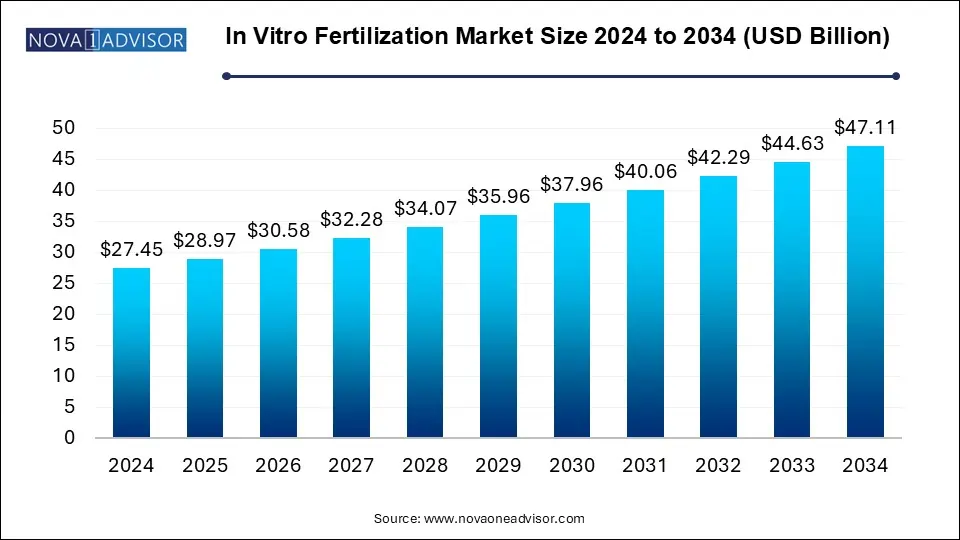

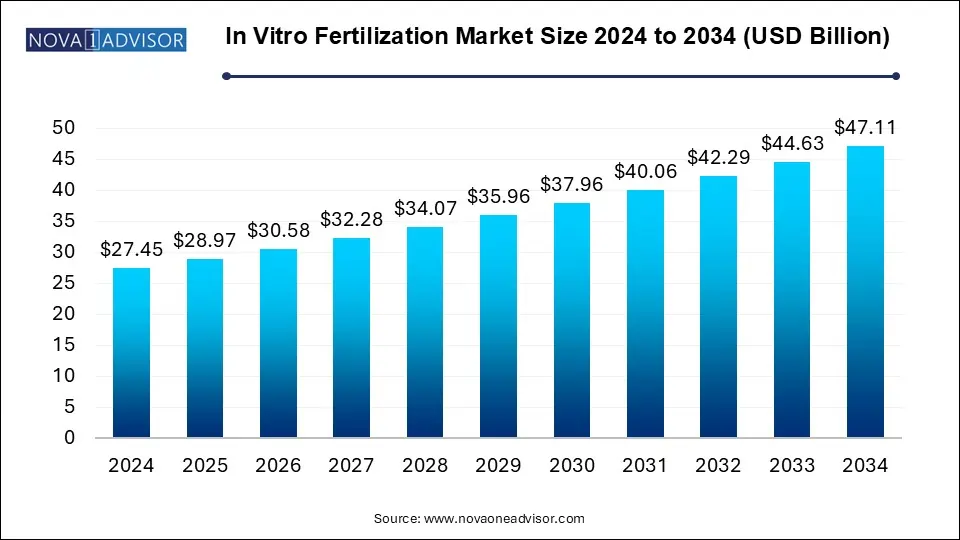

In Vitro Fertilization Market Size and Growth

The global In vitro fertilization market size was exhibited at USD 25.85 billion in 2023 and is projected to hit around USD 44.41 billion by 2033, growing at a CAGR of 5.56% during the forecast period 2024 to 2033.

In Vitro Fertilization Market Key Takeaways:

- The culture media segment dominated the market with the largest revenue share of 40.9 % in 2023.

- Disposable devices segment is expected to grow at the fastest CAGR during forecast years.

- Frozen non-donor segment dominated the market with largest revenue share in 2023 and is expected to witness fastest growth over the forecast period.

- Fertility clinics segment dominated the market with largest revenue share in 2023 and is expected to witness fastest growth over the forecast period.

- Hospitals and other settings segments is expected to grow at a significant CAGR over the forecast period.

- Europe dominated the market with largest revenue share of 36.7% in 2023.

Market Overview

The Global In-Vitro Fertilization (IVF) Market is one of the fastest-growing domains in the assisted reproductive technology (ART) landscape, driven by the increasing prevalence of infertility, advancements in embryo culture technology, evolving social trends, and supportive government initiatives. IVF is a procedure in which eggs are retrieved from a woman’s ovaries and fertilized with sperm in a laboratory setting. The resulting embryos are then implanted in the uterus, increasing the chances of conception in individuals or couples who face difficulties conceiving naturally.

Infertility affects an estimated 15% of couples globally, a figure that continues to rise due to a multitude of factors including sedentary lifestyles, rising maternal age, environmental stressors, increasing incidence of polycystic ovarian syndrome (PCOS), and obesity. Delayed parenthood due to career planning or financial constraints is a particularly relevant trend in urban populations worldwide, contributing to declining fertility rates and growing demand for fertility services.

The IVF market encompasses a broad ecosystem including disposable instruments, advanced equipment, cryopreservation technologies, and specialized culture media. It also includes service providers such as fertility clinics and hospitals that facilitate the IVF journey—from diagnosis to embryo transfer and post-procedure care.

From the introduction of time-lapse embryo imaging to AI-supported embryo grading and genome editing tools like CRISPR in research settings, the IVF domain has witnessed immense technological progression. Countries such as India, the U.S., and Spain have also become global IVF destinations, benefiting from medical tourism due to high success rates and relatively lower treatment costs. As societal acceptance of assisted reproductive technologies increases, so does the scope of the IVF market globally.

Major Trends in the Market

-

Rising Demand for Fertility Preservation Services: Elective egg freezing is increasingly popular among women delaying pregnancy.

-

Shift Toward Frozen Embryo Transfer (FET): Higher success rates and reduced risks of ovarian hyperstimulation are fueling the use of frozen embryos.

-

Expansion of IVF in Male Infertility Treatment: Use of Intracytoplasmic Sperm Injection (ICSI) and sperm separation devices is growing rapidly.

-

AI and Machine Learning in Embryo Selection: AI algorithms are being adopted to enhance embryo viability prediction and improve IVF outcomes.

-

Increased Use of Genetic Screening (PGT-A/PGT-M): Embryo testing is becoming mainstream in identifying genetic abnormalities before implantation.

-

Telehealth in IVF Counseling and Support: Virtual consultations, digital apps, and remote monitoring are becoming integral to the patient journey.

-

Cross-border Reproductive Care and Medical Tourism: Patients from restrictive or expensive regions are increasingly seeking IVF abroad.

-

Rise in LGBTQ+ and Single-parent Fertility Demand: More clinics are expanding services tailored to non-traditional families.

Report Scope of In Vitro Fertilization Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 27.29 Billion |

| Market Size by 2033 |

USD 44.41 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.56% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Instrument, Procedure Type, Providers, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Key Companies Profiled |

Bayer AG; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation); Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife; Boston IVF; Nova IVF; RMA Network (Reproductive Medicine Associates); TFP Thames Valley Fertility; Fortis Healthcare; U.S. Fertility |

Key Market Driver: Rising Infertility Rates Worldwide

The most significant driver for the global IVF market is the rising incidence of infertility, affecting both men and women across developed and developing nations. According to the WHO, infertility is recognized as a disease of the reproductive system defined by the failure to achieve a clinical pregnancy after 12 months or more of regular unprotected sexual intercourse. It impacts nearly 186 million individuals globally, and the causes range from lifestyle-related issues like stress, poor nutrition, and smoking to medical factors such as endometriosis, PCOS, and azoospermia.

In developed countries, couples are increasingly choosing to delay parenthood due to educational and career goals. However, female fertility declines significantly after the age of 35, necessitating the use of ART procedures. In men, declining sperm counts and motility—often attributed to environmental pollution and unhealthy habits—have also contributed to this rising trend. IVF, with or without the use of donor gametes, has become a go-to solution for many of these couples, fueling global market growth.

Key Market Restraint: High Cost and Limited Access

Despite its rising popularity, the IVF market faces a significant challenge in the form of high procedure costs and limited accessibility, especially in low- and middle-income countries. A typical IVF cycle can cost anywhere between $10,000 and $20,000 in the U.S., with similar figures in developed markets. This cost often does not include medication, diagnostic testing, or additional procedures such as ICSI, egg freezing, or genetic screening.

Moreover, IVF is rarely covered by public health insurance in many countries, making it unaffordable for a large section of the population. Even in countries with partial subsidies or reimbursement, the number of covered cycles is often limited. Additionally, rural and underserved regions lack advanced IVF infrastructure and specialist expertise, creating an accessibility gap. This restricts the market from achieving full potential, especially among younger patients and middle-income couples.

Key Market Opportunity: Integration of AI and Genomic Technologies

One of the most promising opportunities in the IVF market is the integration of artificial intelligence (AI) and genomic analysis to improve success rates and customize treatments. AI algorithms are now capable of analyzing time-lapse images of embryo development to assess morphology and predict implantation potential with high accuracy. This helps embryologists select the most viable embryos, reducing trial-and-error cycles and increasing pregnancy success.

Furthermore, advances in preimplantation genetic testing (PGT) enable the identification of chromosomal abnormalities and inherited genetic disorders, thus reducing miscarriage risks and enabling the birth of healthier offspring. Techniques such as PGT-A (for aneuploidy screening) and PGT-M (for monogenic diseases) are being increasingly offered in clinics worldwide. The combination of AI, imaging, and genetic analysis represents the future of personalized IVF, promising to increase efficiency, reduce cost per live birth, and improve patient satisfaction.

In Vitro Fertilization Market By Instrument Insights

Culture Media dominates the instrument segment, primarily due to its indispensable role in the fertilization and embryo culture process. Different types of media—such as ovum processing, embryo culture, sperm processing, and cryopreservation media—are required at each stage of IVF, often with specific formulations tailored to patient or procedural needs. Embryo culture media, in particular, has seen considerable innovation with time-lapse monitoring compatibility and pH buffering systems that mimic the uterine environment. These media solutions directly influence embryo viability, implantation rates, and overall treatment success, making them a crucial recurring component of IVF procedures.

However, Equipment is the fastest-growing subsegment, driven by technological advancements in micromanipulation, cryopreservation, and imaging. Devices such as micromanipulators, sperm analyzers, IVF incubators with time-lapse imaging, and advanced cryosystems are revolutionizing how clinics approach fertilization and embryo assessment. The rising adoption of laser systems for assisted hatching, as well as electronic witness systems to prevent sample mix-ups, further contributes to equipment segment growth. These innovations enhance lab efficiency, reduce manual error, and improve treatment outcomes.

In Vitro Fertilization Market By Procedure Type Insights

Fresh Non-donor cycles currently dominate the procedure type segment, as many patients initially attempt to conceive using their own eggs and sperm. These procedures offer better synchronization of endometrial receptivity and embryo viability when no underlying fertility issues in egg quality exist. In many markets, first-line IVF treatments involve fresh non-donor protocols unless age or health constraints necessitate alternatives. Clinics often recommend fresh embryo transfer in younger women with a normal ovarian reserve to reduce time to pregnancy and avoid the cost and delay of cryopreservation.

That said, Frozen Donor cycles are emerging as the fastest-growing procedure type, particularly due to rising maternal age, increasing use of donor egg banks, and logistical flexibility. Frozen eggs or embryos offer higher convenience in terms of scheduling, reduce ovarian hyperstimulation risks, and provide the ability to conduct genetic screening prior to transfer. With advancements in vitrification techniques, embryo survival rates post-thaw have improved substantially, leading to better clinical outcomes. Donor programs are also gaining popularity among LGBTQ+ couples, single parents, and cancer survivors, contributing to growth in this segment.

In Vitro Fertilization Market By Providers Insights

Fertility Clinics dominate the provider segment, largely because they offer end-to-end reproductive care, often with specialized staff and advanced equipment that hospitals may not always possess. These clinics focus solely on infertility treatments, enabling high patient volumes, specialized expertise, and standardized protocols. Many leading fertility centers operate across multiple geographies with centralized embryology labs, streamlined diagnostics, and personalized treatment plans. Patients prefer fertility clinics due to shorter waiting times, higher success rates, and often better financial packages.

However, Hospitals and Other Settings are witnessing fast growth, especially in emerging countries where infertility services are being integrated into tertiary care centers. Many hospitals are setting up dedicated reproductive units to expand their service portfolio and capitalize on growing infertility awareness. Public hospitals in Europe and Asia are also beginning to offer subsidized or low-cost IVF procedures to expand accessibility. Additionally, partnerships between hospitals and fertility tech companies are emerging to bridge infrastructure gaps through shared services or satellite clinics.

In Vitro Fertilization Market By Regional Insights

Europe currently dominates the global IVF market, owing to strong regulatory frameworks, government-backed treatment funding, and widespread societal acceptance of assisted reproduction. Countries like the U.K., Spain, Denmark, and the Czech Republic are recognized IVF hubs, offering both domestic and cross-border fertility services. In many European nations, national health services or insurance systems partially or fully cover IVF cycles for eligible patients, making the service more accessible. Spain, in particular, is a leader in egg donation services, attracting patients from across Europe and North America due to high donor availability and success rates.

Asia Pacific is the fastest-growing regional market, fueled by demographic trends, rising infertility rates, expanding middle class, and increasing awareness about ART. Countries like India, China, Japan, and South Korea are witnessing rapid growth in fertility clinics, with many private players offering high-quality IVF services at competitive costs. India, for instance, has become a major destination for fertility tourism, with over 3000 ART clinics operating nationwide. The Chinese government has recently relaxed its stance on ART to support population growth, while Japan offers public insurance coverage for fertility treatments. As economic growth continues and social norms evolve, Asia Pacific is expected to be a dominant force in the IVF market.

In Vitro Fertilization Market Recent Developments

-

In January 2025, Vitrolife AB announced a strategic acquisition of a fertility AI startup to integrate embryo selection algorithms into its time-lapse imaging systems.

-

CooperSurgical, in November 2024, launched its latest IVF lab automation platform in Europe, designed to streamline media handling and sample tracking.

-

In October 2024, Genea Biomedx partnered with IVF Australia to pilot its AI-driven sperm selection technology, aiming to improve male infertility outcomes.

-

Ferring Pharmaceuticals, in August 2024, received regulatory clearance in the U.S. for its recombinant human chorionic gonadotropin (r-hCG) product designed to reduce ovarian hyperstimulation syndrome in IVF patients.

-

In September 2024, Merck KGaA introduced a next-generation cryopreservation media for oocyte freezing, improving post-thaw survival and viability.

-

Prelude Fertility, a major U.S.-based IVF network, announced in December 2024 the opening of five new fertility centers, expanding its national footprint to over 70 locations.

Some of the prominent players in the global In vitro fertilization market include:

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring B.V.

- FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

Key Service Providers in In Vitro Fertilization Companies:

- Boston IVF

- Nova IVF

- RMA Network (Reproductive Medicine Associates)

- TFP Thames Valley Fertility

- Fortis Healthcare

- U.S. Fertility

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global In vitro fertilization market

Instrument

- Disposable Devices

- Culture Media

-

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

-

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

Providers

- Fertility Clinics

- Hospitals & Others Setting

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)