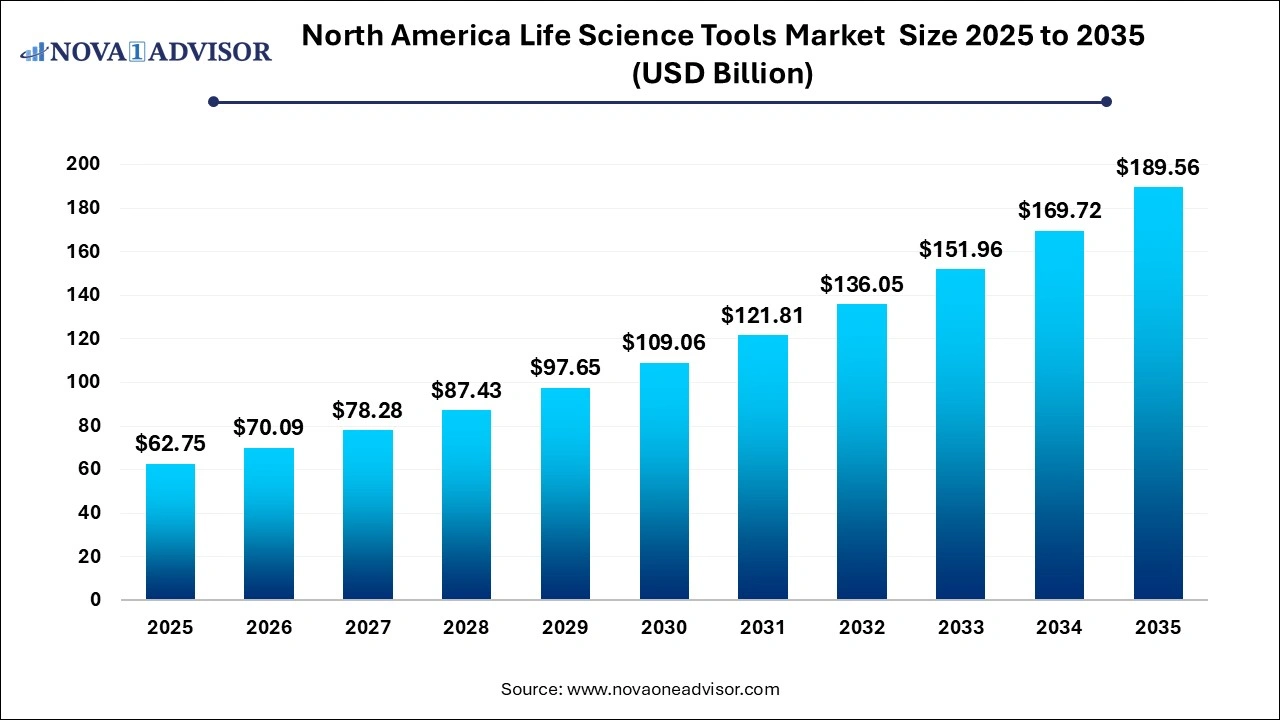

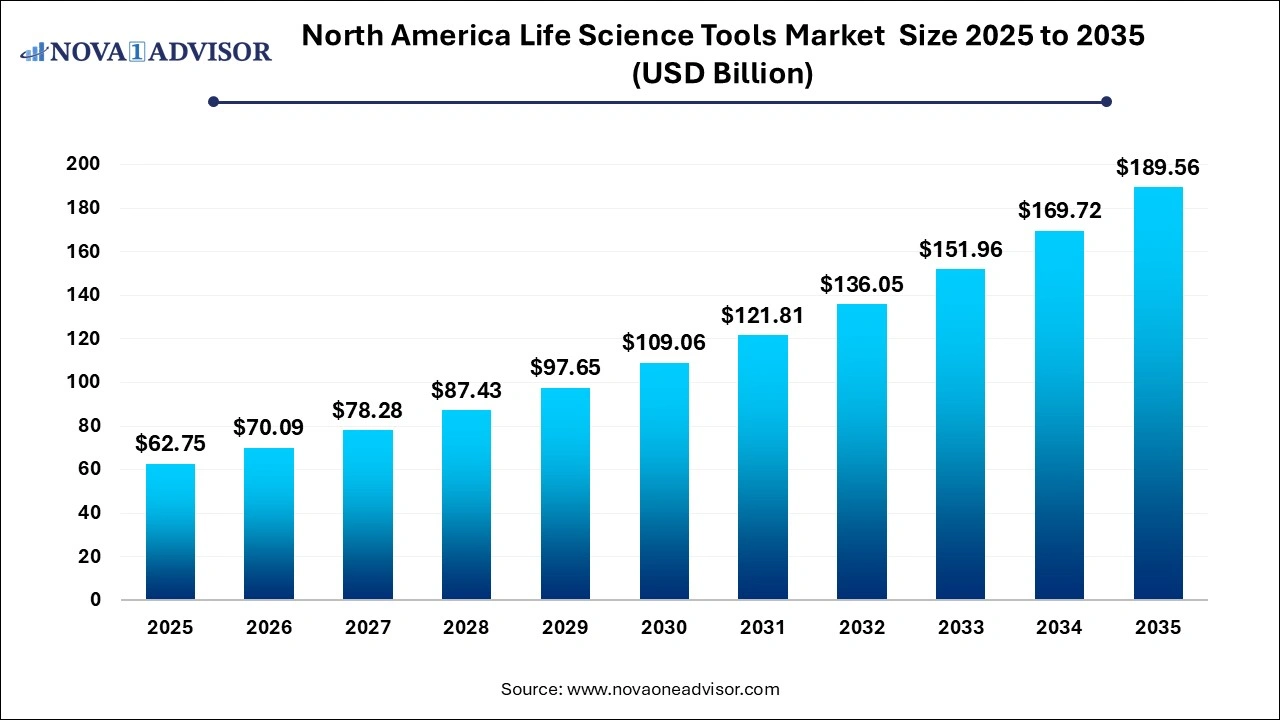

The North America life science tools market size valued at USD 62.75 billion in 2025 and is projected to hit USD 189.56 billion by 2035, growing at a CAGR of 11.69% from 2026 to 2035. The growth of the North America life science tools market is driven by the rising investments for R&D operations, focus on addressing unmet medical needs, increased adoption of digital technologies, and expanding applications of these tools.

- By country, U.S. dominated the North America life science tools market in 2025.

- By technology, the cell biology technology segment dominated the market with the largest share in 2025.

- By product, the cell biology segment accounted for the highest market revenue share in 2025.

- By end-use, the healthcare segment held the largest market share in 2024 and is expected to register the fastest CAGR over the forecast period.

- By end-use, the biopharmaceutical companies segment is expected to grow at significant CAGR during the predicted timeframe.

Life science tools refer to a broad range of instruments, consumables, and services fundamental for scientific discovery and are used in biological and medical research for studying living organisms, cells and molecular processes, further enabling researchers to gain better comprehension into the complexities of life. These tools are widely used for advancing fields like cell biology, drug discovery, genomics, proteomics, among others.

The expansion of biotechnology sector, robust research infrastructure, increasing investments and funding from public and private sectors for research purposes, and growing focus on personalized medicine and development of targeted therapies are creating a strong demand for life science tools and technologies across North America. Additionally, progress in cell biology and genomics fields, innovative product launches, adoption of automation and artificial intelligence (AI), and government support are the factors expanding the market potential.

In August 2025, Thermo Fisher Scientific launched the Applied Biosystems MagMAX HMW DNA Kit, which will offer a streamlined manual and automated extraction workflow, further enabling the reproducible isolation of High Molecular Weight (HMW) DNA suitable for long-read sequencing.

- In March 2025, Beckman Coulter Life Sciences launched the industry’s first-of-a-kind modular spectral flow cytometry solution, the CytoFLEX mosaic Spectral Detection Module, which offers up to 88 channels for detection.

Artificial intelligence (AI) is actively being deployed in the North America life science tools market, driven by factors such as the need for accelerating drug discovery processes, exploding biomedical data from electronic health records (EHRs) and genomics, and the increasing demand for personalized medicine approaches. AI algorithms can be applied for streamlining clinical trial processes like automation of data analysis and other tasks, selection of ideal patient candidates, and for optimizing trial designs. Analysis of medical images such as MRIs and X-rays with AI-powered diagnostic tools can enable early more accurate diagnosis of diseases. AI tools can potentially enhance the efficiency and resilience of supply chains across North America’s large and widespread distribution network for the life sciences industry.

AI platforms, cloud services and computational power necessary for life science research offered by major technology providers like Google, Microsoft and NVIDIA are expanding the market potential. Moreover, specialized AI-based platforms and consulting services are being offered by companies like IQVIA and Schrödinger, with focus on areas such as molecular discovery and clinical analytics.

For instance, in October 2024, Oracle launched the AI-powered Oracle Analytics Intelligence for Life Sciences, which will assist in accelerating insight generation into diseases and their impact on patients by unifying disparate datasets into a single, intelligent workbench, further leading to development of optimized therapeutic launch strategies. The continuously updating analytics platform is linked with real-world data sources like CancerMPact and multiomics.

| Report Coverage |

Details |

| Market Size in 2026 |

USD 70.09 Billion |

| Market Size by 2035 |

USD 189.56 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.67% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, Product, End-use, Country |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Agilent Technologies, Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Inc., Bruker, Corning, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., General Electric Company, Hitachi Koki Co., Ltd., Illumina, Inc., Merck KGaA, Miltenyi Biotec, Oxford, Instruments, Perkin Elmer, Inc., QIAGEN, Shimadzu Corporation, Thermo Fisher Scientific, Inc |

Drivers

Strong R&D Investment and Focus on Biopharmaceutical Innovation

The rising investment in R&D activities by biopharmaceutical companies, venture capital firms and other private organizations are fuelling innovation for the development of advanced therapies, diagnostic tools and sophisticated instruments. Significant funding, research grant and investments made by the governments of the U.S. and Canada for expanding capabilities in the life sciences sector are driving the market growth. Furthermore, focus of biopharmaceutical companies on developing advanced and high-value biologics to expand their product offerings and for addressing unmet medical needs is contributing to the market growth.

Restraints

Complex Regulatory Environment

The lengthy approval processes for new products and technologies by regulatory agencies like the FDA can potentially delay the market entry. Stringent guidelines for development, manufacturing, commercialization as well as for maintaining data privacy can increase the complexity and costs, particularly for small and emerging companies due to lack of resources for meeting full compliance requirements.

Opportunities

Continuous Advancements in Life Science Tools

The increased adoption of AI and machine learning tools as well as digitalization healthcare infrastructure is creating opportunities for the growth of the life science tools market. Companies are actively adopting AI-driven platforms to gain a competitive advantage in the market. Focus on utilizing data-as-a-service platform, due to expanding multiomics data such as genomics, proteomics, transcriptomics is driving the need for cloud-based data analysis and management, further creating an opportunity for technologies providers in the market.

Segmental Insights

What Made Cell Biology Technology the Dominant Market Segment in 2025?

By technology, the cell biology technology segment captured the largest market share in 2025. The rising demand for cell-based therapies like CAR T (Chimeric Antigen Receptor T)- cell therapy is driving the demand for advanced tools required for cell manufacturing, analysis, and in quality control. The increasing incidences of chronic diseases such as cancer is creating the need for sophisticated diagnostics utilizing cell biology tools for early cancer screening through the identification of biomarkers. Heavy investments made by biopharmaceutical companies in cell-based therapy research, expanding pipeline of cell and gene therapies, development of innovative cell biology tools, and expanding applications such as for drug discovery and vaccine development are the factors driving the market dominance of this segment.

How Did the Cell Biology Segment Dominate the Market in 2025?

By product, the cell biology segment dominated the market with the highest revenue share in 2025. The ongoing advancements in cell analysis such as single-cell sequencing, adoption of automated platforms such as automated liquid handlers and high-throughput screening (HTS) platforms, shift towards 3D cell cultures and organoids as well as integration of AI and digital imaging in cytology and cell analysis are driving the demand for cell biology products such as sophisticated instruments and reliable consumables. Development of cell and tissue culture facilities by various organizations such as commercial labs, research institutions and companies for advancing research and offering services for different applications like diagnostics, disease research, drug discovery and plant propagation are contributing to the market growth.

- For instance, in June 2025, World Precision Instruments (WPI), a globally leading company in transepithelial electrical resistance (TEER) instrumentation, in partnership with SynVivo Inc., a pioneer in Organ-on-a-Chip (OOC) technology, commercially launched a next-generation multiplexed TEER-on-a-Chip platform. The new breakthrough platform offers high-throughput and real-time measurement of barrier integrity in advanced Organ-on-a-Chip models.

Why Did the Healthcare Segment Dominated the Market in 2025?

By end-use, the healthcare segment accounted for the largest market share in 2025 and is anticipated to show the fastest growth during the forecast period. The rising prevalence of chronic diseases like cancer, cardiovascular conditions and diabetes, as well as infectious diseases is creating a continuous and increasing demand for advanced life science tools needed for early detection, monitoring of disease progression, and to develop personalized treatment plans. Life science tools are widely being used in healthcare for gaining better comprehension of underlying disease mechanisms, to identify potential drug targets, and for developing innovative and targeted therapies.

The rise in number of specialized diagnostic laboratories as well as expansion of in-house diagnostic services in hospitals offering a wide range of tests such as advanced molecular diagnostics and genetic testing are leading to enhanced efficiency in healthcare services and improved patient life outcomes. The focus on achieving health equity by enabling access to life science tools and technologies for all populations, regardless of geographic location or socioeconomic status of an individual is contributing to the market growth.

By end-use, the biopharmaceutical companies segment is expected to show notable growth over the forecast period. The rising shift of biopharmaceutical companies from small molecule drugs towards the development of more complex and high-value biologics such as cell and gene therapies, monoclonal antibodies, and vaccines is creating huge demand for advanced and sophisticated life science tools crucial for research, development and manufacturing purposes. The increasing adoption of cutting-edge technologies such as cell biology platforms, CRISPR gene-editing tools and next-generation sequencing (NGS) tools are contributing to the development of innovative therapies.

The growing trend for collaboration of biopharmaceutical companies with academic institutes, emerging biotech startups and research organizations for advancing R&D activities is driving the market growth. Additionally, North America’s robust venture capital ecosystem offering significant funding for biomedical research to biotech companies and supportive regulatory landscape expediting approvals of novel drugs and therapies are fuelling the market expansion.

Country Insights

U.S. Life Science Tools Market Trends

U.S. led the life science tools market in North America in 2025. The market growth can be linked to the well-developed healthcare infrastructure, increased adoption of genomic and proteomic technologies, ongoing clinical trials across various therapeutic modalities, presence of major market players, and a rising demand for biopharmaceuticals. Government funding and support for life science research through agencies like the National Institutes of Health (NIH) and the National Science Foundation (NSF) are encouraging innovation and contributing to the market growth. Stringent regulations and streamlined regulatory approval pathways established by the U.S. Food and Drug Administration is fuelling the market expansion.

Canada Life Science Tools Market Trends

The life science tools market in Canada is growing, driven by the factors such as the increasing investments by the government for advancing R&D, a growing biotechnology ecosystem focused on expanding product portfolios, efforts for commercializing innovative therapies and increased healthcare expenditure. The active involvement of the Canadian government through the Biomanufacturing and Life Science’s strategy which focuses on enhancing research infrastructure and improving clinical trial capacity is expanding the potential of life sciences sector.

For instance, in March 2025, the Government of Canada through the Strategic Innovation Fund invested $49.9 million in STEMCELL Technologies Canada Inc. The investment will boost the company’s $222 million project for building two cutting-edge, large-scale biomanufacturing facilities for producing essential inputs used in the development and manufacturing of therapies, vaccines, and diagnostic technologies.

- In January 2025, Clarivate Plc, a globally leading provider of transformative intelligence, launched a modular analytics solution, DRG Fusion, which is an innovative platform powered by real-world data and developed for supporting commercial analytics in life sciences, further empowering commercial teams for optimizing strategies and improving patient outcomes.

- In August 2024, MP Biomedicals launched its diverse product selection of in vitro diagnostic tests for infectious diseases with new immunochromatographic-based qualitative rapid tests. These advanced gastrointestinal disease diagnostic kits will allow healthcare professionals to rapidly and accurately detect Helicobacter pylori, Salmonella typhi, and Vibrio cholerae serogroups O1 and O139.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the North America life science tools market.

By Technology

- Cell Biology Technology

- Genomic Technology

- Proteomics Technology

- Lab Supplies & Technologies

- Other Analytical & Sample Preparation Technology

By Product

- Cell Biology

- Instrument

- Glassware

- Culture ware

- Others

- Consumables

- Cell & Tissue Culture Services

- Cloning

- Kits, Reagents, and Consumables

- Services

- Next-Generation Sequencing

- Instrument

- Consumables

- Services

- PCR & qPCR

- Instrument

- Consumables

- Services

- Flow Cytometry

- Instrument

- Consumables

- Services

- Nuclear Magnetic Resonance Spectroscopy (NMR)

- Instrument

- Consumables

- Services

- Microscopy & Electron Microscopy

- Instrument

- Consumables

- Services

- Liquid Chromatography (LC)

- Instrument

- Consumables

- Services

- Mass Spectrometry (MS)

- Instrument

- Consumables

- Services

- Nucleic Acid Preparation (NAP)

- Instrument

- Consumables

- Services

- Transfection Electroporation

- Other Products & Services

- Antibodies

- General Supplies

- Nucleic Acid Microarray

- Instrument

- Consumables

- Services

- Others

- Instrument

- Consumables

- Services

By End-use

- Biopharmaceutical Companies

- Government & Academic

- Healthcare

- Industrial Application

- Others

By Country