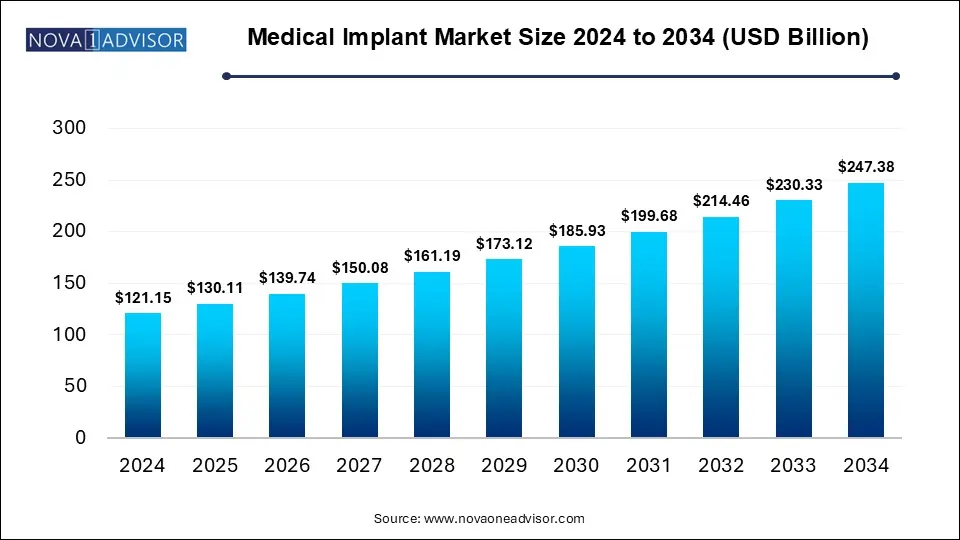

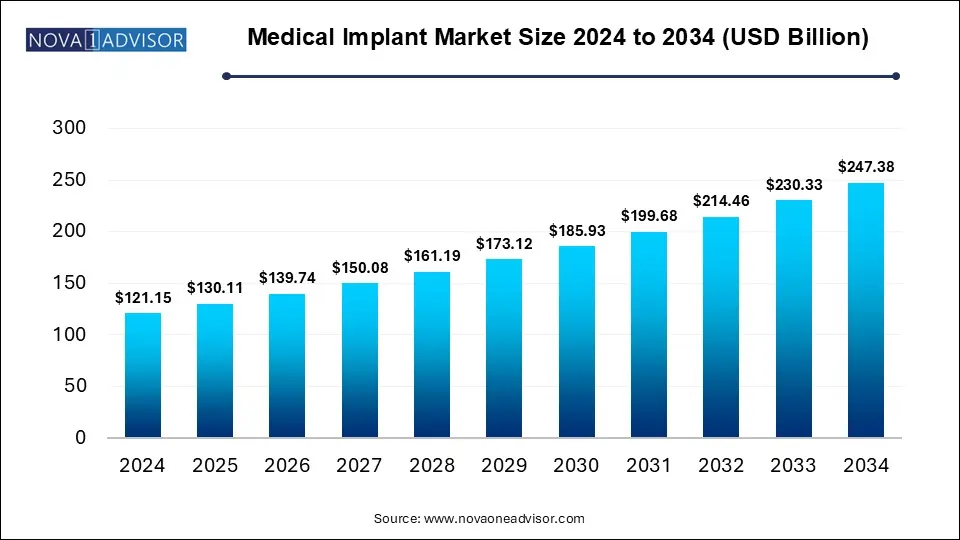

Medical Implant Market Size and Growths

The global medical implant market size is calculated at USD 121.15 billion in 2024, grows to USD 130.11 billion in 2025, and is projected to reach around USD 247.38 billion by 2034, growing at a CAGR of 7.4% from 2025 to 2034 The market is growing due to an aging population and rising cases of chronic diseases like arthritis and heart conditions. Technological advancements and minimally invasive procedures have made implants safer and more effective, boosting their adoption.

Key Takeaways

- North America dominated the medical implant market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product, the orthopedic segment held the major market share.

- By product, the Orth biologics segment is projected to grow at the fastest rate in the market during the forecast period.

- By biomaterial type, the ceramic biomaterials segment was dominant in the market in 2024.

- By biomaterial type, the polymers biomaterial segment is predicted to grow at the fastest CAGR in the market during the studied years.

How is Innovation Impacting the Medical Implant Market?

A medical implant is a device placed inside the body to replace, support, or enhance a biological structure or function, typically made from biocompatible materials. Innovation is significantly transforming the medical implant market by enhancing the safety, functionality, and longevity of implantable devices. Advances in materials sciences have led to the development of more durable and biocompatible implants, reducing the risk of rejection and complications. Additionally, the integration of smart technologies, such as sensors and wireless communication, allows for real-time monitoring and personalized treatment. These innovations are improving patient outcomes, driving greater adoption of new possibilities in precision medicine.

For Instance, According to a study published by Arthritis Research & Therapy in March 2023, the global prevalence of hip osteoarthritis, diagnosed using the K-L grade 2 criteria, was found to be 8.55%. Europe had the highest rate at 12.59%, while Africa reported the lowest at 1.20%. This widespread occurrence of hip osteoarthritis is expected to lead to a higher demand for hip replacement surgeries, which will likely contribute to notable growth in the medical implant market.

What are the leading trends shaping the Medical Implant Market in 2025?

- In February 2023, CurvaFix, Inc. introduced a 7.5mm version of its IM Implant, specifically tailored for patients with smaller bones. This new, smaller-diameter implant is designed to ease the surgical process while delivering secure and stable bone fixation. It offers an effective solution for complex fractures in anatomically smaller patients, enhancing both surgical precision and patient outcomes.

- In March 2023, Miach Orthopaedics, Inc. partnered with Veterans' Health Medical Supply (VHMS) through a distribution agreement. This collaboration allows 236 healthcare facilities under the Department of Defense (DOD) and Department of Veterans Affairs (VA) to access the Bridge-Enhanced ACL Restoration (BEAR) Implant. The implant will be available through the ECAT federal contract, expanding treatment options for ACL injuries across these government-operated medical centers.

How is AI enhancing advancements in the Medical Implant Market?

- Artificial Intelligence is playing a crucial role in advancing the medical implant market by enabling personalized implant designs based on patient-specific data. It enhances surgical planning through accurate imaging analysis and supports real-time decision-making during procedures. AI also aids in the early detection of implant-related complications and improves post-operative care by monitoring patient data. These innovations lead to improved success rates, reduced recovery times, and more efficient treatment outcomes, making AI a key driver in the growth of this market.

- For Instance, In October 2024, Olympus Europa SE & Co. KG announced that its group company, Odin Medical Ltd. (Odin Vision), received CE certification under the Medical Device Regulation (MDR) for its AI-powered endoscopy devices—CADDIE, CADU, and SMARTIBD. This achievement marks a major step toward Olympus’ goal of building an Intelligent Endoscopy Ecosystem. By integrating AI and cloud technology into its endoscopy tools, Olympus aims to enhance clinical outcomes, streamline workflows, and support smarter decision-making in healthcare.

Report Scope of Medical Implant Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 130.11 Billion |

| Market Size by 2034 |

USD 247.38 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Biomaterial Type, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Stryker, Abbott, Boston Scientific, Zimmer Biomet, Medtronic, Johson& Johnson, GE Healthcare, Edwards Lifesciences, Globus Medical, Alcon, Insulet, Baxter |

Market Dynamics

Driver

The Rise in Aging Population

The rise in the aging population is a major factor fueling the medical implant market. As people age, they become more vulnerable to chronic health conditions such as joint degeneration, heart problems, and bone disorders, which often require surgical intervention with implants. Devices like hip and knee replacement, cardiac implants, and spinal supports are in higher demand to maintain mobility and overall well-being. With life expectancy increasing worldwide, the need for reliable and long-lasting implants continues to rise steadily.

For Instance, According to the World Social Report 2023, released in January 2023, the global population aged 65 and above is projected to rise sharply, from 761 million in 2021 to 1.6 billion by 2050. The 80+ age group is growing at an even faster rate. This surge in the elderly population is expected to lead to a higher prevalence of orthopedic conditions, thereby driving greater demand for medical implants in the coming years.

Restraint

High Cost of Implants and Surgical Procedures

Many advanced implants, particularly those incorporating innovative materials and technologies, are expensive, making them less accessible to a large portion of patients, especially in low- and middle-income countries. Additionally, limited insurance coverage and reimbursement policies further increase the financial burden on patients. These factors lead to affordability challenges, reducing the number of procedures performed and slowing the medical implant market growth.

Opportunity

The Development of Smart and Bio-integrated Implants

The development of smart and bio-integrated implants presents a promising future opportunity for the medical implant market because these devices enable real-time monitoring of patient health and implant performance. They can deliver personalized treatment by adapting to changes in the body, reducing complications, and improving recovery. Additionally, bio-integrated implants promote better compatibility with natural tissue, minimizing rejection risks. These advancements can enhance patient outcomes, increase the lifespan of implants, and attract greater adoption, driving growth and innovation within the market.

Segmental Insights

The Orthopedic Segment Major Share

By product, the orthopedic segment held the major market share, because they offer personalized and proactive healthcare solutions. These implants can monitor specific health conditions in real-time, allowing early detection of complications and timely patient outcomes, reducing hospital visits, and lowering healthcare costs. As a result, advanced implants are highly valued by both patients and healthcare providers demand and contribute majorly to the market growth.

The Orthobiologics Segment: Fastest Growing

By product, the orthobiologics segment is projected to grow at the fastest rate in the market during the forecast period. The increasing prevalence of musculoskeletal disorders, such as osteoarthritis and spinal conditions, is driving demand for biologic-based treatment that promotes natural healing and tissue regeneration. Additionally, the integration of personalized medicine approaches, including patient-specific therapies and regenerative techniques, is further propelling the adoption of oethobiologics. These factors contribute to the rapid expansion of the medical implant market.

The Ceramic Biomaterials Segment Dominated

By biomaterial type, the ceramic biomaterials segment was dominant in the market in 2024, due to exceptional biocompatibility, mechanical strength, and resistance to wear and corrosion. Materials like alumina and Zirconia are particularly favored in orthopedic and dental applications for their durability and ability to integrate seamlessly with human tissue. Their high compressive strength makes them ideal for lead-bearing implants such as hip and knee replacement, ensuring long-term functionality. Additionally, creamice minimizes the risk of immune reactions, and their compatibility with imaging technologies has further solidified their dominance in the market.

The Polymers Biomaterial Segment: Fastest Growing

By biomaterial type, the polymers biomaterial segment is predicted to grow at the fastest CAGR in the market during the studied years, due to increasing innovation in bioresorbable materials, which eliminate the need for secondary surgeries. Their adaptability in tissue engineering and drug delivery implants has expanded their use beyond traditional applications. Moreover, ongoing clinical research exploring polymer blends for enhanced healing and integration has accelerated their adoption. These advancements are drawing strong interest from both startups and major players, fueling robust medical implant market expansion.

Regional Insights

How is North America Powering the Medical Implant Market?

North America dominated the medical implant market in 2024 through its advanced healthcare infrastructure, high healthcare expenditure, and strong focus on technological innovation. The region large patient pool with the high prevalence of chronic diseases, driving demand for devices such as cardiac implants, orthopedic implants, and neurostimulators. Additionally, the presence of well-equipped hospitals and specialized treatment centers facilitated the adoption of new medical implants.

For Instance, According to a May 2023 report from the Icahn School of Medicine at Mount Sinai, first-generation bioresorbable vascular scaffolds (BVS) are as safe and effective as drug-eluting metallic stents for treating heart conditions. These findings have encouraged further innovation in BVS technology and increased interest in their clinical application among interventional cardiologists in the U.S. This progress is expected to drive market growth in the coming years.

How is Asia-Pacific approaching the Medical Implant Market in 2024?

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The region's aging population and rising prevalence of chronic diseases have increased demand for orthopedic, dental, and cardiovascular implants. Advancements in healthcare infrastructure and increased healthcare spending, particularly in countries like China and India, are facilitating greater access to implant procedures. Additionally, the emergence of domestic manufacturers is reducing reliance on imports and fostering innovation within the region. This development position in the Asia Pacific is a significant contributor to the global medical implant market.

Top Companies in the Medical Implant Market

- Stryker

- Abbott

- Boston Scientific

- Zimmer Biomet

- Medtronic

- Johson& Johnson

- GE Healthcare

- Edwards Lifesciences

- Globus Medical

- Alcon

- Insulet

- Baxter

Recent Developments in the Medical Implant Market

- In May 2024, Orthofix Medical Inc. received FDA 510(k) approval for its Rodeo Telescopic Nail, designed to address challenges seen in current telescopic rod systems for osteogenesis imperfecta (OI). This new system offers enhanced bone stability for fragile bones through its unique design. It also simplifies the surgical process with improved tools and sterile packaging, helping reduce pre-surgery preparation, lower contamination risks, cut operation time, and improve overall efficiency in the operating room.

- In December 2023, Advanced Bionics received FDA approval for the expansion of its Marvel CI cochlear implant sound processor and its related features. This development aims to enhance hearing care and improve patient outcomes. By broadening its product offerings, the company is working to strengthen its presence in the cochlear implant market and further build a comprehensive portfolio that supports advanced hearing solutions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

-

- Reconstructive Joint Replacements

-

-

- Knee Replacement Implants

- Hip Replacement Implants

- Extremities

-

- Orthobiologics

- Trauma and Craniomaxillofacial

-

-

- Cardiac Resynchronization Therapy Devices (CRTs)

- Implantable Cardioverter Defibrillators (ICDs)

- Implantable Cardiac Pacemakers (ICPs)

-

-

- Coronary stents

- Peripheral stents

- Stent-related Implants

-

- Structural Cardiac Implants

-

-

- Mechanical Heart Valves

- Implantable Ventricular-assist Devices

-

- Spinal fusion implants

- Spinal bone stimulators

- Vertebral Compression Fracture (VCF) Devices

- Motion Preservation Devices/Non-Fusion Devices

-

- Deep Brain Stimulation

- Sacral Nerve Stimulation

- Vagus Nerve Stimulation

- Spinal Cord Stimulation

- Other neurostimulators

-

- Intraocular Lens

Glaucoma Implants

-

- Plate Form Dental Implants

- Root Form Dental Implants

- Facial Implants

Breast implants

By Biomaterial Type

- Metallic Biomaterials

- Ceramic Biomaterials

- Polymers Biomaterials

- Natural Biomaterials

By Region

- North America (U.S., Canada, Mexico)

- Europe (France, Germany, Italy, Spain, UK, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

- LAMEA (Brazil, South Africa, Saudi Arabia, Rest of LAMEA)