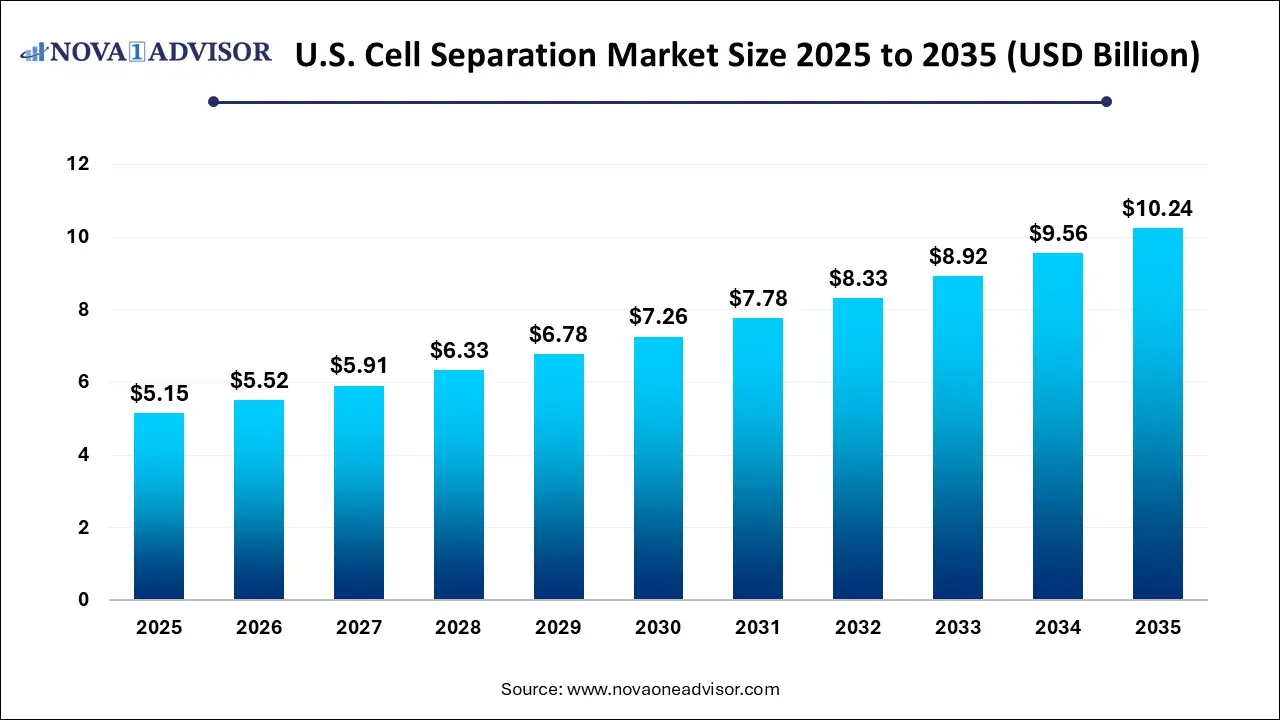

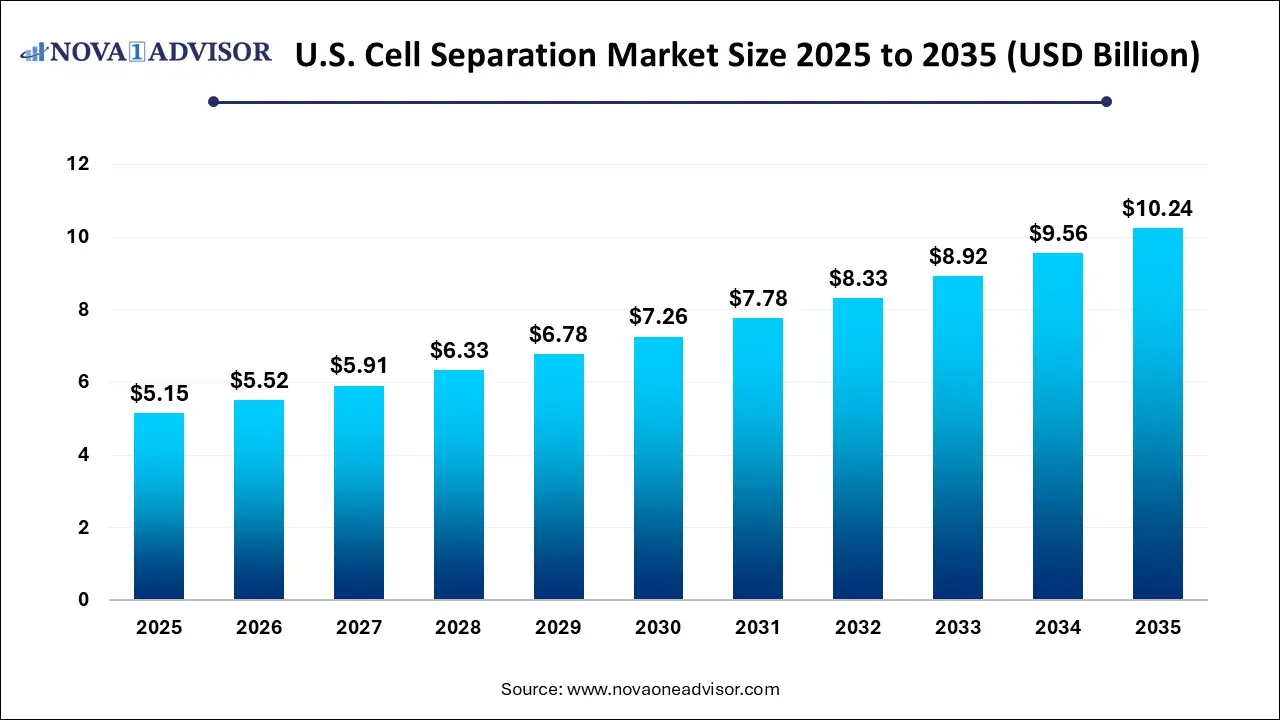

U.S. Cell Separation Market Size and Growth 2026 to 2035

The U.S. cell separation market size was estimated at USD 5.15 billion in 2025 and is projected to hit around USD 10.24 billion by 2035, growing at a CAGR of 7.11% during the forecast period from 2026 to 2035.

Key Takeaways:

- Consumables antibodies held the largest share of 61% in 2025 and this is also expected to witness the fastest growth rate over the forecast period.

- Animal cells held the largest market share of 53% in 2025.

- Human cells are anticipated to grow at a significant rate during the forecast period.

- Centrifugation held the largest market share of 41% in 2025.

- Surface marker is expected to grow at the fastest CAGR from 2026 to 2036.

- Biomolecule isolation held the largest market share of 28% in 2025.

- Biotechnology and biopharmaceutical companies occupied the largest revenue share of 44% in 2025. The segment is also expected to exhibit the fastest growth rate during the forecast period.

Market Overview

The U.S. Cell Separation Market is a vital component of the nation’s biomedical research, therapeutic innovation, and diagnostic infrastructure. Cell separation refers to the process of isolating specific cells from a heterogeneous population based on their physical or biological characteristics. It plays a critical role in applications such as cancer diagnostics, stem cell therapy, regenerative medicine, and biopharmaceutical development. In the U.S., the convergence of advanced research capabilities, a robust biotechnology industry, and strong funding support has positioned the cell separation market as one of the most dynamic sectors in life sciences.

The market has gained significant traction over the past decade due to the rapid growth of personalized medicine, cell-based therapies, and immunology research. As emerging therapies such as CAR-T, T-cell receptor (TCR) therapies, and stem cell-derived treatments gain FDA approvals, the need for precise, high-throughput, and clinically compliant cell separation technologies has intensified. U.S.-based companies, such as Thermo Fisher Scientific, Miltenyi Biotec, and Bio-Rad Laboratories, are at the forefront of developing cutting-edge tools and reagents to meet these demands.

Further supporting the market's growth is the expanding academic and clinical research ecosystem across the country. Institutions such as the NIH, MD Anderson Cancer Center, and Harvard Medical School actively engage in translational research that depends heavily on efficient and accurate cell separation. With the transition from bulk cell population analysis to single-cell studies, the market continues to evolve in complexity, precision, and clinical relevance.

U.S. Cell Separation Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the increasing focus of biotech companies for developing cancer therapeutics along with rapid investment by market players for opening up new research and development centres.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and business expansion. Several cell separation companies such as Thermo Fisher Scientific, Inc., BD, Danaher, Terumo Corp., STEMCELL Technologies Inc. and some others have started investing rapidly for developing advanced cell separation technologies to cater the needs of the end-users.

- Startup Ecosystem: Various startup brands are engaged in developing several types of cell separation tools for the end-users. The prominent startup companies dealing in cell separation comprises of Akadeum Life Sciences, CellFE, Cellino Biotech, Inc and some others.

Major Trends in the Market

-

Shift Toward Automated Cell Separation Systems: Automation is reducing manual error and improving reproducibility, especially in clinical-grade cell separations.

-

Expansion of Magnetic-Activated Cell Sorting (MACS): MACS is gaining popularity for its efficiency in isolating rare cell types, especially in stem cell and immunotherapy research.

-

Rise of Microfluidics-Based Separation: Lab-on-a-chip platforms are providing rapid and scalable separation for diagnostic and point-of-care settings.

-

Growth in Single-Cell Omics Integration: Cell separation is increasingly used as a precursor to downstream applications in single-cell RNA sequencing and proteomics.

-

Increasing Demand for GMP-Compliant Products: The commercialization of cell therapies has driven demand for reagents and systems that meet Good Manufacturing Practices (GMP) standards.

-

Customized Kits for Rare Cell Isolation: Companies are launching kits targeting circulating tumor cells (CTCs), Tregs, and specific immune cells with protocol-specific buffers and antibodies.

-

Collaborations with Pharma and Academia: Strategic partnerships are fueling innovations and scaling manufacturing capacity for clinical-grade products.

-

Eco-Conscious Disposables and Green Manufacturing: Sustainability practices are being adopted in reagent packaging, plastic use, and energy-efficient instrument designs.

U.S. Cell Separation Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 5.52 Billion |

| Market Size by 2035 |

USD 10.24 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.11% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Cell Type, Technique, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories, Inc.; Merck KgaA; Agilent Technologies, Inc.; Corning Inc.; Akadeum Life Sciences |

Market Driver: Surge in Cell-Based Therapies and Immunotherapy

One of the primary drivers of the U.S. Cell Separation Market is the growing adoption of cell-based therapies, particularly in oncology and regenerative medicine. Therapies such as CAR-T cells require the separation and purification of specific immune cells typically T lymphocytes from a patient’s blood. These cells are then genetically engineered and re-infused to target cancer cells. Efficient, viable, and functionally intact separation is crucial to this process, making high-precision technologies indispensable.

In 2023 and 2024, the FDA approved additional CAR-T therapies and initiated expedited reviews of stem-cell-based interventions for neurodegenerative and hematological disorders. This therapeutic momentum is increasing the demand for closed-system, GMP-compliant cell separation platforms. U.S. companies have responded with integrated instruments that automate not just separation but washing, labeling, and quality control. For instance, Miltenyi Biotec’s CliniMACS Prodigy system has become a standard in clinical cell manufacturing suites across leading hospitals. The rising focus on autologous and allogeneic therapies ensures sustained demand for efficient and customizable separation solutions.

Market Restraint: High Cost and Technical Complexity

Despite promising growth, the market faces a significant restraint in the form of high costs and technical complexity associated with advanced cell separation systems. High-throughput instruments equipped with magnetic or flow cytometry-based technologies can cost hundreds of thousands of dollars, excluding consumables, software licenses, and maintenance services. For smaller academic laboratories or early-stage biotech firms, this capital outlay can be prohibitive.

Additionally, these systems often require trained personnel with expertise in immunophenotyping, fluorescence tagging, and instrument calibration. Even minor deviations in protocol execution can lead to poor yields, contamination, or cell loss. The operational complexity and recurring costs of specialty reagents, disposable kits, and cold-chain logistics further limit accessibility. As a result, many institutions opt for centralized core facilities or outsource their separation needs, which can delay turnaround time in fast-paced research environments.

Market Opportunity: Personalized Diagnostics and Liquid Biopsy Expansion

An emerging opportunity in the U.S. Cell Separation Market lies in its integration with personalized diagnostics especially liquid biopsies. These minimally invasive tests rely on isolating rare cells, such as circulating tumor cells (CTCs) or fetal cells in maternal blood, to diagnose disease, monitor treatment, or guide therapeutic decisions. Effective cell separation from complex biofluids is foundational to this process.

As the demand for non-invasive cancer diagnostics grows, so does the need for scalable, user-friendly separation platforms capable of isolating target cells from milliliter volumes of blood with high purity. Companies are responding with microfluidics-based devices and magnetic bead kits optimized for CTC isolation. Thermo Fisher and Bio-Rad have launched diagnostic-grade reagents and cell recovery systems that integrate seamlessly with downstream qPCR or NGS workflows. This convergence of diagnostics, genomics, and cell separation creates a multi-billion-dollar adjacent opportunity for players in the market.

U.S. Cell Separation Market By Product Insights

Consumables dominated the product segment, accounting for a significant portion of recurring revenue across research and clinical applications. Reagents, kits, and media are required for nearly every cell separation protocol and are often customized to the target cell type. Magnetic beads, antibody cocktails, and serum supplements are high-frequency consumables with short shelf lives. Companies like STEMCELL Technologies and Thermo Fisher have built expansive product lines of separation kits, including those targeting stem cells, immune subsets, and cancer biomarkers. Disposables such as sterile tubing sets and sample containers are also in constant demand in GMP environments.

Instruments are the fastest-growing segment, driven by the trend toward automation and precision. Instruments such as magnetic-activated cell separators, flow cytometers with sorting capability, and centrifugal elutriators are replacing manual protocols. As personalized medicine scales up, there is a shift toward closed systems that minimize contamination and operator error. For example, Bio-Rad’s S3e Cell Sorter and Miltenyi’s AutoMACS Pro offer walk-away functionality with integrated QC, making them attractive for both research and manufacturing settings.

U.S. Cell Separation Market By Cell Type Insights

Human cells led the market, reflecting their critical role in clinical diagnostics, personalized medicine, and therapeutic development. Human immune cells (T cells, B cells, NK cells), stem cells (iPSCs, HSCs), and epithelial cells are routinely separated for downstream analysis, therapy, or biobanking. Clinical trials across the U.S. continue to rely on high-purity human cell populations to validate therapeutic efficacy and safety. The use of primary cells over immortalized lines in translational research has further boosted demand for efficient separation protocols specific to human cell phenotypes.

Animal cells are growing in significance, especially in preclinical studies and model development. Rodent-derived cells are essential for early-stage in vivo validation, and the need to separate tissue-specific cell populations such as hepatocytes, neurons, or fibroblasts is driving specialized product development. Companies offer species-specific reagents and protocols tailored to mouse or rat models, enabling higher translational fidelity before human trials.

U.S. Cell Separation Market By Technique Insights

Centrifugation dominated the market, being the most widely adopted and cost-effective technique for cell separation. Density gradient centrifugation using Ficoll or Percoll media remains a standard in blood cell isolation, stem cell preparation, and cancer research. Many U.S. research labs still rely on centrifuge-based protocols due to their affordability and ease of use. Additionally, modern centrifuges offer programmable settings and compatibility with closed-bag systems, expanding their use in GMP manufacturing.

Surface marker-based separation (such as MACS or FACS) is the fastest-growing technique, as specificity and cell viability become more critical in clinical applications. Magnetic bead tagging and flow cytometry-based sorting enable the isolation of rare cells with high precision. Companies like Miltenyi and STEMCELL Technologies continue to innovate in antibody-conjugated beads and fluorescence-based reagents. As single-cell analysis grows, these techniques are indispensable in achieving the purity and throughput required for reliable downstream interpretation.

U.S. Cell Separation Market By Application Insights

Cancer research led the application segment, given the high volume of oncology studies in the U.S. Separation of tumor-infiltrating lymphocytes (TILs), myeloid-derived suppressor cells (MDSCs), and cancer stem cells (CSCs) is central to immuno-oncology pipelines. Cell separation also supports drug sensitivity assays, biomarker discovery, and cytotoxicity studies. The rise of CAR-T and checkpoint inhibitor therapies has only amplified this demand. The ability to isolate patient-specific immune cells and tumor populations is essential to driving these therapies through regulatory approval.

Stem cell research and tissue regeneration are the fastest-growing applications, bolstered by regenerative medicine initiatives and stem cell clinical trials. Isolation of mesenchymal stem cells (MSCs), hematopoietic stem cells (HSCs), and iPSC-derived lineages requires high-yield, high-purity techniques. Many U.S. academic centers and biotech companies are investing in scalable platforms that can support both research and GMP-grade separations for clinical use. The application of stem cell-based therapies in orthopedic, neurological, and cardiovascular diseases is opening new frontiers for market expansion.

U.S. Cell Separation Market By End-use Insights

Biopharmaceutical companies are the fastest-growing end-users, driven by their increasing focus on cell therapy, regenerative medicine, and personalized treatment development. These companies demand scalable, GMP-compliant systems that align with FDA regulatory expectations and can be integrated into manufacturing pipelines. Thermo Fisher’s Gibco CTS series and Miltenyi’s CliniMACS range are tailored to these industrial users. As more biologic drugs enter the pipeline and receive FDA approval, commercial-grade cell separation systems become essential components of the drug development infrastructure.

Research laboratories and academic institutes dominate the end-user segment, representing the largest customer base for cell separation products. These institutions drive early-stage discovery and rely on reproducible, efficient separation to conduct gene expression analysis, phenotyping, and drug screening. NIH-funded labs, university medical schools, and cancer research centers contribute significantly to annual reagent and consumables purchases. The need for protocol flexibility and cross-comparability ensures a steady demand for multi-platform solutions.

Value Chain Analysis

1.Raw Material Procurement

The raw materials for cell separation tools include a variety of polymers, chemical reagents, and inorganic compounds.

- Key Companies: BASF SE, Dow, ExxonMobil and some others.

2. Clinical Trials and Regulatory Approvals

Cell separation tools intended for clinical use are regulated as medical devices or biologic products and require rigorous review and approval from regulatory bodies.

- Key Companies: FDA, Intertek, NAMSA and some others.

3. Distribution Channel

Cell separation tools are primarily distributed through a combination of direct supply chains from manufacturers and specialized partnerships with various entities in the life sciences sector.

- Key Companies: BD, Danaher, Terumo Corp and some others.

U.S. Cell Separation Market Key Company Insights

Key U.S. cell separation companies include Thermo Fisher Scientific, Inc.; BD; and Danaher among others. The market is highly competitive with several leading and emerging companies. The observed growth in this particular sector can be attributed to the implementation of comprehensive expansion strategies, new product development, geographical expansions, and mergers & acquisitions. Companies in the market have been proactive in adopting such strategies to enhance their market presence and drive growth.

U.S. Cell Separation Market Recent Developments

- In June 2025, STEMCELL Technologies launched STEMprep tissue dissociator system. This system is designed for accelerating research discoveries in the U.S.

- In May 2025, Akadeum Life Sciences launched microbubble-based cell separation technology. This separation technique is developed for accelerating the next generation of cell therapies in the U.S. region.

- In May 2025, Becton, Dickinson and Company launched BD SpectralFX Technology. This technology is designed for providing real-time cell imaging solutions to the end-users.

U.S. Cell Separation Market Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. cell separation market.

By Product

- Consumables

- Reagents, Kits, Media, and Sera

- Beads

- Disposables

- Instruments

- Centrifuges

- Flow Cytometers

- Filtration Systems

- Magnetic-activated Cell Separator Systems

By Cell Type

By Technique

- Centrifugation

- Surface Marker

- Filtration

By Application

- Biomolecule Isolation

- Cancer Research

- Stem Cell Research

- Tissue Regeneration

- In Vitro Diagnostics

- Therapeutics

By End-use

- Research Laboratories and Institutes

- Biotechnology and Biopharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Cell Banks