina and GRAIL aims to commercialize early cancer detection tests using genomic data. Similarly, biotech firm 23andMe has expanded beyond ancestry to offer medically actionable insights through direct-to-consumer genetic testing. The U.S. government has also invested in precision health programs, such as the “All of Us” initiative, which seeks to build a diverse health database by sequencing one million Americans. These developments reinforce genomics as the cornerstone of modern biotechnology.

Market Restraint: High Regulatory Hurdles and Long Product Development Timelines

Despite its promise, the biotechnology industry is challenged by extensive regulatory requirements and prolonged development cycles. Obtaining FDA approval for a novel therapy or medical device involves years of clinical trials, meticulous documentation, and substantial financial risk. This burden is especially high for startups that often rely on venture capital and operate within limited timelines.

Moreover, public concerns about gene editing, synthetic biology, and GMOs continue to attract scrutiny. Even in non-medical applications like agriculture, navigating the regulatory landscape can delay market entry. For instance, the approval process for CRISPR-modified crops remains complex and politically sensitive. While these regulations are designed to ensure safety and efficacy, they often slow down innovation and raise entry barriers for smaller players.

Market Opportunity: Expanding Industrial and Environmental Applications

While health-related biotechnology dominates headlines, industrial and environmental biotech represent fast-growing and underexploited opportunities. U.S. companies are increasingly applying biological tools to solve challenges in sustainability, waste management, and industrial production. From microbial biofuels to biodegradable plastics and carbon capture enzymes, industrial biotechnology holds vast commercial potential.

A recent example is LanzaTech, a U.S.-based company using gas fermentation to convert industrial emissions into ethanol and sustainable chemicals. Additionally, agricultural biotech firms are developing nitrogen-fixing microbes to replace chemical fertilizers and reduce environmental runoff. The U.S. Department of Energy continues to fund bio-manufacturing research that supports bio-based production systems, such as algae-derived biofuels and synthetic leather. These emerging sectors could help diversify the U.S. biotech market while supporting environmental goals.

U.S. Biotechnology Market Segmental Insights

By Technology Insights

DNA Sequencing technology leads the U.S. biotechnology market, underpinned by its central role in research, diagnostics, and therapeutics. Next-generation sequencing (NGS) platforms have revolutionized disease discovery and are now integral to clinical decision-making in oncology, infectious diseases, and rare disorders. Companies like Illumina, Thermo Fisher Scientific, and Pacific Biosciences continue to innovate with faster, cheaper, and higher-resolution platforms. Applications extend beyond health to agriculture and biodiversity mapping, making DNA sequencing indispensable across biotechnology.

In contrast, Nanobiotechnology is the fastest-growing technology segment. This field combines nanoscience with biology to create nano-scale materials and drug delivery systems with unprecedented precision. Notably, the success of mRNA COVID-19 vaccines, such as those developed by Moderna and Pfizer-BioNTech, relied on lipid nanoparticles (LNPs) for delivery—an application of nanobiotechnology. The future holds promise for smart nanoparticles in oncology, targeted antibiotics, and nanodiagnostics. Research institutions and private biotech firms are exploring nanosensors, nanocarriers, and quantum dots for both medical and environmental monitoring.

By Application Insights

Health-related biotechnology continues to dominate the U.S. market due to its vast scope in developing novel therapeutics, diagnostics, and vaccines. The emergence of biologics, including monoclonal antibodies and gene therapies, has made biotech a cornerstone of modern medicine. Biotech-derived drugs now represent a significant proportion of the FDA’s annual approvals. Companies like Amgen, Genentech, and Regeneron are pioneering therapies for cancer, autoimmune diseases, and rare genetic conditions. Beyond therapeutics, health biotech includes diagnostic tools such as liquid biopsies and point-of-care genetic tests, further broadening its influence.

Meanwhile, Bioinformatics is growing at an accelerated pace due to the explosion of multi-omics data and the need for integrated analysis platforms. With AI-powered algorithms capable of identifying drug targets, predicting protein folding, and simulating metabolic pathways, bioinformatics is driving efficiencies across all segments of biotechnology. Notable platforms like Deep Genomics, Recursion, and Tempus are using deep learning to accelerate drug discovery and repurpose existing therapies. As personalized medicine becomes standard, the demand for scalable and interpretable bioinformatics solutions will continue to surge.

Recent Developments

-

March 2024: Moderna announced the start of Phase I clinical trials for its mRNA-based cancer vaccine targeting melanoma and non-small cell lung cancer, expanding beyond its COVID-19 portfolio.

-

February 2024: Regeneron Pharmaceuticals revealed positive Phase III trial results for a gene therapy treating inherited retinal dystrophy, positioning it as a market leader in ocular biotech therapies.

-

January 2024: CRISPR Therapeutics and Vertex Pharmaceuticals received FDA approval for exagamglogene autotemcel (exa-cel), the first CRISPR-based therapy for sickle cell disease.

-

April 2024: Ginkgo Bioworks partnered with the U.S. Department of Defense to develop biosensors capable of detecting airborne pathogens, enhancing national biosurveillance capabilities.

-

March 2024: Illumina launched a new sequencing platform—NovaSeq X Plus—boasting 2x throughput and reduced per-genome costs, aimed at broadening accessibility for clinical applications.

Key U.S. Biotechnology Companies:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Biotechnology market.

By Technology

- Nanobiotechnology

- Tissue Engineering and Regeneration

- DNA Sequencing

- Cell-based Assays

- Fermentation

- PCR Technology

- Chromatography

- Others

By Application

- Health

- Food & Agriculture

- Natural Resources & Environment

- Industrial Processing

- Bioinformatics

- Others