Healthcare Command Centers Market Size and Growth 2025 to 2034

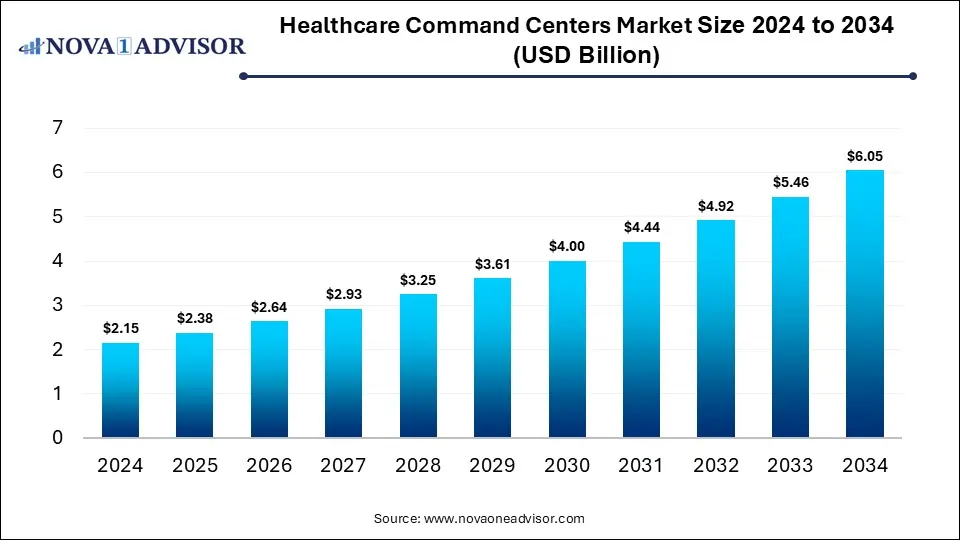

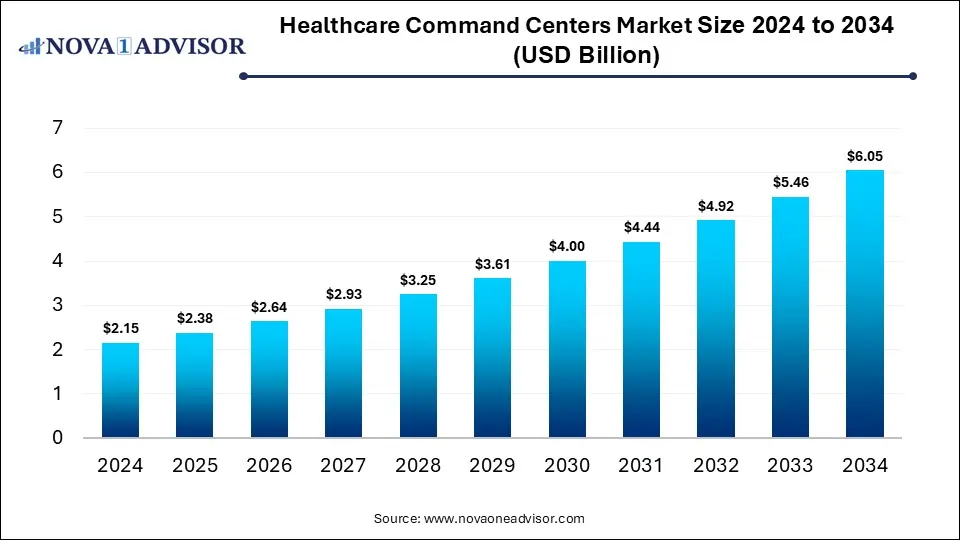

The global healthcare command centers market size was estimated at USD 2.15 billion in 2024 and is expected to reach USD 6.05 billion in 2034, expanding at a CAGR of 10.9% during the forecast period of 2025 and 2034. The market growth is driven by the rising need for real-time hospital operations management, increasing patient volumes, and the adoption of advanced analytics and AI to improve care coordination and resource utilization.

Healthcare Command Centers Market Key Takeaways

- By region, North America held the largest share of the healthcare command centers market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By type, the patient flow command centers segment led the market in 2024.

- By type, the integrated/enterprise-wide command centers segment is expected to expand at the highest CAGR over the projected timeframe.

- By component, the software segment led the market in 2024.

- By component, the services segment is expected to expand at the highest CAGR over the projection period.

- By application, the patient flow & capacity management segment led the market in 2024.

- By end user, the hospitals segment held the dominant share in 2024.

- By deployment mode, the on-premise segment led the market in 2024.

Impact of AI on the Healthcare Command Centers Market

AI is significantly transforming the market by enabling real-time data analysis, predictive insights, and intelligent decision-making. Through machine learning algorithms, AI helps hospitals anticipate patient flow, optimize staff deployment, and manage bed capacity more efficiently. It enhances operational efficiency by automating routine tasks and providing actionable alerts that support faster response times. AI also plays a crucial role in identifying bottlenecks and minimizing delays in care delivery. As hospitals strive for smarter, data-driven systems, AI integration is becoming a key driver of innovation and growth in command center solutions.

Market Overview

The market growth is attributed to the rising healthcare demands, increasing adoption of digital health solutions, and the need for greater efficiency in hospital operations. As health systems face growing pressure to deliver high-quality care with limited resources, command centers are becoming essential for modern, data-driven hospital management. The healthcare command centers market refers to centralized platforms that integrate data, analytics, and operational tools to manage hospital resources, patient flow, and care delivery in real time. These centers offer numerous benefits, including improved coordination across departments, reduced patient waiting times, optimized bed utilization, and faster response to emergencies. They are used in various applications such as capacity management, emergency preparedness, and operational performance monitoring.

- In December 2024, Sahyadri Hospitals, in partnership with Dozee, launched Maharashtra’s first AI-Powered Health Command Centre. This advanced system enables real-time remote monitoring of vital signs, like heart rate, respiration, blood pressure, SPO2, temperature, and ECG, to detect early signs of clinical deterioration. By generating timely alerts for critical cases, it enhances patient safety and enables faster emergency response.

What are the Major Trends in the Healthcare Command Centers Market?

- AI and Predictive Analytics Integration

Healthcare command centers are increasingly incorporating AI and machine learning to forecast patient admissions, optimize staff scheduling, and predict bed availability. This enables more proactive, data-driven decision-making and improves overall hospital efficiency.

- Expansion of Telehealth and Remote Monitoring

Command centers are now being integrated with telehealth platforms to manage virtual care operations and monitor remote patients in real time. This trend supports continuity of care and resource allocation across both in-person and virtual settings.

- Cloud-Based Infrastructure Deployment

Hospitals are shifting from on-premises to cloud-based command center solutions to enable scalability, remote access, and smoother integration with other digital systems. Cloud platforms also enhance data security and support advanced analytics capabilities.

- Focus on Enterprise-Wide Command Centers

Instead of isolated units, healthcare systems are developing enterprise-wide command centers that oversee operations across multiple hospitals or regions. This centralized approach promotes consistency, resource sharing, and coordinated responses during crises like pandemics.

Report Scope of Healthcare Command Centers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.38 Billion |

| Market Size by 2034 |

USD 6.05 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Component, By Application, By End User, By Deployment Mode, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Demand for Real-Time Hospital Operations

Hospitals are under increasing pressure to manage high patient volumes, reduce emergency department congestion, and optimize the use of limited resources. This, in turn, boosts the need for healthcare command centers. Command centers enable real-time visibility into critical operational metrics such as bed availability, patient flow, and staffing, allowing healthcare teams to respond quickly and efficiently. This real-time coordination improves clinical outcomes, reduces delays, and enhances the overall patient experience. As healthcare systems prioritize data-driven decision-making and operational efficiency, the adoption of command centers continues to accelerate.

Need for Cost Optimization and Operational Efficiency

Hospitals and healthcare systems are facing mounting financial pressures due to rising labor costs, resource constraints, and increasing patient demand. Command centers help streamline operations by reducing unnecessary delays, improving staff allocation, and maximizing the use of beds and equipment. This leads to measurable cost savings while maintaining or improving the quality of care. As providers seek to do more with less, the adoption of command centers offers a strategic solution to achieve both financial and clinical performance goals.

Restraint

High Implementation and Maintenance Costs

The market growth is hindered by high costs associated with integration and maintenance of command centers. Establishing a command center requires substantial upfront investment in advanced software, IT infrastructure, hardware, and staff training. For many small or mid-sized hospitals, these costs can be prohibitive, especially without an immediate return on investment. Additionally, ongoing expenses for system upgrades, cybersecurity, and technical support add to the financial burden. These challenges can delay decision-making or limit adoption to only well-funded healthcare systems, slowing broader market expansion.

Opportunity

Growth in Telehealth and Remote Care Coordination

Rising usage of telehealth and need for remote care coordination create immense opportunities in the healthcare command centers market. Command centers play a crucial role in monitoring virtual care operations, managing patient data, and ensuring timely interventions. These centralized platforms enable real-time coordination between in-person and remote care teams, improving continuity of care and resource utilization. With rising demand for home-based care and chronic disease management, command centers are becoming essential for integrating remote monitoring devices, telemedicine platforms, and patient communication tools.

- In October 2024, Medically Home and SCP Health have partnered to provide clinical command center services for hospital-at-home programs. Combining Medically Home’s expertise in decentralized care with SCP’s clinical capabilities, the collaboration offers scalable solutions for health systems to expand inpatient capacity and meet rising demand for home-based hospital care.

Shift Toward Enterprise-Wide Command Systems

There is a rapid shift toward enterprise-wide command systems, which is creating significant opportunities in the market. Unlike single-facility setups, these centralized systems manage operations across multiple hospitals, clinics, and care settings within a health network, enabling standardized processes and shared resources. This approach enhances system-wide visibility, improves care coordination, and reduces redundancies, ultimately leading to better outcomes and lower costs. As large healthcare organizations look to scale their operations and respond more effectively to emergencies or surges in patient volume, enterprise-wide command centers offer a strategic solution

How Macroeconomic Variables Influence the Healthcare Command Centers Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. As national economies strengthen, governments and healthcare providers are more likely to invest in advanced infrastructure, including digital health technologies like command centers. Higher GDP enables greater healthcare spending, which supports the adoption of solutions that improve efficiency, reduce costs, and enhance patient care across health systems.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the healthcare command centers market by, as healthcare providers face rising operational costs and tighter budgets, investments in new technologies like command centers may be delayed or deprioritized. These financial constraints can limit the adoption of advanced systems, particularly in smaller or resource-constrained facilities.

Exchange Rates

Exchange rate fluctuations can negatively affect. Particularly in regions that rely on imported technologies and software. A weaker local currency can increase the cost of foreign hardware, cloud services, and implementation support, making command center investments less affordable. This financial pressure may slow adoption in developing or economically unstable markets.

Segment Outlook

Type Insights

Why Did the Patient Flow Command Centers Segment Lead the Market in 2024?

The patient flow command centers segment led the healthcare command centers market in 2024 due to its critical role in optimizing hospital operations and enhancing patient care. These centers provide real-time visibility into patient admissions, discharges, and transfers, helping hospitals reduce wait times and avoid overcrowding. By streamlining bed management and coordinating staff resources efficiently, patient flow command centers improve overall operational efficiency and patient satisfaction. The increasing demand to manage high patient volumes, especially in emergency departments and during peak periods, further drives the adoption of these systems.

The Integrated/enterprise-wide command centers segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing need for centralized management across multi-hospital systems and large healthcare networks. These integrated platforms enable seamless coordination of resources, patient data, and operational workflows across multiple facilities, improving efficiency and standardizing care delivery. As healthcare organizations face growing complexity and demand for scalability, enterprise-wide solutions provide better visibility and control over regional or system-wide operations. Additionally, advancements in interoperability and cloud-based technologies make integration more feasible and attractive.

Component Insights

How Does the Software Segment Dominate the Healthcare Command Centers Market in 2024?

The software segment dominated the market with the largest share in 2024. This is because of the core of command center functionality, enabling data integration, real-time analytics, and decision support. Software platforms provide essential tools for monitoring patient flow, resource allocation, and operational performance, making them indispensable for effective hospital management. The increasing adoption of AI, machine learning, and predictive analytics within software solutions further enhances their value by enabling proactive interventions and improved outcomes. Additionally, software’s flexibility allows it to be customized and scaled across different healthcare settings, driving widespread adoption.

- In October 2024, GE HealthCare announced a new dashboard tile in the Command Center software that brings together real‑time and historical operational metrics so hospital leaders can get a quick “pulse check” of system bottlenecks. Duke Health is the first customer to adopt it.

The services segment is expected to grow at the fastest CAGR during the projection period, owing to the increasing need for expert support in implementing and managing complex command center solutions. As healthcare providers adopt advanced technologies, they require consulting, integration, training, and ongoing technical support to ensure successful deployment and long-term functionality. The shift toward customized and enterprise-wide command centers further fuels demand for specialized services that can tailor solutions to specific organizational needs. Additionally, the rise of cloud-based and remote care systems requires continuous updates, maintenance, and cybersecurity support, boosting service-related revenue.

Application Insights

Why Did the Patient Flow & Capacity Management Segment Lead the Market in 2024?

The patient flow & capacity management segment led the healthcare command centers market in 2024, due to its critical role in addressing hospital overcrowding and improving operational efficiency. This application enables real-time tracking of patient movements, bed availability, and discharge planning, allowing healthcare providers to optimize patient throughput and reduce delays. With increasing patient volumes and staffing constraints, hospitals rely heavily on these solutions to manage capacity effectively and maintain high-quality care. The segment's dominance is further driven by its proven impact on reducing emergency department wait times and improving resource utilization.

The telehealth & remote care coordination segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing demand for remote patient monitoring and virtual care solutions, especially post-pandemic. Advancements in digital health technologies and the need to reduce hospital visits while maintaining continuous care have accelerated adoption. Additionally, healthcare providers are leveraging command centers to streamline remote care workflows, enhance patient outcomes, and optimize resource allocation.

End User Insights

What Made Hospitals the Dominant Segment in the Market in 2024?

The hospitals segment led the healthcare command centers market in 2024 due to their large-scale need for centralized monitoring and real-time management of patient care, operational efficiency, and resource allocation. Hospitals handle complex workflows and high patient volumes, making command centers essential for improving coordination across departments and enhancing clinical decision-making. The integration of advanced technologies in hospitals allows for better data analytics and predictive insights, which boost patient outcomes and reduce costs. Furthermore, hospitals are increasingly investing in command centers to support emergency response and optimize bed management, solidifying their leading position in the market.

The multi-hospital health systems segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing need for coordinated care and centralized management across multiple facilities. These systems benefit greatly from command centers that enable real-time data sharing, streamlined resource allocation, and unified operational oversight, improving overall efficiency. The drive to enhance patient outcomes and reduce costs across a network of hospitals is pushing adoption. Additionally, as healthcare networks expand, command centers provide critical support for managing capacity, emergency response, and population health management at scale, fueling rapid growth in this segment.

Deployment Mode Insights.

Why Did the On-Premise Segment Lead the Market in 2024?

The on-premise segment led the healthcare command centers market in 2024 due to the preference of healthcare institutions for greater control over data security, system customization, and compliance with regulatory requirements. Many hospitals and large health systems opt for on-premises solutions to maintain direct oversight of sensitive patient information and ensure uninterrupted operations. These deployments offer higher reliability and integration with existing hospital infrastructure, which is critical for real-time decision-making and emergency response. Additionally, the high upfront investment in on-premises systems by established healthcare providers continues to support their dominance in the market despite the growing interest in cloud-based alternatives.

The cloud-based segment is expected to expand at the highest CAGR in the coming years. This is mainly due to its scalability, cost-effectiveness, and ease of implementation across multiple facilities. Cloud-based solutions enable real-time data access, remote monitoring, and seamless integration with other digital health platforms, making them ideal for increasingly connected healthcare environments. As healthcare systems prioritize agility and disaster recovery, cloud deployments offer enhanced flexibility and rapid updates without significant infrastructure investments. Additionally, the rise of telehealth, remote care coordination, and data-driven decision-making is accelerating the demand for cloud-based command centers that support these evolving needs.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the healthcare command centers market while holding the largest share in 2024. The region’s growth is primarily attributed to its advanced healthcare infrastructure and early adoption of cutting-edge technologies. The presence of well-established healthcare systems, strong government initiatives promoting digital health, and significant investments in health IT have fueled market growth. Additionally, the increasing focus on improving patient outcomes, reducing operational costs, and enhancing care coordination drives demand for command center solutions. The U.S., in particular, leads with a high prevalence of chronic diseases and growing telehealth adoption, further solidifying North America’s position as the dominant region in this market.

The U.S. is a major contributor to the North American healthcare command centers market due to its advanced healthcare infrastructure and high adoption of digital health technologies. Strong investments in healthcare IT, supportive government policies, and the presence of numerous leading healthcare providers further bolster market growth. Additionally, the U.S. healthcare system’s focus on improving patient outcomes and operational efficiency through command center solutions plays a key role in its dominant position within the region.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for healthcare command centers. This is due to the increasing healthcare infrastructure development and rising investments in digital health technologies across the region. Rapid urbanization and a growing population are driving demand for more efficient healthcare management and improved patient care. Additionally, governments in countries like China and India are promoting smart healthcare initiatives and expanding telehealth services, which boost the adoption of command centers.

China is a major player in the Asia Pacific healthcare command centers market due to its large population, rapid urbanization, and significant investments in healthcare infrastructure and technology. The Chinese government’s strong focus on digital health initiatives, including telemedicine and smart hospital programs, has accelerated the adoption of command center solutions. Additionally, efforts to improve healthcare access and quality across both urban and rural areas further drive market growth in the country.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 0.9 Million |

5.95% |

Advanced healthcare infrastructure, strong government support, and high digital health adoption |

High initial investment, data privacy concerns |

Dominates due to mature healthcare systems and tech adoption |

| Asia Pacific |

USD 0.6 Million |

7.28% |

Rapid urbanization, increasing healthcare investments, and government initiatives for digital health |

Limited infrastructure in rural areas, regulatory challenges |

Fastest-growing region |

| Europe |

USD 0.5 Million |

9.81% |

Strong healthcare policies, focus on patient outcomes, growing telehealth and remote care |

Stringent regulations, budget constraints |

Steady growth |

| Latin America |

USD 0.2 Million |

3.75% |

Increasing healthcare expenditure, rising awareness of remote care, and improving infrastructure |

Economic challenges, slower tech adoption |

Gradual growth |

| Middle East & Africa |

USD 0.1 Million |

6.5% |

Government investments in healthcare, rising chronic disease prevalence |

Infrastructure gaps, political instability |

Emerging market with steady growth |

Healthcare Command Centers Market Value Chain Analysis

1.Research & Development (R&D)

This stage involves developing innovative technologies, software platforms, and advanced analytics tools for command centers. Companies focus on AI, predictive analytics, workflow optimization tools, and interoperability features to meet the evolving demands of hospitals and health systems.

- Key Players: GE HealthCare, Philips, Siemens Healthineers

2. Technology & Software Development

At this stage, companies develop the core software solutions that power command centers, such as real-time dashboards, patient flow management, and integration platforms. These solutions must be highly scalable, secure, and compatible with existing hospital IT infrastructure (EHRs, IoT devices, etc.).

- Key Players: GE HealthCare, TeleTracking Technologies, Cerner Corporation (Oracle Health), Epic Systems

3. System Integration & Customization

This stage involves tailoring the command center solutions to the specific needs of healthcare organizations, integrating them with existing systems like EMRs, medical devices, and communication platforms. System integrators ensure smooth deployment, user training, and workflow alignment within clinical environments.

- Key Players: IBM Watson Health, Siemens Healthineers, Philips

4. Operations, Monitoring & Maintenance

After deployment, the command centers require continuous monitoring, updates, and support to ensure optimal performance. Service providers offer maintenance contracts, analytics optimization, and real-time support to ensure high uptime and system efficiency.

- Key Players: TeleTracking Technologies, GE HealthCare, Medtronic

5. End Users (Hospitals, Multi-Hospital Systems, Clinics)

End users are the healthcare providers who leverage command center technologies to improve patient care, streamline operations, and manage capacity. They provide valuable feedback to solution providers, influencing future updates and innovation in the ecosystem.

- Key Contributors: Mayo Clinic, Cleveland Clinic, Johns Hopkins Medicine, NHS (UK), Apollo Hospitals (India)

Healthcare Command Centers Market Companies

GE HealthCare is a leading provider of command center platforms, offering advanced real-time analytics and AI-powered tools to improve hospital operations and patient flow. Their command centers are widely implemented in major health systems like Johns Hopkins to drive efficiently, reduce wait times, and enhance care coordination.

Philips provides integrated command center solutions that focus on enterprise monitoring, clinical workflow optimization, and telehealth integration. Their technology helps healthcare providers improve patient outcomes through better decision support and system-wide operational visibility.

- TeleTracking Technologies

TeleTracking specializes in operational command centers, offering solutions for patient flow, capacity management, and resource utilization. Their platform is widely used in large hospitals and multi-facility health systems to reduce bottlenecks and improve patient throughput.

- Cerner Corporation (now Oracle Health)

Cerner, now part of Oracle Health, provides health IT systems that integrate with command centers for real-time data sharing and operational decision-making. Their expertise in electronic health records (EHRs) and cloud infrastructure enhances the functionality and interoperability of command centers.

Siemens Healthineers supports command centers with solutions focused on diagnostics integration, imaging workflow, and enterprise-wide data insights. Their technologies contribute to clinical efficiency and patient safety, particularly in radiology and acute care coordination.

Epic Systems contributes through its integrated EHR platform, which forms a critical backbone for many command center operations. By enabling real-time clinical data access and workflow alignment, Epic enhances communication and decision-making in high-acuity care settings.

- IBM Watson Health (now Merative)

Previously IBM Watson Health, Merative offers AI-driven analytics and cognitive computing capabilities to enhance the intelligence of healthcare command centers. Their solutions enable predictive insights and population health management, supporting proactive care strategies.

Recent Development

- In July 2025, GE Healthcare introduced advanced AI-powered census forecasting and staffing solutions for its Command Center software. Duke Health utilized this platform to predict staffing needs with 95% accuracy, resulting in a reported $40 million reduction in temporary labor costs.

Segments Covered in the Report

By Type

- Operational Command Centers

- Clinical Command Centers

- Patient Flow Command Centers

- Emergency & Disaster Response Command Centers

- Integrated/Enterprise-Wide Command Centers

By Component

- Software

- Hardware

- Services

-

- Implementation Services

- Support & Maintenance

- Consulting & Integration Services

By Application

- Patient Flow & Capacity Management

- Bed Management

- Staff Allocation & Scheduling

- Emergency Response & Crisis Management

- Real-Time Decision Support

- Telehealth & Remote Care Coordination

By End User

- Hospitals

- Multi-Hospital Health Systems

- Ambulatory Surgical Centers

- Specialty Clinics

- Government & Military Health Facilities

By Deployment Mode

- On-Premise

- Cloud-Based

- Hybrid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Healthcare Command Centers Market Size (USD Billion) by Type, 2024–2034

- Table 2: Global Healthcare Command Centers Market Size (USD Billion) by Component, 2024–2034

- Table 3: Global Healthcare Command Centers Market Size (USD Billion) by Application, 2024–2034

- Table 4: Global Healthcare Command Centers Market Size (USD Billion) by End User, 2024–2034

- Table 5: Global Healthcare Command Centers Market Size (USD Billion) by Deployment Mode, 2024–2034

- Table 6: North America Market Size (USD Billion) by Type, 2024–2034

- Table 7: North America Market Size (USD Billion) by Component, 2024–2034

- Table 8: North America Market Size (USD Billion) by Application, 2024–2034

- Table 9: North America Market Size (USD Billion) by End User, 2024–2034

- Table 10: North America Market Size (USD Billion) by Deployment Mode, 2024–2034

- Table 11: U.S. Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 12: Canada Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 13: Mexico Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 14: Europe Market Size (USD Billion) by Type, 2024–2034

- Table 15: Europe Market Size (USD Billion) by Component, 2024–2034

- Table 16: Germany Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 17: France Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 18: UK Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 19: Italy Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 20: Asia Pacific Market Size (USD Billion) by Type, 2024–2034

- Table 21: Asia Pacific Market Size (USD Billion) by Component, 2024–2034

- Table 22: China Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 23: Japan Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 24: India Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 25: South Korea Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 26: Southeast Asia Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 27: Latin America Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 28: Brazil Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 29: Middle East & Africa Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 30: GCC Countries Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 31: Turkey Market Size (USD Billion) by Type, Component & Application, 2024–2034

- Table 32: Africa Market Size (USD Billion) by Type, Component & Application, 2024–2034

List of Figures

- Figure 1: Global Market Share by Type, 2024

- Figure 2: Global Market Share by Component, 2024

- Figure 3: Global Market Share by Application, 2024

- Figure 4: Global Market Share by End User, 2024

- Figure 5: Global Market Share by Deployment Mode, 2024

- Figure 6: North America Market Share by Type, 2024

- Figure 7: North America Market Share by Component, 2024

- Figure 8: North America Market Share by Application, 2024

- Figure 9: North America Market Share by End User, 2024

- Figure 10: North America Market Share by Deployment Mode, 2024

- Figure 11: U.S. Market Share by Type, 2024

- Figure 12: U.S. Market Share by Component, 2024

- Figure 13: U.S. Market Share by Application, 2024

- Figure 14: Canada Market Share by Type, 2024

- Figure 15: Canada Market Share by Component, 2024

- Figure 16: Canada Market Share by Application, 2024

- Figure 17: Mexico Market Share by Type, 2024

- Figure 18: Mexico Market Share by Component, 2024

- Figure 19: Mexico Market Share by Application, 2024

- Figure 20: Europe Market Share by Type, 2024

- Figure 21: Europe Market Share by Component, 2024

- Figure 22: Germany Market Share by Type, 2024

- Figure 23: Germany Market Share by Component, 2024

- Figure 24: France Market Share by Type, 2024

- Figure 25: France Market Share by Component, 2024

- Figure 26: UK Market Share by Type, 2024

- Figure 27: UK Market Share by Component, 2024

- Figure 28: Italy Market Share by Type, 2024

- Figure 29: Italy Market Share by Component, 2024

- Figure 30: Asia Pacific Market Share by Type, 2024

- Figure 31: Asia Pacific Market Share by Component, 2024

- Figure 32: China Market Share by Type, 2024

- Figure 33: China Market Share by Component, 2024

- Figure 34: Japan Market Share by Type, 2024

- Figure 35: Japan Market Share by Component, 2024

- Figure 36: India Market Share by Type, 2024

- Figure 37: India Market Share by Component, 2024

- Figure 38: South Korea Market Share by Type, 2024

- Figure 39: South Korea Market Share by Component, 2024

- Figure 40: Southeast Asia Market Share by Type, 2024

- Figure 41: Southeast Asia Market Share by Component, 2024

- Figure 42: Latin America Market Share by Type, 2024

- Figure 43: Latin America Market Share by Component, 2024

- Figure 44: Brazil Market Share by Type, 2024

- Figure 45: Brazil Market Share by Component, 2024

- Figure 46: Middle East & Africa Market Share by Type, 2024

- Figure 47: Middle East & Africa Market Share by Component, 2024

- Figure 48: GCC Countries Market Share by Type, 2024

- Figure 49: GCC Countries Market Share by Component, 2024

- Figure 50: Turkey Market Share by Type, 2024

- Figure 51: Turkey Market Share by Component, 2024

- Figure 52: Africa Market Share by Type, 2024

- Figure 53: Africa Market Share by Component, 2024