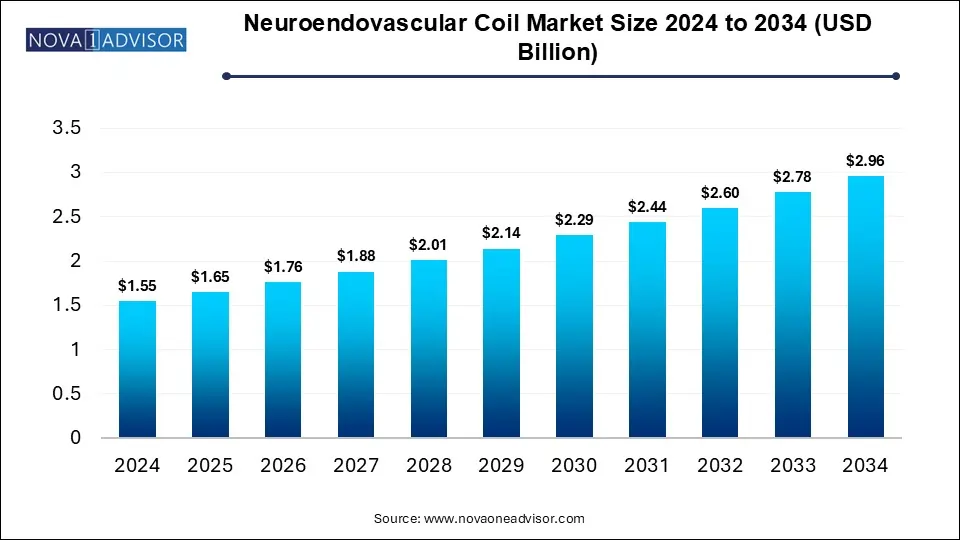

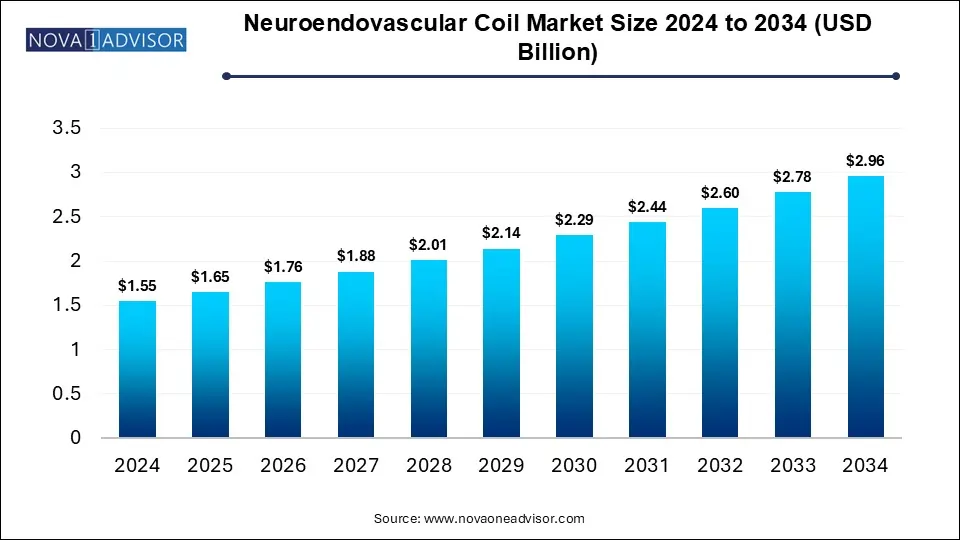

Neuroendovascular Coil Market Size and Growth

The Neuroendovascular coil market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 2.96 billion by 2034, growing at a CAGR of 6.7% during the forecast period 2025 to 2034.

Market Overview

The neuroendovascular coil market has emerged as a crucial segment in the broader neurovascular interventions industry, driven by the increasing prevalence of neurological disorders such as cerebral aneurysms, arteriovenous malformations (AVMs), and cerebral infarctions. Neuroendovascular coils are tiny devices used in minimally invasive procedures to treat aneurysms by promoting clotting and preventing ruptures. Their use is particularly relevant in the treatment of intracranial aneurysms, which can lead to hemorrhagic strokes if untreated.

Advancements in medical imaging, growing adoption of minimally invasive techniques, and heightened awareness of early diagnosis have collectively enhanced the demand for neuroendovascular coils globally. The growing geriatric population—especially in developed economies like the U.S., Japan, and Germany—has significantly influenced the market as age is a major risk factor for neurological diseases. Additionally, governments and private entities have increased investments in healthcare infrastructure, which is encouraging hospitals and specialty clinics to adopt these advanced solutions.

The market has also witnessed robust innovation with the introduction of hydrogel-coated coils, which have improved biocompatibility and reduced recurrence rates of aneurysms. Coupled with evolving reimbursement frameworks and regulatory approvals, the market trajectory points toward consistent growth across emerging and established economies.

Major Trends in the Market

-

Shift Toward Minimally Invasive Procedures: Increasing preference for non-invasive or minimally invasive neurointerventional therapies is driving demand for advanced neuroendovascular coils.

-

Technological Advancements in Coil Design: Innovations such as shape-memory alloys, three-dimensional coils, and bioactive coatings are enhancing efficacy and safety profiles.

-

Rising Demand for Hydrogel-Coated Coils: These coils are gaining popularity due to their superior healing outcomes and lower recurrence rates.

-

Integration of Artificial Intelligence (AI): AI-assisted imaging and robotic interventions are being introduced in neurosurgical procedures, improving precision.

-

Growth in Emerging Economies: Countries like India, Brazil, and China are investing heavily in neurology departments and specialized surgical units.

-

Strategic Partnerships and M&A: Companies are collaborating with technology providers or acquiring competitors to expand their portfolios and geographical presence.

-

Increasing Healthcare Expenditure: Governments globally are increasing spending on healthcare, indirectly boosting the demand for endovascular products.

Report Scope of Neuroendovascular Coil Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.65 Billion |

| Market Size by 2034 |

USD 2.96 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Penumbra; Inc; Kaneka Medical Europe N.V.; Stryker; Lepu Medical Technology (Beijing) Co. Ltd; Balt; NeuroSafe Medical Co., Ltd.; Johnson & Johnson; Boston Scientific Corporation; Medtronic; Terumo Corporation |

Key Market Driver

Growing Prevalence of Cerebral Aneurysms and Stroke

One of the most significant drivers of the neuroendovascular coil market is the rising incidence of cerebral aneurysms and strokes. According to the Brain Aneurysm Foundation, around 6 million people in the U.S. are affected by unruptured brain aneurysms, and nearly 30,000 suffer a rupture each year. These aneurysms, if not managed timely, can result in life-threatening hemorrhages or strokes.

The ability of neuroendovascular coils to be deployed through minimally invasive endovascular procedures provides an effective, safer, and quicker alternative to traditional open surgeries. They facilitate immediate occlusion of aneurysms and minimize the risks of recurrence, making them the preferred treatment in both elective and emergency situations. Moreover, early detection through imaging advancements and the increasing availability of neuro-intervention centers in urban and semi-urban areas further fuels the adoption of coiling procedures.

Key Market Restraint

High Cost of Treatment and Devices

Despite their clinical advantages, neuroendovascular coil treatments are associated with significant costs. The procedures often involve not just the price of the coil itself which can range from $1,000 to $2,000 per unit but also expensive imaging technologies, skilled neurosurgeons, and post-operative care. Additionally, multiple coils may be required per patient depending on the size and location of the aneurysm.

In countries with limited or non-existent healthcare reimbursement policies, these costs become a major deterrent, especially for middle- and low-income groups. Hospitals in these regions may also struggle to maintain the inventory and equipment required for such specialized procedures. This economic burden remains a challenge to widespread adoption, particularly in developing nations.

Key Market Opportunity

Expansion in Untapped Emerging Markets

Emerging economies present a substantial opportunity for the neuroendovascular coil market. Countries in Asia Pacific, Latin America, and parts of the Middle East & Africa are experiencing an epidemiological transition with rising cases of cerebrovascular disorders due to urbanization, sedentary lifestyles, and increasing life expectancy. Despite this, access to neuroendovascular procedures remains limited due to infrastructural constraints.

This gap offers an avenue for medical device companies to expand operations through affordable product lines, local manufacturing, and partnership with regional distributors. Government healthcare reforms and investments in tertiary care hospitals in countries like India, Thailand, and South Africa also support market penetration. Training programs and awareness campaigns can further drive adoption in these regions.

Segmental Analysis

Type Outlook

Bare platinum coils dominated the market in 2024 owing to their long-standing use, clinical acceptance, and cost-effectiveness. These coils are typically the first line of treatment in several hospitals and clinics due to their proven ability to facilitate aneurysm occlusion and compatibility with different delivery systems. Their ease of handling and deployment further enhances their utility, especially in emergency settings. Despite the emergence of newer coil technologies, bare platinum remains highly relevant, particularly in regions where affordability is a key concern.

On the other hand, hydrogel-coated coils are the fastest-growing segment, expected to witness a significant CAGR during the forecast period. These coils offer better aneurysm healing by promoting neointimal growth and reducing recanalization rates. The expansion of clinical trials supporting their efficacy and long-term success is improving physician confidence in using these advanced coils. They are particularly preferred in treating wide-neck aneurysms and complex neurovascular anatomies. As clinical guidelines evolve, these bioactive coils are gaining traction in developed markets like the U.S., Japan, and Germany.

Application Outlook

Cerebral aneurysm application segment held the largest market share, largely due to the rising diagnosis of aneurysms through increased access to MRI and CT scans. The risk of aneurysmal rupture and subsequent complications has led to a proactive approach in treating even unruptured aneurysms, especially in younger populations. Neuroendovascular coiling has become the standard of care in many countries for treating intracranial aneurysms due to its high success rate and fewer complications compared to surgical clipping.

Meanwhile, the cerebral infarction segment is expected to register the fastest growth, as stroke continues to be a leading cause of disability and death worldwide. Innovations in coiling techniques, including stent-assisted coiling and retrievable coils, have widened their application in acute ischemic conditions. Endovascular therapy for stroke is gaining clinical preference, and its increasing usage in stroke centers and emergency neurology departments is set to drive the growth of this application segment.

End Use Outlook

Hospitals continue to dominate the end-use segment due to the availability of advanced neurovascular imaging infrastructure, skilled neurosurgical teams, and emergency care facilities. Tertiary care and teaching hospitals often serve as referral centers for complex aneurysm cases, and their ability to handle high-risk procedures makes them the leading consumer of neuroendovascular coils. With rising stroke volumes and growing healthcare budgets in both public and private hospital sectors, this segment will maintain its leadership position.

Conversely, ambulatory surgical centers (ASCs) are emerging as the fastest-growing end-use segment, particularly in North America and parts of Europe. The shift toward outpatient procedures and shorter recovery times due to minimally invasive techniques is fueling this growth. ASCs offer cost advantages and quicker scheduling for patients, making them a preferred choice for elective aneurysm procedures. Improvements in portable imaging and real-time monitoring systems have further enabled ASCs to handle increasingly complex neurosurgical procedures.

Regional Analysis

North America is the dominant region in the neuroendovascular coil market, accounting for the largest share in 2024. The region benefits from an advanced healthcare infrastructure, widespread adoption of new medical technologies, and a high burden of neurovascular diseases. The U.S. leads the region with significant numbers of endovascular neurosurgery centers and favorable reimbursement frameworks. High awareness, strong government and private funding for neurological research, and partnerships between hospitals and manufacturers drive the regional market.

Asia Pacific is the fastest-growing region, projected to record the highest CAGR through 2030. Rapid urbanization, increasing healthcare expenditure, and rising stroke prevalence are creating demand for neuroendovascular interventions in countries like China, India, and Japan. Moreover, the growing number of neuro-specialty hospitals, availability of skilled medical professionals, and proactive government policies aimed at non-communicable diseases are propelling market expansion. Initiatives like India's Ayushman Bharat and China’s Healthy China 2030 program are also contributing to increased access to advanced neurosurgical treatments.

Some of The Prominent Players in The Neuroendovascular coil market Include:

- Penumbra, Inc

- Kaneka Medical Europe N.V.

- Stryker

- Lepu Medical Technology (Beijing) Co.,Ltd

- Balt

- NeuroSafe Medical Co., Ltd.

- Johnson & Johnson

- Boston Scientific Corporation

- Medtronic

- Terumo Corporation

Recent Developments

-

March 2025 – Medtronic plc announced the launch of its next-generation flow-diverting coil system designed for treating large and complex aneurysms. The company emphasized that the new system showed superior occlusion rates in its clinical trials.

-

January 2025 – Stryker Corporation expanded its neurovascular division by acquiring a European startup specializing in AI-guided coil placement systems. This move aims to integrate precision technologies into their coiling solutions.

-

November 2024 – MicroVention, Inc., a subsidiary of Terumo, received CE mark approval for its LVIS EVO stent-assisted coiling system, boosting its European market presence.

-

September 2024 – Penumbra Inc. partnered with the Singapore General Hospital to open a new neuro-intervention training center in Asia Pacific to promote safe coil deployment techniques.

-

July 2024 – Balt USA unveiled its innovative dual-layer detachable coil system at the SNIS Annual Meeting, receiving positive feedback from neurosurgeons for its flexibility and procedural control.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Type

- Bare Platinum Coils

- Hydrogel-Coated Coils

By Application

- Cerebral Infarction

- Cerebral Aneurysm

- Arteriovenous Malformation (AVM)

- Others

By End Use

- Hospitals

- Ambulatory Surgery Centers

- Specialty Clinics

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)