U.S. In Vitro Diagnostics Market Size, Share, Growth, Trends 2026 to 2035

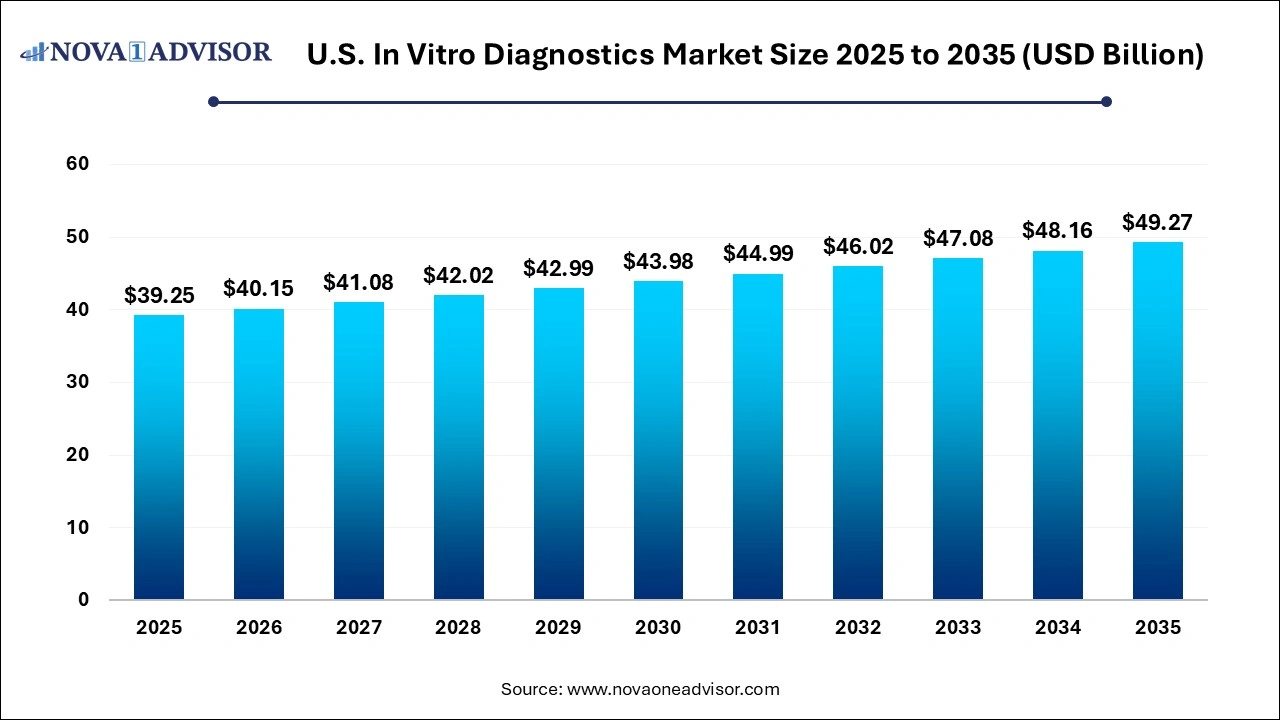

The U.S. In vitro diagnostics market size was valued at USD 39.25 billion in 2025 and is projected to surpass around USD 49.27

billion by 2035, registering a CAGR of 2.3% over the forecast period of 2026 to 2035.

Key Takeaways:

- Reagent segment dominated the market in 2025 with a significant revenue share of 65.79%.

- In 2025, instruments held for second largest revenue share of the market.

- Molecular diagnostics held the largest share in 2025.

- Hematology is anticipated to be fastest-growing segment over the forecast period.

- In 2023, infectious diseases segment held highest revenue share, and is expected to maintain its dominance throughout the projection period.

- Oncology segment is anticipated to witness fastest CAGR over the forecast period.

- Hospitals segment dominated the U.S. in vitro diagnostics market 45.11%in 2025.

- Home care segment is anticipated to exhibit the fastest CAGR during the forecast period.

U.S. In Vitro Diagnostics Market Overview

The U.S. in vitro diagnostics (IVD) market is a foundational pillar of the country's diagnostic infrastructure, enabling rapid, accurate, and minimally invasive disease detection, monitoring, and prognosis. IVD refers to tests performed on samples such as blood, urine, or tissue taken from the human body to detect diseases, conditions, or infections. These diagnostics are indispensable for clinical decision-making across a range of therapeutic areas including infectious diseases, oncology, cardiology, diabetes, autoimmune conditions, and more.

As one of the most technologically advanced healthcare markets globally, the U.S. provides an environment conducive to innovation and early adoption of next-generation IVD solutions. The COVID-19 pandemic underscored the critical importance of scalable and rapid diagnostic testing, leading to an unprecedented expansion of molecular and antigen-based testing platforms. Since then, momentum has continued, with emphasis shifting toward decentralization, home-based diagnostics, multiplexed testing, and integration with digital health platforms.

IVD solutions in the U.S. span a wide variety of modalities, including immunoassays, molecular diagnostics, hematology, microbiology, and clinical chemistry. These are deployed in diverse healthcare settings, from high-volume laboratories and hospitals to point-of-care clinics and home environments. The market is defined by continuous innovation, stringent regulatory oversight (primarily by the FDA), and a growing focus on personalized medicine and preventive care.

U.S. In Vitro Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 40.15 Billion |

| Market Size by 2035 |

USD 49.27 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 2.3% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology, application, product, end-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Abbott; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories, Inc.; Siemens Healthcare GmbH; Agilent Technologies, Inc.; Qiagen; bioMérieux; Quidel Corporation; BD (Becton Dickinson and Company). |

Market Driver: Rising Chronic and Infectious Disease Burden

A major driver propelling the U.S. IVD market is the growing burden of both chronic and infectious diseases. Conditions like diabetes, cardiovascular diseases, autoimmune disorders, and cancer require constant monitoring through routine diagnostics. According to the CDC, six in ten Americans live with at least one chronic disease, creating a sustained demand for diagnostic testing.

Simultaneously, emerging and re-emerging infectious diseases such as COVID-19, RSV, drug-resistant tuberculosis, and sexually transmitted infections (e.g., chlamydia, gonorrhea, HIV) necessitate fast, accurate, and scalable diagnostic solutions. IVDs are integral to surveillance, outbreak response, and ongoing patient management, making them a linchpin of public health and clinical operations.

Market Restraint: Regulatory and Reimbursement Complexities

Despite strong growth potential, the IVD market in the U.S. faces regulatory and reimbursement challenges. FDA oversight of diagnostic products is rigorous, with developers required to demonstrate analytical and clinical validity, which can delay market entry. While Emergency Use Authorizations (EUAs) accelerated approvals during the pandemic, a return to traditional pathways has increased scrutiny.

Moreover, reimbursement remains a significant hurdle. Coverage decisions by CMS and private insurers vary depending on the diagnostic type, clinical indication, and setting. Complex coding, pricing negotiations, and limited coverage for novel tests can disincentivize innovation, especially for small and mid-sized developers. These regulatory and economic factors can constrain market scalability.

Market Opportunity: Rise of Personalized and Precision Diagnostics

A transformative opportunity in the U.S. IVD market is the rise of personalized and precision diagnostics. With the proliferation of genomic data and targeted therapies, there is increasing demand for tests that guide individualized treatment decisions. Companion diagnostics, which identify patients likely to benefit from specific drugs (e.g., in oncology), are gaining FDA approvals at a rapid pace.

Moreover, advances in multi-omics (genomics, proteomics, metabolomics) are enabling a new generation of IVD platforms capable of deep phenotyping and risk stratification. These technologies are instrumental in early disease detection, drug response prediction, and monitoring of minimal residual disease. As the U.S. healthcare system pivots toward precision medicine, IVD developers have an opportunity to align testing solutions with next-generation therapeutics.

Segments Insights

By Product Insights

Reagents dominate the U.S. IVD market, accounting for the largest share due to their recurring usage across all testing platforms. Reagents form the core consumables in assays such as ELISAs, PCR, flow cytometry, and next-generation sequencing. Their continuous demand in routine testing, especially in high-throughput labs, ensures steady market growth. Innovation in reagent formulations such as lyophilized reagents for better shelf life or multiplex reagents for multi-analyte detection is adding clinical value and cost efficiency.

Services are the fastest-growing product category, driven by the rise of outsourced diagnostic testing, digital pathology, and data analytics. With many hospitals and physician groups lacking internal lab infrastructure, demand for third-party testing and analysis is surging. Additionally, services related to test development, compliance, and informatics are growing alongside the adoption of AI and personalized diagnostics.

By Technology Insights

Immunoassays remain the dominant diagnostic technology, especially in applications such as hormone testing, infectious disease screening, and oncology biomarkers. Immunoassays are valued for their sensitivity, scalability, and automation compatibility. Instruments, reagents, and associated services in this category are deployed across hospitals, reference labs, and even point-of-care setups.

Molecular diagnostics are the fastest-growing technology segment, fueled by the evolution of PCR, isothermal amplification, digital PCR, and CRISPR-based diagnostics. These tools are being applied not just in infectious diseases but also in oncology (e.g., liquid biopsy), genetic testing, and pharmacogenomics. As sequencing costs decline and regulatory clarity improves, molecular diagnostics are becoming mainstream.

By Application Insights

Infectious diseases dominate IVD application areas, driven historically by flu and HIV testing and more recently by COVID-19. Syndromic testing panels and rapid molecular assays for pathogens like RSV, MRSA, and C. difficile are widely adopted in urgent care and hospital settings. Labs are also increasingly deploying multiplex PCR for gastrointestinal panels and meningitis workups.

Oncology is the fastest-growing application segment, propelled by the adoption of liquid biopsies, companion diagnostics, and circulating tumor DNA (ctDNA) analysis. IVD tests in oncology are central to early detection, stratification, and therapy monitoring. With a surge in cancer prevalence and targeted therapy approvals, diagnostics will remain an essential pillar of personalized oncology care.

By End-use Insights

Hospitals are the largest end-users of IVD solutions, as they offer a comprehensive range of diagnostic services integrated into clinical workflows. From immunoassays to microbiology and coagulation testing, hospitals rely on IVDs for rapid, evidence-based decision-making in emergency, inpatient, and surgical care settings. High patient volume, 24/7 service models, and integrated lab systems give hospitals scale advantages.

.webp)

Home-care and decentralized diagnostics are the fastest-growing end-use segments, reflecting consumer demand for convenience, rapid results, and chronic disease management. Over-the-counter glucose meters, COVID-19 antigen tests, and fertility kits have opened the door for home-based diagnostics. Startups and established players alike are investing in smartphones connected devices, mail-in kits, and digital reporting platforms to expand access and engagement.

Country-Level Insights United States

The U.S. represents the largest and most dynamic IVD market globally, characterized by rapid innovation, early adoption, and a well-established regulatory and reimbursement infrastructure. Public health agencies such as the CDC and NIH play a key role in surveillance and diagnostics, while the FDA provides a clear framework for test approval.

Recent policy shifts, including efforts to expand insurance coverage for preventive testing and precision diagnostics, have supported IVD growth. Major health systems are consolidating lab operations, investing in lab automation, and integrating diagnostic data into electronic health records (EHRs). Meanwhile, consumer awareness and interest in personal health data are increasing demand for accessible, digital-first IVD solutions.

U.S. In Vitro Diagnostics Market Top Key Companies:

- Abbott

- F. Hoffmann-La Roche Ltd.

- Bio-Rad Laboratories, Inc.

- Siemens Healthcare GmbH

- Agilent Technologies, Inc.

- Qiagen

- bioMérieux

- Quidel Corporation

- BD (Becton Dickinson and Company)

Recent Developments

-

In April 2025, Roche Diagnostics launched a multiplexed respiratory pathogen panel including COVID-19, RSV, and influenza A/B for the U.S. market.

-

In February 2025, Thermo Fisher Scientific announced a partnership with a major health system to expand its oncology companion diagnostics portfolio.

-

In December 2024, Abbott Laboratories introduced a home-based A1C monitoring system integrated with mobile apps.

-

In October 2024, Bio-Rad Laboratories received FDA clearance for its new PCR-based test for multi-drug-resistant tuberculosis.

-

In August 2024, QuidelOrtho Corporation launched a digital point-of-care flu testing platform across U.S. retail clinics.

U.S. In Vitro Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. In Vitro Diagnostics market.

By Product

- Instruments

- Reagents

- Services

By Technology

- Immunoassays

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Infectious Diseases

- Upper respiratory

- Gastrointestinal panel testing

- Methicillin-resistant Staphylococcus Aureus (MRSA)

- Clostridium difficile

- Vancomycin-Resistant Enterococci (VRE)

- Carbapenem-resistant bacteria

- Flu

- Respiratory Syncytial Virus (RSV)

- Candida

- Tuberculosis (TB) and drug-resistant TB

- Meningitis

- Chlamydia

- Gonorrhoea

- HIV

- Hepatitis C

- Hepatitis B

- Other infectious disease

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Hematologic Diseases

- Others

By End-use

- Hospitals

- Immunoassays

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Laboratories

- Immunoassays

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Home-care

- Immunoassays

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Others

.webp)