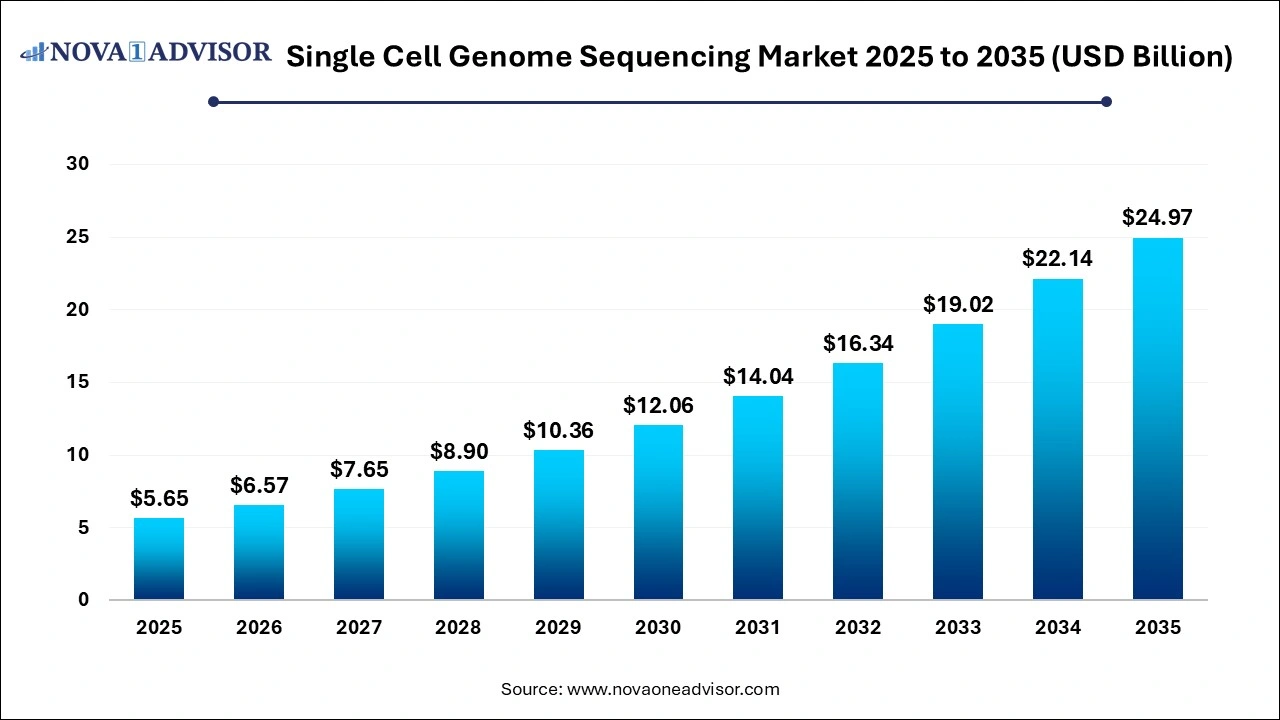

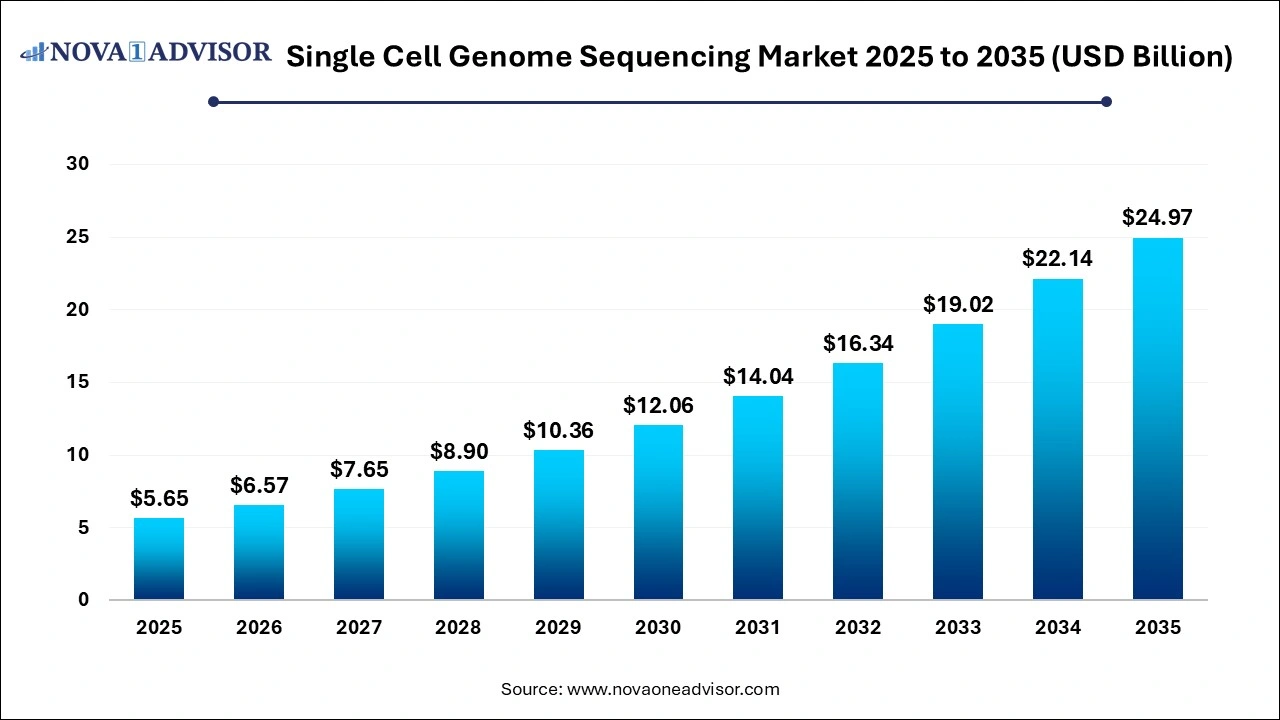

Single Cell Genome Sequencing Market Size and Growth 2026 to 2035

The global single cell genome sequencing market size was estimated at USD 5.65 billion in 2025 and is projected to hit around USD 24.97 billion by 2035, growing at a CAGR of 16.2% during the forecast period from 2026 to 2035.

Single Cell Genome Sequencing Market Key Takeaways

- By product type, reagents dominated the market in 2025.

- By product type, instruments are the fastest growing segments.

- By technology, next-generation sequencing (NGS) led the market as of this year.

- By technology, microarray and multiple displacement amplification (MDA) is seen to be the fastest growing segment.

- By workflow, genomic analysis dominates the market in 2025.

- By workflow, single cell isolation is the fastest-growing segment as of this year.

- By disease area, the cancer segment held the largest market share as of 2025.

- By disease area, the prenatal diagnosis segment is expected to have the fastest growth rate during the forecast period.

- By end user, academic and research laboratories dominated the market this year.

- By end user, Biotechnology and biopharmaceutical companies are seen to be the fastest-growing segment.

- By region, North America held the largest market in 2025.

- By region, Asia-Pacific is estimated to grow at the fastest rate throughout the forecast period.

What is Single Cell Genome Sequencing?

Single-cell sequencing is a method that sequences a single cell at a time in order to study its genome, transcriptome, epigenome or other molecular characteristics. It is useful for studying and analyzing the unique characteristics of cells and understanding how they develop or contribute to diseases. This technique helps healthcare professionals study the differences between various types of cells and how they are related to each other. Unlike traditional sequencing methods, single-cell sequencing looks at one cell at a time which allows the study of the unique genetic makeup of each cell. This helps to study biological processes in detail which is typically not possible with other bulk sequencing methods.

The Single Cell Sequencing Market is rapidly gaining traction, and this growth is driven by the increasing demand for personalized medicine and advanced genomic research. This growth is further fueled by technological advancements as well as a growing emphasis on understanding complex diseases. The convergence of droplet-based platforms, next-generation sequencing (NGS), and computational bioinformatics is reshaping how researchers analyze and interpret genomic variation at the resolution of individual cells. As a result, the single cell genome sequencing market is poised for robust growth over the upcoming years.

What are the Key Trends in the Single Cell Genome Sequencing Market?

- The single cell genome sequencing (scGS) market is experiencing significant growth, and is driven by its applications in understanding complex diseases such as cancer and hematological disorders. This method can drastically improve the development of targeted therapies by detailing cellular mechanisms, thus enhancing patient outcomes through personalized medicine strategies.

- Government initiatives worldwide are boosting this field, recognizing the transformative potential of genomic technologies in disease monitoring and therapy development. Numerous incentives, subsidies and policies are on their way.

- The market is also fueled by increasing import-export regulations. The World Health Organization has called for harmonized regulations to help bolster global scientific collaboration, thereby sustaining innovation in the genomic field.

- There is a rising trend of mergers and acquisitions in the market, which is reshaping the genomic technology sector. This allows companies to integrate complementary strengths, accelerating advancements in single cell genome sequencing technologies and expanding their applications across various research based and clinical domains.

What is the Impact of AI in the Single Cell Genome Sequencing Market?

The integration of artificial intelligence (AI) and machine learning (ML) is completely revolutionizing the single-cell genome sequencing market, primarily by enhancing data analysis capabilities. Integrating these types of technologies and tools into daily workflows helps enable faster and more accurate interpretation of complex genomic data, something which is crucial for advancing in both research based as well as clinical applications.

Several methodologies like scCross and scMaui have already entered the market and have demonstrated substantial improvements in data integration and analysis efficiency. These technologies are able to integrate large-scale single-cell multi-omics data and handle over four million human single cells with notable computational efficiency. In addition to that, they also excel in imputing missing data and correcting batch effects, ensuring robust predictions and high data integrity, which are critical aspects for precise medical interventions.

These advancements highlight AI’s potential to not only streamline data processing in single-cell sequencing but also to propel the field towards more personalized and effective healthcare solutions.

Single Cell Genome Sequencing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 24.97 Billion |

| Market Size by 2035 |

USD 24.97 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.2% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product type, Technology, Workflow, Disease Area, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Bio-Rad Laboratories; 10x Genomics; Novogene; Fluidigm; BGI; Illumina, Inc.; Oxford Nanopore Technologies; Pacific Biosciences; Thermo Fisher Scientific, Inc.; QIAGEN; F Hoffmann-La Roche Ltd. |

Market Dynamics

Driver

Advancements in Precision Medicine

Advancements in precision medicine, particularly the integration of single-cell sequencing technologies, are a key driver propelling the single cell genome sequencing market forward. The demand for these technologies is surging as healthcare sectors are increasingly adopting personalized treatment plans that require a deeper understanding of diseases at an individual or cellular level. Single-cell sequencing offers insights into cellular heterogeneity and helps in identifying unique disease signatures. This is necessary for developing targeted therapies and predicting treatment outcomes with high accuracy.

Such technologies also enable the identification of novel biomarkers within mere weeks, revolutionizing how diseases like cancer are diagnosed and treated at a cellular level, especially when time is key. Furthermore, this improves therapeutic efficacy and also contributes to reducing the overall costs associated with trial and error in treatment protocols.

Restraint

High Costs and Technical Complexity

Despite promising growth prospects, the market does have its fair share of challenges. One such challenge is the high costs and technical complexity. The expenses in this field are multifaceted, with reagent costs for single-cell sequencing being quite higher than compared to traditional bulk RNA sequencing. This can be challenging for small scale and medium scale companies to

Additionally, the complexity of data interpretation and the need for sophisticated computational resources further adds to the costs. High-throughput technologies such as the 10x Genomics Chromium Controller and advanced bioinformatics tools are necessary to manage and analyze the data, thus increasing the overall investment and operational costs. This in turn, slows down market growth and development.

Opportunity

Expansion in Cancer Research

Single cell genome sequencing in the field of oncology is opening up new doors of opportunities in the market by enabling the detailed analysis of tumor heterogeneity and the progression of cancer at a cellular level. This technique is becoming pivotal in identifying unique cancer cell populations and understanding the dynamics within tumors that lead to cancer progression and even therapy resistance. Such advancements in single-cell sequencing can lead to more effective, personalized treatment strategies as they can pinpoint genetic variances within tumors that are not detectable through traditional sequencing methods.

Moreover, this technology also facilitates the exploration of previously unrecognized cellular mechanisms and mutation patterns, contributing to the advancement of cancer diagnostics and therapeutics.

Single Cell Genome Sequencing Market Segmental Insights

By Product Type Insights

Which product type dominated the market in 2025?

Reagents dominated the market as of 2025. This dominance is due to their recurring nature and indispensable role in library preparation, cell lysis, amplification and sequencing reactions. Companies offer specialized reagent kits tailored for low-input DNA extraction, whole genome amplification (WGA) and even barcoding, which are crucial for high-quality single cell sequencing workflows. The demand for reagents is expected to remain steady, especially with the growing adoption of droplet-based and plate-based platforms.

Instruments are seen to be the fastest-growing segment, due to the increasing deployment of integrated platforms that combine single cell capture, sorting and sequencing. Tools such as microfluidic droplet generators, robotic cell sorters and real-time imaging systems are becoming essential in both research and clinical labs. The trend toward miniaturized, benchtop instruments with user-friendly interfaces is further driving the accessibility and adoption of this segment.

By Technology Insights

Which technology segment led the market as of this year?

Next-generation sequencing (NGS) led the market as of this year and is the backbone of nearly all single cell genome sequencing workflows. The advantage of this segment lies in its scalability, accuracy, and multiplexing capabilities, making it ideal for analyzing thousands of single cells in parallel. NGS technologies are widely used across cancer, immunology and stem cell research, with major vendors constantly innovating to improve read length, accuracy and cost-efficiency.

Microarray and multiple displacement amplification (MDA) is expected to have the fastest growth rate throughout the forecast years. This technology is used in cases where targeted analysis or whole genome amplification is required. PCR and qPCR remain integral in pre-sequencing steps for target enrichment and mutation validation. However, their utility is more limited in genome-wide studies compared to NGS-based platforms.

By Disease Area Insights

Which disease area segment dominated the market as of this year?

Cancer dominated the disease area segment as of this year, due to the deep heterogeneity observed within tumor tissues and the growing need for clonal mapping in oncology. Single cell sequencing is revolutionizing our understanding of tumor evolution, minimal residual disease and resistance mechanisms. This segment also supports the development of personalized immunotherapies based on tumor-infiltrating lymphocytes (TILs).

Prenatal diagnosis is the fastest-growing disease area segment as of this year. This growth is due to the emergence of non-invasive cell capture methods and a growing public interest in early, accurate fetal genetic screening. The segment is poised for robust growth in the upcoming years, as researchers apply single cell tools to study complex systems like neural development and immune modulation at a cellular level.

By Workflow Insights

Which workflow segment led the market this year?

Genomic analysis led the single cell genomic sequencing market as of this year, as the final interpretation of sequencing data provides insights into SNPs, CNVs, structural variants, and mutational signatures at the single cell level. This step often involves cloud-based platforms, machine learning algorithms and statistical tools to handle high-dimensional data and draw biological conclusions.

Single cell isolation is estimated to be the fastest-growing segment. This growth is due to innovations in cell capture techniques such as fluorescence-activated cell sorting (FACS), microfluidics, magnetic-activated cell sorting (MACS) and laser capture microdissection. These types of technologies enable high-throughput and precise cell separation, which is a critical aspect for accurate genomic analysis.

By End-use Insights

Which end user held the largest market share in 2025?

Academic and Research Laboratories segment held the largest market share in 2025. This dominance can be attributed to the extensive use of single-cell sequencing in academic research. Such types of projects aim to unravel cellular complexities and molecular functions, which are crucial in advancing scientific understanding. Moreover, collaborations between academic institutions and research labs are bolstering the segment’s robust market presence.

The biotechnology and biopharmaceutical segment is expected to grow at the fastest rate throughout the forecast period. They utilize this technology for drug development and to refine precision medicine approaches, particularly for tackling diseases like cancer and neurological disorders. Clinics are also significant adopters, as they use this technology to enhance diagnostic precision and treatment personalization.

By Regional Analysis

Why is North America dominating the market?

North America dominated the single cell genomic sequencing market in 2025. This dominance is due to significant investments in genomic research, advanced healthcare infrastructure and the growing adoption of next-generation sequencing (NGS) technologies. Additionally, the region also benefits from strong funding from government and private organizations, along with the presence of key industry players. The region’s focus on innovative research and developments in genomic sequencing helps drive its growth and market position.

What are the advancements in Asia-Pacific?

Asia Pacific is seen to be the fastest-growing region. This growth is propelled by increasing investments in precision medicine, growing adoption of sequencing in clinical settings and the emergence of biotech startups in countries like China, India and South Korea. Government-backed genomics initiatives in the region are also boosting infrastructure and demand for cutting-edge single cell technologies.

Top Key Players

Recent Developments

- In October 2025, Atrandi Biosciences, a pioneering life sciences company transforming single-cell analysis with its patented Semi-Permeable Capsule (SPC) technology, will present its latest developments at the American Society of Human Genetics (ASHG) 2025 Annual Meeting. The new application was designed for high-throughput joint profiling of targeted DNA variants and 3 gene expression from the same cell. It supports a variety of sample input types and uses Atrandi’s core SPC technology to process up to millions of cells in parallel.

- In October 2025, BioSkryb Genomics, a pioneer in single-cell and ultra–low-input multiomic solutions, together with Eremid Genomic Services, a specialty high-complexity genomics contract research organization and BioSkryb Certified Service Provider (CSP), announced the launch of an Early Access Program for BioSkryb’s new ResolveSEQ LongRead solution. Through this program, researchers will gain access to services that deliver significantly greater genomic coverage and sensitivity for single-cell whole-genome long-read sequencing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the single cell genome sequencing market.

By Product Type

By Technology

- NGS

- PCR

- qPCR

- Microarray

- MDA

By Workflow

- Genomic Analysis

- Single Cell Isolation

- Sample Preparation

By Disease Area

- Cancer

- Immunology

- Prenatal Diagnosis

- Neurobiology

- Microbiology

- Others

By Application

- Circulating Cells

- Cell Differentiation/Reprogramming

- Genomic Variation

- Subpopulation Characterization

- Others

By End-use

- Academic & Research Laboratories

- Biotechnology & Biopharmaceutical Companies

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

List of Tables

By Country

North America

- Table 1: U.S. Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 2: U.S. Single Cell Genome Sequencing Market Size, by Technology, 2024–2034 (USD Billion)

- Table 3: U.S. Single Cell Genome Sequencing Market Size, by Workflow, 2024–2034 (USD Billion)

- Table 4: U.S. Single Cell Genome Sequencing Market Size, by Disease Area, 2024–2034 (USD Billion)

- Table 5: U.S. Single Cell Genome Sequencing Market Size, by Application, 2024–2034 (USD Billion)

- Table 6: U.S. Single Cell Genome Sequencing Market Size, by End-use, 2024–2034 (USD Billion)

- Table 7: Canada Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 8: Canada Single Cell Genome Sequencing Market Size, by Technology, 2024–2034 (USD Billion)

- Table 9: Canada Single Cell Genome Sequencing Market Size, by Workflow, 2024–2034 (USD Billion)

- Table 10: Canada Single Cell Genome Sequencing Market Size, by Disease Area, 2024–2034 (USD Billion)

- Table 11: Canada Single Cell Genome Sequencing Market Size, by Application, 2024–2034 (USD Billion)

- Table 12: Canada Single Cell Genome Sequencing Market Size, by End-use, 2024–2034 (USD Billion)

- Table 13: Mexico Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 14: Mexico Single Cell Genome Sequencing Market Size, by Technology, 2024–2034 (USD Billion)

- Table 15: Mexico Single Cell Genome Sequencing Market Size, by Workflow, 2024–2034 (USD Billion)

- Table 16: Mexico Single Cell Genome Sequencing Market Size, by Disease Area, 2024–2034 (USD Billion)

- Table 17: Mexico Single Cell Genome Sequencing Market Size, by Application, 2024–2034 (USD Billion)

- Table 18: Mexico Single Cell Genome Sequencing Market Size, by End-use, 2024–2034 (USD Billion)

Europe

- Table 19: Germany Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 20: France Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 21: U.K. Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 22: Italy Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 23: Rest of Europe Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- (Repeat Technology, Workflow, Disease Area, Application, End-use for each major country as above)

Asia Pacific

- Table 24: China Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 25: Japan Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 26: South Korea Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 27: India Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 28: Southeast Asia Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 29: Rest of Asia Pacific Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- (Repeat Technology, Workflow, Disease Area, Application, End-use for each major country as above)

Latin America

- Table 30: Brazil Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 31: Rest of Latin America Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- (Repeat Technology, Workflow, Disease Area, Application, End-use for each)

Middle East & Africa

- Table 32: Turkey Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 33: GCC Countries Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- Table 34: Africa Single Cell Genome Sequencing Market Size, by Product Type, 2024–2034 (USD Billion)

- (Repeat Technology, Workflow, Disease Area, Application, End-use for each)

List of Figures

- Figure 1: Global Single Cell Genome Sequencing Market, 2024–2034 (USD Billion)

- Figure 2: Global Single Cell Genome Sequencing Market Share, by Product Type, 2024 (%)

- Figure 3: Global Single Cell Genome Sequencing Market Share, by Technology, 2024 (%)

- Figure 4: Global Single Cell Genome Sequencing Market Share, by Workflow, 2024 (%)

- Figure 5: Global Single Cell Genome Sequencing Market Share, by Disease Area, 2024 (%)

- Figure 6: Global Single Cell Genome Sequencing Market Share, by Application, 2024 (%)

- Figure 7: Global Single Cell Genome Sequencing Market Share, by End-use, 2024 (%)

- Figure 8: Global Single Cell Genome Sequencing Market Share, by Region, 2024 (%)

- Figure 9: U.S. Single Cell Genome Sequencing Market, by Product Type, 2024–2034 (USD Billion)

- Figure 10: Germany Single Cell Genome Sequencing Market, by Technology, 2024–2034 (USD Billion)

- Figure 11: China Single Cell Genome Sequencing Market, by Application, 2024–2034 (USD Billion)

- Figure 12: Brazil Single Cell Genome Sequencing Market, by Disease Area, 2024–2034 (USD Billion)

- Figure 13: GCC Countries Single Cell Genome Sequencing Market, by End-use, 2024–2034 (USD Billion)

- Figure 14: Competitive Landscape: Market Share of Key Players, 2024 (%)

- Figure 15: Value Chain Analysis of Single Cell Genome Sequencing Market

- Figure 16: Porter’s Five Forces Analysis of the Market