AI In Revenue Cycle Management Market Size and Trends

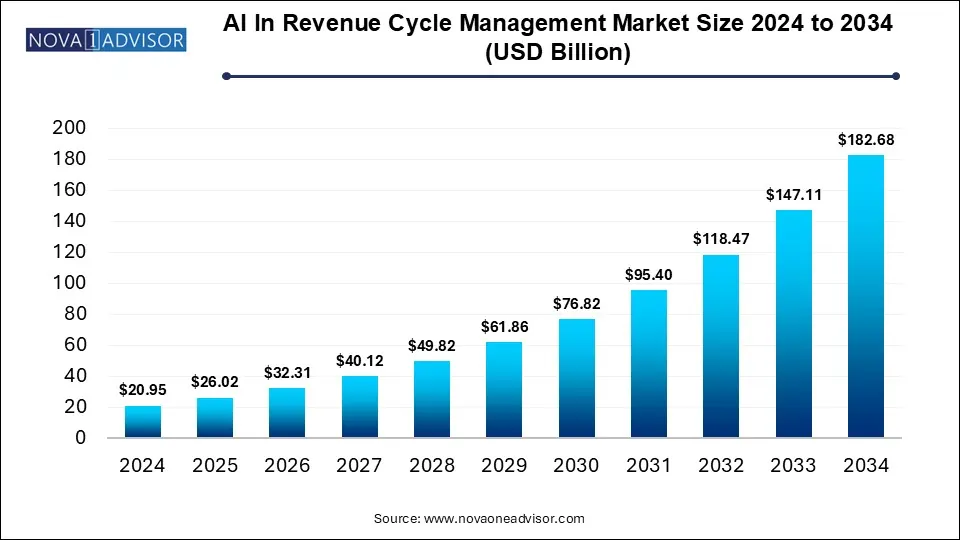

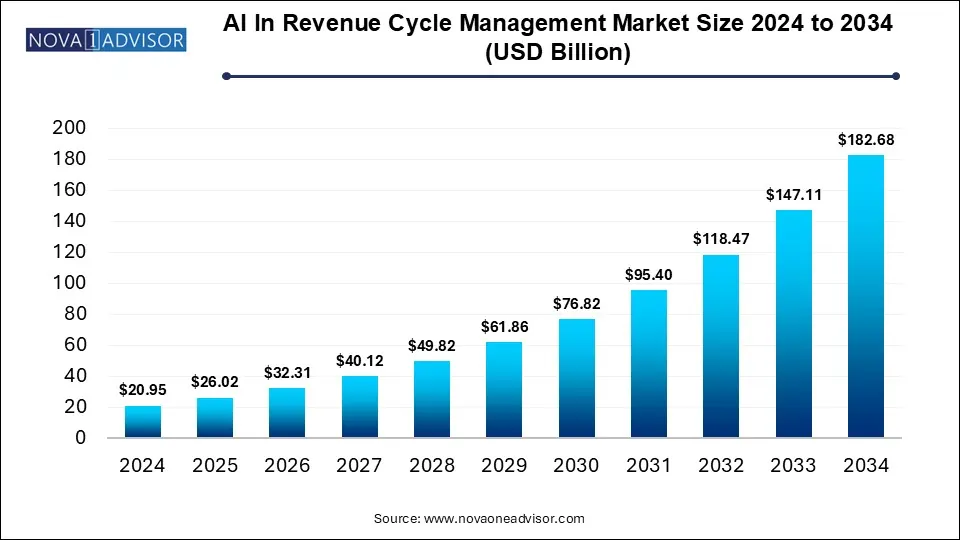

The AI in revenue cycle management market size was exhibited at USD 20.95 billion in 2024 and is projected to hit around USD 182.68 billion by 2034, growing at a CAGR of 24.18% during the forecast period 2025 to 2034.

Key Takeaways:

-

In 2024, the services segment led the market, contributing more than 68% of the total revenue.

-

The integrated category emerged as the market leader in 2024, generating over 71% of the overall revenue.

-

Claims management stood out as the top-performing segment in 2024, delivering the highest share of market revenue.

-

Web-based solutions held the dominant position in 2024, accounting for over 53% of the total market income.

-

The physician back-office segment captured the highest share of market revenue in 2024, exceeding 38%.

-

North America took the lead in the global AI in revenue cycle management market in 2024, with a revenue contribution surpassing 56%.

Market Overview

The integration of artificial intelligence (AI) into revenue cycle management (RCM) is transforming how healthcare providers manage financial operations. Traditionally burdened with manual processes, high error rates, and delayed reimbursements, RCM is now undergoing a digital overhaul thanks to AI technologies like natural language processing (NLP), machine learning (ML), and robotic process automation (RPA). The AI in RCM market addresses the end-to-end lifecycle of financial transactions, including patient registration, coding, billing, claims processing, and payment reconciliation.

Globally, the increasing complexity of healthcare payment systems and pressure to reduce administrative overheads have accelerated the adoption of AI-based solutions. AI's ability to detect claim errors, automate repetitive workflows, forecast revenue cycles, and enhance compliance with changing regulations makes it indispensable. Hospitals, diagnostic labs, and physician practices are now leveraging AI-powered platforms to increase collections, reduce denials, and improve operational efficiency.

As the healthcare ecosystem becomes more data-centric, AI tools are also being embedded into broader hospital information systems (HIS), enhancing interoperability and real-time financial analytics. The AI in RCM market is poised for exponential growth between 2025 and 2030, especially as payers and providers alike pursue digital transformation initiatives to mitigate revenue leakage and boost patient experience.

Major Trends in the Market

-

Rising adoption of AI-based predictive analytics for revenue forecasting

-

Increasing use of machine learning in claims denial management

-

Growing shift toward cloud-based AI RCM platforms

-

Integration of AI-powered chatbots in patient billing and engagement

-

Utilization of NLP for automating medical coding and documentation

-

Surge in partnerships between AI vendors and EHR/RCM platforms

-

Deployment of robotic process automation (RPA) in billing and remittance

-

Expansion of AI RCM tools to outpatient and home healthcare services

Report Scope of AI In Revenue Cycle Management Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 26.02 Billion |

| Market Size by 2034 |

USD 182.68 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 24.18% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Type, Application, Delivery Mode, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Athenahealth, Inc.; Experian Information Solutions, Inc.; R1 RCM, Inc.; McKesson Corporation; CareCloud Corporation; Oracle (Cerner Corporation); eClinicalWorks; Infinx; Care.fi; VisiQuate; IntelligentDX; Thoughtful AI; Adonis; Zentist; Maverick Medical AI Ltd. |

Market Driver: Increasing Healthcare Administrative Burden

One of the most compelling drivers of the AI in revenue cycle management market is the escalating burden of administrative tasks in healthcare. In the U.S. alone, administrative costs account for nearly 25% of total healthcare expenditures, with revenue cycle processes such as claims processing, medical billing, and compliance accounting for a significant portion.

AI directly addresses these pain points by automating labor-intensive workflows, identifying coding errors, detecting fraud, and improving first-pass claim acceptance rates. For instance, large hospital networks using AI-driven coding tools like 3M’s CodeFinder have reduced documentation errors and cut down reimbursement cycles by several days. By reducing human errors and automating follow-ups with payers, providers not only improve operational efficiency but also reduce days in accounts receivable (AR), directly impacting cash flow.

Furthermore, AI's predictive analytics capabilities allow providers to proactively manage denials by analyzing past patterns, offering intelligent suggestions for documentation improvement before claims are submitted. These innovations help providers navigate complex insurance environments with greater agility and financial sustainability.

Market Restraint: Data Privacy and Integration Challenges

Despite its immense potential, the implementation of AI in RCM is hindered by significant data privacy concerns and integration complexities. Healthcare data is highly sensitive and protected by strict regulations like HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR in Europe. Integrating AI systems across fragmented electronic health records (EHRs) and legacy billing systems without compromising security remains a key challenge.

For example, a multi-site hospital adopting AI billing software may encounter issues with data interoperability, especially when systems from different vendors are used in different departments. Data silos can obstruct seamless information flow, reducing the accuracy and efficiency of AI tools. Additionally, AI algorithms require large volumes of clean and structured data to function optimally. In many cases, poor data quality or missing fields can reduce the model’s effectiveness, leading to incorrect predictions or billing errors.

Security breaches or compliance lapses due to AI misconfigurations can result in legal liabilities and loss of patient trust. Hence, the deployment of AI in RCM must be done cautiously with end-to-end encryption, audit trails, and robust IT governance frameworks.

Market Opportunity: AI for Value-Based Reimbursement Models

The global transition from volume-based care to value-based care presents a lucrative opportunity for AI in RCM. In value-based reimbursement models, providers are rewarded based on patient outcomes rather than services rendered. This requires real-time tracking of clinical outcomes, financial KPIs, and compliance metrics—all areas where AI excels.

AI can help providers measure performance across diverse quality indicators, stratify patient risks, and predict cost-to-outcome ratios with high accuracy. For instance, financial analytics modules powered by AI can highlight patients likely to miss payments, identify revenue loss patterns across departments, and recommend corrective actions. This supports smarter contract negotiations with payers and improved budgeting decisions.

In value-based environments, proactive care coordination is essential, and AI can automate outreach, reminders, and eligibility verification, improving both clinical and financial outcomes. As more countries adopt bundled payments and accountable care organization (ACO) models, the demand for AI in RCM will rise sharply.

Segmental Analysis

Product Outlook

Software segment dominated the market and is expected to maintain its lead through 2030 due to its flexibility, scalability, and integration capabilities.

Software solutions form the backbone of AI-driven revenue cycle management by providing tools for coding, billing, claims adjudication, analytics, and payment processing. These platforms often integrate with EHR systems and payer databases, facilitating end-to-end revenue tracking. AI-powered platforms like Olive, Change Healthcare, and OptumInsight are widely used to automate tasks that would otherwise require extensive manpower. Cloud-based delivery models further enhance accessibility, allowing providers to monitor and optimize revenue cycles in real-time.

The services segment is witnessing the fastest growth owing to the demand for managed RCM services and consulting.

Many small and mid-sized providers lack the internal resources or technical skills to manage complex AI systems. Hence, they turn to third-party vendors for implementation, training, and ongoing system management. AI-driven RCM services now include real-time billing audits, denial management, regulatory compliance consulting, and custom reporting solutions. The growth of BPO firms specializing in AI-enhanced RCM has accelerated this trend, especially in Europe and Asia Pacific.

Type Outlook

Integrated AI solutions dominated the market due to their comprehensive functionality and interoperability.

Integrated platforms offer a seamless suite of RCM capabilities—ranging from coding and claims submission to remittance processing and analytics—under a single umbrella. They eliminate the need for multiple vendors and reduce friction between different departments. These platforms are particularly favored by large healthcare systems and hospitals with complex workflows and compliance requirements.

Standalone AI solutions are gaining momentum, especially among smaller providers seeking modular upgrades.

Standalone solutions cater to specific RCM functions such as coding, denial analysis, or patient payment portals. These are ideal for physician back offices and diagnostic labs that want to enhance specific components without replacing their entire RCM system. Startups offering plug-and-play AI tools have found strong uptake among niche segments, especially in emerging markets.

Application Outlook

Claims management emerged as the leading application segment in 2024 and continues to dominate due to the high volume of claims and associated administrative load.

AI in claims management helps detect errors, automate form population, track claim statuses, and predict denials before submission. This improves clean claim rates and accelerates reimbursement timelines. For example, R1 RCM’s AI tool automatically flags claims with incomplete information and suggests corrections, reducing denials by over 30%.

Financial analytics and KPI monitoring is the fastest growing application area.

Providers are increasingly leveraging AI to gain actionable insights into revenue flow, AR days, collection rates, and payer performance. Real-time dashboards supported by ML algorithms provide CFOs and billing managers with strategic visibility into financial performance. As healthcare shifts toward transparency and outcome-based care, the demand for intelligent analytics is surging.

Delivery Mode Outlook

Cloud-based delivery mode dominated the market in 2024 and continues to lead due to its scalability and ease of deployment.

Cloud-based AI RCM solutions offer several benefits including lower upfront costs, remote access, automatic updates, and seamless integration with other cloud systems. Vendors like Oracle Cerner, Epic Systems, and Athenahealth provide cloud-native RCM modules powered by AI. These solutions are particularly beneficial for multi-site operations and geographically dispersed networks.

Web-based systems are growing rapidly due to their suitability for smaller practices and ease of customization.

Web-based solutions are a lighter alternative to cloud systems, offering browser-based access without complex deployment. They are ideal for diagnostic labs and physician offices that need functional yet cost-effective solutions. Many web-based RCM platforms now come with AI plugins that automate reminders, detect underbilling, and provide revenue projections.

End Use Outlook

Hospitals remained the largest end-use segment due to their complex workflows and high patient throughput.

Hospitals face immense billing complexity due to the volume and diversity of procedures, departments, and insurance plans. AI helps streamline end-to-end RCM in hospital networks by optimizing coding, improving charge capture accuracy, and reducing denial rates. Many tertiary care hospitals in the U.S., Germany, and Japan have adopted AI tools to reduce their days in AR and enhance profitability.

Diagnostic laboratories represent the fastest growing end-use segment.

With rising demand for outpatient testing and rapid diagnostics, labs are processing large volumes of transactions that require accurate and timely billing. AI in RCM helps labs by validating payer eligibility, coding pathology reports, and automating invoicing. The integration of AI into lab management software is accelerating adoption, especially in private diagnostic chains.

Regional Analysis

North America dominated the global AI in RCM market in 2024 and is expected to maintain its lead through 2030.

The U.S. accounts for the largest share, owing to its complex multi-payer reimbursement environment, high healthcare spending, and early AI adoption. Key players like Change Healthcare, Optum, and Olive AI are based in North America and have partnered with leading health systems to deploy AI across the revenue cycle. Additionally, strong regulatory incentives for digital health transformation and interoperability are accelerating growth in this region.

Asia Pacific is the fastest growing region, driven by healthcare digitization and expanding insurance coverage.

Countries like India, China, and South Korea are witnessing a boom in healthcare infrastructure and health IT investments. National health insurance schemes and a growing middle class are increasing patient volumes, necessitating efficient RCM tools. Local startups are offering AI-enhanced billing platforms tailored to regional compliance standards, contributing to rapid growth.

Some of The Prominent Players in The AI in revenue cycle management market Include:

- athenahealth, Inc.

- Experian Information Solutions, Inc.

- R1 RCM, Inc.

- McKesson Corporation

- CareCloud Corporation

- Oracle (Cerner Corporation)

- eClinicalWorks

- Infinx

- Care.fi

- VisiQuate

- IntelligentDX

- Thoughtful AI

- Adonis

- Zentist

- Maverick Medical AI Ltd.

Recent Developments

-

February 2025: Change Healthcare launched its AI-powered “Claim Intelligence Suite” to automate prior authorization and predict denials in real time.

-

December 2024: Olive AI partnered with Cleveland Clinic to deploy end-to-end RCM automation, including financial analytics and patient engagement modules.

-

October 2024: Cerner, now part of Oracle, integrated new AI features into its RevElate RCM platform, including payer rule updates and denial prediction models.

-

August 2024: R1 RCM acquired CloudMed to expand its AI-driven analytics capabilities and consolidate its position in the U.S. provider billing space.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

By Type

By Application

- Medical Coding and Charge Capture

- Claims Management

- Payment Posting & Remittance

- Financial Analytics & KPI Monitoring

- Others

By Delivery Mode

- Web-based

- Cloud-based

- On-premise

By End Use

- Physician Back Offices

- Hospitals

- Diagnostic Laboratories

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)