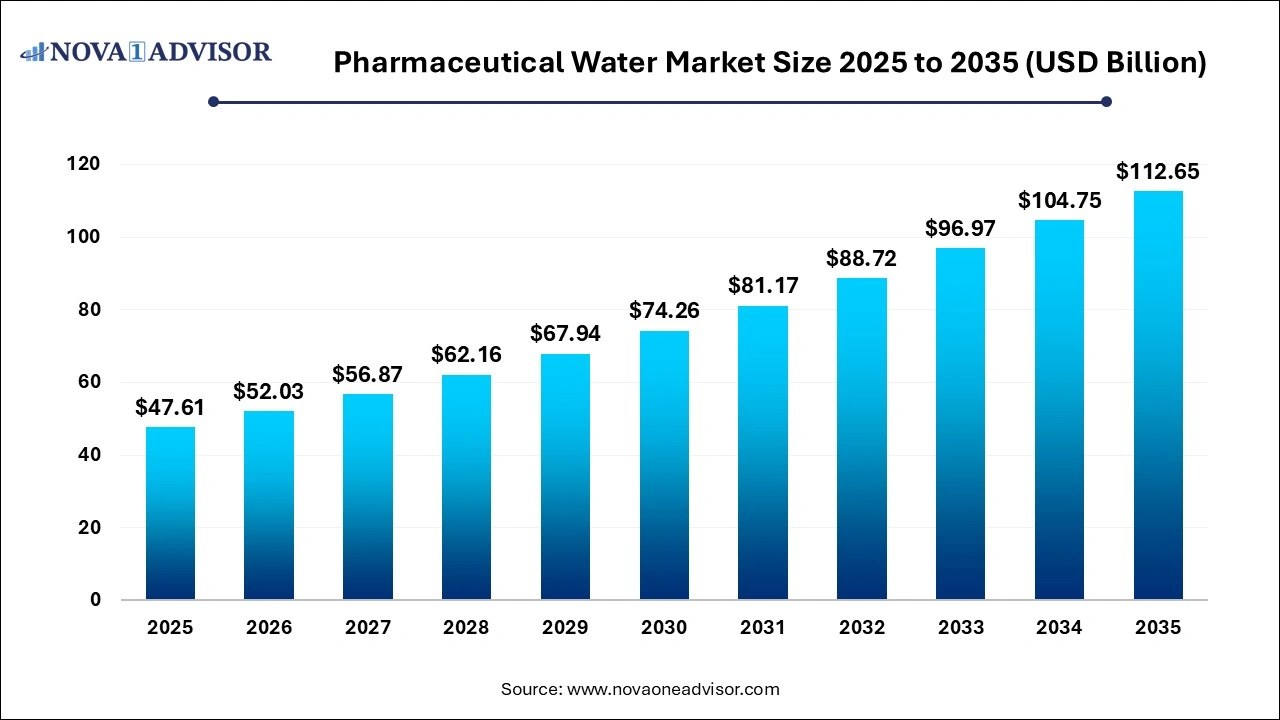

Pharmaceutical Water Market Size and Growth 2026 to 2035

The global pharmaceutical water market size was valued at USD 47.61 billion in 2025 and is anticipated to reach around USD 112.65 billion by 2035, growing at a CAGR of 9.3% from 2026 to 2035.

Pharmaceutical Water Market Key Takeaways

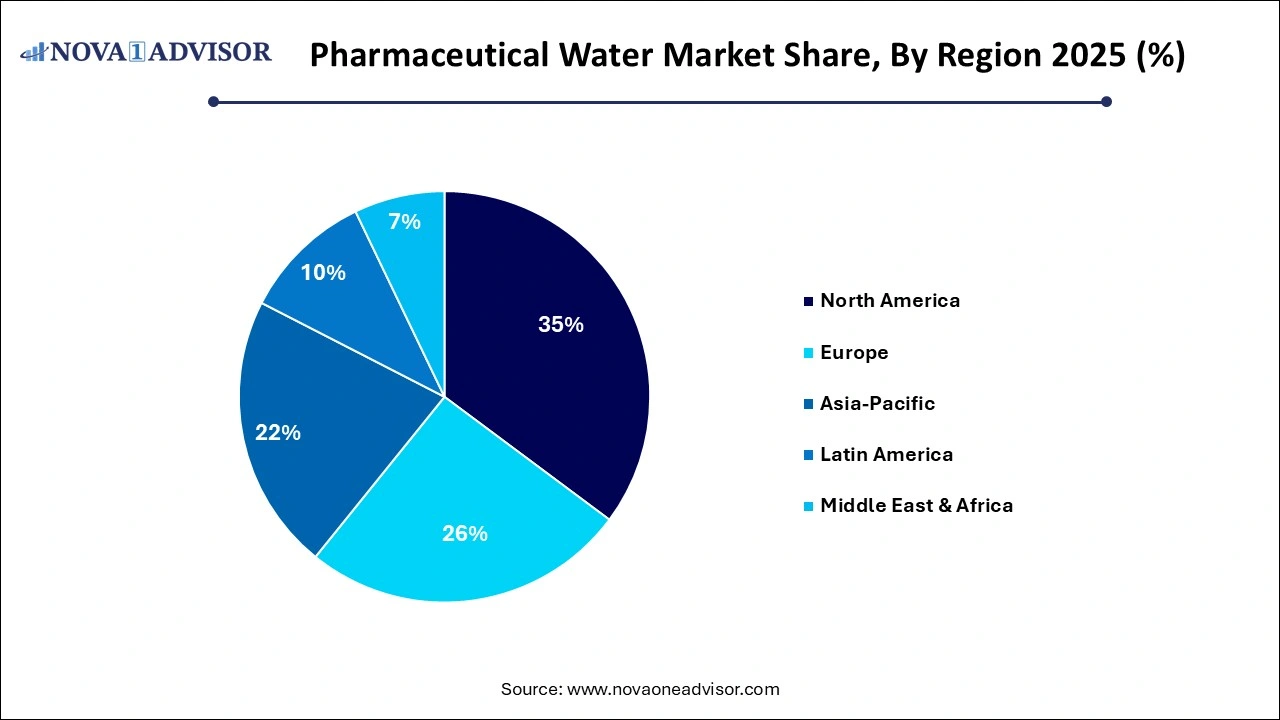

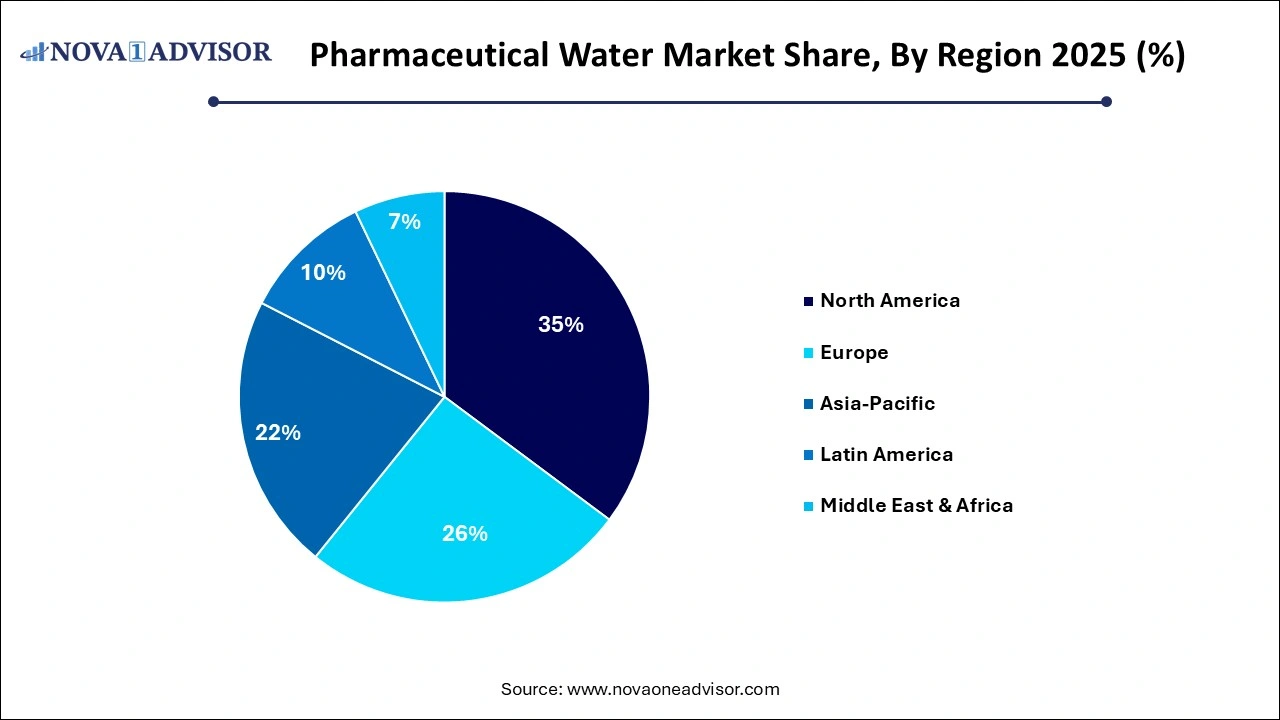

- North America led the global market with the highest market share of 35.19% in 2025.

- Asia-Pacific is estimated to expand at the fastest CAGR of 10.3% from 2024 to 2025.

- By Type, the HPLC grade water segment has held the biggest revenue share of 20.92% in 2025.

- By Type, the water for injection segment is anticipated to expand at the fastest CAGR of 10.2% during the projected period.

- By Application, the pharmaceutical & biotechnology companies segment held the highest market share of 58.14% in 2025 and it is projected to expand at the fastest CAGR of 10.3% over the projected period.

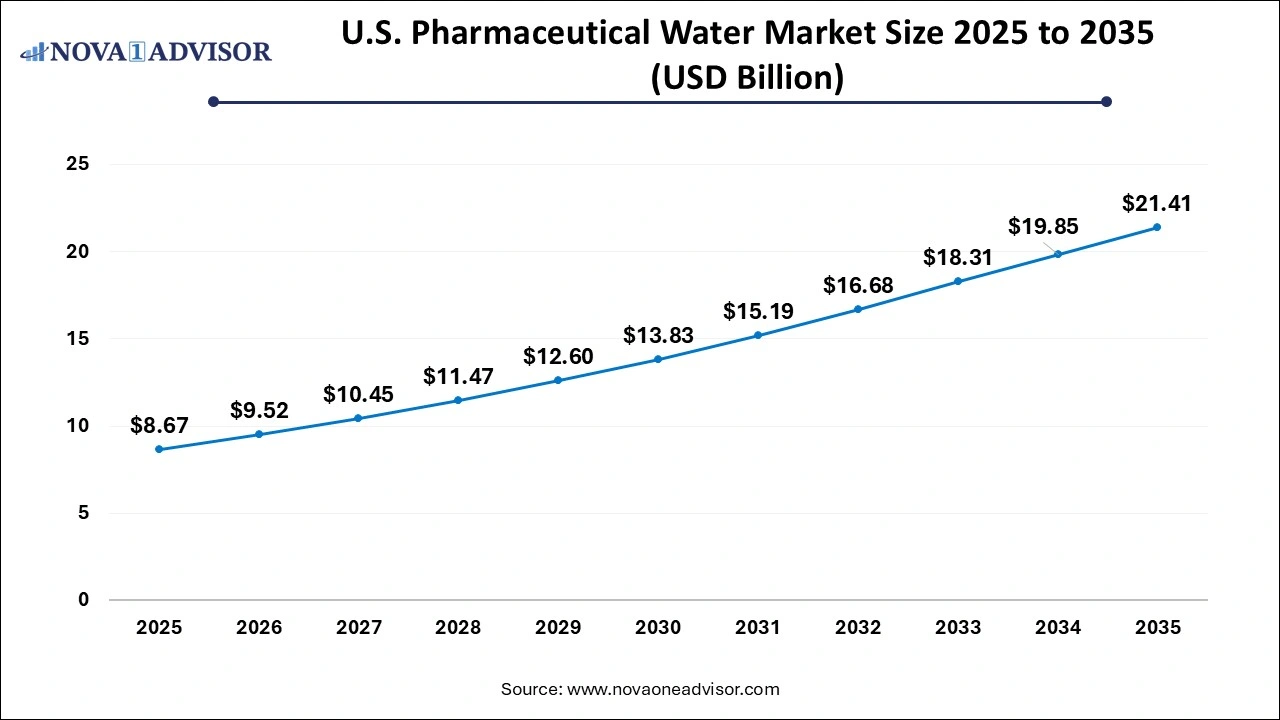

- The U.S. pharmaceutical water market size was valued at USD 7.19 billion in 2025 and is predicted to hit USD 18.31 billion by 2025 with a CAGR of 9.8% from 2026 to 2035.

- Canada pharmaceutical water market was valued at USD 4.49 billion in 2025 and it is growing at a CAGR of 9.3% from 2026 to 2035.

- Germany pharmaceutical water market size was estimated at USD 3.67 billion in 2025 and it is growing at a CAGR of 10.1% from 2026 to 2035.

- China pharmaceutical water market size was reached at USD 3.55 billion in 2025 and it is growing at a CAGR of 11.3% from 2026 to 2035.

The pharmaceutical water market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing demand for high-quality water in the pharmaceutical industry, where stringent regulations and standards necessitate the use of ultra-pure water in various processes, including drug formulation and manufacturing. Additionally, the rising prevalence of chronic diseases and the subsequent growth in pharmaceutical production are fueling the demand for purified water systems. Technological advancements in water purification methods, such as reverse osmosis and ultraviolet disinfection, are also contributing to the market's expansion. Furthermore, the growing focus on quality control and assurance in pharmaceutical processes, driven by regulatory bodies, is pushing companies to invest in advanced water treatment solutions, thereby boosting the market growth.

Pharmaceutical Water Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 52.03 Billion |

| Market Size by 2035 |

USD 112.65 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.99% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Type, Application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

B. Braun Melsungen AG, Merck KGaA, Thermo Fisher Scientific, Inc., Baxter International, Inc., Intermountain Life Sciences, Cytiva (Danaher), Standard Reagents, Pvt. Ltd., FUJIFILM Irvine Scientific, CovaChem, LLC, Pfizer, Inc and Fresenius Kabi AG. |

Growth of Biopharmaceutical and Generic Injectable Drugs Industries: Key Driver

- Demand for biopharmaceutical such as vaccines, proteins, antibodies, plasma, enzymes, biologics, and peptides is high for use in the production of life-saving medications. These biologicals are unstable in solution if stored over a long period of time.

- The biopharmaceutical sector has expanded rapidly in the past few years. It is expected to grow at a rapid pace in the near future. Currently, the biopharmaceutical sector is valued at US$ 165 Bn. It is likely to expand at a CAGR of 8.1% over the next few years, nearly double that of the conventional pharmaceutical sector.

- Growth of the biopharmaceutical industry can be attributed to large unmet medical needs in the treatment of chronic medical conditions, patent expiry of branded biologic drugs leading to development of biosimilar drugs, and a large number of clinical pipeline drugs. Moreover, rapid expansion of the vaccines industry is projected to propel the biopharmaceutical industry in the near future.

- Players operating in the generic injectable market are focused on the development of generic injectable products, especially generic biologic products i.e., biosimilars

- Presently, 28 biosimilar drugs have been approved by the U.S. FDA for the treatment of different types of chronic medical conditions

- Increase in focus of leading players on the development and expansion of manufacturing facilities suitable for generic formulations is anticipated to boost the production of specialty generic injectable products during the forecast period

- Development of generic formulations is a more rapid process compared to branded ones, as these products are exempt from the requirement to conduct clinical trials and toxicity studies. Large number of players are entering the global generic injectable market with cost-effective alternatives to branded products, leading to increased adoption of generic products.

- Pharmaceutical water is an integral part of the biopharmaceutical and generic injectable industries. Hence, demand for pharmaceutical water is expected to increase, along with the expansion of the biopharmaceutical and generic injectable industries during the forecast period.

Pharmaceutical Water Market Insights

By Type Insights

The water for injection segment dominated the pharmaceutical water market in 2025. Water for injection (WFI) is a critical component in pharmaceutical manufacturing processes, particularly for the formulation of parenteral drugs such as injectables, infusions, and sterile solutions. Regulatory agencies such as the United States Pharmacopeia (USP), European Pharmacopoeia (EP), and other international regulatory bodies mandate strict quality standards for WFI to ensure product safety, efficacy, and compliance with Good Manufacturing Practices (GMP).

By Application Insights

The pharmaceutical & biotechnology companies segment led the market with the largest share in 2025. Pharmaceutical water is a critical component in the manufacturing of pharmaceutical products, as it is used in various stages of production, including formulation, cleaning, and quality control. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent requirements for the quality and purity of water used in pharmaceutical manufacturing. Pharmaceutical and biotechnology companies have the expertise, resources, and infrastructure to meet these regulatory standards and ensure the production of high-quality pharmaceutical water.

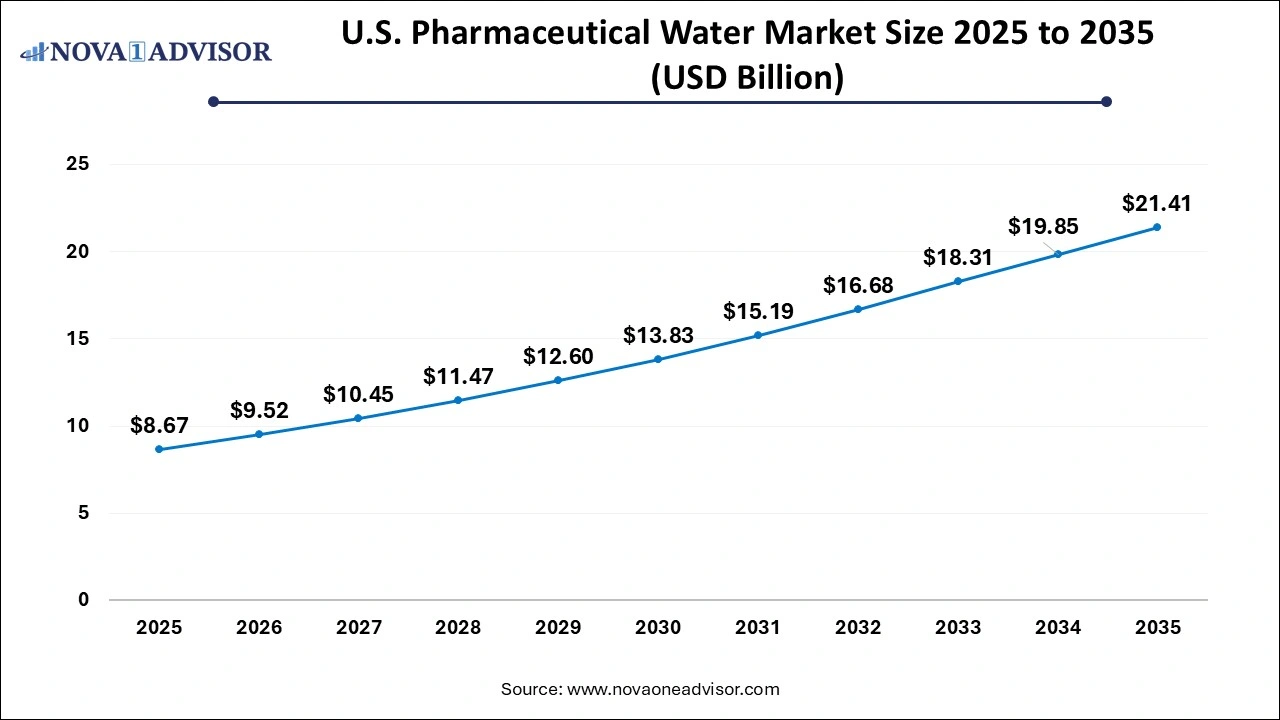

U.S. Pharmaceutical Water Market Size, Industry Report 2026 to 2035

The U.S. pharmaceutical water market size was valued at USD 8.67 billion in 2025 and is predicted to hit USD 21.41 billion by 2035 with a CAGR of 9.46% from 2026 to 2035.

North America is Estimated to be Garner Major Chunk of Pharmaceutical Water Market

The research report covers key trends and prospects of Pharmaceutical Water products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. North America seized major stake of the pharmaceutical water market in 2022. Occurrence of important companies and development strategies accepted by these players are the major influences propelling the growth of pharmaceutical water market in the region.

Emerging countries embrace the majority of prospects for pharmaceuticals water market, with China leading the control. China is expected to be the fastest developing region for outlay in the pharmaceuticals water market. Investments of USD 68.3 million in 2014 are set to increase to USD 130.7 million in 2018. The level of development is being motivated by the rising expectation of progressively large and prosperous population in China, which will consequence in augmented spending on upgraded pharmaceutical and healthcare products. For water-associated corporations, the prospects present in projects presented by international pharmaceutical firms manufacturing in the region. Further, in India, investment in pharmaceutical water will also perceive striking progress during years to come.

Pharmaceutical Water Market Top Key Companies:

Pharmaceutical Water Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 20261 to 2035. For this study, Nova one advisor, Inc. has segmented the Pharmaceutical Water market.

By Type

- HPLC Grade Water

- Water for Injection

By Application

- Pharmaceutical & Biotechnology Companies

- Academics & Research Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)