Telehealth 2.0 Market Size and Forecast 2025 to 2034

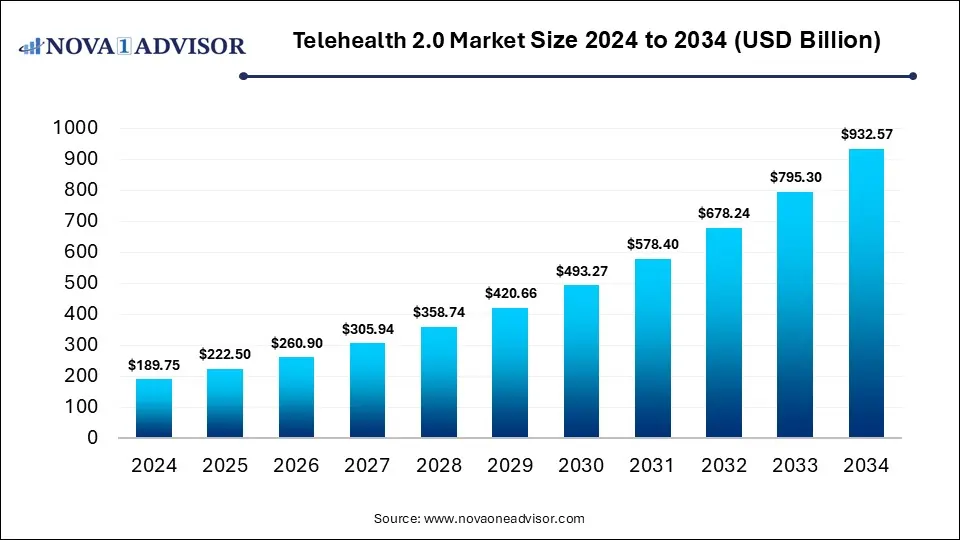

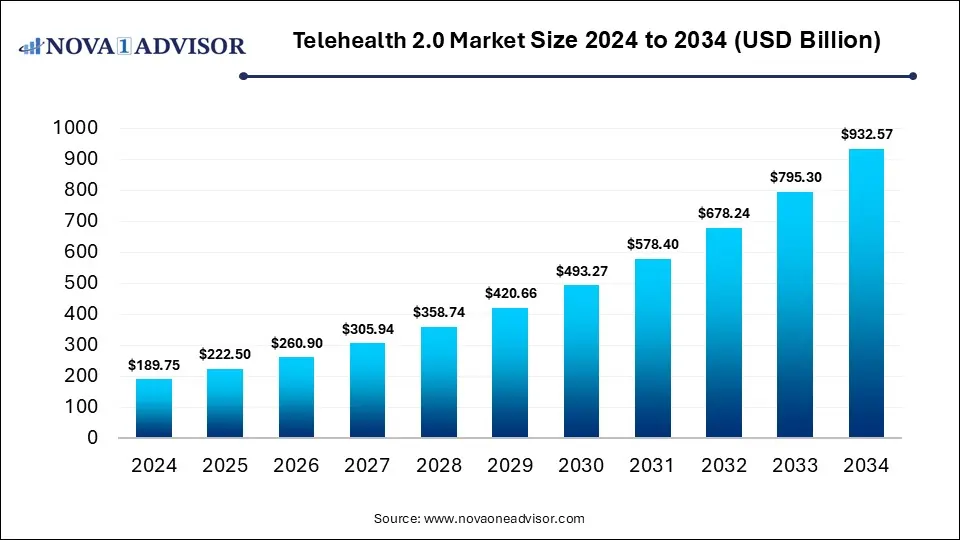

The global telehealth 2.0 market size is calculated at USD 189.75 billion in 2024, grows to USD 222.50 billion in 2025, and is projected to Hit around USD 932.57 billion by 2034, expanding at a CAGR of 17.26% from 2025 to 2034. The market is growing due to increased digital adoption, AI integration, and demand for remote patient care. Enhanced accessibility and cost efficiency are further fueling its expansion.

Telehealth 2.0 Market Key Takeaways

- North America dominated the telehealth 2.0 market with a revenue share in 2024.

- Europe is expected to grow at a significant rate in the market during the forecast period.

- By type, the telemedicine segment led the market with the largest revenue share in 2024.

- By type, the electronic health records segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By service, the monitoring segment held the largest market share in 2024.

- By service, the diagnosis segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the healthcare providers segment held the highest market share in 2024.

- By end user, the insurers segment is expected to grow at a significant rate in the market during the forecast period.

What is Telehealth 2.0?

Telehealth 2.0 is the next generation of virtual healthcare, integrating AI, remote monitoring, and data analytics to deliver personalized and efficient patient care. The telehealth 2.0 market is expanding due to growing demand for accessible, real-time healthcare and advancements in AI, IoT, and remote technologies. Increased smartphone use, digital health awareness, and supportive government policies are enhancing adoption. Additionally, post-pandemic shifts toward hybrid care, remote, and personalized treatment solutions are driving continuous innovation and sustained market growth worldwide.

- For Instance, In July 2025, the World Health Organization (WHO) and the Society of Robotic Surgery (SRS) signed an MoU at the SRS Annual Meeting in Strasbourg, France, to promote equitable access to virtual care and telesurgery. The collaboration, part of WHO’s health innovation agenda, aims to bridge global healthcare gaps by leveraging digital and robotic technologies. It focuses on improving access to quality surgical care, especially in low- and middle-income countries, by strengthening public-private partnerships, regulatory systems, and workforce development. (Source: https://www.who.int/)

What are the Key trends in the Telehealth 2.0 Market in 2024?

- In February 2025, GOQii joined hands with Acrannolife Genomics to launch GrafCare, a program combining AI, genomics, and personalized monitoring to enhance post-transplant patient care. (Source: https://ehealth.eletsonline.com/)

- In November 2024, Bajaj Finserv Health revealed a ₹1,000 crore investment to upgrade its technology and services. After acquiring Vidal Health earlier that year, it plans to launch the innovative ‘Health Saathi’ concierge service. (Source: https://ehealth.eletsonline.com/)

How Can AI Affect the Telehealth 2.0 Market?

AI is revolutionizing the market by enabling accurate diagnostics, personalized treatment plans, and predictive healthcare insights. It enhances virtual consultations, automates administrative tasks, and improves patient monitoring through real-time data analysis. AI-powered chatbots and decision-support tools also boost efficiency and accessibility, making healthcare more proactive, data-driven, and patient-centric, ultimately driving faster adoption and market expansion globally.

Report Scope of Telehealth 2.0 Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 222.50 Billion |

| Market Size by 2034 |

USD 932.57 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 17.26% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Service, By End-User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Athenahealth Inc., iCliniq, Medtronic, Epocrates, Medisafe, Teladoc Health, Inc., LiftLabs, CompuMed Inc., GE Healthcare, Telecare Corporation, Optum Health, Siemens Healthineers, Veradigm LLC, eClinicalWorks |

Market Dynamics

Driver

Rising Cases of Non-communicable Diseases

The rising prevalence of non-communicable diseases, such as diabetes, cardiovascular diseases, and cancer responsible for nearly 74% of global deaths, according to the WHO. The growth of the telehealth 2.0 market. With over 1.5 billion people worldwide living with chronic conditions, telehealth solutions enable continuous monitoring, remote consultations, and personalized care management. This reduces hospital visits, improves treatment adherence, and supports early intervention through AI-driven and data-based health tracking systems.

- For Instance, In 2024, Thailand implemented telemedicine kiosks with biosensors to monitor NCDs. Patients saw improvements like fasting blood glucose dropping from 148 to 130 mg/dL and systolic blood pressure from 152 to 138 mmHg, enabling effective remote care. (Source: https://pmc.ncbi.nlm.nih.gov/)

Restraint

Data Privacy and Cybersecurity Concerns

Data privacy and cybersecurity concerns are major restraints in the telehealth 2.0 market. In 2024, the U.S. healthcare sector reported 656 data breaches, impacting over 172 million individuals. The average cost of a healthcare data breach reached $9.8 million, nearly double that of other industries. Additionally, 43% of patients expressed concerns about the security of their health information during telehealth consultations. These issues slow adoption and limit the scalability of telehealth solutions.

Opportunity

Expansion of Remote Patient Monitoring for Chronic Diseases

The expansion of Remote Patient Monitoring (RPM) offers a significant opportunity in the Telehealth 2.0 market by enabling continuous management of chronic diseases such as diabetes and hypertension. The patients using RPM experienced a 9.3 points, and 76.3% of patients saw their systolic BP reduced. This real-time monitoring allows early intervention, personalized care, improved patient outcomes, and fewer hospital visits, making chronic disease management more effective and accessible.

- For Instance, In March 2023, the American Heart Association released a study involving 1,152 patients, which found that those using RPM had better blood pressure control, averaging 132.3 mm Hg compared to 136.6 mm Hg in the control group, with 72.6% of RPM patients achieving target levels versus 65.6% in the non-RPM group. (Source: https://www.coachcare.com/)

Segmental Insights

What made the telemedicine Segment Dominant in the Telehealth 2.0 Market in 2024?

In 2024, the telemedicine segment led the market due to the increasing demand for real-time virtual consultations. Studies show that over 62% patients preferred video consultations for primary care. While 58% of healthcare providers reported improved patient adherence and outcomes through telemedicine. The widespread adoption of smartphones, high-speed internet, and digital health platforms enables immediate access to care, timely diagnoses, and continued monitoring. Telemedicine the most utilized type of telehealth globally.

The electronic health record (EHR) segment is projected to grow rapidly during the forecast period due to the rising adoption of digital record-keeping and data-driven healthcare solutions. In 2024, over 85% of hospitals in developed countries had implemented EHR systems, while about 68% of clinics in emerging markets were transitioning from paper-based to digital records. EHRs enhance patient data management, streamline clinical workflows, support telehealth integration, and improve decision-making, making them a key driver of healthcare digitization globally.

Telehealth 2.0 Market By Type, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Telemedicine |

41.7 |

48.5 |

56.4 |

65.5 |

76.1 |

88.3 |

102.6 |

119.2 |

138.4 |

160.7 |

186.5 |

| Electronic Health Records (EHRs) |

28.5 |

33.2 |

38.6 |

45.0 |

52.4 |

61.0 |

71.0 |

82.7 |

96.3 |

112.1 |

130.6 |

| E-Prescription |

15.2 |

18.0 |

21.4 |

25.4 |

30.1 |

35.8 |

42.4 |

50.3 |

59.7 |

70.8 |

83.9 |

| Remote Patient Monitoring |

34.2 |

40.9 |

49.1 |

58.7 |

70.3 |

84.1 |

100.6 |

120.3 |

143.8 |

171.8 |

205.2 |

| mHealth |

38.0 |

44.7 |

52.7 |

62.1 |

73.2 |

86.2 |

101.6 |

119.7 |

141.1 |

166.2 |

195.8 |

| Health Information Exchange (HIE) |

19.0 |

22.0 |

25.6 |

29.7 |

34.4 |

40.0 |

46.4 |

53.8 |

62.4 |

72.4 |

83.9 |

| Others |

13.3 |

15.1 |

17.2 |

19.6 |

22.2 |

25.2 |

28.6 |

32.4 |

36.6 |

41.4 |

46.6 |

Why Did the Electronic Health Records Segment Dominate the Telehealth 2.0 Market in 2024?

In 2024, the remote patient monitoring (RPM) segment held the largest market share in telehealth services due to its proven effectiveness in managing chronic conditions. A study by HealthSnap reported that 90% of patients using RPM for chronic care management experienced improved clinical outcomes. Additionally, a systematic review published in npj Digital Medicine found that RPM interventions led to a 38% reduction in hospital admissions and a 51% decrease in emergency department visits. These outcomes underscore RPM's role in enhancing patient care and reducing healthcare system burdens.

The diagnostic services segment in telehealth is expected to grow at the fastest rate during the forecast period due to rising demand for remote testing and early disease detection. In 2024, Labcorp reported a 7.9% increase in diagnostic test volumes, and Quest Diagnostics saw strong uptake in advanced diagnostics as patients resumed deferred health checks. These trends highlight that remote diagnostics, supported by telehealth platforms, are becoming essential for timely care, improved patient outcomes, and efficient healthcare delivery.

Telehealth 2.0 Market By Service, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Monitoring |

75.9 |

89.4 |

105.4 |

124.2 |

146.4 |

172.5 |

203.2 |

239.5 |

282.1 |

332.4 |

391.7 |

| Diagnostic |

62.6 |

73.7 |

86.6 |

101.9 |

119.8 |

140.9 |

165.7 |

194.9 |

229.3 |

269.6 |

317.1 |

| Treatment |

51.2 |

59.4 |

68.9 |

79.9 |

92.6 |

107.3 |

124.3 |

144.0 |

166.9 |

193.3 |

223.8 |

What made the Healthcare Providers Segment Dominant in the Telehealth 2.0 Market in 2024?

In 2024, the healthcare providers segment dominated the market due to extensive adoption of virtual care by hospitals, clinics, and specialty centres. Reports indicate that overall 75% of hospitals in developed countries had integrates telehealth services to support chronic disease management, remote consultations, and continuous patient monitoring. This widespread implementation improved clinical outcomes, operational efficiency, and patient engagement, establishing healthcare providers as the leading contributors to telehealth adoption and the largest segment in the market.

The insurance segment is expected to grow significantly in the telehealth 2.0 market during the projected period due to increasing adoption of telehealth services for policyholder care and cost management. In 2024, over 60% of health insurers in the U.S. reported offering telehealth coverage, helping reduce hospital visits and claims costs. Insurers are leveraging telehealth for preventive care, chronic disease management, and virtual consultations, which enhances member satisfaction, lowers healthcare expenditures, and drives greater integration of digital health solutions.

Telehealth 2.0 Market By End-User, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Healthcare Providers |

129.0 |

150.4 |

175.3 |

204.4 |

238.2 |

277.6 |

323.6 |

377.1 |

439.5 |

512.2 |

596.8 |

| Insurers |

38.0 |

45.4 |

54.3 |

64.9 |

77.5 |

92.6 |

110.5 |

131.9 |

157.4 |

187.7 |

223.8 |

| Others |

22.8 |

26.7 |

31.3 |

36.7 |

43.1 |

50.5 |

59.2 |

69.4 |

81.4 |

95.4 |

111.9 |

Regional Insights

How is North America contributing to the Expansion of the Telehealth 2.0 Market?

In 2024, North America dominated the market due to advanced healthcare infrastructure, widespread internet and smartphone penetration, and strong adoption of digital health technologies. Over 80% of U.S. hospitals offered telehealth services, while around 70% of patients reported using virtual care for consultations. Supportive government policies, favorable reimbursement frameworks, and increasing demand for remote monitoring and chronic disease management further strengthened the region’s leadership in telehealth adoption and innovation.

How is Europe Accelerating the Telehealth 2.0 Market?

Europe is expected to grow significantly in the market during the forecast period due to rising digital healthcare adoption, government initiatives promoting telemedicine, and increased investment in remote patient monitoring and AI-driven solutions. In 2024, over 65% of European hospitals had integrated telehealth services, while approximately 60% of patients expressed willingness to use virtual consultations. Advancements in healthcare infrastructure and growing chronic disease prevalence are further driving telehealth expansion across the region.

Telehealth 2.0 Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

68.3 |

79.2 |

91.8 |

106.5 |

123.4 |

143.0 |

165.7 |

192.0 |

222.5 |

257.7 |

298.4 |

| Europe |

51.2 |

59.6 |

69.4 |

80.8 |

94.0 |

109.4 |

127.3 |

148.1 |

172.3 |

200.4 |

233.1 |

| Asia Pacific |

49.3 |

59.0 |

70.4 |

84.1 |

100.5 |

119.9 |

143.1 |

170.6 |

203.5 |

242.6 |

289.1 |

| Latin America |

11.4 |

13.6 |

16.2 |

19.3 |

23.0 |

27.3 |

32.6 |

38.8 |

46.1 |

54.9 |

65.3 |

| Middle East and Africa (MEA) |

9.5 |

11.1 |

13.0 |

15.3 |

17.9 |

21.0 |

24.7 |

28.9 |

33.9 |

39.8 |

46.6 |

Top Companies in the Telehealth 2.0 Market

Recent Developments in the Telehealth 2.0 Market

- In May 2025, eHealth Technologies launched eHealth Connect Clinical Summary, designed for oncology care teams. The solution uses generative AI and direct EHR integration to quickly compile comprehensive, easy-to-understand patient histories from multiple fragmented data sources, streamlining clinical decision-making and improving care coordination. (Source: https://www.ehealthtechnologies.com/)

- In February 2025, Quokka Care, a healthcare technology company specializing in Remote Patient Monitoring (RPM), secured a strategic growth investment led by entrepreneur Ray Guzman, Montecito Medical Real Estate, and other investors. This funding supports Quokka Care’s mission to transform chronic disease management through its innovative, patient-focused remote monitoring solutions. (Source: https://www.prnewswire.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the telehealth 2.0 market.

By Type

- Telemedicine

- Electronic Health Records (EHRS)

- E-Prescription

- Remote Patient Monitoring

- mHealth

- Health Information Exchange (HIE)

- Others

By Service

- Monitoring

- Diagnostic

- Treatment

By End-User

- Healthcare Providers

- Insurers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Telehealth 2.0 Market Size (USD Billion) by Type, 2024–2034

- Table 2: Global Telehealth 2.0 Market Size (USD Billion) by Service, 2024–2034

- Table 3: Global Telehealth 2.0 Market Size (USD Billion) by End-User, 2024–2034

- Table 4: North America Market Size (USD Billion) by Type, 2024–2034

- Table 5: North America Market Size (USD Billion) by Service, 2024–2034

- Table 6: North America Market Size (USD Billion) by End-User, 2024–2034

- Table 7: U.S. Market Size (USD Billion) by Type & Service, 2024–2034

- Table 8: Canada Market Size (USD Billion) by Type & Service, 2024–2034

- Table 9: Mexico Market Size (USD Billion) by Type & Service, 2024–2034

- Table 10: Europe Market Size (USD Billion) by Type, 2024–2034

- Table 11: Europe Market Size (USD Billion) by Service, 2024–2034

- Table 12: Germany Market Size (USD Billion) by Type & Service, 2024–2034

- Table 13: France Market Size (USD Billion) by Type & Service, 2024–2034

- Table 14: UK Market Size (USD Billion) by Type & Service, 2024–2034

- Table 15: Italy Market Size (USD Billion) by Type & Service, 2024–2034

- Table 16: Asia Pacific Market Size (USD Billion) by Type, 2024–2034

- Table 17: Asia Pacific Market Size (USD Billion) by Service, 2024–2034

- Table 18: China Market Size (USD Billion) by Type & Service, 2024–2034

- Table 19: Japan Market Size (USD Billion) by Type & Service, 2024–2034

- Table 20: India Market Size (USD Billion) by Type & Service, 2024–2034

- Table 21: South Korea Market Size (USD Billion) by Type & Service, 2024–2034

- Table 22: Southeast Asia Market Size (USD Billion) by Type & Service, 2024–2034

- Table 23: Latin America Market Size (USD Billion) by Type & Service, 2024–2034

- Table 24: Brazil Market Size (USD Billion) by Type & Service, 2024–2034

- Table 25: Middle East & Africa Market Size (USD Billion) by Type & Service, 2024–2034

- Table 26: GCC Countries Market Size (USD Billion) by Type & Service, 2024–2034

- Table 27: Turkey Market Size (USD Billion) by Type & Service, 2024–2034

- Table 28: Africa Market Size (USD Billion) by Type & Service, 2024–2034

List of Figures

- Figure 1: Global Market Share by Type, 2024

- Figure 2: Global Market Share by Service, 2024

- Figure 3: Global Market Share by End-User, 2024

- Figure 4: North America Market Share by Type, 2024

- Figure 5: North America Market Share by Service, 2024

- Figure 6: North America Market Share by End-User, 2024

- Figure 7: U.S. Market Share by Type, 2024

- Figure 8: U.S. Market Share by Service, 2024

- Figure 9: Canada Market Share by Type, 2024

- Figure 10: Canada Market Share by Service, 2024

- Figure 11: Mexico Market Share by Type, 2024

- Figure 12: Mexico Market Share by Service, 2024

- Figure 13: Europe Market Share by Type, 2024

- Figure 14: Europe Market Share by Service, 2024

- Figure 15: Germany Market Share by Type, 2024

- Figure 16: Germany Market Share by Service, 2024

- Figure 17: France Market Share by Type, 2024

- Figure 18: France Market Share by Service, 2024

- Figure 19: UK Market Share by Type, 2024

- Figure 20: UK Market Share by Service, 2024

- Figure 21: Italy Market Share by Type, 2024

- Figure 22: Italy Market Share by Service, 2024

- Figure 23: Asia Pacific Market Share by Type, 2024

- Figure 24: Asia Pacific Market Share by Service, 2024

- Figure 25: China Market Share by Type, 2024

- Figure 26: China Market Share by Service, 2024

- Figure 27: Japan Market Share by Type, 2024

- Figure 28: Japan Market Share by Service, 2024

- Figure 29: India Market Share by Type, 2024

- Figure 30: India Market Share by Service, 2024

- Figure 31: South Korea Market Share by Type, 2024

- Figure 32: South Korea Market Share by Service, 2024

- Figure 33: Southeast Asia Market Share by Type, 2024

- Figure 34: Southeast Asia Market Share by Service, 2024

- Figure 35: Latin America Market Share by Type, 2024

- Figure 36: Latin America Market Share by Service, 2024

- Figure 37: Brazil Market Share by Type, 2024

- Figure 38: Brazil Market Share by Service, 2024

- Figure 39: Middle East & Africa Market Share by Type, 2024

- Figure 40: Middle East & Africa Market Share by Service, 2024

- Figure 41: GCC Countries Market Share by Type, 2024

- Figure 42: GCC Countries Market Share by Service, 2024

- Figure 43: Turkey Market Share by Type, 2024

- Figure 44: Turkey Market Share by Service, 2024

- Figure 45: Africa Market Share by Type, 2024

- Figure 46: Africa Market Share by Service, 2024