mRNA Vaccines for Animals Market Size Trends Analysis and Forecast till 2034

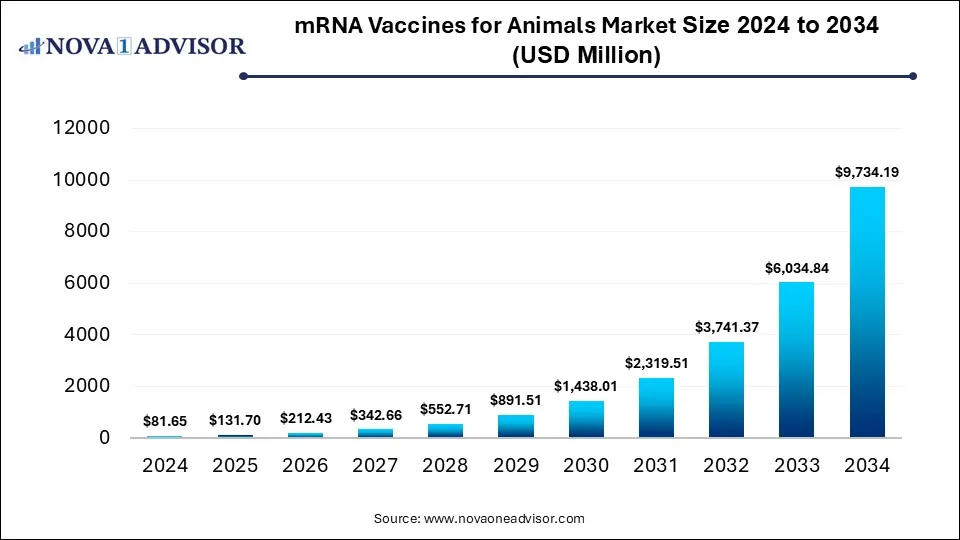

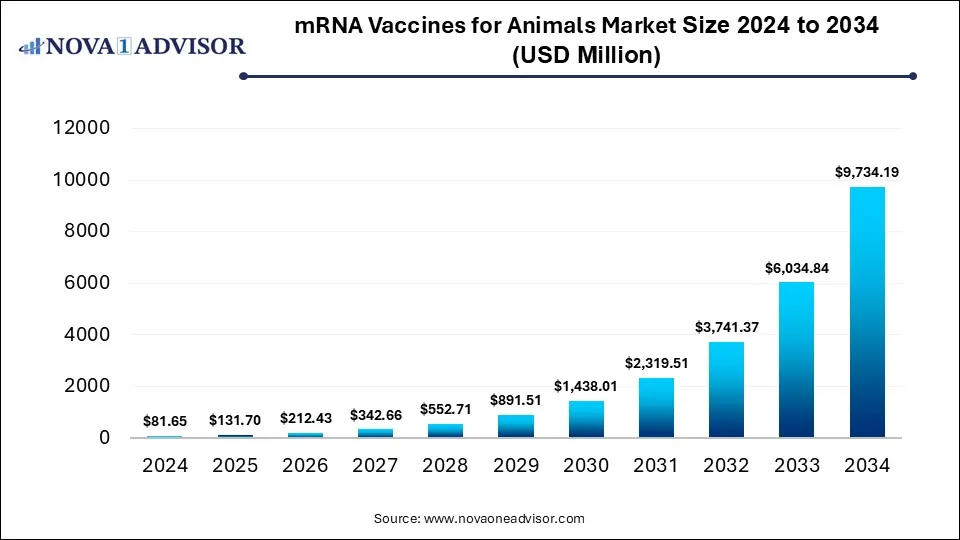

The global mRNA vaccines for animals market size was estimated at USD 81.65 million in 2024 and is expected to reach USD 9,734.19 million in 2034, expanding at a CAGR of 61.3% during the forecast period of 2025 and 2034. The growth of the market is attributed to advancements in vaccine technology, increasing demand for novel vaccines for livestock disease prevention, and the increasing awareness of zoonotic disease.

mRNA Vaccines for Animals Market Key Takeaways

- By region, North America held the largest share of the mRNA vaccines for animals market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By animal type, the livestock segment led the market in 2024.

- By animal type, the companion animals segment is likely to grow at the fastest rate in the coming years.

- By administration route, the injectable segment dominated the market in 2024.

- By administration route, the non-invasive segment is expected to expand at the fastest CAGR during the forecast period.

- By delivery technology, the lipid nanoparticles (LNP) segment dominated the market in 2024.

- By delivery technology, the viral vectors segment is expected to expand at the highest CAGR over the projection period.

- By disease indication, the avian influenza segment continues to dominate the market.

- By end user, the farms segment held the largest share of the market in 2024.

- By end user, the veterinary hospitals & clinics segment is expected to grow at the fastest rate in the upcoming period.

Impact of AI on the mRNA Vaccines for Animals Market

AI is significantly impacting the mRNA vaccines for animals market by accelerating the research and development process. Machine learning algorithms are applicable to analyze large datasets of genetic information, enabling the design of more targeted and effective mRNA vaccine candidates for various animal diseases. AI also streamlines the optimization of vaccine production processes, reducing time-to-market and improving scalability. Additionally, AI-driven predictive models help in identifying potential outbreaks in animal populations, guiding vaccine deployment strategies. This integration of AI is enhancing both the speed and precision of vaccine development, contributing to the rapid expansion of the market.

Market Overview

The mRNA vaccines for animals market includes the development and use of messenger RNA (mRNA) technology to prevent and treat diseases in animals, including livestock and pets. These vaccines offer several benefits over traditional methods, such as faster development times, flexibility in addressing new pathogens, and the ability to target multiple diseases simultaneously. Viral vectors and plasmid DNA manufacturing are pivotal in the mRNA vaccine production process, as they facilitate the safe delivery of genetic material to cells, enhancing immune response while reducing risks. Market growth is driven by the increasing focus on animal health, the rise of zoonotic diseases, advancements in vaccine technology, and the growing demand for more sustainable and effective solutions in the livestock industry. The growing collaboration among major market players is also contributing to market growth.

- In February 2025, Elanco Animal Health partnered with Medgene to commercialize a mRNA-based vaccine for highly pathogenic avian influenza (HPAI) in dairy cattle. The vaccine, developed using Medgene’s platform technology, is in the final stages of USDA review for conditional approval.

What are the Major Trends in the MRNA Vaccines for Animals Market?

- Rising Investment in Veterinary mRNA Research

Governments, pharmaceutical companies, and biotech firms are increasingly funding research into mRNA-based vaccines for animals, recognizing their potential to combat both endemic and emerging diseases.

- Integration of AI and Bioinformatics

AI and computational biology are being used to accelerate antigen discovery, optimize vaccine formulations, and predict immune responses, significantly shortening development timelines and increasing success rates.

- Focus on Zoonotic Disease Prevention

With growing awareness of diseases that can spread from animals to humans, there is a strong push to develop mRNA vaccines that prevent zoonotic outbreaks, especially in livestock and wildlife.

- Expansion into Livestock and Aquaculture Sectors

Initially focused on companion animals, the mRNA vaccine market is expanding to include large-scale use in livestock (e.g., cattle, poultry, swine) and aquaculture, where disease outbreaks can have massive economic and food supply impacts.

Report Scope of mRNA Vaccines for Animals Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 131.70 Million |

| Market Size by 2034 |

USD 9,734.19 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 61.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Animal Type, By Administration Route, By Delivery Technology, By Disease Indication, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Prevalence of Zoonotic and Livestock Diseases

The rising prevalence of zoonotic and livestock diseases is a major driver for the growth of the mRNA vaccine products market for animals. As outbreaks of infectious diseases like avian influenza, swine fever, and zoonotic viruses become more frequent, the need for fast, adaptable, and effective vaccine solutions has intensified. mRNA vaccines offer the advantage of rapid development and customization, allowing for quicker responses to emerging threats compared to traditional vaccines. This has made them an attractive option for both veterinary health organizations and livestock producers aiming to protect animal health and prevent cross-species transmission. As disease pressure increases, demand for innovative vaccine platforms like mRNA is expected to surge, fueling market expansion.

- According to CDC, Zoonotic diseases are highly prevalent globally, including in the U.S. Experts estimate that over 60% of known infectious diseases and 75% of emerging ones in humans originate from animals.

Rapid Development and Scalability

Unlike traditional vaccines, mRNA vaccines can be designed and produced quickly once the genetic sequence of a pathogen is known, enabling faster responses to new or evolving animal diseases. This speed is crucial for controlling outbreaks and minimizing economic losses in livestock industries. Additionally, mRNA manufacturing processes are highly scalable, allowing for large quantities of vaccines to be produced efficiently to meet growing demand. Together, these advantages make mRNA vaccines a preferred choice, accelerating market adoption and expansion.

Restraints

High Development and Production Cost

High development and production costs significantly restrain the growth of the mRNA vaccines for animals market by limiting accessibility, especially for smaller companies and regions with limited resources. Establishing advanced manufacturing facilities and sourcing high-quality materials requires substantial financial investment, which can be prohibitive. Additionally, the complex production process demands rigorous quality control, further increasing expenses and driving up the final vaccine price. These high costs make it challenging to scale production and distribute vaccines widely, particularly in developing countries or among small-scale farmers. As a result, cost barriers slow down market penetration and overall adoption of mRNA vaccines in the veterinary sector.

Cold Chain and Storage Challenges

Cold chain and storage challenges restrain the growth of the mRNA vaccines for animals market by complicating the distribution and administration of these vaccines, especially in remote or resource-limited areas. Many mRNA vaccines require ultra-low temperature storage, which demands specialized refrigeration equipment that is often unavailable or too costly for widespread veterinary use. This limitation increases logistical complexities and costs, making it difficult to maintain vaccine potency during transport and storage. As a result, farmers and veterinary providers in rural or developing regions may hesitate to adopt mRNA vaccines, slowing market expansion. Overcoming these cold chain challenges is critical to unlocking broader accessibility and adoption of mRNA vaccines for animals.

Opportunities

Expansion in Aquaculture Vaccination

The expansion of aquaculture vaccination is opening significant opportunities in the market. As global demand for seafood rises, fish farming is scaling rapidly, increasing the need for effective disease prevention methods. Traditional vaccines face limitations in aquatic environments, making mRNA-based platforms attractive for their precision, adaptability, and rapid development timelines. These vaccines can be tailored to target specific aquatic pathogens, enhancing fish health and reducing antibiotic use. As regulatory bodies and aquaculture producers seek sustainable disease control, mRNA technology is emerging as a promising solution to meet the evolving needs of this growing sector.

- Researchers demonstrated that an mRNA vaccine formulated with lipid nanoparticles (LNPs) encoding the viral hemorrhagic septicemia virus (VHSV) antigen protected rainbow trout against viral challenge, marking one of the first efficacious mRNA vaccine studies in fish.

How Macroeconomic Variables Influence the mRNA Vaccines for Animals Market?

Economic Growth and GDP

Economic growth and rising GDP can have a positive impact on the market by increasing national spending capacity, investments in biotechnology, and access to veterinary healthcare. Higher GDP levels often correlate with better infrastructure, increased livestock production, and stronger government support for animal disease prevention programs. As economies grow, both public and private sectors are more likely to invest in innovative solutions like mRNA vaccines to improve animal health and food security.

Exchange Rates

Exchange rate fluctuations can both positively and negatively impact the market, depending on the direction of the currency movement. A favorable exchange rate can lower the cost of importing raw materials, equipment, or finished vaccines, making mRNA solutions more affordable and boosting adoption in certain countries. Conversely, weak local currencies or volatile exchange rates can increase import costs and reduce purchasing power, particularly in developing markets, thereby restraining growth and limiting access to advanced veterinary technologies.

Segment Outlook

By Animal Type Insights

Why Did the Livestock Segment Lead the Market in 2024?

The livestock segment led the mRNA vaccines for animals market in 2024 due to the high focus on maintaining animal health for meat, dairy, and poultry production. Livestock are particularly vulnerable to infectious diseases that can spread rapidly and cause significant financial losses, driving strong demand for effective, scalable vaccination solutions. mRNA vaccines offer rapid development and adaptability, making them ideal for responding to emerging livestock diseases. Additionally, governments and large agribusinesses are increasingly investing in advanced veterinary technologies to ensure food security and export quality standards.

The companion animals segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increased spending on pet healthcare and growing awareness of zoonotic disease prevention. mRNA technology offers rapid development and high efficacy, making it ideal for addressing emerging infectious diseases in dogs, cats, and other pets. Additionally, pet parents are increasingly demanding advanced and personalized treatments, encouraging the adoption of next-generation vaccines. This trend is further supported by veterinary innovation and increased focus on preventive care in urban settings. The rising pet ownership worldwide is likely to ensure long-term growth of the segment.

- According to the American Pet Products Association (2025), pet ownership in the U.S. continues to rise, with 94 million households (71%) owning a pet, up from 66% in 2023–2024 and 70% in 2022.

By Administration Route Insights

How Does the Injectable Segment Dominate the mRNA Vaccines for Animals Market in 2024?

The injectable segment dominated the market with the largest share in 2024 due to its proven efficacy, established delivery methods, and compatibility with current veterinary practices. Injectable vaccines offer precise dosing and strong immune responses, which are critical for controlling serious livestock and companion animal diseases. Veterinary professionals are more familiar with administering injectables, making them a preferred choice for both large-scale farms and clinical settings. Additionally, most of the mRNA vaccine formulations currently approved or in development are designed for injection, further reinforcing this segment's dominance. Despite emerging interest in non-invasive delivery methods, injectables remain the most trusted and widely adopted format in the market.

The non‑invasive segment is expected to grow at the fastest CAGR during the projection period, owing to its potential to simplify administration and improve animal welfare. Non-invasive methods such as intranasal sprays, oral formulations, or transdermal patches reduce stress and the risk of injury associated with injections, making them especially attractive for large-scale livestock operations and companion animals. These delivery formats also minimize the need for trained personnel, enabling easier vaccination in remote or resource-limited areas. Advances in mRNA stabilization and delivery technologies are making non-invasive options more viable and effective. As demand rises for user-friendly, scalable, and welfare-oriented solutions, the segment is poised for rapid growth in the coming years.

By Delivery Technology Insights

What Made LNP the Dominant Segment in the Market in 2024?

The lipid nanoparticles (LNP) segment dominated the mRNA vaccines for animals market in 2024. This is mainly due to its proven efficiency in delivering mRNA safely and effectively. LNPs protect mRNA molecules from degradation and facilitate their entry into target cells, ensuring strong immune responses. Their scalability and adaptability across various animal species and disease types make them a preferred delivery system. Additionally, the success of LNPs in human mRNA vaccines, such as those for COVID-19, has accelerated their adoption in veterinary applications.

The viral vectors segment is expected to expand at the highest CAGR over the projection period, owing to their high transfection efficiency and ability to induce strong, long-lasting immune responses. They are particularly effective for delivering genetic material in hard-to-reach tissues or in animals with complex immune systems. Advances in viral vector engineering have improved safety and reduced immunogenicity, making them more suitable for veterinary use. As demand grows for targeted and durable vaccines in both livestock and companion animals, viral vectors offer a promising alternative to traditional delivery methods.

By Disease Indication Insights

Why Did the Avian Influenza Segment Lead the mRNA Vaccines for Animals Market?

The avian influenza segment led the market in 2024 and is expected to continue its upward trajectory throughout the projection period. This is primarily due to the recurring outbreaks and high economic impact of the disease on the poultry industry. mRNA vaccines offer rapid development and adaptability, making them ideal for combating evolving strains of avian influenza. Governments and poultry producers are increasingly investing in advanced vaccines to prevent large-scale losses and ensure food security. Additionally, the rising concern over zoonotic transmission to humans further drives demand for effective avian influenza vaccination solutions.

- In February 2025, Zoetis announced that it received a conditional USDA license for its H5N2 Avian Influenza Vaccine, labeled for use in chickens. The license was granted based on demonstrated safety, purity, and expected efficacy from serology data.

By End User Insights

How Does Farms Hold the Largest Share of the Market in 2024?

The farms segment held the largest share of the mRNA vaccines for animals market in 2024 due to the high demand for disease prevention in large-scale livestock and poultry operations. Farms face significant economic risks from outbreaks of infectious diseases, making effective vaccination strategies a top priority. mRNA vaccines offer rapid adaptability to emerging pathogens, helping farms respond quickly and reduce losses. Their ability to induce strong immune responses with fewer doses also makes them cost-effective for mass vaccination. As biosecurity becomes increasingly important in global food production, farms are turning to next-generation solutions like mRNA to safeguard animal health and maintain productivity.

The veterinary hospitals & clinics segment is expected to grow at the fastest rate in the upcoming period due to the rising demand for advanced and personalized care for companion animals. With increasing pet ownership and awareness of zoonotic diseases, more pet owners are seeking cutting-edge treatments offered by veterinary professionals. mRNA vaccines provide fast development and high efficacy, making them suitable for responding to emerging health threats in pets. Veterinary clinics are also well-equipped to handle specialized vaccine storage and administration, supporting broader adoption. This trend is further fueled by innovations in veterinary medicine and greater availability of mRNA-based products for small animals.

Real-World Examples in the Market

1. mRNA Vaccine Shows Strong Immune Response Against H5N1 in Calves

Challenge: The highly pathogenic avian influenza (HPAI) H5N1 clade 2.3.4.4b strain spread rapidly among U.S. dairy cattle herds, infecting over 950 herds in 16 states since March 2024. This posed significant risks to animal health, food safety, and increased zoonotic transmission concerns for farm workers and veterinarians, especially with evidence of virus presence in milk and mucosal secretions.

Solution: Researchers developed an experimental mRNA-lipid nanoparticle (mRNA-LNP) vaccine targeting the H5 HA protein, adapted from the human COVID-19 mRNA vaccine platform. Two doses (50 µg and 500 µg) were administered intramuscularly to Holstein calves to trigger immune responses and reduce viral spread.

Result: The vaccine induced strong antibody and CD8+ T cell responses, with higher doses showing greater immunity. Vaccinated calves exhibited significantly reduced viral shedding and lower viral loads in lung and airway tissues compared to unvaccinated controls. No clinical symptoms were observed, but the vaccine demonstrated potential to limit infection and transmission in cattle.

2. Preclinical Insights into a Serotype O FMDV mRNA Vaccine Candidate

Challenge: Foot-and-mouth disease (FMD), particularly caused by serotype O FMDV, remains one of the most economically devastating and highly contagious diseases in livestock. Existing inactivated vaccines face limitations including poor cross-immunity, adverse effects, complex production involving virulent strains, and challenges with strain matching and immune responses.

Solution: Researchers developed an mRNA-based vaccine targeting serotype O FMDV, leveraging mRNA's advantages such as rapid design, strong immunogenicity, self-adjuvanticity, and genomic safety. The vaccine was tested both in vitro (in RNA-transfected splenic lymphocytes) and in vivo (in guinea pigs and pigs) to assess immune response and protective efficacy.

Result: The mRNA vaccine successfully induced strong neutralizing antibody responses in pigs and protected guinea pigs from lethal FMDV challenge. The study highlights the potential of mRNA technology as a safer, faster, and more effective alternative for controlling FMD in livestock.

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the mRNA vaccines for animals market while holding the largest share in 2024. The region’s dominance is primarily attributed to its advanced biotechnology infrastructure, strong investment in veterinary research, and early adoption of innovative vaccine technologies. The region benefits from well-established regulatory frameworks that support faster approval and commercialization of mRNA-based veterinary products. High livestock production, rising pet ownership, and increased awareness of zoonotic disease prevention further drive demand. Additionally, major pharmaceutical and biotech companies headquartered in the U.S. and Canada are leading the development and scaling of animal mRNA vaccines. These factors collectively position North America at the forefront of market growth and innovation.

The U.S. is a major contributor to the North American mRNA vaccines for animals market due to its strong biotechnology ecosystem and substantial investment in animal health research. The country is home to several leading pharmaceutical and biotech companies actively developing mRNA vaccines for both livestock and companion animals. Additionally, the U.S. has a large and commercially significant livestock industry, along with high pet ownership rates, which fuel consistent demand for advanced veterinary vaccines. Supportive government policies, research funding, and a well-regulated veterinary healthcare system further solidify the U.S. as the dominant force in the regional market.

- In January 2025, in the final days of the Biden Administration, the U.S. Department of Health and Human Services (HHS) awarded Moderna $590 million through BARDA’s Rapid Response Partnership Vehicle to accelerate mRNA vaccine development against pandemic flu viruses. This funding supports Moderna’s work on an H5N1 avian flu mRNA vaccine targeting strains in cows and birds and aims to expand clinical data for potential use against other pandemic flu strains.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for mRNA vaccines for animals. This is due to its rapidly expanding livestock and poultry sectors, which are essential to meet the rising demand for animal protein in densely populated countries like China and India. The region is increasingly vulnerable to outbreaks of zoonotic and livestock diseases, prompting governments and private sectors to invest in advanced vaccine technologies. Growing awareness of animal health, improvements in veterinary infrastructure, and rising income levels are also driving the adoption of innovative solutions like mRNA vaccines. Additionally, supportive government initiatives and expanding biotech capabilities are enabling faster research, development, and deployment of veterinary vaccines.

China is a major player in the Asia Pacific mRNA vaccines for animals market due to its massive livestock population, particularly in swine and poultry, and its increasing focus on biosecurity and disease prevention. The country has made significant investments in biotechnology and vaccine development, with several domestic firms and research institutions actively advancing mRNA vaccine platforms for veterinary use. Government support, including funding and favorable regulatory initiatives, has further accelerated innovation and adoption. China's scale, combined with its urgent need to control outbreaks like African swine fever and avian influenza, makes it the regional frontrunner in driving growth and implementation of mRNA vaccines for animals.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 34.0 billion |

5.86% |

Advanced biotech infrastructure, strong investment in veterinary research, and early adoption of mRNA vaccine technologies |

High development and production costs, cold chain logistics challenges |

Dominant market due to robust infrastructure and early adoption, with steady growth driven by innovation. |

| Europe |

USD 23.9 billion |

7.02% |

Robust regulatory frameworks, strong public and private sector investments, high awareness of zoonotic disease risks |

Cold chain logistics remain a hurdle, with limited adoption in rural areas |

Steady growth with increasing emphasis on preventive healthcare and reduction of antibiotic usage. |

| Asia Pacific |

USD 19.1 billion |

9.91% |

Rapid urbanization, rising disposable incomes, increasing investments in animal husbandry and aquaculture |

Limited access to advanced veterinary technologies, economic constraints |

Fastest-growing region due to untapped potential and increasing demand for innovative animal health solutions. |

| Latin America |

USD 6.6 billion

|

4.67% |

Growing livestock industry, increasing awareness of zoonotic diseases, and government initiatives in animal health |

Limited access to advanced veterinary technologies, economic constraints |

Moderate growth driven by government support and rising awareness, with challenges in infrastructure. |

| Middle East & Africa |

USD 4.2 billion

|

3.3% |

Increasing livestock production, rising demand for animal protein, and government initiatives in animal health |

Limited access to advanced veterinary technologies, economic constraints

|

Moderate growth with potential driven by government initiatives and rising demand for animal protein. |

mRNA Vaccines for Animals Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves the discovery and design of novel mRNA vaccine candidates targeting animal diseases. It includes genetic sequencing, antigen identification, and preclinical trials to ensure vaccine safety and efficacy, leveraging cutting-edge biotechnology to create precise, targeted vaccines.

2. Raw Material Sourcing

Key raw materials like nucleotides, lipid nanoparticles (LNPs), and viral vectors are sourced from specialized suppliers. Ensuring high-quality, contamination-free materials is critical for vaccine stability, potency, and regulatory compliance.

3. Manufacturing & Production

This stage includes mRNA synthesis, encapsulation into delivery systems like LNPs, and formulation of the final vaccine product. Production facilities must adhere to strict Good Manufacturing Practices (GMP) to maintain quality and scalability for commercial demands.

4. Quality Control & Regulatory Approval

Vaccines undergo rigorous testing for purity, potency, and safety through laboratory and field trials. Regulatory bodies review data to grant approvals and licenses, ensuring the vaccine meets all safety and efficacy standards before market release.

5. Distribution & Cold Chain Management

Efficient distribution networks, including cold chain logistics, ensure vaccine integrity during transportation to farms, veterinary clinics, and other end users. Maintaining required temperature controls is crucial to preserving vaccine effectiveness in diverse geographic locations.

6. Marketing & Sales

Companies engage veterinarians, farmers, and animal health professionals through educational campaigns and sales strategies. Awareness-building helps drive adoption by highlighting the benefits of mRNA vaccines over traditional alternatives.

7. Post-Market Surveillance & Support

Monitoring vaccine performance and adverse effects after deployment provides critical feedback for improvements. Ongoing support ensures continued efficacy, customer satisfaction, and trust in mRNA vaccine technologies.

mRNA Vaccines for Animals Market Companies

1. Zoetis Inc.

Zoetis is a global leader in animal health, actively investing in mRNA vaccine technologies to develop innovative vaccines for livestock and companion animals. Their strong R&D capabilities and extensive distribution network help accelerate market adoption of advanced vaccines.

2. Elanco Animal Health

Elanco focuses on developing mRNA vaccines targeting major animal diseases and improving animal welfare globally. Through strategic partnerships and acquisitions, Elanco enhances its pipeline and manufacturing capabilities for mRNA-based solutions.

3. Boehringer Ingelheim Animal Health

Boehringer Ingelheim leverages its expertise in veterinary biologics to pioneer mRNA vaccine development for poultry and livestock. Their commitment to innovation drives new product launches and expands preventive care options for animal health.

4. CureVac AG

CureVac is a key biotech player specializing in mRNA technology, developing next-generation vaccines for animal diseases. Their platform's flexibility allows rapid vaccine design and production, meeting urgent needs in veterinary medicine.

5. Moderna, Inc.

Known for its human mRNA vaccines, Moderna is extending its technology to veterinary applications, partnering with animal health companies to develop mRNA vaccines for farm animals. Their investment in scalable manufacturing accelerates availability for global markets.

6. GSK (GlaxoSmithKline Animal Health)

GSK utilizes its robust vaccine development expertise to incorporate mRNA technologies in its animal health portfolio. Their global presence supports broad vaccine distribution and compliance with veterinary regulatory standards.

7. Vaxxas Pty Ltd

Vaxxas innovates in delivery technology for vaccines, including mRNA platforms, aiming to improve ease of administration and immunogenicity in animals. Their novel needle-free delivery systems enhance vaccine uptake and compliance in farm settings.

8. Agenus Inc.

Agenus develops innovative vaccine platforms including mRNA solutions for animal health, focusing on high safety and efficacy profiles. Their advanced technologies contribute to faster vaccine development and better disease control in livestock.

9. Arcturus Therapeutics

Arcturus leverages its proprietary mRNA platform to design veterinary vaccines targeting infectious diseases in animals. Their focus on stability and delivery efficiency supports robust immune responses in diverse animal species.

10. Inovio Pharmaceuticals

Inovio applies its DNA and mRNA vaccine expertise to develop novel veterinary vaccines, enhancing protection against zoonotic and animal-specific diseases. Their pipeline emphasizes rapid response to emerging animal health threats.

Recent Developments

- In July 2025, an mRNA vaccine for foot-and-mouth disease (FMD), developed by New South Wales and Tiba Biotech, has been successfully tested in cattle at Germany's Friedrich-Loeffler-Institut (FLI). Unlike traditional vaccines, it eliminates the need for high-biosafety virus cultivation and complex antigen purification, streamlining production and safety.

- In February 2024, the University of Pennsylvania’s School of Veterinary Medicine (Penn Vet) has launched a new mRNA Research Initiative to accelerate the development of mRNA-based veterinary vaccines and host-directed therapies. Announced by Dr. Phillip Scott and led by Dr. Christopher Hunter, the initiative aims to apply mRNA technology to protect animal health, food supply, and farming communities.

Segments Covered in the Report

By Animal Type

- Livestock

- Companion Animals

- Poultry

By Administration Route

By Delivery Technology

- Lipid Nanoparticles (LNPs)

- Viral Vectors

By Disease Indication

- Avian Influenza

- Swine Fever

- Canine Diseases

By End User

- Veterinary Hospitals & Clinics

- Research Institutes

- Farms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Global mRNA Vaccines for Animals Market Size, 2024–2034

- Global Market Share by Animal Type, 2024 & 2034

- Global Market Share by Administration Route, 2024 & 2034

- Global Market Share by Delivery Technology, 2024 & 2034

- Global Market Share by Disease Indication, 2024 & 2034

- Global Market Share by End-User, 2024 & 2034

- Global Market Share by Region, 2024 & 2034

- North America Market Size by Country, 2024–2034

- U.S. Market Size by Animal Type, 2024–2034

- Canada Market Size by Animal Type, 2024–2034

- Mexico Market Size by Animal Type, 2024–2034

- North America Market Size by Administration Route, 2024–2034

- Europe Market Size by Country, 2024–2034

- Germany Market Size by Animal Type, 2024–2034

- France Market Size by Animal Type, 2024–2034

- U.K. Market Size by Animal Type, 2024–2034

- Asia Pacific Market Size by Country, 2024–2034

- China Market Size by Animal Type, 2024–2034

- Brazil Market Size by Animal Type, 2024–2034

- Middle East & Africa Market Size by Country, 2024–2034

- Global mRNA Vaccines for Animals Market Outlook, 2024–2034

- Global Market Share by Animal Type, 2024

- Global Market Share by Administration Route, 2024

- Global Market Share by Delivery Technology, 2024

- Global Market Share by Disease Indication, 2024

- Global Market Share by End-User, 2024

- Global Market Share by Region, 2024

- North America Market Share by Country, 2024

- U.S. Market Share by Animal Type, 2024

- Europe Market Share by Country, 2024

- China Market Share by Delivery Technology, 2024

- Latin America Market Share by Country, 2024

- GCC Countries Market Share by Delivery Technology, 2024

- Comparative Growth Rate of mRNA Vaccines for Animals Market, 2024–2034