Oligonucleotide Synthesis Market Size, Share, Growth, Report 2025 to 2034

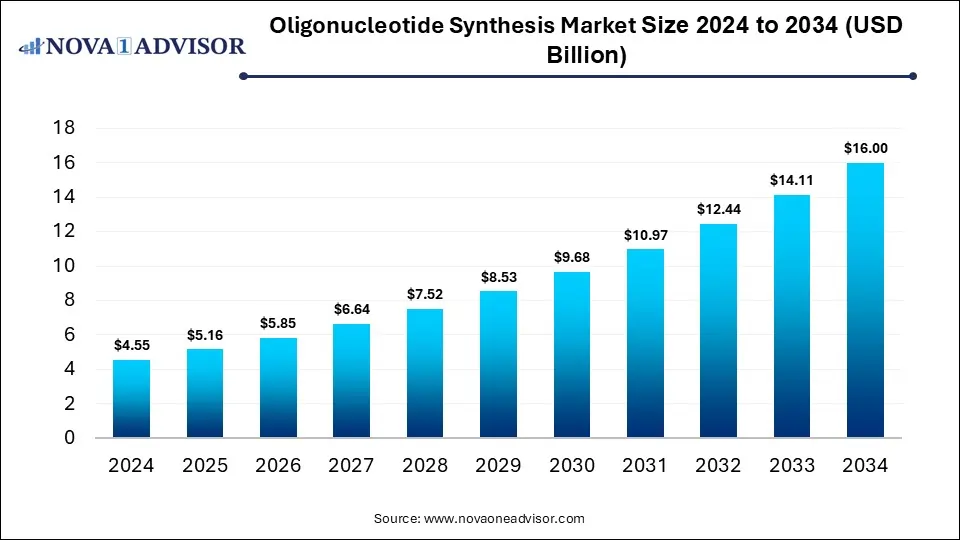

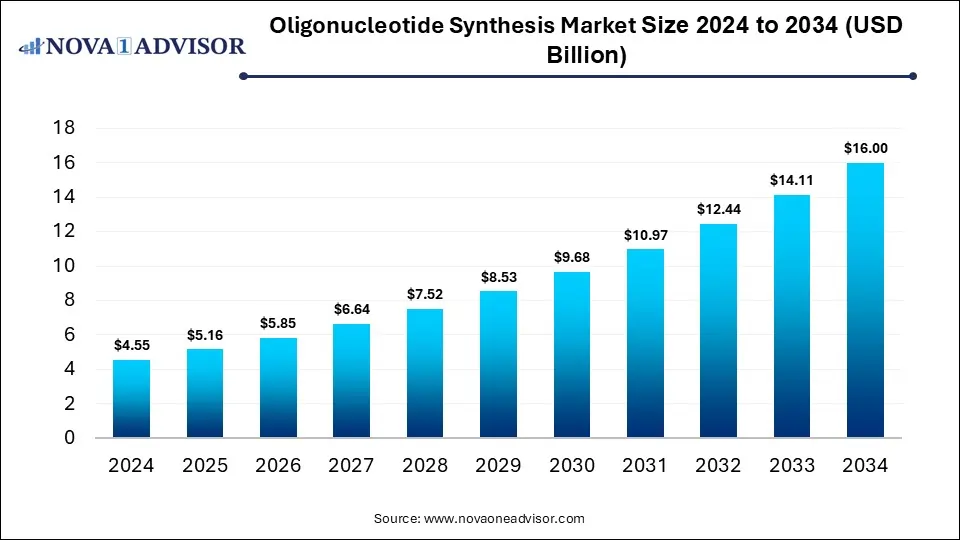

The global oligonucleotide synthesis market size is calculated at USD 4.55 billion in 2024, grows to USD 5.16 billion in 2025, and is projected to reach around USD 16.00 billion by 2034, growing at a CAGR of 13.4% from 2025 to 2034. The market is growing due to rising demand for personalized medicine and targeted therapies. Additionally, advancements in genomics and increasing applications in diagnostics and drug discovery are driving its expansion.

Oligonucleotide Synthesis Market Key Takeaways

- North America dominated the oligonucleotide synthesis market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the services segment held the largest market share in 2024.

- By product, the oligonucleotides segment is expected to grow at a significant rate in the market during the forecast period.

- By application, the PCR primers segment led the market with the largest revenue share in 2024.

- By application, the sequencing segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the academic research institutes segment held the highest market share.

- By end user, the pharmaceutical and biotechnology companies’ segment is expected to grow at a lucrative rate in the market during the forecast period.

What is Oligonucleotide Synthesis?

Oligonucleotide synthesis is the chemical or enzymatic process of creating short DNA or RNA sequences used in research, diagnostics, and therapeutics. The growth of the oligonucleotide synthesis market is also driven by the rising use of synthesis biology and RNA-based technologies, which require high-quality oligos for experimentation. Expansion of CRISPR application, vaccine development, and agricultural biotechnology further boost demand. Increasing availability of cost-effective, automated synthesis platforms is making production faster and more scalable. Moreover, the entry of new players, growing outsourcing of oligo manufacturing, and commercialization of novel synthesis approaches are creating fresh opportunities, accelerating market expansion.

What are the Key trends in the Oligonucleotide Synthesis Market in 2024?

- In December 2024, Co-Dx and CoSara Diagnostics Pvt. Ltd established an oligonucleotide synthesis facility in Ranoli, India, under the “Make in India” initiative, to produce Co-Primers oligos domestically. (Source: https://www.genengnews.com/)

- In July 2024, researchers from Harvard’s Wyss Institute and Harvard Medical School introduced a new technique for template-free enzymatic synthesis of single-stranded RNA, published in Nature Biotechnology. EnPlusOne Biosciences is commercializing this approach, which uses water and enzymes to produce RNA with efficiency and purity comparable to traditional chemical methods. (Source: https://www.genengnews.com/)

How Can AI Affect the Oligonucleotide Synthesis Market?

AI can influence the market by enabling predictive modeling for stability and efficacy, which helps select the most promising candidates early in development. It can also enhance quality control by detecting anomalies in real time during synthesis, ensuring higher consistency. Additionally, AI-powered supply chain optimization can improve resource management and reduce delays. By integrating AI with cloud platforms, collaboration across research teams becomes easier, fostering faster innovation and wider accessibility in oligonucleotide-based solutions.

Report Scope of The Oligonucleotide Synthesis Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.16 Billion |

| Market Size by 2034 |

USD 16.00 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product , Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies; Bio-synthesis; Kaneka Eurogentec S.A; LGC Biosearch Technologies; Biolegio; Twist Bioscience |

Market Dynamics

Driver

Increasing Demand for Oligos in Molecular Diagnostic and Genetic Testing

The demand for oligos in molecular and genetic testing is a key driver as they enable the creation of highly specific probes and primers tailored to individual assays. This flexibility supports the development of innovative diagnostic kits and advanced genetic screening solutions. Expanding newborn screening solutions. Expanding newborn screening programs, rising use of companion diagnostics, and increasing adoption of point-of-care tests further accelerate the need for oligos. These applications not only improve healthcare outcomes but also boost large-scale synthesis requirements, driving market growth.

- For Instance, In April 2024, Asahi Kasei Bioprocess and Axolabs announced a partnership to build a 59,000 sq ft cGMP facility in Berlin specifically for oligonucleotide manufacturing. This new facility aims to scale up production for oligo-based therapeutics, speeding up development and meeting increasing demand in diagnostics and drug development. (Source: https://www.businesswire.com/)

Restraint

High Cost of Synthesis and Manufacturing

High synthesis and manufacturing costs restrain the oligonucleotide synthesis market because scaling up production often leads to complex purification challenges and low material yield, increasing waste and inefficiency. Specialized expertise is required to manage the synthesis workflow, adding lab processes and slowing throughput. Furthermore, the limited availability of cost-effective enzymatic methods compared to chemical synthesis keeps pricing high. These financial and operational barriers discourage adoption, particularly in routine clinical use and in price-sensitive regions, thereby constraining market growth.

Opportunity

RNA-based Therapeutics

The growth of RNA-based therapeutics offers future opportunities in the oligonucleotide synthesis market because it enables the development of next-generation therapies with rapid design and production cycles. Increasing research into RNA vaccines, gene silencing, and personalized RNA treatment is fueling demand for high-purity, custom oligos. Furthermore, regulatory approvals and successful clinical trials are encouraging biotech companies to invest in large-scale RNA oligo manufacturing, creating new revenue streams and expanding the market for innovative oligonucleotide applications.

- For Instance, In June 2024, Roche signed a collaboration and licensing agreement to develop gene therapies using Ascidian’s RNA exon editing technology for neurological diseases, with an initial $42 million payment and potential milestones up to $1.8 billion. This deal highlights the rising demand for oligonucleotides in advanced RNA-based therapies (Source: https://www.prnewswire.com/)

Segmental Insights

How does the Services Segment dominate the Oligonucleotide Synthesis Market in 2024?

The services segment dominated the market in 2024 because it provides access to advanced synthesis technologies, including automated and enzymatic platforms, without the need for companies to maintain specialized equipment. Many startups and small biotech firms rely on external providers to meet high-purity and custom oligonucleotide requirements. Additionally, service providers offer flexible production scales, regulatory compliance support, and technical expertise, making them a preferred choice for both research and therapeutic applications, which drives the market-leading share.

- For Instance, In November 2023, Twist Bioscience launched Express Genes, a gene synthesis service providing fast turnaround of 5–7 business days at its Wilsonville, Oregon, facility, enabling rapid and efficient gene production for genomics and synthetic biology applications. (Source: https://investors.twistbioscience.com/)

The oligonucleotide segment is projected to grow rapidly because of the rising demand for custom and large-scale oligos in emerging applications such as mRNA vaccines, antisense therapies, and diagnostic kits. Increasing collaborations between biotech companies and research institutions, along with the development of novel oligo modifications to improve stability and efficacy, are further boosting market potential. Additionally, expanding use in agricultural biotechnology, synthetic biology, and next-generation sequencing is creating new opportunities, driving strong growth in this segment during the forecast period.

Why Did the PCR Primers Segment Dominate the Market in 2024?

The PCR primers segment dominated the market in 2024 because of its widespread use in next-generation sequencing, drug discovery, and vaccine development. Rising demand for high-throughput and rapid diagnostics testing, along with the increasing prevalence of infectious and genetic diseases, has driven the need for reliable primers. Additionally, advancements in custom primer design, improved specificity, and enhanced stability have made PCR primers a critical component across research and clinical laboratories, securing the segment's largest revenue share.

The sequencing segment is projected to grow rapidly because of expanding applications in transcriptomics, epigenetics, and metagenomics research. An increase in large-scale genomics projects, such as population genomics and precision medicine initiatives, is driving the demand for high-quality oligonucleotides tailored for sequencing workflows. Moreover, improvements in automation and synthesis are enhancing efficiency. The rising adoption of multi-omics approaches across biotechnology and pharmaceutical research is further accelerating growth in the market.

- For Instance, In January 2025, DNA Script unveiled advancements in oligonucleotide synthesis technology. The advancement enabled the production of custom DNA sequences of up to 500 nucleotides in length with unmatched complexity. (Source: https://www.technologynetworks.com/)

How does the Academic Research Institutes Segment Dominate the Oligonucleotide Synthesis Market?

The Academic and Research Institute segment dominated the market because these organizations frequently require rapid, flexible access to diverse oligonucleotides for innovation in synthetic biology, diagnostics, and therapeutic research. Their focus on exploratory studies, method development, and training programs drives consistent demand. Moreover, partnerships with biotech startups and contract research organizations for collaborative projects increase their reliance on external synthesis services, reinforcing their leading market share in the oligonucleotide synthesis industry.

- For Instance, In May 2023, GenScript increased production capacity at its Jiangsu, China facility to manufacture oligonucleotides and peptides, strengthening its two-decade legacy of supplying high-quality products to researchers worldwide. (Source: https://www.genscript.com/)

The pharmaceutical and biotechnology company segment is projected to grow strongly because these companies increasingly rely on oligonucleotides for novel drug discovery, biomarker development, and advanced diagnostics. Expansion in RNA therapeutics, genome editing, and precision medicine programs requires high-purity, customizable oligos at scale. Furthermore, strategic collaborations with contract synthesis providers and investments in automated production technologies enable faster development cycles, reducing time-to-market for new therapies and driving sustained growth of this end-user segment in the oligonucleotide synthesis market.

- For Instance, In September 2024, Lilly teamed up with AI-focused startup Genetic Intelligence, Inc. in a $409 million agreement to develop RNA-targeted therapies. Using Genetic Intelligence’s AI platform, Genetic Leap, Eli Lilly aims to create oligonucleotide drugs for selected therapeutic targets. (Source: https://www.geneonline.com/)

Regional Insights

How is North America contributing to the Expansion of the Oligonucleotide Synthesis Market?

North America led the market in 2024 because of a well-established network of academic institutions and research centers driving demand for high-quality oligos. Strong collaborations between biotech firms and contract synthesis providers, along with early adoption of innovative synthesis technologies and AI-driven platforms, enhanced efficiency and scalability. Additionally, rising government funding for molecular diagnostics, genomic research, and therapeutic development supported large-scale oligonucleotide applications, contributing to the region’s dominant revenue share.

- For Instance, In April 2024, the US FDA and EMA approved 19 oligonucleotide therapies targeting rare genetic disorders, marking a significant advancement in treatment options for these conditions. (Source: https://www.geneonline.com/)

How is Asia-Pacific Accelerating the Oligonucleotide Synthesis Market?

Asia-Pacific is projected to witness the fastest growth because of the rising adoption of advanced molecular diagnostics and oligonucleotide-based therapies in emerging economies. Increasing collaborations between local biotech firms and global players, along with expanding healthcare access and research funding, are boosting demand. Moreover, the region’s focus on developing domestic oligonucleotide manufacturing capabilities, coupled with a growing prevalence of chronic and genetic diseases, is driving rapid market expansion during the forecast period.

- For Instance, In September 2023, Insud Pharma opened its first Oligonucleotides Centre in Hyderabad, India, through its fully-owned subsidiary, Chemo India Formulation. (Source: https://www.insudpharma.com/)

Some of the prominent players in the Oligonucleotide synthesis market include:

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the global oligonucleotide synthesis market.

By Product Outlook

- Oligonucleotides

- Product Type

- Column-based Oligos

- Array-based Oligos

- Nucleic Acid Type

- Equipment/Synthesizer

- Reagents

- Services

-

-

- Oligo Synthesis

- 25 nmol

- 50 nmol

- 200 nmol

- 1000nmol

- 10,000 nmol

- Purification

- Modification

By Application

- PCR Primers

- PCR Assays and Panels

- Sequencing

- DNA Microarrays

- Fluorescence In Situ Hybridization (FISH)

- Antisense Oligonucleotides

- Other Applications

By End-use

- Academic Research Institutes

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

List of Tables

- Global Oligonucleotide Synthesis Market Size, 2024–2034

- Global Market Share by Product Outlook, 2024 & 2034

- Global Market Share by Application, 2024 & 2034

- Global Market Share by End-Use, 2024 & 2034

- Global Market Share by Region, 2024 & 2034

- North America Market Size by Country, 2024–2034

- U.S. Market Size by Product Outlook, 2024–2034

- Canada Market Size by Product Outlook, 2024–2034

- Mexico Market Size by Product Outlook, 2024–2034

- Europe Market Size by Country, 2024–2034

- Asia Pacific Market Size by Country, 2024–2034

- Latin America Market Size by Country, 2024–2034

- Middle East & Africa Market Size by Country, 2024–2034

- Global Oligonucleotide Synthesis Market Outlook, 2024–2034

- Global Market Share by Product Outlook, 2024

- Global Market Share by Application, 2024

- Global Market Share by End-Use, 2024

- Global Market Share by Region, 2024

- North America Market Share by Country, 2024

- U.S. Market Share by Product Outlook, 2024

- Europe Market Share by Country, 2024

- Asia Pacific Market Share by Country, 2024

- Latin America Market Share by Country, 2024

- Middle East & Africa Market Share by Country, 2024

- Comparative Growth Rate of Oligonucleotide Synthesis Market, 2024–2034