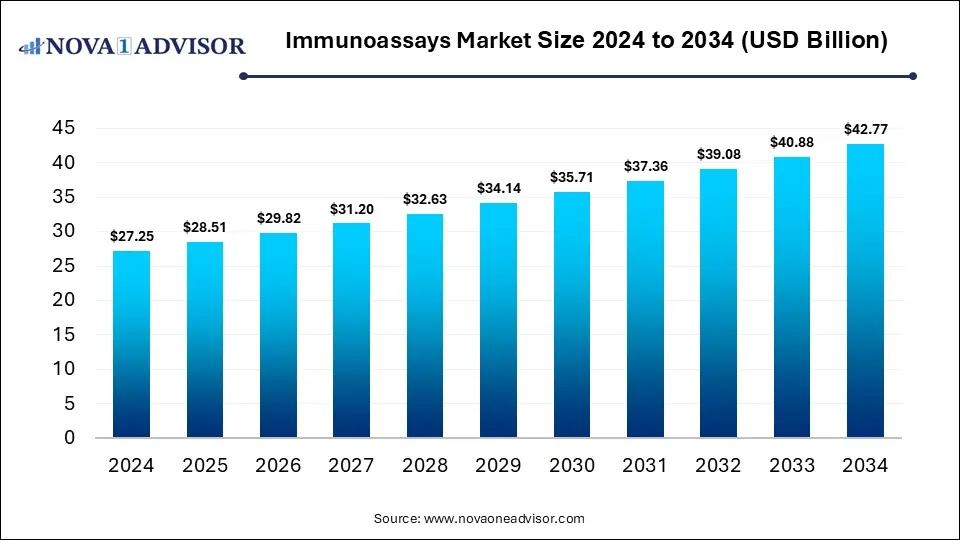

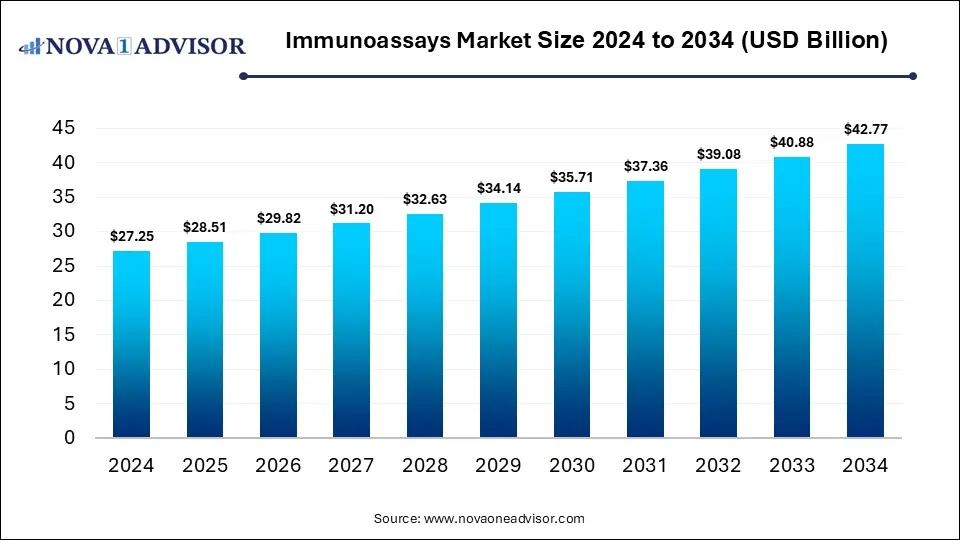

Immunoassays Market Size and Growth 2025 to 2034

The global immunoassays market size was estimated at USD 27.25 billion in 2024 and is expected to reach USD 42.77 billion in 2034, expanding at a CAGR of 4.62% during the forecast period of 2025 and 2034. The market growth is driven by the rising prevalence of chronic and infectious diseases, increasing demand for early and accurate diagnostics, technological advancements in assay platforms, and the expansion of healthcare infrastructure worldwide.

Immunoassays Market Key Takeaways

- By region, North America held the largest share of the immunoassays market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product, the reagents & kits segment led the market in 2024.

- By product, the analyzers segment is expected to expand at the highest CAGR over the projected timeframe.

- By technology, the ELISA segment led the market in 2024.

- By technology, the chemiluminescence immunoassay segment is expected to expand at the highest CAGR over the projection period.

- By application, the infectious diseases segment led the market in 2024.

- By end user, the hospitals & clinics segment led the market in 2024.

- By specimen type, the blood segment led the market in 2024.

Impact of AI on the Immunoassays Market

Artificial intelligence is increasingly transforming the immunoassays market by enhancing assay design, data interpretation, and operational efficiency. AI-driven algorithms enable faster and more accurate analysis of complex datasets, improving diagnostic precision and reducing false positives or negatives. In laboratory workflows, AI supports automation, predictive maintenance, and quality control, thereby optimizing throughput and resource utilization. Moreover, the integration of AI with digital immunoassay platforms facilitates real-time monitoring, remote diagnostics, and personalized medicine applications. Overall, AI is shifting immunoassays from manual, batch-based processes toward intelligent, connected, and data-driven diagnostic ecosystems.

Market Overview

The market growth is driven by the rising prevalence of chronic and infectious diseases, increasing demand for early and accurate diagnostics, technological advancements in assay platforms, and expanding healthcare infrastructure worldwide. The versatility, reliability, and efficiency of immunoassays make them a cornerstone of modern medical testing and research. The immunoassays market involves the use of biochemical tests that measure the presence or concentration of analytes, such as proteins, hormones, or antibodies, through antigen-antibody interactions. These assays offer high sensitivity, specificity, and rapid results, making them indispensable in diagnostics, drug development, and disease monitoring. They are widely applied in detecting infectious diseases, chronic conditions, cancer biomarkers, and for pharmacodynamic studies in clinical research.

What are the Major Trends in the Immunoassays Market?

- Adoption of Point-of-Care Immunoassays

Point-of-care (POC) immunoassays are gaining traction as they allow rapid diagnostics outside conventional laboratories, enabling immediate clinical decision-making. This trend is driven by the growing demand for decentralized testing in hospitals, clinics, and remote locations.

- Integration of Artificial Intelligence (AI) and Machine Learning

AI is increasingly being applied to immunoassay data analysis to enhance accuracy, reduce human error, and predict disease progression. Machine learning algorithms can process complex biomarker patterns, improving personalized diagnostics and treatment strategies.

- Shift Toward High-Sensitivity and Ultra-Sensitive Assays

There is a growing demand for ultra-sensitive immunoassays capable of detecting low-abundance biomarkers. This trend is fueled by the need for early disease detection, especially in oncology, infectious diseases, and neurodegenerative disorders.

- Expansion into Emerging Markets

Emerging regions such as Asia-Pacific, the Middle East, and Latin America are witnessing increased adoption of immunoassays. Factors like improving healthcare infrastructure, rising disease prevalence, and increasing awareness of advanced diagnostics contribute to market growth in these regions.

Report Scope of Immunoassays Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 28.51 Billion |

| Market Size by 2034 |

USD 42.77 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 4.61% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Technology, By Application, By End User, By Specimen Type, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Rising Prevalence of Infectious and Chronic Diseases

The rising prevalence of infectious and chronic diseases is a key driver of growth in the immunoassays market, as it significantly increases the demand for accurate and rapid diagnostic tools. Conditions such as HIV, hepatitis, tuberculosis, diabetes, and cancer require continuous monitoring and early detection, areas where immunoassays play a crucial role due to their high sensitivity and specificity. The growing global burden of these diseases has prompted healthcare systems to adopt immunoassay-based diagnostic platforms for large-scale screening and patient management. Furthermore, the increased focus on early diagnosis and preventive healthcare has fueled investments in immunoassay development, driving innovation and wider market adoption.

- According to the National Library of Medicine, Regulatory approvals of rapid immunoassay kits and high-throughput platforms by agencies like the FDA and CE mark certifications have accelerated adoption in clinical settings.

Growing Use in Therapeutic Drug Monitoring and Biomarker Detection

The growing use of immunoassays in therapeutic drug monitoring and biomarker detection is significantly driving the growth of the immunoassays market. These assays enable precise measurement of drug concentrations in patients, ensuring optimal dosing and minimizing adverse effects, critical for managing chronic conditions, such as cancer, autoimmune diseases, and cardiovascular disorders. Additionally, the expanding field of biomarker-based diagnostics in personalized medicine is boosting demand for immunoassays, as they help identify disease progression and treatment response. Pharmaceutical and biotechnology companies are increasingly integrating immunoassay technologies into drug discovery and clinical trials to enhance accuracy and efficiency.

- In December 2023, the first FDA-approved CDx was an immunoassay for HER2 protein expression, guiding treatment for breast cancer.

Restraints

High Cost of Advanced Immunoassays Analyzer

Market growth is constrained by the high costs associated with advanced immunoassay systems, which require substantial capital investment along with ongoing expenses for maintenance, calibration, and consumables. These financial barriers make adoption challenging for small and mid-sized laboratories and healthcare facilities. In developing regions, limited healthcare budgets and inadequate reimbursement structures further impede uptake. Additionally, the incorporation of advanced features, such as automation, multiplexing, and high-throughput capabilities, adds to overall system costs, restricting market penetration.

Stringent Regulatory Requirements

The market is also hindered by complex and time-intensive regulatory approval processes administered by agencies such as the FDA and EMA. New immunoassay products must meet rigorous standards for accuracy, safety, and reproducibility, requiring extensive clinical validation and detailed documentation. These regulatory challenges elevate development costs and can discourage smaller companies or startups from market entry. As a result, innovation cycles slow, and market expansion is particularly constrained in regions with stringent regulatory frameworks.

Opportunities

Development of Multiplex and Digital Immunoassays

The rising development of multiplex and digital immunoassays creates immense opportunities in the market. These immunoassays allow simultaneous detection of multiple biomarkers in a single test, increasing efficiency and reducing sample and reagent usage. Digital immunoassays enhance sensitivity, accuracy, and data analysis, enabling earlier disease detection and better patient monitoring. These technological advancements cater to the growing demand for personalized medicine and point-of-care diagnostics.

- In September 2025, Beckman Coulter Diagnostics, a Danaher company, launched the industry’s first fully automated Brain-derived Tau (BD-Tau) research-use-only immunoassay. Available on the DxI 9000 and Access 2 Analyzers, this assay expands Beckman Coulter’s neurodegenerative disease portfolio, which also includes p-Tau217, NfL, GFAP, and APOE ε4, enabling advanced precision medicine research on clinical-grade platforms.

Rising Investment in Infectious Disease Research

Significant market opportunities also lie in infectious disease research, where increased funding from governments, healthcare organizations, and private institutions is driving the development of advanced immunoassay technologies for rapid and accurate pathogen detection. The heightened focus on infectious diseases, especially amid global outbreaks and pandemics, has accelerated demand for diagnostic solutions that enable early detection, disease monitoring, and vaccine development. Consequently, immunoassays are becoming increasingly integrated into both research and clinical settings, broadening their applications across diverse therapeutic areas.

How Macroeconomic Variables Influence the Immunoassays Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. increasing healthcare spending and enabling investments in advanced diagnostic technologies. Higher economic stability allows governments and private institutions to expand laboratory infrastructure and adopt innovative testing solutions. Consequently, regions with strong economic growth witness faster market adoption and higher demand for immunoassay products.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the immunoassays market by increasing production, distribution, and procurement costs for diagnostic reagents and instruments. Rising prices limit accessibility, particularly in developing regions with constrained healthcare budgets. As a result, hospitals and laboratories may delay equipment upgrades or testing expansions, slowing overall market growth.

Exchange Rates

Exchange rate fluctuations can negatively affect the cost of imported reagents, instruments, and raw materials. A weaker local currency increases the expense of foreign-manufactured diagnostic products, leading to higher prices for healthcare providers and laboratories. This volatility can disrupt supply chains and hinder market expansion, especially in regions reliant on imports.

Segment Outlook

Product Insights

Why Did the Reagents & Kits Segment Dominate the Immunoassays Market in 2024?

The reagents & kits segment dominated the market with the largest share in 2024. This is due to their essential and recurring use in diagnostic testing across hospitals, research laboratories, and diagnostic centers. These kits are vital for detecting a wide range of biomarkers, including infectious diseases, hormones, and oncology markers, which ensures steady demand. Their ease of use, high sensitivity, and compatibility with automated analyzers make them a preferred choice for reliable and rapid testing.

The analyzers segment is expected to grow at the fastest CAGR during the projection period, driven by the increasing adoption of automation and high-throughput testing in clinical laboratories. These instruments improve accuracy, reduce human error, and greatly shorten turnaround times, making them very appealing for hospitals, diagnostic labs, and research centers. The rising demand for quick and large-scale disease screening, especially during infectious disease outbreaks and chronic disease monitoring, further boosts adoption. Technological advances, such as integration with AI and digital data management, also fuel growth by enabling more efficient and precise biomarker analysis.

Immunoassays Market By Product, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Reagents & Kits |

18.26 |

19.04 |

19.86 |

20.72 |

21.61 |

22.54 |

23.51 |

24.52 |

25.58 |

26.68 |

27.82 |

| Analyzers/Instruments |

7.63 |

7.9 |

8.17 |

8.46 |

8.75 |

9.05 |

9.36 |

9.68 |

10.01 |

10.35 |

10.7 |

| Software & Services |

1.36 |

1.57 |

1.79 |

2.03 |

2.29 |

2.56 |

2.86 |

3.18 |

3.52 |

3.89 |

4.28 |

Technology Insights

Why Did the ELISA Segment Lead the Market in 2024?

The ELISA segment led the immunoassays market in 2024 due to the high accuracy, reliability, and versatility in detecting a wide range of analytes, including hormones, antibodies, and infectious agents. Its cost-effectiveness and established protocols make it the preferred choice for hospitals, diagnostic laboratories, and research institutions worldwide. ELISA’s ability to provide quantitative and qualitative results with minimal sample volume further enhances its widespread adoption. Additionally, continuous advancements in automated ELISA platforms have improved throughput and efficiency, solidifying their leading position in the market.

- In December 2024, Bio-Techne introduced the ESR1 Mutation Monitoring Assay for detecting mutations in metastatic breast cancer.

The chemiluminescence immunoassay segment is expected to expand at the highest CAGR in the coming years. This is mainly due to superior sensitivity and specificity compared to traditional methods like ELISA. CLIA enables rapid, automated, high-throughput testing, making it highly suitable for modern clinical laboratories that require efficient, accurate diagnostics. Its ability to detect low-abundance biomarkers supports early disease diagnosis, particularly in oncology, infectious diseases, and endocrinology. Technological advancements, including integration with digital data analysis and AI-driven interpretation, are further enhancing its adoption.

Application Insights.

Why Did the Infectious Diseases Segment Lead the Market in 2024?

The infectious diseases segment led the immunoassays market in 2024, due to the high global prevalence of infections such as HIV, hepatitis, and tuberculosis. Immunoassays are critical for rapid, accurate, and large-scale detection of pathogens, which is essential for disease management apps and outbreak control. Hospitals, diagnostic laboratories, and public health programs rely heavily on these assays to monitor, prevent, and treat infectious diseases effectively. The continuous development of high-sensitivity and point-of-care immunoassays has further strengthened this segment’s market position.

The endocrinology & hormonal disorders segment is expected to expand at the highest CAGR in the coming years. This is primarily due to the rising prevalence of diabetes, thyroid disorders, and reproductive health issues worldwide. Immunoassays are highly effective for accurate hormone level measurement, enabling early diagnosis and personalized treatment plans. Increasing awareness among healthcare providers and patients about the importance of regular hormonal monitoring is boosting adoption in hospitals and diagnostic labs. Technological advancements, such as automated and high-throughput immunoassay platforms, are making hormone testing faster and more reliable.

End User Insights

Why Did the Hospitals & Clinics Segment Dominate the Immunoassays Market in 2024?

The hospitals & clinics segment dominated the market with the largest share in 2024. This is because of high testing volume and the central role in patient diagnostics. Hospitals and clinics conduct routine and specialized immunoassay tests for infectious diseases, chronic conditions, oncology, and hormonal disorders, ensuring consistent demand for reagents and instruments. Their access to advanced laboratory infrastructure, skilled personnel, and automated analyzers enables efficient, accurate testing. Additionally, hospitals often serve as the primary point of care for both inpatients and outpatients, driving widespread adoption of immunoassay technologies.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR over the projection period, driven by the increasing use of immunoassays in drug discovery, vaccine development, and clinical trials. These companies rely on immunoassays for biomarker identification, pharmacodynamic studies, and therapeutic monitoring, which are critical for developing new drugs and biologics. The growing focus on precision medicine and personalized therapies further drives the demand for high-sensitivity and multiplex immunoassays. Additionally, rising investments in R&D and the expansion of biopharmaceutical pipelines globally are accelerating adoption in the market.

Immunoassays Market By End User, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Hospitals & Clinics |

10.36 |

10.78 |

11.21 |

11.67 |

12.14 |

12.64 |

13.15 |

13.68 |

14.24 |

14.81 |

15.41 |

| Diagnostic Laboratories |

9.26 |

9.72 |

10.2 |

10.7 |

11.23 |

11.78 |

12.36 |

12.97 |

13.61 |

14.28 |

14.98 |

| Research & Academic Institutes |

4.36 |

4.53 |

4.71 |

4.9 |

5.09 |

5.29 |

5.5 |

5.72 |

5.94 |

6.18 |

6.42 |

| Pharmaceutical & Biotechnology Companies |

3.27 |

3.48 |

3.7 |

3.93 |

4.18 |

4.44 |

4.72 |

5.01 |

5.32 |

5.65 |

5.99 |

Specimen Type Insights

Why Did the Blood Segment Lead the Market in 2024?

The blood segment led the immunoassays market in 2024, driven by high biomarker concentrations and the reliability of these assays for accurate disease detection. Blood samples are widely used in diagnosing infectious diseases, hormonal disorders, cardiac conditions, and oncology biomarkers, making them the most preferred specimen type in clinical and research settings. Hospitals, diagnostic laboratories, and research institutions favor blood-based immunoassays for their consistency, reproducibility, and well-established testing protocols.

- In January 2025, bioMérieux acquired SpinChip Diagnostics, gaining access to a new platform that provides rapid, 10-minute whole-blood immunoassay results at near-patient testing sites.

The saliva segment is expected to expand at the highest CAGR in the coming years. This is primarily due to its non-invasive and easy-to-collect nature, making it highly suitable for point-of-care testing and home-based diagnostics. Saliva-based immunoassays are increasingly used for hormone monitoring, infectious disease screening, and drug testing, reducing the need for blood draws and improving patient compliance. The growing demand for rapid, convenient, and patient-friendly diagnostic solutions in telehealth and preventive healthcare is driving adoption. Advances in assay sensitivity and analytical techniques have improved the accuracy of saliva-based tests, further fueling growth.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America maintained dominance in the immunoassays market, accounting for the largest share in 2024. The region’s growth is primarily attributed to advanced healthcare infrastructure, high healthcare expenditure, and widespread adoption of cutting-edge diagnostic technologies. The region benefits from a strong presence of key immunoassay manufacturers and research institutions, enabling rapid innovation and product launches. Government initiatives, such as disease screening programs and public health monitoring, further support the extensive use of immunoassays. Additionally, high awareness among healthcare providers and patients regarding early disease detection drives consistent demand.

The U.S. is a major contributor to the North American immunoassays market due to the advanced healthcare system, high healthcare expenditure, and extensive clinical diagnostics infrastructure. The country hosts a significant number of key immunoassay manufacturers and research institutions, driving innovation and widespread adoption of advanced testing technologies. Additionally, strong government initiatives for disease screening, early diagnosis, and public health monitoring further bolster the market.

- In January 2025, Roche received FDA clearance for its updated Tina-quant Lipoprotein(a) Gen. 2 Molarity assay, which is the first U.S. test to measure Lp(a) in molar units.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for immunoassays. This is due to rapid healthcare modernization, expanding diagnostic infrastructure, and increasing rates of chronic and infectious diseases. Rising investments in hospitals, laboratories, and automated diagnostic systems are enhancing access to advanced immunoassay technologies. Growing awareness about early disease detection and preventive healthcare is boosting demand among patients and healthcare providers. Additionally, emerging economies like China and India are seeing increased adoption of high-throughput and point-of-care immunoassays.

China is a major player in the Asia Pacific immunoassays market due to its rapidly growing healthcare infrastructure, large patient population, and increasing prevalence of chronic and infectious diseases. Significant government investments in healthcare modernization and disease screening programs are driving the adoption of advanced immunoassay technologies. Additionally, rising awareness about early diagnosis and preventive healthcare, along with expanding R&D initiatives in diagnostics, further reinforce China’s position as the fastest-growing market in the region.

What Makes Europe a Significantly Growing Area?

Europe is expected to see significant growth in the market due to its well-developed healthcare infrastructure, high healthcare spending, and widespread adoption of advanced diagnostic technologies. Hospitals and laboratories in the region have access to automated, high-throughput immunoassay systems, ensuring accurate and efficient testing for infectious diseases, cancer, and hormonal disorders. Additionally, increasing awareness of preventive healthcare and early disease detection among patients and healthcare providers supports steady market demand. Strong government regulations and initiatives for disease screening programs further enhance the adoption of immunoassays.

Germany is a key player in the European immunoassays market due to its advanced healthcare system, strong diagnostic infrastructure, and high adoption of innovative immunoassay technologies. The country makes significant investments in hospitals, laboratories, and research institutions, supporting widespread use of immunoassays for infectious diseases, oncology, and hormonal disorders. Additionally, government initiatives that promote early disease detection and preventive healthcare, along with increasing R&D activities, drive market growth.

Region-Wise Market Outlook

| Region |

Approximate Market Size in 2024 |

Projected CAGR (next 5-10 years) |

Major Growth Factors |

Key Restraints / Challenges |

Growth Overview |

| North America |

USD 11.3 Billion |

5.89% |

Advanced healthcare infrastructure, high adoption of automated immunoassays, strong R&D presence |

High cost of advanced instruments and reagents |

Dominant region |

| Asia-Pacific |

USD 8.0 Billion in 2024

|

Highest CAGR 6.98% |

Rapid healthcare modernization, increasing disease prevalence, and expanding diagnostic infrastructure |

Limited access in rural areas, budget constraints in emerging economies |

Region with the fastest growth |

| Europe |

Roughly USD 6.4 Billion

|

Moderate to strong CAGR 9.86% |

Well-established healthcare systems, high awareness of preventive healthcare |

Stringent regulatory requirements and reimbursement challenges |

Significant growth |

| Latin America |

USD 2.2 Billion |

4.58% |

Improving healthcare access, growing diagnostic awareness, and investments in laboratories |

Economic disparities, limited infrastructure in remote regions |

Emerging growth |

| Middle East & Africa |

USD 1.4 Billion |

3.3% |

Rising prevalence of infectious diseases, increasing healthcare investments |

Limited healthcare infrastructure, economic challenges |

Gradual growth |

Immunoassays Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves developing novel immunoassay technologies, biomarkers, and assay platforms to improve sensitivity, specificity, and throughput.

- Key players include: Thermo Fisher Scientific, Abbott Laboratories, and Roche Diagnostics.

2. Manufacturing & Production

In this stage, reagents, kits, and instruments are produced at scale while ensuring quality and compliance with regulatory standards.

Companies like Siemens Healthineers, Bio-Rad Laboratories, and Beckman Coulter lead in manufacturing high-quality immunoassay products for global distribution.

3. Distribution & Supply Chain

This stage focuses on delivering immunoassays to hospitals, diagnostic laboratories, and research institutions efficiently.

- Key players: Cardinal Health, McKesson Corporation, and GE Healthcare.

Immunoassays Market Companies

- Thermo Fisher Scientific – Thermo Fisher provides a comprehensive portfolio of immunoassay reagents, kits, and automated analyzers, supporting clinical diagnostics and research applications globally. The company invests heavily in R&D to introduce innovative immunoassay technologies that enhance sensitivity and throughput.

- Roche Diagnostics – Roche is a leading player offering high-quality immunoassay instruments, reagents, and testing platforms for hospitals, laboratories, and pharmaceutical research. Its strong focus on automation and digital integration ensures accurate and efficient diagnostics, reinforcing its market dominance.

- Abbott Laboratories – Abbott develops advanced immunoassay platforms, including point-of-care and laboratory-based solutions, for infectious diseases, oncology, and hormonal testing. The company emphasizes innovation, reliability, and rapid diagnostics, driving adoption across clinical and research settings.

- Siemens Healthineers – Siemens provides a range of immunoassay analyzers, reagents, and diagnostic solutions with high throughput and accuracy. Its global presence and strong service network support widespread adoption in hospitals and laboratories.

- Bio-Rad Laboratories – Bio-Rad specializes in immunoassay kits, reagents, and quality control solutions for clinical diagnostics and life sciences research. Its focus on high-quality and validated products enhances precision and reliability in diagnostic testing.

- Beckman Coulter – Beckman Coulter offers immunoassay analyzers, reagents, and automation solutions for clinical laboratories and research institutions. The company supports efficiency and accuracy with scalable solutions and comprehensive after-sales services.

- GE Healthcare – GE Healthcare provides immunoassay analyzers and reagents that integrate advanced imaging and diagnostic technologies. Its solutions focus on enhancing laboratory workflows and improving diagnostic outcomes worldwide.

- DiaSorin S.p.A. – DiaSorin develops innovative immunoassay kits and analyzers for infectious diseases, oncology, and autoimmune disorders. Its strong R&D capabilities ensure high sensitivity and specificity, boosting its adoption in clinical diagnostics.

Recent Developments

- In January 2025, Anbio Biotechnology launched the Dry CLIA Solution ADL-1000, offering a fast and cost-effective Dry Chemiluminescence Immunoassay (CLIA) platform for various clinical settings.

- In July 2025, Bio-Techne partnered to distribute Spear Bio's ultrasensitive immunoassays for low-abundance neurological biomarkers, crucial for Alzheimer's disease research.

- In January 2024, Fujirebio and Agappe, they announced a collaboration to advance their Contract Development and Manufacturing Organization (CDMO) strategy in CLIA-based immunoassays.

- In July 2024, Beckman Coulter Diagnostics has launched the DxC 500i Clinical Analyzer, a fully integrated clinical chemistry and immunoassay system designed to enhance operational efficiency across networked laboratories. Leveraging Beckman Coulter’s common reagents and consumables, the DxC 500i delivers commutable patient results, enabling consistent performance, streamlined inventory management, and improved patient care across core, satellite, and independent lab settings.

Segments Covered in the Report

By Product

- Reagents & Kits

- Analyzers/Instruments

- Software & Services

By Technology

- ELISA

- Rapid Tests

- Chemiluminescence Immunoassay (CLIA)

- Radioimmunoassay (RIA)

- Fluorescence Immunoassay (FIA)

By Application

- Infectious Diseases

- Oncology

- Cardiology

- Autoimmune Disorders

- Endocrinology & Hormonal Disorders

- Toxicology & Drug Testing

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Research & Academic Institutes

- Pharmaceutical & Biotechnology Companies

By Specimen Type

- Blood

- Urine

- Saliva

- Other Fluids

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa