Oncology Companion Diagnostic Market Size and Forecast 2026 to 2035

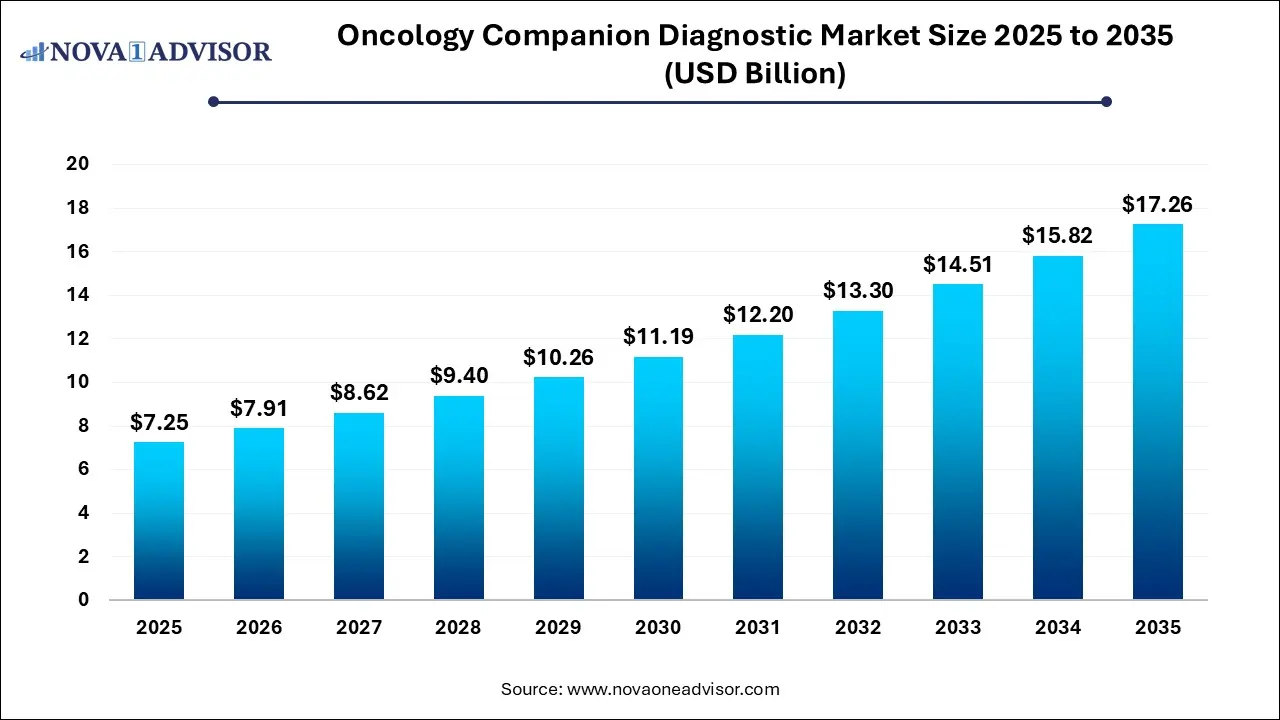

The global oncology companion diagnostic market size was valued at USD 7.25 billion in 2025 and is projected to surpass around USD 17.26 billion by 2035, registering a CAGR of 9.06% over the forecast period of 2026 to 2035. The oncology companion diagnostic market growth is driven by the rising cancer disease burden, increased awareness, development of innovative companion diagnostic techniques, and regulatory support.

Oncology Companion Diagnostic Market Key Takeaways

- North America dominated the market with largest revenue share of 41% in 2025.

- The Asia-Pacific market is expected to witness the fastest CAGR of over the projected period

- Products segment dominated the market with a share of 67% in 2025

- Services segment is expected to register fastest CAGR during the forecast period.

- Polymerase Chain Reaction (PCR) segment dominated the market with a share of 23% in 2025.

- Next-generation Sequencing (NGS) segment is expected to register fastest CAGR during the forecast period.

- Non-small cell lung cancer segment dominated the market with a share of 31% in 2025.

- Breast cancer segment is expected to register fastest CAGR during the forecast period.

- Hospitals segment dominated the oncology companion diagnostic market with a share of 54% in 2025.

- Pathology/Diagnostic laboratory segment is anticipated to grow at fastest growth over the forecast period.

U.S. Oncology Companion Diagnostic Market Size, Industry Report, 2035

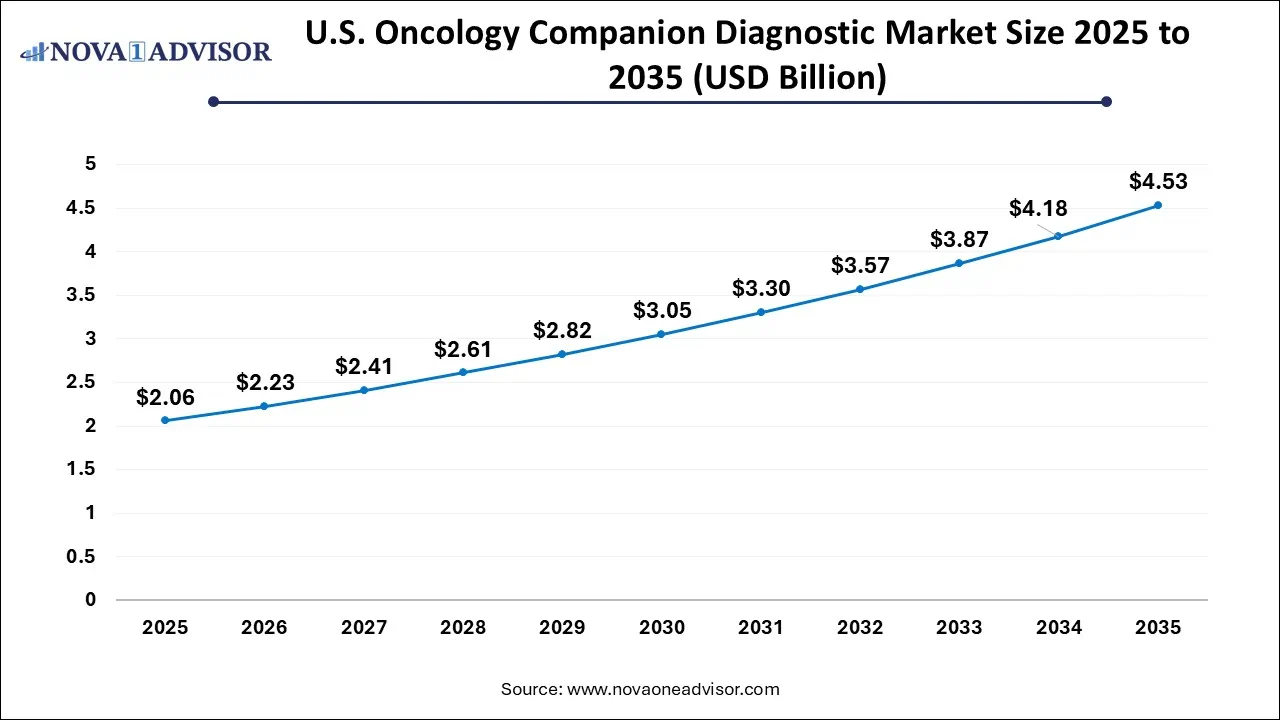

The U.S. Oncology Companion Diagnostic market size was valued at USD 2.06 billion in 2025 and is anticipated to reach around USD 4.53 billion by 2035, growing at a CAGR of 8.19% from 2026 to 2035.

North America particularly the United States dominates the global oncology companion diagnostic market. This leadership is attributed to a robust healthcare infrastructure, extensive R&D activity, and favorable regulatory support from the FDA. The U.S. is home to numerous pharma-diagnostic partnerships that have pioneered the co-approval of therapies and associated tests. High cancer incidence, strong reimbursement frameworks, and a mature genomics ecosystem further contribute to this region’s dominance. Additionally, organizations like the NIH and NCI fund large-scale genomics research that fuels innovation in companion diagnostics.

U.S. Oncology Companion Diagnostic Market Trends

U.S. is a major contributor to the oncology companion diagnostic market in North America. Growing number of cancer cases of various types are creating huge demand for companion diagnostics for accurate identification of patients most likely to benefit from targeted therapies. Continuous advancements in biomarker discovery and genomics research are enabling the development of precise and more effective diagnostic tools. Increased research activities, collaboration among pharmaceutical companies and diagnostic service providers as well as well-established healthcare infrastructure providing access to advanced diagnostic technologies are contributing to the market expansion. Supportive regulatory frameworks are accelerating approvals of companion diagnostics and encouraging innovation. Adoption of comprehensive genomic profiling (CGP) is facilitating better understanding of tumor genomics, further enabling informed treatment decisions for several therapies.

Asia-Pacific is the fastest-growing region, fueled by increasing cancer prevalence, expanding healthcare infrastructure, and supportive government initiatives. Countries like China, Japan, South Korea, and India are investing heavily in precision medicine, genomics, and digital health platforms. Regulatory agencies across Asia are streamlining approval processes, making it easier for CDx tests and targeted therapies to enter the market. The presence of local biotech startups and contract research organizations is also catalyzing growth. Rising awareness among oncologists and patients about the benefits of biomarker-driven therapies is expected to sustain the region’s rapid expansion.

Japan Oncology Companion Diagnostic Market Trends

Japan is anticipated to witness lucrative growth in the market in Asia Pacific, driven by factors such as increased adoption of personalized medicine approaches, rising cancer incidences, robust research infrastructure and rising investments in advancing healthcare infrastructure. Japan’s favourable regulatory environment streamlining the approval of cancer drugs and their corresponding companion diagnostic tests is contributing to the market growth. Increased availability and access to targeted therapies for cancer treatment is driving the demand for companion diagnostics. Adoption of advanced diagnostic technologies such as liquid biopsy and next-generation sequencing (NGS) are enabling more precise diagnosis and treatment selection, further expanding the market potential.

How Did Europe Notably Grow in the Oncology Companion Diagnostic Market?

Europe’s rising cancer cases and the shift to personalized medicine. The technological advances in molecular diagnostics and supportive regulations like the EU's IVDR. Increased R&D collaborations and greater awareness among physicians further accelerate market growth.

Germany Oncology Companion Diagnostic Market Trends

Germany's integration of AI-powered genomic profiling and the mandate of the EU In Vitro Diagnostic Medical Devices Regulation (IVDR). Technological shifts toward liquid biopsies and Next-Generation Sequencing (NGS) are enabling non-invasive, real-time monitoring and early-stage detection, significantly reducing reliance on traditional tissue biopsies.

Strategic Overview of the Global Oncology Companion Diagnostic Industry

The oncology companion diagnostic market has evolved into a cornerstone of precision medicine, bridging the gap between targeted therapies and effective cancer treatment. Companion diagnostics (CDx) are in vitro medical devices used to determine the eligibility of patients for specific oncologic drugs based on biomarker expression, genetic mutations, or other molecular signatures. These tests guide oncologists in selecting the most effective treatment while minimizing unnecessary exposure to toxic drugs and maximizing cost-efficiency.

The increasing prevalence of cancer globally, particularly in the form of lung, breast, colorectal, and prostate cancers, has pushed healthcare systems and pharmaceutical companies to adopt biomarker-guided therapies. According to the World Health Organization, cancer is responsible for nearly 10 million deaths annually, with millions more diagnosed each year. This burden underscores the critical need for stratified medicine supported by robust diagnostic tools.

The oncology CDx market is characterized by a collaborative ecosystem involving diagnostic developers, pharmaceutical giants, contract research organizations, and academic institutions. Co-development models between diagnostics and drug developers have gained momentum, with regulatory authorities such as the FDA increasingly approving therapies with associated companion diagnostics. Advancements in next-generation sequencing (NGS), digital pathology, and real-time PCR technologies are redefining the possibilities in biomarker discovery and diagnostics.

As pharmaceutical pipelines increasingly shift toward molecularly targeted therapies and immuno-oncology, the demand for companion diagnostics is set to rise significantly. The market is expected to witness robust double-digit growth through 2034, supported by growing investments, public-private partnerships, and continuous innovation in genomic technologies.

Market Outlook

- Market Growth Overview: The oncology companion diagnostic market is expected to grow significantly between 2025 and 2034, driven by the rising cancer incidence, trends towards personalized medicine, and biomarker discovery.

- Sustainability Trends: Sustainability trends involve personalized medicine, advanced technologies, and biomarker discovery.

- Major Investors: Major investors in the market include Roche, Thermo Fisher Scientific, QIAGEN, Agilent Technologies, Abbott, Illumina, Guardant Health, and Invivoscribe.

- Startup Economy: The startup economy is focused on technological advancement, adoption of novel business models, and early-stage R&D and biomarker discovery.

Impact of AI on the Oncology Companion Diagnostic Market?

Artificial Intelligence: The Next Growth Catalyst in Oncology Companion Diagnostic

AI is significantly impacting the oncology companion diagnostic (CDx) market by streamlining the analysis of complex data from sources like medical imaging and next-generation sequencing. This enables the identification of subtle biomarkers and genetic mutations with higher accuracy and speed than traditional methods, leading to more precise patient stratification for targeted therapies. By improving the efficiency and accuracy of CDx development, AI is accelerating the creation of personalized treatment plans and the approval of new targeted therapies. Furthermore, it enhances the interpretability of diagnostic results, which helps clinicians make more informed treatment decisions, ultimately driving the growth and effectiveness of precision oncology.

Major Trends in the Market

-

Rise in FDA Approvals for Co-developed Drugs and Diagnostics: The trend of simultaneous drug-diagnostic approvals is accelerating, especially for precision oncology treatments like EGFR and ALK inhibitors.

-

Shift Toward NGS-Based Multiplex Panels: Single-gene tests are gradually being replaced by multiplex NGS panels, enabling comprehensive genomic profiling from a single sample.

-

Increased Use of Liquid Biopsies: Non-invasive diagnostic methods such as liquid biopsies are gaining traction for real-time monitoring of tumor evolution and minimal residual disease.

-

AI and Machine Learning Integration: Artificial intelligence is being utilized in image analysis, variant interpretation, and CDx software platforms to enhance diagnostic accuracy and speed.

-

Strategic Collaborations and Licensing Agreements: Pharma-diagnostic collaborations (e.g., Foundation Medicine and Roche, Thermo Fisher and Illumina) are shaping the competitive landscape.

-

Expansion into Emerging Markets: Pharmaceutical companies are increasingly targeting Asia-Pacific and Latin America for CDx penetration, driven by rising healthcare expenditure and favorable policies.

-

Growth of Immunotherapy-Driven CDx: The demand for PD-L1 and TMB testing is expanding alongside the adoption of immuno-oncology drugs.

Oncology Companion Diagnostic Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 7.91 Billion |

| Market Size by 2035 |

USD 17.26 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.06% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product & Services, Technology, Disease Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Agilent Technologies Inc.; Illumina Inc.; QIAGEN; Thermo Fisher Scientific Inc.; Foundation Medicine Inc.; Myriad Genetics, Inc.; F. Hoffmann-La Roche Ltd.; BioMérieux; Abbott; Leica Biosystems; Guardant Health, Inc.; EntroGen, Inc. |

Market Driver: Personalized Oncology and Targeted Therapy Uptake

The most influential driver of the oncology companion diagnostic market is the growing global shift toward personalized medicine, particularly in oncology. Modern cancer care is increasingly relying on targeted therapies that act on specific molecular pathways altered in tumors. These therapies, such as EGFR inhibitors for non-small cell lung cancer or HER2 inhibitors for breast cancer, are only effective in patients with certain genetic mutations or protein overexpression.

Companion diagnostics are essential for identifying eligible patients, optimizing treatment response, and avoiding ineffective or harmful drugs. Regulatory agencies have recognized the value of such tools, exemplified by FDA approvals that mandate a companion diagnostic test as part of the therapeutic label. With the increasing availability of molecular targets across multiple cancer types, pharmaceutical companies now routinely integrate diagnostic development into their drug pipelines. This alignment not only improves clinical outcomes but also accelerates drug development timelines and enhances payer confidence in reimbursing high-cost oncology therapies.

Market Restraint: Reimbursement Challenges and Cost Constraints

A significant restraint in the oncology companion diagnostic market is the variability and limitations in reimbursement policies. Companion diagnostic tests, particularly those using advanced technologies like NGS, can be costly. In many healthcare systems, insurance coverage does not consistently keep pace with innovation, creating access barriers for patients and limiting test adoption by providers.

In the U.S., while CMS has made strides in expanding Medicare coverage for some tests, reimbursement policies for multi-gene panels or emerging biomarkers are still evolving. In Europe and developing regions, reimbursement often lags behind regulatory approval, causing delays in patient access. Additionally, stakeholders must demonstrate clinical utility and cost-effectiveness through real-world evidence, which requires long-term investments. This financial uncertainty often discourages smaller labs and diagnostic companies from entering the market or launching new tests, limiting innovation and slowing adoption rates.

Market Opportunity: Integration of Liquid Biopsies in CDx Testing

One of the most transformative opportunities in the oncology CDx market lies in the integration of liquid biopsy technologies. Liquid biopsies allow the detection of tumor-derived biomarkers through blood or other bodily fluids, enabling non-invasive, real-time insights into tumor genetics and treatment response. These tests are particularly valuable for patients who are not candidates for tissue biopsies or when tumors are in anatomically challenging locations.

With advancements in ctDNA (circulating tumor DNA) analysis, liquid biopsies are being used to detect mutations in genes like EGFR, BRAF, and ALK. Companies like Guardant Health, Biocept, and Foundation Medicine are investing heavily in this domain. Liquid biopsy-based CDx platforms are also being evaluated for early cancer detection and treatment monitoring, paving the way for longitudinal disease management. As regulatory pathways become clearer and technology matures, the market for liquid biopsy-based companion diagnostics is expected to unlock a new frontier in precision oncology.

Oncology Companion Diagnostic Market Segmentation Insights

By Product & Services Insights

Consumables accounted for the largest share of the oncology companion diagnostic market due to their recurrent usage in diagnostic procedures. Reagents, assay kits, slides, and test cartridges are essential components across PCR, NGS, IHC, and FISH-based diagnostic platforms. Given that each test run requires fresh consumables, their demand scales directly with test volumes. Hospitals, diagnostic labs, and CROs rely on these consumables for routine and specialized testing. The high frequency of use, along with increasing test volumes for targeted therapies, underpins the dominance of this segment.

Software, while currently a smaller segment, is experiencing the fastest growth. With the increasing complexity of data generated from NGS and multiplex panels, bioinformatics platforms and AI-enabled analysis software are becoming indispensable. These tools assist in interpreting large genomic datasets, identifying actionable mutations, and generating clinical reports. Integrated software platforms such as PierianDx and SOPHiA GENETICS are transforming diagnostics by offering cloud-based, scalable, and interoperable solutions. As precision medicine becomes more data-intensive, software will play a central role in diagnostic workflows.

By Technology Insights

Polymerase Chain Reaction (PCR) remains the leading technology due to its affordability, speed, and high sensitivity. PCR-based tests are widely used for detecting specific gene mutations like EGFR, BRAF, and KRAS. Real-time PCR and quantitative PCR have proven to be highly effective in both clinical and laboratory settings for diagnostic and prognostic applications. The technique's established regulatory pathway and ease of use in decentralized settings maintain its dominance in the market.

However, Next-generation Sequencing (NGS) is the fastest-growing segment, driven by its capacity to analyze multiple genes simultaneously. NGS-based companion diagnostics are increasingly being adopted for tumor profiling in complex cancers like NSCLC and colorectal cancer. Companies like Foundation Medicine, Thermo Fisher, and Illumina offer comprehensive NGS-based CDx platforms approved by the FDA. As sequencing costs continue to drop and bioinformatics tools become more user-friendly, NGS adoption is set to accelerate across both academic and clinical settings.

By Disease Type Insights

Non-Small Cell Lung Cancer (NSCLC) holds the largest share in the oncology CDx market. NSCLC is the most common type of lung cancer, accounting for approximately 85% of cases. Numerous targeted therapies—such as EGFR inhibitors (e.g., osimertinib), ALK inhibitors (e.g., crizotinib), and PD-L1-based immunotherapies require companion testing for treatment initiation. The extensive pipeline of targeted drugs and robust biomarker research in NSCLC drive test volumes and regulatory approvals in this indication.

In contrast, Prostate Cancer is emerging as the fastest-growing segment. The increased focus on BRCA1/2 and other homologous recombination repair (HRR) gene mutations for guiding PARP inhibitor therapy is propelling demand for prostate cancer-specific CDx. Companies are developing tests to identify patients who will benefit from therapies like olaparib. Furthermore, advancements in liquid biopsy and MRI-guided biopsies are making CDx testing more accessible for prostate cancer management. The growing prevalence and innovation in precision treatments make this segment a key growth area.

By End Use Insights

Hospitals segment dominated the oncology companion diagnostic market with a share of 54.0% in 2025. They are often the primary point of care for cancer diagnosis, treatment, and monitoring. Most hospitals, particularly tertiary care and cancer specialty centers, maintain in-house pathology and molecular testing labs capable of handling high-throughput diagnostic workloads. Hospitals often have access to high-end technologies, trained personnel, and multidisciplinary tumor boards that utilize CDx results for therapeutic decision-making.

Academic Medical Centers, meanwhile, are growing rapidly due to their central role in clinical trials, biomarker discovery, and translational research. These institutions are often early adopters of emerging technologies and are actively engaged in the co-development of novel CDx platforms with pharma partners. Many serve as innovation hubs where AI, big data analytics, and multi-omics integration are being tested for real-world implementation. Their research-driven approach and access to diverse patient populations position academic medical centers as crucial players in the CDx value chain.

Value Chain Analysis of Oncology Companion Diagnostic Market

Research & Development (R&D) and Biomarker Discovery: This foundational stage involves the identification of specific genetic mutations or protein expressions (biomarkers) associated with a particular cancer and a corresponding therapeutic drug.

- Key Players: F. Hoffmann-La Roche (Genentech), AstraZeneca, Illumina, QIAGEN, and Foundation Medicine

Assay Development & Manufacturing: Once a biomarker is identified and validated, specific assays and kits are developed and manufactured for use in clinical settings. This stage focuses on producing reliable instruments, consumables (reagents, kits, etc.), and software platforms, often based on technologies like PCR or NGS.

- Key Players: Thermo Fisher Scientific, Agilent Technologies (Dako), Abbott, and BioMérieux.

Regulatory Approval & Commercialization: This critical stage involves navigating stringent regulatory pathways (e.g., FDA in the U.S., EMA in Europe) to receive approval for both the diagnostic and its associated drug.

- Key Players: Roche, QIAGEN, Labcorp and Q2 Solutions

Clinical Testing & Service Delivery: In this stage, the approved companion diagnostics are used in real-world clinical practice by healthcare professionals to guide patient treatment decisions.

- Key Players: Quest Diagnostics, LabCorp

Oncology Companion Diagnostic Market Companies

- Agilent Technologies: Develops genomic profiling tools, advanced analytical instruments, and partners with pharma to create tissue-based and liquid biopsy companion diagnostics for precise cancer identification.

- Illumina: A leader in high-throughput sequencing and microarray technology, providing the core platforms for comprehensive genomic analysis in companion diagnostics.

- QIAGEN: Offers solutions for sample-to-insight, focusing on molecular testing and genetic analysis for precision oncology and companion diagnostics.

- Thermo Fisher Scientific: Enhances its microarray and bioinformatics solutions to support genomics, drug discovery, and diagnostic applications in cancer.

- Foundation Medicine: Specializes in comprehensive genomic profiling (CGP) to identify actionable biomarkers in tumors, driving personalized cancer treatment.

- Myriad Genetics: Focuses on genetic testing, including hereditary cancer risk and tumor profiling, to guide treatment decisions for patients.

- F. Hoffmann-La Roche Ltd (Roche): A major player in molecular diagnostics, providing sequencing and PCR solutions for oncology and personalized healthcare.

- BioMérieux: Offers diagnostic solutions, particularly in microbiology and molecular diagnostics, contributing to infection and cancer detection.

- Abbott: Provides a broad range of diagnostic tests and platforms, including those for identifying genetic mutations relevant to cancer therapy.

- Leica Biosystems: Focuses on tissue-based diagnostics, offering solutions for pathology and biomarker detection in cancer.

- Guardant Health: A leader in liquid biopsy, offering non-invasive genomic testing to detect cancer mutations.

- EntroGen, Inc.: Specializes in molecular diagnostics, providing tests for various cancers, including those for personalized medicine.

Oncology Companion Diagnostic Market Recent Developments

- In May 2025, NeoGenomics, Inc. commercially launched c-MET CDx Assay to guide treatment decisions for patients with advanced non-small cell lung cancer (NSCLC) with a 48-hour turnaround time.

- In May 2025, Labcorp expanded its precision oncology portfolio with the addition of new test offerings for solid tumor and hematologic malignancies as well as improved biopharma services support for expediting clinical trials and companion diagnostic development.

- In January 2025, Tempus AI, Inc., nationally launched the xT CDx which is the company’s FDA-approved, NGS-based in vitro diagnostic device. The device offers a 648-gene next-generation sequencing test for solid tumor profiling, including microsatellite instability status and companion diagnostic claims for colorectal cancer patients.

- In January 2025, Roche received the U.S. Food and Drug Administration’s (FDA’s) approval for a label expansion of the PATHWAY® anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody which is the first companion diagnostic for identifying patients with HR-positive, HER2-ultralow metastatic breast cancer eligible for ENHERTU.

- In September 2024, QIAGEN N.V., made a pivotal addition to its digital PCR portfolio with expansion into clinical diagnostics by launching the QIAcuityDx digital PCR system designed for streamlining clinical testing in oncology.

Oncology Companion Diagnostic Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Oncology Companion Diagnostic market.

By Product & Services

- Product

- Instrument

- Consumables

- Software

- Services

By Technology

- Polymerase Chain Reaction (PCR)

- Next-generation Sequencing (NGS)

- Immunohistochemistry (IHC)

- In Situ Hybridization (ISH)/Fluorescence In Situ Hybridization (FISH)

- Other Technologies

By Disease Type

- Breast Cancer

- Non-small Cell Lung Cancer

- Colorectal Cancer

- Leukemia

- Melanoma

- Prostate Cancer

- Others

By End-use

- Hospital

- Pathology/Diagnostic Laboratory

- Academic Medical Center

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)