Hi-Tech Medical Devices Market Size and Forecast 2025 to 2034

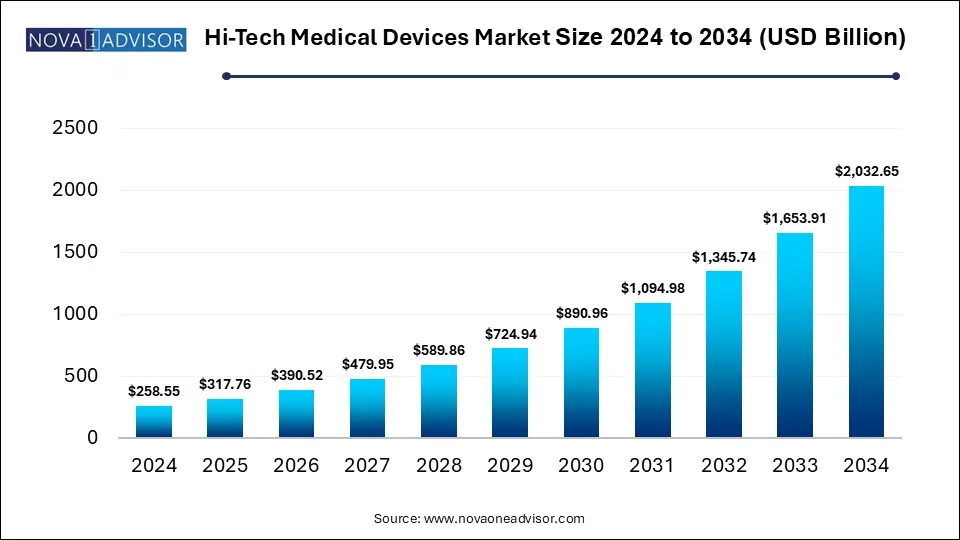

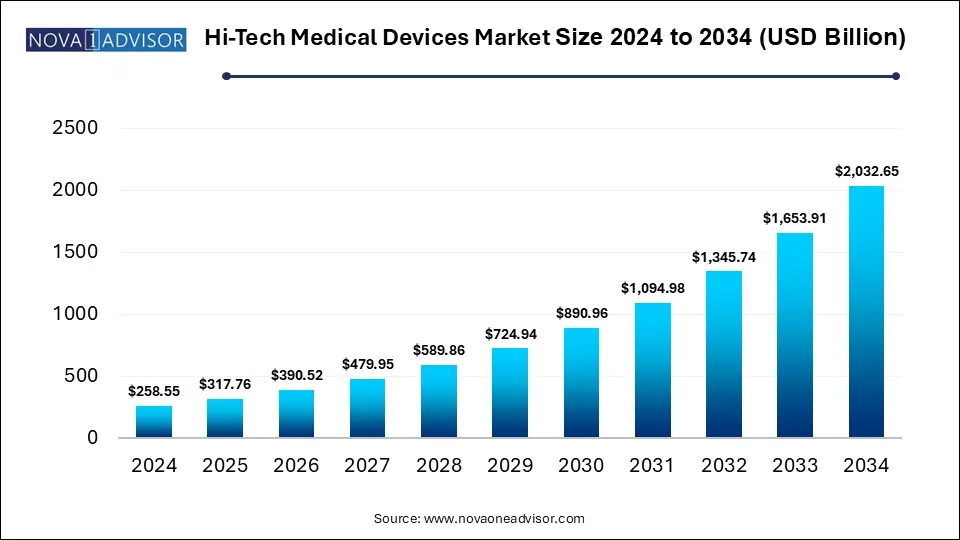

The global hi-tech medical devices market size was valued at USD 258.55 billion in 2024 and is anticipated to reach around USD 2,032.65 billion by 2034, growing at a CAGR of 22.9% from 2025 to 2034. The growth of the hi-tech medical devices market can be linked to increased health awareness, rising healthcare expenditure, focus in patient-centric care and continuous advancements in wearable medical technologies.

Hi-Tech Medical Devices Market Key Takeaways

- Smartphones accounted for the dominant share of the market with 53% in 2024.

- Fitness trackers are expected to register the fastest CAGR of 40% during the forecast period.

- Handheld medical devices have registered the largest market revenue share of 63% in 2024.

- Straps, clips, and bracelets are expected to grow exponentially at a CAGR of 35% during the forecast period.

- North America hi-tech medical devices market dominated the market in 2024.

Market Overview

The Hi-Tech Medical Devices Market represents a rapidly evolving frontier where healthcare converges with advanced digital technologies. Characterized by the integration of sensors, data analytics, wearable interfaces, and wireless communication, hi-tech medical devices are revolutionizing the way individuals monitor, manage, and enhance their health. These devices encompass a wide range of tools from smartwatches and fitness trackers to advanced wearable sensors and virtual reality systems—each designed to support preventive care, chronic disease management, diagnostics, and even mental wellness.

Demand for such devices is being fueled by rising health awareness, the global prevalence of lifestyle-related chronic diseases, and the ongoing shift toward patient-centric, data-driven healthcare delivery. Smart devices now empower users to track real-time metrics like heart rate, oxygen saturation, sleep quality, and activity levels while enabling remote diagnostics and consultations. In clinical settings, connected medical wearables are becoming essential for monitoring patients post-discharge, improving adherence to treatment, and reducing hospital readmissions.

The market's trajectory is further supported by advancements in sensor miniaturization, 5G-enabled data transmission, and artificial intelligence (AI) for predictive analytics. These devices are not only reshaping personal healthcare experiences but also influencing clinical decision-making through continuous, real-world data collection. The growing adoption of IoT in healthcare (IoMT), favorable reimbursement frameworks, and regulatory pathways for digital therapeutics and software-as-a-medical-device (SaMD) are further expanding the market landscape.

Digitalization of healthcare infrastructure and increased adoption of advanced technologies has such as artificial intelligence (AI) is transforming the field of medical devices by enhancing their diagnostic accuracy, enabling tailored treatment planning, facilitating remote patient monitoring and improving patient outcomes. AI-powered diagnostic tools can be applied for analyzing patient data to predict disease risk, further enabling early intervention and personalized treatment plans. Simulation of patient responses and treatment outcomes using AI algorithms and digital twins is leading reduced risks and improved patient outcomes. Wearables integrated with AI technology can monitor patient’ vital signs and various activity levels in the body in real-time, further enhancing patient care by alerting healthcare professionals to potential problems and allowing timely interventions.

What Are the Major Regulatory Shifts Impacting the Hi-Tech Medical Devices Market?

Regulatory shifts in the hi-tech medical devices market are leading to increased worldwide efforts for enhancing patient safety, quality standards and product efficacy. Initiatives by organizations such as the International Medical Device Regulators Forum (IMDRF) are focused on harmonizing regulatory standards across the globe. To address challenges posed by digital health technologies such as Software as a Medical Device (SaMD), regulatory bodies are continuously refining their guidelines to achieve harmonization and establish global standards for unique device identification and improving cybersecurity. Regulatory agencies are developing pathways for accelerating approval of innovative medical devices while ensuring patient safety. Evolving regulatory standards for strong post-market surveillance such as the European Union’s Medical Device Regulation (EU MDR) and Materiovigilance Programme of India (MvPI) are mandating comprehensive and proactive monitoring strategies for addressing issues after a device is on the market.

Hi-Tech Medical Devices Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 317.76 Billion |

| Market Size by 2034 |

USD 2,032.65 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.9% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Apple Inc.; Google Inc.; Xiaomi;Sony Corporation; Elevate Healthcare Inc.; Fitbit LLC; Garmin Ltd.; Honeywell International Inc.; Medtronic; OMRON Healthcare, Inc. |

Market Driver: Rising Demand for Preventive and Personalized Healthcare

One of the strongest drivers of the hi-tech medical devices market is the increasing demand for preventive and personalized healthcare solutions. Traditional healthcare systems are reactive, addressing conditions after symptoms appear. However, today’s consumers are actively seeking tools that help them monitor their physiological states and detect anomalies before they escalate into serious medical issues.

Wearable health devices, like fitness trackers and smartwatches, play a central role in this shift. With features such as continuous heart rate monitoring, irregular rhythm notifications, sleep analytics, and stress tracking, these devices empower users to manage their health proactively. Companies like Apple and Fitbit have made significant strides in making these devices not only consumer-friendly but also FDA-cleared for features such as atrial fibrillation detection.

Additionally, real-time feedback from such devices is encouraging lifestyle changes, promoting fitness, and enhancing adherence to treatment plans. As populations age and chronic diseases like hypertension, diabetes, and obesity continue to rise, hi-tech medical devices offer scalable, user-friendly, and cost-effective solutions to address these burdens at both individual and public health levels.

Market Restraint: Data Privacy and Interoperability Challenges

Despite promising growth, a major restraint affecting market expansion is data privacy and interoperability limitations. Hi-tech medical devices generate enormous volumes of sensitive health data. Managing, storing, and transmitting this data while ensuring compliance with regulatory frameworks such as HIPAA (U.S.) and GDPR (Europe) presents a considerable challenge for manufacturers and healthcare providers.

Patients are increasingly concerned about how their personal health information is used, who has access to it, and whether it can be shared with insurers or employers without consent. The risk of data breaches or cyberattacks not only affects brand trust but can lead to regulatory penalties.

Additionally, interoperability between different platforms, electronic health record (EHR) systems, and wearable device ecosystems remains limited. Devices from different manufacturers often do not communicate seamlessly with one another or with hospital information systems, leading to fragmented care and underutilized data. Addressing these issues will be crucial to unlocking the full potential of connected, hi-tech healthcare delivery.

Market Opportunity: Integration of Hi-Tech Devices with AI-Driven Digital Therapeutics

A transformative opportunity in the market lies in the integration of hi-tech devices with AI-driven digital therapeutics and remote monitoring ecosystems. The ability of wearable and mobile medical devices to feed continuous, high-resolution data into AI algorithms opens new doors in diagnostics, early detection, and behavior modification interventions.

For instance, AI-powered apps that receive glucose data from wearable glucose monitors can offer real-time nutritional coaching to diabetics. Similarly, VR sets are now being used in conjunction with biofeedback sensors to treat PTSD, phobias, and chronic pain through digital cognitive-behavioral therapy (CBT). Smart devices that analyze sleep and respiratory patterns can be linked with digital platforms for sleep apnea management.

As regulatory frameworks evolve to recognize software-as-a-medical-device (SaMD) and reimbursement models begin supporting digital therapeutics, manufacturers that align their hi-tech hardware offerings with evidence-based digital interventions will be able to differentiate and scale effectively in this rapidly expanding segment.

Global Hi-Tech Medical Devices Market Report Segmentation

By Product Trends

Initially developed as fitness-focused wearables, smartwatches have evolved into comprehensive health monitoring platforms. Brands like Apple, Samsung, and Withings have incorporated sensors that monitor ECG, blood oxygen levels (SpO2), skin temperature, and even atrial fibrillation episodes, with FDA clearances strengthening their medical relevance.

These wrist-worn devices appeal to a wide demographic—from health-conscious millennials to elderly users seeking fall detection and medication reminders. Their continuous updates, sleek interfaces, and seamless smartphone integration have contributed to mainstream acceptance, positioning them as both lifestyle accessories and legitimate health tools.

In contrast, virtual reality (VR) sets represent the fastest-growing product segment. The increasing adoption of VR headsets in therapeutic applications—such as pain distraction during procedures, stroke rehabilitation, and exposure therapy for anxiety disorders—is gaining traction. Clinical trials are validating VR-based interventions for conditions like fibromyalgia, schizophrenia, and post-operative recovery, which is expanding their use beyond wellness into clinical care pathways.

By Application Trends

Handheld medical devices have registered the largest market revenue share of 62.67% in 2023. Embedded within insoles or integrated into footwear, these devices capture granular motion, gait, posture, and pressure data. Their role is expanding in post-stroke rehabilitation, orthopedic monitoring, sports biomechanics, and elderly fall prevention. With increasing focus on mobility analytics in aging populations and athletic performance optimization, shoe sensors are attracting R&D investment from both sportswear and medtech companies.

Straps, clips, and bracelets are expected to grow exponentially at a CAGR of 34.6% during the forecast period. accounting for the largest share of user adoption due to comfort, ease of use, and multifunctionality. These devices include fitness bands, cardiac monitoring bracelets, and smart clips that track biometric data such as pulse rate, skin conductance, and body temperature. Their ergonomic design makes them ideal for long-term use, particularly in chronic disease management and wellness tracking.

By Regional Insights

North America, particularly the United States, dominates the hi-tech medical devices market due to its advanced digital infrastructure, strong consumer adoption, and leading position in medtech innovation. The region benefits from favorable reimbursement environments, a high prevalence of chronic diseases, and early adoption of wearables in both clinical and consumer health contexts.

Key market contributors include Apple (Apple Watch), Google (Fitbit), and Meta (VR health applications), which continually launch new features based on user feedback and clinical collaborations. U.S.-based clinical research institutions and hospitals are increasingly integrating wearable data into patient care workflows, particularly in cardiology and endocrinology.

- For instance, in April 2024, the U.S. Food and Drug Administration (FDA) launched the Home as a Health Care Hub which is a new initiative for supporting technology developers and providers in the development of home healthcare models and home-based solutions that strengthen health equity.

Asia-Pacific is the fastest-growing region, driven by growing health awareness, digital transformation in healthcare, and rising disposable incomes. Countries like China, Japan, South Korea, and India are experiencing strong adoption of wearable health tech among both consumers and clinical practitioners.

- For instance, in November 2024, India’s Union Minister for Chemicals and Fertilizers Shri JP Nadda launched " Scheme for Strengthening the Medical Device Industry ". The comprehensive scheme with a total outlay of 500 crores targets crucial areas of the medical device industry such as development of common infrastructure, manufacturing of key components and accessories, skill development, support for clinical studies and industry promotion.

Local tech giants such as Xiaomi and Huawei are investing heavily in wearable R&D and offering affordable alternatives with high-quality biometric sensors. Government programs focused on remote rural healthcare, elderly wellness, and chronic disease management are also boosting demand for scalable, tech-enabled medical devices. The convergence of smart city development, 5G connectivity, and mobile-first healthcare platforms will continue to accelerate growth in this region.

Hi-Tech Medical Devices Market Top Key Companies:

The following are the leading companies in the hi-tech medical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Google Inc.

- Xiaomi

- Sony Corporation

- Elevate Healthcare Inc.

- Garmin Ltd.

- Honeywell International Inc.

- Medtronic

- OMRON Healthcare, Inc.

Hi-Tech Medical Devices Market Recent Developments

- In July 2025, Johnson & Johnson MedTech, launched the VARIPULSE Platform which is the first Pulsed Field Ablation (PFA) system fully integrated with the CARTO™ 3 electroanatomical mapping system. The platform designed for advancing atrial fibrillation treatment is launched across Asia Pacific and is approved in China, Japan, Hong Kong, Australia, Taiwan and Korea.

- In May2025, Alimentiv and Dova Health Intelligence announced the commercial launch of Dova Health’s DovaVision which is an AI-powered dynamic frame-level Mayo Endoscopic Sub-score (MES) feature analysis solution of endoscopy videos, offering adjunct AI-reads for Phase I through IV UC clinical trials.

- In March 2025, a 4D medical device manufacturing project was launched by researchers from the UK’s University of Birmingham and Imperial College London, with the aim of improving patient outcomes, boosting innovation and reducing costs in the UK’s medical device manufacturing sector.

Hi-Tech Medical Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Hi-Tech Medical Devices market.

By Product

- Smart Phones

- Tablets

- Smart Watches

- Fitness Trackers

- Virtual Reality Sets

- Others

By Application

- Handheld

- Headband

- Strap, Clip, Bracelet

- Shoe Sensors

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)