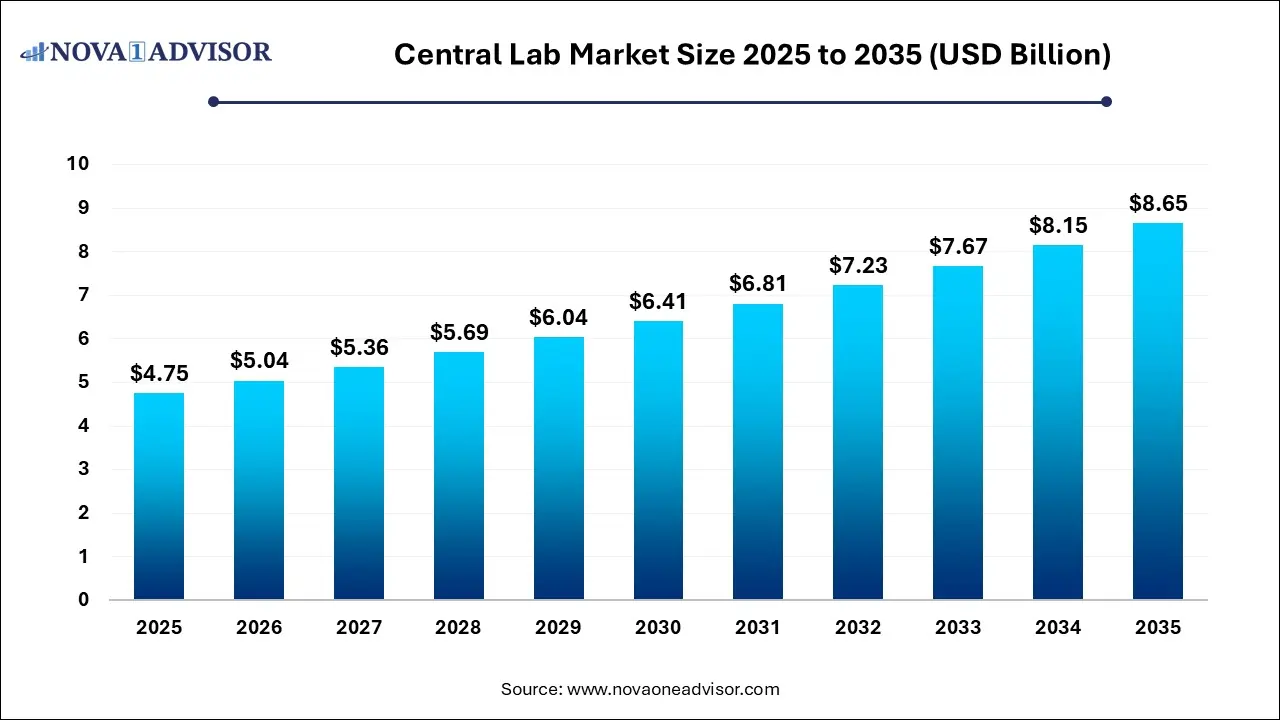

Central Lab Market Size and Growth

The global central lab market size was valued at USD 4.75 billion in 2025 and is projected to surpass around USD 8.65 billion by 2035, registering a CAGR of 6.18% over the forecast period of 2025 to 2035.

Central Lab Market Key Takeaways

- North America dominated the market with a share of 40.03% in 2024.

- Asia Pacific is expected to witness the fastest growth in the market with a CAGR of 7.74% over the forecast period

- Biomarker services held the largest market share of 39.02% in 2024 of the market.

- Genetic services segment is anticipated to grow at the fastest growth rate over the forecast period with a CAGR of 7.67%.

- Pharmaceutical companies end-use segment held the largest market share of 49% in 2024 of the market.

- Biotechnology companies segment is anticipated to grow at the fastest growth rate in the market with a CAGR of 7.10% over the forecast period.

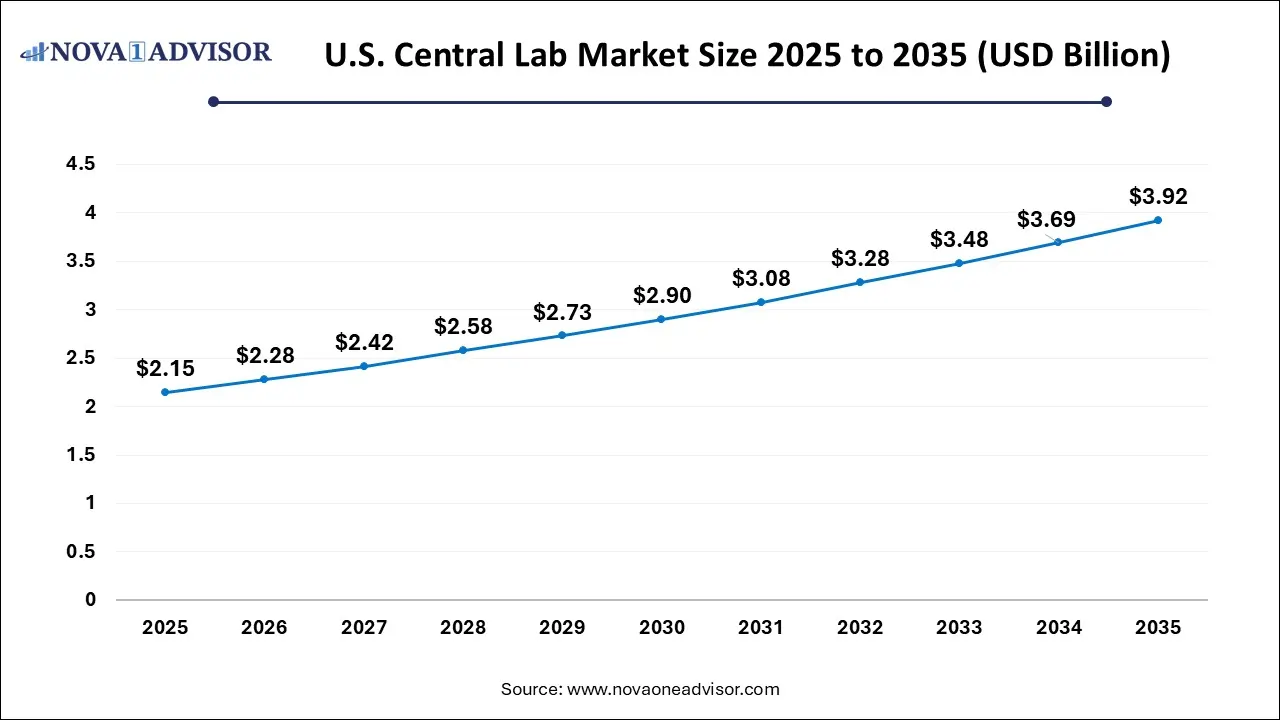

U.S. Central Lab Market Size, Industry Report, 2035

The U.S. central lab market size was valued at USD 2.15 billion in 2025 and is anticipated to reach around USD 3.92 billion by 2035, growing at a CAGR of 6.20% from 2025 to 2035.

North America dominated the Central Lab Market, led by the United States’ robust clinical research ecosystem, abundant funding for biomedical research, and presence of major pharmaceutical and biotechnology companies. Regulatory frameworks like the FDA's 21 CFR Part 11 guidelines emphasize data integrity and quality, making the reliability and compliance capabilities of central labs indispensable. Leading players such as Labcorp Drug Development and IQVIA have extensive operations across North America, offering cutting-edge services that encompass genetic testing, microbiology, special chemistry, and biomarker research. Additionally, the increasing number of early-phase clinical trials in oncology, neurology, and infectious diseases continues to fuel demand for central laboratory services.

On the other hand, Asia-Pacific is the fastest-growing region in the Central Lab Market. Factors driving this growth include cost-effective clinical trial operations, increasing patient diversity, rising investments in healthcare infrastructure, and regulatory reforms promoting international clinical research. Countries like China, India, South Korea, and Australia are rapidly becoming preferred destinations for global clinical trials. Leading CROs and central labs are establishing new facilities and partnerships in the region to tap into this burgeoning market. For example, in early 2025, a major central lab announced the opening of a new genomic research facility in Bangalore, India, aiming to support regional biotech and pharmaceutical companies with advanced genetic and biomarker testing services.

U.S. central lab market trends

The growing demand for genetic therapies for treating a wide range of cancers along with technological advancements in the genetic engineering sector has boosted the market expansion. Moreover, rapid investment by government for developing the biopharma industry is playing a vital role in shaping the industrial landscape.

China central lab market analysis

The rising demand for advanced therapeutics to treat viral diseases coupled with increase in number of biopharma companies has boosted the market expansion. Also, rapid investment by healthcare companies for opening up new manufacturing plants is contributing to the industry in a positive manner.

Why Europe is a significant contributor of the central lab market?

Europe is a significant contributor of the central lab industry. The rising prevalence of chronic diseases in numerous countries including Germany, France, Italy, UK, Denmark and some others has increased the demand for advanced therapeutics, thereby driving the market expansion. Also, rapid investment by biotech companies for opening up new research and development centers is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Genmab A/S, BioNTech SE, Novo Nordisk and some others is expected to boost the growth of the central lab market in this region.

Germany central lab market analysis

The growing emphasis of the healthcare companies to develop a wide range of genetic therapeutics for treating chronic diseases has driven the market expansion. Additionally, technological advancements in the biotechnology sector coupled with rapid investment by market players for advancing R&D of vaccines is playing a prominent role in shaping the industry in a positive manner.

What is the role of Latin America in the central lab industry?

Latin America has played a prominent role in the central lab market. The increase in number of pharmaceutical brands in several nations such as Brazil, Argentina, Peru, Venezuela and some others has driven the market expansion. Also, rapid investment by government for developing the genetic engineering sector is contributing to the industry in a positive manner. Moreover, the presence of numerous biotechnology brands such as Apolo Biotech, AMEGA Biotech, Autem Therapeutics and some others is expected to foster the growth of the central lab market in this region.

Argentina central lab market trends

The rising focus of biotechnology brands to develop a wide range of RNA-based therapies coupled with technological advancements in the pharma sector has boosted the industrial growth. Also, numerous government initiatives aimed at developing the genetic engineering sector is playing a vital role in shaping the industrial landscape.

Why Middle East and Africa held a notable share of the central lab market?

Middle East and Africa held a notable share of the industry. The rising demand for high-quality medicines in numerous countries including UAE, Saudi Arabia, South Africa, Qatar and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the biotechnology sector is playing a vital role in shaping the industrial landscape. Moreover, the presence of several biopharma companies such as G42 Healthcare, Julphar, Hayat Biotech and some others is expected to propel the growth of the central lab market in this region.

UAE central lab market analysis

The growing emphasis of biotech companies to develop advanced therapeutics for treating chronic diseases along with technological advancements in the healthcare sector has driven the market expansion. Additionally, the rise in number of academic & research institutes coupled with rapid expansion of the pharma industry is playing a vital role in shaping the industrial landscape.

Market Overview

The Central Lab Market is an essential pillar of the healthcare and clinical research sectors, serving as a centralized resource for the testing, processing, and analysis of biological samples. These labs provide a range of standardized services to pharmaceutical companies, biotechnology firms, and academic research centers engaged in clinical trials and medical studies. Central labs are pivotal in ensuring the consistency, accuracy, and reliability of laboratory results, which are critical for regulatory submissions and the eventual approval of new therapies.

Recent years have witnessed a tremendous surge in clinical trials, propelled by the growing need for innovative treatments for chronic diseases, emerging infections, and rare disorders. With the complexity of trials increasing, the need for centralized laboratory services offering specialized capabilities such as genetic analysis, biomarker validation, microbiology testing, and advanced chemical assays has also expanded. The COVID-19 pandemic further underscored the importance of fast, reliable, and scalable central lab operations, pushing companies to invest in automation, digitalization, and global expansion.

Central lab market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to numerous government initiatives aimed at developing the pharmaceutical industry coupled with rapid investment by market players for strengthening the biomarker sector.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and launches. Several central lab companies such as LabConnect, Cerba Research, Eurofins Scientific and some others have started investing rapidly for developing the genetic engineering sector.

- Startup Ecosystem: Various startup brands are engaged in developing advanced biomarker solutions in different parts of the world. The prominent startup companies dealing in central lab comprises of Vyome Therapeutics, String Bio, Arthro Biotech and some others.

Major Trends in the Market

-

Rising Adoption of Decentralized and Hybrid Clinical Trials: While central labs remain crucial, there is a growing collaboration with decentralized trial models.

-

Integration of Artificial Intelligence and Machine Learning: AI is increasingly used to optimize sample analysis, predict trial outcomes, and enhance operational efficiency.

-

Focus on Biomarker-driven Studies: The surge in personalized medicine is driving demand for biomarker services in clinical trials.

-

Expansion into Emerging Markets: Central labs are establishing facilities in Asia-Pacific and Latin America to tap into growing clinical research activity.

-

Automation and Digital Transformation: Implementation of Laboratory Information Management Systems (LIMS) and robotics to reduce errors and accelerate processes.

-

Strategic Collaborations and Mergers: Companies are partnering or merging to expand capabilities and geographic reach.

-

Regulatory Emphasis on Data Integrity and Quality Standards: Enhanced focus on compliance with GLP, GCP, and CAP accreditation standards.

Central Lab Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 5.04 Billion |

| Market Size by 2035 |

USD 8.65 Billion |

| Growth Rate From 2025 to 2035 |

CAGR of 6.18% |

| Forecast Period |

2025 to 2035 |

| Segments Covered |

By Product Type, and By End User |

| Base Year |

2024 |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

ACM Global Laboratories; Labconnect; Cerba Research; Eurofins Scientific; Medicover Integrated Clinical Services (MICS) (Synevo Central Labs); Versiti (Cenetron); A.P. Møller Holding A/S (Unilabs); Ampersand Capital Partners (Pacific Biomarkers); Lambda Therapeutics Research Ltd; Cirion Biopharma Research Inc. |

Central Lab Market By Product Type Insights

Genetic Services dominated the product type segment, driven by the surge in genetic and genomic research, particularly in oncology, rare diseases, and infectious diseases. With next-generation sequencing (NGS) technologies becoming more accessible and affordable, genetic testing services have become integral to clinical trials for biomarker discovery, patient stratification, and companion diagnostics development. Central labs offering comprehensive genetic services, including whole-genome sequencing, gene panels, and pharmacogenomic assays, are increasingly favored by pharmaceutical and biotech companies looking to expedite personalized therapy programs.

Meanwhile, Biomarker Services are the fastest-growing product segment, fueled by the boom in precision medicine initiatives. Biomarker-driven trials are now considered the gold standard for developing targeted therapies, especially in oncology and immunology. Central labs are expanding their biomarker service portfolios to include novel biomarkers, immune monitoring panels, and predictive diagnostic assays. Collaborations between central labs and biopharma companies to co-develop validated biomarker assays are becoming commonplace, reflecting the explosive growth potential in this segment.

Central Lab Market By End-use Insights

Pharmaceutical Companies dominated the end user segment, accounting for the largest share of the Central Lab Market. These companies conduct the majority of global clinical trials, seeking comprehensive laboratory services to ensure accurate, reliable, and regulatory-compliant sample analysis. Central labs support pharmaceutical giants by managing complex logistical operations, multi-analyte testing, and data integration across international trial sites. Their ability to deliver high-quality, standardized results across geographies makes them indispensable partners in drug development programs.

Conversely, Biotechnology Companies represent the fastest-growing end-user segment. The biotech sector has witnessed remarkable growth, fueled by venture capital investments, technological innovations, and the surge in orphan drug development. Biotech firms often focus on niche therapeutic areas requiring highly specialized laboratory testing capabilities. Central labs that offer flexible, customized services, and can handle novel assay development, are particularly attractive to biotech startups and mid-sized companies navigating early-stage clinical trials.

Central Lab Market Top Key Companies:

- ACM Global Central Lab

- ICON

- PPD

- Barc Lab (Cerba Research)

- Bioscientia (Sonic Healthcare)

- Celerion

- CIRION BioPharma Research

- Clinical Reference Laboratory

- Lab Corp

- Eurofins Central Laboratory

- Frontage Laboratories, Inc

- icon central labs

- INTERLAB Central Lab Services

- LabConnect

- Medpace

Recent Developments

- In November 2025, Servier India collaborated with Strand Life Sciences. This collaboration is done for launching biomarker IDH1 and IDH2 testing in India.

- In October 2025, Alamar Biosciences launched NULISAqpcr BD-pTau217 Assay. This assay is developed for early detection of Alzheimer’s disease.

- In August 2025, Aptamer Group launched biomarker discovery service. This new service is designed for researchers to identify new diseases.

Central Lab Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the central lab market.

By Product Type

- Genetic Services

- Biomarker Services

- Microbiology Services

- Special Chemistry Services

- Clinical Research & Trial Services

- Others

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Academic & Research Institutes

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)