U.S. Wine Market Size and Trends

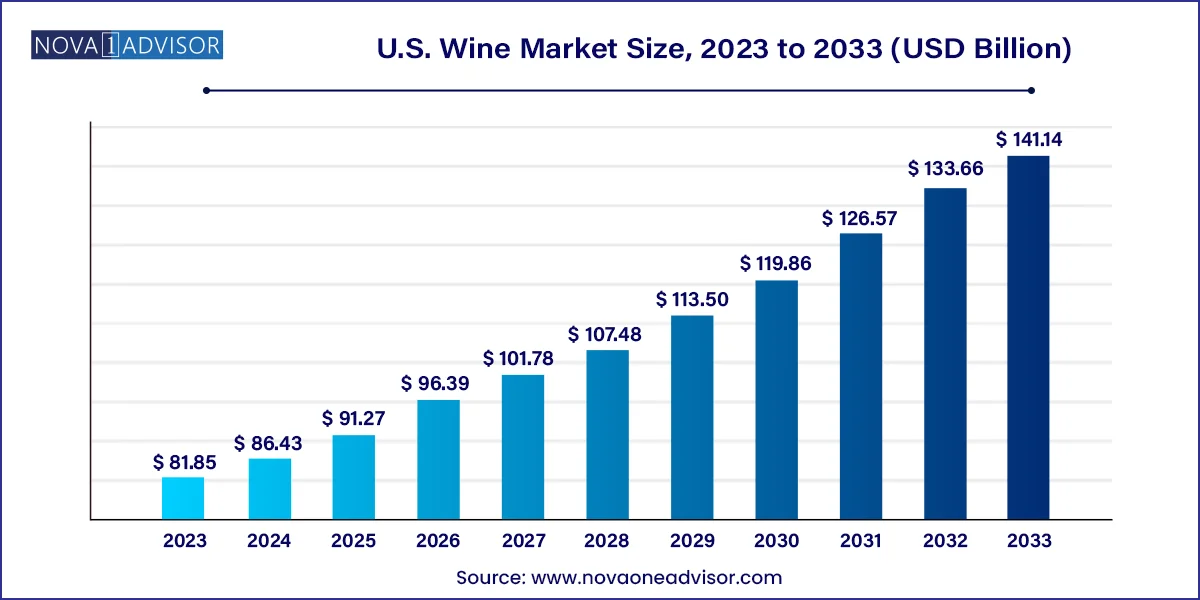

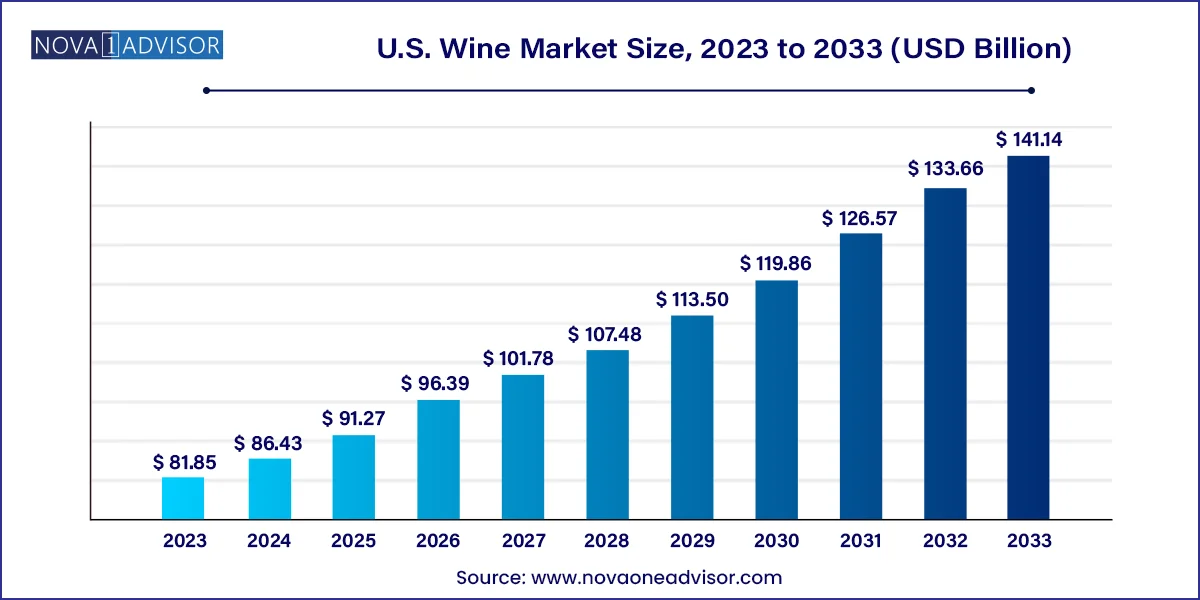

The U.S. wine market size was exhibited at USD 81.85 billion in 2023 and is projected to hit around USD 141.14 billion by 2033, growing at a CAGR of 6.5% during the forecast period 2024 to 2033.

U.S. Wine Market Key Takeaways:

- Table wines led the market and accounted for the largest revenue share of 83.4% in 2023.

- The sparkling wine segment is expected to grow at a CAGR of 6.3% from 2024 to 2033.

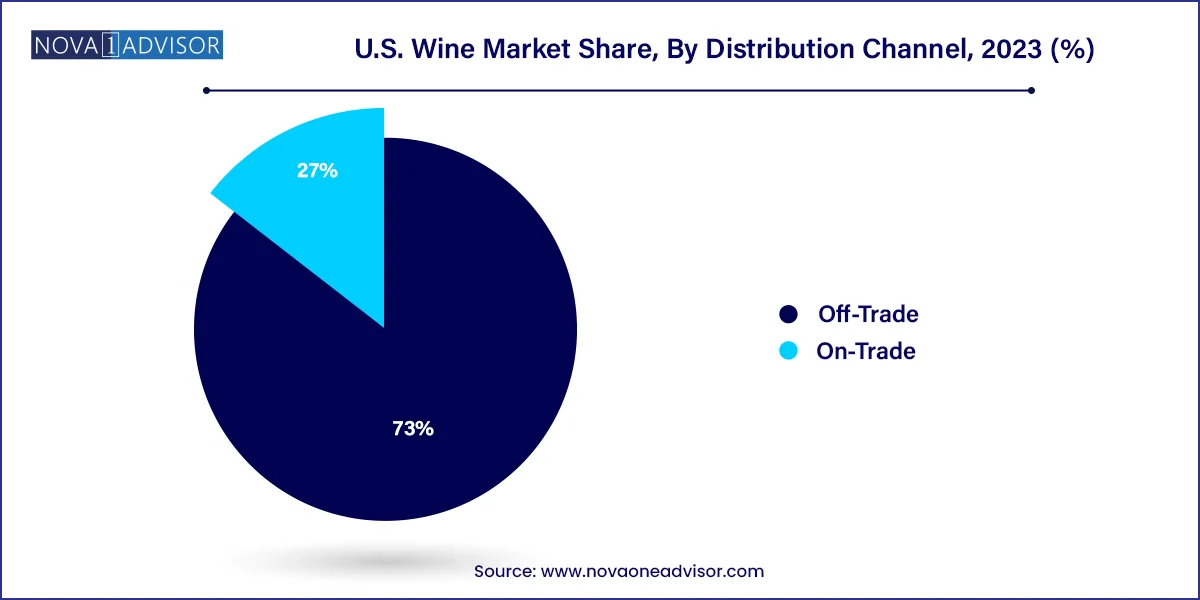

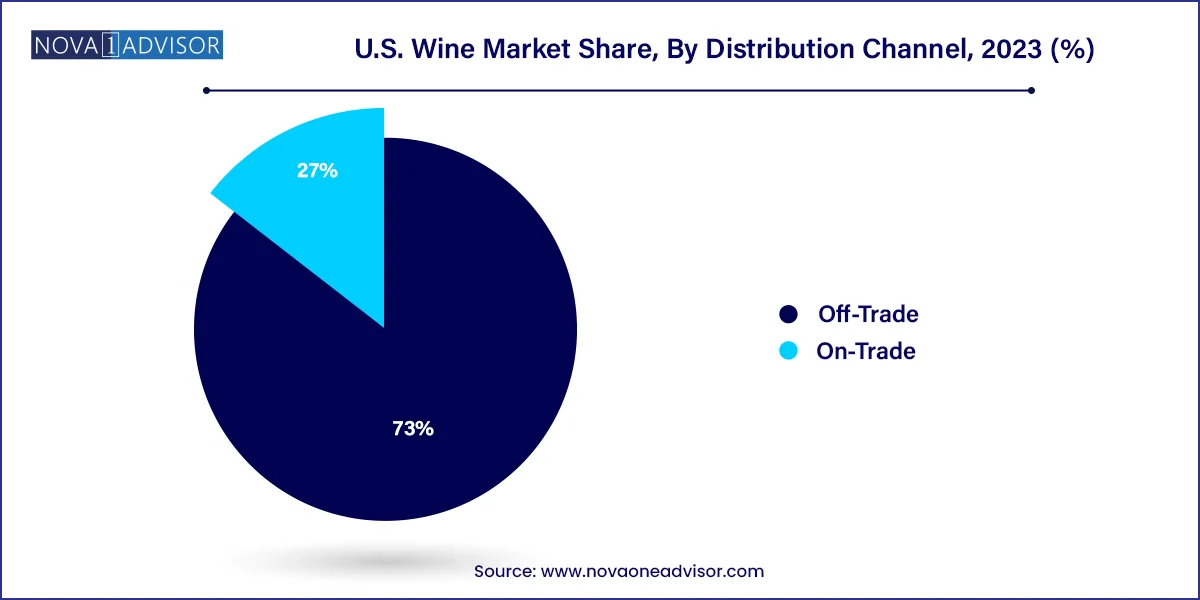

- The sales of wine through off-trade channel accounted for the largest revenue share 73.0% in 2023.

- The sales of wine through on-trade channels are expected to grow at a CAGR of 6.3% from 2024 to 2033.

Market Overview

The U.S. wine market stands as one of the most mature and dynamic alcoholic beverage industries globally. It has evolved significantly over the decades, from a predominantly domestic-focused landscape to an increasingly diverse and consumer-oriented space influenced by international trends, shifting demographics, and cultural sophistication. As of 2024, the U.S. wine market was valued at over USD 80 billion, and it is poised for steady growth through 2034 driven by evolving consumer preferences, increasing demand for premium and craft wines, and the widespread adoption of digital commerce.

Wine consumption in the U.S. has transcended traditional social occasions to become a lifestyle element among various age groups, especially millennials and Gen Z adults. This transformation is supported by increased awareness of wine varieties, regions, and pairings, often fueled by content on social media and wine education platforms. Additionally, American consumers show a growing preference for organic, biodynamic, and sustainably produced wines, indicating a broader consciousness about health and environmental impacts.

The influx of boutique wineries, the emergence of new wine-producing regions beyond California—such as Oregon and Washington—and the rapid expansion of direct-to-consumer (DTC) wine sales have opened up novel revenue streams for producers. Despite the challenges posed by supply chain disruptions and regulatory constraints, the market continues to flourish with innovation in packaging, marketing strategies, and product formulations, including low-alcohol and alcohol-free alternatives.

Major Trends in the Market

-

Rise of Premiumization: Consumers are increasingly opting for high-quality, premium wines with distinct terroirs, artisanal production, and limited-edition releases, particularly in urban and affluent markets.

-

Surge in Organic and Sustainable Wines: There is growing demand for wines produced using organic grapes, minimal intervention techniques, and sustainable practices, aligning with health-conscious consumer values.

-

Digitalization and E-Commerce Growth: Online wine sales have soared post-pandemic, with platforms offering curated selections, subscription models, and virtual tasting experiences.

-

Canned and Single-Serve Wines Gaining Momentum: Convenience and portability have driven the popularity of canned wine formats, especially among younger and outdoor-loving consumers.

-

Celebrity and Influencer Endorsements: Celebrity-backed wine brands (e.g., Snoop Dogg’s 19 Crimes collaboration) are enhancing market visibility and engagement among new demographic segments.

-

Innovations in Packaging: Apart from cans, bag-in-box wines, eco-friendly bottles, and augmented reality (AR) labels are being explored to differentiate products.

-

DTC and Subscription Services Flourish: Direct-to-consumer wine clubs and personalized subscription boxes are changing how consumers discover and purchase wines.

Report Scope of U.S. Wine Market

| Report Coverage |

Details

|

| Market Size in 2024 |

USD 86.43 Billion |

| Market Size by 2033 |

USD 141.14 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

E. & J. Gallo Winery; Constellation Brands, Inc.; The Wine Group; Trinchero Family Estates; Pernod Ricard; Deutsch Family Wine & Spirits; Accolade Wines; Castel Frères; Casella Family Brands; and Bronco Wine Company |

Key Market Driver: Premiumization of Wine Preferences

One of the most influential drivers in the U.S. wine market is the ongoing premiumization trend. As consumers become more discerning and knowledgeable about wine, they are increasingly seeking high-quality, handcrafted, and estate-bottled options that offer unique flavor profiles and origin stories. This is particularly evident among millennials and Gen Z adults, who prioritize authenticity, experience, and craftsmanship over quantity.

Premium wines not only offer sensory value but are often perceived as lifestyle choices, signaling sophistication and cultural engagement. Wineries are responding by focusing on vineyard specificity, organic viticulture, and small-batch productions. Retailers and e-commerce platforms are also adapting by curating selections that highlight boutique producers, limited-edition vintages, and sommelier-recommended picks. According to market observations, premium wines (priced over $15 per bottle) are growing at a faster rate than the overall market, indicating a shift in consumer spending behavior.

Key Market Restraint: Regulatory and Distribution Challenges

Despite promising growth, the U.S. wine market faces significant regulatory constraints, particularly around distribution. The country's three-tier distribution system—comprising producers, wholesalers, and retailers—is governed by complex state-by-state regulations, often hindering direct access to consumers and limiting market flexibility for small producers.

For instance, restrictions on interstate wine shipping and varying taxation policies create bottlenecks for wineries attempting to scale through e-commerce or DTC models. Furthermore, licensing requirements for tasting rooms and online alcohol sales are stringent and vary greatly across jurisdictions. These legal complexities increase operational costs, complicate logistics, and stifle innovation, especially for new entrants or small-scale wineries that lack the resources to navigate the legal landscape.

Key Market Opportunity: Expansion of Direct-to-Consumer Sales

The direct-to-consumer (DTC) channel represents a compelling opportunity for wineries in the U.S., enabling them to bypass intermediaries, capture higher margins, and build brand loyalty through personalized engagement. The DTC model, bolstered by digital tools and e-commerce platforms, has proven particularly effective in post-pandemic consumer behavior.

Wine clubs, virtual tastings, and AI-driven recommendation engines are enabling wineries to deepen their relationships with customers, offer tailored selections, and obtain real-time feedback. Smaller and mid-sized wineries, in particular, are leveraging social media marketing and online storefronts to enhance visibility and storytelling. This opportunity aligns well with broader digital transformation trends and the increasing willingness of consumers to discover and purchase wines online. According to Wine Institute data, DTC shipments in the U.S. reached over $4 billion in 2024, a figure projected to continue growing through 2034.

U.S. Wine Market By Product Insights

Table wines led the market and accounted for the largest revenue share of 83.4% in 2023. It appeals to a broad audience due to its affordability, versatility, and wide availability across both on-trade (restaurants, bars) and off-trade (retail, supermarkets) channels. Table wines are frequently consumed during everyday occasions, including meals, social gatherings, and personal relaxation. Popular varietals such as Cabernet Sauvignon, Chardonnay, and Pinot Noir have maintained strong consumer interest due to their familiarity and food-pairing flexibility. Additionally, domestic table wines, particularly from California’s Napa and Sonoma regions, continue to hold a strong market presence. Private-label table wines sold through supermarket chains have also captured significant market share due to competitive pricing and consistent quality.

The sparkling wine segment is expected to grow at a CAGR of 6.3% from 2024 to 2033. This growth is driven by changing consumer habits that view sparkling wines as suitable for everyday indulgence rather than just celebratory events. Brands have successfully repositioned sparkling wine for casual consumption with smaller bottle formats, low-calorie options, and attractive packaging. Notably, sparkling wine's association with brunch culture, summer events, and its Instagram-worthy appeal among millennials and Gen Z have propelled its demand. Innovations like canned sparkling wines and sparkling rosés have further broadened their reach.

U.S. Wine Market By Distribution Channel Insights

The sales of wine through off-trade channel accounted for the largest revenue share 73.0% in 2023. This dominance is attributed to the convenience, variety, and price sensitivity that these channels offer. The growth of wine e-commerce, particularly through platforms like Vivino, Drizly, and Total Wine, has expanded consumer access to diverse wine portfolios, including international selections and niche brands. Private label offerings by large retail chains such as Trader Joe’s and Costco have also played a pivotal role in off-trade sales growth, offering quality at competitive price points.

The sales of wine through on-trade channels are expected to grow at a CAGR of 6.3% from 2024 to 2033. Restaurants, bars, and tasting lounges have reopened with enhanced wine programs, including curated wine lists, food pairings, and sommelier-led experiences. Upscale dining venues are emphasizing exclusive or reserve wines, while casual dining establishments are incorporating wines on tap, wine flights, and regional offerings to attract new consumers. Additionally, the rise of wine-focused experiential venues—such as wine bars, wine and paint events, and urban wineries—has reinvigorated the on-trade segment. As consumers increasingly value in-person social experiences and curated tastings, this channel is expected to contribute significantly to market growth.

Country-Level Analysis

As the world's largest wine-consuming country by volume, the United States presents a robust and mature market characterized by regional diversity, evolving demographics, and shifting consumption patterns. California remains the cornerstone of domestic wine production, accounting for nearly 85% of U.S. output. However, emerging regions like Oregon, Washington, New York, and Texas are gaining prominence for their unique terroirs and artisanal approaches.

The U.S. consumer base is diverse, with wine preferences varying by age, geography, and lifestyle. Urban centers such as New York City, San Francisco, Chicago, and Los Angeles represent high-density consumption zones with a penchant for premium and imported wines. Meanwhile, suburban and rural areas exhibit strong demand for value-driven domestic table wines.

Demographically, millennial and Gen Z consumers are redefining the market with preferences for sustainable, story-rich brands and digital discovery methods. Meanwhile, baby boomers continue to account for significant volume due to their established wine-drinking habits and disposable income. The market is also witnessing increasing interest in alcohol-free and low-calorie wine alternatives, driven by health-conscious trends and "sober curious" movements.

Some of the prominent players in the U.S. wine market include:

- E. & J. Gallo Winery

- Constellation Brands, Inc.

- The Wine Group

- Trinchero Family Estates

- Pernod Ricard

- Deutsch Family Wine & Spirits

- Accolade Wines

- Castel Frères

- Casella Family Brands

- Bronco Wine Company

Recent Developments

-

March 2024 – E. & J. Gallo Winery announced the expansion of its premium wine portfolio with the acquisition of a boutique Napa Valley producer, further strengthening its position in the luxury wine category.

-

February 2024 – Constellation Brands revealed its collaboration with a sustainability startup to reduce carbon emissions in wine production by implementing solar-powered fermentation systems across its California vineyards.

-

January 2024 – The Duckhorn Portfolio launched a new direct-to-consumer mobile app offering curated selections, virtual sommelier support, and loyalty rewards, aiming to deepen engagement with tech-savvy consumers.

-

December 2023 – Treasury Wine Estates introduced a new line of low-alcohol wines under its 19 Crimes brand, tapping into the growing demand for mindful drinking options.

-

November 2023 – Wine.com reported a 15% YoY increase in subscription box orders during the holiday season, attributing growth to its AI-based wine pairing and recommendation engine.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. wine market

Product

- Table Wine

- Dessert Wine

- Sparkling Wine

Distribution Channel