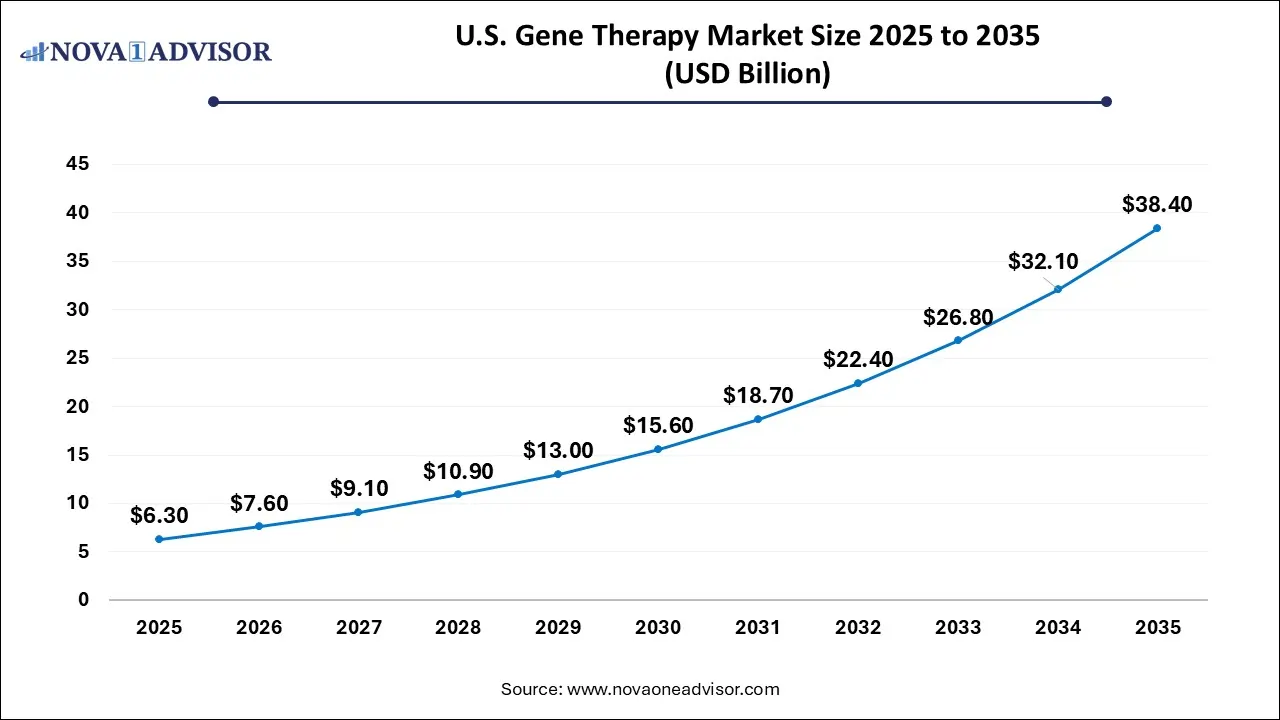

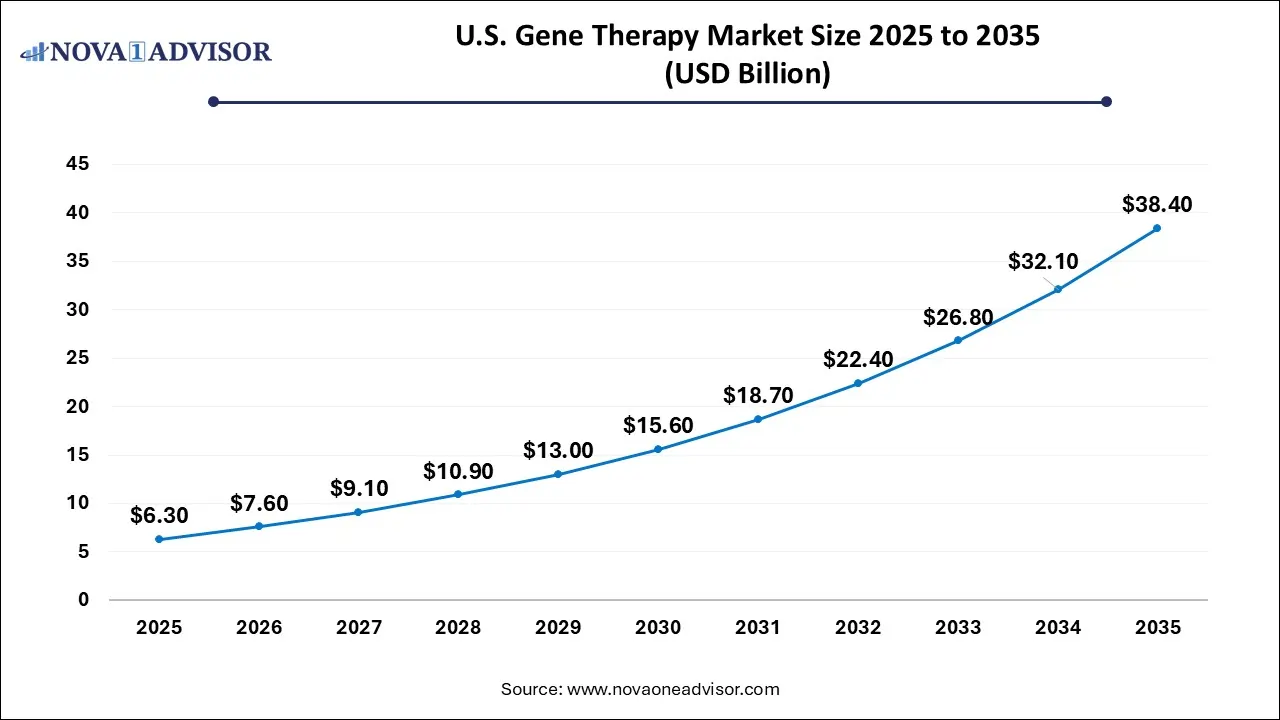

U.S. Gene Therapy Market Size and Growth 2026 to 2035

The U.S. gene therapy market size was estimated at USD 4.85 billion in 2025 and is projected to hit around USD 28.18 billion by 2035, growing at a CAGR of 19.24% during the forecast period from 2026 to 2035.

Key Takeaways:

- The Large B-cell lymphoma segment held the largest revenue share of 36.14% in 2025.

- The inherited retinal disease segment is expected to register a significant CAGR over the forecast period.

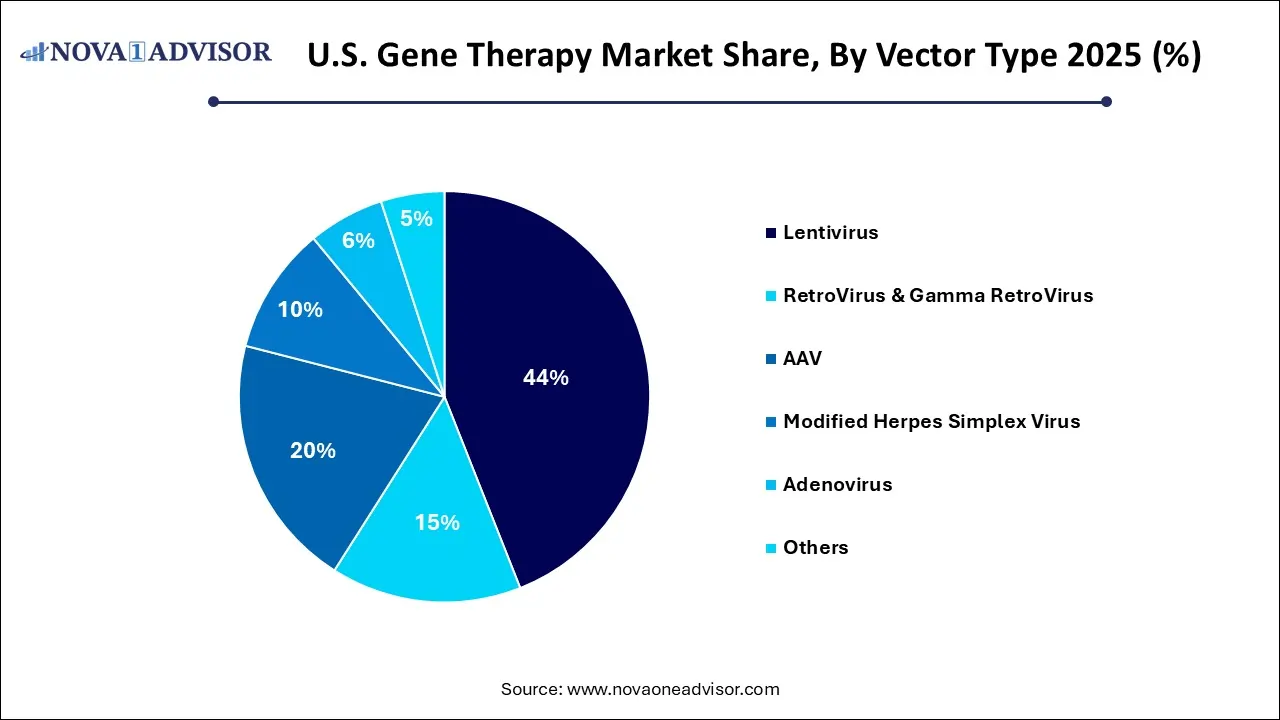

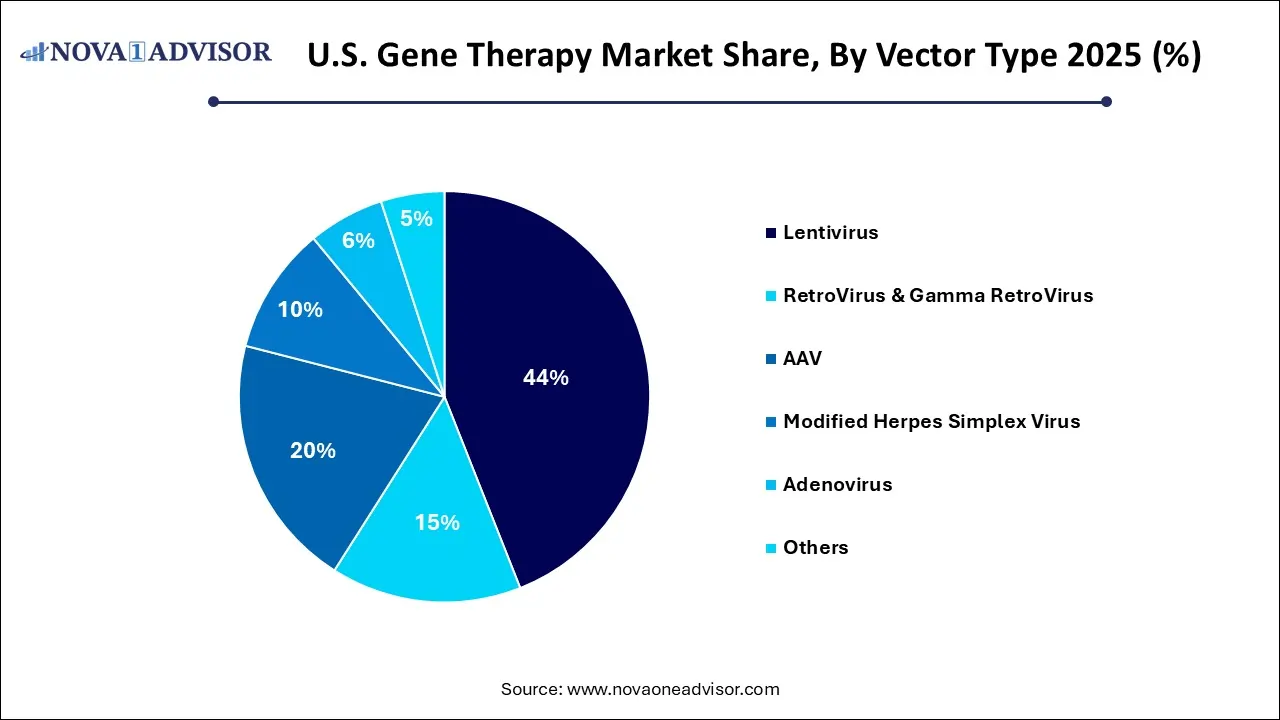

- The lentivirus dominated with a revenue share of 44.0% in 2025.

- The AAV segment is expected to grow at a highest CAGR over the forecast period.

- The intravenous segment dominated the market share in 2025 and is anticipated to grow at a higher CAGR over the forecast period.

- The others segment is expected to grow at a significant CAGR over the forecast period.

Market Overview

The U.S. gene therapy market has emerged as one of the most dynamic and revolutionary sectors in modern biotechnology. With a blend of clinical breakthroughs, regulatory milestones, and investment booms, the country is at the epicenter of transforming medicine from symptomatic treatment to curative genetic intervention. Gene therapy involves the modification or replacement of defective genes to treat or prevent diseases at their molecular roots, offering hope for many previously incurable conditions such as spinal muscular atrophy, inherited blindness, and various hematologic malignancies.

Fueled by a robust pipeline of clinical trials and increasing approvals by the Food and Drug Administration (FDA), gene therapies are no longer experimental fringe concepts but validated therapeutic options. The success of Zolgensma for spinal muscular atrophy and Luxturna for inherited retinal diseases marked a pivotal shift, showcasing the clinical efficacy of gene-based therapeutics and reinforcing their potential commercial viability. In 2023, the FDA approved Casgevy (exagamglogene autotemcel), the first CRISPR-based therapy for sickle cell disease and beta-thalassemia, reflecting an important milestone in gene editing advancement.

The U.S. benefits from a synergistic ecosystem of academic research institutions, biotech startups, contract manufacturing organizations, and regulatory frameworks that encourage innovation while ensuring safety. With hundreds of gene therapies in the pipeline and billions of dollars flowing into research and infrastructure, the market is poised for exponential growth over the next decade.

Major Trends in the Market

-

Increased FDA Approvals for Rare Genetic Diseases: The regulatory landscape is evolving to facilitate faster approvals for life-threatening conditions.

-

Rise of CRISPR and Gene Editing Technologies: Precision tools like CRISPR-Cas9 are opening new frontiers in targeted gene correction.

-

Shift Toward In Vivo Gene Therapies: Growing preference for direct delivery of gene therapies into the patient’s body rather than ex vivo cell manipulation.

-

Adoption of Novel Vectors: The evolution and engineering of safer and more efficient viral vectors such as AAV and lentivirus are driving innovation.

-

Boom in Gene Therapy Startups and IPOs: Venture capital and public markets are fueling the rapid rise of early-stage gene therapy companies.

-

Surge in Contract Development and Manufacturing Organizations (CDMOs): Outsourcing gene therapy manufacturing to specialized CDMOs is becoming a standard strategy.

-

Convergence of AI and Bioinformatics: Machine learning is being increasingly used to identify therapeutic targets and optimize gene constructs.

-

Emphasis on Affordability and Value-Based Pricing Models: As high-cost therapies become common, new reimbursement strategies are emerging to ensure access.

U.S. Gene Therapy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 5.78 Billion |

| Market Size by 2035 |

USD 28.18 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 19.24% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Indication, Route of Administration, Vector Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Amgen Inc.; Novartis AG; F. Hoffmann-La Roche; Gilead Sciences, Inc.; bluebird bio, Inc.; Bristol-Myers Squibb Company; Legend Biotech.; BioMarin.; uniQure N.V.; Merck & Co.; Sarepta Therapeutics, Inc.; Krystal Biotech, Inc.; CRISPR Therapeutics. |

By Indication Insights

Spinal muscular atrophy (SMA) dominated the U.S. gene therapy market due to the early success and widespread adoption of Zolgensma, which received FDA approval in 2019. As a one-time treatment replacing lifelong interventions, Zolgensma demonstrated life-changing outcomes for infants with SMA Type 1. The therapy's strong clinical backing, rapid physician uptake, and proactive marketing by Novartis made it the poster child for gene therapy’s potential. Its launch also educated the healthcare system about gene therapy workflows, reimbursement mechanisms, and patient monitoring strategies, paving the way for future therapies.

In comparison, the beta-thalassemia and sickle cell disease (SCD) segment is witnessing the fastest growth. The FDA’s December 2023 approval of Casgevy (developed by CRISPR Therapeutics and Vertex Pharmaceuticals) marked a historic moment as the first CRISPR-based therapy to reach patients. This therapy has shown remarkable efficacy in reducing painful crises and transfusion dependence, transforming the standard of care. With tens of thousands of patients affected in the U.S., this segment is expected to drive significant future growth and investment, particularly as production becomes more scalable.

By Vector Type Insights

Adeno-associated viruses (AAV) are the most widely used vectors in gene therapy due to their safety profile, ability to transduce non-dividing cells, and long-term gene expression with low immunogenicity. AAV vectors power successful products like Luxturna and Zolgensma and are employed in hundreds of clinical trials targeting diseases ranging from hemophilia to Duchenne muscular dystrophy. Their scalability and precision make them an ideal vector for in vivo therapies, especially those requiring central nervous system and ocular delivery.

Conversely, lentiviral vectors are gaining rapid traction, particularly in ex vivo gene therapies such as CAR-T cells and hematopoietic stem cell transplants. These vectors integrate genetic material into host genomes, offering long-term expression in dividing cells. The approval of lentivirus-based therapies for beta-thalassemia and sickle cell anemia, such as bluebird bio’s Zynteglo, demonstrates the vector’s viability for treating blood-related disorders. Lentiviruses are expected to dominate future development in oncology and regenerative medicine.

By Route Of Administration Insights

Intravenous (IV) administration currently dominates the gene therapy market due to its simplicity, widespread clinical familiarity, and systemic delivery advantages. Most approved therapies and clinical-stage candidates use IV infusion for gene delivery, particularly those targeting hematologic conditions like leukemia, lymphoma, and genetic blood disorders. The IV route allows for broader biodistribution and is especially effective for systemic diseases, where widespread tissue access is required.

However, alternative routes of administration, such as intrathecal and subretinal, are being explored for targeted delivery. For example, Luxturna is delivered via subretinal injection, ensuring direct access to retinal cells and improving efficacy in inherited retinal diseases. Similarly, intrathecal delivery is being investigated for neurological disorders like Batten disease and certain types of lysosomal storage disorders. These non-traditional routes, though technically complex, are growing in clinical usage due to their high tissue specificity.

Key U.S. Gene Therapy Companies:

- Amgen Inc.

- Novartis AG

- F. Hoffmann-La Roche

- Gilead Sciences, Inc.

- bluebird bio, Inc.

- Bristol-Myers Squibb Company

- Legend Biotech.

- BioMarin.

- uniQure N.V.

- Merck & Co.

- Sarepta Therapeutics, Inc.

- Krystal Biotech, Inc.

- CRISPR Therapeutics.

Recent Developments

-

December 2024: The FDA approved Casgevy (exagamglogene autotemcel), the first CRISPR-based gene therapy for sickle cell disease and beta-thalassemia, developed by Vertex Pharmaceuticals and CRISPR Therapeutics.

-

January 2025: Sarepta Therapeutics announced early success in its Phase 3 trial for SRP-9001, a gene therapy candidate targeting Duchenne Muscular Dystrophy (DMD), with a Biologics License Application expected later this year.

-

March 2025: Rocket Pharmaceuticals gained FDA Fast Track designation for RP-A501, its gene therapy for Danon disease, a rare genetic disorder that affects heart muscle function.

-

February 2025: Pfizer announced promising preclinical results for its in vivo gene therapy platform targeting hemophilia A and B, using novel capsid engineering to improve efficiency.

-

April 2025: Novartis initiated a study to evaluate Zolgensma in presymptomatic infants identified via newborn screening, with the goal of expanding indications and outcomes for SMA patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Gene Therapy market.

By Indication

- Large B-cell Lymphoma

- Multiple Myeloma

- Spinal Muscular Atrophy (SMA)

- Acute Lymphoblastic Leukemia (ALL)

- Melanoma (lesions)

- Inherited Retinal Disease

- Beta-thalassemia Major/SCD

- Others

By Route Of Administration

By Vector Type

- Lentivirus

- RetroVirus & Gamma RetroVirus

- AAV

- Modified Herpes Simplex Virus

- Adenovirus

- Others