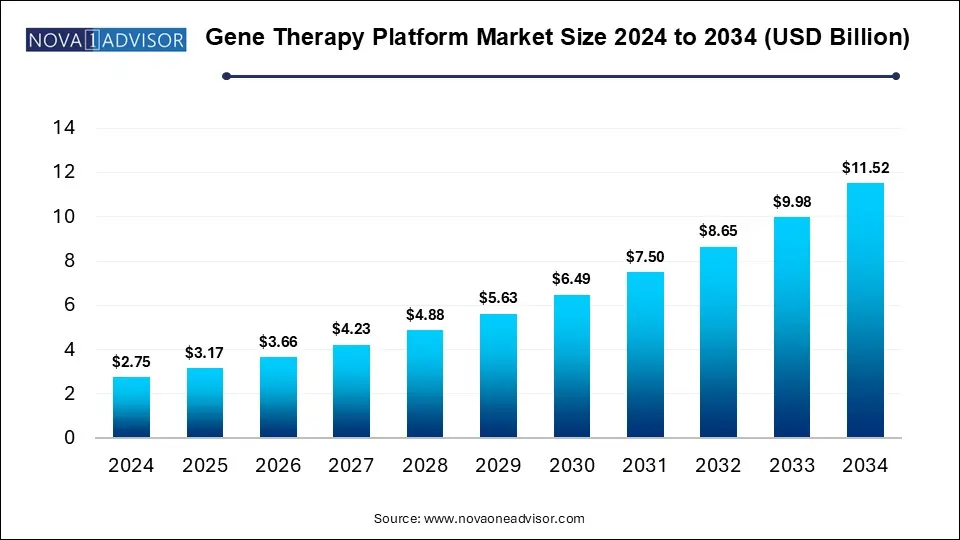

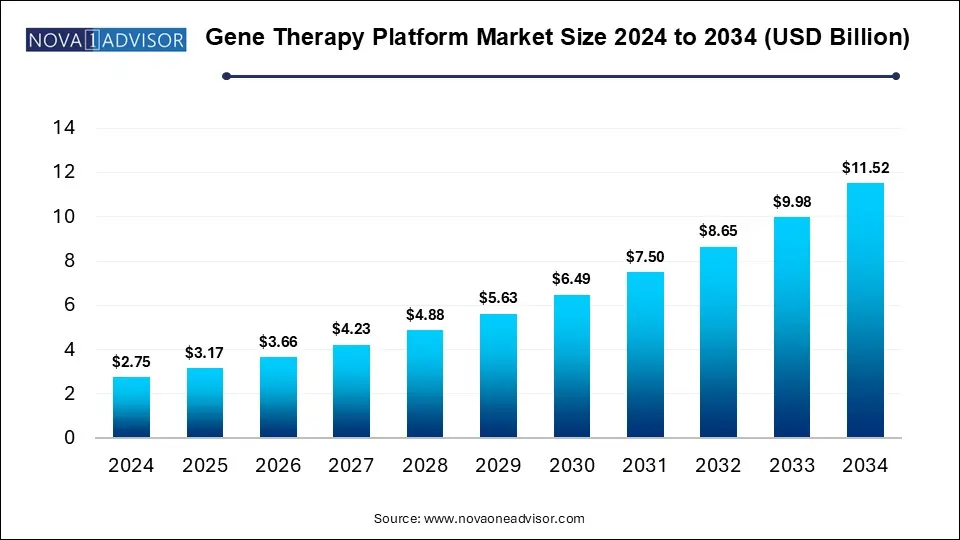

The gene therapy platform market size was exhibited at USD 2.75 billion in 2024 and is projected to hit around USD 11.52 billion by 2034, growing at a CAGR of 15.4% during the forecast period 2025 to 2034.

Key Takeaways:

- North America emerged as the leading region in the global gene therapy platform market, securing the highest market share of 36% in 2024.

- The U.S. gene therapy platform landscape is witnessing swift technological progress and innovation in therapeutic development.

- Among the platform types, viral vector platforms commanded the market in 2024, contributing the highest portion of revenue at 59%.

- Oncology represented the most significant application area, generating the largest revenue share in the gene therapy platform market during 2024.

- In terms of delivery approach, in vivo gene therapy accounted for the majority of market revenue in 2024.

Market Overview

Gene therapy has rapidly emerged as one of the most transformative advancements in modern medicine. By modifying, replacing, or silencing faulty genes responsible for disease development, gene therapy promises long-term therapeutic solutions, particularly for previously untreatable or rare genetic conditions. The gene therapy platform market comprises the underlying technologies and delivery mechanisms that enable these therapies, including viral vectors, non-viral vectors, and gene editing systems.

As the prevalence of genetic and chronic diseases increases globally, gene therapy is seeing growing interest from healthcare providers, biopharmaceutical companies, and research institutions. Additionally, the rise in FDA approvals, the emergence of personalized medicine, and a surge in clinical trials involving novel gene therapy platforms are key indicators of market maturity and growth.

In 2024, the gene therapy platform market is poised to reach multibillion-dollar valuations, driven by increasing investments in R&D, strategic partnerships between biopharma and CDMOs, and supportive government policies. North America continues to lead due to its strong biotechnology ecosystem, but Asia Pacific is rapidly emerging as a hotspot for innovation, supported by rising healthcare infrastructure and favorable regulatory reforms.

Major Trends in the Market

-

Increased Preference for AAV and Lentiviral Vectors: These vectors offer high transduction efficiency and sustained gene expression, making them ideal for treating genetic disorders.

-

Expansion of Non-Viral Delivery Methods: Lipid nanoparticles and electroporation are gaining traction as safer, scalable alternatives to viral vectors, particularly in oncology and rare diseases.

-

CRISPR-Cas Dominance in Gene Editing: CRISPR has outpaced TALENs and ZFNs due to its simplicity, precision, and expanding use in ex vivo and in vivo therapies.

-

Integration of AI in Vector Design: Machine learning algorithms are now used to optimize vector design, improve payload capacity, and reduce off-target effects.

-

Commercialization of Ex Vivo Platforms: Autologous cell-based therapies have moved beyond trials, with commercial launches enhancing accessibility and regulatory clarity.

-

Academic-Industry Collaborations Rising: Institutions are partnering with biopharma firms to co-develop novel delivery mechanisms and expand research pipelines.

-

Focus on Allogeneic Therapies: These off-the-shelf therapies promise reduced costs and faster patient access compared to autologous treatments.

-

Regulatory Advances: The FDA and EMA have introduced accelerated approval pathways for gene therapy products addressing unmet medical needs.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.17 Billion |

| Market Size by 2034 |

USD 11.52 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Platform Type, Application, Delivery Method, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Lonza; BioIT; Autolomous Ltd; Hypertrust Patient Data Care (Part of Accenture); IBM; L7 Informatics Inc.; TrakCel; IDBS; Novartis; SAP SE; DEEP GENOMICS; ElevateBio; Sarepta Therapeutics Inc.; CRISPR Therapeutics; Precision BioSciences; AstraZeneca; Andelyn Biosciences; Renova Therapeutics |

Key Market Driver

Growing Burden of Rare Genetic Disorders

One of the most compelling drivers of the gene therapy platform market is the rising prevalence of rare genetic disorders, many of which lack effective treatments. Disorders such as spinal muscular atrophy (SMA), Duchenne muscular dystrophy, and hemophilia have long posed therapeutic challenges due to their complex genetic underpinnings. Gene therapy offers a curative potential by addressing these disorders at their molecular root cause.

The urgency to treat orphan diseases is amplified by orphan drug legislations and patient advocacy, which push for faster development timelines. For instance, Novartis' Zolgensma, a gene therapy for SMA, has shown life-altering outcomes in infants and underscores the value of robust delivery platforms like AAV. As more gene therapies enter clinical pipelines, demand for reliable and customizable platforms will intensify.

Key Market Restraint

Manufacturing Complexities and High Cost of Production

Despite its promise, gene therapy is hindered by significant manufacturing and scalability challenges. The production of viral vectors, especially AAV and lentivirus, requires highly specialized bioprocessing infrastructure, stringent quality control, and experienced personnel. This results in high capital and operational expenditures, often limiting access for smaller biotech firms.

Moreover, the personalized nature of autologous therapies requires individualized manufacturing, adding to the cost and time burden. Inconsistent yields, purification bottlenecks, and regulatory compliance hurdles further complicate the scenario. These factors collectively constrain the pace of commercial rollout and raise affordability concerns, especially in lower-income regions.

Key Market Opportunity

Rise of Gene Editing in Oncology and Beyond

The gene therapy platform market stands at the cusp of a transformative leap due to the integration of gene editing technologies such as CRISPR-Cas. Initially confined to academic settings, CRISPR is now making inroads into commercial therapeutics, particularly in oncology. Companies are exploring CRISPR-modified T-cell therapies for hematologic malignancies, promising superior specificity and minimal side effects.

In December 2023, the FDA approved the first CRISPR-based therapy for sickle cell disease, opening the floodgates for more applications across infectious diseases, cardiovascular conditions, and metabolic disorders. The adaptability and cost-efficiency of CRISPR, compared to older editing tools like ZFNs, offer a scalable solution that can be customized for diverse patient populations, making it a prime area of investment.

Segmental Analysis

Viral Vector Platforms dominated the gene therapy platform market in 2024. These vectors, particularly AAV and lentivirus, remain the gold standard for gene delivery due to their superior transduction efficiency, tissue tropism, and long-term expression. AAV is especially preferred in treating CNS and ocular disorders, while lentiviruses are integral to hematologic gene therapies. Companies such as Spark Therapeutics and uniQure have leveraged AAV to develop therapies for hemophilia and retinal dystrophy, respectively. However, safety concerns surrounding retroviruses and adenoviruses have somewhat limited their adoption.

Gene Editing Platforms are projected to be the fastest-growing segment by 2030. CRISPR-Cas systems are at the forefront of this surge, driven by a favorable IP landscape and rapid advancements in precision genome engineering. TALENs and ZFNs, although pioneers, are losing ground due to their technical complexity. Nonetheless, academic interest in multiplex editing and base editing ensures continued evolution of this segment. Non-viral vector platforms, especially lipid nanoparticles, also show promise for mRNA delivery and genome targeting.

Application Outlook

Oncology led the application segment in 2024. Cancer remains a major target for gene therapies, especially hematologic malignancies like leukemia and lymphoma. CAR-T cell therapies (e.g., Kymriah, Yescarta) rely on ex vivo gene modification, underlining the role of robust platforms. The potential for combining gene editing with immunotherapy opens new avenues for treatment-resistant cancers. Moreover, glioblastoma and pancreatic cancers are now being explored for gene therapy trials using tumor-specific vectors.

Rare Genetic Disorders are the fastest-growing application area. This surge is driven by increased newborn screening, early diagnosis, and the unmet need for effective treatment options. Therapies like Luxturna and Zolgensma have paved the way for other pipeline candidates targeting conditions like Fabry disease and Tay-Sachs. AAV and CRISPR remain the platforms of choice, with growing use of lipid nanoparticles in CNS-targeted therapies.

Delivery Mode Outlook

In Vivo Gene Therapy held the largest share in 2024. Its appeal lies in the direct administration to target tissues, making it less time-consuming than ex vivo approaches. Ophthalmic and muscular disorders benefit significantly from in vivo delivery due to local accessibility. AAV vectors dominate here due to their non-integrative nature and tropism for neuronal and hepatic tissues.

Ex Vivo Gene Therapy, especially Autologous Cell-Based, is witnessing rapid growth. Used in CAR-T therapies and hematologic disorders, ex vivo methods allow for controlled gene editing, minimizing off-target effects. However, the logistical complexity and cost of autologous therapies have shifted focus toward allogeneic approaches, promising "off-the-shelf" scalability.

End Use Outlook

Pharmaceutical & Biotechnology Companies led in terms of revenue contribution in 2024. These players drive platform innovation, conduct clinical trials, and form strategic alliances with CDMOs for scalable manufacturing. For instance, Pfizer, Novartis, and Bluebird Bio have invested heavily in platform optimization to fast-track product approvals and market entry.

Contract Development & Manufacturing Organizations (CDMOs) are emerging as the fastest-growing end users. With the rise in outsourcing trends, CDMOs like Catalent and Thermo Fisher have expanded their gene therapy capabilities, including vector production and fill-finish services. Their flexible capacity, regulatory expertise, and rapid scalability make them indispensable partners for biotech startups.

Regional Analysis

North America dominated the gene therapy platform market in 2024. The region benefits from a robust biotech ecosystem, significant R&D funding, and a favorable regulatory environment. The U.S. FDA has pioneered accelerated pathways for gene therapies, such as Breakthrough Therapy Designation and RMAT, fostering innovation. High-profile approvals, including CRISPR-based therapeutics for sickle cell disease and beta-thalassemia, underscore North America's leadership. Additionally, collaborations between leading U.S. universities and companies drive platform refinement and early adoption.

Asia Pacific is the fastest-growing region and is rapidly closing the innovation gap. China and South Korea, in particular, have streamlined gene therapy regulations, leading to a boom in clinical trials. Chinese firms like Legend Biotech and JW Therapeutics are developing homegrown therapies while partnering with Western firms to enhance capabilities. Moreover, India's large patient pool, government-led genomics initiatives, and CDMO expansion are turning it into a manufacturing and clinical trial hub.

- Lonza

- BioIT

- Autolomous Ltd

- Hypertrust Patient Data Care (Part of Accenture)

- IBM

- L7 Informatics, Inc.

- TrakCel

- IDBS

- Novartis

- SAP SE

- DEEP GENOMICS

- ElevateBio

- Sarepta Therapeutics, Inc.

- CRISPR Therapeutics

- Precision BioSciences

- AstraZeneca

- Andelyn Biosciences

- Renova Therapeutics

Recent Developments

-

February 2025: CRISPR Therapeutics and Vertex Pharmaceuticals received European Commission approval for their gene-editing therapy, Casgevy, for transfusion-dependent beta-thalassemia.

-

January 2025: Bluebird Bio announced plans to expand its lentiviral vector manufacturing facility in North Carolina, aiming to double output by 2027.

-

November 2024: Thermo Fisher Scientific completed the acquisition of a gene therapy-focused CDMO, ensuring integrated services from development to commercialization.

-

September 2024: Editas Medicine reported positive Phase 1/2 results for EDIT-301, a CRISPR-edited cell therapy targeting sickle cell disease.

-

August 2024: Pfizer launched a global collaboration with a leading AI startup to optimize AAV vector design using generative models.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Platform Type

-

- Adeno-associated Virus (AAV)

- Lentivirus

- Retrovirus

- Adenovirus

- Herpes Simplex Virus (HSV)

- Non-Viral Vector Platforms

-

- Lipid Nanoparticles (LNPs)

- Electroporation & Microinjection Platforms

- Polymer-based Delivery Systems

- Naked DNA/RNA Delivery

-

- CRISPR-Cas Systems

- TALENs

- ZFNs

By Application

- Oncology

- Rare Genetic Disorders

- Cardiovascular Diseases

- Neurological Disorders

- Ophthalmic Diseases

- Hematological Disorders (e.g., Hemophilia, Sickle Cell)

- Musculoskeletal Disorders

- Infectious Diseases (e.g., HIV, COVID-19 adjunct therapies)

By Delivery Mode

- In Vivo Gene Therapy

- Ex Vivo Gene Therapy

-

- Autologous Cell-Based Gene Therapy

- Allogeneic Cell-Based Gene Therapy

- Others (In-situ Gene therapy)

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutions

- Contract Development & Manufacturing Organizations (CDMOs)

- Hospitals & Gene Therapy Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)