Biopharmaceutical CDMO Market Size, Share, Growth, Report 2025 to 2034

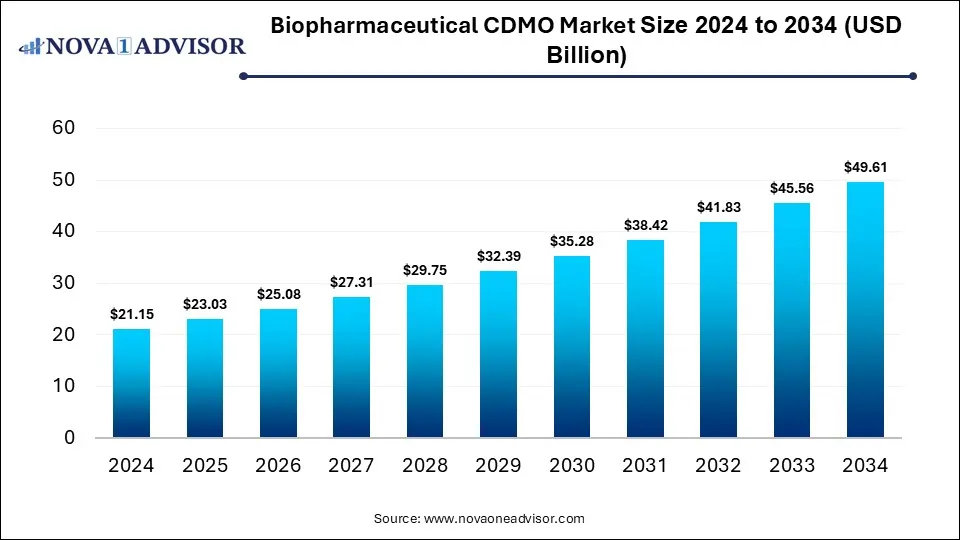

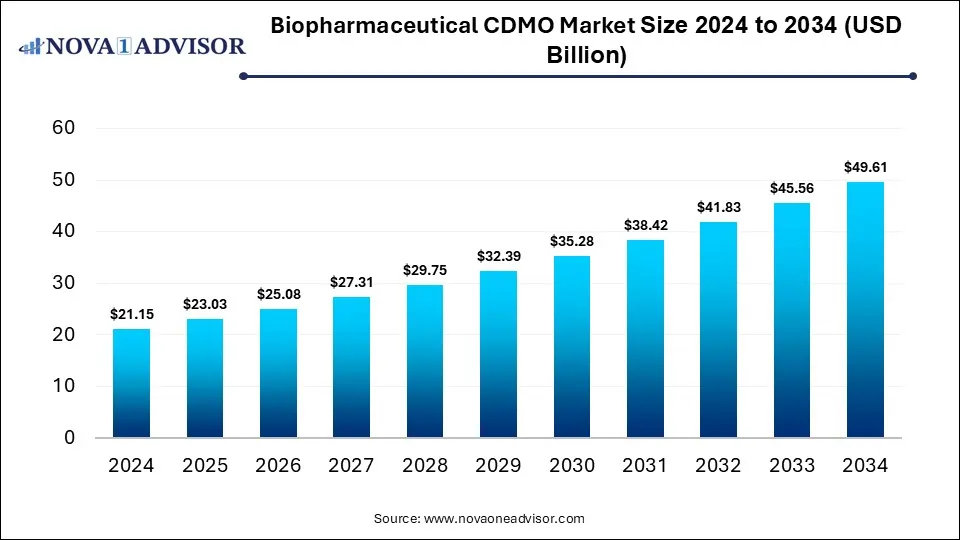

The global biopharmaceutical CDMO market was valued at USD 21.15 billion in 2024 and is projected to hit around USD 49.61 billion by 2034, expanding at a CAGR of 8.9% during the forecast period of 2025 to 2034. The growth of the market is driven by rising biologics demand and the need for cost-effective, scalable manufacturing solutions.

Biopharmaceutical CDMO Market Key Takeaways

- By region, North America dominated the largest share of the biopharmaceutical CDMO market in 2024.

- By region, Asia Pacific is expected to witness the fastest growth between 2025 and 2034.

- By service type, the manufacturing services segment dominated the market in 2024.

- By service type, the development services segment is expected to grow at a significant rate in the coming years.

- By product type, the biologics segment led the market in 2024.

- By product type, the advanced therapies segment is expected to expand at the fastest CAGR during the projection period.

- By production type, the mammalian cell culture segment held a major share of the market in 2024.

- By production type, the microbial fermentation segment is expected to expand at the highest CAGR over the forecast period.

- By therapeutic area, the oncology segment dominated the market in 2024.

- By therapeutic area, the rare and orphan diseases segment is likely to grow at a significant rate in the upcoming period.

- By end-user, the pharmaceutical companies segment contributed the largest market share in 2024.

- By end-user, the biotechnology firms segment is likely to register the fastest CAGR throughout the forecast period.

How is AI Impacting the Biopharmaceutical CDMO Market?

AI is transforming the biopharmaceutical CDMO market by enhancing drug development efficiency and reducing time-to-market through advanced data analytics and predictive modeling. It enables more precise process optimization, quality control, and automation, leading to higher yield and lower costs. AI-powered tools also improve supply chain management and patient stratification in clinical trials, supporting faster and more reliable outcomes. Overall, AI adoption helps CDMOs deliver more innovative and personalized therapies while meeting stringent regulatory requirements.

How Does the Integration of the Internet of Medical Things (IoMT) Impact the Biopharmaceutical CDMO Market?

The integration of the Internet of Medical Things (IoMT) is gradually reshaping the market by enabling smarter, more connected, and data-driven manufacturing and delivery ecosystems. Here’s how IoMT is having an impact:

1. Smarter Drug Delivery Systems

- IoMT enables the development of connected drug-device combinations (e.g., smart inhalers, wearable injectors, connected auto-injectors).

- CDMOs are increasingly partnering with med-tech firms to manufacture these combination products, requiring new capabilities in electronics integration, micro-assembly, and digital compliance.

2. Cold Chain Monitoring & Supply Chain Optimization

- For temperature-sensitive biologics, IoMT enables real-time monitoring of conditions (temperature, humidity, location) during storage and transit.

- CDMOs can leverage this data to improve compliance, reduce spoilage, and ensure product integrity, especially for advanced therapies like mRNA and cell therapies.

3. Improved Traceability and Compliance

- IoMT devices generate large volumes of real-time operational data, which can be used to enhance traceability, enable batch-level tracking, and ensure regulatory compliance (e.g., FDA 21 CFR Part 11).

- CDMOs using IoMT-enabled systems can provide end-to-end transparency for clients and regulators.

4. Patient-Centric Manufacturing

- With connected devices providing real-world patient data (adherence, response, side effects), CDMOs can co-develop personalized medicines or reformulate based on usage patterns.

- This feeds into the trend of precision medicine, where real-time data helps optimize manufacturing to meet specific patient needs.

5. New Business Models & Value-Added Services

- CDMOs can evolve from just manufacturing partners to digital health enablers, offering services like data analytics, device integration, and IoMT platform support.

- This opens up new revenue streams and creates longer-term strategic partnerships with pharma and biotech companies.

Market Overview

The biopharmaceutical CDMO market involves outsourced services for the development and manufacturing of biologic drugs, including monoclonal antibodies, vaccines, and gene therapies. CDMOs offer advantages such as specialized expertise, advanced technology, and scalable production, enabling faster development and cost-effective manufacturing across various therapeutic areas. The market is experiencing significant growth due to the increasing demand for biologics, rising R&D outsourcing by pharma and biotech companies, and advancements in personalized medicine and cell and gene therapies. Additionally, rising alliance between stakeholders is fostering collaboration that accelerates innovation and streamlines drug development processes. By combining expertise, resources, and technologies, these alliances enhance manufacturing capabilities, reduce costs, and improve time-to-market, ultimately driving market growth and competitiveness.

- In June 2025, Zydus Lifesciences Ltd. announced a plan to enter the global biologics CDMO market by acquiring Agenus Inc.’s two biologics manufacturing facilities in California for $75 million upfront, plus $50 million contingent payments. This strategic acquisition provides Zydus with advanced manufacturing capabilities, a key presence in a biotech hub, and expands its global footprint, positioning the company as a comprehensive biologics service provider from development to manufacturing.

What are the Major Trends in the Biopharmaceutical CDMO Market?

- Shift Toward Single-Use Bioprocessing Technologies: CDMOs are widely adopting single-use systems due to their lower contamination risk, faster turnaround, and cost efficiency, especially in small-scale and multi-product facilities.

- Integration of AI and Digital Technologies: Artificial intelligence, machine learning, and digital twins are being used to optimize bioprocessing, predict outcomes, enhance quality control, and streamline supply chains, boosting efficiency and decision-making.

- Growing Preference for End-to-End CDMO Services: Pharma and biotech firms increasingly prefer CDMOs that offer integrated services, from drug development and clinical trials to commercial-scale manufacturing, to simplify vendor management and accelerate timelines.

- Global Expansion and Regional Manufacturing Hubs: CDMOs are expanding into emerging markets such as Asia-Pacific and Latin America, driven by lower operating costs, local regulatory reforms, and growing biopharma activity in these regions.

- Focus on Sustainable and Green Manufacturing Practices: Environmental concerns and regulatory pressures are pushing CDMOs to adopt greener technologies, reduce energy usage, and implement waste management practices, aligning with ESG goals of global pharma companies.

Report Scope of Biopharmaceutical CDMO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 23.03 Billion |

| Market Size by 2034 |

USD 49.61 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service Type, By Product Type, By Production Type, By Therapeutic Area, By End-User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Markt Dynamics

Drivers

Rising Demand for Biologics and Complex Therapies

The rising demand for biologics and complex therapies, such as monoclonal antibodies and gene therapies, is a major factor driving the growth of the biopharmaceutical CDMO market. These advanced treatments require specialized manufacturing capabilities, stringent quality controls, and high regulatory compliance capabilities that many pharma and biotech companies increasingly outsource to experienced CDMOs. As biologics pipelines expand, particularly in oncology, immunology, and rare diseases, the need for scalable and flexible production solutions grows. Therefore, CDMOs with expertise in large molecule production, cell and gene therapy processes, and aseptic fill-finish services are making efforts to expand their CDMO services globally, making them essential partners in biologics development.

- In November 2024, FUJIFILM Biotechnologies, a world-leading CDMO for biologics, vaccines, and advanced therapies, completed the first phase of its Hillerød site expansion, adding six 20,000L mammalian cell bioreactors and doubling total capacity to 12. The next phase will add eight more bioreactors and two downstream processing streams, with fill/finish production starting by mid-2025 and full expansion expected by 2026, expanding the site to 51,500 m².

Increasing Outsourcing by Pharma and Biotech Companies

Increasing outsourcing by pharma and biotech companies is another major factor driving the market growth. Faced with rising R&D costs, complex biologic pipelines, and the need for speed-to-market, many companies are turning to CDMOs to access specialized expertise, advanced technologies, and scalable manufacturing without heavy upfront investments. This trend allows companies to focus on core competencies like drug discovery and commercialization while relying on CDMOs for development, clinical trial production, and commercial-scale manufacturing. Additionally, smaller biotech firms with limited in-house infrastructure depend heavily on CDMOs to bring their therapies to market. As a result, demand for flexible, end-to-end CDMO partnerships continues to grow across the industry.

Increasing Demand for Contract Fill-Finish and Formulation Services

The increasing demand for contract fill-finish and formulation services is significantly driving the growth of the market. As more biologic therapies reach late-stage development and commercialization, the need for specialized, sterile, and high-throughput fill-finish capabilities has surged. Many pharma and biotech companies lack the in-house infrastructure and expertise to handle complex biologic formulations, especially for injectable and temperature-sensitive products. CDMOs with advanced fill-finish technologies and compliance with stringent regulatory standards are becoming essential partners in ensuring product safety, stability, and scalability. This rising outsourcing trend is boosting investments in fill-finish capacity and innovation, further expanding the market.

Restraints

High Capital Investment and Operational Costs

High capital investment and operational costs are significant restraints on the growth of the biopharmaceutical CDMO market. Establishing and maintaining GMP-compliant facilities, acquiring advanced bioprocessing equipment, and ensuring regulatory adherence require substantial financial resources. These high upfront and ongoing expenses can limit the entry of new players and restrict the expansion plans of smaller CDMOs. Additionally, the need for highly skilled personnel and rigorous quality control systems further increases operational costs. This financial burden can slow innovation, reduce competitiveness, and hinder the ability of CDMOs to scale quickly in response to growing demand.

Supply Chain Disruptions and Stringent Regulatory Requirements

Supply chain disruptions and stringent regulatory requirements are also restraining the growth of the market. Global shortages of raw materials, specialized reagents, and single-use components can delay manufacturing timelines and increase costs, especially for complex biologics and personalized therapies. At the same time, CDMOs must navigate strict regulatory standards across multiple jurisdictions, which demand extensive documentation, validation, and compliance procedures. These challenges can slow down production, increase the risk of regulatory delays, and limit the flexibility needed to adapt quickly to client needs. Together, these factors create operational bottlenecks and elevate the risks associated with scaling biopharmaceutical manufacturing.

Opportunities

Expansion into Emerging Regions

Expansion into emerging regions presents significant opportunities for the biopharmaceutical CDMO market, as these regions are experiencing rapid growth in their biopharma industries and implementing more favorable regulatory reforms. Countries in Asia-Pacific, Latin America, and parts of the Middle East are investing heavily in healthcare infrastructure, R&D capabilities, and biotechnology, creating demand for outsourced development and manufacturing services. CDMOs entering these markets can benefit from lower operational costs, access to untapped talent pools, and increasing partnerships with local pharma companies. Additionally, streamlined regulatory processes and government incentives are making it easier for CDMOs to establish facilities and operate efficiently. This regional expansion enables CDMOs to diversify their global footprint and capture new growth opportunities in high-potential markets.

Technological Advancements and Development of Novel Solutions

Technological advancements in bioprocessing, automation, and data analytics are creating significant opportunities in the market by improving production efficiency, consistency, and scalability. Innovations such as continuous manufacturing, single-use bioreactors, and real-time monitoring systems enable CDMOs to reduce production timelines, minimize contamination risks, and optimize resource utilization. Meanwhile, the rising development of innovative CDMO solutions, such as integrated service platforms, digitalized manufacturing, and accelerated development models, is significantly enhancing efficiency and flexibility across the biopharmaceutical value chain. These advancements are attracting more pharmaceutical and biotech companies to outsource complex processes, thereby fueling the growth and competitiveness of the market.

- For instance, Thermo Fisher Scientific launched Accelerator Drug Development, a comprehensive 360° CDMO and CRO solution, at CPHI Milan 2024. Designed to support biotech and pharma companies across the drug development lifecycle, the platform offers customizable manufacturing, clinical research, and supply chain services for small molecules, biologics, and cell and gene therapies.

Segment Outlook

By Service Type

What Made Manufacturing Services the Dominant Segment in the Market in 2024?

The manufacturing services segment dominated the Biopharmaceutical CDMO market, under which the active pharmaceutical ingredient (API) manufacturing sub-segment held the largest market share in 2024. This is due to the growing demand for large-scale production of active pharmaceutical ingredients essential for biologic drugs. As biopharmaceutical companies increasingly outsource API manufacturing to specialized CDMOs, they benefit from cost efficiencies, advanced technology, and regulatory compliance expertise. The complexity and high quality standards required for biologic APIs make outsourcing a strategic choice to ensure consistent supply and scalability. Additionally, the rising number of biologic drug approvals and expanding pipeline further fueled the demand for API manufacturing services.

The finished dosage form (FDF) manufacturing sub-segment is expected to grow at the fastest rate in the coming years due to the increasing complexity and variety of biologic therapies requiring specialized formulation and delivery methods. As more biopharmaceutical companies focus on expanding their product portfolios and reaching global markets, outsourcing FDF manufacturing allows them to leverage the expertise and advanced technologies of CDMOs. Additionally, the growing emphasis on personalized medicine and novel drug delivery systems drives demand for customized dosage forms. Regulatory pressures and the need for efficient scale-up and commercialization also contribute to the rapid growth of this sub-segment.

The development services segment is expected to expand at a significant rate over the forecast period due to the increasing focus on accelerating drug development timelines and improving success rates in clinical trials. As biopharmaceutical companies face growing pressure to bring innovative therapies to market quickly, they are increasingly outsourcing preclinical development, clinical development, analytical testing, and regulatory support to specialized CDMOs. This outsourcing enables access to advanced technologies, expert knowledge, and regulatory expertise, which are critical for navigating complex development processes. Additionally, the rise of personalized medicine and biologics with unique development challenges further drives demand for comprehensive development services.

By Product Type

How Does the Biologics Segment Lead the Biopharmaceutical CDMO Market?

The biologics segment led the market while holding the largest share in 2024 due to the rapid growth and increasing adoption of biologic therapies across various medical fields, including oncology, autoimmune diseases, and rare disorders. Biologics require complex manufacturing processes and specialized expertise, which has led many biopharmaceutical companies to outsource production to experienced CDMOs. The high demand for monoclonal antibodies, vaccines, and cell and gene therapies further propelled the growth of this segment. Additionally, regulatory complexities and the need for advanced technologies in biologics manufacturing have made CDMOs essential partners in ensuring product quality and scalability.

The advanced therapies segment is expected to expand at the fastest CAGR in the upcoming period. This is mainly due to the rising interest in personalized and precision medicine. These innovative therapies, including cell, gene, mRNA, and RNAi therapies, offer potential cures for previously untreatable diseases, driving significant investment and development activity. However, their complex manufacturing processes require specialized facilities and expertise, prompting biopharmaceutical companies to increasingly rely on CDMOs. Additionally, advancements in technology and regulatory support for these cutting-edge treatments are accelerating their development and commercialization, fueling the growth of this segment.

By Production Type

Why Did the Mammalian Cell Culture Dominate the Market in 2024?

The mammalian cell culture segment dominated the pharmaceutical CDMO market with a major share in 2024 due to its critical role in producing complex biologics such as monoclonal antibodies, recombinant proteins, and vaccines. Mammalian cells offer the ability to produce highly complex and properly folded proteins with necessary post-translational modifications, making them essential for effective biologic therapies. The growing demand for these biologics, driven by their success in treating various chronic and life-threatening diseases, fueled the expansion of this segment. Additionally, advancements in cell culture technologies and increasing outsourcing to CDMOs with specialized mammalian cell culture capabilities contributed to the segment’s dominance.

The microbial fermentation segment is expected to expand at the highest CAGR in the coming years, owing to its cost-effectiveness and efficiency in producing a wide range of biologics, including vaccines, enzymes, and antibiotics. Advances in microbial strain engineering and fermentation technologies have enhanced yield and scalability, making microbial fermentation increasingly attractive for biopharmaceutical production. Additionally, the rising demand for biosimilars and novel biologics that can be produced through microbial systems is driving the growth of this segment. The ability of microbial fermentation to support rapid development timelines and flexible manufacturing further positions it for strong expansion in the coming years.

By Therapeutic Area

What Made Oncology the Dominant Segment in the Market in 2024?

The oncology segment dominated the biopharmaceutical CDMO market in 2024 due to the high prevalence of cancer and the urgent need for innovative and effective treatments. The development of targeted therapies, immunotherapies, and personalized medicines has led to a surge in biopharmaceutical products focused on oncology. As a result, biopharmaceutical companies increasingly rely on CDMOs to provide specialized manufacturing and development services required for these complex drugs. Additionally, significant investments and ongoing clinical trials in the oncology space have driven strong demand, making it the largest therapeutic area in the market.

The rare and orphan diseases segment is likely to grow at a significant rate over the projection period. This is primarily due to increasing awareness and advances in genetic research that have identified new targets for treatment. Regulatory incentives, such as orphan drug designations and expedited approval pathways, are encouraging biopharmaceutical companies to invest heavily in developing therapies for these underserved conditions. Additionally, the rise of personalized medicine and targeted therapies is driving demand for specialized manufacturing and development services provided by CDMOs. The growing patient populations and high unmet medical needs are fueling the growth of this segment.

By End-User

Why Did Pharmaceutical Companies Hold the Largest Market Share in 2024?

The pharmaceutical companies segment held the largest share of the biopharmaceutical CDMO market in 2024 due to their heightened need to outsource manufacturing and development activities to meet growing demands and accelerate drug development timelines. These companies increasingly rely on CDMOs to access specialized expertise, advanced technologies, and scalable production capabilities without investing heavily in their own infrastructure. Additionally, outsourcing helps pharmaceutical companies reduce costs, mitigate risks, and focus on core competencies such as research and marketing. The rising complexity of biologics and regulatory requirements further drives pharmaceutical companies to partner with experienced CDMOs, reinforcing their dominant position as end users in the market.

The biotechnology firms segment is expected to register the fastest CAGR during the forecast period due to the surge in innovative biologic and advanced therapy development led by these companies. Biotechnology firms often focus on cutting-edge research and novel therapies, which require specialized development and manufacturing capabilities offered by CDMOs. Outsourcing allows these firms to overcome infrastructure limitations and accelerate time-to-market while managing costs and regulatory complexities. Additionally, the increasing number of biotech startups and partnerships with larger pharmaceutical companies are driving demand for flexible and scalable CDMO services.

By Region

What Made North America the Dominant Region in the Biopharmaceutical CDMO Market?

North America registered dominance in the biopharmaceutical CDMO market by capturing the largest revenue share in 2024. This is mainly due to its well-established pharmaceutical and biotechnology industries, supported by significant investments in research and development. The region boasts advanced infrastructure, cutting-edge technology, and a large pool of skilled professionals, making it a preferred hub for biopharmaceutical manufacturing and development. Additionally, strong regulatory frameworks and supportive government initiatives have encouraged outsourcing to CDMOs to accelerate drug development and commercialization. The presence of numerous leading biopharma companies and increasing demand for biologics and advanced therapies further reinforced North America’s dominant position in the market.

The U.S. is the major contributor to the North America biopharmaceutical CDMO market due to its leading position as a global hub for pharmaceutical and biotechnology innovation. The country hosts numerous top-tier biopharmaceutical companies, research institutions, and a robust network of CDMOs with advanced manufacturing capabilities. Strong government support, extensive funding for R&D, and a well-established regulatory framework further fuel the growth of the market. Additionally, the heightened demand for biologics and personalized medicines and increased approvals for advanced therapies in the U.S. solidify its dominant role in the region.

Mapping FDA-Approved Cell and Gene Therapies in the U.S. by May 2025

| Manufacturers |

Product |

| Celgene Corporation |

ABECMA (idecabtagene vicleucel) |

| SSM Cardinal Glennon Children's Medical Center |

ALLOCORD (HPC, Cord Blood) |

| Iovance Biotherapeutics, Inc. |

AMTAGVI (lifileucel) |

| Pfizer, Inc. |

BEQVEZ (fidanacogene elaparvovec-dzkt) |

| Juno Therapeutics, Inc. |

BREYANZI (lisocabtagene maraleucel) |

| Janssen Biotech, Inc. |

CARVYKTI (ciltacabtagene autoleucel) |

| Vertex Pharmaceuticals Incorporated |

CASGEVY (exagamglogene autotemcel [exa-cel]) |

| Duke University School of Medicine |

Ducord, HPC Cord Blood |

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth throughout the forecast period due to rapidly expanding pharmaceutical and biotechnology sectors in countries like China, India, and South Korea. The region offers cost advantages, large-scale manufacturing capabilities, and improving infrastructure, attracting global biopharmaceutical companies to outsource their development and manufacturing needs. Additionally, favorable government policies, increasing investments in healthcare, and growing demand for biologics and biosimilars are driving market growth. The rising number of clinical trials and expanding skilled workforce further support Asia Pacific’s emergence as a key hub for CDMO services.

China is the major contributor to the Asia Pacific biopharmaceutical CDMO market due to its rapidly growing pharmaceutical industry and significant investments in biotechnology infrastructure. The country offers cost-effective manufacturing, a large skilled workforce, and expanding advanced facilities, attracting both domestic and international biopharmaceutical companies. Supportive government policies and incentives aimed at boosting innovation and self-sufficiency in drug development are further accelerating market growth. Additionally, the increasing demand for biologics, biosimilars, and advanced therapies within China drives the growth of the market.

India is emerging as a key player in the Asia Pacific biopharmaceutical CDMO market due to its cost-competitive manufacturing capabilities and a large pool of skilled scientific talent. Improving infrastructure and increasing investments in biotechnology and pharmaceutical R&D are also driving market growth. The country's growing domestic demand for biologics and biosimilars, combined with an expanding regulatory framework, further enhances its attractiveness as a reliable and efficient CDMO hub in the region. Additionally, strong government support through favorable policies and incentives supports market growth.

- For instance, India’s Finance Minister, Nirmala Sitharaman, recently advocated for the creation of a dedicated regulatory body, Bharat FDA, to establish India’s own pharmaceutical standards. This move aims to tailor regulations specifically to the country’s unique needs, enhancing the quality and efficacy of pharmaceutical products. For the biopharmaceutical CDMO market, this development could be transformative, streamlining approval processes, boosting investor confidence, and encouraging innovation. Ultimately, it positions India as a strategic hub for advanced biopharmaceutical manufacturing and contract development services on the global stage.

Region-Wise Breakdown of the Biopharmaceutical CDMO Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 8.8 Bn |

5.88% |

Presence of major biopharma and biotech companies; large R&D pipelines; high regulatory standards; strong infrastructure; substantial biomanufacturing investments |

High costs; capacity constraints for biologics and advanced therapies; regulatory burden; competition from lower-cost regions; challenges in scaling novel therapy manufacturing |

While North America remains dominant in 2024, its growth rate is more moderate compared with Asia Pacific |

| Asia Pacific |

USD 6.2 Bn |

6.96% |

Cost-competitive manufacturing; strong government support/incentives (especially China and India); improving infrastructure and regulatory alignment; rising domestic demand for biologics and biosimilars |

Regulatory and quality concerns in some countries; gaps in advanced therapy capabilities; possible supply chain or raw material constraints |

Fastest-growing region with significant expansion opportunities |

| Europe |

USD 4.9 Bn |

10.01% |

Strong regulatory and quality expertise; mature pharmaceutical/biotech sectors; increasing biologics, biosimilars, and advanced therapies; supportive healthcare systems |

High operational costs; regulatory timelines; competition from Asia Pacific; environmental compliance costs; slower innovation adoption in some countries |

Notable growth expected with continued outsourcing and biologics demand |

| Latin America |

USD 1.7 Bn |

1.49% |

Increasing healthcare investments; growing prevalence of chronic diseases; rising awareness and healthcare infrastructure improvements |

Economic disparities; limited drug availability; infrastructural challenges in some countries |

Moderate growth with gradual market expansion |

| MEA |

USD 1.1 Bn |

3.46% |

Rising prevalence of lifestyle diseases; expanding healthcare infrastructure; government initiatives to improve healthcare access |

Limited healthcare access in rural areas; regulatory hurdles; political and economic instability in some regions |

Gradual growth with improving healthcare facilities and regulatory environment |

Regulatory Landscape of the Biopharmaceutical CDMO Market

The biopharmaceutical CDMO market operates within a highly regulated environment governed by stringent quality and safety standards to ensure the efficacy and safety of biologics and advanced therapies. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Japan’s Pharmaceuticals and Medical Devices Agency (PMDA), and others set rigorous guidelines that CDMOs must comply with throughout the development and manufacturing processes.

Key regulatory frameworks include Good Manufacturing Practices (GMP), Good Laboratory Practices (GLP), and Good Clinical Practices (GCP), which mandate stringent controls on manufacturing environments, quality assurance, process validation, and documentation. Compliance with these standards is critical for gaining product approval and market access globally. Increasingly, regulators are focusing on advanced therapies, including cell and gene therapies, with evolving guidelines to address their unique manufacturing complexities and safety considerations. CDMOs must stay abreast of such changes to ensure compliance while innovating processes and technologies.

Furthermore, regulatory inspections and audits are frequent, requiring CDMOs to maintain robust quality management systems and transparent traceability throughout the supply chain. Data integrity, cybersecurity, and serialization requirements have also gained prominence, aiming to prevent counterfeiting and ensure product authenticity.

Navigating diverse regional regulations presents a challenge, especially for CDMOs operating globally. Harmonization efforts like the International Council for Harmonisation (ICH) guidelines help streamline compliance but variations still exist, requiring tailored strategies.

Overall, regulatory compliance remains a key factor shaping the biopharmaceutical CDMO market, driving investments in quality systems, staff training, and technology upgrades to meet evolving standards and support faster, safer drug development.

Value Chain Analysis of the Biopharmaceutical CDMO Market

1. Research & Development (R&D) Services

- This stage involves early-phase drug discovery, preclinical development, clinical trial material production, and analytical testing. CDMOs provide expertise in formulation development, bioanalytical services, and regulatory support to accelerate timelines.

- Key players: Catalent, WuXi Biologics, and Lonza are known for strong capabilities in clinical supply manufacturing and development services.

2. Active Pharmaceutical Ingredient (API) Manufacturing

- At this stage, CDMOs manufacture the active substances required for biopharmaceutical products using complex bioprocessing techniques such as mammalian cell culture or microbial fermentation. High-quality API production is critical to ensuring drug safety and efficacy.

- Key players: Samsung Biologics, Fujifilm Diosynth Biotechnologies, and Boehringer Ingelheim are recognized for their large-scale API manufacturing capacity and quality compliance.

3. Finished Dosage Form (FDF) Manufacturing

- This stage focuses on the formulation of APIs into final drug products (injectables, oral solids, etc.), including fill-finish services and packaging. Efficient and compliant FDF manufacturing ensures product stability and delivery effectiveness.

- Key players: Thermo Fisher Scientific, Recipharm, and PCI Pharma Services are experts in aseptic fill-finish and specialized drug product manufacturing.

4. Specialty Services

- Includes ancillary services such as packaging, labeling, cold chain logistics, and supply chain management to ensure the safe distribution and storage of temperature-sensitive biologics and advanced therapies. These services are crucial for maintaining product integrity from manufacturing to end-use.

- Key players: AptarGroup, Sharp Packaging, and Marken are leaders in providing comprehensive specialty logistics and packaging solutions.

5. Regulatory & Quality Compliance

- Throughout all stages, CDMOs ensure adherence to stringent regulatory guidelines (FDA, EMA, ICH) and implement robust quality management systems. This compliance guarantees that biopharmaceutical products meet global standards for safety and efficacy.

- Key players: Most top-tier CDMOs like Lonza, Catalent, and Samsung Biologics invest heavily in regulatory affairs and quality assurance teams to maintain compliance.

Top Players Competing in the Market

1. Lonza

Lonza is a global leader offering integrated development and manufacturing services for biologics, cell and gene therapies, and small molecules. Their extensive capabilities in mammalian cell culture and advanced therapy manufacturing make them a preferred partner for innovative biopharma companies.

2. Catalent

Catalent provides comprehensive drug development, delivery, and supply solutions, including clinical supply manufacturing and commercial-scale biologics production. Their expertise in advanced formulation technologies and global manufacturing footprint helps accelerate time-to-market for clients.

3. Samsung Biologics

Samsung Biologics specializes in large-scale biopharmaceutical manufacturing with state-of-the-art facilities focused on monoclonal antibodies and other biologics. Their scalable production capacity and strong quality compliance support rapid commercialization for global clients.

4. WuXi Biologics

WuXi Biologics offers end-to-end solutions from drug discovery to commercial manufacturing, emphasizing flexible and cost-effective bioprocessing. Their open-access platform and broad service portfolio enable biopharma companies to streamline development timelines and reduce costs.

5. Fujifilm Diosynth Biotechnologies

Fujifilm Diosynth provides contract manufacturing services for complex biologics, including vaccines, gene therapies, and recombinant proteins. Their strong capabilities in microbial fermentation and mammalian cell culture support diverse product pipelines globally.

6. Boehringer Ingelheim BioXcellence

Boehringer Ingelheim’s CDMO division delivers integrated biopharmaceutical development and manufacturing services with a focus on quality and innovation. Their expertise in monoclonal antibodies and viral vectors positions them well in advanced therapy manufacturing.

7. Thermo Fisher Scientific

Thermo Fisher Scientific offers end-to-end CDMO services, including drug substance and drug product manufacturing, analytical testing, and clinical supply services. Their global network and technological innovation help optimize biopharma production and regulatory compliance.

8. Recipharm

Recipharm specializes in drug product manufacturing with a strong focus on aseptic fill-finish and specialty dosage forms. Their expertise in regulatory compliance and packaging ensures safe and efficient delivery of complex biologics.

9. AptarGroup

AptarGroup specializes in advanced drug delivery systems, providing innovative packaging and device solutions that enhance the safety, efficacy, and convenience of biopharmaceutical products. Their expertise in inhalation, injection, and nasal delivery technologies supports CDMOs in developing patient-friendly biologic therapies.

10. Sharp Packaging

Sharp Packaging offers custom packaging solutions tailored to the specific needs of biopharmaceutical products, including compliance labeling and serialization services. Their focus on regulatory adherence and secure packaging helps ensure product integrity throughout the supply chain.

11. Marken

Marken provides specialized clinical trial logistics and cold chain management services, ensuring the safe and timely transportation of temperature-sensitive biologics and advanced therapies globally. Their expertise in global regulatory compliance and supply chain optimization makes them a trusted partner in the biopharma CDMO ecosystem.

12. PCI Pharma Services

PCI Pharma Services delivers comprehensive pharmaceutical manufacturing and packaging solutions, including aseptic fill-finish and specialty dosage form manufacturing. Their global network and quality-driven approach help biopharmaceutical companies streamline commercialization and maintain product stability.

Recent Developments

- In September 2025, Amaran Biotech was awarded “Best Fill-Finish” at the 2025 Asia-Pacific Biologics CDMO Excellence Awards in Singapore, recognizing its advanced aseptic fill-finish capabilities. This milestone highlights Amaran’s leadership in biologics manufacturing and marks a significant achievement for Taiwan’s biotech industry on the global stage.

- In April 2025, AGC Biologics launched a dedicated Cell and Gene Technologies Division to expand its capabilities and support developers with advanced expertise, capacity, and global infrastructure. Unlike others scaling back, AGC is strengthening its cell and gene CDMO services across Milan, Longmont, and Yokohama. The division leverages proprietary platforms like ProntoLVV™ and BravoAAV™ to help clients accelerate to GMP phases while optimizing costs.

- In March 2025, Shilpa Medicare launched a full-service ‘hybrid’ CDMO, serving small and large molecules, peptides, with a focus on oncology. The model combines comprehensive discovery, clinical, and commercial outsourcing with ready-to-license novel formulations, enabling pharma companies to access Shilpa’s oncology expertise while minimizing development risks and timelines.

Segment Covered in the Report

By Service Type

- Development Services

- Preclinical Development

- Clinical Development

- Analytical Testing

- Regulatory Support

- Manufacturing Services

- Active Pharmaceutical Ingredient (API) Manufacturing

- Finished Dosage Form (FDF) Manufacturing

- Specialty Services

- Formulation Development

- Packaging and Labeling

- Supply Chain Management

- Cold Chain Logistics

By Product Type

- Biologics

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Biosimilars

- Monoclonal Antibody Biosimilars

- Recombinant Protein Biosimilars

- Advanced Therapies

- Cell Therapies

- Gene Therapies

- mRNA Therapies

- RNAi Therapies

By Production Type

- Mammalian Cell Culture

- Microbial Fermentation Systems

- Cell-Free Systems

- Plant-Based Systems

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Neurological Disorders

- Autoimmune Diseases

- Infectious Diseases

- Metabolic Disorders

- Ophthalmology

- Respiratory Disorders

- Musculoskeletal Disorders

- Rare and Orphan Diseases

By End-User

- Pharmaceutical Companies

- Biotechnology Firms

- Contract Research Organizations (CROs)

- Academic and Research Institutions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Global Biopharmaceutical CDMO Market Size, 2024–2034

- Global Market Share by Service Type, 2024 & 2034

- Global Market Share by Product Type, 2024 & 2034

- Global Market Share by Production Type, 2024 & 2034

- Global Market Share by Therapeutic Area, 2024 & 2034

- Global Market Share by End-User, 2024 & 2034

- Global Market Share by Region, 2024 & 2034

- North America Market Size by Country, 2024–2034

- U.S. Market Size by Service Type, 2024–2034

- Canada Market Size by Service Type, 2024–2034

- Mexico Market Size by Service Type, 2024–2034

- Europe Market Size by Country, 2024–2034

- Asia Pacific Market Size by Country, 2024–2034

- Latin America Market Size by Country, 2024–2034

- Middle East & Africa Market Size by Country, 2024–2034

- Global Biopharmaceutical CDMO Market Outlook, 2024–2034

- Global Market Share by Service Type, 2024

- Global Market Share by Product Type, 2024

- Global Market Share by Production Type, 2024

- Global Market Share by Therapeutic Area, 2024

- Global Market Share by End-User, 2024

- Global Market Share by Region, 2024

- North America Market Share, by Country, 2024

- Europe Market Share, by Country, 2024

- Asia Pacific Market Share, by Country, 2024

- Latin America Market Share, by Country, 2024

- Middle East & Africa Market Share, by Country, 2024

- Comparative Growth Rate of Biopharmaceutical CDMO Market, 2024–2034