Investigational New Drug CDMO Market Size and Forecast 2024 to 2033

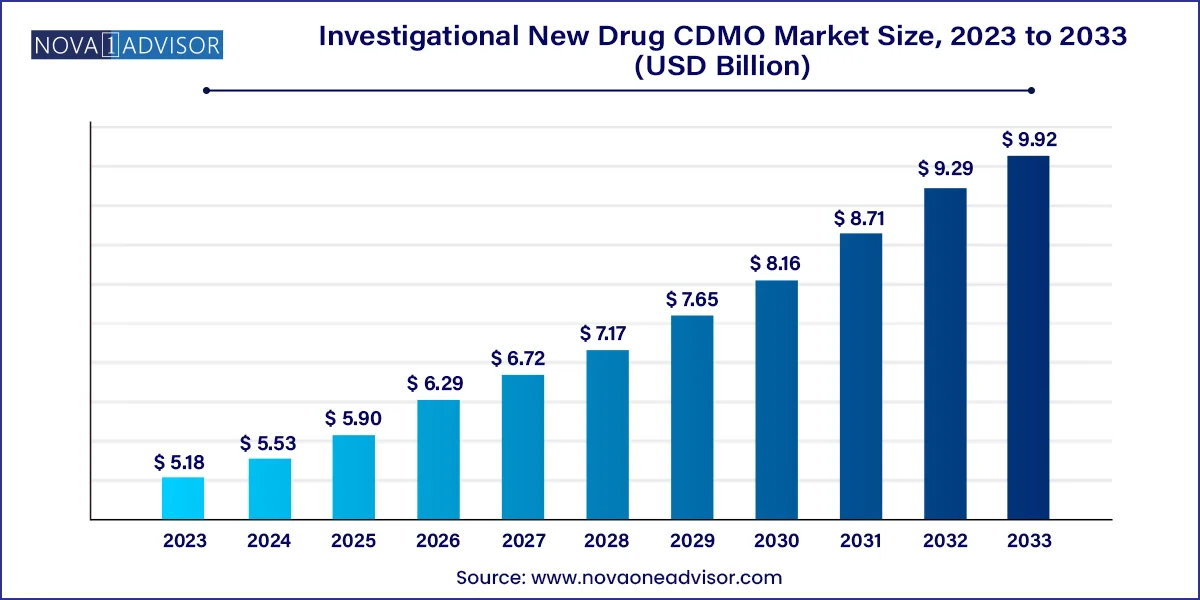

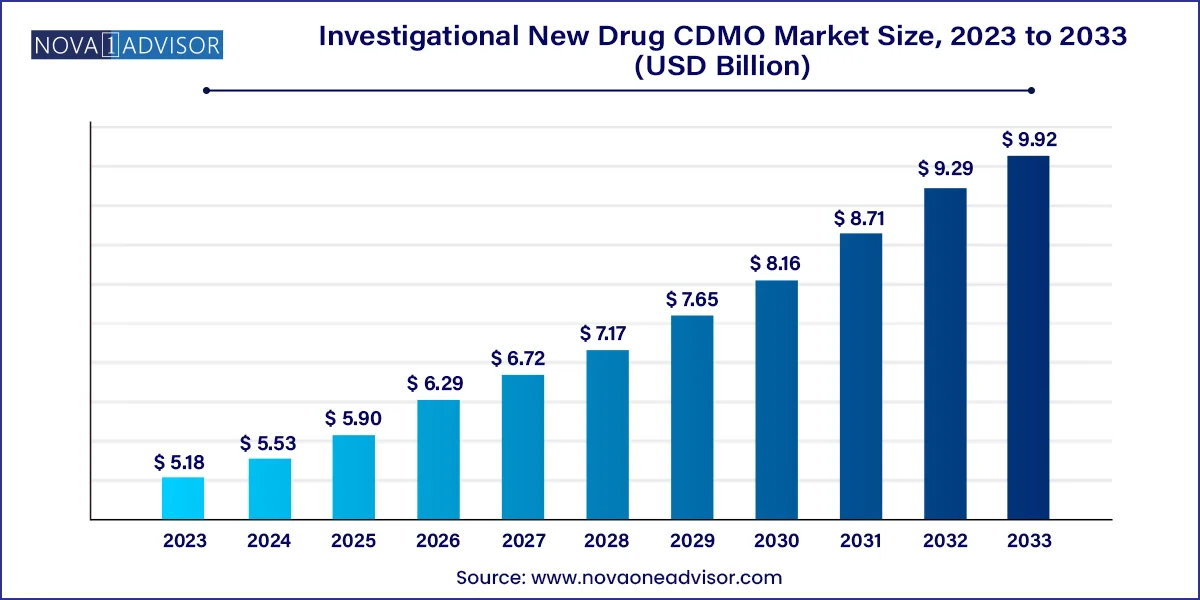

The global investigational new drug CDMO market size was valued at USD 5.18 billion in 2023 and is anticipated to reach around USD 9.92 billion by 2033, growing at a CAGR of 6.71% from 2024 to 2033.

Investigational New Drug CDMO Market Key Takeaways

- Small molecule dominated the market and accounted for a share of 88.14% in 2023.

- Large molecule is expected to register the fastest CAGR during the forecast period.

- Contract development accounted for the largest market revenue share in 2023. The segment is also projected to expand at the fastest CAGR during the forecast period.

- The contract manufacturing segment is anticipated to witness lucrative growth over the forecast period.

- The Pharmaceuticals companies dominated the market in 2023.

- The biotic firms is projected to grow at the fastest CAGR over the forecast period.

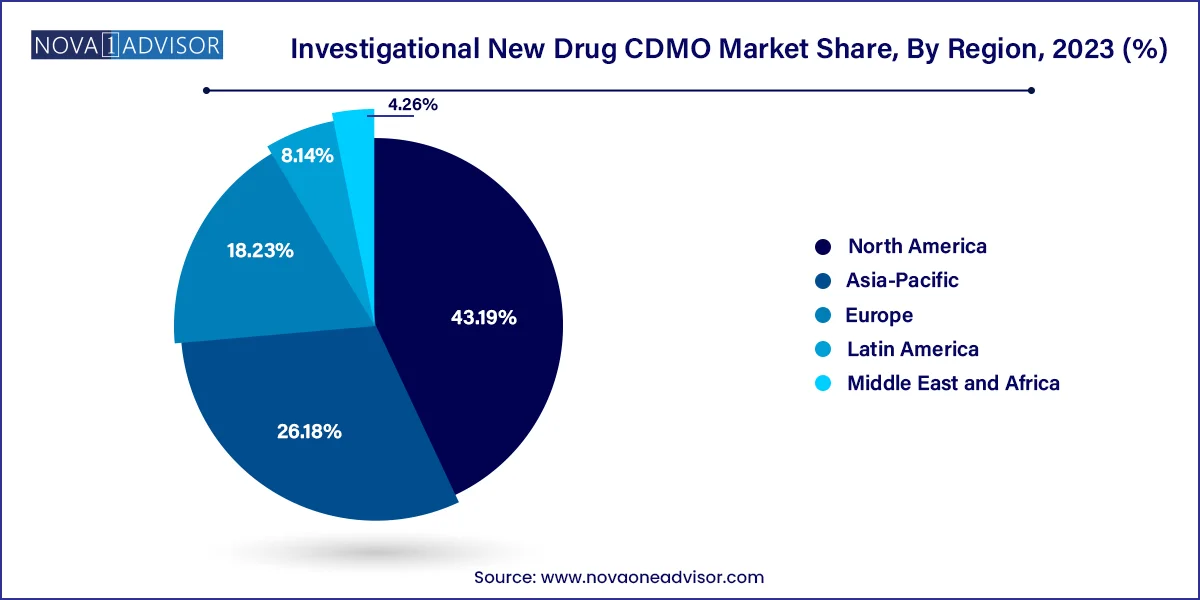

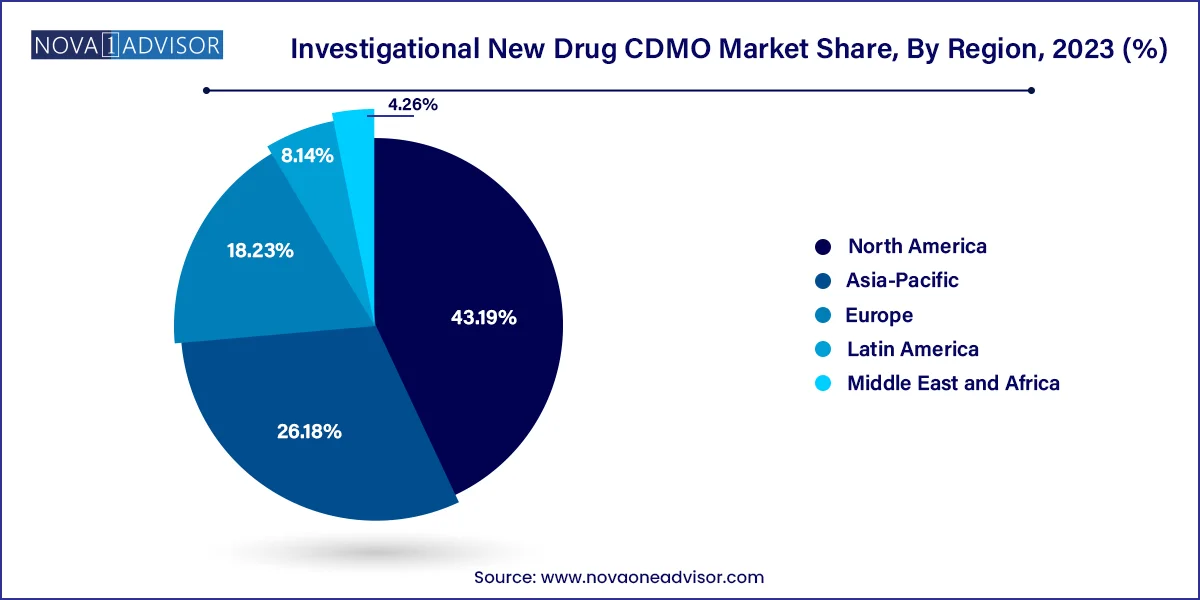

- North America held the largest share of 43.19% in 2023.

- Asia Pacific is anticipated to register the fastest growth rate of 7.8% throughout the forecast period.

Market Overview

The Investigational New Drug (IND) Contract Development and Manufacturing Organization (CDMO) market represents a critical intersection of pharmaceutical innovation and outsourced development expertise. This market has gained significant traction as pharmaceutical and biotechnology companies increasingly seek specialized external partners to accelerate drug discovery, ensure regulatory compliance, and optimize R&D expenditure. IND CDMOs provide comprehensive services to support the early stages of drug development, including preclinical studies, formulation development, scale-up, and initial manufacturing under stringent regulatory standards. These services are instrumental in filing investigational new drug applications, a crucial gateway for clinical trials and subsequent drug commercialization.

Pharmaceutical R&D expenditure has been steadily increasing over the last decade, with more than 40% of drug development budgets now being allocated to outsourced services. The growing complexity of novel drug modalities — including biologics, cell and gene therapies, and highly potent small molecules — has created an urgent need for specialized CDMOs equipped with high-containment facilities, advanced analytical capabilities, and scalable manufacturing platforms.

Additionally, the emergence of virtual and small-scale biotech firms has significantly contributed to market expansion. These firms often lack the infrastructure for in-house development and thus rely on CDMOs to navigate the preclinical and early clinical landscape. IND-enabling CDMO services offer time and cost efficiencies that are particularly attractive to startups working under tight budgets and investor timelines. As the industry shifts toward personalized medicine and complex biological products, the demand for high-quality, flexible, and regulatory-compliant CDMO partnerships is expected to grow robustly in the years ahead.

Major Trends in the Market

-

Growing preference for outsourcing R&D to reduce time-to-market: Biopharmaceutical companies are increasingly outsourcing IND-enabling services to accelerate clinical entry while managing internal resource constraints.

-

Rise of biologics and biosimilars: Large molecule development, particularly monoclonal antibodies (MABs) and recombinant proteins, is driving CDMO innovation and investments in upstream and downstream processing technologies.

-

Integration of AI and data analytics in early-phase development: CDMOs are leveraging AI-powered platforms for predictive modeling, toxicology assessments, and formulation design to enhance efficiency and accuracy.

-

Expansion of virtual biotech ecosystems: The proliferation of small, innovation-driven biotech startups has created a fertile client base for specialized CDMOs focused on investigational drugs.

-

Increasing regulatory stringency and demand for quality assurance: Regulatory bodies like the FDA and EMA are enforcing stricter IND filing requirements, compelling CDMOs to invest in advanced analytical validation and compliance systems.

-

Cross-border collaborations and global CDMO networks: Companies are forging international alliances to tap into regional expertise, cost-effective manufacturing, and rapid scaling capabilities.

-

Surging investment in high-containment and flexible manufacturing facilities: Particularly for highly potent APIs and emerging modalities such as mRNA and ADCs.

Investigational New Drug CDMO Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 5.53 Billion |

| Market Size by 2033 |

USD 9.92 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.71% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, service, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Lonza; Catalent,Inc; Recipharm AB; Siegfried Holding AG; Thermo Fisher Scientific Inc.; Charles River Laboratories; Cambrex Corporation;IQVIA Inc,; Syneous Health |

Key Market Driver: Growing Biotech Innovation and Virtual R&D Models

One of the primary drivers fueling the Investigational New Drug CDMO market is the rapid expansion of the biotechnology sector, particularly the rise of virtual biotech companies. These firms operate with lean internal structures, often devoid of physical labs or production capabilities. Instead, they rely on external partners, primarily CDMOs, to fulfill their developmental and manufacturing needs. This trend has transformed the CDMO model from a transactional service provider to a strategic collaborator throughout the early drug development lifecycle.

Startups pursuing niche therapeutics, such as orphan drugs, immunotherapies, or RNA-based treatments, frequently operate under compressed development timelines. They require flexible, fast, and science-driven partners who can adapt to evolving clinical and regulatory needs. CDMOs that offer integrated services — from preclinical formulation to IND-enabling studies and Phase I manufacturing — are well-positioned to capture a significant portion of this growing demand. In effect, the decentralization of drug development is creating a thriving ecosystem where CDMOs are indispensable innovation enablers.

Key Market Restraint: Complex Regulatory Landscape and Evolving Guidelines

While opportunities abound, one of the most pressing restraints hindering the IND CDMO market is the increasingly complex and evolving global regulatory framework. The path from preclinical development to IND filing involves a multitude of data-intensive requirements — including pharmacokinetics, toxicology, safety pharmacology, stability testing, and Good Manufacturing Practice (GMP) compliance. CDMOs operating in this space must stay ahead of constantly shifting guidelines set forth by agencies like the FDA (U.S.), EMA (Europe), and NMPA (China), which often diverge in their expectations.

For instance, recent regulatory updates require additional risk assessment protocols for biologics, tighter impurity profiling, and expanded long-term stability data, even before clinical trials commence. Meeting these requirements necessitates significant investment in regulatory affairs expertise, documentation infrastructure, and validation procedures — costs that smaller CDMOs may find burdensome. Furthermore, regulatory non-compliance can result in costly rework or trial delays, impacting both CDMO credibility and client success.

Key Market Opportunity: Expansion of Complex Biologic Modalities

A significant opportunity in the market lies in the growing demand for IND services tailored to complex biologics — particularly monoclonal antibodies (MABs), recombinant proteins, gene therapies, and RNA-based drugs. As pharmaceutical pipelines become biologic-heavy, there is a corresponding demand for CDMOs that can offer high-efficiency mammalian cell line development, upstream and downstream process optimization, and characterization of highly sensitive biologics.

For example, the shift toward targeted oncology treatments, autoimmune therapies, and mRNA vaccines has fueled the need for CDMOs with capabilities in microbial and mammalian expression systems, chromatography purification, and aseptic fill-finish operations. Additionally, as regulatory agencies expand expedited approval pathways for breakthrough therapies, there is a growing window of opportunity for CDMOs to provide fast-track IND-enabling services. Investments in biologics infrastructure, biosafety-level facilities, and end-to-end large molecule development capabilities could yield significant returns in the years ahead.

Global Investigational New Drug CDMO Market Report Segmentation

Product Insights & Trends

Small molecule dominated the market and accounted for a share of 88.14% in 2023. Their relatively simple structure, well-understood pharmacokinetics, and cost-effective synthesis make them a preferred choice, especially during the early stages of drug discovery. CDMOs specializing in small molecules offer a broad spectrum of services, including synthetic route development, crystallization, bioanalysis, and stability studies. The ability to rapidly scale small molecule APIs from preclinical to clinical batch sizes further enhances their appeal to sponsors seeking accelerated IND submissions.

However, large molecules are poised to emerge as the fastest-growing product segment. The growing pipeline of biologics, particularly in oncology and autoimmune diseases, is driving the demand for CDMOs with capabilities in mammalian and microbial expression, recombinant protein production, and MABs processing. As biologics transition from niche to mainstream therapeutics, CDMOs investing in advanced biomanufacturing platforms are expected to capture a larger market share.

Service Insights & Trends

Contract development accounted for the largest market revenue share in 2023. driven by rising demand for IND-enabling studies and early formulation expertise. Within this, services such as toxicology testing, analytical method development, and pre-formulation selection remain critical to IND filings. CDMOs offering integrated development services across both small and large molecules are particularly favored by early-stage biotech firms with limited internal R&D bandwidth.

On the other hand, contract manufacturing services are experiencing the fastest growth. As investigational products advance into clinical trials, there is increasing demand for GMP-compliant manufacturing of oral solids, injectables, and biologics. Particularly, the injectable segment for both small and large molecules has seen rising preference due to its relevance in oncology, neurology, and vaccine programs. MABs and recombinant protein-based injectables, supported by modular and flexible manufacturing platforms, are key contributors to this segment’s growth trajectory.

End-use Insights

The Pharmaceuticals companies dominated the market in 2023. leveraging their global scale, multi-program pipelines, and regulatory know-how. These companies often rely on CDMOs for specific IND-support functions such as analytical validation or preclinical formulation, especially for molecules being co-developed through partnerships or acquired from external sources.

Nevertheless, biotechnology companies are the fastest-growing end-users. Many of these firms are venture-funded or spin-offs from academic institutions and lack internal infrastructure for IND-enabling work. Their dependency on CDMOs for full-suite development and manufacturing support — from preclinical to early clinical stages — is a defining characteristic of the market’s shift toward outsourced innovation. As biotech IPOs and M&A activity increase, this trend is expected to further solidify.

Regional Insights

North America held the largest share of 43.19% in 2023. underpinned by a mature pharmaceutical landscape, abundant R&D funding, and a well-established regulatory framework. The U.S. alone contributes to over 40% of global clinical trials and drug approvals, making it a hub for IND-enabling studies. Prominent CDMOs in the region offer extensive capabilities in small and large molecule development, bolstered by strategic partnerships with top pharmaceutical and biotech companies.

Asia-Pacific is expected to witness the fastest growth over the forecast period, driven by increasing clinical trial activity, cost-effective services, and rapid expansion of biopharmaceutical research in countries like China, India, and South Korea. Governments in the region are investing heavily in biomanufacturing hubs and innovation parks to attract global and local CDMOs. For example, the Indian government’s Production Linked Incentive (PLI) scheme and China's "Made in China 2025" strategy both aim to enhance domestic drug development capabilities.

Moreover, a large patient population, improving regulatory frameworks, and rising demand for affordable therapeutics are encouraging foreign sponsors to collaborate with regional CDMOs for preclinical and early clinical development. Several Asia-based CDMOs are also expanding globally by acquiring facilities in the U.S. and Europe, further fueling regional growth.

Investigational New Drug CDMO Market Top Key Companies:

The following are the leading companies in the investigational new drug CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Catalent, Inc.

- Lonza

- Recipharm AB

- Siegfried Holding AG

- Patheon Inc.

- Covance

- IQVIA Holdings Inc.

- Cambrex Corporation

- Charles River Laboratories International, Inc.

- Syneous Health

Investigational New Drug CDMO Market Recent Developments

-

January 2024 – Catalent announced a major $75 million investment in its Bloomington, Indiana facility to expand its preclinical to Phase I biologics development services, including high-speed formulation and fill-finish capacity for IND programs.

-

March 2024 – WuXi Biologics launched a new IND-focused service line at its Suzhou facility, offering integrated mammalian cell line development and IND package preparation to accelerate global filings.

-

February 2024 – Lonza unveiled its new IND-enabling innovation center in Visp, Switzerland, designed to support small biotech firms with a streamlined path from candidate selection to early clinical trials.

-

December 2023 – Thermo Fisher Scientific acquired a 100,000 sq ft CDMO site in North Carolina, aiming to boost its early development capabilities for both small and large molecule programs, particularly for U.S.-based IND filings

Investigational New Drug CDMO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Investigational New Drug CDMO market.

By Product

- Small Molecule

- Large Molecule

By Service

- Contract Development

- Small Molecule

- Bioanalysis and DMPK Studies

- Toxicology Testing

- Pathology and Safety Pharmacology Studies

- Drug Substance Synthetic Route Development

- Drug Substance Process Development

- Form Selection Crystallization Process Development

- Scale-up of Drug Substance

- Pre Formulation

- Preclinical Formulation Selection

- First In Man Formulation/ Process Development

- Analytical Method Development / Validation

- Release Testing of Drug Substance and Drug Product

- Work Up Purification Steps

- Telescoping & Process Refining

- Initial Optimization

- Formal Stability of Drug Substance and Drug Product

- Large Molecule

- Cell Line Development

- Process Development

- Upstream

- Microbial

- Mammalian

- Others

- Downstream

- MABs

- Recombinant Proteins

- Others

- Contract Manufacturing

- Small Molecule

- Oral Solids

- Liquid and Semi-solids

- Injectables

- Others

- Large Molecule

- MABs

- Recombinant Proteins

- Others

By End-use

- Pharmaceutical Companies

- Biotech Companies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)