Electro-medical And Electrotherapeutic Apparatus Market Size and Growth

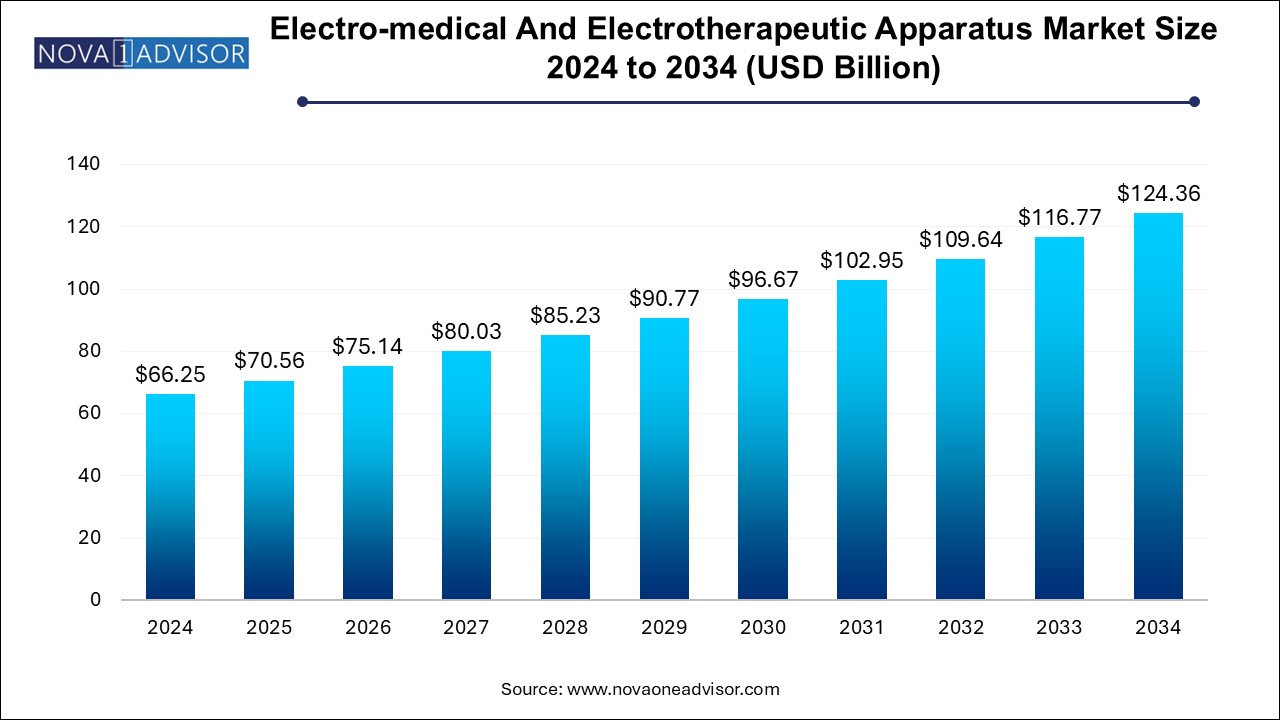

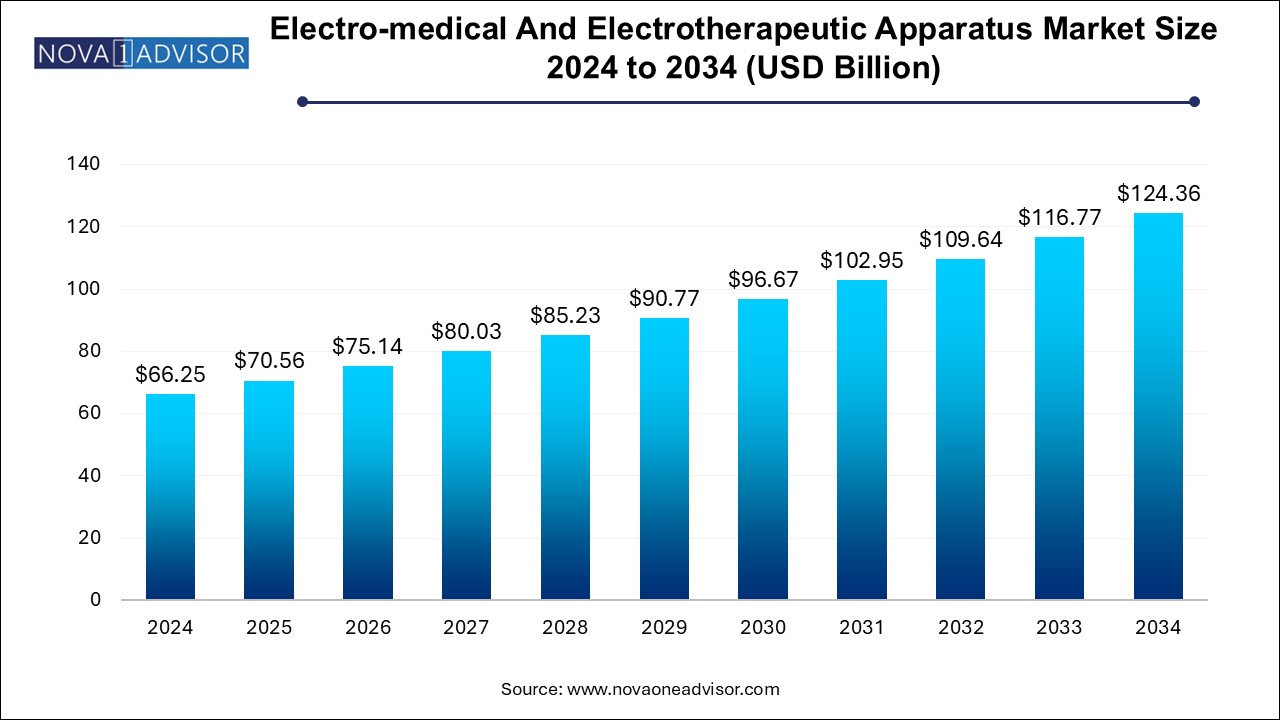

The electro-medical and electrotherapeutic apparatus market size was exhibited at USD 66.25 billion in 2024 and is projected to hit around USD 124.36 billion by 2034, growing at a CAGR of 6.5% during the forecast period 2024 to 2034.

Electro-medical And Electrotherapeutic Apparatus Market Key Takeaways:

- The diagnostic equipment segment dominated the market and held the largest revenue share of 37.9 % in 2024.

- The therapeutic equipment segment is projected to grow at the fastest CAGR over the forecast period.

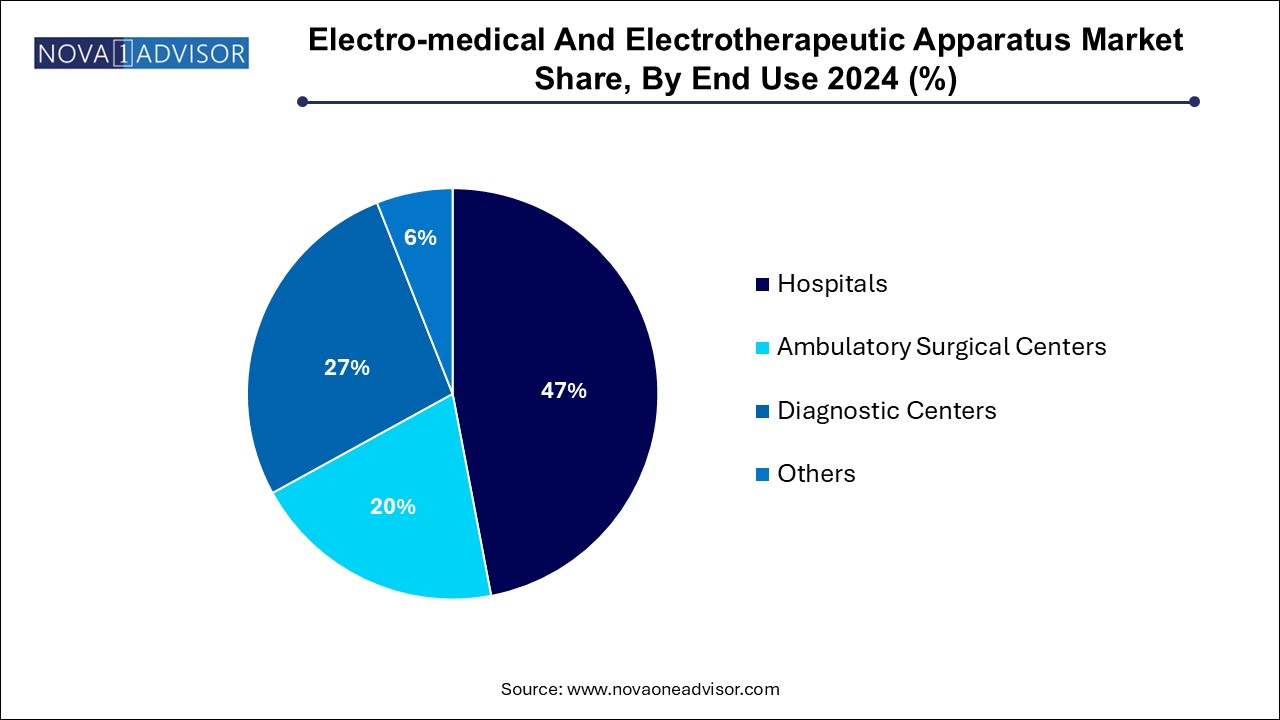

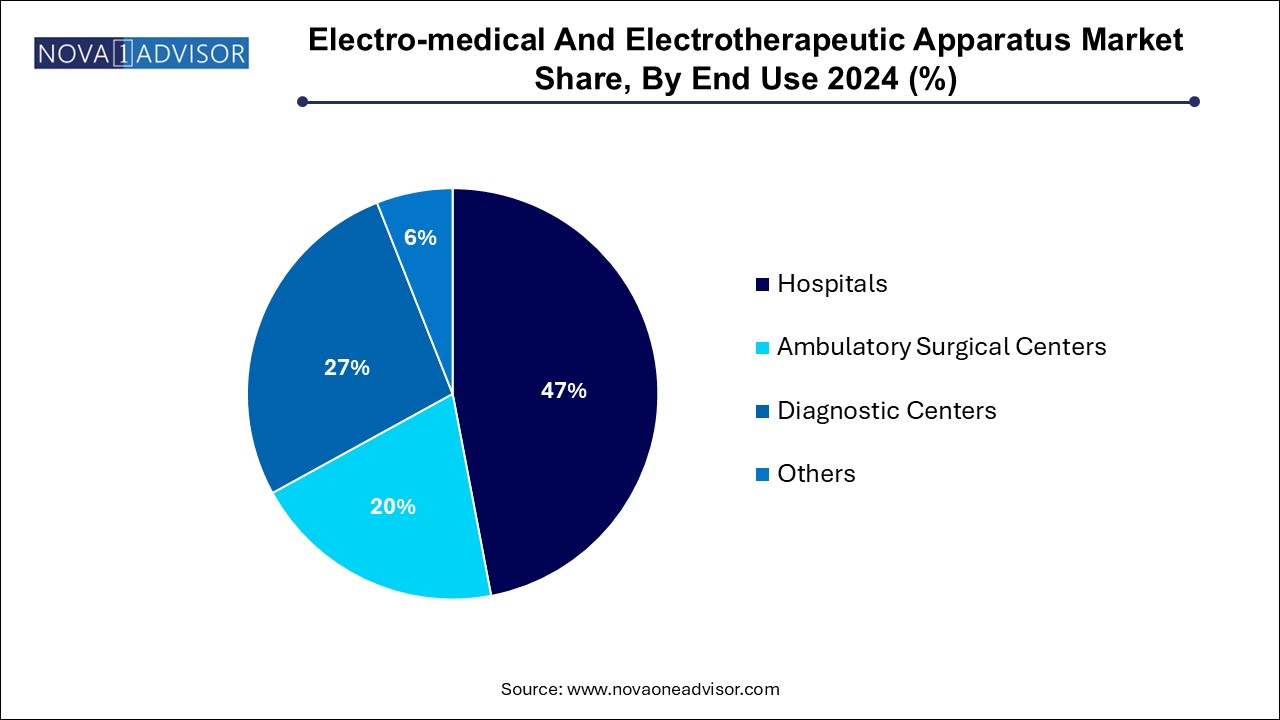

- The hospitals segment held the largest revenue share of 47.0% in 2024.

- The diagnostic centers segment is expected to witness the fastest CAGR during the forecast period.

- The cardiology segment dominated the market and held the largest revenue share of 26.9% in 2024.

- The neurology segment is projected to grow at the fastest CAGR during the forecast period.

- North America electro-medical and electrotherapeutic apparatus market held the largest share of 41.0% in 2024

Market Overview

The electro-medical and electrotherapeutic apparatus market represents a foundational pillar in the global medical technology landscape, encompassing a broad array of devices designed to diagnose, treat, and monitor a wide range of health conditions using electrical energy and electromagnetic fields. These include but are not limited to diagnostic imaging systems, neuromodulation devices, radiofrequency ablation tools, transcutaneous electrical nerve stimulators (TENS), and assistive technologies for patient rehabilitation. The scope of this market spans across clinical specialties such as cardiology, neurology, oncology, orthopedics, gynecology, and urology, making it one of the most interdisciplinary segments within the healthcare industry.

With the rise of chronic diseases, aging populations, and the global push toward personalized and minimally invasive care, electro-medical and electrotherapeutic technologies have become more essential than ever. Their applications range from routine diagnostics in outpatient centers to complex neurosurgical procedures in tertiary hospitals. These devices offer precision, reduce patient recovery time, and in many cases provide non-pharmacological treatment alternatives, especially critical in the context of growing concerns about drug dependency and side effects.

In both developed and emerging economies, the demand for these technologies is being accelerated by advancements in artificial intelligence (AI), robotics, wearable technology, and remote patient monitoring. The market is witnessing significant investment from healthcare systems aiming to improve clinical outcomes, reduce hospitalization costs, and provide value-based care. Moreover, favorable regulatory support and public-private research initiatives are catalyzing the development of next-generation electrotherapeutic solutions, making this market a focal point for innovation in the 21st century.

Major Trends in the Market

-

Rise of Wearable and Portable Electrotherapeutic Devices: Home-based care models and outpatient rehabilitation are propelling the use of wearable electro-stimulation units for pain, muscle recovery, and cardiovascular monitoring.

-

Artificial Intelligence Integration: AI is now embedded in diagnostic and therapeutic apparatus for image enhancement, decision support, and predictive analytics.

-

Miniaturization of Medical Devices: Advances in microelectronics are allowing manufacturers to develop compact and implantable electrotherapeutic solutions with enhanced functionality.

-

Shift Toward Non-Invasive Therapies: Growing preference for minimally invasive treatments has increased the adoption of electro-ablation, high-frequency ultrasound, and neuromodulation techniques.

-

Expansion in Emerging Economies: Governments in Asia Pacific and Latin America are investing in health infrastructure, creating opportunities for market penetration by cost-effective and scalable electro-medical solutions.

-

Telehealth and Remote Monitoring: COVID-19 catalyzed the growth of telemedicine, and devices integrated with remote data-sharing capabilities have become vital to chronic disease management.

-

Value-Based Healthcare Adoption: Reimbursement models in North America and Europe are rewarding outcomes over procedures, encouraging healthcare providers to adopt efficient and outcome-oriented technologies like electrotherapeutics.

Report Scope of Electro-medical And Electrotherapeutic Apparatus Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 70.56 Billion |

| Market Size by 2034 |

USD 124.36 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.5% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers AG; Medtronic; Abbott; Boston Scientific Corporation; Fujifilm Holdings Corporation; Zimmer Biomet; Nihon Kohden Corporation; OMRON Healthcare, Inc.; Invacare Corporation |

Market Driver: Growing Incidence of Chronic and Neurological Disorders

A principal growth driver for the electro-medical and electrotherapeutic apparatus market is the global surge in chronic and neurological health disorders, particularly among aging populations. According to the World Health Organization (WHO), chronic diseases such as diabetes, heart disease, and cancer are responsible for nearly 71% of all deaths globally. Neurological disorders, including Alzheimer's, Parkinson’s, epilepsy, and multiple sclerosis, are also rising in prevalence due to increasing life expectancy and lifestyle-related risk factors.

Electrotherapeutic devices such as spinal cord stimulators, vagus nerve stimulators, and deep brain stimulation systems offer novel approaches to managing these disorders when conventional methods fall short. Meanwhile, electro-medical diagnostic tools such as EEG, EMG, and advanced imaging systems are critical in early detection and disease monitoring. The ability of these apparatuses to provide targeted, non-pharmacological treatment and real-time diagnostics makes them indispensable in managing chronic conditions, especially in multidisciplinary settings such as neurological rehabilitation and oncology care.

Market Restraint: High Equipment Costs and Operational Barriers

Despite their immense utility, the adoption of electro-medical and electrotherapeutic devices is often hindered by high capital and operational costs. Sophisticated equipment such as MRI machines, PET scanners, and robotic electrotherapeutic platforms require substantial initial investment, ongoing maintenance, trained personnel, and infrastructural support. This financial burden is particularly problematic in low-resource healthcare settings and rural hospitals where budget constraints limit access to advanced technology.

Additionally, frequent software upgrades, regulatory compliance costs, and the need for technical training present challenges to healthcare providers. Emerging electrotherapeutic devices may also face uncertain reimbursement pathways in many countries, further deterring adoption. In some regions, lack of patient awareness or clinical guidelines around newer therapies like transcranial magnetic stimulation (TMS) adds to the hesitancy among providers. These factors collectively contribute to market resistance, despite evident clinical benefits.

Market Opportunity: Convergence of Digital Health and Electrotherapeutics

The convergence of digital health platforms with electro-medical and electrotherapeutic technologies offers an exciting growth opportunity. Smart devices integrated with sensors, cloud connectivity, and AI are enabling continuous patient monitoring, personalized treatment adjustments, and predictive maintenance of equipment. For instance, wearable ECG monitors and wireless EEG caps can transmit data in real time to clinicians, enabling proactive intervention in high-risk patients.

This integration supports the larger healthcare trend toward precision medicine, where treatments are tailored based on real-time physiological data and patient history. Moreover, digital platforms enable centralized data analytics, remote diagnosis, and virtual consultations—essential in telehealth ecosystems. The incorporation of mobile health applications and interoperable EHR systems into electrotherapeutic workflows is also enhancing accessibility and compliance. These technologies not only enhance care delivery but also reduce hospital dependency, thus reshaping healthcare economics.

Electro-medical And Electrotherapeutic Apparatus Market By Product Insights

The diagnostic equipment segment dominated the market and held the largest revenue share of 37.9 % in 2024. Tools such as ECG machines, MRI and CT scanners, ultrasound systems, and EEG devices are foundational in medical decision-making across multiple specialties. Hospitals, diagnostic centers, and outpatient clinics rely heavily on these tools to assess organ function, detect abnormalities, and guide surgical interventions. The emphasis on preventive health and the widespread availability of diagnostic reimbursement further consolidate this segment's dominance.

On the other hand, therapeutic equipment is gaining momentum as the fastest-growing segment, primarily driven by its role in treating chronic and degenerative conditions. Devices such as transcutaneous electrical nerve stimulation (TENS), spinal cord stimulators, radiofrequency ablation systems, and wearable therapeutic gadgets are increasingly preferred for non-invasive and personalized treatment approaches. As healthcare systems strive to reduce hospitalization rates and surgical dependency, therapeutic equipment offers scalable and patient-friendly solutions. The rise of mobile rehab, home-based care, and aging-in-place strategies are further fueling the adoption of electrotherapeutic modalities.

Electro-medical And Electrotherapeutic Apparatus Market By End Use Insights

The hospitals segment held the largest revenue share of 47.0% in 2024. owing to their expansive infrastructure, access to capital, and broad range of services offered under one roof. These institutions are equipped with advanced diagnostic imaging, electrotherapy, and surgical capabilities that cater to emergency, inpatient, and specialized care. Their multidisciplinary approach makes them central hubs for high-complexity treatments requiring integrated electro-medical systems.

The diagnostic centers segment is expected to witness the fastest CAGR during the forecast period. Due to the global shift toward same-day procedures and minimally invasive therapies. ASCs benefit from faster patient turnover, lower operating costs, and increasing insurance reimbursements for outpatient interventions. Electrotherapeutic devices that are compact, efficient, and easy to integrate are increasingly being designed for ASC workflows. These centers are particularly leveraging portable diagnostic tools, neuromodulation equipment, and pain management technologies to expand their clinical portfolio without incurring hospital-level expenses.

Electro-medical And Electrotherapeutic Apparatus Market By Application Insights

The cardiology segment dominated the market and held the largest revenue share of 26.9% in 2024. Devices such as ECG monitors, pacemakers, defibrillators, and ablation systems are critical in managing arrhythmias, myocardial infarctions, and heart failure. With cardiovascular disease remaining the leading cause of death worldwide, there is strong demand for both diagnostic and therapeutic electro-medical equipment in cardiac units, ICUs, and ambulatory settings.

However, neurology is the fastest-growing application, driven by the rising incidence of conditions such as epilepsy, Parkinson’s disease, Alzheimer’s, and stroke-related cognitive impairments. Electroencephalography (EEG), nerve conduction studies, deep brain stimulators, and transcranial magnetic stimulators are gaining prominence due to their ability to both diagnose and alleviate neurological symptoms. The non-invasive nature of many neurological devices and their potential for remote monitoring make them ideal for long-term chronic disease management. Emerging research in neuroplasticity and brain-computer interfaces is expected to further drive innovation in this space.

Electro-medical And Electrotherapeutic Apparatus Market By Regional Insights

North America dominates the electro-medical and electrotherapeutic apparatus market, backed by a robust healthcare infrastructure, advanced R&D capabilities, and early adoption of next-generation medical technologies. The United States, in particular, accounts for the majority share due to its high surgical volume, comprehensive insurance systems, and favorable FDA pathways for device approvals. Leading medical technology companies headquartered in the region continue to introduce innovations in AI, robotics, and wearable electrotherapy.

In addition, regulatory agencies such as the Centers for Medicare & Medicaid Services (CMS) provide reimbursement incentives for home-based care and value-driven therapies, encouraging the use of electrotherapeutic systems. Integration of devices into EHRs, emphasis on interoperability, and public-private collaborations are further accelerating market maturity in this region.

Asia Pacific is the fastest-growing region, driven by expanding healthcare access, growing urbanization, and rising disease burden in countries such as China, India, and Indonesia. Governments in the region are significantly increasing investments in hospital infrastructure and medical device imports to meet the demands of their growing populations. The increasing prevalence of chronic diseases, rising awareness about early diagnosis, and proliferation of private diagnostic chains are fueling market expansion.

In India, for example, the emergence of telemedicine and digital health startups has enabled wider dissemination of affordable electrotherapeutic devices in semi-urban and rural regions. In China, the emphasis on AI-driven medical devices and a strong domestic manufacturing base are propelling growth. The region’s openness to technology transfer, combined with a large patient pool, makes it highly attractive for international market entrants.

Some of the prominent players in the electro-medical and electrotherapeutic apparatus market include:

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Medtronic

- Abbott

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Zimmer Biomet

- Nihon Kohden Corporation

- OMRON Healthcare, Inc.

- Invacare Corporation

Electro-medical And Electrotherapeutic Apparatus Market Recent Developments

-

In February 2024, Medtronic plc announced the FDA clearance of its latest Percept™ RC Deep Brain Stimulation system, featuring a rechargeable battery and AI-assisted programming for Parkinson’s treatment.

-

GE HealthCare launched its Revolution Ascend CT scanner in March 2024, incorporating smart workflow automation and reduced radiation doses, targeted for both emerging and developed markets.

-

In January 2024, Boston Scientific Corporation introduced the WaveWriter Alpha™ Spinal Cord Stimulator, offering personalized therapy programming and cloud-based patient management tools.

-

Siemens Healthineers partnered with Amazon Web Services (AWS) in December 2023 to launch a cloud-based diagnostic imaging platform that enables real-time analytics and remote collaboration.

-

Abbott Laboratories introduced Jot Dx™, a long-term implantable cardiac monitor with advanced arrhythmia detection features, in November 2023 to support remote cardiovascular monitoring.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the electro-medical and electrotherapeutic apparatus market

By Product

- Diagnostic Equipment

- Therapeutic Equipment

- Surgical Devices

- Patient Assistive Devices

- Others

By Application

- Cardiology

- Neurology

- Oncology

- Orthopedics

- Gynecology

- Urology

- Others

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)