Wound Dressings Market Size and Research

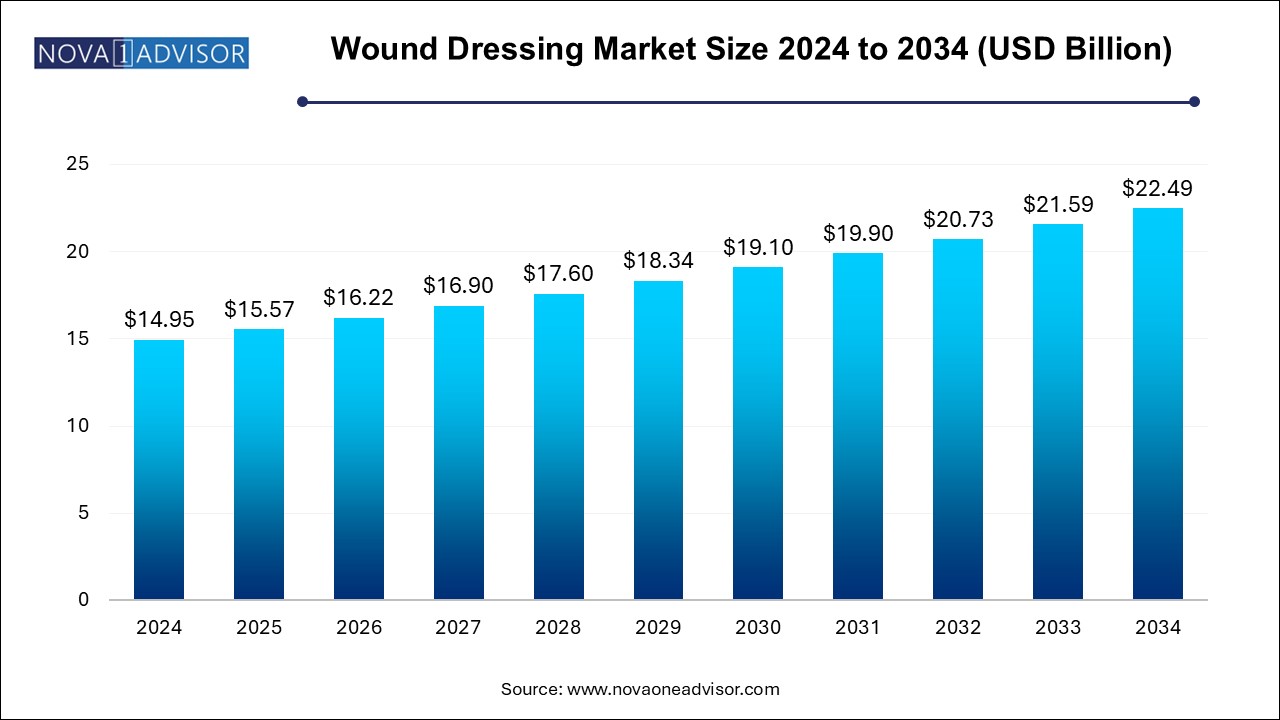

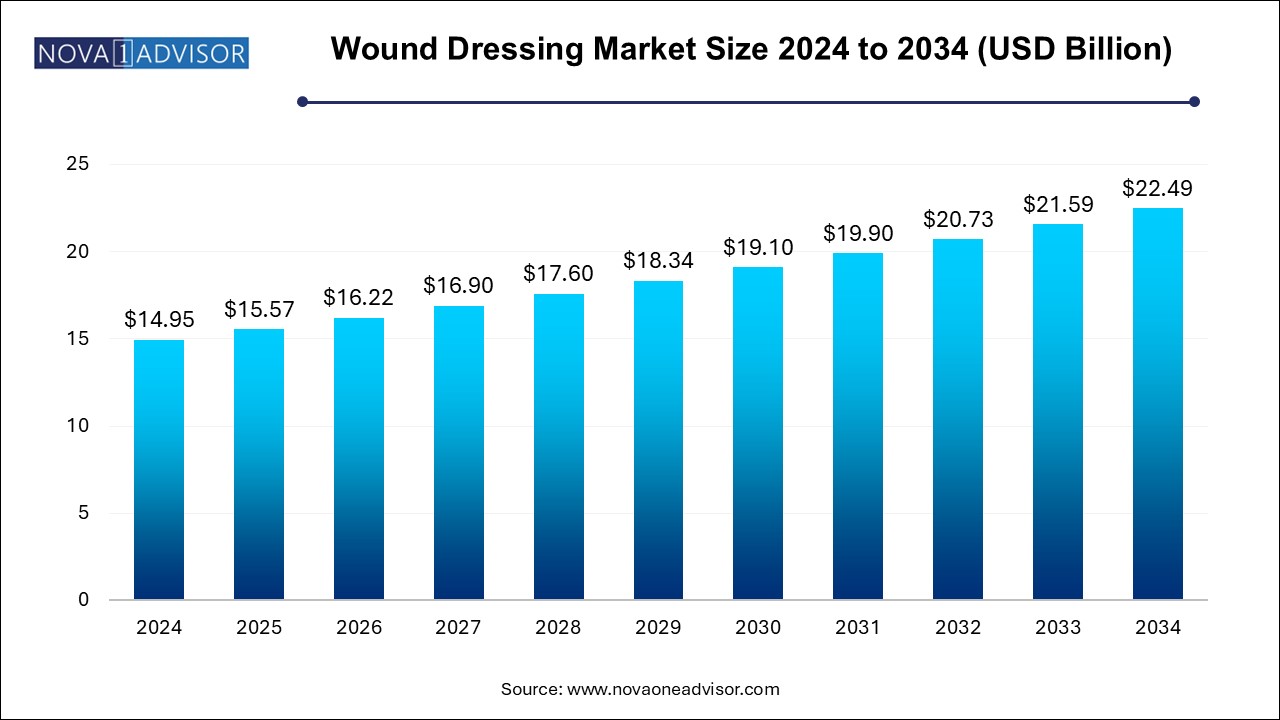

The wound dressing market size was exhibited at USD 14.95 billion in 2024 and is projected to hit around USD 22.49 billion by 2034, growing at a CAGR of 4.17% during the forecast period 2024 to 2034.

Wound Dressing Market Key Takeaways:

- Advanced dressing led the market and accounted for a revenue share of 52.7% in 2024.

- Traditional dressing is expected to witness a considerable CAGR over the forecast period.

- The chronic wounds segment dominated the market in 2024.

- The acute wounds segment is projected to witness a significant CAGR over the forecast period.

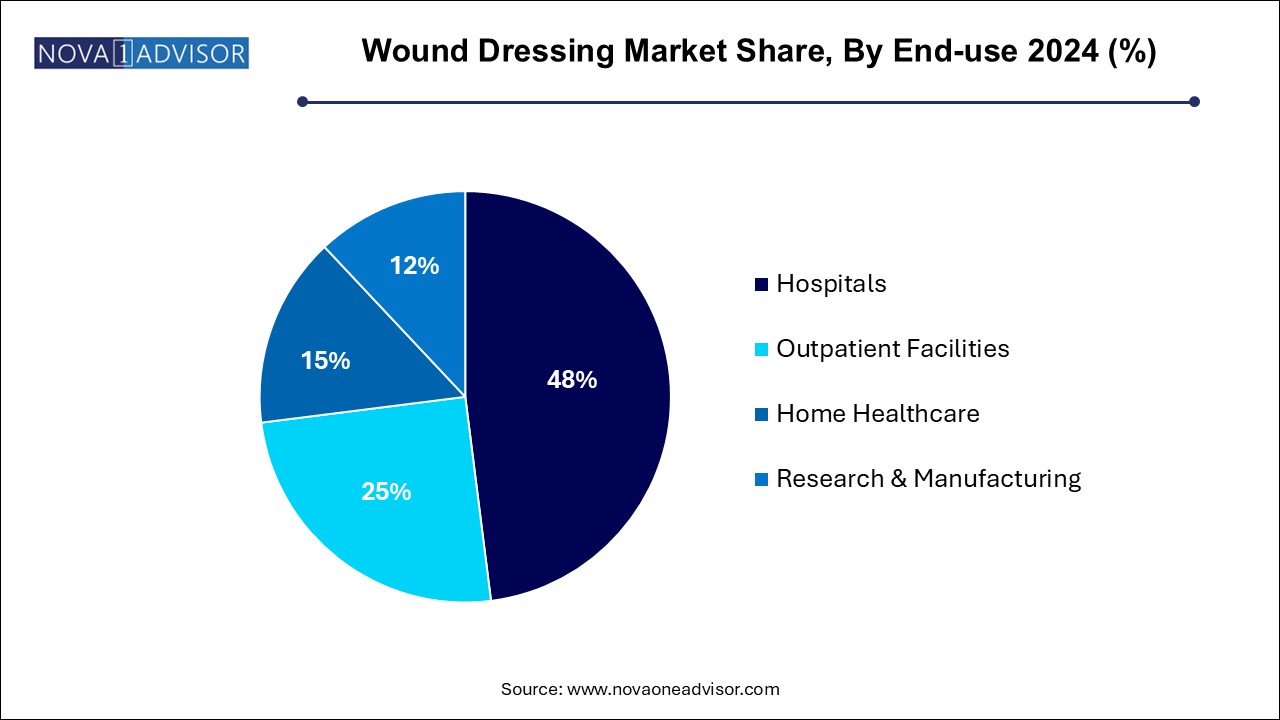

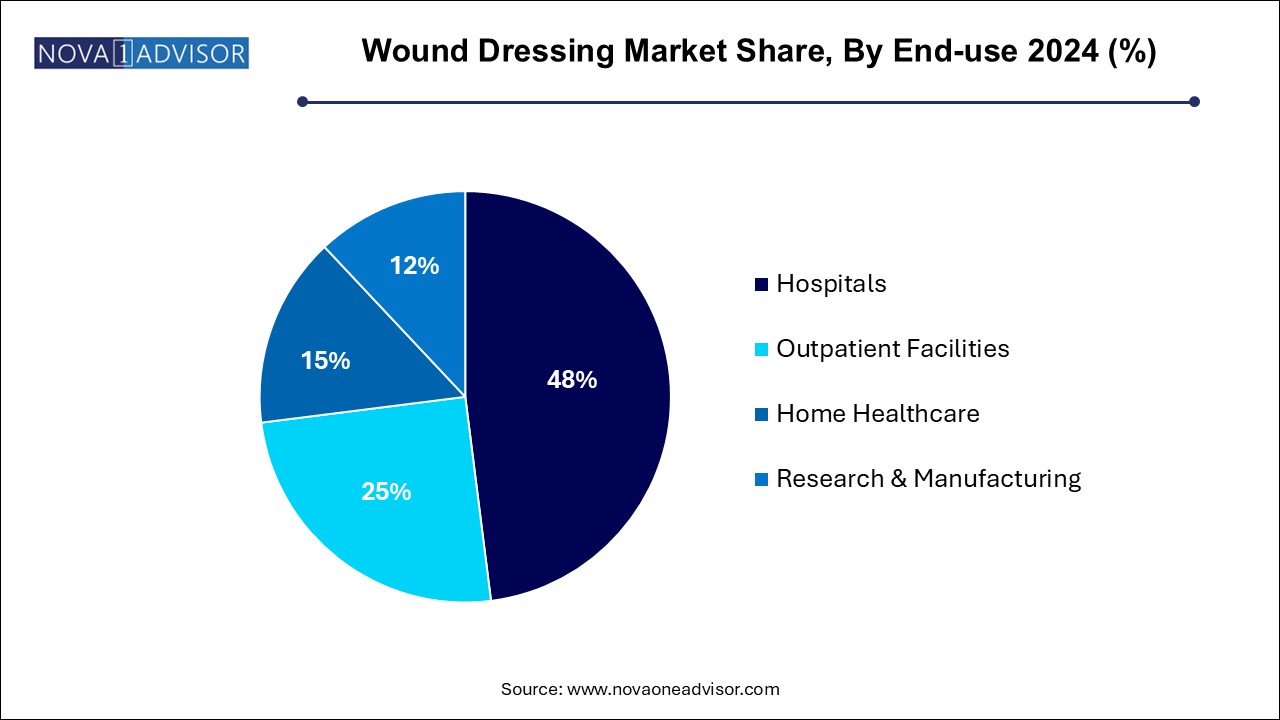

- The hospital segment dominated the market of 48.0% in 2024.

- The home healthcare segment is projected to witness the fastest CAGR during the forecast period.

- North America dominated the market with a revenue share of 45.49% in 2024.

Market Overview

The wound dressings market represents a crucial sector within the global healthcare landscape, offering essential products for the management and treatment of both chronic and acute wounds. Wound dressings, whether traditional or advanced, play a vital role in protecting wounds from infection, promoting faster healing, controlling exudate, and enhancing patient comfort.

Driven by the growing prevalence of chronic diseases such as diabetes and vascular conditions, rising surgical procedures, and increasing incidences of traumatic injuries and burns, the demand for wound dressings is experiencing steady growth worldwide. Advances in biomaterials, nanotechnology, and tissue engineering have led to the development of sophisticated dressing options that actively promote tissue regeneration and reduce healing times.

Furthermore, the rising elderly population, who are more susceptible to chronic wounds, along with increasing healthcare awareness, have contributed significantly to the expansion of the wound dressings market. With healthcare systems shifting focus toward outpatient care, home healthcare, and preventive wound management, the need for versatile, easy-to-apply, and effective wound care products has become more pronounced.

The global wound dressings market is expected to continue its robust growth trajectory, fueled by technological innovations, growing surgical volumes, and heightened investments in advanced wound care research.

Major Trends in the Market

-

Shift from Traditional to Advanced Wound Dressings: Advanced dressings offering moisture balance and infection control are gaining traction over basic gauze and cotton products.

-

Rising Demand for Antimicrobial Dressings: Increased focus on infection prevention, especially post-COVID-19, drives the adoption of antimicrobial silver-based and non-silver dressings.

-

Growth of Bioactive and Skin-substitute Dressings: Incorporation of biomaterials like collagen, hyaluronic acid, and engineered skin for regenerative healing.

-

Expansion of Home Healthcare: Growing use of user-friendly wound dressings suitable for home management of chronic wounds.

-

Introduction of Smart and Interactive Dressings: Research into dressings embedded with sensors to monitor healing progress.

-

Sustainability and Eco-friendly Innovations: Development of biodegradable, natural-fiber wound dressings addressing environmental concerns.

-

Rising Focus on Personalized Wound Care: Tailoring dressing choices based on patient comorbidities, wound type, and healing stage.

-

Increased Mergers and Acquisitions: Companies consolidating portfolios to strengthen offerings in the advanced wound care sector.

Report Scope of Wound Dressing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 15.57 Billion |

| Market Size by 2034 |

USD 22.49 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 4.17% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

3M; Coloplast Corp.; Medline Industries; Smith & Nephew; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Ethicon (Johnson & Johnson); Baxter International; Molnlycke Health Care AB |

Key Market Driver: Rising Prevalence of Chronic Wounds Globally

The most prominent driver of the wound dressings market is the rising prevalence of chronic wounds.

Chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers are increasingly common due to factors like aging populations, the global diabetes epidemic, obesity, and lifestyle-related cardiovascular diseases. According to the American Diabetes Association, approximately 15% of diabetic patients develop foot ulcers, often requiring long-term wound care management.

Chronic wounds are complex to treat, demand extended care, and are associated with high morbidity and healthcare costs. Advanced wound dressings that offer moisture balance, antimicrobial properties, and promote tissue regeneration have become indispensable tools in chronic wound management, thereby significantly driving market demand.

Key Market Restraint: High Costs Associated with Advanced Wound Dressings

Despite their clinical benefits, the high costs associated with advanced wound dressings act as a restraint to widespread adoption, particularly in developing economies.

Advanced dressings such as bioengineered skin substitutes, silver-impregnated dressings, and active dressings are significantly more expensive than traditional gauze or cotton dressings. Limited healthcare reimbursement frameworks in several countries make these products less accessible to uninsured or underinsured patients.

Cost sensitivity among patients and healthcare providers often results in continued reliance on traditional dressings despite slower healing outcomes, particularly in public healthcare settings. Manufacturers face challenges in balancing innovation with affordability to unlock the full market potential.

Key Market Opportunity: Growth of Home Healthcare and Outpatient Wound Management

An emerging opportunity lies in the growth of home healthcare and outpatient wound management sectors.

With healthcare systems emphasizing cost-efficiency, patient comfort, and minimizing hospital stays, there is a growing trend toward managing chronic wounds outside hospital settings. This shift has created strong demand for easy-to-use, self-applicable wound dressings that allow patients and caregivers to manage wounds effectively at home.

Innovations in dressing technologies that simplify application, extend wear time, and provide visual indicators of infection or healing progress are highly sought after. Companies focusing on educating patients and offering home-use wound care kits have a prime opportunity to capture significant market share in this expanding segment.

Wound Dressing Market By Product Insights

Advanced dressings dominate the product segment, surpassing traditional dressings like gauze and cotton in both revenue and clinical preference. Moist wound healing techniques using foam, hydrocolloid, alginate, hydrogel, and film dressings offer faster healing, lower infection rates, and improved patient outcomes. Foam dressings, in particular, have become standard for managing highly exuding wounds.

Active dressings are growing fastest, representing an exciting frontier in wound management. These dressings incorporate bioactive agents such as growth factors, collagen, or engineered skin substitutes, directly promoting tissue regeneration and wound closure. With increasing research investment into biomaterials and regenerative therapies, active dressings are poised to redefine advanced wound care standards.

Wound Dressing Market By Application Insights

Chronic wounds dominate the application segment, accounting for a significant share of the market due to the long-term nature and complexity of treating diabetic foot ulcers, pressure ulcers, and venous ulcers. These wounds require specialized, durable, and moisture-maintaining dressings over extended periods, driving consistent demand for advanced and antimicrobial products.

Acute wounds are growing steadily, including surgical site infections, traumatic injuries, and burn wounds. Advances in post-surgical care protocols and rising numbers of surgeries globally are increasing the demand for wound dressings that promote rapid healing, minimize scarring, and prevent infections, contributing to sustained growth in this segment.

Wound Dressing Market By End-use Insights

Hospitals dominate the end-use segment, as they manage a high volume of chronic and acute wound cases requiring professional wound care. Hospitals benefit from access to the latest dressing technologies and trained wound care specialists, ensuring optimal usage of advanced dressing products.

Home healthcare is growing fastest, reflecting the shift toward outpatient management of chronic conditions. Elderly patients, post-surgical individuals, and those with limited mobility increasingly receive wound care at home, creating demand for dressings that are easy to apply, maintain, and monitor without constant professional supervision.

Wound Dressing Market Regional Insights

North America holds the largest share of the global wound dressings market, driven by a highly developed healthcare infrastructure, high prevalence of chronic wounds, and strong reimbursement policies.

The United States accounts for the majority of the regional revenue, supported by a large diabetic population, rising surgical procedures, and extensive use of advanced wound care technologies. Major players headquartered in the region, combined with a strong focus on research and innovation, further consolidate North America's dominance.

In addition, government programs emphasizing wound care quality improvement and hospital initiatives to reduce hospital-acquired pressure injuries (HAPIs) bolster demand for advanced dressings in the region.

Asia-Pacific is the fastest-growing region, reflecting rapid healthcare expansion, growing awareness about wound management, and rising chronic disease prevalence.

Countries like China, India, Japan, and Australia are witnessing an increase in diabetes, obesity, surgical volumes, and trauma cases, necessitating efficient wound care solutions. Improvements in healthcare access, rising disposable incomes, and increasing investments by multinational wound care companies in the region fuel market growth.

Moreover, government initiatives promoting wound care education and the expansion of private healthcare providers are accelerating Asia-Pacific’s rise as a major contributor to global wound dressings market growth.

Some of the prominent players in the wound dressing market include:

- Smith+Nephew

- Mölnlycke Health Care AB

- Convatec Group PLC

- Ethicon (Johnson & Johnson)

- Coloplast Corp.

- URGO

- Coloplast Corp.

- 3M

- Integra LifeSciences

- PAUL HARTMANN AG

- DR.AUSBÜTTEL (DRACO)

- Integra LifeSciences

- Medline Industries, Inc.

- Brightwake Ltd..

Wound Dressing Market Recent Developments

-

March 2025: Smith & Nephew announced the launch of its next-generation PICO Single Use Negative Pressure Wound Therapy System, designed to enhance wound healing rates for surgical incisions.

-

February 2025: Mölnlycke Health Care AB unveiled its new Mepilex Border Flex Dressing, featuring smart exudate management and extended wear time.

-

January 2025: 3M Health Care introduced the Tegaderm Advanced Transparent Film Dressing with unique moisture vapor transmission technology, improving post-surgical wound protection.

-

December 2024: ConvaTec Group PLC launched the Avelle Negative Pressure Wound Therapy System in Asia, expanding its advanced wound care footprint.

-

November 2024: Coloplast A/S announced plans to develop biodegradable wound dressings as part of its commitment to sustainability and innovation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the wound dressing market

By Product

-

- Gauze

- Tape

- Bandages

- Cotton

- Others

-

-

- Foam Dressing

- Hydrocolloid Dressing

- Film Dressing

- Alginate Dressing

- Hydrogel Dressing

- Collagen Dressing

- Other Advanced Dressing

-

-

- Silver Dressing

- Non-silver Dressing

-

-

- Biomaterials

- Skin-substitute

By Application

-

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

- Acute Wounds

-

- Surgical & Traumatic Wounds

- Burns

By End-use

- Hospitals

- Outpatient Facilities

- Home Healthcare

- Research & Manufacturing

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)