Pharmacy Benefit Management Market Size, Share, Growth, Report 2025 to 2034

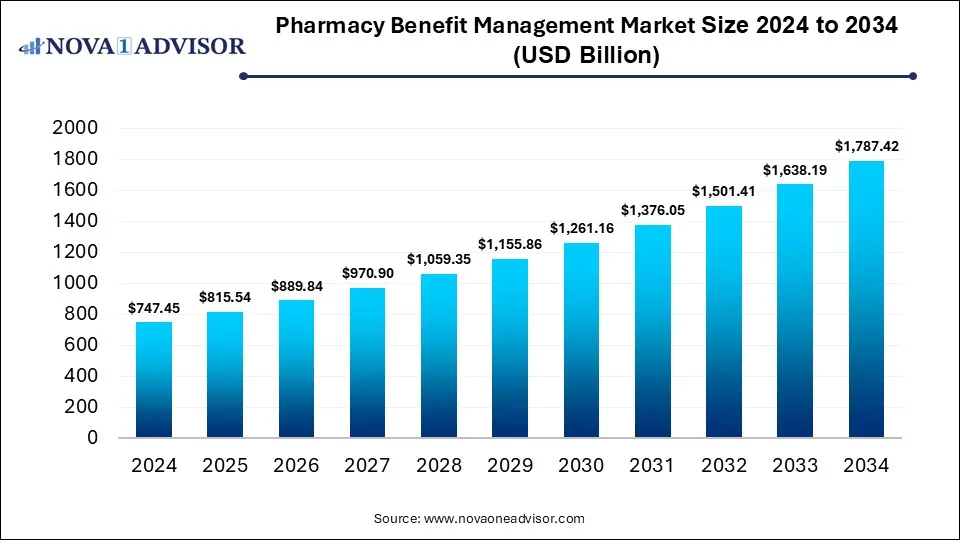

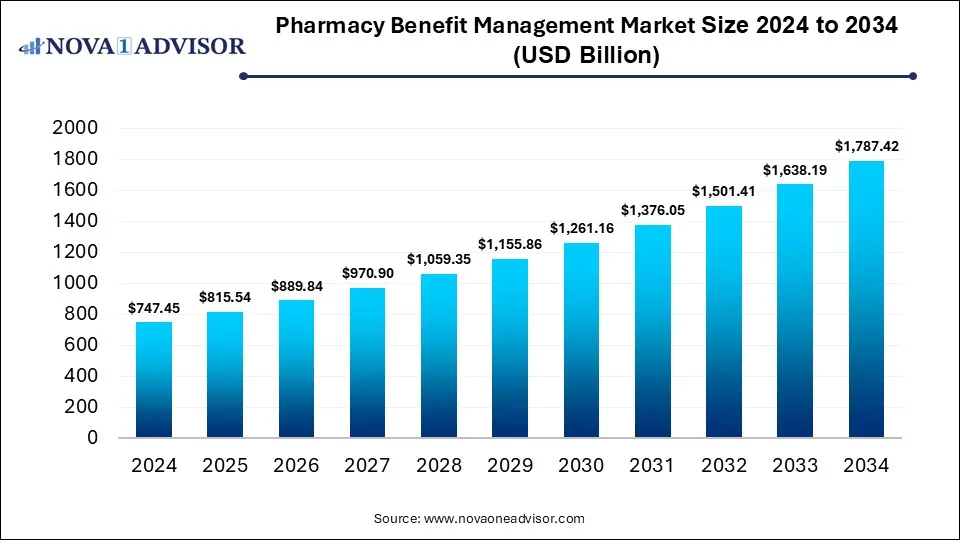

The global pharmacy benefit management market size was estimated at USD 747.45 billion in 2024 and is expected to hit USD 1,787.42 billion in 2034, expanding at a CAGR of 9.11% during the forecast period of 2025 and 2034. The market growth is driven by the rising demand for cost-effective prescription drug management, increasing prevalence of chronic diseases, growing healthcare expenditure, and the rising adoption of digital health solutions and data analytics to optimize pharmacy benefit operations.

Key Takeaways

- By region, North America held the largest share of the pharmacy benefit management market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By service, the specialty pharmacy services segment led the market in 2024.

- By service, the benefit plan design & administration segment is expected to expand at the highest CAGR over the projected timeframe.

- By service provider, the insurance companies segment led the market in 2024.

- By service provider, the retail pharmacies segment is expected to expand at the highest CAGR over the projection period.

- By business model, the health insurance management segment led the market in 2024.

Impact of AI on the Pharmacy Benefit Management Market

AI is significantly enhancing operational efficiency, decision-making, and cost optimization across the pharmaceutical supply chain. AI-powered analytics enable PBMs to predict trends for drug utilization, detect fraud, and personalize formulary designs for better patient outcomes. Machine learning algorithms are improving prior authorization processes and medication adherence programs, reducing administrative delays and improving care quality. Additionally, AI-driven automation streamlines claim processing and formulary management, lowering costs for payers and employers. As PBMs increasingly integrate AI into their platforms, the market is shifting toward a more data-driven, transparent, and patient-centric model.

- In November 2024, Xevant, a leader in automated analytics for the pharmacy benefits industry, launched new AI-powered tools to streamline the ingestion and standardization of complex healthcare data, solving a key challenge for PBMs, health plans, consultants, and employers.

Market Overview

The market growth is attributed to the rising prevalence of chronic diseases, increasing healthcare expenditures, and the growing adoption of digital health technologies for data-driven drug management. The pharmacy benefit management market refers to the industry segment that manages prescription drug benefits on behalf of insurers, employers, and government programs to optimize drug utilization and control costs. PBMs play a crucial role in negotiating drug prices, managing formularies, processing claims, and ensuring patients receive appropriate medications at the lowest possible cost. The key benefits of PBM services include improved medication adherence, cost savings through bulk purchasing and rebates, and enhanced transparency in drug pricing.

What are the Major Trends in the Pharmacy Benefit Management Market?

- Integration of Artificial Intelligence (AI) and Data Analytics

PBMs are increasingly leveraging AI and predictive analytics to optimize formulary design, detect fraud, and personalize medication management. These technologies enhance efficiency, accuracy, and cost control while improving patient outcomes.

- Growth of Specialty Drug Management

With rising demand for high-cost specialty medications, PBMs are developing specialized programs to manage these drugs more effectively. This includes tighter formulary controls, prior authorization, and patient support services to reduce spending and ensure adherence.

- Increasing Adoption of Digital and Cloud-Based Platforms

Digital transformation is reshaping PBM operations, with cloud-based platforms enabling real-time claims processing, transparent data sharing, and advanced analytics. These technologies improve coordination between payers, pharmacies, and healthcare providers.

- Rising Focus on Transparency and Regulatory Compliance

Regulatory bodies are pushing for greater transparency in drug pricing and rebate structures, compelling PBMs to disclose negotiation practices and cost-saving mechanisms. This trend aims to build trust among stakeholders and create a more equitable pharmacy benefits system.

Report Scope of Pharmacy Benefit Management Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 815.54 Billion |

| Market Size by 2034 |

USD 1,787.42 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 9.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service, By Service Provider, By Business Model, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, asthma, and arthritis, is one of the major factors driving the growth of the pharmacy benefits management market. As the number of patients requiring long-term medication therapy increases, the demand for efficient drug management and cost optimization has surged. PBMs play a crucial role in ensuring access to affordable and effective medications by negotiating drug prices, managing formularies, and implementing adherence programs. This helps insurers and employers control healthcare costs while improving patient outcomes.

- In 2020, an estimated 523 million people worldwide had cardiovascular disease (CVD), causing ~19 million deaths, representing 32% of all global deaths and an 18.7% increase from 2010.

Need for Cost Containment in Healthcare

The market growth is driven by the rising prescription drug prices and increasing healthcare expenditures. Payers and employers are turning to PBMs to negotiate better pricing, manage formularies, and reduce overall drug spending. PBMs leverage their scale and data analytics capabilities to secure rebates from manufacturers and ensure cost-effective medication utilization without compromising patient care. By optimizing prescription management and promoting the use of generics or preferred drugs, PBMs help control escalating healthcare costs. This growing focus on financial efficiency and value-based healthcare continues to drive strong demand for PBM services worldwide.

- In July 2023, CVS Caremark®, a CVS Health® company, and GoodRx have launched Caremark® Cost Saver™, a program that automatically applies GoodRx’s lower generic drug prices for eligible CVS Caremark members at the pharmacy counter. Savings count toward members’ deductibles and out-of-pocket limits, with no extra steps or cards required.

Restraint

Lack of Transparency Pricing and Rebates

Many PBMs operate under opaque pricing models, where the details of negotiated discounts, rebates, and reimbursement rates are not fully disclosed to payers or patients. This lack of clarity often leads to mistrust among insurers, employers, and consumers, raising concerns about whether cost savings are being passed on equitably. Regulatory authorities in several countries are scrutinizing PBM practices, pushing for reforms that could disrupt existing business models. As a result, the perception of hidden profits and unclear pricing mechanisms continues to hinder market growth and transparency-driven adoption.

Opportunities

Expansion of Value-Based Care Models

There is a rapid shift toward value-based care models, which is creating immense opportunities in the pharmacy benefit management market. Under this model, PBMs are increasingly partnering with payers and healthcare providers to design performance-based reimbursement systems that reward positive clinical results and medication adherence. This approach encourages the use of evidence-based therapies and enhances accountability across the healthcare ecosystem. By integrating data analytics, real-world evidence, and predictive modelling, PBMs can better assess drug efficacy and patient response, aligning incentives for improved health outcomes.

Growing Demand for Specialty Pharmacy Services

The growing demand for specialty pharmacy services also creates significant opportunities, as specialty drugs now account for a significant portion of total prescription spending. These high-cost, complex medications used to treat chronic, rare, or genetic conditions require specialized handling, monitoring, and patient support programs. PBMs are increasingly offering integrated specialty pharmacy solutions that manage drug distribution, adherence, and reimbursement while negotiating favorable pricing with manufacturers. By leveraging data analytics and coordinated care models, PBMs help improve treatment outcomes and control costs associated with specialty drugs.

How Macroeconomic Variables Influence the Pharmacy Benefit Management Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. increasing healthcare spending and insurance coverage. As economies expand, governments and private sectors invest more in healthcare infrastructure, enabling wider adoption of PBM services to manage prescription drug benefits efficiently. However, in periods of economic slowdown, reduced healthcare budgets and cost-cutting measures can temporarily limit PBM market growth.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the pharmacy benefit management market by increasing operational costs and reducing profit margins. As medication prices surge, PBMs face challenges in negotiating rebates and maintaining affordable formulary structures for payers and patients. However, these pressures also encourage innovation in cost-containment strategies, pushing PBMs to adopt value-based and outcome-driven pricing models.

Exchange Rates

Exchange rate fluctuations negatively affect multinational companies operating across regions with varying currency values. Volatile exchange rates affect import costs for pharmaceuticals and impact rebate negotiations and reimbursement pricing structures. However, in stable economic environments, favorable exchange rates can support cross-border collaborations and investment in global PBM operations.

Segment Outlook

Service Insights

Why Did the Specialty Pharmacy Services Segment Dominate the Pharmacy Benefit Management Market in 2024?

The specialty pharmacy services segment dominated the market with the largest share in 2024. This is because of the increasing demand for high-cost, complex medications used to treat chronic and rare diseases such as cancer, multiple sclerosis drugs, and autoimmune disorders. Specialty pharmacies provide tailored patient support services, including prior authorization assistance, adherence monitoring, and cold-chain management, which are essential for handling these advanced therapies. PBMs rely heavily on specialty pharmacies to control costs and ensure optimal therapeutic outcomes through data-driven utilization management. The growing adoption of biologics and gene therapies, along with the expansion of value-based care models, further strengthens the dominance of this segment.

The benefit plan design & administration segment is expected to grow at the fastest CAGR during the projection period, owing to the increasing need for customized and cost-effective prescription drug benefit solutions. Employers, insurers, and healthcare providers are focusing on optimizing plan structures to balance affordability, access, and quality of care. Advanced analytics and AI-driven tools are enabling PBMs to design more flexible benefit plans that address specific patient populations and therapeutic categories. Additionally, the growing complexity of drug pricing, formulary management, and regulatory compliance is driving demand for expert administrative support.

Pharmacy Benefit Management Market By Service, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Specialty Pharmacy Services |

254.1 |

281.4 |

311.5 |

344.7 |

381.4 |

421.9 |

466.6 |

516.0 |

570.5 |

630.7 |

697.1 |

| Benefit Plan Design & Administration |

134.5 |

146.0 |

158.4 |

171.9 |

186.5 |

202.3 |

219.4 |

238.1 |

258.2 |

280.1 |

303.9 |

| Formulary Management |

127.1 |

137.8 |

149.5 |

162.1 |

175.9 |

190.7 |

206.8 |

224.3 |

243.2 |

263.8 |

286.0 |

| Pharmacy Claims Processing |

194.3 |

208.8 |

224.2 |

240.8 |

258.5 |

277.4 |

297.6 |

319.2 |

342.3 |

367.0 |

393.2 |

| Others |

37.4 |

41.6 |

46.3 |

51.5 |

57.2 |

63.6 |

70.6 |

78.4 |

87.1 |

96.7 |

107.3 |

Service Provider Insights

What Made Insurance Companies the Leading Segment in the Market in 2024?

The insurance companies segment led the pharmacy benefit management market in 2024 due to their crucial role in managing prescription drug benefits and optimizing healthcare costs. Insurance providers partner with PBMs to negotiate drug prices, design formulary structures, and ensure affordable access to medications for policyholders. Their extensive customer base and integration with healthcare networks allow them to implement cost-effective drug management strategies at scale. Additionally, the growing emphasis on value-based care, rising prescription drug expenditures, and the need for efficient claims processing further strengthen insurance companies’ reliance on PBM services.

The retail pharmacies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to its expanding role in direct patient engagement and medication management. Retail pharmacies are increasingly partnering with PBMs to streamline prescription processing, improve drug adherence, and offer convenient access to both branded and generic medicines. The integration of digital health platforms and point-of-sale systems in retail settings enhances efficiency and transparency in benefit management. Moreover, the rise in chronic disease prevalence and patient preference for easily accessible healthcare services further boost the demand for retail pharmacy-based PBM solutions.

Pharmacy Benefit Management Market By Service Provider, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Retail Pharmacies |

209.3 |

226.7 |

245.6 |

266.0 |

288.1 |

312.1 |

338.0 |

366.0 |

396.4 |

429.2 |

464.7 |

| Insurance Companies |

261.6 |

287.9 |

316.8 |

348.6 |

383.5 |

421.9 |

464.1 |

510.5 |

561.5 |

617.6 |

679.2 |

| Standalone Pharmacy Benefit Management Providers |

276.6 |

300.9 |

327.5 |

356.3 |

387.7 |

421.9 |

459.1 |

499.5 |

543.5 |

591.4 |

643.5 |

Business Model Insights

Why Did the Health Insurance Management Segment Lead the Market in 2024?

The health insurance management segment led the pharmacy benefit management market in 2024, due to its pivotal role in coordinating and optimizing prescription drug benefits across large insured populations. Health insurers partner closely with PBMs to negotiate drug pricing, manage formularies, and ensure cost-effective access to medications for policyholders. Their extensive data networks and advanced analytics capabilities enable better cost containment, fraud prevention, and improved patient outcomes. The growing emphasis on value-based care and transparent reimbursement models further strengthens the influence of insurance-driven PBM programs.

The employer-sponsored programs segment is expected to expand at the highest CAGR in the coming years. This is primarily due to the growing emphasis of employers on managing rising healthcare and prescription drug costs. Companies are increasingly adopting PBM services to design tailored benefit plans that enhance employee health outcomes while maintaining cost efficiency. The growing prevalence of chronic diseases and the need for personalized medication management have driven employers to seek integrated PBM solutions that promote preventive care and improve drug adherence. Additionally, the rise of digital health platforms and data-driven analytics enables employers to monitor utilization trends and optimize benefit structures in real time.

Pharmacy Benefit Management Market By Business Model, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Government Health Programs |

306.45 |

336 |

368.39 |

403.89 |

442.81 |

485.46 |

532.21 |

583.44 |

639.6 |

701.15 |

768.59 |

| Employer-Sponsored Programs |

246.66 |

266.68 |

288.31 |

311.66 |

336.87 |

364.1 |

393.48 |

425.2 |

459.43 |

496.37 |

536.23 |

| Health Insurance Management |

194.34 |

212.86 |

233.14 |

255.35 |

279.67 |

306.3 |

335.47 |

367.41 |

402.38 |

440.67 |

482.6 |

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the pharmacy benefit management market while holding the largest share in 2024. The region’s growth is primarily attributed to its well-established healthcare infrastructure, high prescription drug spending, and strong presence of major PBM providers. The region benefits from advanced digital healthcare systems, widespread insurance coverage, and the growing adoption of value-based care models that emphasize cost control and outcome optimization. Additionally, strategic partnerships between PBMs, insurers, and pharmaceutical companies have enhanced drug price transparency and formulary management efficiency. The rising prevalence of chronic diseases and the increasing demand for specialty medications further drive PBM utilization across the U.S. and Canada.

- An estimated 129 million Americans have at least one major chronic disease (e.g., heart disease, cancer, diabetes). Five of the top 10 causes of death in the U.S. are linked to preventable, treatable chronic conditions. Prevalence has risen steadily over the past two decades and is expected to continue growing.

The U.S. is a major contributor to the North American pharmacy benefit management market due to the country’s high healthcare expenditure, extensive insurance coverage, and the strong presence of leading PBM companies such as CVS Health, Cigna (Express Scripts), and OptumRx. The U.S. also has a well-established regulatory framework and widespread adoption of digital healthcare solutions that support efficient prescription benefit management. Additionally, the rising prevalence of chronic diseases and growing demand for cost-effective drug management programs continue to strengthen the country’s leadership in the regional PBM market.

- In September 2025, Optum Rx rolled out a program to support independent pharmacies, giving them higher reimbursement rates for generics/brand, removing certain fees (DIR fees, clawbacks) in certain contracts. This is aimed at sustaining local/community pharmacies, which have been under pressure.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for pharmacy benefit management. This is due to expanding healthcare infrastructure, increasing insurance coverage, and a growing focus on cost-effective drug management. Rapid urbanization, rising disposable incomes, and the increasing prevalence of chronic diseases such as diabetes and cardiovascular disorders are driving demand for structured medication and benefit management systems. Governments across countries like China, India, and Japan are implementing healthcare reforms and digital health initiatives that encourage PBM adoption to enhance the accessibility and affordability of medicines. Additionally, the rise of private health insurers and the integration of advanced technologies like AI and data analytics in claims and formulary management are accelerating market development.

China is a major player in the Asia Pacific pharmacy benefit management market due to its rapidly expanding healthcare infrastructure, large patient population, and increasing government focus on healthcare reform. The country’s efforts to improve drug affordability and streamline reimbursement systems have accelerated the adoption of PBM-like models. Additionally, the growing presence of private insurers and partnerships with global healthcare technology companies are enhancing efficiency in drug pricing and benefit management. China’s strong push toward digital health transformation and data-driven healthcare solutions further strengthens its leadership in the regional PBM market.

Region-Wise Market Outlook

| Region |

Approximate Market Size in 2024 |

Projected CAGR (next 5-10 years) |

Major Growth Factors |

Key Restraints / Challenges |

Growth |

| North America |

USD 310.9 Billion |

5.88% |

High healthcare spending; large chronic disease burden; well-developed insurance & PBM infrastructures. |

Regulatory/legislative scrutiny, cost pressures, backlash or oversight around PBM-pharmacy relationships |

Dominant region |

| Asia-Pacific |

USD 218.3 Billion |

7.03% |

Expanding healthcare coverage; rising middle-class / incomes. |

Challenges of uneven infrastructure across countries and regulatory hurdles. |

Region with the fastest growth |

| Europe |

USD 174.5 Billion |

9,94% |

Rising healthcare expenditures, policy and regulatory focus on price transparency. |

Single-payer or more centralized systems in many countries reduce the role of intermediaries. |

Steady growth |

| Latin America |

USD 60.3 Billion |

4.7% |

Growing healthcare access, increasing prescription use. |

Economic instability; lower per capita healthcare spend. |

Emerging region |

| Middle East & Africa |

USD 38.3 Billion |

3.38% |

Increasing burden of chronic diseases. |

Very uneven infrastructure; regulatory/policy heterogeneity. |

Gradual growth |

Pharmacy Benefit Management Market Value Chain Analysis

1. Drug Manufacturers (Pharmaceutical Companies)

This stage involves the development, production, and pricing of prescription drugs by pharmaceutical manufacturers. They play a crucial role in determining the baseline drug costs that flow through the PBM system. PBMs negotiate with manufacturers to secure rebates, discounts, and formulary placements.

- Key Players: Pfizer Inc., Johnson & Johnson, Merck & Co., Bristol-Myers Squibb, and Amgen Inc.

2. Pharmacy Benefit Managers (Core PBM Providers)

PBMs act as intermediaries between insurers, employers, pharmacies, and drug manufacturers to manage prescription benefits and reduce drug costs. They design formularies, negotiate rebates, process claims, and ensure medication accessibility while maintaining cost efficiency.

- Key Players: CVS Health (Caremark), Cigna (Express Scripts), OptumRx (UnitedHealth Group), Prime Therapeutics, and MedImpact Healthcare Systems.

3. Health Insurance Providers and Employers (Plan Sponsors)

Health insurers and employers serve as plan sponsors, collaborating with PBMs to develop and administer prescription benefit plans for members or employees. They focus on balancing cost control with patient access to essential medicines through tailored coverage plans.

- Key Players: Anthem, Aetna, Blue Cross Blue Shield, Humana, and large corporate employers offering self-insured health plans.

4. Pharmacies and Specialty Pharmacies (Dispensing & Distribution Stage)

Retail and specialty pharmacies are responsible for the dispensing and distribution of medications prescribed under PBM-managed plans. Specialty pharmacies handle complex or high-cost therapies requiring patient monitoring and storage control, playing an increasingly vital role in chronic and rare disease management.

- Key Players: Walgreens Boots Alliance, Walmart Pharmacy, CVS Pharmacy, Diplomat Specialty Pharmacy, and Accredo Health Group.

5. Patients (End Users)

Patients are the final beneficiaries in the PBM value chain, receiving medications at optimized costs due to the coordination of all preceding stakeholders. Their adherence, satisfaction, and health outcomes directly influence formulary adjustments, pricing strategies, and value-based reimbursement models.

- Key Stakeholders: Patients enrolled in employer-sponsored, government, or private insurance programs who interact with PBM-managed plans.

Pharmacy Benefit Management Market Companies

CVS Health Corporation (Caremark)

CVS Health is one of the largest PBM providers globally, offering integrated pharmacy benefit and retail pharmacy services through its Caremark division. The company leverages its vast pharmacy network and analytics capabilities to manage costs, improve medication adherence, and deliver value-based care solutions.

- Cigna Corporation (Express Scripts)

Express Scripts, a subsidiary of Cigna, provides comprehensive PBM services including formulary management, claims processing, and specialty pharmacy operations. It focuses on optimizing prescription costs and enhancing patient outcomes through data-driven insights and advanced medication management programs.

- UnitedHealth Group (OptumRx)

OptumRx, the PBM arm of UnitedHealth Group, integrates technology and healthcare analytics to deliver personalized pharmacy benefits. The company emphasizes cost transparency, specialty drug management, and efficient claims processing to enhance access and affordability.

Owned by a consortium of Blue Cross and Blue Shield health plans, Prime Therapeutics manages drug benefits for millions of members across the U.S. It focuses on collaborative cost-management strategies and clinical programs that promote safe and effective medication use.

- MedImpact Healthcare Systems, Inc.

MedImpact is a leading independent PBM offering pharmacy benefit solutions to health plans, employers, and government agencies. The company emphasizes transparency, flexible benefit design, and data analytics to improve cost efficiency and member satisfaction.

- Anthem, Inc. (Now Elevance Health)

Through its IngenioRx division (rebranded as CarelonRx), Anthem provides PBM services that integrate closely with its health insurance operations. The company aims to streamline drug management and lower total healthcare costs through coordinated care models.

- Humana Pharmacy Solutions

Humana operates its own PBM to support its insurance members with cost-effective medication management. It leverages digital health tools and clinical support programs to improve patient adherence and overall health outcomes.

Walgreens partners with PBMs and payers to deliver pharmacy dispensing, specialty drug distribution, and value-based care services. Its extensive retail network enhances patient accessibility and supports prescription benefit programs across diverse populations.

- Kroger Prescription Plans (KPP)

Kroger’s PBM arm focuses on providing cost-effective, transparent benefit solutions for employers and plan sponsors. It integrates retail pharmacy services and clinical expertise to improve medication management and reduce drug spending.

- Rite Aid Corporation (Elixir)

Rite Aid’s Elixir division offers PBM services including formulary management, mail-order pharmacy, and clinical programs. It emphasizes personalized care, transparency, and innovative benefit design to improve affordability and adherence for members.

Recent Developments

- In September 2025, RxBenefits, Inc. added Illuminate Rx, Inc. to its pharmacy benefits marketplace, reinforcing its commitment to transforming PBM solutions for employers, benefits advisors, and members.

- In September 2024, Accion Labs launched PBM NexaPro, a dedicated unit focused on transforming Pharmacy Benefit Management through advanced services that optimize prescription benefits, improve patient outcomes, and drive operational innovation.

- In August 2024, UNC Health launched UNC Health Pharmacy Solutions, a transparent, clinically driven PBM platform tailored for the Carolinas. Proven to deliver up to 32% savings and boasting a 95 NPS, it aims to become the PBM of choice in North and South Carolina with a holistic, high-satisfaction approach to pharmacy care.

Segments Covered in the Report

By Service

- Specialty Pharmacy Services

- Benefit Plan Design & Administration

- Formulary Management

- Pharmacy Claims Processing

- Others

By Service Provider

- Retail Pharmacies

- Insurance Companies

- Standalone Pharmacy Benefit Management Providers

By Business Model

- Government Health Programs

- Employer-Sponsored Programs

- Health Insurance Management

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Pharmacy Benefit Management Market Size (USD Billion) by Service, 2024–2034

- Table 2: Global Pharmacy Benefit Management Market Size (USD Billion) by Service Provider, 2024–2034

- Table 3: Global Pharmacy Benefit Management Market Size (USD Billion) by Business Model, 2024–2034

- Table 4: North America Market Size (USD Billion) by Service, 2024–2034

- Table 5: North America Market Size (USD Billion) by Service Provider, 2024–2034

- Table 6: North America Market Size (USD Billion) by Business Model, 2024–2034

- Table 7: U.S. Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 8: Canada Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 9: Mexico Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 10: Europe Market Size (USD Billion) by Service, 2024–2034

- Table 11: Europe Market Size (USD Billion) by Service Provider, 2024–2034

- Table 12: Europe Market Size (USD Billion) by Business Model, 2024–2034

- Table 13: Germany Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 14: France Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 15: UK Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 16: Italy Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 17: Asia Pacific Market Size (USD Billion) by Service, 2024–2034

- Table 18: Asia Pacific Market Size (USD Billion) by Service Provider, 2024–2034

- Table 19: Asia Pacific Market Size (USD Billion) by Business Model, 2024–2034

- Table 20: China Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 21: Japan Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 22: India Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 23: South Korea Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 24: Southeast Asia Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 25: Latin America Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 26: Brazil Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 27: Middle East & Africa Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 28: GCC Countries Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 29: Turkey Market Size (USD Billion) by Service & Service Provider, 2024–2034

- Table 30: Africa Market Size (USD Billion) by Service & Service Provider, 2024–2034

List of Figures

- Figure 1: Global Market Share by Service, 2024

- Figure 2: Global Market Share by Service Provider, 2024

- Figure 3: Global Market Share by Business Model, 2024

- Figure 4: North America Market Share by Service, 2024

- Figure 5: North America Market Share by Service Provider, 2024

- Figure 6: North America Market Share by Business Model, 2024

- Figure 7: U.S. Market Share by Service, 2024

- Figure 8: U.S. Market Share by Service Provider, 2024

- Figure 9: Canada Market Share by Service, 2024

- Figure 10: Canada Market Share by Service Provider, 2024

- Figure 11: Mexico Market Share by Service, 2024

- Figure 12: Mexico Market Share by Service Provider, 2024

- Figure 13: Europe Market Share by Service, 2024

- Figure 14: Europe Market Share by Service Provider, 2024

- Figure 15: Europe Market Share by Business Model, 2024

- Figure 16: Germany Market Share by Service, 2024

- Figure 17: Germany Market Share by Service Provider, 2024

- Figure 18: France Market Share by Service, 2024

- Figure 19: France Market Share by Service Provider, 2024

- Figure 20: UK Market Share by Service, 2024

- Figure 21: UK Market Share by Service Provider, 2024

- Figure 22: Italy Market Share by Service, 2024

- Figure 23: Italy Market Share by Service Provider, 2024

- Figure 24: Asia Pacific Market Share by Service, 2024

- Figure 25: Asia Pacific Market Share by Service Provider, 2024

- Figure 26: Asia Pacific Market Share by Business Model, 2024

- Figure 27: China Market Share by Service, 2024

- Figure 28: China Market Share by Service Provider, 2024

- Figure 29: Japan Market Share by Service, 2024

- Figure 30: Japan Market Share by Service Provider, 2024

- Figure 31: India Market Share by Service, 2024

- Figure 32: India Market Share by Service Provider, 2024

- Figure 33: South Korea Market Share by Service, 2024

- Figure 34: South Korea Market Share by Service Provider, 2024

- Figure 35: Southeast Asia Market Share by Service, 2024

- Figure 36: Southeast Asia Market Share by Service Provider, 2024

- Figure 37: Latin America Market Share by Service, 2024

- Figure 38: Latin America Market Share by Service Provider, 2024

- Figure 39: Brazil Market Share by Service, 2024

- Figure 40: Brazil Market Share by Service Provider, 2024

- Figure 41: Middle East & Africa Market Share by Service, 2024

- Figure 42: Middle East & Africa Market Share by Service Provider, 2024

- Figure 43: GCC Countries Market Share by Service, 2024

- Figure 44: GCC Countries Market Share by Service Provider, 2024

- Figure 45: Turkey Market Share by Service, 2024

- Figure 46: Turkey Market Share by Service Provider, 2024

- Figure 47: Africa Market Share by Service, 2024

- Figure 48: Africa Market Share by Service Provider, 2024