Contract Research Organization Services Market Size, Share, Growth, Report 2025 to 2034

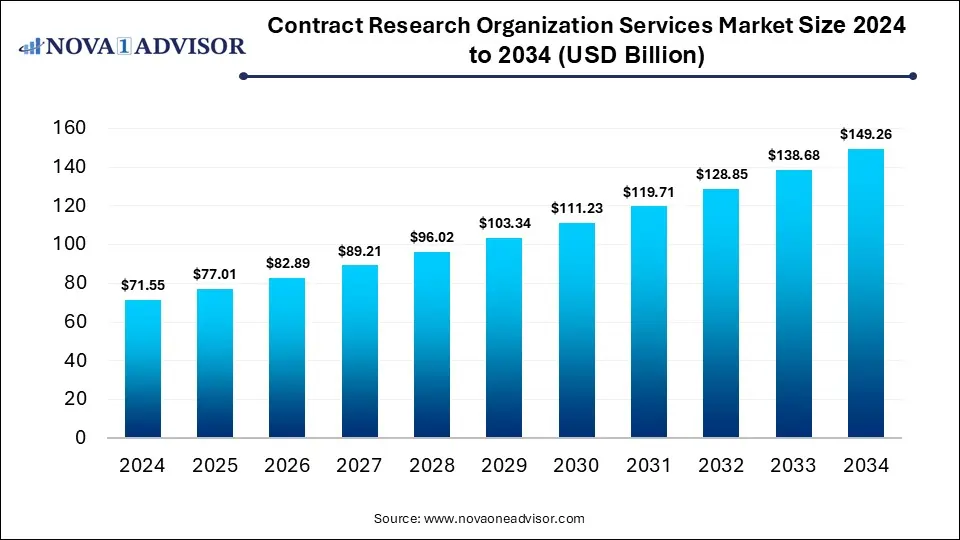

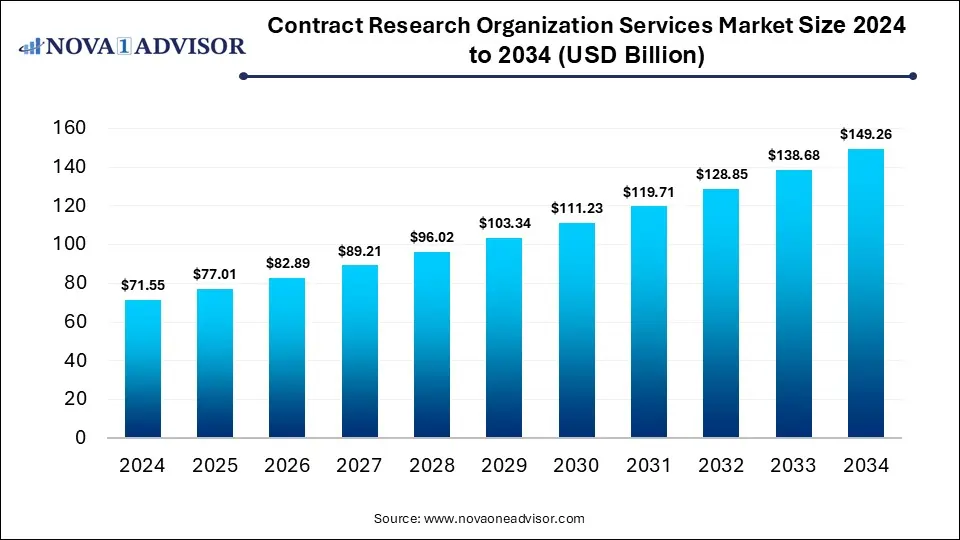

The global contract research organization services market size is calculated at USD 71.55 billion in 2024, grows to USD 77.01 billion in 2025, and is projected to reach around USD 149.26 billion by 2034, growing at a CAGR of 7.62% from 2025 to 2034. The market is growing due to the increasing outsourcing of R&D activities by pharmaceutical and biotech companies to reduce costs and accelerate drug development timelines. Rising clinical trial volumes and demand for specialized expertise further drive market expansion.

Key Takeaways

- North America dominated the contract research organization services market with a revenue share in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By service type, the drug discovery segment led the market with the largest revenue share in 2024.

- By service type, the preclinical segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the oncology segment held the largest market share in 2024.

- By end user, the pharmaceutical and biotechnological segment held the highest market share in 2024.

- By end user, the academic and research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Contract Research Organization Services?

Contract research organization services refer to outsourced research support provided to pharmaceutical, biotechnology, and medical device companies, offering expertise in clinical trials, regulatory affairs, data management, and drug development to streamline and accelerate R&D processes. The contract research organization services market is growing due to the increasing outsourcing of R&D activities by pharmaceutical and biotechnology firms to reduce operational costs and improve efficiency. Rising demand for new drug development, complex clinical trials, and regulatory compliance has boosted CRO adoption. Additionally, the growth of personalized medicine and advancements in clinical technologies are driving partnerships with CRO’s supporting faster and cost-effective drug discovery and development globally.

- For Instance, In November 2024, Novotech partnered with Beijing Biostar Pharmaceuticals Co., Ltd. to strengthen and accelerate the company’s clinical research and development initiatives.

What are the Key trends in the Contract Research Organization Services Market in 2024?

- In February 2024, Charles River Laboratories collaborated with Wheeler Bio to accelerate the transition from therapeutic discovery to manufacturing for its clients.

- In January 2024, WuXi Biologics partnered with BioNTech SE to develop potential next-generation therapies by identifying new investigational monoclonal antibodies.

How Can AI Affect the Contract Research Organization Services Market?

AI is transforming the market by enhancing data analysis, improving clinical trial design, and accelerating drug discovery processes. It enables faster patient recruitment, predictive modeling, and real-time monitoring, reducing trial costs and timelines. AI-driven automation also minimizes human error and boosts decision-making accuracy. As a result, CROs are increasingly integrating AI technologies to deliver more efficient, precise, and cost-effective research and development solutions for pharmaceutical and biotech companies.

Report Scope of Contract Research Organization Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 77.01 Billion |

| Market Size by 2034 |

USD 149.26 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.63% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service Type, By Application, and By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

BIO Agile Therapeutics, Novotech Health Holding, Parexel International, Firma Clinical Research, Charles River Laboratories, Axcent Advanced Analytics, Geneticist In., Dove Quality Solutions, Frontage Holding Corporation, WuXi AppTec |

Market Dynamics

Driver

Growing number of Clinical Trials

The increasing number of clinical trials globally is a key driver of the contract research organizations' services market. As pharmaceutical and biotech firms expand their pipelines to meet rising healthcare demands, they increasingly depend on CROs for expertise in trial management, data analysis, and regulatory compliance. CROs help streamline operations, reduce costs, and accelerate timelines. This surge in clinical research, particularly for complex diseases, continues to boost the demand for CRO services worldwide.

Restraint

Stringent Regulatory Requirements

Stringent regulatory requirements significantly limit growth in the contract research organization services market. CROs must comply with diverse rules across countries, covering patient safety, clinical trial protocols, and data reporting standards. Navigating these regulations increases operational costs, extends timelines, and adds administrative burdens. Smaller or mid-sized CROs may struggle to meet such stringent standards, limiting their global expansion. Consequently, regulatory challenges slow market growth and adoption of outsourced research services.

Opportunity

Adoption of Advanced Technologies

The adoption of advanced technologies, including AI, machine learning, and digital platforms, offers a key opportunity in the contract research organizations' services market. These tools enhance clinical trial efficiency through faster data analysis, predictive modelling, and real-time monitoring, while reducing costs and minimizing errors. By streamlining drug development processes, CROs can provide a more precise, timely, and cost-effective solution. As pharmaceutical and biotech companies increasingly demand innovative R&D approaches, technology integration is set to drive significant market growth.

- For Instance, In March 2024, Novotech integrated AI and machine learning to optimize clinical trial designs, improving protocol efficiency and increasing success rates in drug development.

Segmental Insights

What made the Drug Discovery Segment Dominant in the Contract Research Organization Services Market in 2024?

In 2024, the drug discovery segment held the largest revenue share in the market due to the rising demand for new and innovative therapies. Pharmaceutical and biotechnology companies increasingly outsourced early-stage research, including target identification, lead optimization, and preclinical studies, to CROs for cost efficiency and expertise. The complexity of drug discovery, coupled with advancements in biologics, personalized medicine, and AI-driven research tools, further drives the reliance on CROs, boosting revenue in this segment.

The preclinical segment is expected to grow at the fastest CAGR in the contract research organization services market due to increasing demand for thorough safety and efficacy testing before clinical trials. Rising investments in novel drug development, biologics, and personalized therapies are driving the need for comprehensive preclinical studies. Additionally, advancements in in-vitro and in-vivo models, automation, and AI-driven testing are improving efficiency and reducing timelines, making CROs a preferred choice for conducting preclinical research globally.

How did Oncology Dominate the Contract Research Organization Services Market in 2024?

In 2024, the oncology segment held the highest market share in the market due to the rising prevalence of cancer and increasing demand for targeted therapies and immunotherapies. Pharmaceutical and biotechnology companies are heavily investing in oncology drug development, which requires complex, multi-phase clinical trials. CROs provide specialized expertise, advanced technology, and global trial management capabilities, enabling efficient study execution. This high demand for oncology-focused R&D drives the segment's leading market position.

Why the Pharmaceutical and Biotechnological Segment Dominated the Contract Research Organization Services Market in 2024?

In 2024, the pharmaceutical and biotechnology segment held the highest market share in the market due to the growing number of drug development programs and increasing R&D investment. These companies outsourcing clinical trials, preclinical studies, and regulatory processes to CROs to reduce costs, accelerate timelines, and access specialized expertise. The rising focus on biologics, personalized medicine, and innovative therapies further drives the reliance on CROs, solidifying their dominance as the largest end-user segment.

The academic and research institutes segment is expected to grow at the fastest CAGR in the contract research organization services market due to increasing collaborations with CROs for advanced research and clinical studies. Rising funding for medical research, growing focus on innovative therapies, and the need for specialized expertise in preclinical and translational studies are driving this trend. By outsourcing complex research activities, academic institutions can accelerate discoveries, optimize resources, and enhance the efficiency of their R&D programs, fueling market growth.

Regional Insights

How is North America contributing to the Expansion of the Contract Research Organization Services Market?

North America dominated the market in 2024 due to the presence of a large number of pharmaceutical and biotechnology companies, advanced healthcare infrastructure, and high R&D investments. The region's strong regulatory, well established clinical trial networks, and early adoption of advanced technologies such as AI and digital platforms further support CRO activities. Additionally, rising demand for innovative therapies, particularly in oncology and rare diseases, drives the outsourcing of research and development, contributing to North America’s leading revenue share.

How is Asia-Pacific Accelerating the Contract Research Organization Services Market?

The Asia Pacific is anticipated to grow at the fastest CAGR in the market during the forecast period due to increasing pharmaceutical and biotechnology R&D activities, rising clinical trial outsourcing, and cost advantages in the region. Rapidly developing healthcare infrastructure, supportive government policies, and a large patient pool for clinical studies further drive growth. Additionally, the expansion of biologics, personalized medicine, and emerging biotech companies in countries like China and India is contributing to the region's accelerating market adoption.

Top Companies in the Contract Research Organization Services Market

- BIO Agile Therapeutics

- Novotech Health Holding

- Parexel International

- Firma Clinical Research

- Charles River Laboratories

- Axcent Advanced Analytics

- Geneticist In.

- Dove Quality Solutions

- Frontage Holding Corporation

- WuXi AppTec

Recent Developments in the Contract Research Organization Services Market

- In May 2025, Questex’s Fierce Biotech announced the finalists for the second annual Fierce CRO Awards, highlighting the essential role of CROs in advancing life sciences research and improving patient outcomes.

- In May 2025, Julius Clinical and Peachtree BioResearch Solutions merged to create a fully integrated clinical research organization, aiming to deliver scientific and operational excellence while strengthening expertise in therapeutic areas, particularly in CNS.

Segments Covered in the Report

By Service Type

- Drug Discovery

- Preclinical Studies

- Phase I

- Phase II

- Phase III

- Phase IV

- Others

By Application

- Oncology

- Cardiology

- Infectious Disease

- Metabolic Disorders

- Others

By End User

- Pharmaceutical & Biotechnological Companies

- Medical Device Companies

- Academic & Research Institutes

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global CRO Services Market Size (USD Billion) by Service Type, 2024–2034

- Table 2: Global CRO Services Market Size (USD Billion) by Application, 2024–2034

- Table 3: Global CRO Services Market Size (USD Billion) by End User, 2024–2034

- Table 4: North America Market Size (USD Billion) by Service Type, 2024–2034

- Table 5: North America Market Size (USD Billion) by Application, 2024–2034

- Table 6: North America Market Size (USD Billion) by End User, 2024–2034

- Table 7: U.S. Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 8: Canada Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 9: Mexico Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 10: Europe Market Size (USD Billion) by Service Type, 2024–2034

- Table 11: Europe Market Size (USD Billion) by Application, 2024–2034

- Table 12: Europe Market Size (USD Billion) by End User, 2024–2034

- Table 13: Germany Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 14: France Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 15: UK Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 16: Italy Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 17: Asia Pacific Market Size (USD Billion) by Service Type, 2024–2034

- Table 18: Asia Pacific Market Size (USD Billion) by Application, 2024–2034

- Table 19: Asia Pacific Market Size (USD Billion) by End User, 2024–2034

- Table 20: China Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 21: Japan Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 22: India Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 23: South Korea Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 24: Southeast Asia Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 25: Latin America Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 26: Brazil Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 27: Middle East & Africa Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 28: GCC Countries Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 29: Turkey Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

- Table 30: Africa Market Size (USD Billion) by Service Type, Application & End User, 2024–2034

List of Figures

- Figure 1: Global Market Share by Service Type, 2024

- Figure 2: Global Market Share by Application, 2024

- Figure 3: Global Market Share by End User, 2024

- Figure 4: North America Market Share by Service Type, 2024

- Figure 5: North America Market Share by Application, 2024

- Figure 6: North America Market Share by End User, 2024

- Figure 7: U.S. Market Share by Service Type, 2024

- Figure 8: U.S. Market Share by Application, 2024

- Figure 9: U.S. Market Share by End User, 2024

- Figure 10: Canada Market Share by Service Type, 2024

- Figure 11: Canada Market Share by Application, 2024

- Figure 12: Canada Market Share by End User, 2024

- Figure 13: Mexico Market Share by Service Type, 2024

- Figure 14: Mexico Market Share by Application, 2024

- Figure 15: Mexico Market Share by End User, 2024

- Figure 16: Europe Market Share by Service Type, 2024

- Figure 17: Europe Market Share by Application, 2024

- Figure 18: Europe Market Share by End User, 2024

- Figure 19: Germany Market Share by Service Type, 2024

- Figure 20: Germany Market Share by Application, 2024

- Figure 21: Germany Market Share by End User, 2024

- Figure 22: France Market Share by Service Type, 2024

- Figure 23: France Market Share by Application, 2024

- Figure 24: France Market Share by End User, 2024

- Figure 25: UK Market Share by Service Type, 2024

- Figure 26: UK Market Share by Application, 2024

- Figure 27: UK Market Share by End User, 2024

- Figure 28: Italy Market Share by Service Type, 2024

- Figure 29: Italy Market Share by Application, 2024

- Figure 30: Italy Market Share by End User, 2024

- Figure 31: Asia Pacific Market Share by Service Type, 2024

- Figure 32: Asia Pacific Market Share by Application, 2024

- Figure 33: Asia Pacific Market Share by End User, 2024

- Figure 34: China Market Share by Service Type, 2024

- Figure 35: China Market Share by Application, 2024

- Figure 36: China Market Share by End User, 2024

- Figure 37: Japan Market Share by Service Type, 2024

- Figure 38: Japan Market Share by Application, 2024

- Figure 39: Japan Market Share by End User, 2024

- Figure 40: India Market Share by Service Type, 2024

- Figure 41: India Market Share by Application, 2024

- Figure 42: India Market Share by End User, 2024

- Figure 43: South Korea Market Share by Service Type, 2024

- Figure 44: South Korea Market Share by Application, 2024

- Figure 45: South Korea Market Share by End User, 2024

- Figure 46: Southeast Asia Market Share by Service Type, 2024

- Figure 47: Southeast Asia Market Share by Application, 2024

- Figure 48: Southeast Asia Market Share by End User, 2024

- Figure 49: Latin America Market Share by Service Type, 2024

- Figure 50: Latin America Market Share by Application, 2024

- Figure 51: Brazil Market Share by Service Type, 2024

- Figure 52: Brazil Market Share by Application, 2024

- Figure 53: Brazil Market Share by End User, 2024

- Figure 54: Middle East & Africa Market Share by Service Type, 2024

- Figure 55: Middle East & Africa Market Share by Application, 2024

- Figure 56: Middle East & Africa Market Share by End User, 2024

- Figure 57: GCC Countries Market Share by Service Type, 2024

- Figure 58: GCC Countries Market Share by Application, 2024

- Figure 59: GCC Countries Market Share by End User, 2024

- Figure 60: Turkey Market Share by Service Type, 2024

- Figure 61: Turkey Market Share by Application, 2024

- Figure 62: Turkey Market Share by End User, 2024

- Figure 63: Africa Market Share by Service Type, 2024

- Figure 64: Africa Market Share by Application, 2024

- Figure 65: Africa Market Share by End User, 2024