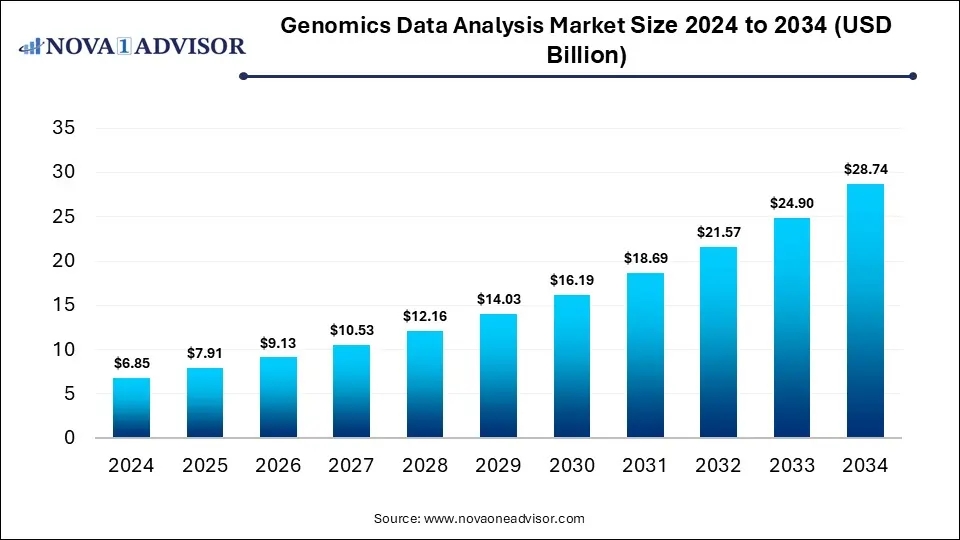

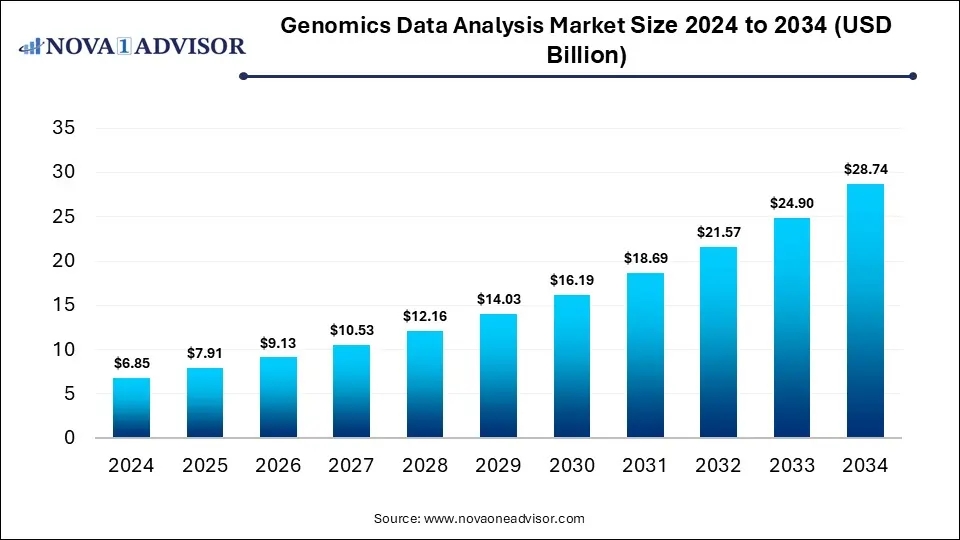

Genomics Data Analysis Market Size and Growth 2025 to 2034

The global genomics data analysis market size is calculated at USD 6.85 billion in 2024, grows to USD 7.91 billion in 2025, and is projected to reach around USD 28.74 billion by 2034, growing at a CAGR of 15.42% from 2025 to 2034. The market is growing due to increasing adoption of precision medicine and next-generation sequencing technologies, enabling deeper insights into genetic disorders and personalized treatment development.

Genomics Data Analysis Market Key Takeaways

- North America dominated the genomics data analysis market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By service/workflow type, the variant calling & annotation segment led the market with the largest revenue share in 2024.

- By service/workflow type, the data preprocessing & quality control segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology/platform, the next-generation sequencing (NGS) segment held the largest market share in 2024.

- By technology/platform, the CRISPR segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the drug discovery & development segment held the highest market share in 2024.

- By application, the diagnostics / clinical diagnostics / personalized medicine segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-user, the pharmaceutical & biotechnology companies segment dominated the market with the major revenue share.

- By end-user, the hospitals & diagnostic laboratories segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Genomics Data Analysis?

Genomics data analysis is the process of interpreting and extracting meaningful biological insights from genetic data using computational tools, helping identify variation, disease markers, and therapeutic targets. The genomics data analysis market is expanding rapidly due to the increasing use of next-generation sequencing (NGS) and precision medicine approaches.

Growing investments in genomic research, advancements in AI-driven bioinformatics tools, and declining sequencing costs are accelerating data generation and analysis. Additionally, rising demand for personalized therapies in oncology and rare diseases, along with government-funded genomics initiatives, is driving widespread adoption of genomics data analysis across research, clinical diagnostics, and pharmaceutical applications.

- For Instance, In March 2025, the Genomics Health Futures Mission has allocated $500.1 million to advance genomic research, aiming to enhance disease testing and diagnosis, ultimately supporting market growth and innovation in healthcare.

What are the Key trends in the Genomics Data Analysis Market in 2024?

- In January 2025, India advanced its genomics sector by launching the Indian Genomic Data Set and IBDC portals to support global research. Dr. Jitendra Singh emphasized that this initiative marks India’s move toward self-reliance in genomic data.

- In November 2024, the World Health Organization (WHO) introduced ethical guidelines for collecting, accessing, and sharing human genomic data to safeguard individual rights, ensure fairness, and encourage responsible global research collaboration.

How Can AI Affect the Genomics Data Analysis Market?

AI is transforming the market by accelerating the interpretation of complex genetic data and identifying disease-causing variants more accurately. It enhances predictive modeling, drug discovery, and personalized medicine development. By automating large-scale data processing and pattern recognition, AI reduces analysis time and cost, enabling faster clinical insights and supporting precision healthcare advancements across research and diagnostic applications.

Report Scope of Genomics Data Analysis Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.91 Billion |

| Market Size by 2034 |

USD 28.74 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 16.42% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service / Workflow Type, By Technology / Platform, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc., Agilent Technologies Inc., F. Hoffmann-LA Roche Ltd., QIAGEN N.V., Pacific Biosciences of California Inc., 10x Genomics, Inc., PerkinElmer Inc., Invitae Corporation,Bio-Rad Laboratories Inc., Celerion,Myriad Genetics, Inc., SoftGenetics LLC |

Market Dynamics

Driver

Rising Adoption of Next-Generation Sequencing (NGS) Technologies

The rising adoption of next-generation sequencing (NGS) technologies drives the genomics data analysis market because it generates a massive volume of genetic data that requires advanced analytical tools for interpretation. NGS enables faster, more accurate, and cost-effective sequencing, supporting personalized medicine, disease diagnosis, and drug discovery.

As healthcare and research institutions increasingly rely on NGS for genomic insights, the demand for efficient data analysis platforms and bioinformatics solutions continues to grow significantly.

- For Instance, In January 2025, India launched the Indian Genomic Data Set and the Indian Biological Data Centre (IBDC) portals, making 10,000 whole-genome samples accessible globally. This initiative underscores the country's commitment to self-reliance in genomics and highlights the growing demand for advanced data analysis tools to interpret large-scale genomic datasets.

Restraint

High Cost of Genomics Data Analysis and Interpretation

The high cost of genomic data analysis and interpretation acts as a restraint because advanced sequencing technologies, bioinformatics software, and skilled personnel require substantial investment. Many healthcare providers and research institutions, especially in developing regions, may struggle to afford these services.

Additionally, expensive analysis of precision medicine, restricting the overall growth of the genomics data analysis market despite rising demand for personalized diagnostics and therapeutic solutions.

Opportunity

Advancements in Sequencing Technology

Advancements in sequencing technology, particularly next-generation sequencing(NGS), have drastically reduced the cost and time required for genome sequencing, making large-scale genomic studies more feasible. Faster, more accurate sequencing enables researchers and clinicians to analyze complex genetic data efficiently, supporting personalized medicine and targeted therapies. Companies working to lower sequencing costs further expand accessibility. This technological progress creates a significant future opportunity in the genomics data analysis market by driving adoption across research, diagnostics, and drug development sectors.

- For Instance, In 2024, Ultima Genomics reduced whole-genome sequencing costs to $100 per genome, enabling faster, large-scale genomic studies and boosting opportunities in genomic data analysis.

Segmental Insights

What made the Variant Calling & Annotation Segment Dominant in the Genomics Data Analysis Market in 2024?

The variant calling & annotation segment led the genomics data analysis market in 2024 due to its critical role in identifying genetic variations linked to diseases. This workflow enables researchers and clinicians to interpret sequencing data accurately, supporting personalized medicine and targeted therapies. Increasing demand for precision diagnostics, coupled with advancements in bioinformatics tools and AI-driven annotation platforms, contributed to its largest revenue share, as it forms the backbone of effective genomic data analysis and clinical decision-making.

The data preprocessing & quality control segment is expected to grow rapidly during the forecast period because accurate and reliable genomic analysis depends on high-quality input data. Increasing adoption of next-generation sequencing generates massive datasets that require rigorous preprocessing to remove errors and standardize formats. Growing demand for precision medicine, clinical diagnostics, and large-scale genomic studies drives the need for efficient quality control workflows. Advancements in automated preprocessing tools and AI-driven error detection further accelerate the segment’s growth year-on-year.

- For Instance, In April 2024, Nonacus introduced a genomic profiling test that combines advanced bioinformatics and analysis software, showcasing the expanding opportunities and adoption of genomic data analysis in the market.

Genomics Data Analysis Market By Service / Workflow Type, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Variant calling & annotation |

1.03 |

1.19 |

1.37 |

1.58 |

1.82 |

2.10 |

2.43 |

2.80 |

3.24 |

3.74 |

4.31 |

| Gene expression analysis |

1.37 |

1.58 |

1.83 |

2.11 |

2.43 |

2.81 |

3.24 |

3.74 |

4.31 |

4.98 |

5.75 |

| Data preprocessing & quality control |

0.69 |

0.79 |

0.91 |

1.05 |

1.22 |

1.40 |

1.62 |

1.87 |

2.16 |

2.49 |

2.87 |

| Secondary data analysis |

1.03 |

1.19 |

1.37 |

1.58 |

1.82 |

2.10 |

2.43 |

2.80 |

3.24 |

3.74 |

4.31 |

| Tertiary / interpretation / visualization |

2.74 |

3.16 |

3.65 |

4.21 |

4.86 |

5.61 |

6.48 |

7.48 |

8.63 |

9.96 |

11.50 |

How did Next-generation Sequencing (NGS) Dominate the Genomics Data Analysis Market in 2024?

The next-generation sequencing (NGS) segment held the largest market share in 2024 due to its high throughput, accuracy, and cost-effectiveness in analyzing complex genomes. NGS enables rapid sequencing of large datasets, supporting applications in personalized medicine, disease research, and clinical diagnostics. Increasing adoption in oncology, rare disease detection, and pharmacogenomics, along with continuous technological advancements and decreasing sequencing costs, has strengthened its dominance. Its ability to generate comprehensive genomic insights makes NGS the preferred platform in the genomics data analysis market.

- For Instance, Illumina’s XLEAP-SBS technology delivers quicker sequencing with improved accuracy and reliability over conventional methods, boosting the efficiency of genomic data analysis.

The CRISPR segment is expected to grow at the fastest CAGR during the forecast period due to its precision, efficiency, and versatility in gene editing. Increasing applications in therapeutics, functional genomics, and disease modeling drive demand, while ongoing innovations reduce off-target effects and enhance delivery methods. Rising investments by biotech companies and research institutions, coupled with regulatory approvals for CRISPR-based therapies, are accelerating adoption. Its potential to revolutionize personalized medicine and targeted treatments positions CRISPR as a high-growth platform in genomic data analysis.

Why the Drug Discovery & Development Segment Dominated the Genomics Data Analysis Market in 2024?

The drug discovery & development segment held the largest market share in 2024 because genomic data analysis accelerates the identification of disease-associated genes and potential drug targets. Integrating genomics with AI and bioinformatics allows for efficient candidate screening, biomarker discovery, and personalized therapy development. Growing demand for targeted treatments in oncology, rare diseases, and chronic conditions, along with rising investments by pharmaceutical companies in genomics-driven R&D, has strengthened this segment’s dominance, making it a key application in the genomics data analysis market.

The diagnostic & personalized medicine segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for early disease detection and tailored treatment strategies. Advances in genomic data analysis enable precise identification of genetic mutations and biomarkers, improving diagnostic accuracy. Rising prevalence of chronic and hereditary diseases, coupled with growing adoption of precision medicine and government initiatives supporting genomics-based healthcare, are driving the segment’s rapid growth, making it a key focus area in the market.

Why was the Pharmaceutical & Biotechnology Companies Segment Dominant in the Genomics Data Analysis Market in 2024?

The pharmaceutical & biotechnology company segment dominated the market with the largest revenue share due to their extensive use of genomic insights for drug discovery, development, and precision therapies. These companies increasingly rely on sequencing and bioinformatics to identify disease targets, develop personalized treatments, and optimize clinical trials. Rising R&D investments, focus on targeted therapies, and collaborations with genomic technology providers further strengthen their market position, making them the primary end-users driving revenue growth in 2024.

The hospital & diagnostic laboratory segment is expected to grow at the fastest CAGR during the forecast period due to increasing adoption of genomic testing for early disease detection, personalized treatment, and preventive healthcare. Rising prevalence of chronic and genetic disorders, coupled with advancements in next-generation sequencing and AI-driven diagnostic tools, is driving demand. Expanding healthcare infrastructure, government support, and growing awareness of precision medicine further accelerate the integration of genomic data analysis in clinical settings, boosting segment growth.

Genomics Data Analysis Market By End User, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Pharmaceutical & biotechnology companies |

3.42 |

3.95 |

4.56 |

5.27 |

6.08 |

7.02 |

8.1 |

9.35 |

10.79 |

12.45 |

14.37 |

| Hospitals & diagnostic laboratories |

2.06 |

2.37 |

2.74 |

3.16 |

3.65 |

4.21 |

4.86 |

5.61 |

6.47 |

7.47 |

8.62 |

| Research & academic institutes |

1.37 |

1.58 |

1.83 |

2.11 |

2.43 |

2.81 |

3.24 |

3.74 |

4.31 |

4.98 |

5.75 |

Regional Insights

How is North America contributing to the Expansion of the Genomics Data Analysis Market?

North America dominated the market in 2024 due to advanced healthcare infrastructure, high adoption of next-generation sequencing, and significant R&D investments by pharmaceutical and biotechnology companies. The presence of leading genomics firms, robust government support, and widespread implementation of precision medicine and personalized healthcare further strengthened the region’s market position. Additionally, increasing prevalence of chronic and genetic disorders, coupled with technological innovations in bioinformatics and AI-driven analysis, contributed to North America capturing the largest revenue share.

How is Asia-Pacific Accelerating the Genomics Data Analysis Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period due to increasing healthcare investments, rising adoption of next-generation sequencing, and expanding genomics research initiatives. Growing prevalence of genetic and chronic diseases, coupled with government support for precision medicine and biopharmaceutical development, is driving demand for genomic data analysis. Additionally, emerging markets like China and India are witnessing rapid expansion of healthcare infrastructure and collaborations with global genomics firms, fueling the region’s accelerated market growth.

Genomics Data Analysis Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

2.74 |

3.16 |

3.65 |

4.21 |

4.86 |

5.61 |

6.48 |

7.48 |

8.63 |

9.96 |

11.5 |

| Europe |

2.06 |

2.37 |

2.74 |

3.16 |

3.65 |

4.21 |

4.86 |

5.61 |

6.47 |

7.47 |

8.62 |

| Asia Pacific |

1.37 |

1.58 |

1.83 |

2.11 |

2.43 |

2.81 |

3.24 |

3.74 |

4.31 |

4.98 |

5.75 |

| Latin America |

0.34 |

0.4 |

0.46 |

0.53 |

0.61 |

0.7 |

0.81 |

0.93 |

1.08 |

1.25 |

1.44 |

| Middle East and Africa (MEA) |

0.34 |

0.4 |

0.46 |

0.53 |

0.61 |

0.7 |

0.81 |

0.93 |

1.08 |

1.25 |

1.44 |

Top Companies in the Genomics Data Analysis Market

Recent Developments in the Genomics Data Analysis Market

- In April 2025, GeneDx announced its acquisition of Fabric Genomics, an AI-driven genomic interpretation company, aiming to strengthen its role in genomic medicine by combining decentralized testing with centralized intelligence.

- In October 2024, Illumina Inc. introduced its MiSeq i100 Series, enhancing next-generation sequencing with faster, user-friendly benchtop systems that enable efficient and high-quality genomic analysis in laboratories.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the genomics data analysis market.

By Service / Workflow Type

- Variant calling & annotation

- Gene expression analysis

- Data preprocessing & quality control

- Secondary data analysis

- Tertiary/interpretation / visualization

By Technology / Platform

- Next Generation Sequencing (NGS)

- Whole Genome Sequencing (WGS)

- RNA Sequencing

- PCR & qPCR

- Microarray

- CRISPR based tools- Fastest

By Application

- Drug discovery & development

- Diagnostics / clinical diagnostics / personalized medicine

- Biomarker discovery

- Functional genomics / epigenomics / pathway analysis

By End User

- Pharmaceutical & biotechnology companies

- Hospitals & diagnostic laboratories

- Research & academic institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Genomics Data Analysis Market Size (USD Billion) by Service/Workflow Type, 2024–2034

- Table 2: Global Genomics Data Analysis Market Size (USD Billion) by Technology/Platform, 2024–2034

- Table 3: Global Genomics Data Analysis Market Size (USD Billion) by Application, 2024–2034

- Table 4: Global Genomics Data Analysis Market Size (USD Billion) by End User, 2024–2034

- Table 5: North America Market Size (USD Billion) by Service/Workflow Type, 2024–2034

- Table 6: North America Market Size (USD Billion) by Technology/Platform, 2024–2034

- Table 7: North America Market Size (USD Billion) by Application, 2024–2034

- Table 8: North America Market Size (USD Billion) by End User, 2024–2034

- Table 9: U.S. Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 10: Canada Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 11: Mexico Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 12: Europe Market Size (USD Billion) by Service/Workflow Type, 2024–2034

- Table 13: Europe Market Size (USD Billion) by Technology/Platform, 2024–2034

- Table 14: Germany Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 15: France Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 16: UK Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 17: Italy Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 18: Asia Pacific Market Size (USD Billion) by Service/Workflow Type, 2024–2034

- Table 19: Asia Pacific Market Size (USD Billion) by Technology/Platform, 2024–2034

- Table 20: China Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 21: Japan Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 22: India Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 23: South Korea Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 24: Southeast Asia Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 25: Latin America Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 26: Brazil Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 27: Middle East & Africa Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 28: GCC Countries Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 29: Turkey Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

- Table 30: Africa Market Size (USD Billion) by Service/Workflow Type & Technology/Platform, 2024–2034

List of Figures

- Figure 1: Global Market Share by Service/Workflow Type, 2024

- Figure 2: Global Market Share by Technology/Platform, 2024

- Figure 3: Global Market Share by Application, 2024

- Figure 4: Global Market Share by End User, 2024

- Figure 5: North America Market Share by Service/Workflow Type, 2024

- Figure 6: North America Market Share by Technology/Platform, 2024

- Figure 7: North America Market Share by Application, 2024

- Figure 8: North America Market Share by End User, 2024

- Figure 9: U.S. Market Share by Service/Workflow Type, 2024

- Figure 10: U.S. Market Share by Technology/Platform, 2024

- Figure 11: Canada Market Share by Service/Workflow Type, 2024

- Figure 12: Canada Market Share by Technology/Platform, 2024

- Figure 13: Mexico Market Share by Service/Workflow Type, 2024

- Figure 14: Mexico Market Share by Technology/Platform, 2024

- Figure 15: Europe Market Share by Service/Workflow Type, 2024

- Figure 16: Europe Market Share by Technology/Platform, 2024

- Figure 17: Germany Market Share by Service/Workflow Type, 2024

- Figure 18: Germany Market Share by Technology/Platform, 2024

- Figure 19: France Market Share by Service/Workflow Type, 2024

- Figure 20: France Market Share by Technology/Platform, 2024

- Figure 21: UK Market Share by Service/Workflow Type, 2024

- Figure 22: UK Market Share by Technology/Platform, 2024

- Figure 23: Italy Market Share by Service/Workflow Type, 2024

- Figure 24: Italy Market Share by Technology/Platform, 2024

- Figure 25: Asia Pacific Market Share by Service/Workflow Type, 2024

- Figure 26: Asia Pacific Market Share by Technology/Platform, 2024

- Figure 27: China Market Share by Service/Workflow Type, 2024

- Figure 28: China Market Share by Technology/Platform, 2024

- Figure 29: Japan Market Share by Service/Workflow Type, 2024

- Figure 30: Japan Market Share by Technology/Platform, 2024

- Figure 31: India Market Share by Service/Workflow Type, 2024

- Figure 32: India Market Share by Technology/Platform, 2024

- Figure 33: South Korea Market Share by Service/Workflow Type, 2024

- Figure 34: South Korea Market Share by Technology/Platform, 2024

- Figure 35: Southeast Asia Market Share by Service/Workflow Type, 2024

- Figure 36: Southeast Asia Market Share by Technology/Platform, 2024

- Figure 37: Latin America Market Share by Service/Workflow Type, 2024

- Figure 38: Latin America Market Share by Technology/Platform, 2024

- Figure 39: Brazil Market Share by Service/Workflow Type, 2024

- Figure 40: Brazil Market Share by Technology/Platform, 2024

- Figure 41: Middle East & Africa Market Share by Service/Workflow Type, 2024

- Figure 42: Middle East & Africa Market Share by Technology/Platform, 2024

- Figure 43: GCC Countries Market Share by Service/Workflow Type, 2024

- Figure 44: GCC Countries Market Share by Technology/Platform, 2024

- Figure 45: Turkey Market Share by Service/Workflow Type, 2024

- Figure 46: Turkey Market Share by Technology/Platform, 2024

- Figure 47: Africa Market Share by Service/Workflow Type, 2024

- Figure 48: Africa Market Share by Technology/Platform, 2024