Diabetes Management Apps Market Size and Trends

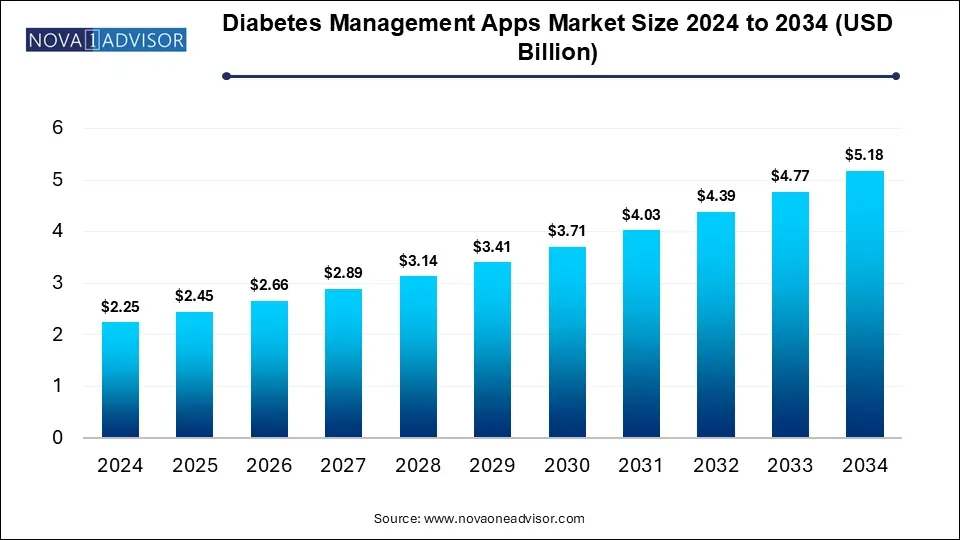

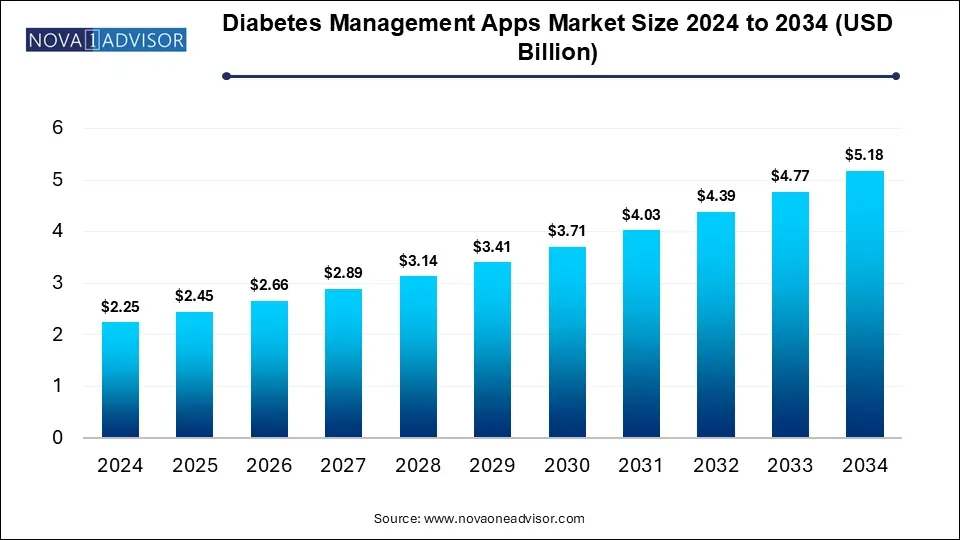

The Diabetes Management Apps Market size was exhibited at USD 2.25 billion in 2024 and is projected to hit around USD 5.18 billion by 2034, growing at a CAGR of 8.7% during the forecast period 2025 to 2034.

Key Takeaways:

- In terms of type, Type 2 diabetes emerged as the leading segment, accounting for 52% of the total market revenue in 2024.

- On the basis of platform, Android-based applications held the highest market share in 2024, contributing 51% to the overall revenue.

- When categorized by functionality, blood glucose monitoring apps represented the most prominent segment, generating 52% of the market revenue in 2024.

- Considering the subscription model, subscription-based services led the market in 2024, making up 34% of the total revenue.

- Among the end-user categories, patients formed the largest user group, with their segment commanding 50% of the revenue share in 2024.

- Regionally, North America held the dominant position in the diabetes management apps market, capturing 38% of the global revenue in 2024.

Market Overview

The global diabetes management apps market is undergoing significant transformation driven by rising diabetes prevalence, rapid digitization of healthcare, and increasing consumer inclination toward self-care management. Diabetes, a chronic metabolic disorder affecting blood sugar levels, necessitates continuous monitoring, lifestyle adaptation, and medication. The emergence of digital health platforms, particularly mobile applications, has redefined diabetes care by offering real-time monitoring, educational tools, treatment adherence features, and health data integration with wearables and electronic medical records.

As of 2024, over 540 million adults are living with diabetes globally, a figure expected to exceed 640 million by 2034. This escalating burden necessitates scalable, efficient, and patient-centric solutions. Diabetes management apps fulfill this need by enabling individuals to track their blood glucose levels, physical activity, diet, medication, and other health metrics from smartphones or connected devices. These apps enhance patient engagement, reduce emergency hospital visits, and facilitate personalized treatment regimens.

Key players such as mySugr (a Roche company), One Drop, Glooko, and Health2Sync are actively expanding their offerings with AI-driven analytics, cloud integrations, and telehealth features. Furthermore, increasing penetration of smartphones, favorable reimbursement frameworks, and growing awareness about digital health are poised to sustain market expansion through the next decade.

Major Trends in the Market

-

Integration with Wearable Devices: Apps are increasingly being integrated with CGM (continuous glucose monitoring) and smartwatches for real-time data synchronization.

-

AI and Machine Learning: Apps utilize AI for personalized alerts, predictive analytics, and insulin dosage optimization.

-

Gamification of Health Behaviors: Use of gamified elements to enhance user engagement and long-term app retention.

-

Interoperability with EHRs: Apps offer seamless data exchange with electronic health records to assist healthcare providers in patient management.

-

Voice Assistant and Chatbot Features: Natural language processing is being leveraged to provide conversational health coaching and reminders.

-

Teleconsultation Integration: Many platforms now support virtual consultations within the app interface, enhancing access to remote care.

-

Insurance-Driven App Adoption: Insurers are increasingly subsidizing or reimbursing digital diabetes tools to lower long-term treatment costs.

Report Scope of Diabetes Management Apps Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.45 Billion |

| Market Size by 2034 |

USD 5.18 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Platform, Functionality, End use, Subscription Model, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott; Dexcom, Inc.; Medtronic; Insulet Corporation; F. Hoffmann-La Roche Ltd; Glooko, Inc.; Diabetes: M; DarioHealth Corp.; LifeScan IP Holdings, LLC; Glucose Buddy (Azumio) |

Market Driver: Rising Global Diabetes Prevalence

The most compelling driver for the diabetes management apps market is the surging global prevalence of diabetes, particularly Type 2 diabetes. Sedentary lifestyles, aging populations, and rising obesity rates have contributed significantly to this chronic condition. According to the International Diabetes Federation (IDF), around 1 in 10 adults were living with diabetes in 2023. The growing diabetic population is fostering demand for solutions that empower patients to monitor and manage their condition independently. Diabetes management apps act as vital enablers in this digital transition, offering patients control over blood glucose monitoring, nutrition tracking, and medication adherence. This driver is further reinforced by increasing smartphone adoption across emerging economies, where access to traditional healthcare may be limited.

Market Restraint: Data Privacy and Regulatory Concerns

Despite their potential, diabetes management apps face serious scrutiny over user data security and regulatory compliance. The apps often handle sensitive health data such as glucose levels, insulin dosages, and personal identifiers, making them prime targets for cyber threats. Furthermore, there is variability in how these apps comply with health regulations such as HIPAA (U.S.), GDPR (EU), and equivalent standards in other regions. Mismanagement or unauthorized sharing of health data can lead to mistrust, legal repercussions, and hinder adoption. Additionally, the lack of standardized regulatory frameworks across countries complicates app deployment and market entry for new players, particularly startups.

Market Opportunity: Integration with Telemedicine and Virtual Care

The post-COVID era has seen a seismic shift toward telehealth services, opening a massive opportunity for diabetes management apps to serve as integrated virtual care platforms. By embedding teleconsultation capabilities and remote monitoring tools, these apps can facilitate end-to-end diabetes care from diagnostics to treatment adjustments. For instance, apps like BlueStar (WellDoc) now offer provider dashboards that synchronize with patient devices, allowing doctors to adjust insulin dosages remotely. This integrated care model not only boosts patient outcomes but also appeals to payers and providers aiming to reduce in-clinic workload and costs. The opportunity is especially potent in underserved or rural areas lacking endocrinology specialists.

Segmental Analysis

Type Outlook

Type 2 Diabetes dominated the market in 2024 and continues to be the largest revenue contributor. This is attributed to the high global prevalence of Type 2 diabetes, which comprises over 90% of all diabetes cases. Individuals with this type often require lifestyle modifications, continuous glucose monitoring, and medication adherence, all of which are supported by diabetes management apps. Popular apps in this segment offer daily check-ins, reminders, and personalized insights to maintain blood sugar levels within the target range. With its typically gradual onset, Type 2 diabetes allows ample time for early intervention, making digital management tools highly valuable.

Pre-diabetes is emerging as the fastest growing segment due to increased public health efforts aimed at prevention and early detection. Millions of individuals globally fall into the pre-diabetic category without knowing it. Digital apps tailored to this group focus on lifestyle coaching, dietary plans, and weight management. Government-backed screening programs and corporate wellness initiatives are increasingly including these apps as part of preventive care frameworks. The growing inclination toward preventive health, particularly among younger and tech-savvy populations, is expected to fuel robust growth in this segment over the forecast period.

Android-based apps led the market share owing to their broader accessibility across global markets. The Android operating system dominates smartphone penetration in emerging markets like India, Brazil, and several African nations. Many app developers target Android due to its open-source flexibility and lower entry barriers. Moreover, companies often launch Android versions first to quickly scale user acquisition in price-sensitive regions, thereby generating higher initial traction.

Integrated Digital Ecosystems are witnessing the fastest growth as consumers and providers increasingly demand seamless multi-device experiences. These platforms combine mobile apps, wearables, web portals, and even smart insulin pens into unified solutions. Examples include Roche’s mySugr and Dexcom Clarity, which synchronize with various health trackers and electronic records. The rapid expansion of connected healthcare infrastructure supports this trend, with health-tech companies focusing on holistic, cloud-based platforms.

Functionality Outlook

Blood Glucose Monitoring Apps dominate the segment due to their core utility in diabetes care. These apps help users log and visualize their glucose levels throughout the day, set alarms for testing, and sync with glucometers. Such functionalities are essential for daily diabetes management, making them the most utilized category. Many also offer trend reports that can be shared with healthcare providers.

Diet & Nutrition Planning Apps are the fastest growing segment, reflecting a shift toward holistic care that incorporates lifestyle management. These apps allow users to track calorie intake, carbohydrate consumption, and glycemic load, often incorporating barcode scanners and meal recommendations. Their appeal lies in empowering users with actionable insights on food choices that directly impact glucose levels.

Subscription Model Outlook

Freemium models lead in user base and initial adoption, especially among newly diagnosed patients exploring digital health tools. This model allows free access to core features, while offering premium options like analytics and teleconsultations for a fee. Companies benefit from this model by building a large user base and gradually converting loyal users into paying subscribers.

Subscription-Based models are the fastest growing, driven by the inclusion of advanced features such as AI-powered coaching, integration with CGM devices, and physician access. Apps like One Drop and BlueStar have adopted monthly or yearly plans, appealing to users seeking long-term digital diabetes management support.

End Use Outlook

Patients constitute the dominant end-user group, accounting for the largest share due to the app’s primary utility in daily self-management. These users rely on apps for routine monitoring, medication tracking, and receiving alerts. The demand is highest among adults aged 30–60 who often manage the condition alongside work and family responsibilities.

Payers/Insurance Companies represent the fastest growing end-user segment, largely due to the realization that digital tools can lower long-term treatment costs. Several insurance companies now offer subsidized or free access to certified diabetes apps as part of wellness and disease management programs. This trend is particularly visible in the U.S. and parts of Europe.

Regional Analysis

North America dominates the diabetes management apps market, led by the United States. High smartphone penetration, robust healthcare IT infrastructure, and widespread insurance coverage for digital health tools contribute to regional dominance. The U.S. Centers for Medicare & Medicaid Services (CMS) have approved certain mobile apps for diabetes management under reimbursement programs. Additionally, key players like Livongo (Teladoc Health) and Glooko are headquartered in this region, continuously innovating and expanding partnerships with providers and employers.

Asia Pacific is the fastest growing region, driven by an alarming increase in diabetes incidence, rapid urbanization, and rising smartphone usage. Countries like India and China are witnessing mass adoption of mobile health technologies, particularly in metropolitan and semi-urban areas. Government programs such as India’s Ayushman Bharat are exploring digital health integrations, and private insurers are launching diabetes-specific wellness apps to manage population-level risk. The youth-dominant demographics further bolster app engagement rates in this region.

Some of The Prominent Players in The Diabetes Management Apps Market Include:

- Abbott

- Dexcom, Inc.

- Medtronic

- Insulet Corporation

- F. Hoffmann-La Roche Ltd

- Glooko, Inc.

- Diabetes: M

- DarioHealth Corp.

- LifeScan IP Holdings, LLC

Recent Developments

-

January 2025: Roche’s mySugr app received an update with AI-based insulin bolus calculator for Android users, improving accuracy in insulin dosing.

-

March 2025: Glooko partnered with Novo Nordisk to integrate insulin pen data into its app for more accurate dosage tracking.

-

February 2025: One Drop launched its digital coaching program in Canada, expanding its geographic footprint with localized content and regulatory compliance.

-

April 2025: Health2Sync rolled out a feature enabling real-time sharing of glucose data with caregivers and family members in Asia Pacific markets.

-

December 2024: WellDoc announced a partnership with Blue Cross Blue Shield to provide its BlueStar app to over 1 million members with Type 2 diabetes in the U.S.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Type

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Pre-diabetes

By Platform

- iOS

- Android

- Web-based Applications

- Integrated Digital Ecosystems

By Functionality

- Blood Glucose Monitoring Apps

- Insulin Tracking Apps

- Diet & Nutrition Planning Apps

- Physical Activity Tracking Apps

By Subscription model

- Freemium

- Subscription-Based

- One-time Purchase

- Ad-Supported

- Insurance Reimbursement-Based

By End Use

- Patients

- Healthcare Providers

- Payers/Insurance Companies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)