Cell And Gene Therapy Bioanalytical Testing Services Market Size and Trends

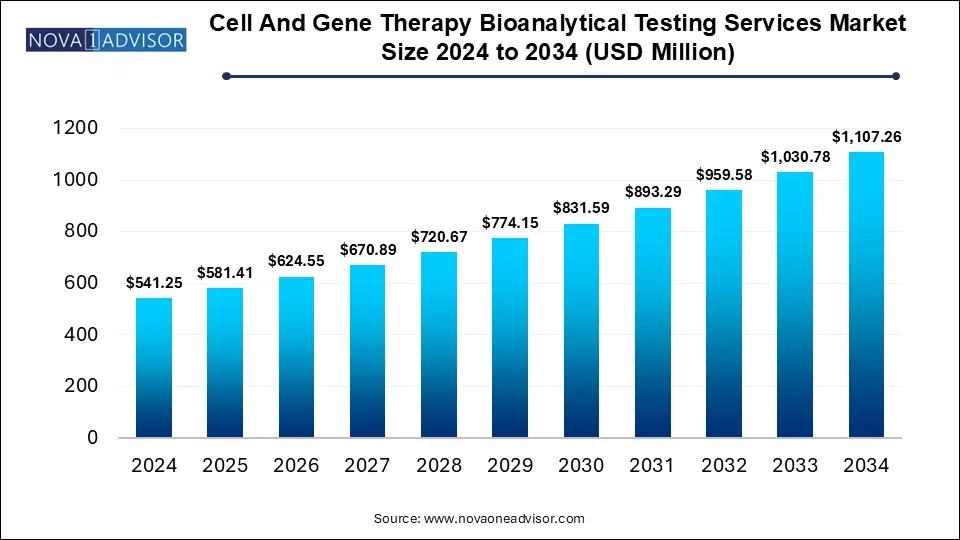

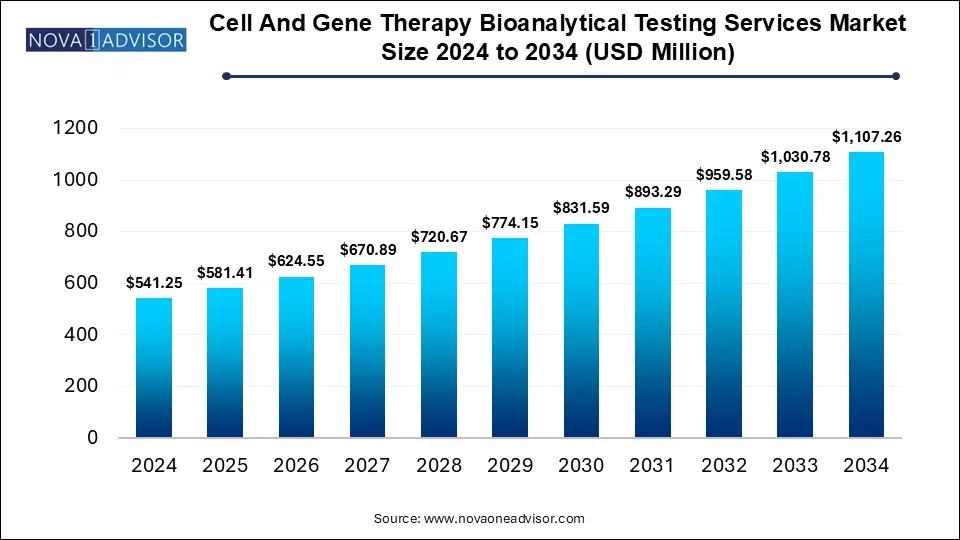

The Cell and gene therapy bioanalytical testing services market size was exhibited at USD 541.25 million in 2024 and is projected to hit around USD 1,107.26 million by 2034, growing at a CAGR of 7.42% during the forecast period 2025 to 2034.

Key Takeaways:

- In 2024, North America emerged as the leading region in the cell and gene therapy bioanalytical testing services market, capturing 42% of the total revenue.

- The oncology application segment led the market, holding the largest share at 50% in 2024.

- Within product categories, cell therapy held the dominant position in the market during 2024.

- The non-clinical phase segment was the market leader in 2024.

- Bioavailability and bioequivalence studies accounted for the highest share, representing 36% of the market in 2024.

Market Overview

The cell and gene therapy (CGT) bioanalytical testing services market is rapidly evolving as these innovative therapies progress from research labs to clinical applications. The complexity of CGT products requires sophisticated testing to ensure safety, efficacy, and compliance with regulatory standards. Bioanalytical testing in this domain supports pharmacokinetic (PK), pharmacodynamic (PD), and biomarker assessments during clinical and non-clinical development. This segment encompasses a wide range of services, from bioavailability and bioequivalence studies to the detection of vector copy numbers, immune response, and gene expression levels.

As personalized medicine gains traction, especially in oncology and rare diseases, the reliance on bioanalytical testing has surged. The increasing number of CGT trials worldwide and the regulatory agencies' emphasis on stringent analytical validation have driven demand for robust testing frameworks. According to estimates, hundreds of clinical trials involving CGT products are underway globally, with many moving into advanced phases, which significantly propels the need for consistent and standardized bioanalytical support.

Biopharmaceutical companies are increasingly outsourcing these services to specialized contract research organizations (CROs) and bioanalytical labs with niche capabilities in handling complex biologics. The growing portfolio of approved CGT therapies, such as Novartis's Kymriah and Spark Therapeutics' Luxturna, exemplifies the necessity for integrated testing services from development to post-marketing surveillance.

Major Trends in the Market

-

Rising Number of Cell and Gene Therapy Approvals: A growing number of FDA and EMA approvals are increasing demand for comprehensive bioanalytical testing.

-

Increased Outsourcing to CROs: Biotech firms are increasingly partnering with CROs to reduce development timelines and access advanced testing platforms.

-

Adoption of Advanced Analytical Platforms: High-throughput sequencing, qPCR, and digital droplet PCR are widely adopted for precise genetic quantification and analysis.

-

Integrated Testing Solutions: Companies are offering end-to-end services covering preclinical through post-market surveillance testing.

-

Focus on Regulatory Compliance: Regulatory bodies like the FDA and EMA emphasize rigorous analytical validation protocols, prompting investment in compliant lab infrastructures.

-

Emergence of Novel Therapy Modalities: Technologies like CAR-T, TCR-T, and CRISPR have created new testing requirements.

-

Expansion into Emerging Markets: Latin America and Asia-Pacific are witnessing increasing investments in bioanalytical testing infrastructure.

-

Strategic Acquisitions and Collaborations: Larger CROs and bioanalytical labs are acquiring smaller niche players to bolster testing capabilities.

Report Scope of Cell And Gene Therapy Bioanalytical Testing Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 581.41 Million |

| Market Size by 2034 |

USD 1,107.26 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.42% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Test Type, Product Type, Stage of Development by Product Type, Indication, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

BioAgilytix Labs; KCAS Bioanalytical Services; IQVIA, Inc.; Laboratory Corporation of America Holdings; Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific Inc.); Prolytix; Pharmaron; Charles River Laboratories; Syneos Health; SGS SA; Intertek Group Plc |

Market Driver – Increasing Clinical Trials and Regulatory Requirements

A major driver of the market is the surge in clinical trials for CGT therapies, particularly for complex and rare diseases. As of 2024, over 2,000 gene and cell therapy trials were ongoing globally, many of which required meticulous pharmacokinetic and immunogenicity assessments. Regulatory bodies have mandated comprehensive bioanalytical evaluation to approve these therapies, increasing the volume and complexity of required tests. For instance, vector biodistribution and persistence studies have become critical for gene therapies using viral vectors. This evolving regulatory landscape necessitates robust testing solutions, thereby fueling demand for specialized bioanalytical service providers.

Market Restraint – High Cost and Infrastructure Requirements

The implementation of CGT bioanalytical testing requires advanced equipment, skilled personnel, and controlled environments. This significantly raises the capital and operational expenses, particularly for new entrants and smaller firms. The sophisticated nature of assays such as cell transduction efficiency, transgene expression, and off-target effects requires expensive reagents and prolonged validation cycles. Moreover, maintaining compliance with GLP/GMP standards imposes additional cost and administrative burdens. These factors collectively act as a constraint, limiting the market's growth among smaller biotech firms and in price-sensitive regions.

Market Opportunity – Expansion in Emerging Markets

Emerging economies in Asia-Pacific and Latin America are witnessing increased investment in biotechnology infrastructure, presenting a substantial opportunity for market players. Governments in countries like India, China, and Brazil are offering funding and tax incentives to foster biotech innovation. With lower operational costs and a growing patient pool for clinical trials, these regions have become attractive destinations for CGT development and testing. Establishing bioanalytical testing facilities in these markets allows companies to scale services and offer cost-effective solutions while tapping into local talent and patient populations.

Segmental Analysis

Test Type Outlook

Bioavailability and Bioequivalence Studies dominated the test type segment due to their regulatory significance during drug development. These tests are fundamental in determining the pharmacokinetic profiles of therapeutic candidates, especially for therapies with systemic delivery. Bioavailability studies help evaluate the extent and rate of a drug’s active ingredient entering the circulation, while bioequivalence studies compare generic products to innovator drugs. In CGT, these evaluations are pivotal in optimizing dosage and delivery mechanisms, making them indispensable in clinical trial phases.

Pharmacodynamics (PD) testing is the fastest growing within the test type segment. PD testing provides insights into the biological effects of a therapy at the cellular or molecular level, particularly important in CGT therapies where immune response and therapeutic expression need close monitoring. The rise in personalized medicine has further driven the need for PD biomarkers to assess therapy effectiveness and patient-specific responses, making this segment a critical area of growth.

Product Type Outlook

Gene Therapy dominated the product type segment, primarily due to the increasing number of in-vivo gene therapy approvals and ongoing clinical studies. The growing acceptance of adeno-associated virus (AAV) and lentiviral vectors for genetic diseases such as hemophilia and spinal muscular atrophy (SMA) has accelerated this trend. In-vivo gene therapy, in particular, has gained significant traction as it offers direct treatment administration without ex vivo manipulation, streamlining the treatment process and enhancing patient outcomes.

Gene-Modified Cell Therapy is the fastest-growing product type, fueled by the increasing success of CAR-T therapies in oncology. With products like Yescarta and Breyanzi achieving commercial success, companies are rapidly expanding R&D in gene-modified modalities including CAR-NK and TCR-T cell therapies. These therapies necessitate complex bioanalytical tests, including transgene integration, immune profiling, and vector copy number analysis, thereby expanding service demands across multiple test types.

Stage of Development by Product Type Outlook

Clinical testing stage dominated this segment due to the regulatory necessity for advanced pharmacokinetic, biodistribution, and immunogenicity assessments in later-stage trials. With increasing numbers of CGT therapies progressing into Phase II/III trials, the demand for bioanalytical services has soared. Clinical testing also includes confirmatory safety and efficacy assessments, aligning with FDA and EMA submission requirements.

Non-clinical testing is growing rapidly, particularly in early-stage companies and academic settings exploring novel gene editing and delivery technologies. These settings rely heavily on preclinical pharmacology, toxicology, and biodistribution studies before initiating human trials. With newer modalities like CRISPR entering preclinical pipelines, non-clinical testing is witnessing renewed focus and investment.

Indication Outlook

Oncology dominated the indication segment, driven by the robust pipeline of CGT products targeting hematologic malignancies and solid tumors. CAR-T therapies targeting CD19 and BCMA antigens have transformed treatment paradigms in leukemia and multiple myeloma. These therapies require multi-parametric flow cytometry, gene expression, and cytokine profiling—all of which necessitate bioanalytical support. The increasing patient acceptance and high reimbursement potential also support sustained growth in this area.

Rare Diseases are the fastest-growing indication, propelled by regulatory incentives like orphan drug designation and fast-track approvals. Gene therapy has shown promise in conditions like Duchenne muscular dystrophy and Leber congenital amaurosis, where standard treatments were previously unavailable. These therapies demand robust and sensitive analytical methods to demonstrate long-term efficacy and safety, offering ample opportunities for specialized bioanalytical service providers.

Regional Analysis

North America dominated the regional landscape due to its advanced healthcare infrastructure, a large concentration of biotech firms, and supportive regulatory frameworks. The presence of key market players, including Labcorp, ICON plc, and Charles River Laboratories, has contributed to the region’s leadership. Furthermore, the U.S. FDA’s proactive guidance on CGT product development has instilled confidence in investors and developers alike. With a growing number of academic collaborations and clinical trial centers, North America remains the epicenter for CGT testing services.

Asia Pacific is the fastest-growing region, driven by increasing government investments in biotechnology and clinical research infrastructure. Countries like China and India are witnessing a boom in CGT clinical trials and manufacturing. Strategic partnerships between local research institutes and global CROs are enabling the establishment of GLP/GMP-compliant testing laboratories. Additionally, the region’s lower cost of operations and rising patient pool offer a compelling value proposition for bioanalytical service providers expanding their global footprint.

Some of The Prominent Players in The Cell and gene therapy bioanalytical testing services market Include:

- BioAgilytix Labs

- KCAS Bioanalytical Services

- IQVIA, Inc.

- Laboratory Corporation of America Holdings

- Pharmaceutical Product Development, Inc. (Thermo Fisher Scientific Inc.)

- Prolytix

- Pharmaron

- Charles River Laboratories

- Syneos Health

- SGS SA

- Intertek Group Plc

Recent Developments

-

In March 2025, ICON plc announced the expansion of its bioanalytical lab in Dublin to accommodate increasing demand for CGT bioanalytical services, including gene expression and immunogenicity testing.

-

In January 2025, Charles River Laboratories launched a new viral vector characterization platform tailored for ex vivo gene-modified therapies, enhancing analytical capabilities for early-phase studies.

-

In November 2024, Labcorp collaborated with a Korean biotech firm to provide specialized CGT testing services across Asia Pacific, focusing on CAR-T and in-vivo gene therapies.

-

In October 2024, WuXi AppTec introduced a comprehensive CGT testing suite including ddPCR, NGS-based assays, and T-cell functionality analysis for global clients.

-

In August 2024, Eurofins Scientific inaugurated a state-of-the-art CGT testing facility in the U.S., integrating high-throughput immunogenicity testing with regulatory compliance features.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Test Type

- Bioavailability & Bioequivalence Studies

- Pharmacokinetics

- Pharmacodynamics

- Other Test Type

By Product Type

- Gene-Modified Cell Therapy

-

- CAR T-cell therapies

- CAR-NK cell therapy

- TCR-T cell therapy

- Other

By Stage of Development by Product Type

-

- Gene Therapy

- Gene-Modified Cell Therapy

- Cell Therapy

-

- Gene Therapy

- Gene-Modified Cell Therapy

- Cell Therapy

By Indication

- Oncology

- Infectious Diseases

- Neurological disorders

- Rare Diseases

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)