U.S. Cell and Gene Therapy Clinical Trials Market Size, Share, Growth, Report 2026 to 2035

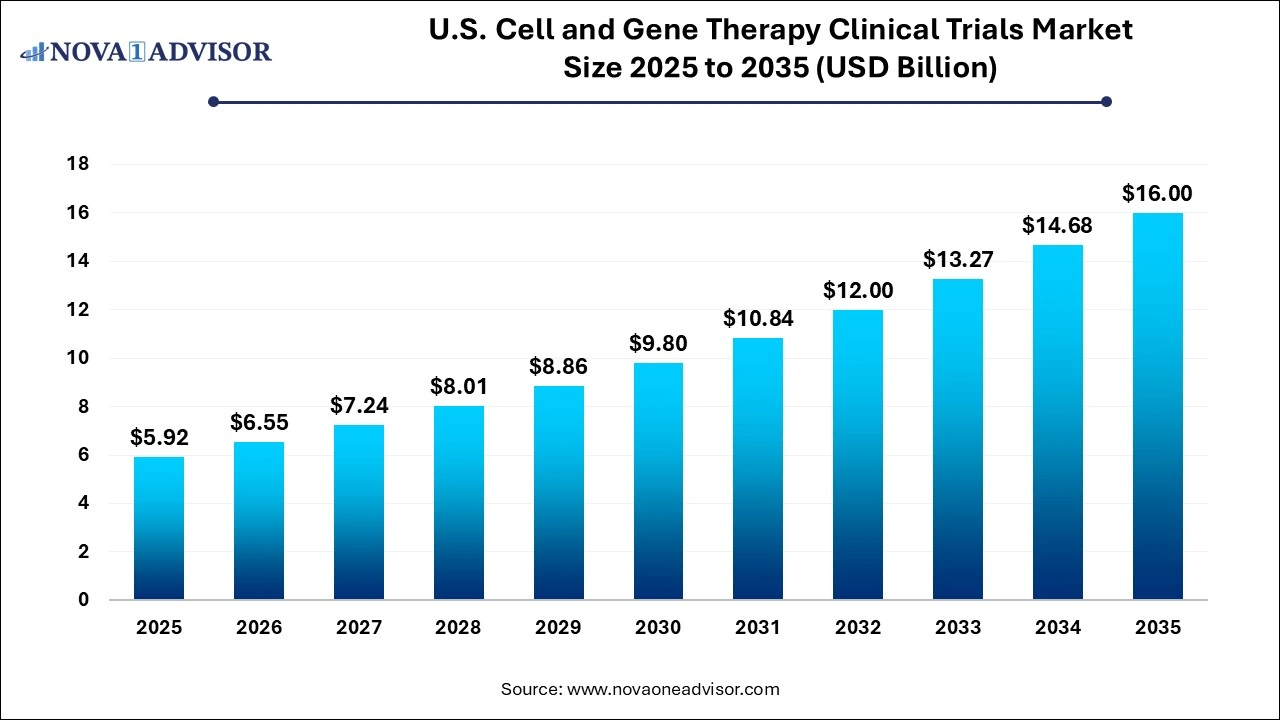

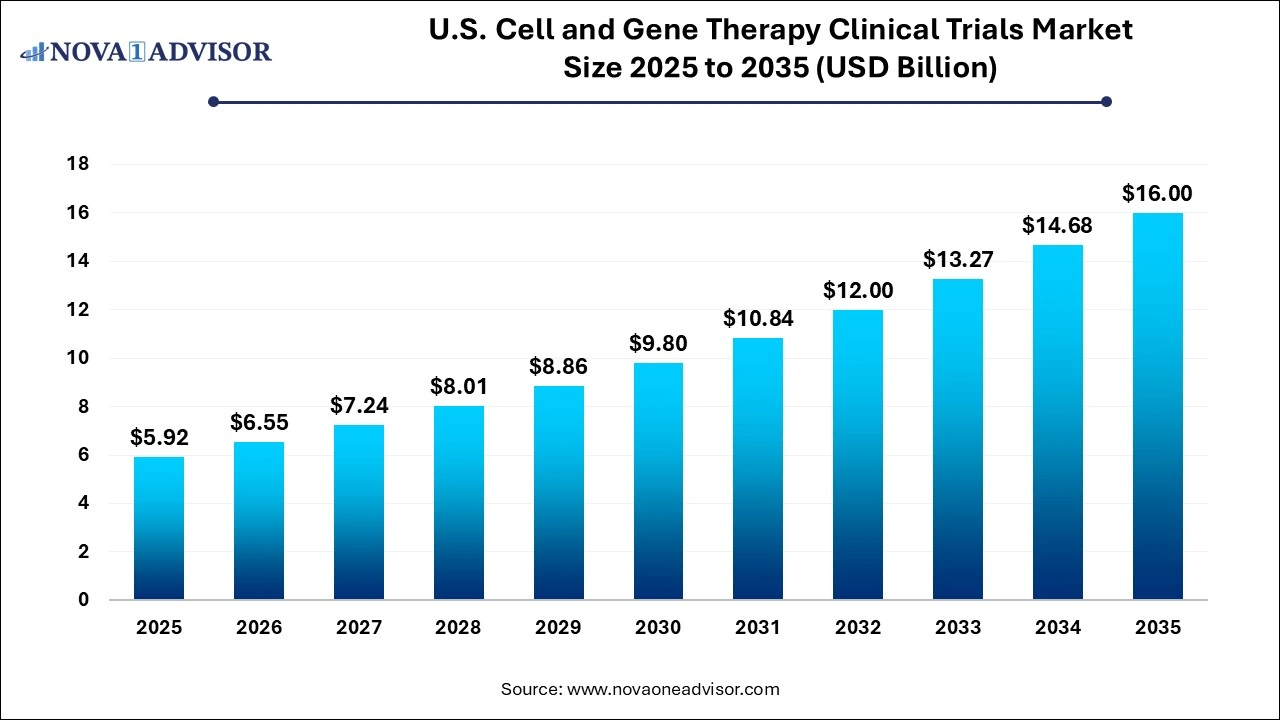

The U.S. cell and gene therapy clinical trials market size is calculated at USD 5.92 billion in 2025, grows to USD 6.55 billion in 2026, and is projected to reach around USD 16.00 billion by 2035, growing at a CAGR of 10.45 from 2026 to 2035. The U.S. cell and gene therapy clinical trials market growth is driven by the rising burden of chronic diseases and genetic disorders, streamlined regulatory approval processes, and increasing emphasis on personalized medicine.

U.S. Cell and Gene Therapy Clinical Trials Market Key Takeaways

- By phase, the phase III segment dominated the market with the largest share in 2025.

- By phase, the phase I segment is expected to show the fastest growth over the forecast period.

- By indication, the oncology segment held the largest market share in 2025.

- By indication, the cardiology segment is expected to register fastest growth during the forecast period.

How is the U.S. Cell and Gene Therapy Clinical Trials Market Expanding?

Cell and gene therapy clinical trials refer to clinical research studies conducted for evaluating the safety, efficacy and potency of novel therapies designed for modifying a patient’s genes or cells for treating or preventing a disease or a condition. These trials open new horizons in the field of medicine, leading to development of new treatment options for various untreated conditions. The ongoing advancements in gene editing technologies such as CRISPR-Cas9, expanding applications across wide range of diseases such as autoimmune diseases and neurological disorders as well as increased collaboration and R&D activities are driving the growth of the U.S. cell and gene therapy clinical trials market.

What Are the Key Trends in the U.S. Cell and Gene Therapy Clinical Trials Market?

- In July 2025, the Centers for Medicare & Medicaid Services (CMS) expanded access to lifesaving gene therapies for patients with sickle cell disease through innovative state agreements. The 33 participating states, along with the District of Columbia and Puerto Rico, will be offered a bold new approach with the Cell and Gene Therapy (CGT) Access Model for delivering state-of-the-art treatments for people on Medicaid and living with sickle cell disease.

- In May 2025, Medable Inc., a leading provider of technology platform for decentralized clinical trials, launched its digital-first Long-Term Follow-Up (LTFU) model for cell and gene therapy (CGT) trials which enables patient engagement and retention.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms in cell and gene therapy (CGT) clinical trials in the U.S. is accelerating development processes and enhancing their efficiency and success rates. There is a rising shift towards adoption of AI platforms by companies and research organizations to expedite CGT clinical trials and gain a competitive advantage in the market. Analysis of patient data such as genomic data and real-world evidence (RWE) with AI algorithms can help in selection of candidates, for predicting potential adverse events, and for optimizing trial protocols, further leading to more efficient and targeted clinical trials.

Development of personalized treatment approaches and identification of biomarkers by leveraging AI algorithms can potentially improve patient life outcomes. Use of AI-powered systems for manufacturing processes can help in real-time monitoring, detection of deviations and making timely adjustments, further ensuring product quality and safety as well as improved efficiency and reduced costs for scaling up these therapies.

Report Scope of U.S. Cell and Gene Therapy Clinical Trials Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 6.55 Billion |

| Market Size by 2035 |

USD 16.00 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.45% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Phase, Indication |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Charles River Laboratories, ICON Plc, IQVIA, LabCorp, Medpace, Novotech, PAREXEL International Corp.,Syneos Health, Thermo Fisher Scientific, Inc., Veristat, LLC |

U.S. Cell and Gene Therapy Clinical Trials Market Dynamics

Drivers

Unmet Medical Needs

The increasing prevalence of chronic diseases like cancer and diabetes, autoimmune conditions, as well as rare genetic disorders, is creating a huge demand for addressing these unmet medical needs through novel and effective therapies with curative potentials such as cell and gene therapies. There is a rapid surge in preclinical studies and Phase I clinical trials focused on developing therapies for rare and orphan diseases as well as other prevailing chronic conditions with increasing investments in R&D operations, further contributing to the market growth.

Restraints

High Costs and Scientific Hurdles

The high costs associated with cell and gene therapies development and production which include significant investments in research, preclinical studies and conduction of clinical trials can lead to hundreds of millions or even billions of dollars, further restraining the market growth. Furthermore, complex regulatory requirements such as specialized manufacturing facilities, manufacturing quality control (CMC), long-term safety follow-up studies, among other can potentially lead to delays and also drive up the costs.

Additionally, a major challenge in CGT clinical trials is ensuring the safety and efficacy of these therapies such as management of potential side effects and adverse events, to avoid off-target effects, to monitor immune responses and ensure proper delivery to the targeted genome.

- For instance, in July 2025, the U.S. Food and Drug Administration (FDA) revoked Sarepta Therapeutics’ platform technology designation for the AAVrh74 viral vector is uses in gene therapy products for multiple muscular dystrophy indications. The decision made by the FDA follows the recent death of a 51-year-old patient undergoing treatment with Sarepta’s investigational gene therapy SRP-9004 for nonambulant limb-girdle muscular dystrophy (LGMD) type 2D/R3, using the AAVrh74 serotype, in a phase 1 clinical trial (DISCOVERY; NCT01976091).

Opportunities

Improvements in CGT Technologies

The ongoing advancements in cell and gene therapies are fundamentally improving the safety, efficacy and potential of these therapies. Improvements in gene editing technologies such as reduced off-target effects and more precision with tools like CRISPR-Cas9 as well as expansion of therapeutic targets to a broad range of genetic mutations. Enhanced CAR-T cell therapies through cytokine engineering along them to express cytokines such as IL-15, further improving their application and in vivo cytotoxic activity as well as incorporation of inducible suicide switches allowing controlled elimination of engineered immune cells in case of severe toxicity.

Advanced technologies are facilitating the development of allogeneic, off-the-shelf therapies using healthy donor cells, further reducing logistical complexity and enabling production of personalized therapies, making them more accessible and scalable for a larger patient pool. Moreover, automation and robotics are revolutionizing CGT manufacturing processes, leading to reduced manual interventions, minimized contamination risk and human errors and lowered costs.

U.S. Cell and Gene Therapy Clinical Trials Market Segmental Insights

By Phase Insights

What Made Phase III the Dominant Segment in the Market in 2025?

The phase III segment accounted for the largest market revenue share in 2025. Phase III clinical trials are a crucial stage in confirming the efficacy of new therapies across a wide range of patient populations at multiple sites. The rigorous data collection of large patient pool, high complexity, extensive nature, need for specialized personnel, and demand for sophisticated data analysis tools are the factors leading to high costs of these trials, further driving their market revenue share and dominance.

Additionally, increasing investments by domestic as well as internationals companies, rise in number of early-stage clinical trials, growing focus on rare diseases and supportive regulatory frameworks are contributing to the market expansion. The U.S. Food and Drug Administration (FDA) led initiatives such as Fast Track, Breakthrough Therapy Designation, Accelerated Approval and Priority Review are encouraging innovation and expanding the market potential.

The phase I segment is expected to register the fastest CAGR over the projected timeframe. A major drover for this segment is the rise in number of new cell and gene therapy Investigational New Drug (IND) filings and first-in-human studies which is an important for assessing and establishing the safety, tolerability, and dosage of new therapies in smaller patient populations. The rise of emerging biotech startups, focus of companies of strengthening and expanding CGT products portfolio, increasing emphasis on personalized medicine approaches, and strategic alliances to boost R&D efforts are the factors fuelling the market growth of this segment.

Advancements in cell therapy manufacturing processes such as the utilization of hollow fiber bioreactors and multi-stack cell factories for Mesenchymal Stromal Cell (MSC) expansion, development of microfluidics-based systems and GMP boxes are enhancing the efficiency and scalability of cell and gene therapy production, further contributing to the market growth of this segment. Furthermore, specialized phase I service offerings such as recruitment of healthy volunteers, cell processing units, access to specialized toxicology labs, and regulatory expertise, among others provided by Contract Research Organizations (CROs) are expediting the entry of potential therapies for phase I clinical trials.

By Indication Insights

How Did the Oncology Segment Dominate the Market in 2025?

The oncology segment dominated the market with the highest revenue share in 2025. The high cancer disease burden with increasing morbidity and mortality rates is driving a huge need for effective treatments such as cell and gene therapies offering highly targeted and durable treatment solutions with curative potential. This huge demand is driving significant investments for research and clinical trial activity. According to the cancer statistics provided by the National Cancer Institute (NCI), approximately 2,041,910 new cases of cancer will be diagnosed and about 618,120 people will die from the disease in the U.S. in 2025.

In oncology, CGT clinical trials are particularly focused on CAR-T (Chimeric Antigen Receptor T-cell) therapy, TCR-T (T-cell Receptor T-cell) therapy, and gene-edited immune cell therapies for solid tumors like glioblastoma and melanoma as well as for treating hematological cancers like acute lymphoblastic leukemia, multiple myeloma, and non-Hodgkin lymphoma. Factors such as the high success rates of CAR-T therapies, focus on developing combination therapies, advancements in immune-oncology field, and expanding applications of these therapies are driving the segment’s market dominance.

- For instance, in September 2024, Poseida Therapeutics, Inc., was granted the U.S. FDA’s Regenerative Medicine Advanced Therapy (RMAT) designation for P-BCMA-ALLO1, which is an investigational stem cell memory T cell (TSCM)-based allogeneic CAR-T cell therapy in Phase 1/1b clinical development to treat patients with relapsed/refractory multiple myeloma (RRMM). The therapy was also granted Orphan Drug Designation by FDA in March, 2024.

The cardiology segment is anticipated to show the fastest CAGR over the forecast period. Cardiovascular diseases are becoming more common in the U.S. population and are a leading cause of death and disability, further creating the need for novel and effective treatments addressing the root cause. Significant investments are being made by biopharmaceutical companies, venture capital firms, research organizations as well as government institutions to develop cell and gene therapies for cardiovascular disease knowing their potential to regenerate cardiac function, to repair damaged heart tissue and to treat underlying genetic causes of inherited heart disorders. The rising focus on developing novel therapeutic approaches such as gene therapies for hereditary heart conditions such as hypertrophic cardiomyopathy by directly addressing genetic mutations is contributing to the market growth.

Country-Level Analysis

The U.S. is experiencing significant growth in the cell and gene therapy clinical trials market. There is a significant and continuous focus on expansion of product pipelines for CGTs, which attracts investments in conduction of clinical trials. The rise in strategic collaborations for advancing the development of these therapies, presence of well-established healthcare infrastructure, rising disease burden, increased emphasis on late-stage clinical trials, widespread distribution networks, and government support are the factors fuelling the market expansion.

Regulatory considerations such as implementation of Good Manufacturing Practice (GMP) imposed by the FDA are contributing to the market growth. Technology providers in the U.S. are developing new and advanced analytical tools and digital platforms for quality control, allowing constant monitoring throughout the entire manufacturing processes, further enhancing the transparency and improving the product consistency and patient outcomes.

Some of the Prominent Players in the U.S. Cell and Gene Therapy Clinical Trials Market

- Charles River Laboratories

- ICON Plc

- IQVIA

- LabCorp

- Medpace

- Novotech

- PAREXEL International Corp.

- Syneos Health

- Thermo Fisher Scientific, Inc.

- Veristat, LLC

U.S. Cell And Gene Therapy Clinical Trials Market Recent Developments

- In November 2024, UCSF Benioff Children’s Hospital Oakland started enrolling patients for a novel gene therapy clinical trial to treat and cure sickle cell disease. The first-of-a-kind trial in the U.S. focuses on applying non-viral CRISPR-Cas9 gene-editing technology in humans for directly correcting the disease causing genetic mutation. (Source: https://www.ucsf.edu/ )

- In October 2024, New York’s Governor Kathy Hochul announced the expansion of the next phase of Long Island’s nation-leading Cell and Gene Therapy Innovation Hub by disclosing plans for New York BioGenesis Park, which is a breakthrough $430 million project for advancing research, development and commercialization of life-saving therapies, further transforming patient care statewide and beyond. (Source: https://www.governor.ny.gov/ )

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. cell and gene therapy clinical trials market.

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Indication

- Oncology

- Cardiology

- CNS

- Musculoskeletal

- Infectious diseases

- Dermatology

- Endocrine, metabolic, genetic

- Immunology & inflammation

- Ophthalmology

- Hematology

- Gastroenterology

- Others