Blood Pressure Monitoring Devices Market Size and Research

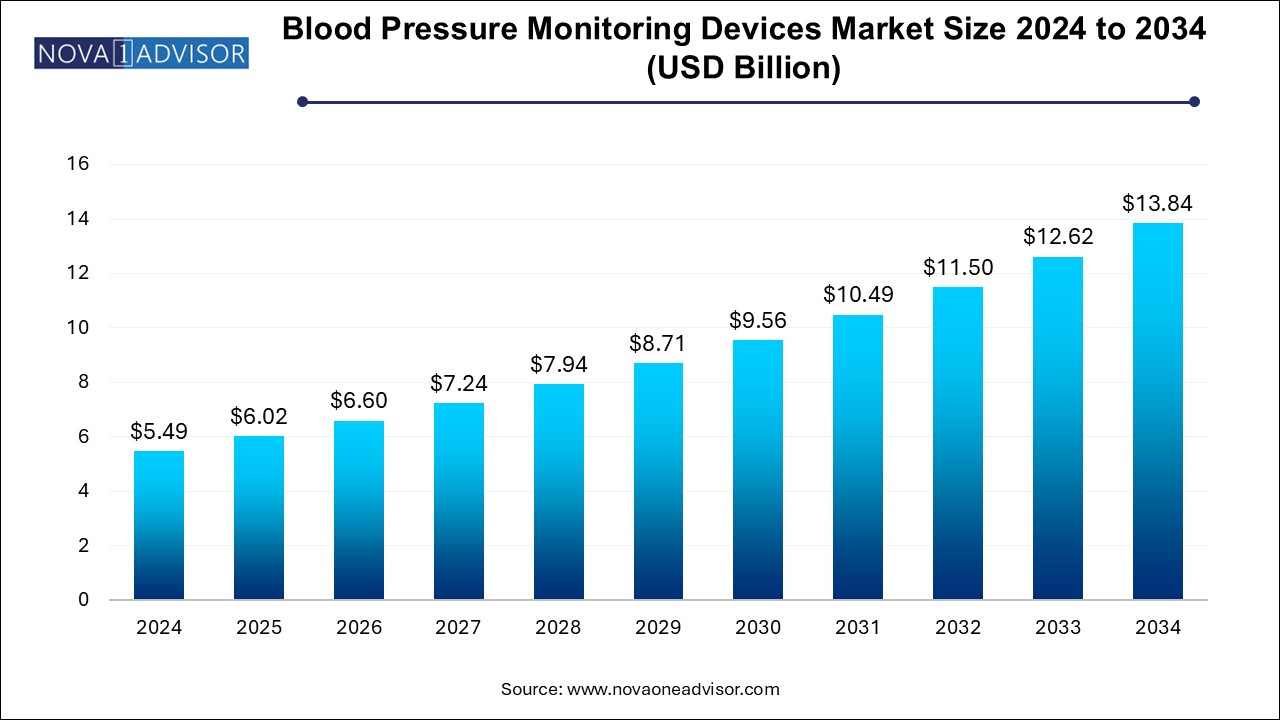

The blood pressure monitoring devices market size was exhibited at USD 5.49 billion in 2024 and is projected to hit around USD 13.84 billion by 2034, growing at a CAGR of 9.7% during the forecast period 2025 to 2034.

Blood Pressure Monitoring Devices Market Key Takeaways:

- The automated/digital blood pressure monitor accounted for the largest market share at over 48.4% due to their growing demand in 2024.

- The blood pressure cuffs market is expected to grow significantly at a CAGR of over 8.0% over the forecast period

- The hospital segment accounted for the largest revenue share of 65.0% in 2024

- Homecare is anticipated to exhibit a sturdy CAGR of around 11.5% over the forecast period.

- North America blood pressure monitoring devices market held the most significant revenue with over 36.0% share in 2024

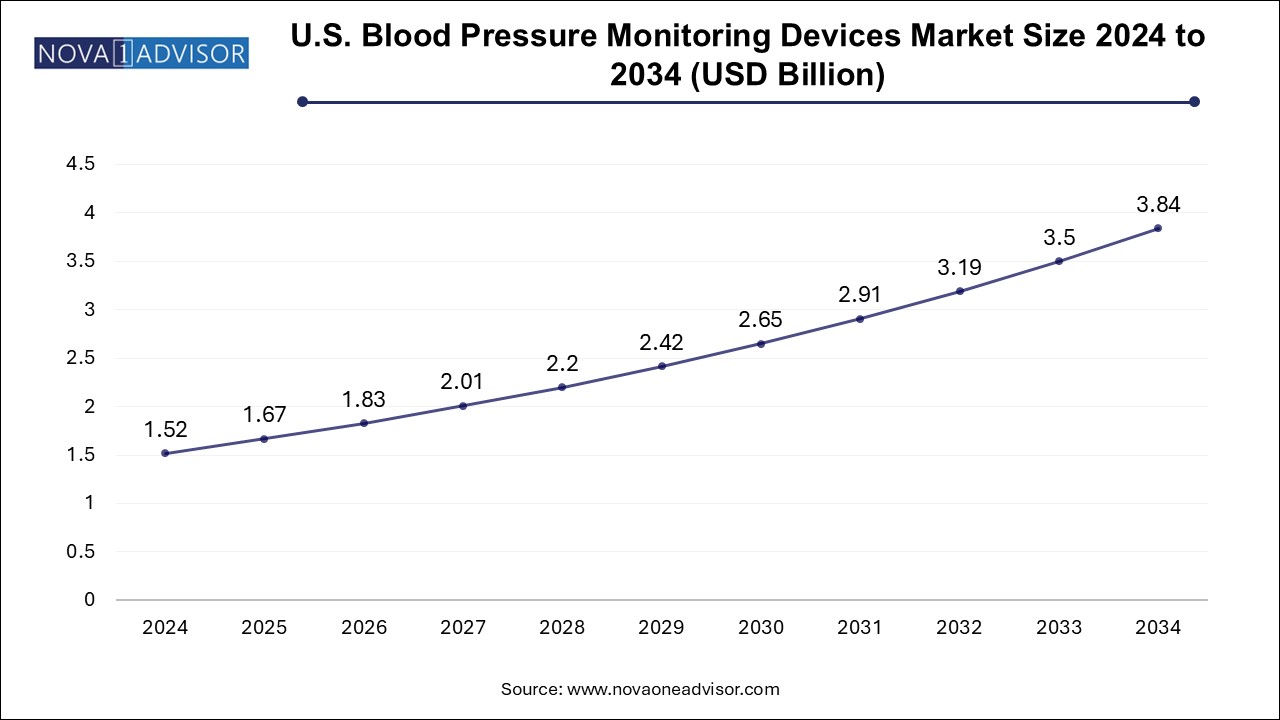

U.S. Blood Pressure Monitoring Devices Market Size and Growth 2025 to 2034

The U.S. blood pressure monitoring devices market size is evaluated at USD 1.52 billion in 2024 and is projected to be worth around USD 3.84 billion by 2034, growing at a CAGR of 8.79% from 2025 to 2034.

North America, led by the United States, accounts for the largest share of the global blood pressure monitoring devices market. The region’s dominance is attributed to a high burden of hypertension, strong consumer awareness, advanced healthcare infrastructure, and widespread access to insurance. According to the CDC, nearly half of all American adults have high blood pressure, fueling ongoing demand for monitoring solutions.

In addition, the presence of leading manufacturers, regulatory support for remote patient monitoring, and rapid adoption of digital health innovations make North America a mature and innovation-driven market. Companies like Omron, Welch Allyn, and GE Healthcare continue to introduce new models with app connectivity and smart features tailored to this region’s tech-savvy consumers.

Asia Pacific is the fastest-growing region, driven by increasing healthcare expenditure, rising incidence of hypertension, and the rapid growth of middle-class and aging populations. Countries like China, India, and Japan are seeing a surge in home health devices, supported by smartphone penetration and public health campaigns.

Japan leads in the adoption of portable BP monitors due to its high elderly population and awareness of cardiovascular health. Meanwhile, India and China are expanding retail and e-commerce access to affordable digital monitors, often manufactured locally. Government health programs aimed at chronic disease screening and homecare integration are further propelling market expansion in this region.

Market Overview

The blood pressure monitoring devices market is a pivotal segment of the global medical devices industry, addressing one of the most prevalent and critical health conditions worldwide—hypertension. With an estimated 1.28 billion adults globally suffering from elevated blood pressure (WHO), the need for accurate, convenient, and continuous monitoring tools has never been more pressing. Blood pressure monitoring devices are used not only for diagnosing hypertension but also for managing a wide array of cardiovascular, renal, and metabolic disorders.

From traditional sphygmomanometers to highly sophisticated automated digital monitors, the industry has witnessed rapid evolution. The shift from manual readings to smart, connected, and wearable technologies is transforming how both professionals and patients monitor blood pressure. Home-based monitoring has gained widespread traction due to increased health consciousness, the availability of user-friendly devices, and the convenience of remote data sharing with healthcare providers.

The market is also expanding due to the aging global population, rising sedentary lifestyles, dietary habits, and increased incidence of lifestyle-related diseases. Additionally, the post-pandemic emphasis on home-based care and the growth of telehealth are significantly bolstering the adoption of digital BP monitoring solutions. With ongoing innovation in sensor technology, mobile app integration, and cloud connectivity, the blood pressure monitoring devices market is poised for strong and sustained growth through 2034.

Major Trends in the Market

-

Rapid Growth of Home-Based Blood Pressure Monitoring Solutions

-

Integration of Bluetooth and Mobile App Connectivity in Digital BP Devices

-

Rising Popularity of Wearable and Continuous Monitoring BP Devices

-

Increased Demand for Ambulatory Blood Pressure Monitoring in Clinical Settings

-

Technological Advancements in Cuffless and Wrist-Based Monitoring Systems

-

Miniaturization and Portability Driving Use in Homecare and Travel Applications

-

Shift from Manual Sphygmomanometers to Automated, AI-Enabled Monitors

-

Widening Access to BP Monitors Through Pharmacies and E-commerce Channels

-

Incorporation of BP Monitoring in Smart Watches and Fitness Bands

-

Global Public Health Campaigns Promoting Early Detection of Hypertension

Report Scope of Blood Pressure Monitoring Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.02 Billion |

| Market Size by 2034 |

USD 13.84 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Omron Healthcare Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corporation; Withings; Briggs Healthcare; GE Healthcare; Kaz Inc.; Microlife AG; Rossmax International Ltd.; GF Health Products Inc.; Spacelabs Healthcare Inc.; Philips Healthcare; B. Braun |

Market Driver: Rising Global Prevalence of Hypertension and Cardiovascular Diseases

A key driver of the blood pressure monitoring devices market is the growing global burden of hypertension, often referred to as the "silent killer." Hypertension is a leading risk factor for cardiovascular diseases (CVDs), which account for approximately 17.9 million deaths each year (WHO). The increase in hypertension cases is attributed to urbanization, stress, high salt intake, physical inactivity, and obesity.

Blood pressure monitoring is essential for both early detection and long-term management of hypertension. Home-use devices are enabling patients to track fluctuations more regularly, while clinical-grade monitors are critical in emergency care and chronic disease management. The consistent rise in CVD cases worldwide directly contributes to the demand for reliable BP monitors across all healthcare levels—from hospitals to households.

Market Restraint: Accuracy Concerns and Device Calibration Issues

Despite technological progress, accuracy and calibration concerns remain a significant barrier to widespread adoption of BP monitoring devices. Variations in cuff positioning, arm size, patient movement, and device sensitivity can lead to inconsistent readings. Particularly in low-cost devices, inaccuracies are more common and can result in misdiagnosis or inappropriate treatment adjustments.

Healthcare professionals often prefer validated devices that meet standards set by organizations like the American Heart Association (AHA) or the European Society of Hypertension (ESH). However, not all consumer-grade or app-connected devices go through rigorous validation. This discrepancy can erode trust and hinder the adoption of digital BP monitoring tools, especially in regions where regulatory enforcement is limited.

Market Opportunity: Emergence of Smart and Cuffless BP Monitoring Devices

An emerging opportunity within this market is the development of smart, non-invasive, and cuffless blood pressure monitoring devices. Leveraging photoplethysmography (PPG), artificial intelligence (AI), and biosensors, new-generation monitors can deliver accurate BP readings without the need for traditional cuffs. These innovations are particularly promising for wearable integration—such as in smartwatches and wristbands—enabling passive and continuous monitoring.

As patient preferences lean toward ease-of-use and non-intrusiveness, cuffless solutions represent the next frontier in BP tracking. Companies investing in R&D around optical sensors, pulse transit time (PTT), and AI-driven predictive analytics have the potential to revolutionize outpatient and preventive cardiovascular care. With regulatory support and clinical validation, this segment could see exponential growth in the coming years.

Blood Pressure Monitoring Devices Market By Product Insights

The automated/digital blood pressure monitor accounted for the largest market share at over 48.4% due to their growing demand in 2024. owing to their ease of use, accuracy, and broad availability for both professional and personal use. Among these, arm-based monitors are the most popular due to their higher precision and ability to measure at the brachial artery, which is a standard clinical location. These devices are preferred in homecare settings, outpatient clinics, and even pharmacies.

Wrist and finger monitors are gaining popularity for their portability, though concerns remain about their accuracy. Wrist monitors, in particular, are widely adopted among tech-savvy users who prioritize convenience, and many now offer Bluetooth syncing and mobile app integration for data sharing. Despite this, finger monitors are niche products, often reserved for backup use or wellness tracking rather than clinical evaluation.

Meanwhile, ambulatory BP monitors (ABPMs) are growing rapidly in clinical practice, especially in cardiology and nephrology departments. These devices measure blood pressure at regular intervals over 24 to 48 hours, offering insights into nocturnal hypertension and medication effectiveness. ABPMs are critical for diagnosing white-coat and masked hypertension and are becoming the gold standard in hypertension evaluation.

Blood Pressure Monitoring Devices Market By End Use Insights

Hospitals continue to be the dominant end users of blood pressure monitoring devices due to their high patient volumes, need for constant monitoring in ICUs, and usage in emergency and surgical settings. Hospitals also require ABPMs and intra-arterial monitors for more complex evaluations. Accuracy, regulatory compliance, and multi-patient compatibility are key factors driving procurement decisions in this segment.

However, the homecare segment is growing at the fastest rate, fueled by the increasing emphasis on preventive care, chronic disease management, and cost control. Portable and automated monitors, coupled with digital health platforms, are enabling users to monitor BP at home and share data with healthcare providers in real-time. The rise in self-care awareness, especially among aging populations, has made home BP monitoring a household routine.

Ambulatory surgical centers and clinics form an important mid-tier end-use segment, using BP monitors for pre- and post-operative monitoring, outpatient cardiology visits, and regular check-ups. The need for compact, accurate, and easy-to-use devices supports continued growth in this category.

Some of the prominent players in the blood pressure monitoring devices market include:

Blood Pressure Monitoring Devices Market Recent Developments

-

March 2025: Omron Healthcare introduced a new wrist-based BP monitor integrated with ECG tracking and real-time alert features, targeting high-risk cardiac patients.

-

February 2025: Withings received FDA clearance for its hybrid smartwatch with cuffless BP monitoring capabilities, expected to launch globally by mid-2025.

-

January 2025: GE HealthCare collaborated with a U.S. telemedicine platform to integrate its digital BP monitoring systems into remote hypertension care workflows.

-

December 2024: Microlife Corporation launched a multiparameter home health station combining BP, body temperature, and pulse oximetry in a single user-friendly interface.

-

November 2024: A&D Medical expanded its Bluetooth-enabled monitor line with AI-based features to help predict hypertensive episodes based on past data trends.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the blood pressure monitoring devices market

By Product

- Sphygmomanometer/Aneroid BP Monitor

- Automated/Digital Blood Pressure Monitor

- Ambulatory Blood Pressure Monitor

- Transducers

- Instruments and Accessories

By End Use

- Hospitals

- Ambulatory Surgical Centers & Clinics

- Homecare

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)