Fencing Market Size and Trends

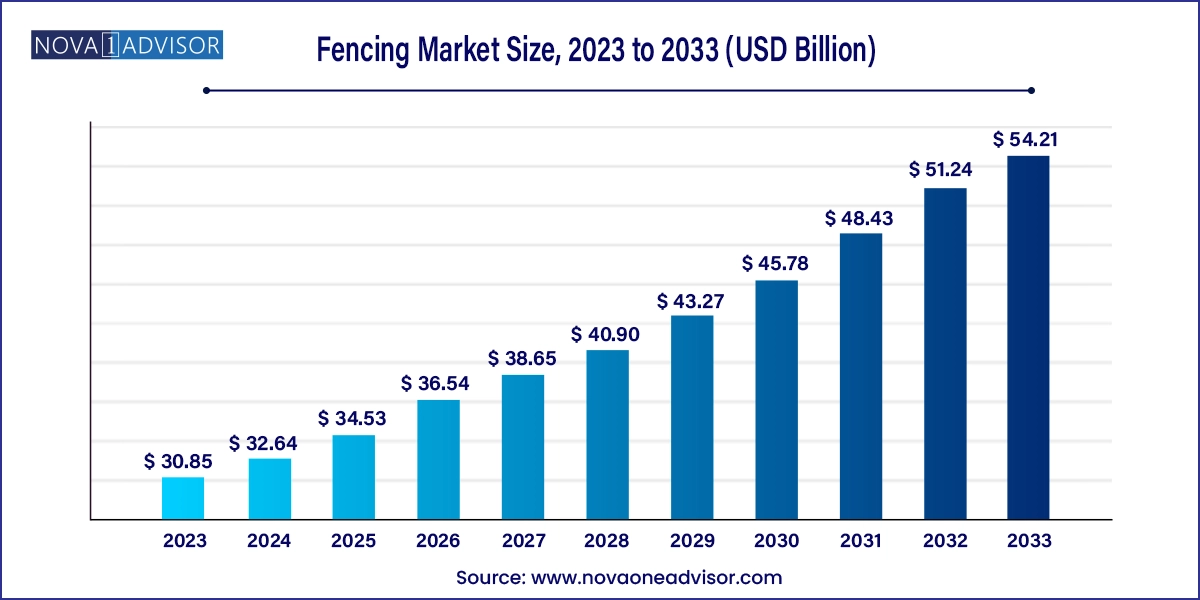

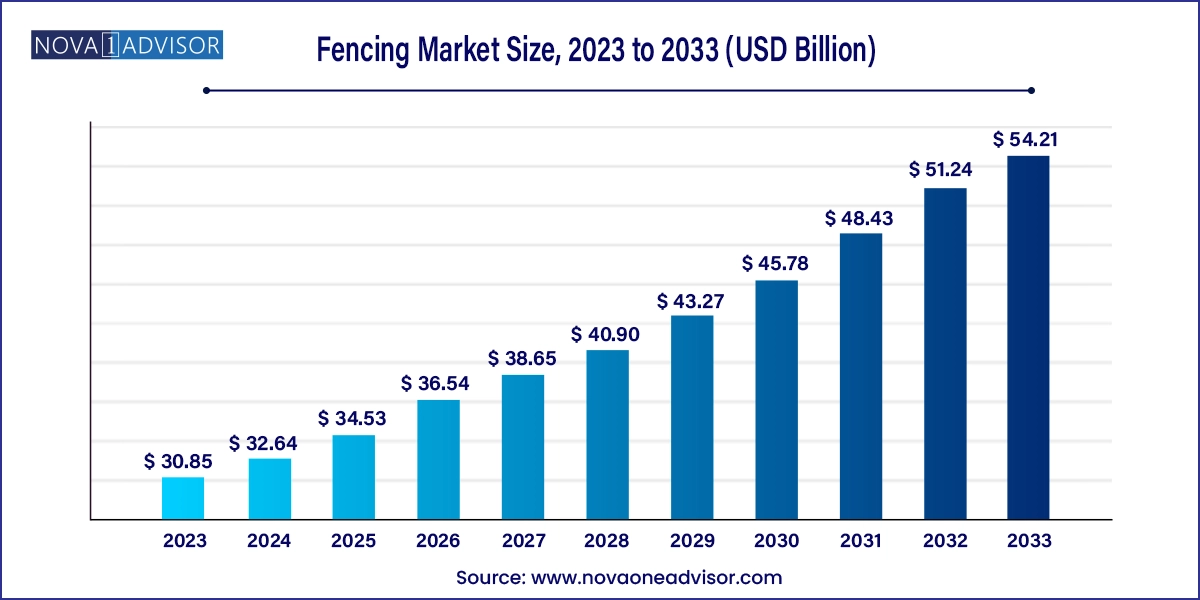

The global fencing market size was exhibited at USD 30.85 billion in 2023 and is projected to hit around USD 54.21 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2024 to 2033.

Fencing Market Key Takeaways:

- The metal segment accounted for the largest revenue share of over 52% in 2023.

- The retail segment accounted for the largest market share in 2023.

- The online segment is expected to register the fastest growth over the forecast period.

- The contractor segment dominated the fencing market in 2023.

- The residential segment led the market in 2023.

- The military & defense segment accounted for the largest market share in 2023.

- North America dominated the fencing market in 2021 with a revenue share of over 34%.

- The Asia Pacific regional market is anticipated to gain traction over the forecast period.

Market Overview

The global fencing market has witnessed a consistent surge in demand due to growing concerns around security, privacy, and property aesthetics across residential, industrial, commercial, and government sectors. Fencing, long seen as a basic boundary tool, has transformed into a dynamic component of architectural design and security systems. The market encompasses a wide range of materials, designs, and technologies that cater to diverse climatic, economic, and cultural contexts across different geographies.

Population growth, urbanization, increasing construction activity, and stricter zoning regulations have driven the fencing industry forward. In many countries, fencing is no longer just about physical demarcation but about style, sustainability, and smart capabilities. A parallel rise in consumer awareness and DIY trends, especially in North America and Europe, continues to fuel innovation in installation and customization options. Governments and enterprises are also investing in security infrastructure, particularly for transport, energy, and defense applications, contributing to the commercial and industrial fencing segments.

Major Trends in the Market

-

Rising preference for low-maintenance, weather-resistant materials such as vinyl, composites, and powder-coated metal.

-

Integration of smart technology and automation in fencing systems, including motion sensors, cameras, and alarms.

-

Increased adoption of fencing in renewable energy facilities, especially in solar and wind farm perimeters.

-

DIY installation kits gaining popularity, especially among residential users in developed countries.

-

Growth in demand for temporary fencing in construction, events, and emergency response.

-

Eco-friendly fencing options made from recycled or biodegradable materials gaining traction.

-

Customizable and decorative fencing becoming a standard expectation in premium residential and hospitality spaces.

-

Rural electrification and animal control fencing driving demand in agricultural zones of developing economies.

Report Scope of Fencing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 32.64 Billion |

| Market Size by 2033 |

USD 54.21 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Installation, Application, Distribution Channel, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Allied Tube & Conduit; Ameristar Fence Products Incorporated; Associated Materials LLC; Bekaert; Betafence NV; CertainTeed Corporation; Gregory Industries, Inc.; Jerith Manufacturing Company Inc.; Long Fence Company Inc.; Ply Gem Holdings Inc.; Poly Vinyl Creations Inc.,The American Fence Company |

Market Driver: Urbanization and Infrastructure Development

A key driver propelling the global fencing market is the rapid urbanization witnessed across developing and developed countries alike. As urban centers expand and new residential communities emerge, the demand for fencing solutions both functional and decorative has grown significantly. Governments and developers are investing heavily in infrastructure projects, including roads, bridges, schools, and transport systems, all of which require secure perimeters.

For instance, large-scale infrastructure programs like China’s Belt and Road Initiative, India’s Smart Cities Mission, and urban regeneration in the EU are fostering demand for industrial and government fencing systems. Even commercial projects like logistics hubs and business parks require extensive boundary demarcation and access control, which is often achieved using metal or concrete fencing with security features.

Market Restraint: Cost Volatility in Raw Materials

The global fencing industry is sensitive to the fluctuating prices of raw materials such as steel, wood, and plastic composites. These fluctuations, driven by geopolitical tensions, supply chain disruptions, and climate events, can significantly affect manufacturing costs and consumer prices. For example, the steel tariffs imposed during international trade conflicts have had ripple effects across multiple markets, causing price hikes and project delays.

Moreover, natural disasters and environmental regulations can restrict the availability of quality timber, leading to increased reliance on engineered or synthetic alternatives. While these alternatives are growing in popularity, their higher base costs and unfamiliarity in some markets still present a challenge. Consequently, market penetration in cost-sensitive regions is often hindered during inflationary periods or commodity shortages.

Market Opportunity: Smart and Modular Fencing Systems

The convergence of fencing with IoT and smart security technologies represents a significant growth opportunity. Smart fences can now be equipped with surveillance cameras, proximity sensors, facial recognition systems, and mobile alerts, offering a high level of protection for both residential and commercial properties. These innovations are especially attractive in urban areas with high crime rates or critical infrastructure sites requiring real-time monitoring.

Modular fencing systems, on the other hand, offer flexibility in installation, customization, and maintenance. These systems are ideal for applications such as temporary barriers at public events or construction sites, where speed and ease of deployment are crucial. Additionally, modularity appeals to customers who frequently renovate or move properties, offering reusability and aesthetic versatility.

Fencing Market By Material Insights

Metal fencing led the market in 2024, due to its durability, strength, and broad applicability in both commercial and government sectors. Steel, aluminum, and wrought iron are widely used in urban, high-security, and infrastructure settings. Metal fences offer high impact resistance, long life, and are available in ornate as well as functional designs. Powder-coating and galvanization technologies have improved their corrosion resistance, making them suitable for diverse climates.

Plastic & composite materials are the fastest growing, fueled by consumer preferences for low-maintenance, eco-friendly options. Vinyl, PVC, and recycled plastic composites offer advantages such as resistance to rust, termites, and UV degradation. Their ability to mimic wood and stone aesthetics without the associated upkeep has driven residential adoption. The environmental sustainability of these materials also aligns with green building certifications, making them popular in urban residential developments.

Fencing Market By Distribution Channel Insights

Retail distribution continues to dominate, particularly in markets like North America and Europe where consumer familiarity and DIY trends are prominent. Home improvement stores, garden centers, and specialized fencing retailers provide a wide range of material options, styles, and installation aids. Retailers have also responded to customization demands by offering modular panels, accessories, and support services that cater to project-specific needs.

Online distribution is growing rapidly, especially post-pandemic, as consumers increasingly prefer digital browsing, virtual consultations, and doorstep delivery. E-commerce platforms offer bundled kits, comparison tools, and even remote installation assistance. Companies are leveraging AR and VR technologies to let customers visualize fencing in their outdoor spaces before purchase. This shift toward digital sales channels is expected to intensify, especially among millennial homeowners and small contractors.

Fencing Market By Installation Insights

Contractor-based installations remain dominant, especially in commercial and government projects where precision, code compliance, and warranty guarantees are paramount. Professional installation ensures the longevity and functionality of fencing systems, particularly in challenging terrains or high-security applications. Contractors often source bulk materials, customize on-site, and manage regulatory approvals, which simplifies the process for clients.

Do-It-Yourself (DIY) is the fastest-growing installation mode, as manufacturers design user-friendly kits that require minimal tools and time. Homeowners, especially in developed markets, are increasingly installing their own fences for gardens, backyards, and pet enclosures. With the aid of video tutorials, online communities, and smart tools, DIY has become both feasible and financially attractive. This segment is witnessing increased innovation in pre-fabrication and tool-free systems.

Fencing Market By Application Insights

The residential sector is the largest application segment, driven by rising demand for privacy, boundary marking, and aesthetic enhancement. Urban housing expansions, backyard renovations, and home security concerns are motivating fence installations. In the U.S., suburban developments and homeowner association (HOA) rules often necessitate fencing, while in Asia, rising middle-class affluence contributes to similar trends.

Agricultural fencing is rapidly growing, especially in emerging economies where livestock containment and crop protection are essential. Rural electrification and governmental subsidies in countries like India and Brazil have enabled farmers to invest in perimeter solutions. Technologies like solar-powered electric fencing, wildlife deterrent systems, and barbed wire enhancements are gaining ground in this category.

Fencing Market By End-use Insights

Government facilities dominated the end-use segment, due to stringent security needs at embassies, schools, transport terminals, and border areas. These projects often demand high-spec metal or concrete fencing, sometimes with surveillance and intrusion detection systems. Government procurement also drives innovation, as suppliers compete on durability, design, and technological integration.

The energy & power segment is among the fastest-growing, with renewable energy installations (solar farms, wind turbines) requiring secure perimeters. Fencing in this segment is expected to withstand harsh conditions and prevent unauthorized access. Electrified fences, smart gates, and even AI-integrated systems are being deployed in these sites to protect high-value infrastructure and personnel.

Fencing Market By Regional Insights

North America held the largest share of the fencing market in 2024, supported by robust demand across residential, commercial, and industrial sectors. The U.S. remains the single largest national market due to its large housing sector, widespread use of fencing for privacy, and extensive security infrastructure. Moreover, the rising trend of home improvement and DIY projects has significantly increased retail and e-commerce fencing activity. Canada also contributes strongly, with its mix of rural fencing needs and urban property development.

Asia Pacific is the fastest growing region, driven by rapid urbanization, infrastructure expansion, and agricultural modernization. Countries like China, India, and Indonesia are heavily investing in smart cities, logistics parks, and transportation corridors—all of which require fencing. The demand in rural areas is boosted by livestock and crop protection needs, while urban consumers focus more on decorative and security-oriented fencing. Government programs aimed at rural safety and housing are acting as further catalysts for market growth in this region.

Fencing Market Recent Developments

-

In April 2024, Betafence Group announced the expansion of its manufacturing facility in Poland to meet rising demand in Eastern Europe.

-

In March 2024, Fortress Building Products introduced a line of bamboo-composite fencing panels for eco-conscious residential customers.

-

In February 2024, Jacksons Fencing (UK) launched a cloud-integrated smart perimeter solution for data centers and airports.

-

In January 2024, CertainTeed partnered with a European startup to co-develop AI-integrated monitoring systems for fencing applications.

-

In December 2023, Merchants Metals released a new series of galvanized security fencing optimized for remote energy installations.

Some of the prominent players in the global fencing market include:

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global fencing market

Material

- Metal

- Wood

- Plastic & Composite

- Concrete

Distribution Channel

Installation

- Do-It-Yourself

- Contractor

Application

- Residential

- Agricultural

- Industrial

End-use

- Government

- Petroleum & Chemicals

- Military & Defense

- Mining

- Energy & Power

- Transport

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA